Professional Documents

Culture Documents

In October Nicole Eliminated All Existing Inventory of Cosmetic Items

Uploaded by

Let's Talk With Hassan0 ratings0% found this document useful (0 votes)

154 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

154 views1 pageIn October Nicole Eliminated All Existing Inventory of Cosmetic Items

Uploaded by

Let's Talk With HassanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

In October Nicole eliminated all existing inventory of

cosmetic items #2751

In October, Nicole eliminated all existing inventory of cosmetic items. The trouble of ordering

and tracking each product line had exceeded the profits earned. In December, a supplier asked

her to sell a prepackaged spa kit. Feeling she could manage a single product line, Nicole

agreed. Nicole’s Getaway Spa (NGS) would make monthly purchases from the supplier at a

cost that included production costs and a transportation charge. NGS would keep track of its

new inventory using a perpetual inventory system.On December 31, NGS purchased 10 units at

a total cost of $ 6 per unit. Nicole purchased 25 more units at $ 8 in February. In March, Nicole

purchased 15 units at $ 10 per unit. In May, 50 units were purchased at $ 9.80 per unit. In June,

NGS sold 50 units at a selling price of $ 12 per unit and 35 units at $ 10 per unit.Required:1.

Explain whether the transportation cost included in each purchase should be recorded as a cost

of the inventory or immediately expensed.2. Compute the Cost of Goods Available for Sale,

Cost of Goods Sold, and Cost of Ending Inventory using the first-in, first-out (FIFO) method.3.

Calculate the inventory turnover ratio (round to one decimal place), using the inventory

purchased on December 31 as the beginning inventory. The supplier reported that the typical

inventory turnover ratio was 6.0. How does NGS’s ratio compare?4. Would a different inventory

cost flow assumption allow Nicole’s Getaway Spa to better minimize its income tax?View

Solution:

In October Nicole eliminated all existing inventory of cosmetic items

ANSWER

http://paperinstant.com/downloads/in-october-nicole-eliminated-all-existing-inventory-of-

cosmetic-items/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Nicole S Getaway Spa Ngs Has Been So Successful That NicoleDocument1 pageNicole S Getaway Spa Ngs Has Been So Successful That NicoleHassan JanNo ratings yet

- Chapter 6 TestDocument10 pagesChapter 6 TestJasonNo ratings yet

- Nicole Has Been Financing Nicole S Getaway Spa Ngs Using EquityDocument1 pageNicole Has Been Financing Nicole S Getaway Spa Ngs Using EquityHassan JanNo ratings yet

- Accounting 2 DR Selim Chapter 4Document23 pagesAccounting 2 DR Selim Chapter 4Souliman MuhammadNo ratings yet

- INVENTORIES and COST OF GOODS SOLDDocument75 pagesINVENTORIES and COST OF GOODS SOLDNeway AlemNo ratings yet

- Chapter 6 Inventory Question ReviewDocument12 pagesChapter 6 Inventory Question ReviewPooja SNo ratings yet

- Chap 6 HomeworkDocument2 pagesChap 6 HomeworkTaghi MammadovNo ratings yet

- Case Study On L.L.Bean, Inc. (Item Forecasting and Inventory Management)Document11 pagesCase Study On L.L.Bean, Inc. (Item Forecasting and Inventory Management)shivendrakadamNo ratings yet

- L.L.Bean, Inc.: (Item Forecasting and Inventory Management)Document9 pagesL.L.Bean, Inc.: (Item Forecasting and Inventory Management)Swarnajit SahaNo ratings yet

- Chapter 6Document49 pagesChapter 6Nguyen Vu Thuc Uyen (K17 QN)No ratings yet

- 3311 CH 8 REVIEWDocument5 pages3311 CH 8 REVIEWVernon Dwanye LewisNo ratings yet

- MIP PresentationDocument19 pagesMIP Presentationsanjay sayankarNo ratings yet

- Sslides - Vatel - Lslides - Review of Chap 6Document11 pagesSslides - Vatel - Lslides - Review of Chap 6uyenthanhtran2312No ratings yet

- Inventory and Cost of Goods Sold (Practice Quiz)Document4 pagesInventory and Cost of Goods Sold (Practice Quiz)Monique100% (1)

