Professional Documents

Culture Documents

Solved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDF

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDF

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) Assuming a 25 percent tax rate compute the

after tax cost

Assuming a 25 percent tax rate, compute the after-tax cost of the following business

expenditures: a. $14,200 cost of a survey capitalized to land. b. $44,750 research and

experimental expenditure. c. $23,000 advertising cost. d. $120,000 cost of grading land used in

a non-farming business. e. $120,000 cost of grading […]

Corporation J manufactures electrical appliances. Corporation K provides architectural services.

During the year, both corporations paid $56,000 annual premiums to carry fire and casualty

insurance on their tangible assets. Corporation J was required to capitalize the $56,000 cost for

tax purposes while Corporation K was allowed a $56,000 deduction. Can […]

Moleri, an accrual basis corporation with a fiscal taxable year ending on July 31, owns real

estate on which it pays annual property tax to Madison County, Texas. The county assesses the

tax for the upcoming calendar year on January 1, and the tax becomes a lien on the property […]

Bontaine Publications, an accrual basis, calendar year Corporation, publishes and sells weekly

and monthly magazines to retail bookstores and newsstands. The sales agreement provides

that the retailers may return any unsold magazines during the one-month period after purchase.

Bontaine will refund one-half of the purchase prices of each returned magazine. […]

GET ANSWER- https://accanswer.com/downloads/page/1523/

Brillo Company uses the calendar year and the cash method of accounting. On December 31,

2015, Brillo made the following cash payments. To what extent can Brillo deduct the payment in

2015? a. $50,000 for a two-year office lease beginning on February 1, 2016. b. $79,000 of

inventory items held […]

RTY is a calendar year corporation. On December 12, RTY billed a client $17,800 for services

rendered during October and November. It had not received payment by December 31. On

December 10, RTY received a $4,000 check from a tenant that leases office space from the

corporation. The payment was […]

TRW Inc. began business in 2007 and was profitable for its first three years. In 2010, it

generated a $741,000 net operating loss. The following table shows TRW’s taxable income

before consideration of this NOL. Recompute TRW’s taxable income for this eight-year period

assuming that it didn’t elect to give […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1523/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Book-Keeping Form Three PDFDocument4 pagesBook-Keeping Form Three PDFdesa ntosNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Earlier Segments of This Problem Have Described How Mary GrahamDocument2 pagesEarlier Segments of This Problem Have Described How Mary GrahamTaimur Technologist0% (1)

- The Following Data Relate To The Operations of Slick SoftwareDocument2 pagesThe Following Data Relate To The Operations of Slick SoftwareAmit PandeyNo ratings yet

- Basic Question On C Language 1Document2 pagesBasic Question On C Language 1Akfd100% (1)

- On December 31 2016 Robey Company Accumulated The Following InformationDocument1 pageOn December 31 2016 Robey Company Accumulated The Following InformationHassan JanNo ratings yet

- Exercise 14Document11 pagesExercise 14dwitaNo ratings yet

- Using The Trial Balance Prepared For Binbutti Engineering in PartDocument1 pageUsing The Trial Balance Prepared For Binbutti Engineering in PartFreelance Worker0% (2)

- Pecos Company and Suaro CompanyDocument4 pagesPecos Company and Suaro CompanyCharlotte0% (1)

- Brewer Chapter 2 Alt ProbDocument6 pagesBrewer Chapter 2 Alt ProbAtif RehmanNo ratings yet

- Mac006 A T2 2021 FexDocument7 pagesMac006 A T2 2021 FexHaris MalikNo ratings yet

- CH 12Document3 pagesCH 12ghsoub777No ratings yet

- Accrual and ProvisionDocument66 pagesAccrual and ProvisionVeronica Bailey100% (1)

- D2 S3 ISAK 16 - IFRIC 12 Illustrative Examples-HTDocument22 pagesD2 S3 ISAK 16 - IFRIC 12 Illustrative Examples-HTHendri Pecinta KedamaiAnNo ratings yet

- Management Accounting Individual AssignmentDocument10 pagesManagement Accounting Individual AssignmentendalNo ratings yet

- Practice Questions and SolutionsDocument7 pagesPractice Questions and SolutionsLiy TehNo ratings yet

- Planning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be AnsweredDocument5 pagesPlanning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be Answeredapi-19836745No ratings yet

- Seminar Questions Royality and ContainerDocument10 pagesSeminar Questions Royality and ContainerEligius NyikaNo ratings yet

- CTA Level 1 Tax Module 2014 Practice Questions and SolutionsDocument117 pagesCTA Level 1 Tax Module 2014 Practice Questions and SolutionsBernard TynoNo ratings yet

- Acct101 Financial Accounting: Instructions To CandidatesDocument26 pagesAcct101 Financial Accounting: Instructions To CandidatesYing Sheng ÖNo ratings yet

- Depreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Document3 pagesDepreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Charles Kevin Mina100% (1)

