Professional Documents

Culture Documents

Jessica Pothier Opened Funflatables On June 1 The Company Rents

Uploaded by

Let's Talk With Hassan0 ratings0% found this document useful (0 votes)

12 views1 pageOriginal Title

Jessica Pothier Opened Funflatables on June 1 the Company Rents

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageJessica Pothier Opened Funflatables On June 1 The Company Rents

Uploaded by

Let's Talk With HassanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Jessica Pothier opened FunFlatables on June 1 The

company rents #2701

Jessica Pothier opened FunFlatables on June 1. The company rents out moon walks and

inflatable slides for parties and corporate events. The company also has obtained the use of an

abandoned ice rink located in a local shopping mall, where its rental products are displayed and

available for casual hourly rental by mall patrons. The following transactions occurred during the

first month of operations.1. Jessica contributed $ 50,000 cash to the company on June 1 in

exchange for its common stock.2. Purchased inflatable rides and inflation equipment on June 2,

paying $ 20,000 cash.3. Received $ 5,000 cash from casual hourly rentals at the mall on June

3.4. Rented rides and equipment to customers for $ 10,000. Received cash of $ 2,000 on June

4 and the rest is due from customers.5. Received $ 2,500 from a large corporate customer on

June 5 as a deposit on a party booking for July 4.6. Began to prepare for the July 4 party by

purchasing various party supplies on June 6 on account for $ 600.7. On June 7, paid $ 6,000 in

cash for renting the mall space this month.8. On June 8, prepaid next month’s mall space rental

charge of $ 6,000.9. Received $ 1,000 on June 9 from customers on accounts receivable.10.

Paid $ 1,000 for running a television ad on June 10.11. Paid $ 4,000 in wages to employees on

June 30 for work done during the month.Required:1. Record the effects of transactions (1)

through (11) using journal entries.2. If you are completing this requirement manually, set up

appropriate T- accounts. All accounts begin with zero balances. Summarize the journal entries

from requirement 1 in the T- accounts, referencing each transaction in the accounts with the

transaction number. Show the unadjusted ending balances in the T- accounts. If you are using

the GL tool in Connect, your answers to requirement 1 will have been posted automatically to

general ledger accounts that are similar in appearance to Exhibit 2.9.3. Prepare an unadjusted

trial balance for the end of June. If you are using the GL tool in Connect, this requirement is

completed automatically using your previous answers.4. Refer to the revenues and expenses

shown on the unadjusted trial balance to calculate preliminary net income and determine

whether the net profit margin is better or worse than the 30.0 percent earned by a close

competitor.View Solution:

Jessica Pothier opened FunFlatables on June 1 The company rents

ANSWER

http://paperinstant.com/downloads/jessica-pothier-opened-funflatables-on-june-1-the-company-

rents/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- On June 1 of The Current Year Bret Eisen EstablishedDocument1 pageOn June 1 of The Current Year Bret Eisen EstablishedAmit PandeyNo ratings yet

- On June 1 2014 Ellie Hopkins Established An Interior DecoratingDocument1 pageOn June 1 2014 Ellie Hopkins Established An Interior DecoratingAmit PandeyNo ratings yet

- For The Past Several Years Derrick Epstein Has Operated ADocument1 pageFor The Past Several Years Derrick Epstein Has Operated AM Bilal SaleemNo ratings yet

- Truro Excavating Co Owned by Raul Truro Began Operations In: Unlock Answers Here Solutiondone - OnlineDocument1 pageTruro Excavating Co Owned by Raul Truro Began Operations In: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- On December 1 Curt Walton Began An Auto Repair Shop PDFDocument1 pageOn December 1 Curt Walton Began An Auto Repair Shop PDFhassan taimourNo ratings yet

- Les Stanley Established An Insurance Agency On July 1 20y5Document1 pageLes Stanley Established An Insurance Agency On July 1 20y5Miroslav GegoskiNo ratings yet

- Dodge City Realty Acts As An Agent in Buying SellingDocument1 pageDodge City Realty Acts As An Agent in Buying Sellingtrilocksp SinghNo ratings yet

- Assignment 5Document12 pagesAssignment 5morry123No ratings yet

- FA Week 1Document8 pagesFA Week 1Azure JohnsonNo ratings yet

- Case Summary WalthamDocument2 pagesCase Summary WalthamAnurag ChatarkarNo ratings yet

