Professional Documents

Culture Documents

Notice of Assessment Original: Printed Via Mytax Portal

Uploaded by

Nelly HOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notice of Assessment Original: Printed Via Mytax Portal

Uploaded by

Nelly HCopyright:

Available Formats

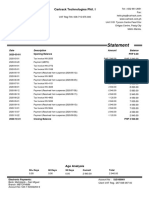

Tax Reference No : SXXXX451E NOTICE OF ASSESSMENT

Year of Assessment : 2020

Income Tax ORIGINAL

Date : 15 Jun 2020

Please quote the Tax Reference Number (eg. NRIC, FIN, etc) in full when corresponding with us.

MS NELLY TERUMI MASUDA HOLLAND

20 IRRAWADDY RD

#24-03

SINGAPORE 329550

55 Newton Road

(3295505) Revenue House

Singapore 307987

Tel: 1800-356 8300

Website: http://www.iras.gov.sg

e-Services: https://mytax.iras.gov.sg

1-1

OTHER 1. Your tax assessment is

S'PORE ($) COUNTRIES ($) TOTAL ($) based on information given by

you through e-Filing on 29 May

TRADE 8,953.00 8,953.00 2020.

EMPLOYMENT 130,000.00 130,000.00

2. You can view your total

TOTAL INCOME 138,953.00 138,953.00 outstanding income tax

payable, if any, via the View

ASSESSABLE INCOME 138,953.00 Account Summary e-Service.

LESS: PERSONAL RELIEFS As you are on GIRO,

Earned Income 1,000.00 deductions for any outstanding

Provident Fund/Life Insurance 615.00 income tax payable will be

made from your bank account

TOTAL PERSONAL RELIEFS 1,615.00 based on your GIRO plan.

CHARGEABLE INCOME 137,338.00 3. If you have any objection,

please submit your objection

FIRST 120,000.00 7,950.00 online within 30 days via the

NEXT 17,338.00 @ 15.00% 2,600.70 10,550.70 Object to Assessment e-service

or email us at myTax Portal.

TAX PAYABLE BY 15 JUL 2020 10,550.70 DR

If you need help with your tax payment, please check go.gov.sg/iras-difficulty-paying-tax

on how you may apply for a longer GIRO payment arrangement.

NG WAI CHOONG

COMPTROLLER OF INCOME TAX

Printed via myTax Portal https://mytax.iras.gov.sg

1-1 Page 1 of 1 301 CFN03101 616-13-645598833-0-8

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Noa-Iit Ob2120200629085533331Document1 pageNoa-Iit Ob2120200629085533331Jay Maung MaungNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Noa-Iit Ob2620150425142233zb4 PDFDocument1 pageNoa-Iit Ob2620150425142233zb4 PDFKanza KhanNo ratings yet

- Notice of Assessment Tax Ref No SXXXX913EDocument1 pageNotice of Assessment Tax Ref No SXXXX913EilamahizhNo ratings yet

- Noa-Iit Ob25202003170642261sf PDFDocument1 pageNoa-Iit Ob25202003170642261sf PDFSoon SoonNo ratings yet

- Noa-Iit Ob2320190701042209hz8Document1 pageNoa-Iit Ob2320190701042209hz8Jay Maung MaungNo ratings yet

- Notice of Assessment Tax ReferenceDocument1 pageNotice of Assessment Tax ReferenceWawan SaidNo ratings yet

- Notice of Assessment Original: Printed Via Mytax PortalDocument1 pageNotice of Assessment Original: Printed Via Mytax PortalAbdul HalimNo ratings yet

- Noa-Iit Ob2320170627071310ufp PDFDocument1 pageNoa-Iit Ob2320170627071310ufp PDFjasper haiNo ratings yet

- Assesment Notice 2017Document1 pageAssesment Notice 2017Shounak KossambeNo ratings yet

- Noa-Iit Ob2620220516193754ktiDocument2 pagesNoa-Iit Ob2620220516193754ktiSelva SelvaNo ratings yet

