Professional Documents

Culture Documents

Ias 12 Summary Notes

Uploaded by

husseinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ias 12 Summary Notes

Uploaded by

husseinCopyright:

Available Formats

IAS 12 – INCOME TAX

(Application of Matching Principle)

This treatment is done because of difference! Difference of reporting in Accounting World & Tax World.

Accounting World Accrual Basis

Tax World Cash Basis/ Receipt Basis

And because of this difference of these two worlds, DEFERRED TAX came into this world!

Income will match with (result in) Tax Expense i.e. Income Increases Tax Expense Increases

Expense will match with (result in) Tax Benefit i.e. Expense Increases Tax Benefit Increases

DIFFERENCE

Timing Difference Abhi nahi Aur kabhi nahi

TEMPORARY NON-TEMPORARY

1. Dividends Receivable 1. IAS 20 – Government Grants

2. Provisions, Accrued Expense 2. Fines/ Penalties (Buray Log)

3. IAS 2 – Inventory (Damage) 3. Political Donations

4. Issue Cost (Loan Notes) 4. Goodwill in Business Combination (Tax Dept. treats P. Co.’s

5. Tax Accelerated Depreciation investment in S. Co. as a Normal Investment. They don’t

6. IAS 38 – Capitalized Development Cost recognize goodwill and so amortization. But in accounting

7. IFRS – 16 Leases (Tax Dept. treats all leases as Operating books, we record goodwill impairment as an expense & if we

Lease) go to Tax Dept., they will say ABHI NAHI AUR KABHI NAHI. In

8. Convertible loan notes (Tax Dept. treats it as a pure loan) Tax world, goodwill is taken as Investment in Shares)

9. IAS 19 – Employee Benefits, DBO Accounting (Current

Service Cost)

10. IFRS 2 – Share Based Payments

Prepared by: Arsalan M. Khan Page 1 of 3

TEMPORARY DIFFERENCE

TAXABLE TEMPORARY DIFFERENCE DEDUCTABLE TEMPORARY DIFFERENCE

1. Because of which future taxable profit increases 1. Because of which future taxable profit decreases

2. You need to pay tax in future. 2. You get tax benefit in future.

3. Results in Deferred Tax Liability 3. Results in Deferred Tax Asset

4. E.g. Dividends 4. E.g. Provisions

P&L XXX D.T.A XXX

D.T.L XXX P&L XXX

SOFP APPROACH:

Carrying Value Tax Base Temporary Difference

Asset TAXABLE TEMPORARY DIFFERENCE

Asset DEDUCTABLE TEMPORARY

DIFFERENCE

DEDUCTABLE TEMPORARY

Liability

DIFFERENCE

Liability TAXABLE TEMPORARY DIFFERENCE

Note: Answers will be same in Income Statement Approach & SOFP Approach. As whatever comes in

Income Statement goes later to SOFP.

E.g. Receivables XXX

Sales XXX

UNUSED TAX LOSSES

D.T.A, due to unused tax losses, can only be recognized, if it is probable that they will set off

future taxable profits. In some jurisdictions, there is an expiry date of unused losses. In that

case, it must be probable that future taxable profits arises before the expiry date.

Prepared by: Arsalan M. Khan Page 2 of 3

If the company has sufficient taxable temporary difference to use the deductible temporary

difference (E.g. Dividends Receivable)

If tax planning opportunities are available to the company (75% group P. Co offsets S. Cos losses)

If that loss arises from identifiable reasons and that reason is ceased now (Flop Product)

EXCEPTION (NON-TEMPORARY DIFFERENCE):

In case of Undistributed Profits of Subsidiary Co. & Associates, where P. Co. has control over the

dividend policy of S. Co. & it is probable that P. Co. wont withdraw any dividends from S. Co.

o “YOU CAN BUT YOU WON’T”

Corporate America saves its money in Mexico

IMPORTANT POINTS:

Entry: D.T.A. XXX

P&L XXX

In any case, D.T.A can only be booked, if it’s probable that company will get tax benefit

Any change in D.T.A or D.T.L is adjusted prospectively

D.T.A & D.T.L can be offset, if company has legal & enforceable right to offset current tax

payment

That’s why normally, D.T.A in P. Co.’s books and D.T.L in S. Co.’s books can’t offset each other.

