Professional Documents

Culture Documents

EXIM BANK TANZANIA FINANCIALS

Uploaded by

Lucas MgangaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EXIM BANK TANZANIA FINANCIALS

Uploaded by

Lucas MgangaCopyright:

Available Formats

(PAT)

Net

13%*

Interest

Income

13%*

EXIM AT EXIM AT

YoY WORK

13%(H1) WORK

TODAY FOR

YoYequity

(H1)gain TOMORROW

“EXIM AT WORK , TODAY, FOR TOMORROW” TODAY FOR

*without TOMORROW

YoY (H1)

*without equity gain

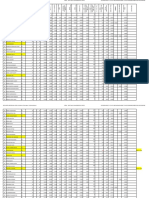

EXIM BANK (TANZANIA) LIMITED AUDITED FINANCIAL STATEMENTS

Report of Condition of Bank issued pursuant to regulations 7 and 8 of the banking

and financial institutions (disclosures) regulations , 2014.

BALANCE SHEET AS AT 31 DECEMBER 2020 CASH FLOW STATEMENT FOR THE YEAR ENDED 31ST DECEMBER 2020

(AMOUNTS IN MILLION SHILLINGS) (AMOUNTS IN MILLION SHILLINGS)

Net

Interest

Profit

Sh Income

areholders' GROUP GROUP COMPANY COMPANY

GROUP

CURRENT

GROUP

PREVIOUS

COMPANY

CURRENT

COMPANY

PREVIOUS

CURRENT YEAR PREVIOUS YEAR CURRENT YEAR PREVIOUS YEAR

funds

YEAR YEAR YEAR YEAR

31-Dec-20 31-Dec-19 31-Dec-20 31-Dec-19 31-Dec-20 31-Dec-19 31-Dec-20 31-Dec-19

13%

Total A ASSETS

I Cash flow from operating activities:

@

Assets

Net income(Loss)

Adjustment for :

29,793 (8,378) 22,358 (14,526)

1 Cash 60,994 42,243 51,101 24,393 -Impairment/Amortization 28,071 68,148 17,127 50,449

TZS 2 Balances with Central Banks 246,331 136,401 67,151 67,683 -Net change in loans and advances (150,257) (113,181) 7,634 (78,497)

YoY (H1) -Gain/Loss on sale of assets 125 (41) 186 (7)

179 3 Investment in Government Securities 324,196 244,827 313,821 241,033

5%

-Net change in Deposits 180,021 144,043 (27,022) 69,165

-Net change in Short term negotiable securities - - - -

4 Balances with Other Banks and financial

Billion institutions 34,595 70,955 21,935 31,796

-Net change in Other Liabilities

-Net change in Other Assets

41,840

(793)

18,947

1,012

24,571

(1,668)

24,566

3,280

-Net Increase in non-current assets held-for-sale -

5 Cheques and Items for Clearing 2,357 3,692 1,394 1,953 -Tax paid (9,874) (6,570) (8,087) (4,731)

(PAT) 6 Interbranch float items - - - - -Others (Net Change in Derivatives Assets, Bonds & GVT Securities)

Net cash provided (used) by operating activities

(76,590)

42,335

(9,727)

94,253

(68,463)

(33,364)

(21,028)

28,671

7 Bills Negotiated - - - -

8 Customers' liabilities for acceptances - - - - II Cash flow from investing activities:

Dividend Received 40 21 3,014 21

9 Interbank Loan Receivables 39,340 158,631 10,504 111,051 Purchase of fixed assets (15,525) (11,493) (4,264) (5,572)

Proceeds from sale of fixed assets 804 380 562 7

10 Investments in Other securities 29,301 30,583 5,122 7,797 Purchase of non-dealing securities - - - -

11 Loans, Advances and Overdrafts 1,095,304 953,374 699,928 708,745 Proceeds from sale of non-dealing securities - - - -

Others - (Equity Investment and purchase of other assets) - (4,050) - (4,050)

(Net of allowances for Probable losses) Net cash provided (used) by investing activities (14,681) (15,142) (688) (9,594)