- Foreign Branches QuestionsDocument12 pagesForeign Branches QuestionsNicole TaylorNo ratings yet

- Cost Accounting Chapter 21 NOTESDocument12 pagesCost Accounting Chapter 21 NOTESQuintin Jerome BellNo ratings yet

- PAPER: Financial Accounting (FA) : Certified College of Accountancy's Mock ExamDocument8 pagesPAPER: Financial Accounting (FA) : Certified College of Accountancy's Mock ExamJack PayneNo ratings yet

- ACCT 6011 Assignment #2 Template W21Document5 pagesACCT 6011 Assignment #2 Template W21patel avaniNo ratings yet

- Reimers Finacct03 sm09 PDFDocument48 pagesReimers Finacct03 sm09 PDFChandani DesaiNo ratings yet

- Assignment 5 SolutionDocument4 pagesAssignment 5 SolutionBracu 2023100% (1)

- Costing Booster Batch: FOR MAY 2023Document244 pagesCosting Booster Batch: FOR MAY 2023Vishal VermaNo ratings yet

- t10 2010 Jun QDocument10 pagest10 2010 Jun QAjay TakiarNo ratings yet

- Answers R41920 Acctg Varsity Basic Acctg Level 2Document12 pagesAnswers R41920 Acctg Varsity Basic Acctg Level 2John AceNo ratings yet

- Solved Stan Rented An Office Building To Clay For 3 000 PerDocument1 pageSolved Stan Rented An Office Building To Clay For 3 000 PerAnbu jaromiaNo ratings yet

- Quick Company Acquired A Piece of Equipment in Year 1Document1 pageQuick Company Acquired A Piece of Equipment in Year 1Taimour HassanNo ratings yet

- Case 1-4 Boeing's E-Enabled AdvantageDocument12 pagesCase 1-4 Boeing's E-Enabled AdvantageanjiroNo ratings yet

- Government and Not For Profit Organizations Quiz CH 5 Capital Assets KEY01Document2 pagesGovernment and Not For Profit Organizations Quiz CH 5 Capital Assets KEY01Yijian ZhaoNo ratings yet

- Describe How The Following Business Transactions Affect The Three Elements of The AccountingDocument3 pagesDescribe How The Following Business Transactions Affect The Three Elements of The AccountingUserNo ratings yet

- Actg 1Document12 pagesActg 1oconn1No ratings yet

- ACCO ch10Document80 pagesACCO ch10Samar BarakehNo ratings yet

- Management Accounting HWDocument5 pagesManagement Accounting HWHw SolutionNo ratings yet

- Section VI: NRV Vs Fair Value: ExampleDocument5 pagesSection VI: NRV Vs Fair Value: ExamplebinuNo ratings yet

- Test Bank - Problems and Essays 2008Document148 pagesTest Bank - Problems and Essays 2008okkie50% (6)

- Ratio Problems 2Document7 pagesRatio Problems 2Vivek Mathi100% (1)

- 1 ACC 2234 Hand-In Assignment 1 v2 2019Document4 pages1 ACC 2234 Hand-In Assignment 1 v2 2019Sameer Shabbir0% (2)

- WileyPlus PPEDocument9 pagesWileyPlus PPEKaiWenNgNo ratings yet

- Capital Budgeting - Homework-2 AnswersDocument3 pagesCapital Budgeting - Homework-2 AnswersYasmine GouyNo ratings yet

- Zica T5Document30 pagesZica T5Andrew TemboNo ratings yet

- Chapter - 2 Problem Related Financial StatementDocument6 pagesChapter - 2 Problem Related Financial StatementAshfaq ZameerNo ratings yet

- I Am Sharing 'UPDATED' With YouDocument258 pagesI Am Sharing 'UPDATED' With Youjessamae gundanNo ratings yet

- ACCT 6011 Assignment #1 TemplateDocument8 pagesACCT 6011 Assignment #1 Templatepatel avaniNo ratings yet

- Contentitemfile Clakzwt9mx9sk0a212lma0ytv PDFDocument4 pagesContentitemfile Clakzwt9mx9sk0a212lma0ytv PDFJoseph OndariNo ratings yet

- On August 1 Year 3 Carleton LTD Ordered Machinery From PDFDocument1 pageOn August 1 Year 3 Carleton LTD Ordered Machinery From PDFDoreenNo ratings yet

- Assignment 02 Leases-SolutionDocument7 pagesAssignment 02 Leases-SolutionJaziel SestosoNo ratings yet

- CH 10Document81 pagesCH 10Putu DenyNo ratings yet

- Solved Paris Corporation Holds A 100 000 Unrealized Net Capital GainDocument1 pageSolved Paris Corporation Holds A 100 000 Unrealized Net Capital GainAnbu jaromiaNo ratings yet

- Solutions Manual - Baker / Lembke / King / Jeffrey, Advanced Financial Accounting, 7eDocument61 pagesSolutions Manual - Baker / Lembke / King / Jeffrey, Advanced Financial Accounting, 7eNatasya JulyetaNo ratings yet