For deferred tax, use those tax rates which are enacted before reporting date.

REASONS FOR DIFFERENCE IN ACTUAL TAX RATE & EFFECTIVE TAX RATE

Non Temporary difference

Foreign subsidiaries different tax rates

Over/ under provision of last year.

Deferred tax booked on different rates

Prepared by: Arsalan M. Khan Page 3 of 3

You might also like

- IAS 12 BinderDocument20 pagesIAS 12 BinderUmer Shah100% (1)

- Deferred tax RELEVANT TO acca papers f7 and p2Document9 pagesDeferred tax RELEVANT TO acca papers f7 and p2Javid HumbatovNo ratings yet

- IAS 12 Income TaxDocument43 pagesIAS 12 Income TaxMinal BihaniNo ratings yet

- IAS 12 GuideDocument52 pagesIAS 12 Guidezubair_zNo ratings yet

- FR - MID - TERM - TEST - 2020 CPA Financial ReportingDocument13 pagesFR - MID - TERM - TEST - 2020 CPA Financial ReportingH M Yasir MuyidNo ratings yet

- IAS 37 Provision NotesDocument26 pagesIAS 37 Provision Notessteven lino2No ratings yet

- Taxation Sammary Ranjan SirDocument76 pagesTaxation Sammary Ranjan SirWahid100% (2)

- Ias 12Document38 pagesIas 12lindsay boncodinNo ratings yet

- Ias 12 Income TaxesDocument70 pagesIas 12 Income Taxeszulfi100% (1)

- IAS 7 Cash Flow Statement NotesDocument14 pagesIAS 7 Cash Flow Statement Notesmusic niNo ratings yet

- Accounting For PropertyDocument6 pagesAccounting For PropertyBijoy SalahuddinNo ratings yet

- Mock Exam QuestionsDocument21 pagesMock Exam QuestionsDixie CheeloNo ratings yet

- Tfrs 15: Ready For The ChallengesDocument19 pagesTfrs 15: Ready For The ChallengesSudharaka PereraNo ratings yet

- ACCA P2 Corporate Reporting - Mock Exam Answers 1 PDFDocument24 pagesACCA P2 Corporate Reporting - Mock Exam Answers 1 PDFමිලන්No ratings yet

- F6 Revision Notes PDFDocument124 pagesF6 Revision Notes PDFЛюба Иванова100% (1)

- F7 Sir Zubair NotesDocument119 pagesF7 Sir Zubair NotesAli OpNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument32 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAmrita TamangNo ratings yet

- IAS 12 Income TaxesDocument4 pagesIAS 12 Income Taxeshae1234No ratings yet

- Principles of Consolidated Financial StatementsDocument13 pagesPrinciples of Consolidated Financial StatementsADEYANJU AKEEM100% (1)

- Example 1 - Over and Under Provision of Current TaxDocument14 pagesExample 1 - Over and Under Provision of Current TaxPui YanNo ratings yet

- ACCA - Applied Skills Financial ReportingDocument274 pagesACCA - Applied Skills Financial Reportingerickson tyroneNo ratings yet

- IAS 16 Property Plant Equipment GuideDocument4 pagesIAS 16 Property Plant Equipment GuideMD Hafizul Islam HafizNo ratings yet

- IAS 40 Investment Property SummaryDocument16 pagesIAS 40 Investment Property SummaryPhebieon MukwenhaNo ratings yet

- Business Combinations - ASPEDocument3 pagesBusiness Combinations - ASPEShariful HoqueNo ratings yet