- Computing The Total Storage Space: Student Date PeriodDocument7 pagesComputing The Total Storage Space: Student Date PeriodJennifer Nicole DomingoNo ratings yet

- Inventory Problems For QuestionnaireDocument3 pagesInventory Problems For QuestionnairehieuNo ratings yet

- ACTG 240 - Week 7Document48 pagesACTG 240 - Week 7xxmbetaNo ratings yet

- Q2 G9 ThematicDocument21 pagesQ2 G9 ThematicIrish Angela PolanNo ratings yet

- Chapter 5 Inventories and CGSDocument68 pagesChapter 5 Inventories and CGSAddisalem Mesfin100% (1)

- The Following Transactions Occurred Over The Months of September ToDocument1 pageThe Following Transactions Occurred Over The Months of September ToTaimour HassanNo ratings yet

- Nestlé's 4P Marketing Strategy for Pure Life WaterDocument2 pagesNestlé's 4P Marketing Strategy for Pure Life WaterMarie NoëlNo ratings yet

- Assignment2revised1Document5 pagesAssignment2revised1Pankaj KhannaNo ratings yet

- Standard Costing ExercisesDocument5 pagesStandard Costing Exercisessehun ohNo ratings yet

- Nicole Mackisey Is Thinking of Forming Her Own Spa BusinessDocument1 pageNicole Mackisey Is Thinking of Forming Her Own Spa BusinessHassan JanNo ratings yet

- IceKube SimulationDocument3 pagesIceKube SimulationMaryModNo ratings yet

- 8 Altprob 6eDocument5 pages8 Altprob 6eAshish BhallaNo ratings yet

- Chapter 5 ICADocument1 pageChapter 5 ICAAndrew MarchukNo ratings yet

- Cursod Albert DLLDocument5 pagesCursod Albert DLLAlbert Ventero CursodNo ratings yet

- Inventories Valuation A Cost Basis ApproachDocument19 pagesInventories Valuation A Cost Basis Approachabshir haybeNo ratings yet

- Break Even AnalysisDocument20 pagesBreak Even AnalysisirissocabaNo ratings yet

- Best Yet Electronic Center Began October With 100 Units ofDocument1 pageBest Yet Electronic Center Began October With 100 Units ofhassan taimourNo ratings yet

- Any Kind of Plagiarism (Cheating, Copying, Googling Etc.) Will Lead Towards A Straight 0 (Zero) in TheDocument2 pagesAny Kind of Plagiarism (Cheating, Copying, Googling Etc.) Will Lead Towards A Straight 0 (Zero) in TheMaverickNo ratings yet

- Activity No. 3 ProblemsDocument2 pagesActivity No. 3 ProblemsKrung KrungNo ratings yet

- Inventory: Key Topics To KnowDocument9 pagesInventory: Key Topics To KnowYaregal YeshiwasNo ratings yet

- Cost Accounting Materials ProceduresDocument31 pagesCost Accounting Materials ProceduresBhupendra SinghNo ratings yet

- Management Accounting II Problem Solving QuizDocument2 pagesManagement Accounting II Problem Solving QuizOlivia Chanco ManriqueNo ratings yet

- Management Accounting II Quiz SolutionsDocument2 pagesManagement Accounting II Quiz SolutionsOlivia Chanco ManriqueNo ratings yet

- At The Beginning of November Yoshi Inc S Inventory Consists ofDocument1 pageAt The Beginning of November Yoshi Inc S Inventory Consists ofMiroslav GegoskiNo ratings yet

- Bis Sheet 3Document11 pagesBis Sheet 3magdy kamelNo ratings yet

- Chapter One InventoryDocument76 pagesChapter One Inventorykenenisagetachew856No ratings yet

- At December 31 2015 The Records of Kozmetsky Corporation Provided PDFDocument1 pageAt December 31 2015 The Records of Kozmetsky Corporation Provided PDFFreelance WorkerNo ratings yet

- Saint Mary's University: Chapter FiveDocument63 pagesSaint Mary's University: Chapter FivehenockNo ratings yet

- Lecture 7 Inventories and Cost of Sales Teaching - NUS ACC1002 2020 SpringDocument39 pagesLecture 7 Inventories and Cost of Sales Teaching - NUS ACC1002 2020 SpringZenyuiNo ratings yet