- Assignment QuestionsDocument13 pagesAssignment QuestionsAiman KhanNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Barbara Jones Opened Barb S Book Business On February 1 YouDocument1 pageBarbara Jones Opened Barb S Book Business On February 1 YouTaimur TechnologistNo ratings yet

- Valor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsDocument1 pageValor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsFreelance WorkerNo ratings yet

- In June 2011 Wendy Winger Organized A Corporation To ProvideDocument1 pageIn June 2011 Wendy Winger Organized A Corporation To Providetrilocksp SinghNo ratings yet

- Sanlucas Inc Provides Home Inspection Services To Its Clients The PDFDocument2 pagesSanlucas Inc Provides Home Inspection Services To Its Clients The PDFDoreen0% (1)

- D Lite Dry Cleaners Is Owned and Operated by Joel PalkDocument1 pageD Lite Dry Cleaners Is Owned and Operated by Joel Palktrilocksp SinghNo ratings yet

- Chapter 4 AssignmentDocument3 pagesChapter 4 Assignmentfatima airis aradais100% (1)

- April Layton An Architect Opened An Office On June 1Document1 pageApril Layton An Architect Opened An Office On June 1trilocksp SinghNo ratings yet

- Amy Austin Established An Insurance Agency On March 1 Of: Unlock Answers Here Solutiondone - OnlineDocument1 pageAmy Austin Established An Insurance Agency On March 1 Of: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Exercises P Class5-2022Document6 pagesExercises P Class5-2022Angel MéndezNo ratings yet

- Jill Wahpoosywan Opened A Computer Consulting Business Called Techno WizardsDocument1 pageJill Wahpoosywan Opened A Computer Consulting Business Called Techno WizardsFreelance WorkerNo ratings yet

- Practice For Final ExamDocument7 pagesPractice For Final ExamNgọc Hân TrầnNo ratings yet

- Apple Realty Acts As An Agent in Buying Selling Renting: Unlock Answers Here Solutiondone - OnlineDocument1 pageApple Realty Acts As An Agent in Buying Selling Renting: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Three Former RIM Employees Decided To Go Into Business For: Unlock Answers Here Solutiondone - OnlineDocument1 pageThree Former RIM Employees Decided To Go Into Business For: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Ruberstein Inc Was Founded On April 1 and Entered Into PDFDocument1 pageRuberstein Inc Was Founded On April 1 and Entered Into PDFTaimour Hassan0% (1)

- Singh Company Started Business On January 1 2011 The FollowingDocument1 pageSingh Company Started Business On January 1 2011 The FollowingTaimour HassanNo ratings yet

- Fund and Other Investments & DerivativesDocument4 pagesFund and Other Investments & DerivativesShaira BugayongNo ratings yet

- On June 1 2014 Bob Lutz Opened Lutz Repair ServiceDocument1 pageOn June 1 2014 Bob Lutz Opened Lutz Repair ServiceAmit PandeyNo ratings yet

- For The Past Several Years Dawn Lytle Has Operated ADocument1 pageFor The Past Several Years Dawn Lytle Has Operated AM Bilal SaleemNo ratings yet

- 1accounting Process ExercisesDocument7 pages1accounting Process Exercisesasuna0% (1)

- A J Smith Company Started Business On January 1 2016Document1 pageA J Smith Company Started Business On January 1 2016hassan taimourNo ratings yet

- Record The Following Transactions On Page 2 of The Journal:: InstructionsDocument3 pagesRecord The Following Transactions On Page 2 of The Journal:: InstructionsItsF2bleAP 37100% (1)

- Socket Realty Acts As An Agent in Buying Selling RentingDocument1 pageSocket Realty Acts As An Agent in Buying Selling RentingM Bilal SaleemNo ratings yet

- Gypsum Realty Acts As An Agent in Buying Selling RentingDocument1 pageGypsum Realty Acts As An Agent in Buying Selling RentingM Bilal SaleemNo ratings yet

- A Company Had The Following Transactions During Its Most RecentDocument1 pageA Company Had The Following Transactions During Its Most RecentLet's Talk With HassanNo ratings yet

- P2-6a 001Document1 pageP2-6a 001Abu ZakiNo ratings yet

- FABM ProblemsDocument1 pageFABM ProblemsNeil Gumban40% (5)

- PICPA - 1st Year QuestionsDocument1 pagePICPA - 1st Year QuestionsVincent Larrie MoldezNo ratings yet