12 Other Assets 38,470 44,348 32,984 38,808

13 Equity Investments 2,447 2,529 35,310 36,253 III Cash flow from financing activities:

14 Underwriting accounts - - - - Repayment of long-term debt (43,111) (26,932) (43,111) (27,069)

Total

Net 15 Intangibles, Property, Plant and Equipment 77,324 81,414 51,318 60,090

Proceeds from issuance of long term debt

Proceeds from issuance of share capital

-

-

62,159

2,863

-

-

62,159

(4,053)

Interest

Assets 16 Non-current assets held-for-sale 13,751 16,907 12,905 15,949 Payment of cash dividends - - - -

Total

Income 17 TOTAL ASSETS 1,964,410 1,785,904 1,303,473 1,345,551

Net change in other borrowings

Others -Long term financing

-

(10,785)

-

(12,570)

-

(5,809)

-

(7,049)

Total Assets

Assets Net cash provided (used) by financing activities (53,896) 25,520 (48,920) 23,988

5%

13% B LIABILITIES

18 Deposits from other banks and financial 135,586 98,993 212,518 273,720 IV Cash and Cash Equivalents:

5%

Net increase/(decrease) in cash and cash equivalents (26,242) 104,631 (82,972) 50,987

@ institutions Cash and cash equivalents at the beginning of the year

Effect of movement in Foreign exchange Difference& Cash Reserve

336,811

(13,185)

205,184

26,996

187,570

884

136,583

7,922

19 Customer Deposits 1,441,605 1,298,177 755,488 721,308

TZS

YoY (H1) 20 Cash letters of credit 25,445 8,486 23,202 6,852

Cash and cash equivalents at the end of the year 297,384 336,811 105,482 187,570

1.96 21 Special Deposits 0 0 0 0

CONDENSED STATEMENT OF CHANGES IN EQUITY AS AT 31ST DECEMBER 2020

22 Payments orders / transfers payable 282 282 282 282

Trillion 23 Bankers' cheques and drafts issued 2,111 2,843 1,492 1,576 (AMOUNTS IN MILLION SHILLINGS)

24 Accrued taxes and expenses payable 4,989 4,941 3,988 4,160 Share Share Retained Regulatory General Others Total

Capital premium Earnings Reserve Provision reserves

25 Acceptances outstanding - - - - COMPANY Reserve

26 Interbranch float items - - - - Current Year

27 Unearned income and other deferred charges 6,833 9,365 6,285 8,851 Balance as at the beginning of the year 12,900 - 91,188 37,372 - 624 142,084

Profit/(Loss) for the year - - 12,335 - - 12,335

28 Other Liabilities 58,576 60,468 34,835 42,498 Other Comprehensive Income - - - - - 504 504

(PAT) 29 Borrowings 110,460 144,220 110,460 144,220 Transactions with owners

Dividends Paid

-

-

-

-

-

-

-

- -

-

-

-

-

30 TOTAL LIABILITIES 1,785,887 1,627,775 1,148,550 1,203,467 Regulatory Reserve - - - - - - -

General Provision Reserve - - 19,412 (19,412.) - -

Other reserve - - - - - - -

13%* 31

C

NET ASSETS/(LIABILITIES)(17 MINUS 30)

SHAREHOLDERS'FUNDS

178,523 158,129 154,923 142,084 Balance as at the end of the period

Previous Year

Balance as at the beginning of the year

12,900

12,900

-

-

122,935

135,452

17,960

10,877

- 1,128 154,923

159,229

Total

Gross Loan 32 Paid up Share Capital 12,900 12,900 12,900 12,900 Impact of initial application of IFRS 9 - - - - - - -

Assets

Book 33 Capital Reserves 31,253 44,416 19,088 37,996

Transfer to Regulatory reserve on initial

application of IFRS 9

- - - - - - -

Gross Loan

YoY (H1) 34 Retained Earnings 108,217 103,873 110,600 108,957 Restated Balance at 1 January 2019

Profit/(Loss) for the year

12,900

-

-

-

135,452

(17,769)

10,877

-

-

-

-

-

159,229

(17,769)

Book 35 Profit (Loss) Account 15,892 (14,993) 12,335 (17,769)