- F2 Notes LatestDocument267 pagesF2 Notes LatestWaseem Ahmad100% (1)

- Audit and Assurance Aa Revison Notes 2019Document85 pagesAudit and Assurance Aa Revison Notes 2019Jeshna JoomuckNo ratings yet

- Additional Deferred Tax Examples.2Document3 pagesAdditional Deferred Tax Examples.2milton1986100% (1)

- Acca - Chapter 1-9 SummaryDocument5 pagesAcca - Chapter 1-9 SummaryBianca Alexa SacabonNo ratings yet

- f7 Mock QuestionDocument20 pagesf7 Mock Questionnoor ul anumNo ratings yet

- Final Examinations Advanced Accounting and Financial ReportingDocument4 pagesFinal Examinations Advanced Accounting and Financial ReportingSheharyar HasanNo ratings yet

- Derivatives AFMDocument63 pagesDerivatives AFMSamarth SinghNo ratings yet

- IAS-12 BinderDocument27 pagesIAS-12 Binderzahid awanNo ratings yet

- F7 Course Note by Mezbah UddinDocument107 pagesF7 Course Note by Mezbah UddinAsim NazirNo ratings yet

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- Analysis and Interpretation of Financial Statements: Powerpoint To AccompanyDocument34 pagesAnalysis and Interpretation of Financial Statements: Powerpoint To AccompanyCamesha CapeNo ratings yet

- Consolidated Financial StatementsDocument33 pagesConsolidated Financial StatementsTamirat Eshetu Wolde100% (1)

- F5 Mapit Workbook Questions & Solutions PDFDocument11 pagesF5 Mapit Workbook Questions & Solutions PDFMarlyn Richards100% (1)

- SA 701 MCQsDocument2 pagesSA 701 MCQspreethesh kumarNo ratings yet

- Part C F5 RevisionDocument20 pagesPart C F5 RevisionMazni HanisahNo ratings yet

- IFRS 15 Mapping Linked To Illustrative Examples - Page 1Document3 pagesIFRS 15 Mapping Linked To Illustrative Examples - Page 1See-Anne RamsuranNo ratings yet

- Management Information Question Bank 2019Document336 pagesManagement Information Question Bank 2019k20b.lehoangvu100% (1)

- Analyzing Financial Reports with RatiosDocument32 pagesAnalyzing Financial Reports with Ratiostuga100% (1)

- CIMA F1 2019 NotesDocument164 pagesCIMA F1 2019 Notessolstice567567No ratings yet

- ICAEW AssuranceDocument156 pagesICAEW AssuranceThành Vinh NguyễnNo ratings yet

- CFAP5 AdvancedTaxation PDFDocument195 pagesCFAP5 AdvancedTaxation PDFHassan NaeemNo ratings yet

- Consolidation Notes Consolidated Statement of Cash FlowsDocument10 pagesConsolidation Notes Consolidated Statement of Cash FlowsamitsinghslideshareNo ratings yet

- Notes IAS 19Document18 pagesNotes IAS 19Nasir IqbalNo ratings yet

- Module 3 - Events After The Reporting Period PDFDocument7 pagesModule 3 - Events After The Reporting Period PDFCaroline Bagsik100% (1)

- Fa Mcqs (Icap)Document133 pagesFa Mcqs (Icap)MUHAMMAD ASLAMNo ratings yet

- ICAEW - Accounting 2020 - Chap 4Document78 pagesICAEW - Accounting 2020 - Chap 4TRIEN DINH TIENNo ratings yet

- CA - Advanced Reporting Revision Kit PDFDocument451 pagesCA - Advanced Reporting Revision Kit PDFSyed Arham MurtazaNo ratings yet

- PM - Decision Making Techniques: Relevant CostingDocument17 pagesPM - Decision Making Techniques: Relevant CostingBhupendra Singh100% (1)

