Professional Documents

Culture Documents

Solved This Year Fig Corporation Made A 100 000 Contribution To Charity

Uploaded by

Anbu jaromiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved This Year Fig Corporation Made A 100 000 Contribution To Charity

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) This year Fig Corporation made a 100 000

contribution to charity

This year, Fig Corporation made a $100,000 contribution to charity. In each of the following

situations, compute the after-tax cost of this contribution assuming that Fig uses a 6 percent

discount rate to compute NPV. a. Fig had $8 million taxable income before consideration of the

contribution. b. Fig had […]

This year, GHJ Inc. received the following dividends: BP Inc. (a taxable California corporation in

which GHJ holds a 2% stock interest) ……………….. $17,300 MN Inc. (a taxable Florida corporation in

which GHJ holds a 52% stock interest) ……………….. 80,800 AB Inc. (a taxable French corporation in

which GHJ holds […]

This year, Napa Corporation received the following dividends: KLP Inc. (a taxable Delaware

corporation in which Napa holds an 8% stock interest) ……………… $ 55,000 Gamma Inc. (a taxable

Florida corporation in which Napa holds a 90% stock interest) ………………. 120,000 Napa and

Gamma do not file a consolidated tax […]

Corporation P owns 93 percent of the outstanding stock of Corporation T. This year, the

corporations’ records provide the following information: a. Compute each corporation’s taxable

income if they file separate tax returns. b. Compute consolidated taxable income if Corporation

P and Corporation T file a consolidated tax return.

GET ANSWER- https://accanswer.com/downloads/page/1506/

Griffin Corporation received $50,000 of dividend income from Eagle, Inc. Griffin owns 5 percent

of the outstanding stock of Eagle. Griffin’s marginal tax rate is 35 percent. a. Calculate Griffin’s

allowable dividends-received deduction and its after-tax cash flow as a result of the dividend

from Eagle. b. How would your […]

James, who is in the 35 percent marginal tax bracket, owns 100 percent of the stock of JJ Inc.

This year, JJ generates $500,000 taxable income and pays a $100,000 dividend to James.

Compute his tax on the dividend under each of the following assumptions: a. The federal tax

rules […]

Hall Corporation was formed in 2011 and was exempt from AMT for that year. For 2012 through

2014, its regular tax and tentative minimum tax were as follows: a. Compute Hall’s tax for 2012,

2013, and 2014. b. Compute Hall’s tax for 2015 if its regular taxable income is $9 […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1506/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Determining relevant cash flows for hoist replacementDocument19 pagesDetermining relevant cash flows for hoist replacementJhoni Lim67% (3)

- TSB Bank Statement SummaryDocument4 pagesTSB Bank Statement SummaryDotopuberNo ratings yet

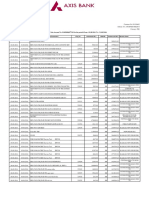

- AGICL Axis Bank Statement Aug 2016 PDFDocument7 pagesAGICL Axis Bank Statement Aug 2016 PDFSagar Asati100% (1)

- EIN and Biz RegistrationDocument2 pagesEIN and Biz RegistrationmaufunctNo ratings yet

- Test Bank For McGraw Hill's Taxation of Individuals and Business Entities, 2024 15th EditionDocument57 pagesTest Bank For McGraw Hill's Taxation of Individuals and Business Entities, 2024 15th EditionDiya ReddyNo ratings yet

- CH 16Document12 pagesCH 16DaleClemence09100% (1)

- BIR Ruling No 05714Document4 pagesBIR Ruling No 05714Harvey Bourdain LenonNo ratings yet

- Chapter c10Document42 pagesChapter c10DrellyNo ratings yet

- Intercompany Indebtedness Chapter SolutionsDocument61 pagesIntercompany Indebtedness Chapter SolutionsNatasya JulyetaNo ratings yet

- Chapter 19 Solutions ManualDocument28 pagesChapter 19 Solutions ManualLeigh RojasNo ratings yet

- CH 4 Classpack With SolutionsDocument24 pagesCH 4 Classpack With SolutionsjimenaNo ratings yet

- MGMT 343 Exam 2 ReviewDocument3 pagesMGMT 343 Exam 2 ReviewBreann MorrisNo ratings yet

- Solutions BD3 SM24 GEDocument4 pagesSolutions BD3 SM24 GEAgnes ChewNo ratings yet

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanNo ratings yet

- The Polks Tax CalculationDocument8 pagesThe Polks Tax CalculationhuytrinhxNo ratings yet

- Week 3 Answers To Questions Final DFTDocument10 pagesWeek 3 Answers To Questions Final DFTGabriel Aaron Dionne0% (1)

- Corporate Tax HW SolutionsDocument12 pagesCorporate Tax HW SolutionsbiziakmNo ratings yet

- Solved Stan Rented An Office Building To Clay For 3 000 PerDocument1 pageSolved Stan Rented An Office Building To Clay For 3 000 PerAnbu jaromiaNo ratings yet

