Professional Documents

Culture Documents

Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax Details

Uploaded by

Natalino GuterresOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax Details

Uploaded by

Natalino GuterresCopyright:

Available Formats

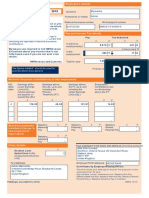

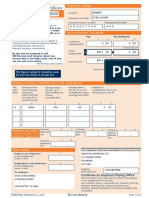

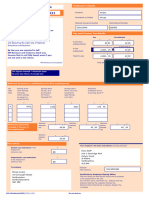

Employee's details

P60 End of Year Certificate

Surname Guterres

Tax year to 5 April 2020

This is a printed copy of an eP60 Forenames or Initials Natalino

National Insurance number Works/payroll number

To the employee: SS757372A 100000024516382

Please keep this certificate in a safe place as

you will need it if you have to fill in a tax Pay and Income Tax details

return. You also need it to make a claim Pay Tax deducted

for tax credits and Universal Credit or to £ p £ p

renew your claim. In previous

0 00 0 00

employment(s)

It also helps you check that your employer is if refund mark 'R'

using the correct National Insurance number In this

and deducting the right rate of 19338 34 1353 60

employment

National insurance contributions.

By law you are required to tell

Total for year 19338 34 1353 60

HM Revenue and Customs about any

income that is not fully taxed, even if you

are not sent a tax return.

HM Revenue and Customs

The figures marked should be used for your Final tax code 1256L

tax return, if you get one

National Insurance contributions in this employment

NIC Earnings at the Lower Earnings above Earnings above Employee's

table Earnings Limit (LEL) the LEL, up to the PT, up to and contributions due on all

letter (where earnings are and including the including the Upper earnings above the PT

Primary

equal to or Earnings Limit (UEL)

Threshold (PT)

exceed the LEL)

£ £ £ £ p

A 6136 2496 10706 1284 75

£ p £ p £ p

Statutory payments Statutory Statutory Statutory

Maternity 0 00 Paternity 0 00 Shared 0 00

included in the pay 'In this Pay Pay Parental

employment' figure above Pay

£ p

Statutory

Adoption 0 00

Pay

Other details Your employer's full name and address (including postcode)

£ Wm Morrison Supermarkets PLC

Student Loan deductions

in this employment 0 Hilmore House

(whole £s only) Gain Lane

£ Bradford

Postgraduate Loan deductions

in this employment

BD3 7DL

(whole £s only) 0

Employer PAYE reference 072 / M2A

To employee

Natalino Guterres Certificate by Employer/Paying Office:

14 Hankey Street This form shows your total pay for Income Tax purposes

PETERBOROUGH in this employment for the year.

PE1 2HH Any overtime, bonus, commission etc, Statutory Sick Pay,

Statutory Maternity Pay, Statutory Paternity Pay,

Statutory Shared Parental Pay or Statutory Adoption Pay

is included.

P60 (Substitute) (Oracle UK) (2019 to 2020) Do not destroy

© Copyright Oracle Corporation UK

You might also like

- Ep60 2016-17 PDFDocument1 pageEp60 2016-17 PDFAnonymous ZoN0SOKzVNo ratings yet

- Tax Year To 5 April: P60 End of Year CertificateDocument1 pageTax Year To 5 April: P60 End of Year CertificateВолодимир МельникNo ratings yet

- P60single 2Document1 pageP60single 2Claira JervisNo ratings yet

- P60 End of Year Certificate 10 05 19 16 14 16 5273Document1 pageP60 End of Year Certificate 10 05 19 16 14 16 527313KARATNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- 2021 FullDocument14 pages2021 FullDamian MikaNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkDenis VitalieviciNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- Avis 2018 Revenus 2017Document15 pagesAvis 2018 Revenus 2017Arnaud CalisteNo ratings yet

- Inspired Sisters LTD Online) AUDocument3 pagesInspired Sisters LTD Online) AUthankksNo ratings yet

- PrintP45 PDFDocument3 pagesPrintP45 PDFIstoc AngelaNo ratings yet

- Inbound Paper SA1 Form With Instruction - SignedDocument3 pagesInbound Paper SA1 Form With Instruction - SignedKushal SharmaNo ratings yet

- Leaving The UK - Getting Your Tax Right: About This FormDocument4 pagesLeaving The UK - Getting Your Tax Right: About This Form_Cristi_No ratings yet

- Payslip Month Ending 30 November 2022Document1 pagePayslip Month Ending 30 November 2022zeppo1234No ratings yet

- Copy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnDocument3 pagesCopy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnZavache DanaNo ratings yet

- Staff - p45Document4 pagesStaff - p45velorutionNo ratings yet

- 5184 P45 (Online) PDFDocument3 pages5184 P45 (Online) PDFAlejandroe AuditoreNo ratings yet

- HMRC Leaving The UK Getting Your Tax Right UIY IBG4 OYADocument4 pagesHMRC Leaving The UK Getting Your Tax Right UIY IBG4 OYAAbhay PatodiNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkCaleb PriceNo ratings yet

