Professional Documents

Culture Documents

P45 - Ms Wenyi Zhao (2022) - Employee 4

Uploaded by

Ming WuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P45 - Ms Wenyi Zhao (2022) - Employee 4

Uploaded by

Ming WuCopyright:

Available Formats

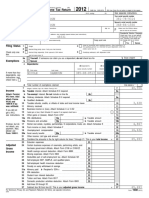

P45 Part 1A

Details of employee leaving work

Copy for employee

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

120 / KA94561

6 Tax code at leaving date

2 Employee's National Insurance number

1253L

SN778898C If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/month 1

Ms 7 Last entries on Payroll record/Deductions Working Sheet.

Surname or family name Complete only if tax code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

Zhao

First name(s) Week number 2 Month number

Wenyi Total pay to date

4 Leaving date DD MM YYYY

£ 752.72 p

Total tax to date

12 04 2022

£ 54.00 p

8 This employment pay and tax. If no entry here, the amounts 12 Employee’s private address

are those shown at box 7.

Total pay in this employment

134 Catherine Garden

£ p Hounslow

Total tax in this employment

p Postcode

£

TW3 2PW

9 Works number/Payroll number and Department or branch

(if any) 13 I certify that the details entered in items 1 to 11 on

this form are correct.

Employer name and address

1

Guillermo Frohlich

10 Gender. Enter 'X' in the appropriate box 3 Railway Cottages

Brewery Lane

Male Female X

11 Date of birth DD MM YYYY Postcode

27 02 1972 TW1 1BB

Date DD MM YYYY

14 04 2022

To the employee Tax credits and Universal Credit

The P45 is in 3 parts. Please keep this part (Part 1A) safe. Tax credits and Universal Credit are flexible. They adapt to

Copies are not available. You might need the information in changes in your life, such as leaving a job. If you need to let us

Part 1A to fill in a tax return if you are sent one. know about a change in your income, phone 0345 300 3900.

Please read the notes in Part 2 that accompany Part 1A. To the new employer

The notes give some important information about what you If your new employee gives you this Part 1A, please return

should do next and what you should do with Parts 2 and 3 of it to them. Check the information on Parts 2 and 3 of this

this form. form is correct and transfer the information onto the

Payroll record/Deductions Working Sheet.

P45(Continuous) Part 1A Page 2 HMRC 12/15

P45 Part 2

Details of employee leaving work

Copy for new employer

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

120 / KA94561

6 Tax code at leaving date

2 Employee's National Insurance number

1253L

SN778898C If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/month 1

Ms 7 Last entries on Payroll record/Deductions Working Sheet.

Surname or family name Complete only if tax code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

Zhao

First name(s) Week number 2 Month number

Wenyi Total pay to date

4 Leaving date DD MM YYYY

£ 752.72 p

Total tax to date

12 04 2022

£ 54.00 p

To the employee

This form is important to you. Take good care of it and keep it Claiming Jobseeker's Allowance or

safe. Copies are not available. Please keep Parts 2 and 3 of Employment and Support Allowance (ESA)

the form together and do not alter them in any way. Take this form to your Jobcentre Plus office. They will pay you

Going to a new job any tax refund you may be entitled to when your claim ends,

Give Parts 2 and 3 of this form to your new employer, or you or at 5 April if this is earlier.

will have tax deducted using the emergency code and may Not working and not claiming Jobseeker's Allowance or

pay too much tax. If you do not want your new employer to Employment and Support Allowance (ESA)

know the details on this form, send it to your HM Revenue & If you have paid tax and wish to claim a refund fill in form

Customs (HMRC) office immediately with a letter saying so P50, ‘Claiming tax back when you have stopped working’,

and giving the name and address of your new employer. go to www.gov.uk/government/publications/income-tax-

HMRC can make special arrangements, but you may pay too claiming-tax-back-when-you-have-stopped-working-p50

much tax for a while as a result of this.

Help

Going abroad

If you need more help, go to www.gov.uk/topic/business-

If you are going abroad or returning to a country

tax/paye

outside the UK fill in form P85, ‘Leaving the United Kingdom’,

go to www.gov.uk/government/publications/income-tax- To the new employer

leaving-the-uk-getting-your-tax-right-p85 Check this form, record the start date and report it to HMRC

Becoming self-employed in the first Full Payment Submission for your employee.

