Professional Documents

Culture Documents

P45 (ONLINE) Duc Trong Duong 2

Uploaded by

Duc Trong DuongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P45 (ONLINE) Duc Trong Duong 2

Uploaded by

Duc Trong DuongCopyright:

Available Formats

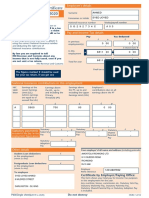

P45 Part 1A

Details of employee leaving work

Copy for employee

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

475 NB34492

/ 6 Tax Code at leaving date

2 Employee's National Insurance number 1150L

NR 21 72 70 C If week 1 or month 1 applies, enter 'X' in the box below.

Week 1/Month 1

3 Title - enter MR, MRS, MISS, MS or other title

Mr. 7 Last entries on P11 Deductions Working Sheet.

Complete only if Tax Code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

Surname or family name

Duong Week number Month number 6

First or given name(s) Total pay to date

Duc Trong £ 5850.00 p

4 Leaving date DD MM YYYY Total tax to date

30 09 2017 £ 19.00 p

8 This employment pay and tax. If no entry here, the amounts 12 Employee's private address

are those shown at box 7.

101 Nevile Close

Total pay in this employment London

£ p

Total tax in this employment

Postcode

£ p SE15 5UF

9 Works number/Payroll number and Department or branch

13 I certify that the details entered in items 1 to 11 on

(if any)

this form are correct.

Employer name and address

16

Comtam Ltd T/A OA Comtam

232 Holloway Rd

10 Gender. Enter 'X' in the appropriate box London

Male X Female

Postcode

11 Date of birth DD MM YYYY

04 03 1964 N7 8DA

Date DD MM YYYY

09 10 2017

To the employee Tax Credits

The P45 is in three parts. Please keep this part (Part1A) safe. Tax credits are flexible. They adapt to changes in your life, such

Copies are not available. You might need the information in as leaving a job. If you need to let us know about a change in

Part 1A to fill in a Tax Return if you are sent one. your income, phone 0845 300 3900.

Please read the notes in Part 2 that accompany Part 1A.

The notes give some important information about what you To the new employer

should do next and what you should do with Parts 2 and 3 of If your new employee gives you this Part 1A, please return

this form. it to them. Deal with Parts 2 and 3 as normal.

P45(Online) Part 1 A HMRC 10/08

P45 Part 2

Details of employee leaving work

Copy for new employer

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

475 NB34492

/ 6 Tax Code at leaving date

2 Employee's National Insurance number 1150L

NR 21 72 70 C If week 1 or month 1 applies, enter 'X' in the box below.

Week 1/Month 1

3 Title - enter MR, MRS, MISS, MS or other title

Mr. 7 Last entries on P11 Deductions Working Sheet.

Complete only if Tax Code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

Surname or family name

Duong Week number Month number 6

First or given name(s) Total pay to date

Duc Trong £ 5850.00 p

4 Leaving date DD MM YYYY Total tax to date

30 09 2017 £ 19.00 p

To the employee

This form is important to you. Take good care of it and Claiming Jobseeker's Allowance or

keep it safe. Copies are not available. Please keep Employment and Support Allowance (ESA)

Parts 2 and 3 of the form together and do not alter them

in any way. Take this form to your Jobcentre Plus Office. They will pay you

any tax refund you may be entitled to when your claim ends,

or at 5 April if this is earlier.

Going to a new job

Give Parts 2 and 3 of this form to your new employer, Not working and claiming Jobseeker's Allowance or

or you will have tax deducted using the emergency Employment and Support Allowance (ESA)

code and may pay too much tax. If you do not want

your new employer to know the details on this form, If you have paid tax and wish to claim a refund ask for

send it to your HM Revenue & Customs (HMRC) office form P50 Claiming tax back when you have stopped working

immediately with a letter saying so and giving the from any HMRC office or Enquiry Centre.

name and address of your new employer. HMRC can

make special arrangements, but you may pay too Help

much tax for a while as a result of this.

If you need further help you can contact any HMRC office

or Enquiry Centre. You can find us in The Phone Book under

Going abroad HM Revenue & Customs or go to www.hmrc.gov.uk

If you are going abroad or returning to a country

outside the UK ask for form P85 Leaving the United Kingdom To the new employer

from any HMRC office or Enquiry Centre.

Check this form and complete boxes 8 to 18 in Part 3

and prepare a form P11 Deductions Working Sheet.

