Professional Documents

Culture Documents

Assesment Notice 2017

Uploaded by

Shounak KossambeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assesment Notice 2017

Uploaded by

Shounak KossambeCopyright:

Available Formats

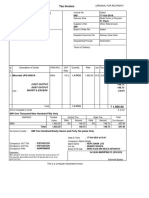

Tax Reference No : G5996331M NOTICE OF ASSESSMENT

Year of Assessment : 2017

Income Tax ORIGINAL

Date : 05 Jul 2017

Please quote the Tax Reference Number (eg. NRIC, FIN, etc) in full when corresponding with us.

MR KOSSAMBE NANDAN

631 CHOA CHU KANG NORTH 6

#05-231

SINGAPORE 680631

55 Newton Road

(680631H) Revenue House

Singapore 307987

Tel: 1800-356 8300

Website: http://www.iras.gov.sg

e-Services: https://mytax.iras.gov.sg

1-1

OTHER 1. Your tax assessment is

S'PORE ($) COUNTRIES ($) TOTAL ($) based on information obtained

from the relevant organisations

EMPLOYMENT 127,934.00 127,934.00 and your last year's tax record,

DIVIDENDS 1.00 1.00 if any. Please notify us of any

understatement or omission of

TOTAL INCOME 127,935.00 127,935.00 any income or of any excessive

tax relief as there are penalties

ASSESSABLE INCOME 127,935.00 for failing to do so.

LESS: PERSONAL RELIEFS

2. Pay your income tax by GIRO

Earned Income 1,000.00 to enjoy up to 12-month interest

Spouse/Handicapped Spouse 2,000.00 free instalments. If you prefer

other modes of payment,

Child (QCR) 4,000.00 please pay the amount stated in

TOTAL PERSONAL RELIEFS 7,000.00 this Notice by the due date,

even if you object to the

CHARGEABLE INCOME 120,935.00 assessment.

FIRST 120,000.00 7,950.00 Your total outstanding income

NEXT 935.00 @ 15.00% 140.25 8,090.25 tax balance is shown in the

Statement of Account which is

LESS: TAX SETOFFS attached / will be sent to you

shortly.

20 % Tax Rebate (capped at $500) 500.00

TAX PAYABLE BY 05 AUG 2017 7,590.25 DR 3. If you have any objection,

please submit your objection

Thank you for your contribution towards nation building online within 30 days via the

Object to Assessment e-service

or email us at myTax Portal.

TAN TEE HOW

COMPTROLLER OF INCOME TAX

Printed via myTax Portal https://mytax.iras.gov.sg

1-1 Page 1 of 1 301 CFN03101 106-13-552263387-0-2

You might also like

- Notice of Assessment Original: Printed Via Mytax PortalDocument1 pageNotice of Assessment Original: Printed Via Mytax PortalAbdul HalimNo ratings yet

- Notice of Assessment OriginalDocument1 pageNotice of Assessment OriginalWawan SaidNo ratings yet

- Noa-Iit Ob212020062419132485y PDFDocument1 pageNoa-Iit Ob212020062419132485y PDFilamahizhNo ratings yet

- Noa-Iit Ob2320170627071310ufp PDFDocument1 pageNoa-Iit Ob2320170627071310ufp PDFjasper haiNo ratings yet

- Noa-Iit Ob2620150425142233zb4 PDFDocument1 pageNoa-Iit Ob2620150425142233zb4 PDFKanza KhanNo ratings yet

- Aircel Nov BillDocument14 pagesAircel Nov BillPavnesh SharmaaNo ratings yet

- Cor - Indonesia PDFDocument1 pageCor - Indonesia PDFsyaefulNo ratings yet

- 000001098403750Document8 pages000001098403750cyrus1988No ratings yet

- Account Summary: Credit Card NumberDocument6 pagesAccount Summary: Credit Card Numberanilvishaka7621No ratings yet

- Abhinav Sharma - Broadband Invoice Apr - Jun 2019Document1 pageAbhinav Sharma - Broadband Invoice Apr - Jun 2019HarshulNo ratings yet

- Awb TNT NavarraDocument5 pagesAwb TNT NavarramarschkakatuleNo ratings yet

- Statement of Account: Penyata AkaunDocument4 pagesStatement of Account: Penyata Akaunrazali1982No ratings yet

- CreditCardStatement625385 - 2077 - 13-Sep-19Document1 pageCreditCardStatement625385 - 2077 - 13-Sep-19muhammad baqirNo ratings yet

- Ishan Netsol Private Limited: Tax InvoiceDocument2 pagesIshan Netsol Private Limited: Tax InvoiceSunil Patel100% (1)