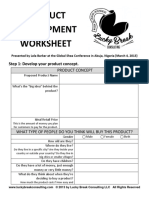

- Product Development WorksheetDocument8 pagesProduct Development WorksheetSOURAV MONDALNo ratings yet

- ACC 1100 Day 12&13 InventoryDocument36 pagesACC 1100 Day 12&13 InventoryMai Anh ĐàoNo ratings yet

- LIFO Method Periodic InvtyDocument9 pagesLIFO Method Periodic InvtyHassleBustNo ratings yet

- Take Home QUIZ and PROBLEM SET in ORDocument1 pageTake Home QUIZ and PROBLEM SET in ORRyan Jeffrey Padua CurbanoNo ratings yet

- Genuine Spice Inc Began Operations On January 1 2016 TheDocument1 pageGenuine Spice Inc Began Operations On January 1 2016 TheMuhammad ShahidNo ratings yet

- Chapter 5 Inventories and CGSDocument68 pagesChapter 5 Inventories and CGSZemene HailuNo ratings yet

- Fa Mock Test Chapter 6&9Document13 pagesFa Mock Test Chapter 6&9Van NguyenNo ratings yet

- CH 06Document6 pagesCH 06Rabie HarounNo ratings yet

- Reduce Consumerism and Reuse for SustainabilityDocument2 pagesReduce Consumerism and Reuse for SustainabilityGianni RaffaNo ratings yet

- Cost Accounting Tutorial 8 - PROBLEMDocument3 pagesCost Accounting Tutorial 8 - PROBLEMelgaavNo ratings yet

- g8 Foods 1st Activity SheetDocument9 pagesg8 Foods 1st Activity SheetanneNo ratings yet

- Problem-1 (Materials, Labor and Variable Overhead Variances)Document3 pagesProblem-1 (Materials, Labor and Variable Overhead Variances)Khim RamosNo ratings yet

- Langley Inc Inventory Records For A Particular Development Program ShowDocument1 pageLangley Inc Inventory Records For A Particular Development Program ShowMuhammad ShahidNo ratings yet

- InventoryDocument57 pagesInventoryGaluh Boga KuswaraNo ratings yet

- Week 3 Chapter 5 - Inventories and Cost of Sales ACC 201 - National UniversityDocument135 pagesWeek 3 Chapter 5 - Inventories and Cost of Sales ACC 201 - National Universitymusic niNo ratings yet

- Wipro Limited Together With Its Subsidiaries and Equity Accounted InvesteesDocument1 pageWipro Limited Together With Its Subsidiaries and Equity Accounted InvesteesLet's Talk With HassanNo ratings yet

- You Are A French Investor Holding A Portfolio of U SDocument1 pageYou Are A French Investor Holding A Portfolio of U SLet's Talk With HassanNo ratings yet

- Wyeth Formerly American Home Products Is A Global Leader inDocument1 pageWyeth Formerly American Home Products Is A Global Leader inLet's Talk With HassanNo ratings yet

- You Are A British Exporter Who Knows in December ThatDocument1 pageYou Are A British Exporter Who Knows in December ThatLet's Talk With HassanNo ratings yet

- Yoklic Corporation Currently Manufactures A Subassembly For Its Main ProductDocument1 pageYoklic Corporation Currently Manufactures A Subassembly For Its Main ProductLet's Talk With HassanNo ratings yet

- XM Satellite Radio Which Launched Its Satellite Radio Service inDocument1 pageXM Satellite Radio Which Launched Its Satellite Radio Service inLet's Talk With HassanNo ratings yet

- Xion Supply Uses A Sales Journal A Purchases Journal ADocument1 pageXion Supply Uses A Sales Journal A Purchases Journal ALet's Talk With HassanNo ratings yet

- Wonderweb Prepares Adjusting Entries Monthly in Reviewing The Accounts OnDocument1 pageWonderweb Prepares Adjusting Entries Monthly in Reviewing The Accounts OnLet's Talk With HassanNo ratings yet

- Wondra Supplies Showed The Following Selected Adjusted Balances at ItsDocument1 pageWondra Supplies Showed The Following Selected Adjusted Balances at ItsLet's Talk With HassanNo ratings yet