5%

Other Comprehensive Income - - - 624 624

14%

*without equity gain

Shareholder’s

36

37

Other Capital Accounts/Capital Advance

Minority Interest

-

10,261

-

11,933

-

0

-

0

Transactions with owners

Dividends Paid

Regulatory Reserve

-

-

-

-

-

-

-

6,402

(32,897)

-

(6,402)

32,897

-

-

-

-

-

-

-

-

14%

Fund 38 TOTAL SHAREHOLDERS' FUNDS 178,523 158,129 154,923 142,084 General Provision Reserve

Other reserve

Balance as at the end of the period

-

-

12,900

-

-

-

-

-

91,188

-

-

37,372

-

-

-

-

-

624 142,084

-

-

39 Contingent Liabilities 222,717 203,516 160,425 141,508

12%

GROUP

Current Year

40 Non-Performing Loans and Advances 144,858 199,022 122,508 169,393 Balance as at the beginning of the year 12,900 - 88,880 40,042 16,307 158,129

Customers' 41 Allowances for Probable Losses 54,364 78,457 43,093 57,825 Profit for the year - - 17,570 - - (1,678) 15,892

Other Comprehensive Income - - - - - 4,502 4,502

Deposits 42 Other Non-Performing assets 2,799 2,914 2,799 2,914 Transactions with owners - - - - - - -

D PERFORMANCE INDICATORS Dividends Paid - - - - - - -

Regulatory Reserve - - 20,929 (20,929) - -

(I) Shareholders Funds to Total Assets 9.09% 8.85% 11.89% 10.56% General Provision Reserve - - (3,270) 3,270 -

@ (II) Non Performing loans to Total Gross Loans 12.75% 22.66% 16.79% 22.06% Others -Translation reserve

Balance as at the end of the current period

-

12,900

-

- 124,109

- -

22,383

-

-

-

19,131

-

178,523

Net

TZS (III) Gross Loans and Advances to Total Deposits 76.91% 75.56% 79.32% 77.16% Previous Year

Interest (IV)Loans and Advances to Total Assets 55.76% 53.38% 53.70% 52.67% Balance as at the beginning of the year 12,900 - 129,395 13,341 10,814 166,450

1.44

Income (V) Earning Assets to Total Assets 77.64% 81.80% 83.36% 84.48%

Impact of initial application of IFRS 9 -

Transfer to Regulatory reserve on initial application of IFRS 9 -

-

-

-

-

-

-

-

-

-

- -

At 1 January 2019 - Restated 12,900 - 129,395 13,341 - 10,814 166,450

(VI)Deposits Growth 12.88% 11.49% -2.72% 7.47%

Trillion (VII) Assets Growth 10.00% 14.16% -3.13% 11.21%

Profit for the year

Other Comprehensive Income

-

-

-

-

(13,814)

-

-

-

-

-

(1,179)

3,809

(14,993)

3,809

13% Transactions with owners - - - - - 2,863 2,863

Dividends Paid - - - - - -

Regulatory Reserve - - 6,196 (6,196) - -

Gross Loan STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME General Provision Reserve

Others -Translation reserve

-

-

-

-

(32,897)

-

32,897

- - -

-

-

Book FOR THE YEAR ENDED 31ST DECEMBER 2020(AMOUNT IN MILLION SHILLINGS) Balance as at the end of the current period 12,900 - 88,880 40,042 - 16,307 158,129

YoY (H1)

Shareholder’s

14%

GROUP GROUP COMPANY COMPANY

Fund CURRENT

YEAR

PREVIOUS

YEAR

CURRENT

YEAR

PREVIOUS

YEAR

The above extracts are from the Financial Statements of the Bank for the year ended December 31,2020 which have been

31-Dec-20 31/12/2019 31-Dec-20 31/12/2019 prepared in accordance with International Financial Reporting Standards(IFRS). The financial Statements were audited by

Deloitte & Touche Certified Public Accountants and received a clean audit report. The financial statements were approved by