Becoming self-employed Follow the instructions in the Employer Helpbook

You must register with HMRC within three months of E13 Day-to-day payroll, for how to prepare a P11 Deductions

becoming self-employed or you could incur a penalty. Working Sheet. Send Part 3 of this form to your HMRC

To register as newly self-employed see The Phone Book office immediately. Keep Part 2.

under HM Revenue & Customs or go to www.hmrc.gov.uk

to get a copy of the booklet SE1 Are you thinking of working

for yourself?

P45(Online) Part 2 HMRC 10/08

P45 Part 3

New employee details

For completion by new employer

File your employee's P45 online at www.hmrc.gov.uk Use capital letters when completing this form

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

475 NB34492

/ 6 Tax Code at leaving date

2 Employee's National Insurance number 1150L

NR 21 72 70 C If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/Month 1

Mr. 7 Last entries on P11 Deductions Working Sheet.

Complete only if Tax Code is cumulative. If there is an 'X'

Surname or family name at box 6 there will be no entries here.

Duong

Week number Month number 6

First or given name(s)

Total pay to date

Duc Trong £ 5850.00 p

4 Leaving date DD MM YYYY

Total tax to date

30 09 2017 £ 19.00 p

To the new employer Complete boxes 8 to 18 and send P45 Part 3 only to your HMRC office immediately.

8 New Employer PAYE reference 15 Employee's private address

Office number Reference number

/

9 Date new employment started DD MM YYYY

Postcode

10 Works number/Payroll number and Department or branch

(if any) 16 Gender. Enter 'X' in the appropriate box

Male Female

17 Date of birth DD MM YYYY

11 Enter 'P' here if employee will not be paid by you

between the date employment began and the

next 5 April.

Declaration

12 Enter Tax Code in use if different to the Tax Code at box 6. 18 I have prepared a P11 Deductions Working Sheet in

accordance with the details above.

Employer name and address

If week 1 or month 1 applies, enter 'X' in the box below.

Week 1/Month 1

13 If the tax figure you are entering on P11 Deductions

Working Sheet differs from box 7 (see the E13 Employer

Helpbook Day-to-day payroll) please enter the

Postcode

figure here.

£ p

Date DD MM YYYY

14 New employee's job title or job description

P45(Online) Part 3 HMRC 10/08

You might also like

- P45 68148Document4 pagesP45 68148Эдварт АнтонNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- Copy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnDocument3 pagesCopy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnZavache DanaNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkDenis VitalieviciNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkCaleb PriceNo ratings yet

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Document1 pageFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkDan NolanNo ratings yet

- Inspired Sisters LTD Online) AUDocument3 pagesInspired Sisters LTD Online) AUthankksNo ratings yet

- Staff - p45Document4 pagesStaff - p45velorutionNo ratings yet

- UK Legal Entity: Assets TransferredDocument3 pagesUK Legal Entity: Assets Transferredshu1706No ratings yet

- p45 Tomasz Jureczko Diamonds Digital LTDDocument3 pagesp45 Tomasz Jureczko Diamonds Digital LTDTomasz JureczkoNo ratings yet

- PrintP45 PDFDocument3 pagesPrintP45 PDFIstoc AngelaNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkSteve OrtonNo ratings yet

- 5184 P45 (Online) PDFDocument3 pages5184 P45 (Online) PDFAlejandroe AuditoreNo ratings yet

- P45 - Ms Wenyi Zhao (2022) - Employee 4Document3 pagesP45 - Ms Wenyi Zhao (2022) - Employee 4Ming WuNo ratings yet

- Ion Onl Y: Copy For HM Revenue & CustomsDocument4 pagesIon Onl Y: Copy For HM Revenue & CustomsM Muneeb SaeedNo ratings yet

- P60single 2Document1 pageP60single 2Claira JervisNo ratings yet

- Payslip Month Ending 30 November 2022Document1 pagePayslip Month Ending 30 November 2022zeppo1234No ratings yet

- ПЭЙСЛИП OutputDocument1 pageПЭЙСЛИП Output13KARATNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- Receipts - 2022 10 18 - 2023 02 12Document12 pagesReceipts - 2022 10 18 - 2023 02 12TUYISINGIZE AngeliqueNo ratings yet

- R43 2019 PDFDocument4 pagesR43 2019 PDFDavid Mark AldridgeNo ratings yet

- Inbound Paper SA1 Form With Instruction - SignedDocument3 pagesInbound Paper SA1 Form With Instruction - SignedKushal SharmaNo ratings yet

- Ep60 2016-17 PDFDocument1 pageEp60 2016-17 PDFAnonymous ZoN0SOKzVNo ratings yet