- Solution To Mid-Term Exam ADM4348M Winter 2011Document17 pagesSolution To Mid-Term Exam ADM4348M Winter 2011SKNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Chapter 17 Test BankDocument52 pagesChapter 17 Test BankBrandon LeeNo ratings yet

- Advance Payment Bank GuaranteeDocument2 pagesAdvance Payment Bank GuaranteenawajhaNo ratings yet

- Chapter c4Document44 pagesChapter c4bobNo ratings yet

- Corporation TaxationDocument16 pagesCorporation TaxationMeg Lee0% (1)

- Chapter c10Document48 pagesChapter c10bobNo ratings yet

- Chapter 009 Test BankDocument13 pagesChapter 009 Test Banknadecho1No ratings yet

- Chapter c9Document45 pagesChapter c9bobNo ratings yet

- Except: © 2009 Pearson Education, Inc. Publishing As Prentice HallDocument10 pagesExcept: © 2009 Pearson Education, Inc. Publishing As Prentice Hallb-80815bNo ratings yet

- Chapter c3Document47 pagesChapter c3bobNo ratings yet

- ACC 430 Chapter 10Document20 pagesACC 430 Chapter 10vikkiNo ratings yet

- Financial Statment TestDocument3 pagesFinancial Statment TestDerick FloresNo ratings yet

- TB Special - PDF 15 & 16Document12 pagesTB Special - PDF 15 & 16Rabie HarounNo ratings yet

- Property Plant Equipment: Sukhpreet KaurDocument79 pagesProperty Plant Equipment: Sukhpreet KaurJeryl AlfantaNo ratings yet

- Advanced Accounting Baker Test Bank - Chap009Document57 pagesAdvanced Accounting Baker Test Bank - Chap009donkazotey100% (3)

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Document4 pagesPayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangNo ratings yet

- Hoyle Sg03Document17 pagesHoyle Sg03AgentSkySkyNo ratings yet

- Chapter Eight: Cost-Volume-Profit AnalysisDocument34 pagesChapter Eight: Cost-Volume-Profit AnalysisBartholomew SzoldNo ratings yet

- MC Practice Ch 16 Capital StructureDocument3 pagesMC Practice Ch 16 Capital Structurebusiness docNo ratings yet

- Consolidated Financial Statements - Intra-Entity Asset TransactionsDocument15 pagesConsolidated Financial Statements - Intra-Entity Asset TransactionsAdi Putra Pratama NNo ratings yet

- Aicpa 040212far SimDocument118 pagesAicpa 040212far SimHanabusa Kawaii IdouNo ratings yet

- EBIT-EPS analysis for financing plan decisionsDocument6 pagesEBIT-EPS analysis for financing plan decisionsSthephany GranadosNo ratings yet

- IMChap 011Document24 pagesIMChap 011Aaron Hamilton100% (2)

- Download: Acc 307 Final Exam Part 1Document2 pagesDownload: Acc 307 Final Exam Part 1AlexNo ratings yet

- The John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)Document10 pagesThe John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)aicellNo ratings yet

- FR15. Provision, Contingent Liab & Assets (Practice)Document4 pagesFR15. Provision, Contingent Liab & Assets (Practice)duong duongNo ratings yet

- Answers R41920 Acctg Varsity Basic Acctg Level 2Document12 pagesAnswers R41920 Acctg Varsity Basic Acctg Level 2John AceNo ratings yet

- Accounting 1 Final Study Guide Version 1Document12 pagesAccounting 1 Final Study Guide Version 1johannaNo ratings yet

- AF308 Short Test 2 MCQsDocument3 pagesAF308 Short Test 2 MCQsShayal ChandNo ratings yet

- CH 5Document83 pagesCH 5Von BerjaNo ratings yet

- Financial Reporting and Changing PricesDocument6 pagesFinancial Reporting and Changing PricesFia RahmaNo ratings yet

- CH 13Document85 pagesCH 13Michael Fine100% (3)

- Understanding Financial StatementsDocument10 pagesUnderstanding Financial StatementsNguyet NguyenNo ratings yet

- Financial Analysis Harley DavidsonDocument5 pagesFinancial Analysis Harley DavidsonAyu Eka Putri50% (2)

- REVIEWERDocument10 pagesREVIEWERRhyna Vergara SumaoyNo ratings yet

- Chapter 8 Case Studies on Inventory Valuation and Accounts ReceivableDocument17 pagesChapter 8 Case Studies on Inventory Valuation and Accounts ReceivableAhmadYaseenNo ratings yet

- Partnership AllocationDocument63 pagesPartnership AllocationMitchelGramaticaNo ratings yet

- (D) Capital of The Surviving SpouseDocument3 pages(D) Capital of The Surviving SpouseAnthony Angel TejaresNo ratings yet

- Delta Oil Company Uses The Successful Efforts Method To Account ForDocument1 pageDelta Oil Company Uses The Successful Efforts Method To Account ForFreelance WorkerNo ratings yet

