Professional Documents

Culture Documents

Solved Comet Operates Solely Within The United States It Owns Two PDF

Uploaded by

Anbu jaromiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Comet Operates Solely Within The United States It Owns Two PDF

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) Comet operates solely within the United States It

owns two

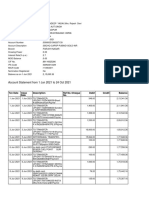

Comet operates solely within the United States. It owns two subsidiaries conducting business in

the United States and several foreign countries. Both subsidiaries are U.S. corporations. This

year, the three corporations report the following: a. If Comet and its two subsidiaries file a

consolidated U.S. tax return, compute consolidated income […]

Aqua, a South Carolina corporation, is a 20 percent partner in a Swiss partnership. This year,

Aqua earned $2 million U.S. source income and $190,000 foreign source income. It paid no

foreign income tax. The Swiss partnership earned $1.73 million foreign source income and paid

$660,000 income tax to Switzerland, […]

Transcom, an Ohio corporation, earned $700,000 U.S. source income from sales of goods to

U.S. customers and $330,000 foreign source income from sales of goods to customers in

Canada. Canada’s corporate income tax rate is 40 percent, and the United States and Canada

have a bilateral tax treaty. a. Compute […]

Column Corporation has a subsidiary operating exclusively in Country A and a subsidiary

operating exclusively in Country Z. a. Both subsidiaries were incorporated under Delaware law

and are therefore U.S. corporations. Can Column use the losses from the Country A subsidiary

to reduce the income from the Country Z subsidiary? […]

GET ANSWER- https://accanswer.com/downloads/page/1502/

Togo Inc. has a subsidiary incorporated in Country H, which does not have a corporate income

tax. Which of the following activities generates subpart F income? a. The subsidiary buys

woolen clothing products manufactured by a Swedish company and sells the products to

unrelated wholesalers in the United States. Togo […]

Halifax Inc. operates its business in Country U through a subsidiary incorporated under Country

U law. The subsidiary has never paid a dividend and has accumulated over $10 million after-tax

earnings. a. Country U has a 45 percent corporate income tax. Describe the tax consequences

to Halifax if it receives […]

Posse Corporation plans to form a foreign subsidiary through which to conduct a new business

in Country J. Posse projects that this business will operate at a loss for several years. a. To

what extent will the subsidiary’s losses generate U.S. tax savings? b. To what extent will the

subsidiary’s […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1502/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- LoanStatement PDFDocument3 pagesLoanStatement PDFjangra17No ratings yet

- August 2017 Wells Fargo StatementDocument11 pagesAugust 2017 Wells Fargo StatementAnonymous qQaGsVkFNo ratings yet

- Titanium Dioxide ExhibitsDocument7 pagesTitanium Dioxide Exhibitssanjayhk7No ratings yet

- Gross Profit AnalysisDocument5 pagesGross Profit AnalysisInayat Ur RehmanNo ratings yet

- March XfinityDocument11 pagesMarch Xfinityeleggua03No ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- Committee CalculatorDocument3 pagesCommittee CalculatorSayee KrishnanNo ratings yet

- IAS 36 Impairment of Assets Illustrative Examples PDFDocument17 pagesIAS 36 Impairment of Assets Illustrative Examples PDFMaey RoledaNo ratings yet

- Grainger ApplicationDocument1 pageGrainger ApplicationCarlos Calderon100% (1)

- Zica T5Document30 pagesZica T5Andrew TemboNo ratings yet

- Delta Oil Company Uses The Successful Efforts Method To Account ForDocument1 pageDelta Oil Company Uses The Successful Efforts Method To Account ForFreelance WorkerNo ratings yet

- Additional Deferred Tax Examples.2Document3 pagesAdditional Deferred Tax Examples.2milton1986100% (1)

- 20 Marks 2019 Adjustments To Net Income: Consolidated Income Statement 2019Document4 pages20 Marks 2019 Adjustments To Net Income: Consolidated Income Statement 2019Jax TellerNo ratings yet