- Swan Dry Cleaners Is Owned and Operated by Peyton Keyes PDFDocument1 pageSwan Dry Cleaners Is Owned and Operated by Peyton Keyes PDFAnbu jaromiaNo ratings yet

- Timothy Monroe Opened A Law Office On January 1 2017 PDFDocument1 pageTimothy Monroe Opened A Law Office On January 1 2017 PDFAhsan KhanNo ratings yet

- Terrific Temps Fills Temporary Employment Positions For Local Businesses SomeDocument2 pagesTerrific Temps Fills Temporary Employment Positions For Local Businesses SomeAmit PandeyNo ratings yet

- A1c - SW#3 PDFDocument3 pagesA1c - SW#3 PDFLemuel ReñaNo ratings yet

- Utopia Realty Acts As An Agent in Buying Selling RentingDocument1 pageUtopia Realty Acts As An Agent in Buying Selling RentingM Bilal SaleemNo ratings yet

- FARDocument6 pagesFARJenica BautistaNo ratings yet

- One Product Corp Opc Incorporated at The Beginning of LastDocument2 pagesOne Product Corp Opc Incorporated at The Beginning of LastLet's Talk With HassanNo ratings yet

- At The End of The Current Year Jodi Corporation S ControllerDocument1 pageAt The End of The Current Year Jodi Corporation S ControllerTaimur TechnologistNo ratings yet

- 118.2 - Illustrative Examples - IFRS15 Part 2Document2 pages118.2 - Illustrative Examples - IFRS15 Part 2Ian De DiosNo ratings yet

- Exam QuizbowlersDocument7 pagesExam QuizbowlersJohnAllenMarillaNo ratings yet

- For CDEEDocument7 pagesFor CDEEmikiyas zeyedeNo ratings yet

- Hannah Knox An Architect Opened An Office On July 1Document1 pageHannah Knox An Architect Opened An Office On July 1Amit PandeyNo ratings yet

- UntitledDocument9 pagesUntitledPriya NairNo ratings yet

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- Fin. Acc - Chapter-2 JournalDocument4 pagesFin. Acc - Chapter-2 JournalFayez AmanNo ratings yet

- Practice Tests Final ExamDocument10 pagesPractice Tests Final Examgio gio0% (1)

- On July 1 2006 Leon Cruz Established An Interior DecoratingDocument1 pageOn July 1 2006 Leon Cruz Established An Interior DecoratingM Bilal SaleemNo ratings yet

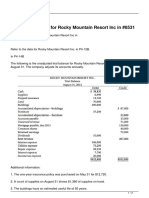

- Refer To The Data For Rocky Mountain Resort Inc inDocument2 pagesRefer To The Data For Rocky Mountain Resort Inc inMiroslav GegoskiNo ratings yet

- B6110 Fall 2015 Term Test 1 WITH SOLUTIONDocument13 pagesB6110 Fall 2015 Term Test 1 WITH SOLUTIONadamNo ratings yet

- Kraft Unlimited Inc Was Organized and Authorized To Issue 5 000Document1 pageKraft Unlimited Inc Was Organized and Authorized To Issue 5 000trilocksp SinghNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Xion Supply Uses A Sales Journal A Purchases Journal ADocument1 pageXion Supply Uses A Sales Journal A Purchases Journal ALet's Talk With HassanNo ratings yet

- You Are A French Investor Holding A Portfolio of U SDocument1 pageYou Are A French Investor Holding A Portfolio of U SLet's Talk With HassanNo ratings yet

- Wonderweb Prepares Adjusting Entries Monthly in Reviewing The Accounts OnDocument1 pageWonderweb Prepares Adjusting Entries Monthly in Reviewing The Accounts OnLet's Talk With HassanNo ratings yet

- Wipro Limited Together With Its Subsidiaries and Equity Accounted InvesteesDocument1 pageWipro Limited Together With Its Subsidiaries and Equity Accounted InvesteesLet's Talk With HassanNo ratings yet

- Yoklic Corporation Currently Manufactures A Subassembly For Its Main ProductDocument1 pageYoklic Corporation Currently Manufactures A Subassembly For Its Main ProductLet's Talk With HassanNo ratings yet

- Wondra Supplies Showed The Following Selected Adjusted Balances at ItsDocument1 pageWondra Supplies Showed The Following Selected Adjusted Balances at ItsLet's Talk With HassanNo ratings yet

