Professional Documents

Culture Documents

Amended Tax Credit Certificate 2022: 9371000KA Pps No

Uploaded by

Jose ArevaloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amended Tax Credit Certificate 2022: 9371000KA Pps No

Uploaded by

Jose ArevaloCopyright:

Available Formats

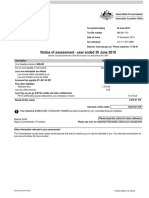

In all correspondence please quote: Pat Murphy

PPS No: 9371000KA Personal Division

PAYE Services

P.O. Box 327

Notice No: 95494511−16067W Cork

ytcc V712 1 R O S 20220120

JHENNY JHOSSELIN SUAREZ ZEBALLOS

5 BELVEDERE PLACE

FLAT 3

DUBLIN

DUBLIN 1

Enquiries:

online − www.revenue.ie/myAccount

Phone − 01 7383636

20 January 2022

Amended Tax Credit Certificate 2022

Claiming your tax credits and entitlements ensures you pay the right amount of tax.

Please see overleaf details of your Tax Credits, Rate Bands and Universal Social Charge (USC) for 2022 which are based on

the most recent information available to Revenue. Please review the information in the Allocation of your Tax Credits section to

ensure it is up to date and accurate. If you wish to make amendments, the quickest and easiest way to manage your tax and

claim your entitlements is through myAccount at www.revenue.ie/myaccount 'PAYE Services', 'Manage your Tax 2022'.

Real Time Credits

A Real Time Credit facility is available to claim Health Expenses and Nursing Home expenses as they are incurred. Use the

'Manage Your Tax 2022' link to make a claim. From February 2022 the facility to claim Remote Working Relief expenses for

2022 in real time will be available. By claiming in real time, you can benefit from increased tax credits in your next payroll

payment from your employer.

View your Pay and Tax

You can view the pay and statutory deductions reported to Revenue by your employer or Pension Provider under 'Manage Your

Tax 2022'.

Tax years 2018−2021

Employment Detail Summary (EDS)

From January 2022 you can view, download, and print an EDS for 2021 and prior years under 'PAYE Services', 'Review your

tax 2018−2021', in myAccount. This Summary will contain your income and statutory deductions for 2021, as reported by your

employer or pension provider. This can be used as proof of your income for a third party.

Preliminary End of Year Statement (PEOYS)

From 17 January 2022, your 2021 PEOYS will be available to view at 'Review your tax 2018−2021' in 'PAYE Services'. The

PEOYS is based on the information on your Revenue record in respect of your incomes and entitlements for 2021. This is a

preliminary calculation only. When you complete your Income Tax Return you will receive your Statement of Liability which will

show your final position. Please ensure the correct bank account details are on record so any tax refunds due to you are paid

directly and quickly.

Income Tax Return (ITR)

To claim* additional tax credits/reliefs or declare additional incomes you will need to request a Statement of Liability by

completing your ITR. To do this select PAYE Services − 'Review your tax 2018−2021' Statement of Liability and Complete your

Income Tax Return.

*There is a 4−year time limit on claiming tax refunds, so it is important to claim your entitlements on time.

Statement of Liability (SOL)

After you submit your Income Tax Return, your SOL will be made available, in due course, in 'myDocuments' in myAccount,

unless further information is requested by Revenue in support of your claim. An email will issue to you from Revenue when your

SOL is available to view/download.

££pdfname££ 9549451116067_1 gfdID−ENTITYdfg9371000KAgfdID−ENTITYdfg

TAX CREDIT AND UNIVERSAL SOCIAL CHARGE CERTIFICATE

FOR THE PERIOD 1 JANUARY 2022 TO 31 DECEMBER 2022

Tax Credits €

Personal Tax Credit 1,700.00

Employee Tax Credit 1,700.00

Gross Tax Credits 3,400.00

Net Tax Credits 3,400.00

Tax Rate Bands €

Rate Band 1 36,800.00

The amount of your income taxable at 20% 36,800.00

All income over €36,800.00 is taxable at 40%

Allocation of your Tax Credits and Rate Bands (Subject to Rounding)

Tax Credits € Tax Rate Bands €

Employer Rate

Yearly Monthly Weekly Yearly Monthly Weekly

Band

GLOBAL ASIAN RESTAURA. 3,400.00 283.34 65.39 20% 36,800.00 3,066.67 707.70

Universal Social Charge (USC)

You are deemed exempt from paying the Universal Social Charge (USC) for the current year as your total income for

the year (excluding all payments from the Department of Social Protection) has been estimated to not exceed

€13,000.00.

