Professional Documents

Culture Documents

Leverage Analsysis

Uploaded by

IfraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Leverage Analsysis

Uploaded by

IfraCopyright:

Available Formats

Leverage Analysis

Lever or leverage is the use of fix costs and debts to magnify

the returns of the business.

Types of leverage:

1. Operating leverage: The use of operating costs to magnify

the returns of the business

2. Financial leverage : The use of financing to magnify the

returns of the business

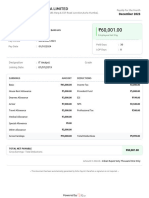

Income statement

FY 2018 FY 2019 Changes (%)

Sales 25000 30000 (Sales – Sales )/ Sales

2019 2018 2018

{(30000-25000)/25000} x100

= +20%

Less CGS

Gross Profit

Less Operating

Expenses

EBIT 5000 5200 (EBIT 2019 – EBIT2018)/ EBIT2018

[(5200-5000)/5000]x100

= +4%

Less Interest

EBT

Less Taxes

EAT

EPS 1.2 1.35 (EPS – EPS )/ EPs

2019 2018 2018

[(1.35-1.2/1.2]x 100

+12.5%

EPS = EAT/ no of

share of common

stock outstanding

From Sale to EBIT --------- operating leverage

From EBIT to EAT or EPS -------------- Financial Leverage

Measurement of Leverage

1. Degree of Operating leverage: DOL : The numerical

measure of operating leverage is called DOL

DOL = %Change in EBIT/ %change in Sales

If DOL > 1 then operating leverage exist, the higher the

value of DOL higher the operating leverage

DOL is used as proxy or measure of operating risk or

business risk as well: If a firm is unable to pay its

operating cost then it is called that operating risk exist

which we have to eradicate or minimize:

DOL = % change in EBIT/ % change in Sales

DOL = +4% /+20%

DOL = 0.2

DOL < 1 so operating leverage does not exist

Degree of Financial Leverage DFL

The numerical measure of financial leverage is called

Degree of Financial leverage: DFL is used as proxy or

measure of financial risk as well: If a firm is unable to

pay its financial cost then it is called that financial risk

exist: we have to manage or diversify this risk as well:

DFL = % change in EPS/ % change in EBIT

DFL = 12.5%/ 4% = 3.125

DFL > 1 it means financial leverage exist:

Degree of Total Leverage

DTL measures the overall leverage

DTL = DOL x DFL

DTL = 0.2 x 3.125 = 0.625

DTL = % change in EPS / % change in Sales

DTL = 12.5%/20% = 0.625

TOTAL RISK = operating risk + Financial Risk

What is Cost:

Cost is an unexpired expense:

Expense is an expired portion of cost:

Costs : Fixed cost and Variable Cost

Fixed Cost: Fixed cost remains fix in total but varies

per unit:

27000/27 = 1000

27000/ 20 = 1350

Variable Cost : Variable cost remain vary in total but

remain fix per unit

100x 5 = 500

100x7 = 700

Break even point = BEP is that point at which no profit

and no loss

BEP = FC/( p-vc)

FC = 2500

Price per unit = Rs 10

Vc per unit = 8

BEP = 2500/ (10-8)

BEP = 1250

Contribution Margin = (Sales Revenue – Variable Cost)

You might also like

- Auditing For Non-AccountantsDocument229 pagesAuditing For Non-AccountantsRheneir Mora100% (2)

- Leverage: Leverage Is That Portion of The Fixed Costs Which Represents A Risk To The Firm. TypesDocument17 pagesLeverage: Leverage Is That Portion of The Fixed Costs Which Represents A Risk To The Firm. Typessameer0725No ratings yet

- Leverage AnalysisDocument29 pagesLeverage AnalysisFALAK OBERAINo ratings yet

- LeverageDocument64 pagesLeverageUsha Padyana100% (1)

- Assignment 05 - Virgin GroupDocument8 pagesAssignment 05 - Virgin GroupFazlanMarikkar100% (1)

- Insurance Awareness PDFDocument20 pagesInsurance Awareness PDFsrutiNo ratings yet