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresNo ratings yet

- Private and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duDocument1 pagePrivate and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duElaine HicksNo ratings yet

- N26 Kurfürstenstraße 72 Berl I N, 10787 Tel Ephone: 44 2035 107126 Www. n26. ComDocument1 pageN26 Kurfürstenstraße 72 Berl I N, 10787 Tel Ephone: 44 2035 107126 Www. n26. ComThomas ShelbyNo ratings yet

- Soa PDFDocument1 pageSoa PDFLiezel TapiaNo ratings yet

- Gta 6Document5 pagesGta 6CharmieNo ratings yet

- Account Number: LT493500010003046018: February 6, 2023 22:03 Lahreche Merouane El Hadika Metlili, GhardaiaDocument2 pagesAccount Number: LT493500010003046018: February 6, 2023 22:03 Lahreche Merouane El Hadika Metlili, GhardaiaBlacky Burn100% (1)

- End of Year Certificate: Mrs Lyn Lakers School Acres WK508S, 57ADocument1 pageEnd of Year Certificate: Mrs Lyn Lakers School Acres WK508S, 57AMrSplanNo ratings yet

- LicenseDocument6 pagesLicenseRazvannusNo ratings yet

- 2021 FullDocument14 pages2021 FullDamian MikaNo ratings yet

- Proof of Income Letter - ArtemPavlenko PDFDocument1 pageProof of Income Letter - ArtemPavlenko PDFАлексейNo ratings yet

- BoothPeterDarren 2022 1Document14 pagesBoothPeterDarren 2022 1Αριστείδης ΜέγαςNo ratings yet

- Transaction ReportDocument1 pageTransaction ReportRoger BurkeNo ratings yet

- HMRC - Tax Years 2021Document2 pagesHMRC - Tax Years 2021mxpskdff7cNo ratings yet

- Bulkhaul Limited: FalseDocument1 pageBulkhaul Limited: FalseJamie ElliottNo ratings yet

- HSBC FR RibDocument1 pageHSBC FR RibloengNo ratings yet

- Tax Year To 5 April: P60 End of Year CertificateDocument1 pageTax Year To 5 April: P60 End of Year CertificateВолодимир МельникNo ratings yet

- AAA - Chamber of CommerceDocument47 pagesAAA - Chamber of CommerceTusew PereraNo ratings yet

- 64-8 Form (Másolat)Document2 pages64-8 Form (Másolat)Molnar FerencneNo ratings yet

- وصية شرعيةDocument5 pagesوصية شرعيةWaleed OthmanNo ratings yet

- Book1 PsDocument2 pagesBook1 PsVincent IgnacioNo ratings yet

- HMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDocument3 pagesHMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDavid Gatt100% (1)

- Leaving The UK - Getting Your Tax Right: About This FormDocument4 pagesLeaving The UK - Getting Your Tax Right: About This Form_Cristi_No ratings yet

- DCN 180620142147 5460177Document3 pagesDCN 180620142147 5460177Sarath S SundarNo ratings yet

- CLR 2020 Tax ReturnDocument14 pagesCLR 2020 Tax ReturnAlexander Barno AlexNo ratings yet

- Factura AlibabaDocument1 pageFactura AlibabaWillian CordovaNo ratings yet

- Proof of Income DeclarationDocument2 pagesProof of Income DeclarationElin MarlinaNo ratings yet

- DocDocument6 pagesDocwizardzx2No ratings yet

- KYC For JP Fuel (KPS)Document6 pagesKYC For JP Fuel (KPS)LorraineNo ratings yet

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDocument7 pagesA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNo ratings yet

- Iso 9001Document6 pagesIso 9001IulianNo ratings yet

- Claim For Repayment of Tax Deducted From Savings and InvestmentsDocument4 pagesClaim For Repayment of Tax Deducted From Savings and InvestmentsxzmangeshNo ratings yet

- Eonnext - 3rd of Jun - 25th of Jun 2023Document5 pagesEonnext - 3rd of Jun - 25th of Jun 2023qzvg5csbmnNo ratings yet

- Factory April BillDocument3 pagesFactory April BillSumit AgarwalNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkPapa JP JohnNo ratings yet

- P45 94142 (1) BunDocument4 pagesP45 94142 (1) BunCosty DutaNo ratings yet

- P45 (Online) - LJDocument3 pagesP45 (Online) - LJGreat EmmanuelNo ratings yet

- Text File 10Document1 pageText File 10Duc Trong DuongNo ratings yet

- A Universal Time Kill All Players (Fe)Document1 pageA Universal Time Kill All Players (Fe)Duc Trong DuongNo ratings yet