Please notify your Revenue office if it is likely that your income will in fact exceed €13,000.00.

.

gfdID−ENTITYdfg9371000KAgfdID−ENTITYdfg

You might also like

- Amended Tax Certificate for 2020Document2 pagesAmended Tax Certificate for 2020Aurimas AurisNo ratings yet

- Notice of Assessment Tax Ref No SXXXX913EDocument1 pageNotice of Assessment Tax Ref No SXXXX913EilamahizhNo ratings yet

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- Notice of Assessment 2019 04 29 02 32 21 264865Document4 pagesNotice of Assessment 2019 04 29 02 32 21 264865Dennis EnnsNo ratings yet

- Noa-Iit Ob2620150425142233zb4 PDFDocument1 pageNoa-Iit Ob2620150425142233zb4 PDFKanza KhanNo ratings yet

- Tax Notice Assessment No PayableDocument1 pageTax Notice Assessment No PayabletehtarikNo ratings yet

- Notice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118Document2 pagesNotice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118shadforth1977No ratings yet

- IKEA InvoiceDocument1 pageIKEA Invoicenewell.cliveNo ratings yet

- Barclaycard Application Form PDFDocument2 pagesBarclaycard Application Form PDFAnonymous oMlOwksvCYNo ratings yet

- Agent Appointment FormDocument2 pagesAgent Appointment FormSatyen ChikhliaNo ratings yet

- Your Gold Account StatementDocument1 pageYour Gold Account Statementmohamed elmakhzniNo ratings yet

- Tax Ry 2020Document2 pagesTax Ry 2020Ruth Polimar YamutaNo ratings yet

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- Ambulance: VictoriaDocument2 pagesAmbulance: VictoriaJames WearneNo ratings yet

- Payslip Month Ending 30 November 2022Document1 pagePayslip Month Ending 30 November 2022zeppo1234No ratings yet

- FBN App StatementDocument2 pagesFBN App StatementBecca FriasNo ratings yet

- SARS Notice of Assessment for 2020Document1 pageSARS Notice of Assessment for 2020FolaNo ratings yet

- Leaving UK - Get Tax RightDocument4 pagesLeaving UK - Get Tax Right_Cristi_No ratings yet

- Example Tax ReturnDocument6 pagesExample Tax Returnapi-252304176No ratings yet

- Bank StatementDocument2 pagesBank StatementIT100% (1)

- Notice of AssessmentDocument4 pagesNotice of AssessmentziggyNo ratings yet

- FreedomBill 20221020Document8 pagesFreedomBill 20221020Payroll TeamNo ratings yet

- Vat Summary-30-09-2010Document2 pagesVat Summary-30-09-2010anon_978060No ratings yet

- 2022 T1 Form - CompletedDocument8 pages2022 T1 Form - CompletedARSH GROVERNo ratings yet

- E0800J3WXBDocument2 pagesE0800J3WXBAhmed Al AdawiNo ratings yet

- R43 2019 PDFDocument4 pagesR43 2019 PDFDavid Mark AldridgeNo ratings yet

- Account History-TD Canada Trust-Savving2122Document2 pagesAccount History-TD Canada Trust-Savving2122AhsanNo ratings yet

- Form 1099nec-PDF Reader ProDocument7 pagesForm 1099nec-PDF Reader ProSakib AhmedNo ratings yet

- Account Statement - : February 2014Document2 pagesAccount Statement - : February 2014Fernando BatesNo ratings yet

- Ita34 1058123249Document3 pagesIta34 1058123249Bahlakoana NtsasaNo ratings yet

- Document Pack 9ST99MJR PDFDocument6 pagesDocument Pack 9ST99MJR PDFMohamed Diaa Mortada100% (1)