1 Interest Income 141,034 130,794 107,134 102,552 the board of Directors and signed on its behalf by:

12%

2 Interest Expense (41,810) (38,997) (36,592) (35,627)

3 Net Interest Income (1 Minus 2) 99,224 91,797 70,542 66,925

4 Bad debts written off - - - -

5 Impairment Losses on Loans and Advances 74 (39,994) 3,563 (30,352)

NAME AND TITLE SIGNATURE DATE

6 Non-Interest Income 59,658 57,201 36,823 34,442

6.1 Foreign exchange profit/(loss) 16,962 13,807 10,731 8,757 Ambassador Juma Mwapachu ……………………………….. 01st June 2021

6.2 Fees and Commissions 33,611 35,817 17,154 20,226

6.3 Dividend Income 40 21 3,014 21

6.4 Other Operating Income 9,045 7,556 5,924 5,438 CHAIRMAN

7 Non-Interest Expense (129,163) (117,382) (88,570) (85,541)

7.1 Salaries and Benefits (55,966) (53,058) (36,481) (35,578) Kalpesh Mehta ……………………………….. 01st June 2021

7.2 Fees and Commission (140) (174) (140) (161) DIRECTOR

7.3 Other Operating Expenses (73,057) (64,150) (51,949) (49,802)

Loans & 8

9

Operating Income/(Loss) before tax

Income Tax Provision

29,793

(13,901)

(8,378) 22,358 (14,526)

(6,615) (10,023) (3,243)

Advances

10 Net income (loss) after income tax 15,892 (14,993) 12,335 (17,769)

@ 11

12

Number of Employees

Basic Earning Per Share

962

1,232

1,001

(1,162)

619

956

688

(1,377)

TZS

Shareholder’s

13

14

Diluted Earning Per Share

Number of Branches

1,232

45

(1,162)

48

956

30

(1,377)

33

1

Fund PERFORMANCE INDICATORS

(I) Return on average total assets 1% -1% 1% -1%

Trillion (II) Return on Average shareholders' funds

(III) Non interest expense to gross income

9%

75%

-10%

83%

8%

73%

-13%

85%

12% (IV) Net Interest margin to average earning assets 7% 8% 7% 6%

For more details call 080 078 0111 or visit www.eximbank.co.tz

You might also like

- 2015 Dodge Journey 2.4L Eng VIN B AVPDocument79 pages2015 Dodge Journey 2.4L Eng VIN B AVPData TécnicaNo ratings yet

- For Training Purposes Only: CF-SFM CF-SFMDocument2 pagesFor Training Purposes Only: CF-SFM CF-SFMNurul BhuiyanNo ratings yet

- Project progress dashboard under 40 charactersDocument234 pagesProject progress dashboard under 40 characterssrirammadhira88No ratings yet

- 2020 Jeep Compass Altitude 2.4LDocument111 pages2020 Jeep Compass Altitude 2.4LRaul Gerardo DelatourNo ratings yet

- RAM 5.7 2020 EcmDocument7 pagesRAM 5.7 2020 Ecmjesus mtzNo ratings yet

- Drum and Blade Attachment Under Platform: CS56B, CP56B, CS68B, and CP68B Hydraulic System Vibratory Soil CompactorsDocument2 pagesDrum and Blade Attachment Under Platform: CS56B, CP56B, CS68B, and CP68B Hydraulic System Vibratory Soil CompactorsAndresCorreaNo ratings yet

- IKEA Company OverviewDocument21 pagesIKEA Company OverviewHazleen RostamNo ratings yet

- BGW-11 Standby ReportDocument1 pageBGW-11 Standby ReportPronami BoraNo ratings yet

- Stop The SaleDocument1 pageStop The Salemossjake5915No ratings yet

- CHARTDocument1 pageCHARTJemil Rose SamosNo ratings yet

- A220 CockpitDocument1 pageA220 CockpitΤηλέμαχος ΧριστιάςNo ratings yet

- 2012ram35006 7lDocument29 pages2012ram35006 7lAndre VPNo ratings yet

- Computer Data Lines 2006 Ram 3.7 AutoclinicDocument3 pagesComputer Data Lines 2006 Ram 3.7 Autoclinicautoclinic33No ratings yet

- Salary Sheet 22 23Document65 pagesSalary Sheet 22 23Manojit GamingNo ratings yet

- Profit: NMB Bank PLC Audited Financial StatementsDocument1 pageProfit: NMB Bank PLC Audited Financial StatementsMFIIFM2022No ratings yet

- F18 - Sanremo MultiboilerDocument2 pagesF18 - Sanremo MultiboilertribyNo ratings yet