- Wicom Servicing Completed These Transactions During November 2014 Its FirstDocument1 pageWicom Servicing Completed These Transactions During November 2014 Its FirstLet's Talk With HassanNo ratings yet

- Wilson Machine Tools Inc A Manufacturer of Fabricated Metal ProductsDocument1 pageWilson Machine Tools Inc A Manufacturer of Fabricated Metal ProductsLet's Talk With HassanNo ratings yet

- Wright Company Leases An Asset For Five Years On DecemberDocument1 pageWright Company Leases An Asset For Five Years On DecemberLet's Talk With HassanNo ratings yet

- WPP Group Headquartered in The United Kingdom Is One ofDocument1 pageWPP Group Headquartered in The United Kingdom Is One ofLet's Talk With HassanNo ratings yet

- Will That Be Cash Credit or Fingertip11 Have You Ever FoundDocument1 pageWill That Be Cash Credit or Fingertip11 Have You Ever FoundLet's Talk With HassanNo ratings yet

- Xenakis A Young Greek Person Arrives On The First DayDocument1 pageXenakis A Young Greek Person Arrives On The First DayLet's Talk With HassanNo ratings yet

- WPP Is A Uk Group Engaged in The Provision ofDocument1 pageWPP Is A Uk Group Engaged in The Provision ofLet's Talk With HassanNo ratings yet

- Wedona Energy Consultants Prepares Adjusting Entries Monthly Based On AnDocument1 pageWedona Energy Consultants Prepares Adjusting Entries Monthly Based On AnLet's Talk With Hassan100% (1)

- The State of Michigan Is Considering A Bill That WouldDocument1 pageThe State of Michigan Is Considering A Bill That WouldLet's Talk With HassanNo ratings yet

- The Shares of Microsoft Were Trading On Nasdaq On JanuaryDocument1 pageThe Shares of Microsoft Were Trading On Nasdaq On JanuaryLet's Talk With HassanNo ratings yet

- Winfrey Designs Had An Unadjusted Credit Balance in Its AllowanceDocument1 pageWinfrey Designs Had An Unadjusted Credit Balance in Its AllowanceLet's Talk With HassanNo ratings yet

- Wilm Schmidt The Owner of Wilm S Window Washing Services HadDocument1 pageWilm Schmidt The Owner of Wilm S Window Washing Services HadLet's Talk With HassanNo ratings yet

- The Spot Exchange Rate Is 10 Mexican Pesos MXP PerDocument1 pageThe Spot Exchange Rate Is 10 Mexican Pesos MXP PerLet's Talk With HassanNo ratings yet

- What Is The Basis of The New Property in EachDocument1 pageWhat Is The Basis of The New Property in EachLet's Talk With HassanNo ratings yet

- The Shares of Volkswagen Trade On The Frankfurt Stock ExchangeDocument1 pageThe Shares of Volkswagen Trade On The Frankfurt Stock ExchangeLet's Talk With HassanNo ratings yet

- The Reality Check Macquarie Leasing Forays Into Australian Motor VehicleDocument1 pageThe Reality Check Macquarie Leasing Forays Into Australian Motor VehicleLet's Talk With HassanNo ratings yet

- The Shares of An Italian Firm Have Been Trading EarlierDocument1 pageThe Shares of An Italian Firm Have Been Trading EarlierLet's Talk With HassanNo ratings yet

- The Standard Deviation of A Foreign Asset in Local CurrencyDocument1 pageThe Standard Deviation of A Foreign Asset in Local CurrencyLet's Talk With HassanNo ratings yet

- The Simon Machine Tools Company Is Considering Purchasing A NewDocument1 pageThe Simon Machine Tools Company Is Considering Purchasing A NewLet's Talk With HassanNo ratings yet

- The Qantas Group Integrates A Sustainability Report With Its AnnualDocument1 pageThe Qantas Group Integrates A Sustainability Report With Its AnnualLet's Talk With HassanNo ratings yet

- The Savage Corporation Purchased Three Milling Machines On January 1Document1 pageThe Savage Corporation Purchased Three Milling Machines On January 1Let's Talk With HassanNo ratings yet

