Professional Documents

Culture Documents

Noa-Iit Ob26202204230848372gn PDF

Uploaded by

Walter SengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Noa-Iit Ob26202204230848372gn PDF

Uploaded by

Walter SengCopyright:

Available Formats

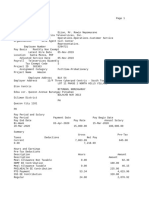

Tax Reference Number : SXXXX871A

Date : 29 Apr 2022

Please quote the Tax Reference Number (e.g. NRIC, FIN etc.) in full when corresponding with us.

MS TAN SIO LING (CHEN XIAOLING)

APT BLK 93

HENDERSON ROAD

#12-238

SINGAPORE 150093

(127649G)

1-1

Income Tax - Notice of Assessment (Original)

YEAR OF ASSESSMENT 2022

-

INCOME^ ($) DEDUCTIONS ($) CHARGEABLE ($)

+ 82,458.00 43,400.00 = INCOME

39,058.00

EMPLOYMENT 30,000.00 RELIEFS 43,400.00 TAX COMPUTATION

Earned Income 1,000.00 First 30,000.00 200.00

OTHERS 52,458.00 Grandparent (GCR) 3,000.00 Next 9,058.00 @ 3.5% 317.03

Child (QCR) 8,000.00 Tax Payable

Parent 5,500.00 by 30 May 2022

^ All income are net after deduction of Provident Fund/ Life 20,400.00 $517.03

expenses. Insurance

Course Fee 5,500.00

• Your tax assessment is based on information given by you through e-Filing on 02 Apr 2022.

• If you disagree with the assessment, Object to Assessment under 'Individuals' at myTax Portal within 30 days, i.e.

by 29 May 2022. Please pay the amount, if any, in this Notice by the due date, even if you object to the

assessment.

• Please pay your taxes, if any, by the due date to avoid late payment penalties and other recovery actions.

• View Account Summary under 'Account' at myTax Portal for your latest income tax

balance.

If you need help with your tax payment, please check go.gov.sg/iras-difficulty-paying-tax on how you may apply for

a longer GIRO payment arrangement.

NG WAI CHOONG

COMPTROLLER OF INCOME TAX

Website: www.iras.gov.sg • myTax Portal: mytax.iras.gov.sg

Tel: 1800-356 8300

1- 1 Page 1 of 1 301 CFN03101 176-13-716153418-0-4

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Noa-Iit Ob26202204230848372gnDocument2 pagesNoa-Iit Ob26202204230848372gnWalter SengNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Noa-Iit Ob2620220516204800b91Document2 pagesNoa-Iit Ob2620220516204800b91Tha OoNo ratings yet

- Noa-Iit Ob2620220516193754ktiDocument2 pagesNoa-Iit Ob2620220516193754ktiSelva SelvaNo ratings yet

- Noa-Iit Ob2420230619070707preDocument1 pageNoa-Iit Ob2420230619070707prehvikashNo ratings yet

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do?Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do?tehtarikNo ratings yet

- Noa-Iit Ob2420230527195835v3iDocument1 pageNoa-Iit Ob2420230527195835v3iRyan TanNo ratings yet

- Noa-Iit Ob2220231215050837ibnDocument1 pageNoa-Iit Ob2220231215050837ibnFrankie TanNo ratings yet

- Noa-Iit Ob25202106140521020nzDocument1 pageNoa-Iit Ob25202106140521020nz江宗朋No ratings yet

- Noa-Iit Ob2620220530013620coDocument1 pageNoa-Iit Ob2620220530013620coChan Yin YenNo ratings yet

- Noa-Iit Ob212020062419132485y PDFDocument1 pageNoa-Iit Ob212020062419132485y PDFilamahizhNo ratings yet

- Notice of Assessment OriginalDocument1 pageNotice of Assessment OriginalWawan SaidNo ratings yet

- Notice of Assessment Original: Printed Via Mytax PortalDocument1 pageNotice of Assessment Original: Printed Via Mytax PortalAbdul HalimNo ratings yet

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44wahleng ChewNo ratings yet

- Noa-Iit Ob25202003170642261sf PDFDocument1 pageNoa-Iit Ob25202003170642261sf PDFSoon SoonNo ratings yet

- Noa-Iit Ob2620150425142233zb4 PDFDocument1 pageNoa-Iit Ob2620150425142233zb4 PDFKanza KhanNo ratings yet

- Notice of Assessment Amended: Printed Via Mytax PortalDocument1 pageNotice of Assessment Amended: Printed Via Mytax Portalmayoo1986No ratings yet

