Professional Documents

Culture Documents

During 2016 Ryel Company S Controller Asked You To Prepare Correcting

During 2016 Ryel Company S Controller Asked You To Prepare Correcting

Uploaded by

Freelance Worker0 ratings0% found this document useful (0 votes)

100 views1 pageRyel Company's controller asked for correcting journal entries for 3 situations involving fixed asset depreciation calculations. Situation 1 involves adjusting the service life estimate and accumulated depreciation for Machine A. Situation 2 involves changing the depreciation method for Machine B from double declining balance to straight line. Situation 3 involves correcting an error that included the estimated residual value in the depreciation calculation for Machine C.

Original Description:

Original Title

During 2016 Ryel Company s Controller Asked You to Prepare Correcting

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRyel Company's controller asked for correcting journal entries for 3 situations involving fixed asset depreciation calculations. Situation 1 involves adjusting the service life estimate and accumulated depreciation for Machine A. Situation 2 involves changing the depreciation method for Machine B from double declining balance to straight line. Situation 3 involves correcting an error that included the estimated residual value in the depreciation calculation for Machine C.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

100 views1 pageDuring 2016 Ryel Company S Controller Asked You To Prepare Correcting

During 2016 Ryel Company S Controller Asked You To Prepare Correcting

Uploaded by

Freelance WorkerRyel Company's controller asked for correcting journal entries for 3 situations involving fixed asset depreciation calculations. Situation 1 involves adjusting the service life estimate and accumulated depreciation for Machine A. Situation 2 involves changing the depreciation method for Machine B from double declining balance to straight line. Situation 3 involves correcting an error that included the estimated residual value in the depreciation calculation for Machine C.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

During 2016 Ryel Company s controller asked you to

prepare correcting #2520

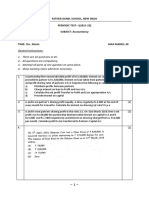

During 2016, Ryel Company’s controller asked you to prepare correcting journal entries for the

following three situations:1. Machine A was purchased for $ 50,000 on January 1, 2011.

Straight- line depreciation has been recorded for 5 years, and the Accumulated Depreciation

account has a balance of $ 25,000. The estimated residual value remains at $ 5,000, but the

service life is now estimated to be 1 year longer than estimated originally.2. Machine B was

purchased for $ 40,000 on January 1, 2014. It had an estimated residual value of $ 5,000 and

an estimated service life of 10 years. It has been depreciated under the double- declining-

balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change

to the straight- line method.3. Machine C was purchased for $ 20,000 on January 1, 2015.

Double- declining- balance depreciation has been recorded for 1 year. The estimated residual

value of the machine is $ 2,000 and the estimated service life is 5 years. The computation of the

depreciation erroneously included the estimated residual value.Required:Prepare any

necessary correcting journal entries for each situation. Also prepare the journal entry necessary

for each situation to record depreciation expense for 2016.View Solution:

During 2016 Ryel Company s controller asked you to prepare correcting

ANSWER

http://paperinstant.com/downloads/during-2016-ryel-company-s-controller-asked-you-to-prepare-

correcting/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- AIS16Exercises SCDocument6 pagesAIS16Exercises SCSarah GherdaouiNo ratings yet

- Prism Region 4a-Pnc Cup Far QuestionsDocument16 pagesPrism Region 4a-Pnc Cup Far QuestionsShin YaeNo ratings yet

- Fzb10 FR Module ADocument21 pagesFzb10 FR Module Aluckylover6543No ratings yet

- The Following Figures Have Been Extracted From The Accounting RecordsDocument1 pageThe Following Figures Have Been Extracted From The Accounting RecordsHassan JanNo ratings yet

- Ias 16Document6 pagesIas 16Noman Anser0% (1)

- Chapter 10 Noncurrent Assets: Discussion QuestionsDocument6 pagesChapter 10 Noncurrent Assets: Discussion QuestionskietNo ratings yet

- Nonaccelerated Depreciation MethodsDocument4 pagesNonaccelerated Depreciation Methodsrahman.mahfuz9966No ratings yet

- You Have Been Assigned To Examine The Financial Statements of PDFDocument2 pagesYou Have Been Assigned To Examine The Financial Statements of PDFHassan JanNo ratings yet