- Seg Funds N Annuities PDFDocument258 pagesSeg Funds N Annuities PDFTaz0007No ratings yet

- Topic 7 - Financial Leverage - Part 1Document82 pagesTopic 7 - Financial Leverage - Part 1Baby KhorNo ratings yet

- Leverage Analysis: Learning ObjectivesDocument19 pagesLeverage Analysis: Learning Objectivesveerd2mp67% (3)

- Cost of Capital ProjectDocument49 pagesCost of Capital ProjectJasmandeep brar100% (3)

- Test Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Document17 pagesTest Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Kimberly Etulle Celona100% (1)

- 8 Capital Budgeting - Problems - With AnswersDocument15 pages8 Capital Budgeting - Problems - With AnswersIamnti domnateNo ratings yet

- Leverage Chap 7 - PoliteknikDocument83 pagesLeverage Chap 7 - PoliteknikShazwani AzmanNo ratings yet

- Day5 - Margin vs. MarkupDocument14 pagesDay5 - Margin vs. MarkupFfrekgtreh FygkohkNo ratings yet

- Draft Refund RulesDocument7 pagesDraft Refund RulessridharanNo ratings yet

- Module 5 1Document6 pagesModule 5 1Manvendra Singh ShekhawatNo ratings yet

- ACCT 311 - Exam 2 Review and SolutionsDocument6 pagesACCT 311 - Exam 2 Review and SolutionsSummerNo ratings yet

- CIR vs. Burroghs, G.R. No. 66653, June 19, 1986Document1 pageCIR vs. Burroghs, G.R. No. 66653, June 19, 1986Oro ChamberNo ratings yet

- Analysis of LeverageDocument20 pagesAnalysis of LeverageIam JaiNo ratings yet

- LeveragesDocument41 pagesLeveragesSohini ChakrabortyNo ratings yet

- The Measure Indicates How A Particular Product Contributes To The Overall Profit of The CompanyDocument3 pagesThe Measure Indicates How A Particular Product Contributes To The Overall Profit of The CompanyNathalie matitoNo ratings yet

- Finance For Managers-Module 4B-LeveragesDocument27 pagesFinance For Managers-Module 4B-LeveragesChayaGandhiNo ratings yet

- Hid - Chapter IV Capital Structure PolicyDocument18 pagesHid - Chapter IV Capital Structure PolicyTsi AwekeNo ratings yet

- Financial LeverageDocument18 pagesFinancial LeverageSTEVE ROGERSNo ratings yet

- Chapter 15 - Analysis and Impact of LeverageDocument38 pagesChapter 15 - Analysis and Impact of LeveragepranavNo ratings yet

- FM FormulasDocument13 pagesFM Formulassudhir.kochhar3530No ratings yet

- Ratio AnalysisDocument32 pagesRatio AnalysisVignesh NarayananNo ratings yet

- Leverage AnalysisDocument22 pagesLeverage AnalysisSiddharthNo ratings yet

- Operating and Financial LeverageDocument31 pagesOperating and Financial LeveragebharatNo ratings yet

- Ratio Analysis I. Profitability RatiosDocument4 pagesRatio Analysis I. Profitability RatiosEnergy GasNo ratings yet

- Operating and Financial Leverages - FinalDocument51 pagesOperating and Financial Leverages - Finalchittesh23No ratings yet

- 07 Capital Structure and LeverageDocument25 pages07 Capital Structure and LeverageRishabh SarawagiNo ratings yet

- Computation of Cost of CapitalDocument6 pagesComputation of Cost of CapitalRajdeep Kaur Bal-RM 20RM935No ratings yet

- Analysis and Impact of Leverage: Operating Leverage Financial Leverage Combined LeverageDocument98 pagesAnalysis and Impact of Leverage: Operating Leverage Financial Leverage Combined Leveragethella deva prasadNo ratings yet

- Operating and Financial Liverage: Presented by Deepak Anand Zafar KamalDocument13 pagesOperating and Financial Liverage: Presented by Deepak Anand Zafar KamalZafar KamalNo ratings yet