- 1 Prof Chauvins Instructions For Bingham CH 4Document35 pages1 Prof Chauvins Instructions For Bingham CH 4Danielle Baldwin100% (2)

- The Following Tables Contain Financial Statements For Dynastatics Corporation AlthoughDocument2 pagesThe Following Tables Contain Financial Statements For Dynastatics Corporation Althoughtrilocksp SinghNo ratings yet

- Exercise Chapter 15Document39 pagesExercise Chapter 1521070286 Dương Thùy AnhNo ratings yet

- Problems On TaxationDocument3 pagesProblems On TaxationRandy ManzanoNo ratings yet

- AFAR Problem MCQDocument45 pagesAFAR Problem MCQGJames ApostolNo ratings yet

- Appellant DSNLU VishakapatnamDocument40 pagesAppellant DSNLU VishakapatnamKeerthana Gedela89% (9)

- Finalstax1samplex 20 21Document16 pagesFinalstax1samplex 20 21Abigael SeverinoNo ratings yet

- D) The Periodic Amount of Bond Interest Revenue Will Always Be Less To Than The Periodic Amount of Cash ReceivedDocument24 pagesD) The Periodic Amount of Bond Interest Revenue Will Always Be Less To Than The Periodic Amount of Cash ReceivedPatrick WaltersNo ratings yet

- Solved This Year Fig Corporation Made A 100 000 Contribution To CharityDocument1 pageSolved This Year Fig Corporation Made A 100 000 Contribution To CharityAnbu jaromiaNo ratings yet

- Acct11 2hwDocument4 pagesAcct11 2hwRonald James Siruno MonisNo ratings yet

- Case Q4Document2 pagesCase Q4Yimin Jin100% (1)

- Advanced Taxation Practice Question QuestionDocument8 pagesAdvanced Taxation Practice Question QuestionDanisa NdhlovuNo ratings yet

- CH 04 - SolutionsDocument17 pagesCH 04 - SolutionsLuong Hoang Vu100% (2)

- CUAC 408 Group Assignment 1 2021Document6 pagesCUAC 408 Group Assignment 1 2021Blessed Nyama100% (1)

- Comprehension Questions: 1. What Are Minimum Lease Payments'?Document13 pagesComprehension Questions: 1. What Are Minimum Lease Payments'?Amit ShuklaNo ratings yet

- International Finanacial ManagementDocument6 pagesInternational Finanacial ManagementAyesha SiddikaNo ratings yet

- BUSI 353 S18 Assignment 4 SOLUTIONDocument2 pagesBUSI 353 S18 Assignment 4 SOLUTIONTanNo ratings yet

- Chapter-11 Commercial BanksDocument15 pagesChapter-11 Commercial BanksRachrz KohNo ratings yet

- Mac006 A T2 2021 FexDocument7 pagesMac006 A T2 2021 FexHaris MalikNo ratings yet

- Question & Answer 28072015 InventoryDocument5 pagesQuestion & Answer 28072015 InventoryGreen StoneNo ratings yet

- Accrual and ProvisionDocument66 pagesAccrual and ProvisionVeronica Bailey100% (1)

- BUSI 353 S18 Assignment 5 SOLUTIONDocument5 pagesBUSI 353 S18 Assignment 5 SOLUTIONTan100% (2)

- AF308 Second Semester 2020 Short Test TwoDocument3 pagesAF308 Second Semester 2020 Short Test TwoShayal ChandNo ratings yet

- Basic Earnings Per ShareDocument2 pagesBasic Earnings Per Sharedagohoy kennethNo ratings yet

- CH 03 - SolutionsDocument17 pagesCH 03 - SolutionsLuong Hoang Vu80% (5)

- Morris - Breann - 343 - White - Fall2020 Exam #2Document3 pagesMorris - Breann - 343 - White - Fall2020 Exam #2Breann MorrisNo ratings yet