- So A 900920160610Document1 pageSo A 900920160610Francisco Oringo Sr ESNo ratings yet

- City BankDocument3 pagesCity BankChong ShanNo ratings yet

- Smart Aug 2018Document6 pagesSmart Aug 2018Ash MangueraNo ratings yet

- Go Green and Receive Your Income Tax Notices Electronically: WWW - Iras.gov - SG Mytax - Iras.gov - SGDocument2 pagesGo Green and Receive Your Income Tax Notices Electronically: WWW - Iras.gov - SG Mytax - Iras.gov - SGJinchi WeiNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/02/2019Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/02/2019pravv vvvNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisJumain B SaideNo ratings yet

- Receipt - LinkedIn January PDFDocument2 pagesReceipt - LinkedIn January PDFNikolaxMNo ratings yet

- Valued Customer:: Leaving VerifyDocument1 pageValued Customer:: Leaving VerifyJomar GarciaNo ratings yet

- Statement of Account: 678170259 16-Jul-2019 588.84 PDocument2 pagesStatement of Account: 678170259 16-Jul-2019 588.84 PIvy PantalunanNo ratings yet

- Thank You For Paying On-Time: Basic Housing Solutions, IncDocument1 pageThank You For Paying On-Time: Basic Housing Solutions, IncMarcelo AnfoneNo ratings yet

- R A 7836Document4 pagesR A 7836Les Camacho SorianoNo ratings yet

- ViewSoa PDFDocument6 pagesViewSoa PDFIan DelesNo ratings yet

- CL Invoice SampleDocument4 pagesCL Invoice SampleRanjita08No ratings yet

- Shipment Document ServletDocument3 pagesShipment Document ServletSalman JoharNo ratings yet

- Invoice IAB22330 2020 04 17Document1 pageInvoice IAB22330 2020 04 17dsenabulyaNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisThivasinee ThivaNo ratings yet

- INVOICESDocument3 pagesINVOICEShbmmzaNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice Detailsvamshi krishnaNo ratings yet

- Electronic Invoice: Your Account at A GlanceDocument3 pagesElectronic Invoice: Your Account at A GlanceAlexander AlexanderNo ratings yet

- Statement Details: Your Account SummaryDocument3 pagesStatement Details: Your Account SummaryTJ JanssenNo ratings yet

- Tax Invoice: Mathru Indane Gas SERVICE (0000273708)Document2 pagesTax Invoice: Mathru Indane Gas SERVICE (0000273708)Shashi KiranNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisJAGO TRADINGNo ratings yet

- Spectra Net 2Document4 pagesSpectra Net 2nitinNo ratings yet

- Monthly Charges For Scott's Computer Service: Summary Report RMM MAV WEB MOB App Control SubtotalDocument25 pagesMonthly Charges For Scott's Computer Service: Summary Report RMM MAV WEB MOB App Control SubtotalScott MayerNo ratings yet

- Airtel BillDocument3 pagesAirtel Billsonuindia88No ratings yet

- Your Account Summary: F-240 Telephone Number: MultipleDocument4 pagesYour Account Summary: F-240 Telephone Number: MultipleAaron CruzNo ratings yet

- Format of Tax InvoiceDocument5 pagesFormat of Tax InvoiceHiren ShahNo ratings yet

- TaxInvoice 01052016 PDFDocument5 pagesTaxInvoice 01052016 PDFeka qhairishNo ratings yet

- Hotel HeritageDocument2 pagesHotel HeritageAraltNo ratings yet

- Application Form Account Opening20112016031008Document4 pagesApplication Form Account Opening20112016031008Jim AlanNo ratings yet

- Su20101219231310x32 328505783 833898083Document7 pagesSu20101219231310x32 328505783 833898083Alif AkatsukiNo ratings yet

- Sample Telephone BillDocument2 pagesSample Telephone BillAnonymous e29tN9pNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument3 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisLok Shin YeiNo ratings yet

- Exim Bank 2020 Financial StatementDocument1 pageExim Bank 2020 Financial StatementLucas MgangaNo ratings yet

- AprilDocument2 pagesAprilLorelie LimNo ratings yet

- (Original) : Freight Invoice / Tax InvoiceDocument8 pages(Original) : Freight Invoice / Tax InvoiceEdith Olivera NozupNo ratings yet

- B1 65375921Document2 pagesB1 65375921Sandeep RanaNo ratings yet

- Umesh BillDocument1 pageUmesh Billlokesh naikNo ratings yet

- Invoice and Payment For Invoice Confir - 202201071635Document1 pageInvoice and Payment For Invoice Confir - 202201071635Engelbert BalderNo ratings yet