- Financial LeverageDocument16 pagesFinancial LeverageEvan MiñozaNo ratings yet

- Chapter 4 Capital Structure PolicyDocument17 pagesChapter 4 Capital Structure PolicyAndualem ZenebeNo ratings yet

- Capital Structure and Leverage Chapter - One Part-1Document38 pagesCapital Structure and Leverage Chapter - One Part-1shimelisNo ratings yet

- Leverage: " Give Me A Lever Long Enough and A Fulcrum On Which To Place It and I Shall Move The World"Document51 pagesLeverage: " Give Me A Lever Long Enough and A Fulcrum On Which To Place It and I Shall Move The World"vints_87No ratings yet

- Unit 8Document17 pagesUnit 8sheetal gudseNo ratings yet

- Business Studies FinalDocument20 pagesBusiness Studies FinalWillard MusengeyiNo ratings yet

- FM S3 LeverageDocument20 pagesFM S3 LeverageSunny RajoraNo ratings yet

- Bavishna UpdatedDocument3 pagesBavishna UpdatedMayur MandhubNo ratings yet

- CH 6Document6 pagesCH 6Melkamu TemesgenNo ratings yet

- Inancing Ecisions Everages: Analysis of LeverageDocument8 pagesInancing Ecisions Everages: Analysis of LeverageParth BindalNo ratings yet

- Breakeven AnalysisDocument7 pagesBreakeven AnalysisMohit SidhwaniNo ratings yet

- Leverage & Capital Structure: Prepared by Keldon BauerDocument25 pagesLeverage & Capital Structure: Prepared by Keldon Bauergeeths207No ratings yet

- LeverageDocument23 pagesLeverageHanuman PrasadNo ratings yet

- Acc 6050: Accounting and Financial ReportingDocument5 pagesAcc 6050: Accounting and Financial ReportingDEE0% (1)

- Operating and Financial LeverageDocument23 pagesOperating and Financial Leverageheraaa12345No ratings yet

- FM AssignmentDocument9 pagesFM AssignmentAkshul AgarwalNo ratings yet

- Leverages 1Document33 pagesLeverages 1mahato28No ratings yet

- Leverage AND TYPES of LeaverageDocument10 pagesLeverage AND TYPES of Leaveragesalim1321100% (2)

- Week 5 - Risk Analysis and LeverageDocument20 pagesWeek 5 - Risk Analysis and LeveragePollsNo ratings yet

- Leverage Unit-4 Part - IIDocument34 pagesLeverage Unit-4 Part - IIAstha ParmanandkaNo ratings yet

- LeverageDocument8 pagesLeverageKalam SikderNo ratings yet

- (8b) Analysis of Leverages (Cir. 9.3.2017)Document44 pages(8b) Analysis of Leverages (Cir. 9.3.2017)Sarvar PathanNo ratings yet

- Financial Management - Operating Leverage vs. Financial Leverage - MBA 2019-21 - Sem-IIDocument27 pagesFinancial Management - Operating Leverage vs. Financial Leverage - MBA 2019-21 - Sem-IIYash RampuriaNo ratings yet

- Financing Decision - LeverageDocument6 pagesFinancing Decision - Leverageஇலக்கியச்செல்வி உமாபதிNo ratings yet

- Leverage: Analysis (Analysis Dan Implikasi Pengungkit)Document28 pagesLeverage: Analysis (Analysis Dan Implikasi Pengungkit)arigiofaniNo ratings yet

- Chapter 7 LeverageDocument21 pagesChapter 7 Leveragemuluken walelgnNo ratings yet

- Chapter: Leverage: DOL Sales-VC Ebit DFL Ebit Ebit-I DCL Dol X DFLDocument7 pagesChapter: Leverage: DOL Sales-VC Ebit DFL Ebit Ebit-I DCL Dol X DFLJagadeesh RocckzNo ratings yet

- Financial Management: Operating Leverage & Financial LeverageDocument70 pagesFinancial Management: Operating Leverage & Financial LeverageHarnitNo ratings yet

- Maria FinalDocument8 pagesMaria FinalrideralfiNo ratings yet

- DBB2104 Unit-06Document21 pagesDBB2104 Unit-06anamikarajendran441998No ratings yet