- Solved Watkins Inc Acquires All of The Outstanding Stock of GlenDocument1 pageSolved Watkins Inc Acquires All of The Outstanding Stock of GlenAnbu jaromiaNo ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- Case AlliedDocument2 pagesCase AlliedChiNo ratings yet

- Depreciation TutorialsDocument4 pagesDepreciation TutorialsTifran JuniorNo ratings yet

- 2021 COAF 4201 GroupsDocument16 pages2021 COAF 4201 GroupsTawanda Tatenda HerbertNo ratings yet

- As Audit Partner For Grupo and Rijo You Are in PDFDocument1 pageAs Audit Partner For Grupo and Rijo You Are in PDFAnbu jaromiaNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- Depreciation AssignmentDocument2 pagesDepreciation AssignmentAdil Khan LodhiNo ratings yet

- CH 11Document6 pagesCH 11Saleh RaoufNo ratings yet

- Case Set 7 - Subsequent Events and Going ConcernDocument5 pagesCase Set 7 - Subsequent Events and Going ConcernTimothy WongNo ratings yet

- Rise FAR 2 LecturesDocument288 pagesRise FAR 2 LecturesmusaNo ratings yet

- MN20501 Lecture 9 Review ExerciseDocument3 pagesMN20501 Lecture 9 Review Exercisesamvrab1919No ratings yet

- Specific Financial Reporting Ac413 May19cDocument5 pagesSpecific Financial Reporting Ac413 May19cAnishahNo ratings yet

- Managerial Accounting Assignment: Company Chosen: SAILDocument11 pagesManagerial Accounting Assignment: Company Chosen: SAILBloomy devasiaNo ratings yet

- PPE QUIZ MAY 2 ProblemsDocument3 pagesPPE QUIZ MAY 2 ProblemsGenivy SalidoNo ratings yet

- On January 1 2011 Borstad Company Purchased Equipment ForDocument1 pageOn January 1 2011 Borstad Company Purchased Equipment ForHassan JanNo ratings yet

- Last - 105Document10 pagesLast - 105ricamae saladagaNo ratings yet

- Part 2 Long Term Decision 1Document4 pagesPart 2 Long Term Decision 1Aye Mya KhineNo ratings yet

- Tutorial 13 & 14 (Exercise)Document2 pagesTutorial 13 & 14 (Exercise)Vidya IntaniNo ratings yet

- PPE ExerciseDocument4 pagesPPE ExerciseLlyod Francis LaylayNo ratings yet

- MJ16 Hybrid F8 QP Clean ProofDocument5 pagesMJ16 Hybrid F8 QP Clean ProofjoelvalentinorNo ratings yet

- M - Limited Companies (After Edit)Document41 pagesM - Limited Companies (After Edit)PublicEnemy007No ratings yet

- Acc 308-Week3 - 3-2 Homework Chapter 11Document7 pagesAcc 308-Week3 - 3-2 Homework Chapter 11Lilian LNo ratings yet

- Acc2142 Tutorial 1Document2 pagesAcc2142 Tutorial 1Ndivho MavhethaNo ratings yet

- 1458118002cbse Pariksha Accountancy I For 17 March ExamDocument11 pages1458118002cbse Pariksha Accountancy I For 17 March ExamMerlin KNo ratings yet

- Ac413 Supp Feb20Document5 pagesAc413 Supp Feb20AnishahNo ratings yet

- 29Document3 pages29sharathk916No ratings yet

- Ajanta Public School: General InstructionsDocument3 pagesAjanta Public School: General Instructionsbhumika aggarwalNo ratings yet

- Cbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Document6 pagesCbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Sukhman DhillonNo ratings yet

- CACC021 CF - Questions (2023)Document10 pagesCACC021 CF - Questions (2023)ShantellNo ratings yet

- Class Exercises - Reporting AssetsDocument6 pagesClass Exercises - Reporting AssetsShiftussy Enjoyer (JoniXx)No ratings yet

- Notes Part 1Document9 pagesNotes Part 1dgdeguzmanNo ratings yet

- Gurukripa's Guideline Answers To Nov 2013 Exam Questions CA Inter (IPC) Group I AccountingDocument14 pagesGurukripa's Guideline Answers To Nov 2013 Exam Questions CA Inter (IPC) Group I AccountingAbhishek ChowdhuryNo ratings yet

