Professional Documents

Culture Documents

Noa-Iit Ob25202003170642261sf PDF

Uploaded by

Soon SoonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Noa-Iit Ob25202003170642261sf PDF

Uploaded by

Soon SoonCopyright:

Available Formats

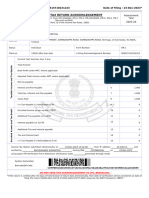

Tax Reference No : G6934097R NOTICE OF ASSESSMENT

Year of Assessment : 2021

Income Tax ORIGINAL

Date : 24 Mar 2020

CLEARANCE

Please quote the Tax Reference Number (eg. NRIC, FIN, etc) in full when corresponding with us.

MR CHONG HOW SOON

535 JURONG WEST ST 52

#06-475

SINGAPORE 640535

55 Newton Road

(6405354) Revenue House

Singapore 307987

Tel: 1800-356 8300

Website: http://www.iras.gov.sg

e-Services: https://mytax.iras.gov.sg

1-1

OTHER 1. This assessment includes the

S'PORE ($) COUNTRIES ($) TOTAL ($) employment income reported

by your ex-employer in their

EMPLOYMENT 7,355.00 7,355.00 Form IR21 dated 16 Mar 2020.

TOTAL INCOME 7,355.00 7,355.00

2. For Tax Clearance, any

ASSESSABLE INCOME 7,355.00 instalment arrangement will be

LESS: PERSONAL RELIEFS cancelled. You can view your

total outstanding income tax

Earned Income 1,000.00 payable, if any, via the View

Child (QCR) 4,000.00 Account Summary e-service or

the attached Statement of

TOTAL PERSONAL RELIEFS 5,000.00 Account. You are required to

pay any outstanding tax, even if

CHARGEABLE INCOME 2,355.00 you object to the assessment.

TAX PAYABLE 0.00

3. If you have any objection,

please submit your objection

online within 30 days via the

Object to Assessment e-service

or email us at myTax Portal.

NG WAI CHOONG

COMPTROLLER OF INCOME TAX

Printed via myTax Portal https://mytax.iras.gov.sg

1-1 Page 1 of 1 301 CFN03101 106-13-636269006-0-9

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Noa-Iit Ob212020062419132485y PDFDocument1 pageNoa-Iit Ob212020062419132485y PDFilamahizhNo ratings yet

- Noa-Iit Ob2320170627071310ufp PDFDocument1 pageNoa-Iit Ob2320170627071310ufp PDFjasper haiNo ratings yet

- Notice of Assessment Original: Printed Via Mytax PortalDocument1 pageNotice of Assessment Original: Printed Via Mytax PortalNelly HNo ratings yet

- Assesment Notice 2017Document1 pageAssesment Notice 2017Shounak KossambeNo ratings yet

- Notice of Assessment OriginalDocument1 pageNotice of Assessment OriginalWawan SaidNo ratings yet

- Noa-Iit Ob2120200629085533331Document1 pageNoa-Iit Ob2120200629085533331Jay Maung MaungNo ratings yet

- Notice of Assessment Original: Printed Via Mytax PortalDocument1 pageNotice of Assessment Original: Printed Via Mytax PortalAbdul HalimNo ratings yet

- Noa-Iit Ob2320190701042209hz8Document1 pageNoa-Iit Ob2320190701042209hz8Jay Maung MaungNo ratings yet

- Noa-Iit Ob2620150425142233zb4 PDFDocument1 pageNoa-Iit Ob2620150425142233zb4 PDFKanza KhanNo ratings yet

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do?Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do?tehtarikNo ratings yet

- Notice of Assessment Amended: Printed Via Mytax PortalDocument1 pageNotice of Assessment Amended: Printed Via Mytax Portalmayoo1986No ratings yet

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44wahleng ChewNo ratings yet

- Noa-Iit Ob2620220516193754ktiDocument2 pagesNoa-Iit Ob2620220516193754ktiSelva SelvaNo ratings yet

- Noa-Iit Ob26202204230848372gn PDFDocument1 pageNoa-Iit Ob26202204230848372gn PDFWalter SengNo ratings yet

- Noa-Iit Ob2620220516204800b91Document2 pagesNoa-Iit Ob2620220516204800b91Tha OoNo ratings yet

- Noa-Iit Ob2220231215050837ibnDocument1 pageNoa-Iit Ob2220231215050837ibnFrankie TanNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- Noa-Iit Ob2620220530013620coDocument1 pageNoa-Iit Ob2620220530013620coChan Yin YenNo ratings yet

- Noa-Iit Ob2420230619070707preDocument1 pageNoa-Iit Ob2420230619070707prehvikashNo ratings yet

- Tax Credit Certificate 2023 9753768935878Document2 pagesTax Credit Certificate 2023 9753768935878Rogério LimaNo ratings yet