- RatiosDocument4 pagesRatiosshashankNo ratings yet

- What Leverage ProblemsDocument11 pagesWhat Leverage ProblemssanNo ratings yet

- Leverage My PptsDocument34 pagesLeverage My PptsMadhuram SharmaNo ratings yet

- 3 - Topic3 Financial and Operating Leveraging-EditedDocument44 pages3 - Topic3 Financial and Operating Leveraging-EditedCOCONUTNo ratings yet

- Class 1 Source of FundsDocument5 pagesClass 1 Source of FundsMahasweta RoyNo ratings yet

- Dol DFL DTLDocument30 pagesDol DFL DTLZiya M MursalzadeNo ratings yet

- Costs: FinancingDocument6 pagesCosts: FinancingIfraNo ratings yet

- Public LTD Company: Joint Stock CompaniesDocument7 pagesPublic LTD Company: Joint Stock CompaniesIfraNo ratings yet

- Capital Budgeting: 2. Cost and Benefit AnalysisDocument12 pagesCapital Budgeting: 2. Cost and Benefit AnalysisIfraNo ratings yet

- Finance Ratios AnalysisDocument27 pagesFinance Ratios AnalysisIfraNo ratings yet

- Financial Analysis of Security Paper Limited (Ifra Arshad 2016-Ag-7558)Document9 pagesFinancial Analysis of Security Paper Limited (Ifra Arshad 2016-Ag-7558)IfraNo ratings yet

- Reliance Industries Limited (RIL) Is An Indian: Industriies IntroductionDocument8 pagesReliance Industries Limited (RIL) Is An Indian: Industriies IntroductionRahul GaikwadNo ratings yet

- Payslip PIL11250 Jan 2024 4221054843624738094 1706890631521Document1 pagePayslip PIL11250 Jan 2024 4221054843624738094 1706890631521Dipankar BarmanNo ratings yet

- Agency Severance LetterDocument8 pagesAgency Severance Lettercara12345No ratings yet

- GR 103982Document17 pagesGR 103982thefiledetectorNo ratings yet

- Relience Weaving Mills LTD 2015Document30 pagesRelience Weaving Mills LTD 2015haidersarwarNo ratings yet

- Journal FSRUDocument63 pagesJournal FSRUShah Reza Dwiputra100% (1)

- Working Paper Working Paper: Strategic Objectives: Financial Implications: References: Assembly Resolutions in ForceDocument7 pagesWorking Paper Working Paper: Strategic Objectives: Financial Implications: References: Assembly Resolutions in ForceJay309No ratings yet

- BSBFIM501 Assessment Templates V2.0620Document20 pagesBSBFIM501 Assessment Templates V2.0620Maria Clara Forero GNo ratings yet

- Indian Accounting Standard 5Document12 pagesIndian Accounting Standard 5Rattan Preet SinghNo ratings yet

- Chapt-11 Income Tax - IndividualsDocument10 pagesChapt-11 Income Tax - Individualshumnarvios100% (4)

- 9-25 Variable Versus Absorption Costing. The Zeta Company Manufactures Trendy, GoodDocument3 pages9-25 Variable Versus Absorption Costing. The Zeta Company Manufactures Trendy, GoodElliot Richard100% (1)

- Summer Internship ReportDocument23 pagesSummer Internship ReportAyush MishraNo ratings yet

- REXEL SA - Research Report - FinalDocument6 pagesREXEL SA - Research Report - FinalGlen BorgNo ratings yet

- Buacc5934 Financial AccountingDocument12 pagesBuacc5934 Financial AccountingamnaNo ratings yet

- Marico: Marico Announces Restructuring PlanDocument8 pagesMarico: Marico Announces Restructuring PlanAngel BrokingNo ratings yet

- CH 1 QuizDocument4 pagesCH 1 QuizBreann MorrisNo ratings yet

- Ing Direct Case StudyDocument27 pagesIng Direct Case StudySreerag GangadharanNo ratings yet

- Modified UCA Cash Flow FormatDocument48 pagesModified UCA Cash Flow FormatJohan100% (1)