- Assesment Notice 2017Document1 pageAssesment Notice 2017Shounak KossambeNo ratings yet

- Notice of Assessment Original: Printed Via Mytax PortalDocument1 pageNotice of Assessment Original: Printed Via Mytax PortalNelly HNo ratings yet

- Noa-Iit Ob2320170627071310ufp PDFDocument1 pageNoa-Iit Ob2320170627071310ufp PDFjasper haiNo ratings yet

- Noa-Iit Ob2120200629085533331Document1 pageNoa-Iit Ob2120200629085533331Jay Maung MaungNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- Noa-Iit Ob2320190701042209hz8Document1 pageNoa-Iit Ob2320190701042209hz8Jay Maung MaungNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Viraj Wijeratne 2223 Revised SET ComputationDocument1 pageViraj Wijeratne 2223 Revised SET Computationattackdfg2002No ratings yet

- Inv TG B1 50939724 101360733900 September 2021Document2 pagesInv TG B1 50939724 101360733900 September 2021b kranthi kumarNo ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 847068Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318No ratings yet

- Basic SolDocument3 pagesBasic SolADARSH MISHRANo ratings yet

- At Io N at Et: The Polytechnic Ibadan IRSDocument1 pageAt Io N at Et: The Polytechnic Ibadan IRSadegbola hamzatNo ratings yet

- Attachment 2 Guidance For AssessmentDocument5 pagesAttachment 2 Guidance For Assessmentultimatecombat92No ratings yet

- Income Tax Divyastra CH 15 Advance Tax R 1Document7 pagesIncome Tax Divyastra CH 15 Advance Tax R 1wareva7754No ratings yet

- File 1831Document1 pageFile 183176xzv4kk5vNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäDocument4 pagesNotice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäClaudia AttardNo ratings yet

- Computation 2019Document16 pagesComputation 2019Giri SukumarNo ratings yet

- Amended Tax Credit Certificate 2020 7243210862511Document2 pagesAmended Tax Credit Certificate 2020 7243210862511Aurimas AurisNo ratings yet

- PDFDocument3 pagesPDFdelmundomarkanthony15No ratings yet

- Tax Credit Certificate - 2018 : PPS No: 1793106MADocument4 pagesTax Credit Certificate - 2018 : PPS No: 1793106MAAlexandru CiobanuNo ratings yet

- Sample 4Document1 pageSample 4Josephine LimNo ratings yet

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- Notice of Assessment 2023 04 11 11 51 12 947361Document4 pagesNotice of Assessment 2023 04 11 11 51 12 947361Amelia D. LopezNo ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- Draft Return For ReviewDocument4 pagesDraft Return For ReviewsajjadNo ratings yet

- ReceiptDocument1 pageReceiptmwendwabenjamin431No ratings yet

- ReceiptDocument1 pageReceiptmwendwabenjamin431No ratings yet

- AY2021-22 ANISETTY SINDHU-EFPPS3410N-ComputationDocument3 pagesAY2021-22 ANISETTY SINDHU-EFPPS3410N-Computationforty oneNo ratings yet

- Notice of Assessment 2021 03 18 13 33 09 783841Document4 pagesNotice of Assessment 2021 03 18 13 33 09 783841Maria Fe CeleciosNo ratings yet

- Outbound Regular InvoiceDocument4 pagesOutbound Regular InvoiceSaruwatari MichiyoNo ratings yet

- Tax Credit Certificate 2023 9553776791212Document2 pagesTax Credit Certificate 2023 9553776791212Mariana SurduNo ratings yet

- Inv TG B1 60409095 101630937035 April 2022 1Document2 pagesInv TG B1 60409095 101630937035 April 2022 1Lokesh reddyNo ratings yet

- KRA202310990621Document1 pageKRA202310990621spandyno1No ratings yet

- Declaration3520299732361 - Income - (2018 - Submitted On 30)Document3 pagesDeclaration3520299732361 - Income - (2018 - Submitted On 30)Munir HussainNo ratings yet

- Noa 2022 3Document4 pagesNoa 2022 3haroldkenardNo ratings yet

- CrystalReportViewer1 3Document1 pageCrystalReportViewer1 3Mehedi HasanNo ratings yet

- 20200731-0100003503-SMMG-Mall-CULLINAN GROUP INCDocument4 pages20200731-0100003503-SMMG-Mall-CULLINAN GROUP INCEdjon AndalNo ratings yet

- Notice of Assessment 2021 03 22 16 13 15 065002Document4 pagesNotice of Assessment 2021 03 22 16 13 15 065002kulbirsinghxxxxNo ratings yet