- Emergency Site Plan KeyDocument1 pageEmergency Site Plan KeySLPlanner PlannerNo ratings yet

- Bus TerminalDocument1 pageBus TerminalClarisse DoriaNo ratings yet

- The Accelerator Map PDFDocument1 pageThe Accelerator Map PDFSheila EnglishNo ratings yet

- Value Output (Financial & Valuation) : Dead Capital Company BuilderDocument1 pageValue Output (Financial & Valuation) : Dead Capital Company BuilderSheila EnglishNo ratings yet

- Ram2009 5.7 HemiDocument5 pagesRam2009 5.7 HemiJessica BustillosNo ratings yet

- Notes:: Key PlanDocument1 pageNotes:: Key PlanSLPlanner PlannerNo ratings yet

- Notes:: Key PlanDocument1 pageNotes:: Key PlanSLPlanner PlannerNo ratings yet

- Key site plan layout and emergency exitsDocument1 pageKey site plan layout and emergency exitsSLPlanner PlannerNo ratings yet

- 100 Bedded General Hospital: Second Floor PlanDocument1 page100 Bedded General Hospital: Second Floor PlanAshish chauhanNo ratings yet

- Print - P&P NH-44 (Sheripally) Opt-3Document3 pagesPrint - P&P NH-44 (Sheripally) Opt-3Rakibul JamanNo ratings yet

- DAILY SALES PROGRESS REPORTDocument1 pageDAILY SALES PROGRESS REPORTSarohman RohmanNo ratings yet

- Print - P&P NH-44 (Sheripally) Opt-3ADocument5 pagesPrint - P&P NH-44 (Sheripally) Opt-3ARakibul JamanNo ratings yet

- Staircase MSDDocument2 pagesStaircase MSDMaqbool FatimaNo ratings yet

- Water Tank Sump Pit Location-Layout1Document1 pageWater Tank Sump Pit Location-Layout1SLPlanner PlannerNo ratings yet

- Cherokee 2009Document5 pagesCherokee 2009jose luis martinezNo ratings yet

- Diare 11Document1 pageDiare 11Nirmala SariNo ratings yet

- Engine Controls (Powertrain Management) Chev Silverado 2008Document4 pagesEngine Controls (Powertrain Management) Chev Silverado 2008jaime floresNo ratings yet

- New Production Schedule Update Pkin-Gb1Document74 pagesNew Production Schedule Update Pkin-Gb1jic42271No ratings yet

- transmision 1 town countryDocument1 pagetransmision 1 town countryPablo Enrique EspejelNo ratings yet

- VULCAN ROAD - 4pp A5INSERT-01-1Document1 pageVULCAN ROAD - 4pp A5INSERT-01-1Dan ThompsonNo ratings yet

- Print - P&P NH-44 (Kanimetta)Document3 pagesPrint - P&P NH-44 (Kanimetta)Rakibul JamanNo ratings yet

- Engine Controls (Powertrain Management) - ALLDATA RepairDocument6 pagesEngine Controls (Powertrain Management) - ALLDATA RepairJose GregorioNo ratings yet

- Downtown Des Moines Skywalk MapDocument1 pageDowntown Des Moines Skywalk MapannaNo ratings yet

- Josefina S. Meneses Proposed Five Storey Multi-Residential BuildingDocument1 pageJosefina S. Meneses Proposed Five Storey Multi-Residential BuildingRron de GuzmanNo ratings yet

- Daily Sales Progress 181021Document1 pageDaily Sales Progress 181021Sarohman RohmanNo ratings yet

- Camión 789C Schematic AirDocument8 pagesCamión 789C Schematic AirJorge VizcainoNo ratings yet

- Amarah Site Map_08-AugDocument1 pageAmarah Site Map_08-AugN SKNo ratings yet

- FLOOR PLAN DRAFT-ModelDocument1 pageFLOOR PLAN DRAFT-ModelCarla Joyce GraceNo ratings yet