- XM Satellite Radio Which Launched Its Satellite Radio Service inDocument1 pageXM Satellite Radio Which Launched Its Satellite Radio Service inLet's Talk With HassanNo ratings yet

- You Are A British Exporter Who Knows in December ThatDocument1 pageYou Are A British Exporter Who Knows in December ThatLet's Talk With HassanNo ratings yet

- Will That Be Cash Credit or Fingertip11 Have You Ever FoundDocument1 pageWill That Be Cash Credit or Fingertip11 Have You Ever FoundLet's Talk With HassanNo ratings yet

- Wilson Machine Tools Inc A Manufacturer of Fabricated Metal ProductsDocument1 pageWilson Machine Tools Inc A Manufacturer of Fabricated Metal ProductsLet's Talk With HassanNo ratings yet

- Wyeth Formerly American Home Products Is A Global Leader inDocument1 pageWyeth Formerly American Home Products Is A Global Leader inLet's Talk With HassanNo ratings yet

- WPP Group Headquartered in The United Kingdom Is One ofDocument1 pageWPP Group Headquartered in The United Kingdom Is One ofLet's Talk With HassanNo ratings yet

- Xenakis A Young Greek Person Arrives On The First DayDocument1 pageXenakis A Young Greek Person Arrives On The First DayLet's Talk With HassanNo ratings yet

- Wright Company Leases An Asset For Five Years On DecemberDocument1 pageWright Company Leases An Asset For Five Years On DecemberLet's Talk With HassanNo ratings yet

- What Is The Basis of The New Property in EachDocument1 pageWhat Is The Basis of The New Property in EachLet's Talk With HassanNo ratings yet

- Wedona Energy Consultants Prepares Adjusting Entries Monthly Based On AnDocument1 pageWedona Energy Consultants Prepares Adjusting Entries Monthly Based On AnLet's Talk With Hassan100% (1)

- Wilm Schmidt The Owner of Wilm S Window Washing Services HadDocument1 pageWilm Schmidt The Owner of Wilm S Window Washing Services HadLet's Talk With HassanNo ratings yet

- Wicom Servicing Completed These Transactions During November 2014 Its FirstDocument1 pageWicom Servicing Completed These Transactions During November 2014 Its FirstLet's Talk With HassanNo ratings yet

- WPP Is A Uk Group Engaged in The Provision ofDocument1 pageWPP Is A Uk Group Engaged in The Provision ofLet's Talk With HassanNo ratings yet

- Winfrey Designs Had An Unadjusted Credit Balance in Its AllowanceDocument1 pageWinfrey Designs Had An Unadjusted Credit Balance in Its AllowanceLet's Talk With HassanNo ratings yet

- The Standard Deviation of A Foreign Asset in Local CurrencyDocument1 pageThe Standard Deviation of A Foreign Asset in Local CurrencyLet's Talk With HassanNo ratings yet

- The Spot Exchange Rate Is 10 Mexican Pesos MXP PerDocument1 pageThe Spot Exchange Rate Is 10 Mexican Pesos MXP PerLet's Talk With HassanNo ratings yet

- The Simon Machine Tools Company Is Considering Purchasing A NewDocument1 pageThe Simon Machine Tools Company Is Considering Purchasing A NewLet's Talk With HassanNo ratings yet

- The Shares of Microsoft Were Trading On Nasdaq On JanuaryDocument1 pageThe Shares of Microsoft Were Trading On Nasdaq On JanuaryLet's Talk With HassanNo ratings yet

- The Savage Corporation Purchased Three Milling Machines On January 1Document1 pageThe Savage Corporation Purchased Three Milling Machines On January 1Let's Talk With HassanNo ratings yet

- The State of Michigan Is Considering A Bill That WouldDocument1 pageThe State of Michigan Is Considering A Bill That WouldLet's Talk With HassanNo ratings yet

- The Shares of An Italian Firm Have Been Trading EarlierDocument1 pageThe Shares of An Italian Firm Have Been Trading EarlierLet's Talk With HassanNo ratings yet

- The Shares of Volkswagen Trade On The Frankfurt Stock ExchangeDocument1 pageThe Shares of Volkswagen Trade On The Frankfurt Stock ExchangeLet's Talk With HassanNo ratings yet

- The Reality Check Macquarie Leasing Forays Into Australian Motor VehicleDocument1 pageThe Reality Check Macquarie Leasing Forays Into Australian Motor VehicleLet's Talk With HassanNo ratings yet