- Your Estimated Gas Bill: MR Madhava Avvula Flat 184, City View Centreway Apartments, Axon Place Ilford Essex Ig1 1NlDocument4 pagesYour Estimated Gas Bill: MR Madhava Avvula Flat 184, City View Centreway Apartments, Axon Place Ilford Essex Ig1 1NlMadhava Reddy AvvulaNo ratings yet

- Mutual of Omaha - LTD 03 16Document2 pagesMutual of Omaha - LTD 03 16api-252555369No ratings yet

- 03KBH19z-51JH053EH6999 B43a99a8 PDFDocument4 pages03KBH19z-51JH053EH6999 B43a99a8 PDFPeter ChanNo ratings yet

- Get NoticeDocument3 pagesGet NoticeLetsoai MalesaNo ratings yet

- Preview 26Document15 pagesPreview 26kakabadzebaiaNo ratings yet

- Employee Information Pay Stub InformationDocument1 pageEmployee Information Pay Stub Informationrenato pimentelNo ratings yet

- Claim For Repayment of Tax Deducted From Savings and InvestmentsDocument4 pagesClaim For Repayment of Tax Deducted From Savings and InvestmentsxzmangeshNo ratings yet

- 2012 Ontario Tax FormDocument2 pages2012 Ontario Tax FormHassan MhNo ratings yet

- Private and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASDocument1 pagePrivate and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASMihaela MiscaNo ratings yet

- Acrobat DocumentDocument8 pagesAcrobat DocumentjametyasiskaNo ratings yet

- MBNA Statement StatementHistoryOpenSave PDFDocument4 pagesMBNA Statement StatementHistoryOpenSave PDFAlireza YamghaniNo ratings yet

- TD Bank StatementDocument2 pagesTD Bank Statementbie eileenNo ratings yet

- Enrolment Fee: 1 5.00 Including Vat. Please Make Cheques Payable To Seatax LTD 9Document6 pagesEnrolment Fee: 1 5.00 Including Vat. Please Make Cheques Payable To Seatax LTD 9Bob471372No ratings yet

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDocument6 pagesICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNo ratings yet

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresNo ratings yet

- Proof of Balance Report: Jasmine Petrovski 5/71 Pine Street Reservoir Vic 3073 Australia Account BalancesDocument1 pageProof of Balance Report: Jasmine Petrovski 5/71 Pine Street Reservoir Vic 3073 Australia Account BalancesgeorgiaNo ratings yet

- CurrentAccountStatement 07102023Document4 pagesCurrentAccountStatement 07102023caraleighjaneNo ratings yet

- Statement of Benefits 30 04 2020Document10 pagesStatement of Benefits 30 04 2020Chris MillsNo ratings yet

- Account Opening FormDocument2 pagesAccount Opening Formsalmanarshad2009No ratings yet

- Your Universal Credit Claim: We Need To Find Out More About Your Health ConditionDocument4 pagesYour Universal Credit Claim: We Need To Find Out More About Your Health ConditionNasir KarwanNo ratings yet

- Tax Return Enclosures List: FEDERAL T1 2009Document16 pagesTax Return Enclosures List: FEDERAL T1 2009Christine TemplemanNo ratings yet

- Request for a Business NumberDocument5 pagesRequest for a Business Numberrouzbeh1797No ratings yet

- Monzo Bank Statement 2023Document4 pagesMonzo Bank Statement 2023arcodtal20No ratings yet

- Grow Management Consultants Pty LTD Profit and Loss Statement July 17 To June 18Document2 pagesGrow Management Consultants Pty LTD Profit and Loss Statement July 17 To June 18Hussnain ShahNo ratings yet

- Private & Confidential: Re: Your Medical Card ApplicationDocument7 pagesPrivate & Confidential: Re: Your Medical Card ApplicationjulieannagormanNo ratings yet

- Financial Statement: Funds SummaryDocument1 pageFinancial Statement: Funds SummarymorganNo ratings yet

- Murad Engineering Services Statement SummaryDocument2 pagesMurad Engineering Services Statement SummarysajuNo ratings yet

- Tax Credit Certificate 2023 9553776791212Document2 pagesTax Credit Certificate 2023 9553776791212Mariana SurduNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Practice Exam 2Document15 pagesPractice Exam 2Comennius YayoNo ratings yet