- Screenshot 2020-12-27 at 10.30.30Document1 pageScreenshot 2020-12-27 at 10.30.30Duc Trong DuongNo ratings yet

- Screenshot 2020-12-27 at 10.30.30Document1 pageScreenshot 2020-12-27 at 10.30.30Duc Trong DuongNo ratings yet

- Loan Amount 12 MonthsDocument2 pagesLoan Amount 12 MonthsMaroden Sanchez GarciaNo ratings yet

- 10.1 Lung Center V Quezon City DigestDocument2 pages10.1 Lung Center V Quezon City DigestCara Lucille Diaz RosNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document6 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Maria AmberNo ratings yet

- CIR v. Enron Subic Power CorporationDocument2 pagesCIR v. Enron Subic Power CorporationGain DeeNo ratings yet

- Prestige Atlas 3.0 Induction Cooktop: Grand Total 999.00Document1 pagePrestige Atlas 3.0 Induction Cooktop: Grand Total 999.00Alok KumarNo ratings yet

- IncTax and PostEmpBenDocument42 pagesIncTax and PostEmpBenMarcus MonocayNo ratings yet

- 119242-2003-China Banking Corp. v. Court of AppealsDocument17 pages119242-2003-China Banking Corp. v. Court of AppealsColleen GuimbalNo ratings yet

- Abm Fabm2 Module 8 Lesson 2 Income and Business TaxationDocument24 pagesAbm Fabm2 Module 8 Lesson 2 Income and Business TaxationMelody Fabreag76% (25)

- Taxation in Sri LankaDocument11 pagesTaxation in Sri LankaThiluneluNo ratings yet

- Deductions U/s 80C To 80 U From Gross Total Income: For The AY-2018-19 FY-2017-18Document19 pagesDeductions U/s 80C To 80 U From Gross Total Income: For The AY-2018-19 FY-2017-18Shamrao GhodakeNo ratings yet

- Normal Acc BalanceDocument1 pageNormal Acc BalanceRavi Shankar SNo ratings yet

- Government of Khyber PakhtunkhwaDocument1 pageGovernment of Khyber PakhtunkhwaSSP Traffic AbbottabadNo ratings yet

- JEEVES Invoice PDFDocument1 pageJEEVES Invoice PDFBijay BeheraNo ratings yet

- Annexure V Comparative ChartDocument4 pagesAnnexure V Comparative ChartRaju HalderNo ratings yet

- Case Study OutputDocument7 pagesCase Study OutputRoshel Guadalquiver100% (1)

- Dream Catcher Events Financial PlanDocument10 pagesDream Catcher Events Financial PlanPrince Jeffrey FernandoNo ratings yet

- Mercury Drug CorporationDocument5 pagesMercury Drug CorporationLiDdy Cebrero Belen0% (1)

- CORRECTED (If Checked)Document2 pagesCORRECTED (If Checked)Dennis100% (1)

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSuhani GargNo ratings yet

- APC 210813164011619null 1795785832Document1 pageAPC 210813164011619null 1795785832ratnesh vaviaNo ratings yet

- Projected Statement of Financial PositionDocument3 pagesProjected Statement of Financial PositionNouman BaigNo ratings yet

- Tax INDIVIDUALPre-Board NCPARDocument6 pagesTax INDIVIDUALPre-Board NCPARlorenceabad07100% (1)

- Form DGT 12017Document16 pagesForm DGT 12017hendrikNo ratings yet

- BIR Ruling 756-19 (Assoc Dues EXMPT From Income Tax)Document4 pagesBIR Ruling 756-19 (Assoc Dues EXMPT From Income Tax)ilovelawschoolNo ratings yet

- Feb+ActFiber Invoice2022Document2 pagesFeb+ActFiber Invoice2022shiva krishnaNo ratings yet

- 2017 Bar - Taxation LawDocument5 pages2017 Bar - Taxation LawMiamor NatividadNo ratings yet

- CASE Digests For Tax Review Starting From INCOME TaxDocument69 pagesCASE Digests For Tax Review Starting From INCOME TaxAna LogosandprintsNo ratings yet

- Noise in voiceOD120797931100670000Document3 pagesNoise in voiceOD120797931100670000Pandu RachaNo ratings yet

- Tax Return Receipt Confirmation San Aguurstin SDocument2 pagesTax Return Receipt Confirmation San Aguurstin SNacho100% (1)

- IncomeTax Banggawan Ch11Document9 pagesIncomeTax Banggawan Ch11Noreen Ledda33% (9)