- Management Accounting 2Document3 pagesManagement Accounting 2ROB101512No ratings yet

- Generally Accepted Accounting Principles (GAAP) andDocument58 pagesGenerally Accepted Accounting Principles (GAAP) andamithkiran100% (1)

- Corporate Reporting (United Kingdom) : Tuesday 13 December 2011Document6 pagesCorporate Reporting (United Kingdom) : Tuesday 13 December 2011Neel ShahNo ratings yet

- DepreciationDocument4 pagesDepreciationeunwink eunwinkNo ratings yet

- The Draft Trial Balance of Regent LTD As at 31Document1 pageThe Draft Trial Balance of Regent LTD As at 31Miroslav GegoskiNo ratings yet

- Eefm ProblemsDocument4 pagesEefm ProblemsChitrala DhruvNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument12 pages© The Institute of Chartered Accountants of IndiaOcto ManNo ratings yet

- Tutorial Questions-SolvedDocument9 pagesTutorial Questions-SolvedRami RRKNo ratings yet

- Chapter 3 - Economic Evaluation of AlternativesDocument21 pagesChapter 3 - Economic Evaluation of Alternativessam guptNo ratings yet

- Assignment On DepreciationDocument4 pagesAssignment On DepreciationNouman MujahidNo ratings yet

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyNo ratings yet

- The General Ledger of Pipers Plumbing at January 1 2012Document1 pageThe General Ledger of Pipers Plumbing at January 1 2012Bube KachevskaNo ratings yet

- Tutorial 10 (Exercise)Document1 pageTutorial 10 (Exercise)Vidya IntaniNo ratings yet

- DocumentDocument12 pagesDocumentTanuNo ratings yet

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- CF1 Homework 4Document2 pagesCF1 Homework 4Rudine Pak MulNo ratings yet

- Error DiscussionDocument2 pagesError DiscussionGloria Beltran100% (1)

- Laurus Labs Q4FY20 Concall HighlightsDocument2 pagesLaurus Labs Q4FY20 Concall HighlightssudhakarrrrrrNo ratings yet

- Using The Trial Balance Prepared For X Factor Accounting in PartDocument1 pageUsing The Trial Balance Prepared For X Factor Accounting in PartFreelance WorkerNo ratings yet

- Using The Trial Balance Prepared For Binbutti Engineering in PartDocument1 pageUsing The Trial Balance Prepared For Binbutti Engineering in PartFreelance Worker0% (2)

- Vencap Inc Is A Venture Capital Financier It Estimates ThatDocument1 pageVencap Inc Is A Venture Capital Financier It Estimates ThatFreelance WorkerNo ratings yet

- Valor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsDocument1 pageValor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsFreelance WorkerNo ratings yet

- Using The Ledger Balances and Additional Data Shown On TheDocument1 pageUsing The Ledger Balances and Additional Data Shown On TheFreelance WorkerNo ratings yet

- Using The Information Provided in Part 1 of Problem 1Document1 pageUsing The Information Provided in Part 1 of Problem 1Freelance WorkerNo ratings yet

- Using The Information in Problem 3 9a Complete The Following in ProblemDocument1 pageUsing The Information in Problem 3 9a Complete The Following in ProblemFreelance WorkerNo ratings yet

- Using The Information in Exercise 7 A Present The Journal EntriesDocument1 pageUsing The Information in Exercise 7 A Present The Journal EntriesFreelance WorkerNo ratings yet

- Use The Data From Problem 6 5a and Do The QuestionDocument1 pageUse The Data From Problem 6 5a and Do The QuestionFreelance WorkerNo ratings yet

- Using The General Journal Entries Prepared in Problem 2 3b CompleteDocument1 pageUsing The General Journal Entries Prepared in Problem 2 3b CompleteFreelance WorkerNo ratings yet

- Using The Following Independent Situations Answer The Following Questions SituationDocument1 pageUsing The Following Independent Situations Answer The Following Questions SituationFreelance WorkerNo ratings yet

- Two Alternative Machines Are Being Considered For A Cost Reduction ProjectDocument1 pageTwo Alternative Machines Are Being Considered For A Cost Reduction ProjectFreelance WorkerNo ratings yet

- Ubs Ag Is A Global Provider of Financial Services ToDocument1 pageUbs Ag Is A Global Provider of Financial Services ToFreelance WorkerNo ratings yet