- Corporate Valuation and Financial Planning: Answers To End-Of-Chapter QuestionsDocument27 pagesCorporate Valuation and Financial Planning: Answers To End-Of-Chapter QuestionsAbdullah SohailNo ratings yet

- Test Bank Ch6 ACCTDocument89 pagesTest Bank Ch6 ACCTMajed100% (1)

- Chapter 9Document18 pagesChapter 9Rubén ZúñigaNo ratings yet

- Chapter 3Document8 pagesChapter 3lijijiw23No ratings yet

- CH 1Document81 pagesCH 1Michael FineNo ratings yet

- Generally Accepted Auditing Standards A Complete Guide - 2020 EditionFrom EverandGenerally Accepted Auditing Standards A Complete Guide - 2020 EditionNo ratings yet

- Solved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromDocument1 pageSolved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromAnbu jaromia0% (1)

- 6352 Pract Exam Part 1Document5 pages6352 Pract Exam Part 1iluvumiNo ratings yet

- Tax ProblemsDocument3 pagesTax Problemsstrikers154No ratings yet

- Solved in Each of The Following Independent Situations Determine The Corporation SDocument1 pageSolved in Each of The Following Independent Situations Determine The Corporation SAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Your Colleague Picks Up The 2012 Annual Report of MicrosoftDocument1 pageSolved Your Colleague Picks Up The 2012 Annual Report of MicrosoftAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved You Have An Employee Who Has A Chemical Imbalance inDocument1 pageSolved You Have An Employee Who Has A Chemical Imbalance inAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved With The Recent Changes in The Tax Law Definition ofDocument1 pageSolved With The Recent Changes in The Tax Law Definition ofAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved White S Printing LTD S Year End Is February 28 The AccountingDocument1 pageSolved White S Printing LTD S Year End Is February 28 The AccountingAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- SITXFIN201 Assessment 2Document10 pagesSITXFIN201 Assessment 2DaveNo ratings yet

- Chapter 11Document2 pagesChapter 11Alyssa BerangberangNo ratings yet

- Tax Remedies: Buslaw3 Atty. MGCDDocument42 pagesTax Remedies: Buslaw3 Atty. MGCDLourenzo GardiolaNo ratings yet

- Order - EnebaDocument1 pageOrder - Enebayannisss61No ratings yet

- CGST & Central Excise - Range OfficeDocument2 pagesCGST & Central Excise - Range OfficeAYUSH PRADHANNo ratings yet

- Christian Medical College Appointment for Bangladeshi PatientDocument2 pagesChristian Medical College Appointment for Bangladeshi Patientrana ranaNo ratings yet

- Account Statement From 1 Mar 2019 To 12 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 1 Mar 2019 To 12 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAkhil ThannikalNo ratings yet

- EA-Part - 3Document106 pagesEA-Part - 3aman9936543060No ratings yet

- EUR To USD - Convert EUR To USD - Exchange Euro To US Dollar - Currency ConverterDocument2 pagesEUR To USD - Convert EUR To USD - Exchange Euro To US Dollar - Currency ConverterBehroz KarimporNo ratings yet

- Del225872Document1 pageDel225872Shriram suryaNo ratings yet

- ATT - USA X 256gbDocument3 pagesATT - USA X 256gbLavish SoodNo ratings yet

- The Billing Mechanism Has Been Revised So That The Benefit of One Previous / Preceeding Slab Is Available To Domestic Consumers (Residential User)Document1 pageThe Billing Mechanism Has Been Revised So That The Benefit of One Previous / Preceeding Slab Is Available To Domestic Consumers (Residential User)Mehtab MalikNo ratings yet

- Circle Electric 40, Yousuf Mansion, New Elephant Road, Dhaka Pay SlipDocument12 pagesCircle Electric 40, Yousuf Mansion, New Elephant Road, Dhaka Pay SlipDJ ATANUNo ratings yet

- 1040x2 PDFDocument2 pages1040x2 PDFolddiggerNo ratings yet

- Payments 101Document37 pagesPayments 101David Leeman100% (1)

- Course DetailsDocument7 pagesCourse DetailsPriyanka KhannaNo ratings yet

- Electronic Payment SystemDocument14 pagesElectronic Payment SystemToppers of WorldsNo ratings yet

- TAXATION KEY POINTSDocument3 pagesTAXATION KEY POINTScherry blossomNo ratings yet

- PBBK Credit Card Form 201912Document5 pagesPBBK Credit Card Form 201912faezNo ratings yet

- Chapter 4-1Document18 pagesChapter 4-1syahiir syauqiiNo ratings yet

- Appendix 46 - RERDocument1 pageAppendix 46 - RERpdmu regionixNo ratings yet

- E4 5Document3 pagesE4 5Andrew ChowNo ratings yet

- CIR Vs Toshiba Information Equipment (Phils) Inc: 150154: August 9, 2005: J.Document12 pagesCIR Vs Toshiba Information Equipment (Phils) Inc: 150154: August 9, 2005: J.Iris MendiolaNo ratings yet