- Ecm 1.5l 2 de 3Document2 pagesEcm 1.5l 2 de 3Felix VelasquezNo ratings yet

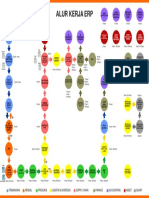

- Alur Kerja Erp: Pemasaran Rendal Produksi Logistik & Ekspedisi Supply Chain Finance Accounting Asset QuaryDocument1 pageAlur Kerja Erp: Pemasaran Rendal Produksi Logistik & Ekspedisi Supply Chain Finance Accounting Asset QuaryMuhammad FairusNo ratings yet

- Diagrama 3 AntenaDocument1 pageDiagrama 3 AntenaEnrique Arevalo LeyvaNo ratings yet

- Anti-Theft Systems for 2007 Jeep Compass 2WDDocument1 pageAnti-Theft Systems for 2007 Jeep Compass 2WDJuan Antonio Ochoa PadronNo ratings yet

- Ab Elec B126 106Document1 pageAb Elec B126 106arainzada807No ratings yet

- Mind Map Cost of ProductionDocument1 pageMind Map Cost of ProductionDimas Mahendra P BozerNo ratings yet

- Daily Sales Progress: Irawan/Yani V V V VDocument1 pageDaily Sales Progress: Irawan/Yani V V V VSarohman Rohman0% (1)

- 2003 - Nissan Murano VQ35, Diagrama MotorDocument5 pages2003 - Nissan Murano VQ35, Diagrama MotorAlfredo Magno Rios RamosNo ratings yet

- Daily Sales Progress: Ovh & Dynotest Cat3512 1 Sumatera & Kalimantan V Irawan/Yani V 100921 SQ000240 Fu PoDocument1 pageDaily Sales Progress: Ovh & Dynotest Cat3512 1 Sumatera & Kalimantan V Irawan/Yani V 100921 SQ000240 Fu PoSarohman RohmanNo ratings yet

- To Hyderabad To Bengaluru: Design Chainage Proposed Span (M) Type of Structure Proposal Achieved FRLDocument2 pagesTo Hyderabad To Bengaluru: Design Chainage Proposed Span (M) Type of Structure Proposal Achieved FRLRakibul JamanNo ratings yet

- SEMESTER-2 AUTOMOBILE ENGINEERING RESULT PASS/FAIL STATUSDocument7 pagesSEMESTER-2 AUTOMOBILE ENGINEERING RESULT PASS/FAIL STATUSShashwat ThakurNo ratings yet

- Daily Sales Progress 081021Document1 pageDaily Sales Progress 081021Sarohman RohmanNo ratings yet

- Engine Controls (Powertrain Management)Document4 pagesEngine Controls (Powertrain Management)Alejandro Quiñones VelazquezNo ratings yet

- HSP Daily Dashboard 20230812Document1 pageHSP Daily Dashboard 20230812Noli BenongoNo ratings yet

- Line Designation Table ExampleDocument1 pageLine Designation Table Examplejkrifa1702No ratings yet

- PROSPECTUSDocument202 pagesPROSPECTUSLucas MgangaNo ratings yet

- Ellen PresentationDocument7 pagesEllen PresentationLucas MgangaNo ratings yet

- SCORE OnDeck Business Plan Template Existing BusinessDocument35 pagesSCORE OnDeck Business Plan Template Existing BusinessSrinivas Kumar KSNo ratings yet

- Notes 230411 115510 73aDocument4 pagesNotes 230411 115510 73aLucas MgangaNo ratings yet

- Review Questions Costs of ProductionDocument3 pagesReview Questions Costs of ProductionLucas MgangaNo ratings yet

- Financial Statements List of Types and How To Read ThemDocument18 pagesFinancial Statements List of Types and How To Read ThemLucas MgangaNo ratings yet

- Statement of Financial Position Example Format and DefinitionDocument1 pageStatement of Financial Position Example Format and DefinitionLucas MgangaNo ratings yet

- Exim Bank 2019 Financial StatementDocument1 pageExim Bank 2019 Financial StatementLucas MgangaNo ratings yet

- Statement of Financial Position 1Document2 pagesStatement of Financial Position 1Lucas MgangaNo ratings yet

- Aicpa Draft-Inventory-Valuation-GuidanceDocument50 pagesAicpa Draft-Inventory-Valuation-GuidanceOmar OteroNo ratings yet

- Accounting For DepreciationDocument6 pagesAccounting For DepreciationKaran GNo ratings yet