- Maverick - Book ReviewDocument13 pagesMaverick - Book ReviewLoviNo ratings yet

- Project Proposal Format GuideDocument4 pagesProject Proposal Format GuideRishi ChaudharyNo ratings yet

- Procurement Guide: CHP Financing: 1. OverviewDocument9 pagesProcurement Guide: CHP Financing: 1. OverviewCarlos LinaresNo ratings yet

- Internship Co ListDocument10 pagesInternship Co ListEveline Lv EweNo ratings yet

- Real Estate Management Business PlanDocument36 pagesReal Estate Management Business PlanIbrahim MuhammedNo ratings yet

- Strategic Analysis On SonyDocument37 pagesStrategic Analysis On Sonylavkush_khannaNo ratings yet

- JPMorgan Asia Pacific Equity Strategy 20100903Document36 pagesJPMorgan Asia Pacific Equity Strategy 20100903iamdennismiracleNo ratings yet

- Strategic Risk TakingDocument9 pagesStrategic Risk TakingDipock MondalNo ratings yet

- Defunding Police and Reallocating ResourcesDocument4 pagesDefunding Police and Reallocating ResourcesRedi AliajNo ratings yet

- Harvard Business ReviewDocument4 pagesHarvard Business Reviewসাদা কালোNo ratings yet

- HRMP and ToiDocument29 pagesHRMP and ToiMuhammad Tanzeel Qaisar DogarNo ratings yet

- ITC QuestionnaireDocument7 pagesITC QuestionnaireKaivan Lilaoonwala88% (8)

- Strategy Analysis & ChoiceDocument46 pagesStrategy Analysis & ChoiceUsama AkhlaqNo ratings yet

- Marketing Cost and Profitability AnalysisDocument39 pagesMarketing Cost and Profitability AnalysisShahid Ashraf100% (3)

- Invoice - Best Ayurvedic Company in India Which Provides Best Ayurvedic ProductsDocument2 pagesInvoice - Best Ayurvedic Company in India Which Provides Best Ayurvedic ProductsSomnath PalNo ratings yet

- Santos ECO Fin HW04Document6 pagesSantos ECO Fin HW04deanyangg25No ratings yet

- FEES SCHEDULE 2011 - 2012: Australian International SchoolDocument2 pagesFEES SCHEDULE 2011 - 2012: Australian International SchoollephammydungNo ratings yet

- Credit Sources and Credit CardsDocument11 pagesCredit Sources and Credit CardsPoonam VermaNo ratings yet

- Skip To Main ContentDocument232 pagesSkip To Main Content187190No ratings yet

- Global E-Business & CollaborationDocument2 pagesGlobal E-Business & CollaborationNurinda Ramadhanti PratamaNo ratings yet

- Case Study in Industrialized Building System (IBS)Document17 pagesCase Study in Industrialized Building System (IBS)Mohamed A. SattiNo ratings yet

- Mutual Fund Litrature ReviewDocument7 pagesMutual Fund Litrature ReviewRavi KumarNo ratings yet

- ResearchDocument14 pagesResearchJohnBanda100% (1)

- Guide 15 Taxable and Non Taxable Income3Document9 pagesGuide 15 Taxable and Non Taxable Income3Zubair GhaznaviNo ratings yet

- H.B. Fuller Investor Day 2018 - Leading The Way PDFDocument141 pagesH.B. Fuller Investor Day 2018 - Leading The Way PDFHồng Ân TrầnNo ratings yet

- By:-Saurabh Nema (Dmims) : A Project Report On "Document17 pagesBy:-Saurabh Nema (Dmims) : A Project Report On "Ujjwal PandeyNo ratings yet

- Project Procurement Management - PPTDocument15 pagesProject Procurement Management - PPTHappy100% (2)

- TransactionSummary 915020007543226 160523031507-q4Document1 pageTransactionSummary 915020007543226 160523031507-q4RAJNo ratings yet

- Customer Relationship Management in Banking Sector: A StudyDocument13 pagesCustomer Relationship Management in Banking Sector: A StudyPARADIGM SHIFTS IN MANAGEMENT PRACTICESNo ratings yet