- IRS Fines Ron Paul's Campaign For LibertyDocument4 pagesIRS Fines Ron Paul's Campaign For Libertytshoes100% (1)

- Date Transaction Description Amount (In RS.)Document1 pageDate Transaction Description Amount (In RS.)shashi singhNo ratings yet

- UPS BillDocument2 pagesUPS Billmack100% (1)

- April Airtel BillDocument26 pagesApril Airtel BillRakesh Kumar Singh0% (2)

- MobileBill 1067824907Document23 pagesMobileBill 1067824907Abhik ChakrabortyNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisMohd Salleh AmboNo ratings yet

- Noa-Iit Ob2320190701042209hz8Document1 pageNoa-Iit Ob2320190701042209hz8Jay Maung MaungNo ratings yet

- Arfmtsv56 N1 P133 146Document14 pagesArfmtsv56 N1 P133 146Shounak KossambeNo ratings yet

- Application Template - Tech Summers 2020Document5 pagesApplication Template - Tech Summers 2020Shounak KossambeNo ratings yet

- Covidcare PDSADocument1 pageCovidcare PDSAShounak KossambeNo ratings yet

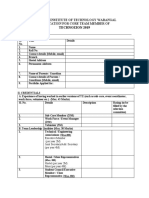

- Technozion 2019: National Institute of Technology Warangal Application For Core Team Member ofDocument3 pagesTechnozion 2019: National Institute of Technology Warangal Application For Core Team Member ofShounak KossambeNo ratings yet

- Tuition Fee - Instructions To Students NITW - UG STUDENTS DEC-2020Document5 pagesTuition Fee - Instructions To Students NITW - UG STUDENTS DEC-2020Shounak KossambeNo ratings yet

- National Institute of Technology, Warangal: Academic ResultDocument1 pageNational Institute of Technology, Warangal: Academic ResultShounak KossambeNo ratings yet

- CAD CAM Third Edition Solution ManualDocument155 pagesCAD CAM Third Edition Solution ManualShounak Kossambe0% (1)

- Cantilever Non HarmonicDocument10 pagesCantilever Non HarmonicShounak KossambeNo ratings yet

- By:Shounak Rajat Mukesh Project Supervisor:KV SAI SRINADHDocument9 pagesBy:Shounak Rajat Mukesh Project Supervisor:KV SAI SRINADHShounak KossambeNo ratings yet

- Monthly Continuous Evaluation ReportDocument2 pagesMonthly Continuous Evaluation ReportShounak KossambeNo ratings yet

- CourseraDocument1 pageCourseraShounak KossambeNo ratings yet

- Lec 8Document20 pagesLec 8Shounak KossambeNo ratings yet

- CourseraDocument1 pageCourseraShounak KossambeNo ratings yet

- FEA TheoryDocument49 pagesFEA Theoryof_switzerlandNo ratings yet

- Components of RefrigeratorDocument4 pagesComponents of RefrigeratorShounak KossambeNo ratings yet

- Lec 30Document15 pagesLec 30Shounak KossambeNo ratings yet

- Appendix - D Parent DeclarationDocument1 pageAppendix - D Parent DeclarationShounak KossambeNo ratings yet

- SAT Subject Tests: ChemistryDocument2 pagesSAT Subject Tests: ChemistryShounak KossambeNo ratings yet

- Welding Tool ListDocument1 pageWelding Tool ListdesrytandiNo ratings yet

- IES Exam Paper 2015 Conventional Mechanical Engineering Paper I - WWW - Iasexamportal.comDocument12 pagesIES Exam Paper 2015 Conventional Mechanical Engineering Paper I - WWW - Iasexamportal.comShounak KossambeNo ratings yet

- Gate Cxe 2008 PDFDocument5 pagesGate Cxe 2008 PDFShounak KossambeNo ratings yet

- Introduction To Tabla,: The Ancient Indian DrumsDocument10 pagesIntroduction To Tabla,: The Ancient Indian DrumsAkshay KNo ratings yet

- WSDC - Student PortalDocument4 pagesWSDC - Student PortalShounak KossambeNo ratings yet

- Kinematics Lab Manual: Set-IDocument46 pagesKinematics Lab Manual: Set-IShounak KossambeNo ratings yet

- File 002Document1 pageFile 002Shounak KossambeNo ratings yet

- AIEEE Paper 2011 Solved PDFDocument30 pagesAIEEE Paper 2011 Solved PDFPraveen KumarpillaiNo ratings yet