- Employment Income UdomDocument13 pagesEmployment Income UdomMaster KihimbwaNo ratings yet

- Unit 2: Accounting Concepts and Trial BalanceDocument12 pagesUnit 2: Accounting Concepts and Trial Balanceyaivna gopeeNo ratings yet

- Acct11 2hwDocument4 pagesAcct11 2hwRonald James Siruno MonisNo ratings yet

- Partnership - I: Change in Profit Sharing RatioDocument33 pagesPartnership - I: Change in Profit Sharing RatioUjjwal BeriwalNo ratings yet

- Solved Corporation R Signed A Contract To Undertake A Transaction ThatDocument1 pageSolved Corporation R Signed A Contract To Undertake A Transaction ThatAnbu jaromiaNo ratings yet

- Solved Mclelland Inc Reported Net Income of 175 000 For 2019 andDocument1 pageSolved Mclelland Inc Reported Net Income of 175 000 For 2019 andAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Ias 12 Summary NotesDocument3 pagesIas 12 Summary NoteshusseinNo ratings yet

- Tax 1 CorpDocument16 pagesTax 1 CorpRen A Eleponio0% (1)

- Bine MakautDocument37 pagesBine Makauts ghoshNo ratings yet

- It 000144418085 2024 10Document1 pageIt 000144418085 2024 10Sheeraz AhmedNo ratings yet

- Bitumen Rate Wef 01.02.17Document1 pageBitumen Rate Wef 01.02.17कुमुद पाठकNo ratings yet

- ProjectionDocument13 pagesProjectionNeha ThakurNo ratings yet

- Chapter 2Document9 pagesChapter 2Sheilamae Sernadilla GregorioNo ratings yet

- CH 005Document2 pagesCH 005Joana TrinidadNo ratings yet

- International Tax United Kingdom Highlights 2022: Updated January 2022Document13 pagesInternational Tax United Kingdom Highlights 2022: Updated January 2022Paulo PatrãoNo ratings yet

- Annexure To Form 16 - TCS - 20202021Document3 pagesAnnexure To Form 16 - TCS - 20202021Kritansh BindalNo ratings yet

- id-tax-ID - Individual Income Tax Guide 2021Document24 pagesid-tax-ID - Individual Income Tax Guide 2021galuh vindriarsoNo ratings yet

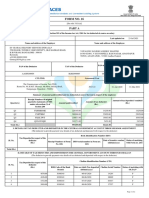

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinuthna ChinnapaNo ratings yet

- Training GuideDocument9 pagesTraining GuideVishal AgarwalNo ratings yet

- TAX Setup in FusionDocument109 pagesTAX Setup in FusionObulareddy BiyyamNo ratings yet

- icicoo07373 Prparéd byDocument1 pageicicoo07373 Prparéd byA.T RamNo ratings yet

- INCOME TAXATION Tabag Summary Chapter 1 and Chapter 2 Docx (Repaired)Document3 pagesINCOME TAXATION Tabag Summary Chapter 1 and Chapter 2 Docx (Repaired)Beus0% (1)

- Introduction To Business Taxation: Property of STIDocument3 pagesIntroduction To Business Taxation: Property of STIDong RoselloNo ratings yet

- Payroll - With Payslip ActivityDocument17 pagesPayroll - With Payslip Activitylheamaecayabyab4No ratings yet

- Chapter 11 - Computation of Taxable Income and TaxDocument22 pagesChapter 11 - Computation of Taxable Income and TaxMichelle Tan100% (1)

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document52 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)jeanieNo ratings yet

- Collector V Goodrich DigestDocument2 pagesCollector V Goodrich DigestmbNo ratings yet

- O&L Group of CompaniesDocument1 pageO&L Group of CompaniesKahere usutaNo ratings yet

- A222 Tutorial 3 ALLOWANCESDocument2 pagesA222 Tutorial 3 ALLOWANCESChye Poh LimNo ratings yet

- Tax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyDocument1 pageTax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyMuhammad sarfrazNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKaka JENo ratings yet

- Amit Singh-Payslip - Jun-2021-Unlocked PDFDocument3 pagesAmit Singh-Payslip - Jun-2021-Unlocked PDFamitNo ratings yet

- Gayatri Sales & Services: Terms & Conditions Prices: PricesDocument1 pageGayatri Sales & Services: Terms & Conditions Prices: Pricesarpit85No ratings yet

- PDFDocument1 pagePDFVENKAT RAO0% (1)

- Baran-Final Exam TaxDocument3 pagesBaran-Final Exam TaxAlona JeanNo ratings yet

- Essentials of Federal Taxation 3rd Edition Spilker Solutions Manual Full Chapter PDFDocument67 pagesEssentials of Federal Taxation 3rd Edition Spilker Solutions Manual Full Chapter PDFdilysiristtes5100% (13)