- Notice of Assessment Amended: Printed Via Mytax PortalDocument1 pageNotice of Assessment Amended: Printed Via Mytax Portalmayoo1986No ratings yet

- Notice of Tax Assessment 2010Document1 pageNotice of Tax Assessment 2010eimanoNo ratings yet

- Tax Notice Assessment No PayableDocument1 pageTax Notice Assessment No PayabletehtarikNo ratings yet

- Noa-Iit Ob2620220516204800b91Document2 pagesNoa-Iit Ob2620220516204800b91Tha OoNo ratings yet

- Tax Credit Certificate 2023 9753768935878Document2 pagesTax Credit Certificate 2023 9753768935878Rogério LimaNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- Noa-Iit Ob26202204230848372gn PDFDocument1 pageNoa-Iit Ob26202204230848372gn PDFWalter SengNo ratings yet

- Noa-Iit Ob2620220530013620coDocument1 pageNoa-Iit Ob2620220530013620coChan Yin YenNo ratings yet

- Noa-Iit Ob2420230619070707preDocument1 pageNoa-Iit Ob2420230619070707prehvikashNo ratings yet

- Tax Credit Certificate 2023 9553776791212Document2 pagesTax Credit Certificate 2023 9553776791212Mariana SurduNo ratings yet

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- Noa-Iit Ob2420230527195835v3iDocument1 pageNoa-Iit Ob2420230527195835v3iRyan TanNo ratings yet

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44wahleng ChewNo ratings yet

- NOA-IIT_OB2220231215050837IBNDocument1 pageNOA-IIT_OB2220231215050837IBNFrankie TanNo ratings yet

- Tax Credit Certificate 2023 9552941697409 PDFDocument2 pagesTax Credit Certificate 2023 9552941697409 PDFCarlos ResendeNo ratings yet

- NOA-IIT_OB25202106140521020NZDocument1 pageNOA-IIT_OB25202106140521020NZ江宗朋No ratings yet

- Notice of Assessment 2022Document2 pagesNotice of Assessment 2022Walter SengNo ratings yet

- SAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Document1 pageSAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Mharck AtienzaNo ratings yet

- Summary of Account: Invoice/Statement of Account Service Tax REG. NO:B16-1808-31031789Document4 pagesSummary of Account: Invoice/Statement of Account Service Tax REG. NO:B16-1808-31031789NKNo ratings yet

- 3122110932007 (2)Document2 pages3122110932007 (2)aalampathan76No ratings yet

- iPhone XS Max InvoiceDocument1 pageiPhone XS Max InvoiceHameed Sarmad100% (4)

- ITR Acknowledgement for Individual Filing ITR-4Document4 pagesITR Acknowledgement for Individual Filing ITR-4Neduri Kalyan SrinivasNo ratings yet

- We Have Many Ways To SERVE YOU!: Statement Date: Mar 12, 2020 Billing Period Covering: Feb 13, 2020 - Mar 12, 2020Document4 pagesWe Have Many Ways To SERVE YOU!: Statement Date: Mar 12, 2020 Billing Period Covering: Feb 13, 2020 - Mar 12, 2020Zhalii CaranayNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Tax Credit Certificate - 2018 : PPS No: 1793106MADocument4 pagesTax Credit Certificate - 2018 : PPS No: 1793106MAAlexandru CiobanuNo ratings yet

- Statement of Account: 0322 Adarna Ext. Unit V - Commonwealth Quezon City Metro ManilaDocument1 pageStatement of Account: 0322 Adarna Ext. Unit V - Commonwealth Quezon City Metro ManilaYsiad LlantosNo ratings yet

- Airw 3Document1 pageAirw 3Bhupendra SinghNo ratings yet

- House No. A-900/102, Workshop Road, GHARIBABAD, Dadu, Dadu. Ali Ahmed BhattiDocument3 pagesHouse No. A-900/102, Workshop Road, GHARIBABAD, Dadu, Dadu. Ali Ahmed BhattiMohsin Ali Shaikh vlogsNo ratings yet