- Preview 26Document15 pagesPreview 26kakabadzebaiaNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkDan NolanNo ratings yet

- p45 Tomasz Jureczko Diamonds Digital LTDDocument3 pagesp45 Tomasz Jureczko Diamonds Digital LTDTomasz JureczkoNo ratings yet

- Pillay Naidoo 56 Vaalboskat Street Hesteapark Ext 8 Pretoria Noord 0182Document4 pagesPillay Naidoo 56 Vaalboskat Street Hesteapark Ext 8 Pretoria Noord 0182Spoton AutomotiveNo ratings yet

- R43 2019 PDFDocument4 pagesR43 2019 PDFDavid Mark AldridgeNo ratings yet

- P 50Document2 pagesP 50Emily DeerNo ratings yet

- Private and Confidential FAO Addressee Only: Miss V GlibiciucDocument2 pagesPrivate and Confidential FAO Addressee Only: Miss V GlibiciucGlibiciuc IlieNo ratings yet

- Richard Pizzey Archive Cra 19 PDFDocument17 pagesRichard Pizzey Archive Cra 19 PDFnancy2handsorNo ratings yet

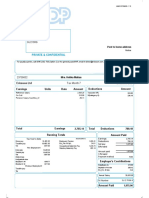

- Private & Confidential: Dept: PADDB Paddington BarDocument1 pagePrivate & Confidential: Dept: PADDB Paddington BarCarlos Freitas0% (1)

- Mrs M Altman 2019-20 Tax ReturnDocument22 pagesMrs M Altman 2019-20 Tax Returnyochanan altman100% (1)

- Payslip 46044522Document2 pagesPayslip 46044522Steve OrtonNo ratings yet

- Tax Return 2018-19Document18 pagesTax Return 2018-19Kasam ANo ratings yet

- UK Legal Entity: Assets TransferredDocument3 pagesUK Legal Entity: Assets Transferredshu1706No ratings yet

- Miss V Becerra Bastidas 9 Hockett Close London Se8 3Px: Deductions PaymentsDocument1 pageMiss V Becerra Bastidas 9 Hockett Close London Se8 3Px: Deductions Paymentsvictoria BeceraNo ratings yet

- Your Account Summary BalanceDocument1 pageYour Account Summary BalanceВиктория ГринькоNo ratings yet

- Payslip Kuwdlpjk0czpth5Document1 pagePayslip Kuwdlpjk0czpth5Alejandroe AuditoreNo ratings yet

- My Payslips 2022-11-07Document16 pagesMy Payslips 2022-11-07Ildikó Pető-Jánosi0% (1)

- Form To Get NinoDocument3 pagesForm To Get NinoFrancisco Vergara PerucichNo ratings yet

- Payslip Guip47020020112020 PDFDocument1 pagePayslip Guip47020020112020 PDFElena BarsukovaNo ratings yet

- GU215RG Post To Home Address: SurreyDocument1 pageGU215RG Post To Home Address: SurreyhelikacarvalhoNo ratings yet

- Tax Return 2016Document18 pagesTax Return 2016kezia dugdale0% (1)

- Pay Advice: Mundial Service LTDDocument2 pagesPay Advice: Mundial Service LTDfuddy luziNo ratings yet

- Payslip EPay 20231026Document1 pagePayslip EPay 20231026jacksparrow2023mayNo ratings yet

- ПЭЙСЛИП OutputDocument1 pageПЭЙСЛИП Output13KARATNo ratings yet

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- Single Resource LTD: Pay AdviceDocument1 pageSingle Resource LTD: Pay AdviceZavache DanaNo ratings yet

- Annexure 1B PDFDocument1 pageAnnexure 1B PDFFolaNo ratings yet

- Ita34 1058123249Document3 pagesIta34 1058123249Bahlakoana NtsasaNo ratings yet

- Get NoticeDocument3 pagesGet NoticeJo anne Jo anneNo ratings yet

- LicenseDocument6 pagesLicenseRazvannusNo ratings yet

- P45 (ONLINE) Duc Trong Duong 2Document3 pagesP45 (ONLINE) Duc Trong Duong 2Duc Trong DuongNo ratings yet

- PreviewDocument3 pagesPreviewvi6205552No ratings yet

- CLR 2020 Tax ReturnDocument14 pagesCLR 2020 Tax ReturnAlexander Barno AlexNo ratings yet

- BoothPeterDarren 2022 1Document14 pagesBoothPeterDarren 2022 1Αριστείδης ΜέγαςNo ratings yet

- customs: CorporationDocument2 pagescustoms: Corporationbilal sarfrazNo ratings yet

- CurrentAccountStatement 07102023Document4 pagesCurrentAccountStatement 07102023caraleighjaneNo ratings yet

- Your National Insurance Number: About This FormDocument4 pagesYour National Insurance Number: About This FormTatyana TerziyskaNo ratings yet