- Noa-Iit Ob2420230527195835v3iDocument1 pageNoa-Iit Ob2420230527195835v3iRyan TanNo ratings yet

- Noa-Iit Ob26202204230848372gnDocument2 pagesNoa-Iit Ob26202204230848372gnWalter SengNo ratings yet

- Noa-Iit Ob25202106140521020nzDocument1 pageNoa-Iit Ob25202106140521020nz江宗朋No ratings yet

- Irs 2010Document1 pageIrs 2010eimanoNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Ilovepdf MergedDocument7 pagesIlovepdf MergedRavi ChristoNo ratings yet

- Preview Notice of AssessmentDocument2 pagesPreview Notice of Assessmentmayoo1986No ratings yet

- Tax Credit Certificate 2023 9553776791212Document2 pagesTax Credit Certificate 2023 9553776791212Mariana SurduNo ratings yet

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- Ponugoti Manga Itr 2022Document4 pagesPonugoti Manga Itr 2022Neduri Kalyan SrinivasNo ratings yet

- Amended Tax Credit Certificate 2020 7243210862511Document2 pagesAmended Tax Credit Certificate 2020 7243210862511Aurimas AurisNo ratings yet

- Tax I CasesDocument119 pagesTax I CasesJANINE MARIE BERNADETTE CASTRONo ratings yet

- Tax Credit Certificate - 2018 : PPS No: 1793106MADocument4 pagesTax Credit Certificate - 2018 : PPS No: 1793106MAAlexandru CiobanuNo ratings yet

- Tax Credit Certificate 2023 9552941697409 PDFDocument2 pagesTax Credit Certificate 2023 9552941697409 PDFCarlos ResendeNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- G.R. No. 205955 University Physicians Services Inc. - Management, Inc., Petitioner Commissioner of Internal Revenue, Respondent Decision Martires, J.Document8 pagesG.R. No. 205955 University Physicians Services Inc. - Management, Inc., Petitioner Commissioner of Internal Revenue, Respondent Decision Martires, J.JomongNo ratings yet

- f1062 Guide To HMRC Tax CalcDocument7 pagesf1062 Guide To HMRC Tax CalcFake Documents of Simply Jodan's LLCNo ratings yet

- Sal Slip Feb 2019Document1 pageSal Slip Feb 2019pankajNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäDocument4 pagesNotice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäClaudia AttardNo ratings yet

- Í - at - nÈ0Â LEVAGENTÂHERBALÂP ÂÂÂ Â Ç/L !6iî Levagent Herbal Products ManufacturingDocument2 pagesÍ - at - nÈ0Â LEVAGENTÂHERBALÂP ÂÂÂ Â Ç/L !6iî Levagent Herbal Products ManufacturingJesrael MahinayNo ratings yet

- Draft Return For ReviewDocument4 pagesDraft Return For ReviewsajjadNo ratings yet

- SalaryDocument1 pageSalarypankajNo ratings yet

- Final Ready SampleDocument15 pagesFinal Ready SampleachsamirksNo ratings yet

- Salary Structure CalculatorDocument7 pagesSalary Structure CalculatorMakesh Gopalakrishnan0% (1)

- Declaration 4230128218297Document4 pagesDeclaration 4230128218297maazraza123No ratings yet

- Summary of Account: Invoice/Statement of Account Service Tax REG. NO:B16-1808-31031789Document4 pagesSummary of Account: Invoice/Statement of Account Service Tax REG. NO:B16-1808-31031789NKNo ratings yet

- PDF 569515710231223Document1 pagePDF 569515710231223sushmithasaptharshiofficialNo ratings yet

- Notice of Assessment 2021 04 01 17 31 56 853329Document4 pagesNotice of Assessment 2021 04 01 17 31 56 85332969j8mpp2scNo ratings yet

- 2018 University - Physicians - Services20210505 13 12cju04Document15 pages2018 University - Physicians - Services20210505 13 12cju04Bluei FaustoNo ratings yet

- UnknownDocument1 pageUnknownAjit KumarNo ratings yet

- 2017 - 2018 Supreme Court DecisionsDocument1,412 pages2017 - 2018 Supreme Court DecisionsJerwin DaveNo ratings yet

- Cpa 9Document10 pagesCpa 9ENOCKNo ratings yet

- UnknownDocument1 pageUnknownFiroz ShaikhNo ratings yet

- University Physician Services M V CIRDocument15 pagesUniversity Physician Services M V CIRYoo Si JinNo ratings yet