- I Cap If Rs QuestionsDocument34 pagesI Cap If Rs QuestionsUsmän MïrżäNo ratings yet

- Open RubricDocument264 pagesOpen RubricDonavan Balgobind100% (1)

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Document68 pagesQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Optimal Management SolutionNo ratings yet

- SBR SummaryDocument10 pagesSBR SummaryWaleedSultanNo ratings yet

- Ind As 12: Income Taxes: Definitions Concept Insight ExamplesDocument2 pagesInd As 12: Income Taxes: Definitions Concept Insight ExamplesDeepak singhNo ratings yet

- IND AS 12 - Bhavik Chokshi - FR ShieldDocument7 pagesIND AS 12 - Bhavik Chokshi - FR ShieldSoham UpadhyayNo ratings yet

- UntitledDocument4 pagesUntitledGayathri DhandapaniNo ratings yet

- UntitledDocument4 pagesUntitledGayathri DhandapaniNo ratings yet

- Traffic LightsDocument2 pagesTraffic LightshusseinNo ratings yet

- Matty M J 21Document2 pagesMatty M J 21husseinNo ratings yet

- 2-Webinar QuestionsDocument11 pages2-Webinar QuestionshusseinNo ratings yet

- MCQ'sDocument12 pagesMCQ'shusseinNo ratings yet

- Day1 S 1Document46 pagesDay1 S 1husseinNo ratings yet

- Climate Related RiskDocument2 pagesClimate Related RiskhusseinNo ratings yet

- 9-IAS 41 - SummaryDocument2 pages9-IAS 41 - SummaryhusseinNo ratings yet

- IFRS 10 and 3 ExamplesDocument9 pagesIFRS 10 and 3 ExampleshusseinNo ratings yet

- 14-IFRS 9 - SummaryDocument12 pages14-IFRS 9 - SummaryhusseinNo ratings yet

- Ashanti Consolidated Soci 123Document4 pagesAshanti Consolidated Soci 123husseinNo ratings yet

- Ias 37Document7 pagesIas 37husseinNo ratings yet

- Ias 19 Employee Benefit 123Document10 pagesIas 19 Employee Benefit 123husseinNo ratings yet

- 15-IFRS 15 - SummaryDocument6 pages15-IFRS 15 - SummaryhusseinNo ratings yet

- Consolidated SOFP - Kaplan Questions.Document33 pagesConsolidated SOFP - Kaplan Questions.husseinNo ratings yet

- Q - 204 - Peony CompnayDocument4 pagesQ - 204 - Peony CompnayhusseinNo ratings yet

- Capital Budgeting V2 - Click Read Only To View DocumentDocument40 pagesCapital Budgeting V2 - Click Read Only To View DocumentSamantha Meril PandithaNo ratings yet

- ECS1601 Assignment 05 Practice Semester 01 2023 General Feedback PDFDocument3 pagesECS1601 Assignment 05 Practice Semester 01 2023 General Feedback PDFbenathi layishaNo ratings yet

- Begum Rukshani Mohamed Refai Batch 42Document24 pagesBegum Rukshani Mohamed Refai Batch 42Rukshani RefaiNo ratings yet

- Physical Delivery Guide: Page 1 of 79Document79 pagesPhysical Delivery Guide: Page 1 of 79maheshNo ratings yet

- Wow Skin Science Brightening Vitamin C For Hyperpigmentation Face WashDocument1 pageWow Skin Science Brightening Vitamin C For Hyperpigmentation Face WashShivanshu ParasharNo ratings yet

- How economic systems attempt to allocate and make effective use of resources (40 charactersDocument2 pagesHow economic systems attempt to allocate and make effective use of resources (40 characterssaleihasharif67% (3)

- DG - 0015 PDFDocument1 pageDG - 0015 PDFGasBuddyNo ratings yet

- Measuring Exposure To Exchange Rate FluctuationsDocument36 pagesMeasuring Exposure To Exchange Rate FluctuationsTawhid Ahmed ChowdhuryNo ratings yet