- HoansmessDocument3 pagesHoansmessShounak KossambeNo ratings yet

- NIT Warangal: Payer DetailsDocument2 pagesNIT Warangal: Payer DetailsShounak KossambeNo ratings yet

- Welding Tool ListDocument1 pageWelding Tool ListdesrytandiNo ratings yet

- Eminence Capital & Fincorp Web Page ContentDocument37 pagesEminence Capital & Fincorp Web Page ContentChinmaya DasNo ratings yet

- Original PDF The Economics of Women Men and Work 8th PDFDocument41 pagesOriginal PDF The Economics of Women Men and Work 8th PDFthomas.coffelt514100% (36)

- Book HumanResourceManagementDocument232 pagesBook HumanResourceManagementTiara SafitriNo ratings yet

- Publications 13 JICA Operation Map PhilippinesDocument2 pagesPublications 13 JICA Operation Map PhilippinesCarlos105No ratings yet

- The Expenditure Cycle: Purchasing and Cash Disbursements: Accounting Information Systems 9 EditionDocument55 pagesThe Expenditure Cycle: Purchasing and Cash Disbursements: Accounting Information Systems 9 Editionaprian100% (1)

- Guagua National Colleges Graduate School Master's in Business AdministrationDocument25 pagesGuagua National Colleges Graduate School Master's in Business AdministrationLee K.No ratings yet

- Tugas Ke 2 Akm 3Document4 pagesTugas Ke 2 Akm 3RizkiNo ratings yet

- CsaqDocument4 pagesCsaqHIRA KHAN L1S15MBAM0023No ratings yet

- Seu Act500 Module02 PPT Ch02Document37 pagesSeu Act500 Module02 PPT Ch02Fatima WassliNo ratings yet

- Loi / Icpo Draft: Letter of Intent / Irrevocable Confirmed Purchase OrderDocument3 pagesLoi / Icpo Draft: Letter of Intent / Irrevocable Confirmed Purchase OrderДејан РадуловићNo ratings yet

- Sales Invoice: Bill To: Ship ToDocument1 pageSales Invoice: Bill To: Ship ToRoseanne CarsolaNo ratings yet

- Plagiarism Declaration Form (T-DF)Document12 pagesPlagiarism Declaration Form (T-DF)Nur HidayahNo ratings yet

- Kafue Natinal ParkDocument110 pagesKafue Natinal ParkBrianNo ratings yet

- Midwest Lesson Plan 1Document9 pagesMidwest Lesson Plan 1api-269401169No ratings yet

- Presentation 8-Project AppraisalDocument22 pagesPresentation 8-Project AppraisalafzalNo ratings yet

- History and Origin of EcommerceDocument5 pagesHistory and Origin of EcommerceAhmar naveerNo ratings yet

- EMI Calculator PlusDocument47 pagesEMI Calculator Plustibolj86No ratings yet

- Commodities Market ModuleDocument170 pagesCommodities Market ModuleSameera Kadiyala100% (1)

- IFP - Loan CalutationDocument23 pagesIFP - Loan CalutationnishiNo ratings yet

- Operations Management (OPM530) - C12 QualityDocument54 pagesOperations Management (OPM530) - C12 Qualityazwan ayop100% (1)

- SBADocument21 pagesSBAJamella BraithwaiteNo ratings yet

- VIJAY SHARMA C.v..docx 123Document4 pagesVIJAY SHARMA C.v..docx 123Anupriya SinghNo ratings yet

- Chapter 08 Translation of Foreign Currency Financial StatementsDocument11 pagesChapter 08 Translation of Foreign Currency Financial StatementsDiana100% (1)

- Variance Report - 19-12-2021Document65 pagesVariance Report - 19-12-2021abdelrahmanNo ratings yet

- Bayer Ag Annual Report 2019 PDFDocument239 pagesBayer Ag Annual Report 2019 PDFkrrajanNo ratings yet

- Minutes: 1 Quorum and Declarations of InterestDocument9 pagesMinutes: 1 Quorum and Declarations of InterestleseNo ratings yet

- Chap 13 DWDocument45 pagesChap 13 DWMehrab IslamNo ratings yet

- Reforming Research and Extension Systems in Nepal Emerging Models of Technology Development and Transfer 1Document12 pagesReforming Research and Extension Systems in Nepal Emerging Models of Technology Development and Transfer 1Zernan De RamosNo ratings yet

- Proposal Coffee GGDocument5 pagesProposal Coffee GGWendy May Villapa100% (1)

- SWOT and PESTLE Analysis of NikeDocument21 pagesSWOT and PESTLE Analysis of NikenaumanNo ratings yet