- Law of Corporate FinanceDocument3 pagesLaw of Corporate FinanceAbdul Qadir Juzer AeranpurewalaNo ratings yet

- Final Exam - Project Appraisal (Palendeng, Sellya Gabriela)Document7 pagesFinal Exam - Project Appraisal (Palendeng, Sellya Gabriela)tiphanie lumintangNo ratings yet

- Company AnalysisDocument18 pagesCompany Analysiskrishansshrestha1No ratings yet

- EDB Guide To Setting Up Your Business in SingaporeDocument24 pagesEDB Guide To Setting Up Your Business in SingaporePT.Bulawa Mineral Utama BMUNo ratings yet

- Intermediate Accounting 15Th Edition Kieso Solutions Manual Full Chapter PDFDocument67 pagesIntermediate Accounting 15Th Edition Kieso Solutions Manual Full Chapter PDFprise.attone.itur100% (10)

- Pass The Necessary Journal Entries and Post The Entries in The Ledger AccountsDocument37 pagesPass The Necessary Journal Entries and Post The Entries in The Ledger AccountsBhavya Patel0% (1)

- Capital and Revenue ReceiptDocument14 pagesCapital and Revenue ReceiptMuskan BohraNo ratings yet

- ISyE 313 Fall 2012 Exam 2 SolutionsDocument8 pagesISyE 313 Fall 2012 Exam 2 SolutionsChrisy210No ratings yet

- Business Combinations ExplainedDocument53 pagesBusiness Combinations ExplainedMisganaw DebasNo ratings yet

- Popularity of radio advertising on food supplements among senior citizensDocument19 pagesPopularity of radio advertising on food supplements among senior citizensJohn Patrick Tolosa NavarroNo ratings yet

- Indomie Case RevDocument33 pagesIndomie Case RevGloriaaa28No ratings yet

- Retargeting Roadmap FrameworkDocument1 pageRetargeting Roadmap FrameworkSimoNo ratings yet

- Welcome To ACT14: Conceptual Framework and Accounting Standards (CFAS)Document38 pagesWelcome To ACT14: Conceptual Framework and Accounting Standards (CFAS)Jashi SiñelNo ratings yet

- Cost Associated With InventoryDocument14 pagesCost Associated With InventoryMohamed AshikNo ratings yet

- Problems On Income StatementDocument2 pagesProblems On Income Statementits4krishna3776No ratings yet

- Synthetic ETFs Under The MicroscopeDocument63 pagesSynthetic ETFs Under The Microscopeed_nycNo ratings yet

- Think Tree - Credential - June21Document9 pagesThink Tree - Credential - June21Think Tree TechnologiesNo ratings yet

- Kering SA: Probing The Performance Gap With LVMH: Case 2Document7 pagesKering SA: Probing The Performance Gap With LVMH: Case 2fioNo ratings yet

- MANAGERIAL ECONOMICS: PRICING THEORYDocument117 pagesMANAGERIAL ECONOMICS: PRICING THEORYKhanal NilambarNo ratings yet

- Patanjali Marketing StrategiesDocument58 pagesPatanjali Marketing StrategiesTwinkle VermaNo ratings yet

- Transactions For The Hartman Company For The Month of NovemberDocument4 pagesTransactions For The Hartman Company For The Month of NovemberthunyanNo ratings yet

- Chapter-7: Strategy and TechnologyDocument23 pagesChapter-7: Strategy and Technologysteven smithNo ratings yet

- Channel Sales.2Document31 pagesChannel Sales.2Sukhdev Singh ChanneNo ratings yet

- Viral Marketing: Issues and ChallengesDocument14 pagesViral Marketing: Issues and ChallengesDibyadip DasNo ratings yet

- Pecm 1Document131 pagesPecm 1Dharshanth .SNo ratings yet

- Dom 102: Principles of Operations Management: Transformation of Inputs Into Outputs. (Slack 2001)Document5 pagesDom 102: Principles of Operations Management: Transformation of Inputs Into Outputs. (Slack 2001)Nura BasmerNo ratings yet

- FSM 2-Introduction To Service ManagementDocument30 pagesFSM 2-Introduction To Service ManagementPiyush ThakarNo ratings yet