- Statement of Account: Dap-Dap Blk-40 Lot-32 Anupul Bamban TarlacDocument1 pageStatement of Account: Dap-Dap Blk-40 Lot-32 Anupul Bamban TarlacJoyce Gregorio ZamoraNo ratings yet

- 20200731-0100003503-SMMG-Mall-CULLINAN GROUP INCDocument4 pages20200731-0100003503-SMMG-Mall-CULLINAN GROUP INCEdjon AndalNo ratings yet

- Terp Asia Construction Corp.: Statement of AccountDocument4 pagesTerp Asia Construction Corp.: Statement of AccountMark Israel DirectoNo ratings yet

- Social Security System: Collection List Summary For The Month of June 2018Document2 pagesSocial Security System: Collection List Summary For The Month of June 2018Anonymous yIFv8NHHnNo ratings yet

- Preview Notice of AssessmentDocument2 pagesPreview Notice of Assessmentmayoo1986No ratings yet

- 070718515510102010141712Document2 pages070718515510102010141712Shara Joyce Galvez100% (1)

- Í - T pÈ0Â DIGOSÂDOCTORSÂHOS ÂÂÂ Â ÇP") &77Î Digos Doctors Hospital IncDocument2 pagesÍ - T pÈ0Â DIGOSÂDOCTORSÂHOS ÂÂÂ Â ÇP") &77Î Digos Doctors Hospital IncDigos Doctors' Hospital, Inc. IT DepartmentNo ratings yet

- 2020-09-01-002013-0495065Document2 pages2020-09-01-002013-0495065Jefferry Gerome FerryNo ratings yet

- WS51H883AS0716 - 01-Apr-2019TO30-Apr-2019Document1 pageWS51H883AS0716 - 01-Apr-2019TO30-Apr-2019Avineet SadaniNo ratings yet

- Payment PAYE JUNEDocument1 pagePayment PAYE JUNEbidda samuelNo ratings yet

- Tax I CasesDocument119 pagesTax I CasesJANINE MARIE BERNADETTE CASTRONo ratings yet

- A-15 Block - 7/8 Kchs Union Karachi-78400 Karachi Usman Shahid KhanDocument2 pagesA-15 Block - 7/8 Kchs Union Karachi-78400 Karachi Usman Shahid KhanAnjum RasheedNo ratings yet

- Statement: Cartrack Technologies Phil. IDocument1 pageStatement: Cartrack Technologies Phil. IJong-jong Tulod ArcillasNo ratings yet

- Billing StatementDocument2 pagesBilling Statementmetserf sett100% (1)

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/ 05/2018Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/ 05/2018Hima VeeramachaneniNo ratings yet

- Smart Postpaid Bill Nov 2019Document8 pagesSmart Postpaid Bill Nov 2019Ace ViarNo ratings yet

- MPPL It 2019 - 1Document3 pagesMPPL It 2019 - 1Fareed KhanNo ratings yet

- Cir v. Cebu HoldingsDocument16 pagesCir v. Cebu HoldingsBeltran KathNo ratings yet

- PDFDocument4 pagesPDFSaoirse MinNo ratings yet

- Invoice: NellyDocument1 pageInvoice: NellyNelly HNo ratings yet

- 1.1 AXA SG Agency Comm (Partnership Annoucement and Intro To Naluri)Document1 page1.1 AXA SG Agency Comm (Partnership Annoucement and Intro To Naluri)Nelly HNo ratings yet

- Appendix - Revised Premium Rates Table AXA Basic Care For Plan A B PDFDocument1 pageAppendix - Revised Premium Rates Table AXA Basic Care For Plan A B PDFNelly HNo ratings yet

- SALEM ILESE Mad at DisneyDocument3 pagesSALEM ILESE Mad at DisneyNelly H50% (2)

- Policy Illustration Document(s)Document22 pagesPolicy Illustration Document(s)Nelly HNo ratings yet

- Axa Smartcare Sme Plus BrochureDocument16 pagesAxa Smartcare Sme Plus BrochureNelly HNo ratings yet