- UnknownDocument1 pageUnknownNISHCHAL AGARWALNo ratings yet

- PDF 383442410310722Document1 pagePDF 383442410310722Ritik JangidNo ratings yet

- Í - T pÈ0Â DIGOSÂDOCTORSÂHOS ÂÂÂ Â ÇP") &77Î Digos Doctors Hospital IncDocument2 pagesÍ - T pÈ0Â DIGOSÂDOCTORSÂHOS ÂÂÂ Â ÇP") &77Î Digos Doctors Hospital IncDigos Doctors' Hospital, Inc. IT DepartmentNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Mooe School Forms 2020Document48 pagesMooe School Forms 2020KrisPaulineSantuaNo ratings yet

- Background: Bangladesh Bank'S Supervision On Banking SectorDocument11 pagesBackground: Bangladesh Bank'S Supervision On Banking Sectorrajin_rammsteinNo ratings yet

- AFAR MOD 1 AnswersDocument9 pagesAFAR MOD 1 AnswersJenn sayongNo ratings yet

- Essentials of Economics 9Th Edition John Sloman Full ChapterDocument67 pagesEssentials of Economics 9Th Edition John Sloman Full Chapterpeter.voit454100% (5)

- Ogl 200 Discussion 2Document4 pagesOgl 200 Discussion 2api-554893928No ratings yet

- LAW485Document4 pagesLAW485Rabiatul AdawiyahNo ratings yet

- Cap. 1 Hospitality Industry AccountingDocument25 pagesCap. 1 Hospitality Industry Accountingdianelys alejandroNo ratings yet

- Senior Corporate Communications Executive in New York City Resume Joe GoodeDocument2 pagesSenior Corporate Communications Executive in New York City Resume Joe GoodeJoeGoodeNo ratings yet

- Foreign Teacher ContractDocument3 pagesForeign Teacher ContractMuntana Tewpaingam100% (1)

- D155: Demo of Hse Document KitDocument8 pagesD155: Demo of Hse Document Kitfaroz khanNo ratings yet

- Infor WMS: Architected For Agility, Usability, and ResultsDocument3 pagesInfor WMS: Architected For Agility, Usability, and Resultsyi jingNo ratings yet

- Annual Report On Bangladesh Mobile Industry 2018.v3.09.04.2019Document4 pagesAnnual Report On Bangladesh Mobile Industry 2018.v3.09.04.2019Ayan MitraNo ratings yet

- Skripsi Full Tanpa Bab PemabahasanDocument80 pagesSkripsi Full Tanpa Bab Pemabahasanwahyu rizkiNo ratings yet

- Staff-Car-Rules-1980-amended-October, 2020Document19 pagesStaff-Car-Rules-1980-amended-October, 2020Waqar AhmadNo ratings yet

- CLC Byo Treasurers ReportDocument3 pagesCLC Byo Treasurers ReportAndrew May NcubeNo ratings yet

- Subenji Offer Letter FinalDocument2 pagesSubenji Offer Letter FinalAbhijith M WarrierNo ratings yet

- Teller Job DescriptionDocument8 pagesTeller Job DescriptionDianne Bernadeth Cos-agonNo ratings yet

- ACE Recruitment GlobalDocument2 pagesACE Recruitment GlobalQuratulain WahabNo ratings yet

- Federal Resume SampleDocument5 pagesFederal Resume Samplef5dq3ch5100% (2)

- Ch02 Recording Business Transactions SVDocument28 pagesCh02 Recording Business Transactions SVBảo DươngNo ratings yet

- Long-Run Economic Growth: Intermediate MacroeconomicsDocument23 pagesLong-Run Economic Growth: Intermediate MacroeconomicsDinda AmeliaNo ratings yet

- Internship Report of YamahaDocument46 pagesInternship Report of YamahaSurya PrakashNo ratings yet

- Coffee Shop Co CaseDocument3 pagesCoffee Shop Co Caserashmi shrivastavaNo ratings yet

- Lesson 1 RIGHT OF APPRAISALDocument6 pagesLesson 1 RIGHT OF APPRAISALDi CanNo ratings yet

- Borja, Ma. Sofia Madeline N. Bsba HRM 1-1N Case AnalysisDocument4 pagesBorja, Ma. Sofia Madeline N. Bsba HRM 1-1N Case AnalysisMadie StellarNo ratings yet

- ACT1202.Case Study No. 3 Answer SheetDocument6 pagesACT1202.Case Study No. 3 Answer SheetDonise Ronadel SantosNo ratings yet

- HR Strategy GlobalizationDocument55 pagesHR Strategy Globalizationmyszeyka100% (1)

- Sms TemplatesDocument83 pagesSms TemplatesSee ThaNo ratings yet

- Complete IELTS Unit 06 (Pp. 57-67)Document11 pagesComplete IELTS Unit 06 (Pp. 57-67)rifqi bambangNo ratings yet

- Reissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Document1 pageReissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Sadiki LuhandeNo ratings yet