You must register with HMRC within 3 months of becoming Prepare a Payroll record/Deductions Working Sheet. Follow

self-employed or you could incur a penalty. the instructions at www.gov.uk/payroll-software

To register as newly self-employed, go to Keep Part 2.

www.gov.uk/topic/business-tax/self-employed

P45(Continuous) Part 2 Page 3 HMRC 12/15

P45 Part 3

New employee details

For completion by new employer

Use capital letters when completing this form

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

120 / KA94561

6 Tax code at leaving date

2 Employee's National Insurance number

1253L

SN778898C If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/month 1

Ms 7 Last entries on the Payroll record/Deductions Working

Surname or family name Sheet. Complete only if tax code is cumulative. If there is

an 'X' at box 6 there will be no entries here.

Zhao

First name(s) Week number 2 Month number

Wenyi Total pay to date

4 Leaving date DD MM YYYY

£ 752.72 p

Total tax to date

12 04 2022

£ 54.00 p

To the new employer

8 New employer PAYE reference 15 Employee's private address

Office number Reference number

/

9 Date new employment started DD MM YYYY

Postcode

10 Works number/Payroll number and Department or branch

(if any) 16 Gender. Enter 'X' in the appropriate box

Male Female

17 Date of birth DD MM YYYY

11 Enter 'P' here if employee will not be paid by you

between the date employment began and the

next 5 April.

Declaration

12 Enter tax code in use if different to the tax code at box 6.

18 I have prepared a Payroll record/Deductions Working

Sheet in accordance with the details above.

Employer name and address

If week 1 or month 1 applies, enter 'X' in the box below.

Week 1/month 1

13 If the tax figure you are entering on the Payroll

record/Deductions Working Sheet differs from box 7

please enter the figure here.

Postcode

£ p

14 New employee's job title or job description Date DD MM YYYY

P45(Continuous) Part 3 Page 4 HMRC 12/15

You might also like

- Credit ApplicationDocument1 pageCredit Applicationdhine77No ratings yet

- U.S. Individual Income Tax Return: Standard DeductionDocument3 pagesU.S. Individual Income Tax Return: Standard DeductionAkNo ratings yet

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- Rhonda TX RTNDocument18 pagesRhonda TX RTNobriens05No ratings yet

- Michael Easley 1040 2017Document2 pagesMichael Easley 1040 2017MichaelNo ratings yet

- Enrolment Fee: 1 5.00 Including Vat. Please Make Cheques Payable To Seatax LTD 9Document6 pagesEnrolment Fee: 1 5.00 Including Vat. Please Make Cheques Payable To Seatax LTD 9Bob471372No ratings yet

- Advia Credit Union 2Document1 pageAdvia Credit Union 2kathyNo ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- 4 - Home Loan TerminolgyDocument210 pages4 - Home Loan Terminolgypurit83No ratings yet

- Direct Deposit FormDocument2 pagesDirect Deposit FormCamiloNo ratings yet

- Title MaxDocument1 pageTitle MaxHumayon MalekNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Zambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Document15 pagesZambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Yaidhyt PradoNo ratings yet

- CLR 2020 Tax ReturnDocument14 pagesCLR 2020 Tax ReturnAlexander Barno AlexNo ratings yet

- ApplicationDocument2 pagesApplicationFabian SandovalNo ratings yet

- 16 540-SignedDocument5 pages16 540-Signedapi-352277890No ratings yet

- Imigracion 2Document15 pagesImigracion 2erickNo ratings yet

- Form - I 9 - 10 21 2019Document3 pagesForm - I 9 - 10 21 2019Mitch SabioNo ratings yet

- Request For A Domestic Wire Transfer: Please NoteDocument1 pageRequest For A Domestic Wire Transfer: Please NoteCharmin N. RickardsNo ratings yet

- 540 FinalDocument5 pages540 Finalapi-350796322No ratings yet

- 2022 T1 Form - CompletedDocument8 pages2022 T1 Form - CompletedARSH GROVERNo ratings yet

- Aging in PlaceDocument53 pagesAging in Placecluelessss8No ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationYut ChiaNo ratings yet

- Captura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Document4 pagesCaptura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Adriana AnsurezNo ratings yet

- Risk Appetite GuideDocument50 pagesRisk Appetite GuideAmlan Kumar SahuNo ratings yet