- Your Bill Highlights: Your Electricity Usage Over Time You Used A Total of 1,681 KWH From Feb 26, 2021 To Apr 27, 2021Document2 pagesYour Bill Highlights: Your Electricity Usage Over Time You Used A Total of 1,681 KWH From Feb 26, 2021 To Apr 27, 2021Fast BlastNo ratings yet

- Briñez VillalobosDocument2 pagesBriñez VillalobosMundo RealNo ratings yet

- Tax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsduhgyusdfuiosNo ratings yet

- P60-Mircea AndreiDocument1 pageP60-Mircea AndreiAndrei AlbertoNo ratings yet

- UntitledDocument18 pagesUntitledjake ruthNo ratings yet

- EREMES KOOKOORITCHKIN v. SOLICITOR GENERALDocument8 pagesEREMES KOOKOORITCHKIN v. SOLICITOR GENERALjake31No ratings yet

- Anaphy Finals ReviewerDocument193 pagesAnaphy Finals Reviewerxuxi dulNo ratings yet

- Test 5Document4 pagesTest 5Lam ThúyNo ratings yet

- Executive Summary: Source of Commission: PMA Date of Commission: 16 March 2009 Date of Rank: 16 March 2016Document3 pagesExecutive Summary: Source of Commission: PMA Date of Commission: 16 March 2009 Date of Rank: 16 March 2016Yanna PerezNo ratings yet

- Lesson Plan - PovertyDocument4 pagesLesson Plan - Povertyapi-315995277No ratings yet

- 1ST Term J3 Business StudiesDocument19 pages1ST Term J3 Business Studiesoluwaseun francisNo ratings yet

- Acknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyDocument3 pagesAcknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyLanie BatoyNo ratings yet

- AssignmentDocument25 pagesAssignmentPrashan Shaalin FernandoNo ratings yet

- Lec 15. National Income Accounting V3 REVISEDDocument33 pagesLec 15. National Income Accounting V3 REVISEDAbhijeet SinghNo ratings yet

- CIT Exercises - June 2020 - ACEDocument16 pagesCIT Exercises - June 2020 - ACEKHUÊ TRẦN ÁINo ratings yet

- Basic Fortigate Firewall Configuration: Content at A GlanceDocument17 pagesBasic Fortigate Firewall Configuration: Content at A GlanceDenisa PriftiNo ratings yet

- Option Valuation and Dividend Payments F-1523Document11 pagesOption Valuation and Dividend Payments F-1523Nguyen Quoc TuNo ratings yet

- DAP-1160 A1 Manual 1.20Document71 pagesDAP-1160 A1 Manual 1.20Cecilia FerronNo ratings yet

- Republic of The Philippines vs. Bagtas, 6 SCRA 262, 25 October 1962Document2 pagesRepublic of The Philippines vs. Bagtas, 6 SCRA 262, 25 October 1962DAblue ReyNo ratings yet

- Judgments of Adminstrative LawDocument22 pagesJudgments of Adminstrative Lawpunit gaurNo ratings yet

- Tiktok PresentationDocument17 pagesTiktok Presentationapi-681531475No ratings yet

- Lead The Competition: Latest Current AffairsDocument12 pagesLead The Competition: Latest Current AffairsSagarias AlbusNo ratings yet

- Swepp 1Document11 pagesSwepp 1Augusta Altobar100% (2)

- Estimating Guideline: A) Clearing & GrubbingDocument23 pagesEstimating Guideline: A) Clearing & GrubbingFreedom Love NabalNo ratings yet

- NRes1 Work Activity 1 - LEGARTEDocument4 pagesNRes1 Work Activity 1 - LEGARTEJuliana LegarteNo ratings yet

- Eve Berlin PDFDocument2 pagesEve Berlin PDFJeffNo ratings yet

- Tucker Travis-Reel Site 2013-1Document2 pagesTucker Travis-Reel Site 2013-1api-243050578No ratings yet

- PERDEV2Document7 pagesPERDEV2Riza Mae GardoseNo ratings yet

- How To Make A Detailed OutlineDocument8 pagesHow To Make A Detailed OutlineIvan Clark PalabaoNo ratings yet

- Assets Misappropriation in The Malaysian Public AnDocument5 pagesAssets Misappropriation in The Malaysian Public AnRamadona SimbolonNo ratings yet

- Keys For Change - Myles Munroe PDFDocument46 pagesKeys For Change - Myles Munroe PDFAndressi Label100% (2)

- About ArevaDocument86 pagesAbout ArevaAbhinav TyagiNo ratings yet

- Problem Set 9Document2 pagesProblem Set 9Siham BuuleNo ratings yet

- Snyder, Timothy. The Reconstruction of Nations. Poland, Ukraine, Lithuania, Belarus, 1569-1999 (2003)Document384 pagesSnyder, Timothy. The Reconstruction of Nations. Poland, Ukraine, Lithuania, Belarus, 1569-1999 (2003)Ivan Grishin100% (8)