- This Study Resource Was: Adjust CreditDocument4 pagesThis Study Resource Was: Adjust CreditJalaj GuptaNo ratings yet

- WileyPlus PPEDocument9 pagesWileyPlus PPEKaiWenNgNo ratings yet

- Diesel Engines V 4000 M 70 Maintenance Schedule M050488/04EDocument4 pagesDiesel Engines V 4000 M 70 Maintenance Schedule M050488/04EsxturboNo ratings yet

- Do You Think It Was Important For Michael To Stipulate That He Wanted A Business That HeDocument17 pagesDo You Think It Was Important For Michael To Stipulate That He Wanted A Business That Hemiss_hazel85100% (1)

- Problem 1 - 5-6Document4 pagesProblem 1 - 5-6Lowellah Marie BringasNo ratings yet

- Chapter 9 HW QuestionsDocument2 pagesChapter 9 HW QuestionsKayla Shelton0% (1)

- Barstow Company Is Contemplating The Acquisition of The Net AssetsDocument1 pageBarstow Company Is Contemplating The Acquisition of The Net AssetsMuhammad ShahidNo ratings yet

- ACCA F7 MockDocument17 pagesACCA F7 MockayeshaghufranNo ratings yet

- Chapter 15Document16 pagesChapter 15kylicia bestNo ratings yet

- Ias 21 Effects of Changes in Foreign Exchange RatesDocument8 pagesIas 21 Effects of Changes in Foreign Exchange RatesTawanda Tatenda HerbertNo ratings yet

- Chapter 8.6Document3 pagesChapter 8.6CarlosnyNo ratings yet

- IAS 19 QuestionsDocument4 pagesIAS 19 QuestionsJuma AllyNo ratings yet

- UST Case Study As of 1993: March 2016Document19 pagesUST Case Study As of 1993: March 2016KshitishNo ratings yet

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanNo ratings yet

- Paper Ii, Question 1: Preparing For The 2003 UFE Understanding The Evaluation Methodology June 2002Document16 pagesPaper Ii, Question 1: Preparing For The 2003 UFE Understanding The Evaluation Methodology June 2002xsnoweyxNo ratings yet

- Pset 1Document5 pagesPset 1KennethFuNo ratings yet

- Module 5Document6 pagesModule 5Mon Ram0% (1)

- 13 International FinanceDocument27 pages13 International FinanceMohammad DwidarNo ratings yet

- Solution Practice 6 Consolidations 3Document8 pagesSolution Practice 6 Consolidations 3Mya Hmuu KhinNo ratings yet

- Decision MakingDocument8 pagesDecision MakingkhandakeralihossainNo ratings yet

- 2 PDocument238 pages2 Pbillyryan1100% (3)

- Chapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeDocument9 pagesChapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeAnna TaylorNo ratings yet

- Rolfe Company A U S Based Company Has A Subsidiary in NigeriaDocument2 pagesRolfe Company A U S Based Company Has A Subsidiary in NigeriaAmit PandeyNo ratings yet

- CH 03Document4 pagesCH 03flrnciairnNo ratings yet

- Chapter 009 Test BankDocument13 pagesChapter 009 Test Banknadecho1No ratings yet

- Earning Per Shares 1Document45 pagesEarning Per Shares 1kaviyapriyaNo ratings yet

- Solved Calabra S A A Peruvian Corporation Manufactures Inventory in Peru The PDFDocument1 pageSolved Calabra S A A Peruvian Corporation Manufactures Inventory in Peru The PDFAnbu jaromiaNo ratings yet