- 2022 Individual Tax ReturnDocument6 pages2022 Individual Tax ReturnstephinecaustonNo ratings yet

- View Tax Return PDFDocument14 pagesView Tax Return PDFEmil AndriesNo ratings yet

- BoothPeterDarren 2022 1Document14 pagesBoothPeterDarren 2022 1Αριστείδης ΜέγαςNo ratings yet

- BNL Reviewer QuestionnaireDocument29 pagesBNL Reviewer QuestionnaireKent Mathew BacusNo ratings yet

- Payslip Month Ending 30 November 2022Document1 pagePayslip Month Ending 30 November 2022zeppo1234No ratings yet

- Application 18802654 20191029044618 PDFDocument10 pagesApplication 18802654 20191029044618 PDFAnna GassettNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkCaleb PriceNo ratings yet

- 257772why You Should Spend More Time Thinking About wgw88 Online CasinoDocument2 pages257772why You Should Spend More Time Thinking About wgw88 Online Casinomaldorkscy100% (1)

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- LicenseDocument6 pagesLicenseRazvannusNo ratings yet

- Tax Return Enclosures List: FEDERAL T1 2009Document16 pagesTax Return Enclosures List: FEDERAL T1 2009Christine TemplemanNo ratings yet

- Private and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASDocument1 pagePrivate and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASMihaela MiscaNo ratings yet

- P45 (ONLINE) Duc Trong Duong 2Document3 pagesP45 (ONLINE) Duc Trong Duong 2Duc Trong DuongNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkSteve OrtonNo ratings yet

- View Completed FormsDocument10 pagesView Completed FormsRui FariaNo ratings yet

- HMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDocument3 pagesHMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDavid Gatt100% (1)

- Tax Return 2018-19Document18 pagesTax Return 2018-19Kasam ANo ratings yet

- PCE Trial Exam 1Document55 pagesPCE Trial Exam 1Kenny Chen68% (22)

- Royal Air Force Interest Form - Officer: Customer Id: 14911956 Request Id: 20273155Document14 pagesRoyal Air Force Interest Form - Officer: Customer Id: 14911956 Request Id: 20273155Jay SayNo ratings yet

- P60single 2Document1 pageP60single 2Claira JervisNo ratings yet

- Contact Information: Mirosanu I Do Not Have A Middle Name / Initial ToniDocument9 pagesContact Information: Mirosanu I Do Not Have A Middle Name / Initial ToniToni MirosanuNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkDan NolanNo ratings yet

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Document1 pageFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanNo ratings yet

- ПЭЙСЛИП OutputDocument1 pageПЭЙСЛИП Output13KARATNo ratings yet

- What Is Aadhaar KYC Know e KYC For Aadhaar CardDocument3 pagesWhat Is Aadhaar KYC Know e KYC For Aadhaar CardHARSHNo ratings yet

- Turkey PDFDocument1 pageTurkey PDFlessthanleoNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkDenis VitalieviciNo ratings yet

- Estmt - 2024 02 29Document5 pagesEstmt - 2024 02 29sayedsajid653100% (1)

- Customs Worksheet in Respect of Bill of Entry: SUPPLIER'S INVOICE #01315829 40.00 EUR 0.058961 678Document14 pagesCustoms Worksheet in Respect of Bill of Entry: SUPPLIER'S INVOICE #01315829 40.00 EUR 0.058961 678Olivio Nhampossa100% (1)

- Copy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnDocument3 pagesCopy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnZavache DanaNo ratings yet

- R43 2019 PDFDocument4 pagesR43 2019 PDFDavid Mark AldridgeNo ratings yet

- Staff - p45Document4 pagesStaff - p45velorutionNo ratings yet

- Malayan Insurance V CADocument2 pagesMalayan Insurance V CAPer-Vito DansNo ratings yet

- P46: Employee Without A Form P45: Section OneDocument2 pagesP46: Employee Without A Form P45: Section Onedeepika505No ratings yet

- KYC For JP Fuel (KPS)Document6 pagesKYC For JP Fuel (KPS)LorraineNo ratings yet

- Hillside Children's Center, New York 2014 IRS ReportDocument76 pagesHillside Children's Center, New York 2014 IRS ReportBeverly TranNo ratings yet

- Book1 PsDocument2 pagesBook1 PsVincent IgnacioNo ratings yet

- Fall 2023 - Tax ProjectDocument4 pagesFall 2023 - Tax Projectacwriters123No ratings yet