- The Qantas Group Integrates A Sustainability Report With Its AnnualDocument1 pageThe Qantas Group Integrates A Sustainability Report With Its AnnualLet's Talk With HassanNo ratings yet

- Unit 2 Lab Manual ChemistryDocument9 pagesUnit 2 Lab Manual ChemistryAldayne ParkesNo ratings yet

- Hop Movie WorksheetDocument3 pagesHop Movie WorksheetMARIA RIERA PRATSNo ratings yet

- LEGO Group A Strategic and Valuation AnalysisDocument85 pagesLEGO Group A Strategic and Valuation AnalysisRudmila Ahmed50% (2)

- CONCEPTUAL LITERATURE (Chapter 2)Document2 pagesCONCEPTUAL LITERATURE (Chapter 2)lilibeth garciaNo ratings yet

- Administrative Clerk Resume TemplateDocument2 pagesAdministrative Clerk Resume TemplateManuelNo ratings yet

- Excel For MAC Quick Start GuideDocument4 pagesExcel For MAC Quick Start GuideMalaquías HuamánNo ratings yet

- MPLS Fundamentals - Forwardi..Document4 pagesMPLS Fundamentals - Forwardi..Rafael Ricardo Rubiano PavíaNo ratings yet

- Computer Awareness: Special Edition E-BookDocument54 pagesComputer Awareness: Special Edition E-BookTanujit SahaNo ratings yet

- Job Description: Jette Parker Young Artists ProgrammeDocument2 pagesJob Description: Jette Parker Young Artists ProgrammeMayela LouNo ratings yet

- Corporate Plan 2018 2021Document94 pagesCorporate Plan 2018 2021Nkugwa Mark WilliamNo ratings yet

- The Old Rugged Cross - George Bennard: RefrainDocument5 pagesThe Old Rugged Cross - George Bennard: RefrainwilsonNo ratings yet

- A1 - The Canterville Ghost WorksheetsDocument8 pagesA1 - The Canterville Ghost WorksheetsТатьяна ЩукинаNo ratings yet

- Abb PB - Power-En - e PDFDocument16 pagesAbb PB - Power-En - e PDFsontungNo ratings yet

- Botswana Ref Ranges PaperDocument7 pagesBotswana Ref Ranges PaperMunyaradzi MangwendezaNo ratings yet

- Bank ATM Use CasesDocument12 pagesBank ATM Use Casessbr11No ratings yet

- Bar Waiter/waitress Duties and Responsibilities Step by Step Cruise Ship GuideDocument6 pagesBar Waiter/waitress Duties and Responsibilities Step by Step Cruise Ship GuideAmahl CericoNo ratings yet

- Bos 22393Document64 pagesBos 22393mooorthuNo ratings yet

- IO RE 04 Distance Learning Module and WorksheetDocument21 pagesIO RE 04 Distance Learning Module and WorksheetVince Bryan San PabloNo ratings yet

- 3 Habits For SuccessDocument1 page3 Habits For SuccesssiveramNo ratings yet

- 21 and 22 Case DigestDocument3 pages21 and 22 Case DigestRosalia L. Completano LptNo ratings yet

- Defender of Catholic FaithDocument47 pagesDefender of Catholic FaithJimmy GutierrezNo ratings yet

- Critical Evaluation of Biomedical LiteraturesDocument34 pagesCritical Evaluation of Biomedical LiteraturesPratibha NatarajNo ratings yet

- Use Case Diagram ShopeeDocument6 pagesUse Case Diagram ShopeeAtmayantiNo ratings yet

- FS 1 - Episode 1Document18 pagesFS 1 - Episode 1Bhabierhose Saliwan LhacroNo ratings yet

- Miraculous MedalDocument2 pagesMiraculous MedalCad work1No ratings yet

- Coca-Cola Femsa Philippines, Tacloban PlantDocument29 pagesCoca-Cola Femsa Philippines, Tacloban PlantJuocel Tampil Ocayo0% (1)

- Generator Faults and RemediesDocument7 pagesGenerator Faults and Remediesemmahenge100% (2)

- Pronoun AntecedentDocument4 pagesPronoun AntecedentJanna Rose AregadasNo ratings yet

- AgrippaDocument4 pagesAgrippaFloorkitNo ratings yet

- MCSE Sample QuestionsDocument19 pagesMCSE Sample QuestionsSuchitKNo ratings yet