- Notice of Assessment - Year Ended 30 June 2023: !H!ÎÈ/, g4 Î!Ef6ÄDocument4 pagesNotice of Assessment - Year Ended 30 June 2023: !H!ÎÈ/, g4 Î!Ef6Äjoshiepow3llNo ratings yet

- Tax Credit Certificate 2023 9753768935878Document2 pagesTax Credit Certificate 2023 9753768935878Rogério LimaNo ratings yet

- 20200731-0100001646-SMCC-Mall North Wing-TECHNOMARINE ENTERPRISES PHILS INC PDFDocument6 pages20200731-0100001646-SMCC-Mall North Wing-TECHNOMARINE ENTERPRISES PHILS INC PDFEdjon AndalNo ratings yet

- In VoiceDocument2 pagesIn VoiceBenny PriprasetyoNo ratings yet

- 1.functional Specification PTP With EDIDocument36 pages1.functional Specification PTP With EDIAnil Kumar100% (4)

- Midterm Exam StatconDocument4 pagesMidterm Exam Statconlhemnaval100% (4)

- Starrett 3812Document18 pagesStarrett 3812cdokepNo ratings yet

- Chapter 123 RevisedDocument23 pagesChapter 123 RevisedCristy Ann BallanNo ratings yet

- SDM Case AssignmentDocument15 pagesSDM Case Assignmentcharith sai t 122013601002No ratings yet

- VoIP Testing With TEMS InvestigationDocument20 pagesVoIP Testing With TEMS Investigationquantum3510No ratings yet

- Si KaDocument12 pagesSi KanasmineNo ratings yet

- Ap06 - Ev04 Taller en Idioma Inglés Sobre Sistema de DistribuciónDocument9 pagesAp06 - Ev04 Taller en Idioma Inglés Sobre Sistema de DistribuciónJenny Lozano Charry50% (2)

- D6a - D8a PDFDocument168 pagesD6a - D8a PDFduongpn63% (8)

- Central Banking and Monetary PolicyDocument13 pagesCentral Banking and Monetary PolicyLuisaNo ratings yet

- Woodward GCP30 Configuration 37278 - BDocument174 pagesWoodward GCP30 Configuration 37278 - BDave Potter100% (1)

- scx4521f SeriesDocument173 pagesscx4521f SeriesVuleticJovanNo ratings yet

- Strength and Microscale Properties of Bamboo FiberDocument14 pagesStrength and Microscale Properties of Bamboo FiberDm EerzaNo ratings yet

- Faida WTP - Control PhilosophyDocument19 pagesFaida WTP - Control PhilosophyDelshad DuhokiNo ratings yet

- Well Stimulation TechniquesDocument165 pagesWell Stimulation TechniquesRafael MorenoNo ratings yet

- Stainless Steel 1.4404 316lDocument3 pagesStainless Steel 1.4404 316lDilipSinghNo ratings yet

- Massive X-16x9 Version 5.0 - 5.3 (Latest New Updates in Here!!!)Document158 pagesMassive X-16x9 Version 5.0 - 5.3 (Latest New Updates in Here!!!)JF DVNo ratings yet

- DevelopersDocument88 pagesDevelopersdiegoesNo ratings yet

- Catalog enDocument292 pagesCatalog enSella KumarNo ratings yet

- Channel System: Presented byDocument78 pagesChannel System: Presented bygrace22mba22No ratings yet

- Annotated Portfolio - Wired EyeDocument26 pagesAnnotated Portfolio - Wired Eyeanu1905No ratings yet

- Installation Manual EnUS 2691840011Document4 pagesInstallation Manual EnUS 2691840011Patts MarcNo ratings yet

- MSEA News, Jan-Feb 2014Document20 pagesMSEA News, Jan-Feb 2014Justin HinkleyNo ratings yet

- 2 and 3 Hinged Arch ReportDocument10 pages2 and 3 Hinged Arch ReportelhammeNo ratings yet

- 8524Document8 pages8524Ghulam MurtazaNo ratings yet

- G JaxDocument4 pagesG Jaxlevin696No ratings yet

- BS en Iso 11666-2010Document26 pagesBS en Iso 11666-2010Ali Frat SeyranNo ratings yet

- ADS Chapter 303 Grants and Cooperative Agreements Non USDocument81 pagesADS Chapter 303 Grants and Cooperative Agreements Non USMartin JcNo ratings yet

- Learner Guide HDB Resale Procedure and Financial Plan - V2Document0 pagesLearner Guide HDB Resale Procedure and Financial Plan - V2wangks1980No ratings yet

- Study of Means End Value Chain ModelDocument19 pagesStudy of Means End Value Chain ModelPiyush Padgil100% (1)