- Barclays Bank Statement 2Document5 pagesBarclays Bank Statement 2zainabNo ratings yet

- Financial Analysis of Investment Projects: January 1999Document9 pagesFinancial Analysis of Investment Projects: January 1999Nicolae NistorNo ratings yet

- Exercise 1 Demand Theory and Elasticities01Document3 pagesExercise 1 Demand Theory and Elasticities01Muhammad FikryNo ratings yet

- Analysis of Financial Statements: Stay Ahead With HMB!Document33 pagesAnalysis of Financial Statements: Stay Ahead With HMB!Sk0% (1)

- Assignment On "Analysis of Gafla Movie Scam": Submitted By: - Enrollment No. NameDocument14 pagesAssignment On "Analysis of Gafla Movie Scam": Submitted By: - Enrollment No. NameDhrupal TripathiNo ratings yet

- wg11 TextilesDocument390 pageswg11 Textilesjpsingh75No ratings yet

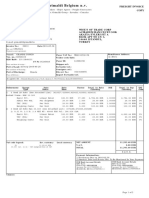

- Grimaldi Belgium N.V.: Freight InvoiceDocument2 pagesGrimaldi Belgium N.V.: Freight InvoiceAyseColakNo ratings yet

- MCQ Entrepreneurship 5Document3 pagesMCQ Entrepreneurship 5Dgcc Information technology deprtmentNo ratings yet

- Bomcpe11,+Journal+Manager,+87 99Document13 pagesBomcpe11,+Journal+Manager,+87 99ayoub oumouhNo ratings yet

- A Picture of Some of the World's InhabitantsDocument12 pagesA Picture of Some of the World's InhabitantsBlue LangurNo ratings yet

- Chapter - 8 Foreign Exchange Forwards and Futures: Example 8.1Document40 pagesChapter - 8 Foreign Exchange Forwards and Futures: Example 8.1debojyotiNo ratings yet

- Penawaran Harga Seragam SATPAMDocument2 pagesPenawaran Harga Seragam SATPAMIndra WardanaNo ratings yet

- Invoice To: Despatch ToDocument1 pageInvoice To: Despatch ToAYUSH PRADHANNo ratings yet

- NCUK IFY ECONS EOS1 V2 2122Document8 pagesNCUK IFY ECONS EOS1 V2 2122callista.1109088No ratings yet

- Today Gold Price in Kuwait - India Gold RateDocument1 pageToday Gold Price in Kuwait - India Gold RateERAGA ROHINI KUMARNo ratings yet

- Course: Word Economic Geography of ServicesDocument34 pagesCourse: Word Economic Geography of ServicesThanh ChauNo ratings yet

- Abp On RiceDocument65 pagesAbp On RiceImoter TyovendaNo ratings yet

- India - Rado Service Price List - 01.10.2020Document1 pageIndia - Rado Service Price List - 01.10.2020PrachiNo ratings yet

- ECO201 - SP23 - IB1702 - Group Assignment - Group 4Document15 pagesECO201 - SP23 - IB1702 - Group Assignment - Group 4JinyNo ratings yet

- Top 300+ Questions: Banking & Financial AwarenessDocument40 pagesTop 300+ Questions: Banking & Financial AwarenessNeradabilli EswarNo ratings yet

- Write A Report Summarising The Information. Select and Describe The Main Features, and Make Comparisons Where Relevant. Write at Least 150 WordsDocument10 pagesWrite A Report Summarising The Information. Select and Describe The Main Features, and Make Comparisons Where Relevant. Write at Least 150 WordsChi Vinh TranNo ratings yet

- About NTPC's Joint Venture PartnershipsDocument6 pagesAbout NTPC's Joint Venture Partnershipsshantanu kumar BaralNo ratings yet