- Doctor List PDFDocument1 pageDoctor List PDFNelly HNo ratings yet

- Doctor/Clinic Listing for Queenstown AreaDocument1 pageDoctor/Clinic Listing for Queenstown AreaNelly HNo ratings yet

- Doctor ListDocument1 pageDoctor ListNelly HNo ratings yet

- AXA 19-737 GC Update1906 06 SINGLEDocument24 pagesAXA 19-737 GC Update1906 06 SINGLENelly HNo ratings yet

- Your Health Cover: Is Too Important To Leave BehindDocument4 pagesYour Health Cover: Is Too Important To Leave BehindNelly HNo ratings yet

- AXA Mum's Advantage - Nov18Document2 pagesAXA Mum's Advantage - Nov18Nelly HNo ratings yet

- Complete Care For Your Family: HealthDocument19 pagesComplete Care For Your Family: HealthNelly HNo ratings yet

- Mental Health QuestionnaireDocument1 pageMental Health QuestionnaireNelly HNo ratings yet

- Empower Your Future: General Product FeaturesDocument2 pagesEmpower Your Future: General Product FeaturesNelly HNo ratings yet

- Travel The World With Complete Peace of MindDocument6 pagesTravel The World With Complete Peace of MindNelly HNo ratings yet

- GlobalCare General Provisions (2 Sept 2019-Final)Document33 pagesGlobalCare General Provisions (2 Sept 2019-Final)Nelly HNo ratings yet

- Consumer Advisory Notice - 29jun2020Document1 pageConsumer Advisory Notice - 29jun2020Nelly HNo ratings yet

- Does Your Business Need AttentionDocument1 pageDoes Your Business Need AttentionNelly HNo ratings yet

- Policy Illustration Document(s)Document22 pagesPolicy Illustration Document(s)Nelly HNo ratings yet

- Supplementary Form July 2019Document1 pageSupplementary Form July 2019Nelly HNo ratings yet

- Appendix - Revised Premium Rates Table AXA Basic Care For Plan A BDocument1 pageAppendix - Revised Premium Rates Table AXA Basic Care For Plan A BNelly HNo ratings yet

- Consumer Product Fact Sheet Reminder - 29jun2020Document5 pagesConsumer Product Fact Sheet Reminder - 29jun2020Nelly HNo ratings yet

- Doctor ListDocument1 pageDoctor ListNelly HNo ratings yet

- Electronic Keyboard Repair Service FeesDocument1 pageElectronic Keyboard Repair Service FeesNelly HNo ratings yet

- Remote Advisory Training Slides PDFDocument12 pagesRemote Advisory Training Slides PDFNelly HNo ratings yet

- Delivery & Takeaway Menu: How To OrderDocument8 pagesDelivery & Takeaway Menu: How To OrderNelly HNo ratings yet

- Candlenut: Circuit Breaker MenuDocument2 pagesCandlenut: Circuit Breaker MenuNelly HNo ratings yet

- GIRO Instalment Plan For Income Tax: Month Month Amount ($) Amount ($)Document2 pagesGIRO Instalment Plan For Income Tax: Month Month Amount ($) Amount ($)Nelly HNo ratings yet

- Exercise 2 Income Statement - MerchandisingzzzsDocument2 pagesExercise 2 Income Statement - MerchandisingzzzsMarc Viduya0% (1)

- G.R. No. 194964-65Document3 pagesG.R. No. 194964-65Adrian Olaguer AguasNo ratings yet

- New Grandma in California Does Sleuthing and Discovers Major Robo Notary Operation - AND RADIO INTERVIEWDocument6 pagesNew Grandma in California Does Sleuthing and Discovers Major Robo Notary Operation - AND RADIO INTERVIEW83jjmack100% (1)

- Econ 132 Problems For Chapter 1-3, and 5Document5 pagesEcon 132 Problems For Chapter 1-3, and 5jononfireNo ratings yet