- Solved Night Inc A Domestic Corporation Earned 300 000 From Foreign ManufacturingDocument1 pageSolved Night Inc A Domestic Corporation Earned 300 000 From Foreign ManufacturingAnbu jaromiaNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Colleague Picks Up The 2012 Annual Report of MicrosoftDocument1 pageSolved Your Colleague Picks Up The 2012 Annual Report of MicrosoftAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Have An Employee Who Has A Chemical Imbalance inDocument1 pageSolved You Have An Employee Who Has A Chemical Imbalance inAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved With The Recent Changes in The Tax Law Definition ofDocument1 pageSolved With The Recent Changes in The Tax Law Definition ofAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved White S Printing LTD S Year End Is February 28 The AccountingDocument1 pageSolved White S Printing LTD S Year End Is February 28 The AccountingAnbu jaromiaNo ratings yet

- Alpha Group Company Profile 12.8.21Document28 pagesAlpha Group Company Profile 12.8.21Laeth HarebNo ratings yet

- RTGS Indian Overseas BankDocument2 pagesRTGS Indian Overseas Bankanaga1982No ratings yet

- Tax Notes TodayDocument2 pagesTax Notes TodayThe Washington PostNo ratings yet

- Gradfee2013 To 2016Document37 pagesGradfee2013 To 2016nemson999No ratings yet

- Module No. 2 - Special CorporationsDocument8 pagesModule No. 2 - Special CorporationsJohn Russel PacunNo ratings yet

- SalarySlip 1 - 2023Document1 pageSalarySlip 1 - 2023Rizham IbniNo ratings yet

- Gmail - Booking Confirmation On IRCTC, Train - 22181, 09-Dec-2019, SL, JBP - NZMDocument3 pagesGmail - Booking Confirmation On IRCTC, Train - 22181, 09-Dec-2019, SL, JBP - NZMShivamSrivastavaNo ratings yet

- 2010-11 PAYG - FN Tax TablesDocument12 pages2010-11 PAYG - FN Tax Tablescyclops4569No ratings yet

- Keafer Mfg. Cash BudgetDocument2 pagesKeafer Mfg. Cash BudgetElcah Myrrh LaridaNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityACYATAN & CO., CPAs 2020No ratings yet

- Phil Guaranty Co Vs Commissioner, G.R. No. L-22074 April 30, 1965Document3 pagesPhil Guaranty Co Vs Commissioner, G.R. No. L-22074 April 30, 1965Antonio Palpal-latocNo ratings yet

- Wire TransferDocument4 pagesWire Transfermichaelgracias700No ratings yet

- Insync CTC Breakup PDFDocument1 pageInsync CTC Breakup PDFSocialIndostoriesNo ratings yet

- Fiber Monthly Statement: This Month's SummaryDocument4 pagesFiber Monthly Statement: This Month's SummaryShivang SethNo ratings yet

- 929 Vimala InvoicegstDocument1 page929 Vimala InvoicegstMugesh KumarNo ratings yet

- 1FSales and Distribution Accounting EntriesDocument4 pages1FSales and Distribution Accounting EntriesKunjunni MashNo ratings yet

- Penalties and RemediesDocument3 pagesPenalties and RemediesAerl XuanNo ratings yet

- Your Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan NovemberDocument3 pagesYour Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan NovemberQeena QaleesyaNo ratings yet

- Authorisation and Declaration 20230313Document1 pageAuthorisation and Declaration 20230313VikramNo ratings yet

- SE FY14 - Compensation Plan Group IIIDocument2 pagesSE FY14 - Compensation Plan Group IIISabyasachi DeNo ratings yet

- Proforma Invoice: SNO Particulars PAX Rate SER. CHG @5% TAX @18/12% Rate With Tax Total Waived Off Waived Off Waived OffDocument1 pageProforma Invoice: SNO Particulars PAX Rate SER. CHG @5% TAX @18/12% Rate With Tax Total Waived Off Waived Off Waived OffNigel PasannaNo ratings yet

- Fine Print Pay StubDocument3 pagesFine Print Pay Stubapi-680806307No ratings yet

- Account Statement From 1 Jun 2021 To 24 Oct 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 1 Jun 2021 To 24 Oct 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceProxyNo ratings yet