- E. Mortiz Lawyer WorksheetDocument2 pagesE. Mortiz Lawyer WorksheetMellyn CuencoNo ratings yet

- HSBC v. CIRDocument2 pagesHSBC v. CIRReymart-Vin MagulianoNo ratings yet

- Selected Transactions Completed by Equinox Products Inc During The FiscalDocument2 pagesSelected Transactions Completed by Equinox Products Inc During The FiscalAmit PandeyNo ratings yet

- BAAC4206 CH 4 Employement IncomeDocument43 pagesBAAC4206 CH 4 Employement IncomeWijdan Saleem EdwanNo ratings yet

- Finance ProjectDocument83 pagesFinance ProjectSandeep71% (42)

- Business Income IllustrationsDocument12 pagesBusiness Income IllustrationsPatricia NjeriNo ratings yet

- 2.summary - Financial Analysis - GAILDocument7 pages2.summary - Financial Analysis - GAILrahulNo ratings yet

- Practice Set Sol Campus Cycle Practice Campus Cycle Practice SetDocument31 pagesPractice Set Sol Campus Cycle Practice Campus Cycle Practice Setcharrisedelarosa0% (2)

- Akuntansi 1Document1 pageAkuntansi 1Bintang FitriNo ratings yet

- Case Study - Manufacturing Accounting - 10Document2 pagesCase Study - Manufacturing Accounting - 10nadwa dariah50% (2)

- Dragon Oil plc Annual Report highlights record revenues and productionDocument102 pagesDragon Oil plc Annual Report highlights record revenues and productionfaizulramliNo ratings yet

- Saito Solar - Discounted Cash Flow ValuationDocument8 pagesSaito Solar - Discounted Cash Flow ValuationSana BatoolNo ratings yet

- What Are The Main Types of Depreciation Methods?Document8 pagesWhat Are The Main Types of Depreciation Methods?Arkei Fortaleza100% (1)

- Risk Analysis, Real Options and Capital Budgeting PDFDocument62 pagesRisk Analysis, Real Options and Capital Budgeting PDFAMIT SINHA MA ECO DEL 2022-24No ratings yet

- Insteel Wire ProductsDocument9 pagesInsteel Wire ProductsFIN GYAAN100% (1)

- AcadsDocument3 pagesAcadsReid PaladNo ratings yet

- Budget Worksheet: Monthly Net IncomeDocument1 pageBudget Worksheet: Monthly Net IncomeErnestKalamboNo ratings yet

- Notice of Assessment Original: Printed Via Mytax PortalDocument1 pageNotice of Assessment Original: Printed Via Mytax PortalNelly HNo ratings yet

- Reporting ProfitsDocument52 pagesReporting ProfitsxxmbetaNo ratings yet

- NFJPIA Mockboard 2011 P1Document7 pagesNFJPIA Mockboard 2011 P1Jaymee Andomang Os-agNo ratings yet

- Case Questions - Grocery GatewayDocument4 pagesCase Questions - Grocery GatewayPankaj SharmaNo ratings yet

- Interim 7 Consolidation AFAR1Document7 pagesInterim 7 Consolidation AFAR1Bea Tepace PototNo ratings yet

- ANSWERKEYDocument25 pagesANSWERKEYIryne Kim PalatanNo ratings yet

- Quiz 4 - Gross IncomeDocument6 pagesQuiz 4 - Gross IncomeVanessa Grace100% (1)

- Test FAR 570 Feb 2021Document2 pagesTest FAR 570 Feb 2021Putri Naajihah 4GNo ratings yet

- Transaction Cycles - Test of Controls and Substantive Tests of TransactionsDocument9 pagesTransaction Cycles - Test of Controls and Substantive Tests of TransactionsfeNo ratings yet

- Eco Book For May 2023Document185 pagesEco Book For May 2023Kshitij PatilNo ratings yet

- G.R. No. L-9692Document10 pagesG.R. No. L-9692mar corNo ratings yet

- Ent530 - Business Plan - Guidelines & TemplateDocument16 pagesEnt530 - Business Plan - Guidelines & Templateafiqah100% (1)

- Gross Profit Method Inventory EstimationDocument11 pagesGross Profit Method Inventory EstimationJo MalaluanNo ratings yet