- Avcbvi †Μwwu Kvw© Av‡E'‡Bi Rb¨ ¸Iæz¡C~Y© Z - ¨Vw': Mövnk A½XkvibvgvDocument4 pagesAvcbvi †Μwwu Kvw© Av‡E'‡Bi Rb¨ ¸Iæz¡C~Y© Z - ¨Vw': Mövnk A½Xkvibvgvtanvir019No ratings yet

- IC 92 Multiple Question BankDocument54 pagesIC 92 Multiple Question BankTRANSFORMERLOGICS90% (10)

- Oracle Apps Accounts Payables FunctionalityDocument60 pagesOracle Apps Accounts Payables FunctionalitySra1$93% (15)

- Legal Ethics No. 15 Tan vs. SabandalDocument1 pageLegal Ethics No. 15 Tan vs. SabandalDah RinNo ratings yet

- Reliance Industries Limited Annual Report 1991-92Document75 pagesReliance Industries Limited Annual Report 1991-92Surjya BanerjeeNo ratings yet

- Director Commercial Real Estate in Columbus OH Resume Richard WolneyDocument2 pagesDirector Commercial Real Estate in Columbus OH Resume Richard WolneyRichardWolneyNo ratings yet

- Fin 370 All My Finance LabDocument12 pagesFin 370 All My Finance Labjupiteruk0% (1)

- Screening FormDocument6 pagesScreening FormHarsh JiandaniNo ratings yet

- Askri BankDocument17 pagesAskri Bankanon_772670No ratings yet

- Tutorial Questions (Chapter 3)Document2 pagesTutorial Questions (Chapter 3)Nabilah Razak0% (1)

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- Boston Beer Company Case ExhibitsDocument2 pagesBoston Beer Company Case ExhibitsDavidNo ratings yet

- Seminar On Financial Accounting: The Analysis of PT. Asuransi Jiwasraya Case: Corporate GovernanceDocument14 pagesSeminar On Financial Accounting: The Analysis of PT. Asuransi Jiwasraya Case: Corporate Governanceratu shaviraNo ratings yet

- Microfinance Intern ReportDocument13 pagesMicrofinance Intern Reportfeelnknow100% (1)

- MoneysupplyDocument27 pagesMoneysupplySufian HimelNo ratings yet

- Manage Debt Maturity Structure to Reduce CostsDocument19 pagesManage Debt Maturity Structure to Reduce CostsfaezaNo ratings yet

- Reaction Paper On GRP 12Document2 pagesReaction Paper On GRP 12Ayen YambaoNo ratings yet

- Case Digest - FRIADocument13 pagesCase Digest - FRIAAiko DalaganNo ratings yet

- Aditya Birla Capital scales Equentis ratingsDocument2 pagesAditya Birla Capital scales Equentis ratingssayuj83No ratings yet

- ICICI Bank - India's Leading Private Sector BankDocument18 pagesICICI Bank - India's Leading Private Sector Bankvenkatesh RNo ratings yet

- Translation Problems NoreenDocument2 pagesTranslation Problems NoreenAdam SmithNo ratings yet

- Financial Operations of Private InsurersDocument14 pagesFinancial Operations of Private InsurersRayhan0% (1)

- Legal Due DiligenceDocument4 pagesLegal Due Diligencezeeshanshahbaz50% (2)

- Some Facts I Think Are Important To Zakheim and LaVrar Law OfficeDocument4 pagesSome Facts I Think Are Important To Zakheim and LaVrar Law OfficeNiceIrishLadyNo ratings yet

- Model Question Set 1Document2 pagesModel Question Set 1Destiny Tuition CentreNo ratings yet

- Name: Darshan Shrikant Dhoot Roll No: 721013 Guided By: Prof - Prasad SahasrabuddhiDocument8 pagesName: Darshan Shrikant Dhoot Roll No: 721013 Guided By: Prof - Prasad Sahasrabuddhidarshan dhootNo ratings yet

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistFrom EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistRating: 5 out of 5 stars5/5 (6)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- The Hidden Wealth Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth Nations: The Scourge of Tax HavensRating: 4.5 out of 5 stars4.5/5 (40)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreFrom EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNo ratings yet

- Streetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessFrom EverandStreetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessNo ratings yet