- Tax Return 2023Document2 pagesTax Return 2023jacksonleah313No ratings yet

- P 46Document2 pagesP 46Charlotte JamesNo ratings yet

- Corporate Income Tax Return: Paradise Produce Dist., Inc. 59-3024048Document31 pagesCorporate Income Tax Return: Paradise Produce Dist., Inc. 59-3024048kevin kuhnNo ratings yet

- Sample SpielsDocument17 pagesSample SpielsAnthony MateoNo ratings yet

- Indemnity Bond /: (To Be Printed On A Plain A4 Paper) (Document2 pagesIndemnity Bond /: (To Be Printed On A Plain A4 Paper) (VasanthNo ratings yet

- I - ESIC IP Interface ROOPADocument1 pageI - ESIC IP Interface ROOPAYogesh DevkareNo ratings yet

- Guia Medico Unimed LitoralDocument75 pagesGuia Medico Unimed LitoralLucas BortoluzziNo ratings yet

- 2100 Customs Brokers, Inc. v. Philam Insurance Co.Document15 pages2100 Customs Brokers, Inc. v. Philam Insurance Co.Cassie GacottNo ratings yet

- Moving From First Additions To The Barclays Bank Account With Tech Pack - 28-SEP-15 PDFDocument7 pagesMoving From First Additions To The Barclays Bank Account With Tech Pack - 28-SEP-15 PDFDecodare GsmNo ratings yet

- Kami Export - Year 11 Spring Break RevisionDocument90 pagesKami Export - Year 11 Spring Break Revisionbkhmnrq4d6No ratings yet

- Chapter Three: Financial Institutions and OperationsDocument122 pagesChapter Three: Financial Institutions and OperationsYismawNo ratings yet

- Manjeet Singh Vs National Insurance Company LTDDocument30 pagesManjeet Singh Vs National Insurance Company LTDVANSHIKA SINGHNo ratings yet

- Corporate Accounting 1: III Semester BBADocument57 pagesCorporate Accounting 1: III Semester BBAAR Ananth Rohith BhatNo ratings yet

- Rbi Grade B 2020: Discussion On Government Schemes Through Mcqs - VDocument22 pagesRbi Grade B 2020: Discussion On Government Schemes Through Mcqs - VTarun GargNo ratings yet

- Star Cardiac Care Brochure PlatinumDocument8 pagesStar Cardiac Care Brochure PlatinumyankiNo ratings yet

- Policy No. Plan Name Frequency Installment PremiumDocument1 pagePolicy No. Plan Name Frequency Installment PremiumMotilal HembramNo ratings yet

- Outcomes Pre-Int VocabBuilder Unit15Document6 pagesOutcomes Pre-Int VocabBuilder Unit15Eyad SobehNo ratings yet

- GDL-1690 AntiFraud Plan GuideDocument10 pagesGDL-1690 AntiFraud Plan GuideHeru SusmonoNo ratings yet

- Exam P Sample QuestionsDocument136 pagesExam P Sample QuestionsKarimaNo ratings yet

- BCC Sca 108 Licuas J2003 2023Document20 pagesBCC Sca 108 Licuas J2003 2023Mohamed shehataNo ratings yet

- United India Insurance Company LimitedDocument3 pagesUnited India Insurance Company Limitedsree digitals DigitalsNo ratings yet

- Insurance Circular Letter No. 052-14: CD Technologies Asia, Inc. © 2019Document2 pagesInsurance Circular Letter No. 052-14: CD Technologies Asia, Inc. © 2019Mary Mayne LamusaoNo ratings yet

- Apsun PDFDocument8 pagesApsun PDFStafford34CaldwellNo ratings yet

- HCM 345 Final Project 1Document13 pagesHCM 345 Final Project 1Eunice AppiahNo ratings yet

- PADMALIFE-Annual Report - 2017Document74 pagesPADMALIFE-Annual Report - 2017Saram ShahNo ratings yet

- Understanding Contracts 2: Unit 10B/HigherDocument25 pagesUnderstanding Contracts 2: Unit 10B/HigherBoris RuizNo ratings yet

- Acko Bike Policy - DBCR00233281261 - 00Document1 pageAcko Bike Policy - DBCR00233281261 - 00Sunil TontekarNo ratings yet