Professional Documents

Culture Documents

In June 2011 Wendy Winger Organized A Corporation To Provide

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In June 2011 Wendy Winger Organized A Corporation To Provide

Uploaded by

trilocksp SinghCopyright:

Available Formats

In June 2011 Wendy Winger organized a corporation to

provide

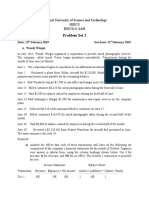

In June 2011, Wendy Winger organized a corporation to provide aerial photography services.

The company, called Aerial Views, began operations immediately. Transactions during the

month of June were as follows:June 1 The Corporation issued 60,000 shares of capital stock to

Wendy Winger in exchange for $60,000 cash. June 2 Purchased a plane from Utility Aircraft for

$220,000. Made a $40,000 cash down payment and issued a note payable for the remaining

balance. June 4 Paid Woodrow Airport $2,500 to rent office and hangar space for the month.

June 15 Billed customers $8,320 for aerial photographs taken during the first half of June. June

15 Paid $5,880 in salaries earned by employees during the first half of June. June 18 Paid

Hanigan’s Hangar $1,890 for maintenance and repair services on the company plane. June 25

Collected $4,910 of the amounts billed to customers on June 15. June 30 Billed customers

$16,450 for aerial photographs taken during the second half of the month. June 30 Paid $6,000

in salaries earned by employees during the second half of the month. June 30 Received a

$2,510 bill from Peatree Petroleum for aircraft fuel purchased in June. The entire amount is due

July 10. June 30 Declared a $2,000 dividend payable on July 15. The account titles used by

Aerial Views are: Cash.....................Retained Earnings Accounts

Receivable.................Dividends Aircraft......................Aerial Photography Revenue Notes

Payable...................Maintenance Expense Accounts Payable.................Fuel Expense

Dividends Payable................Salaries Expense Capital Stock..................Rent Expense

InstructionsAnalyze the effects that each of these transactions will have on the following six

components of the company’s financial statements for the month of June. Organize your

answer in tabular form, using the column headings shown. Use I for increase, D for decrease,

and NE for no effect. The June 1 transaction is provided for you:Prepare journal entries

(including explanations) for each transaction. Post each transaction to the appropriate ledger

accounts (use a running balance format as illustrated in Exhibit 3–4 on page 95). Prepare a trial

balance dated June 30, 2011. Using figures from the trial balance prepared in part d, compute

total assets, total liabilities, and owners’ equity. Are these the figures that the company will

report in its June 30 balance sheet? Explain your answerbriefly.

View Solution:

In June 2011 Wendy Winger organized a corporation to provide

SOLUTION-- http://solutiondone.online/downloads/in-june-2011-wendy-winger-organized-a-

corporation-to-provide/

Unlock answers here solutiondone.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityFrom EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityRating: 4 out of 5 stars4/5 (2)

- On June 1 2014 Ellie Hopkins Established An Interior DecoratingDocument1 pageOn June 1 2014 Ellie Hopkins Established An Interior DecoratingAmit PandeyNo ratings yet

- Lynn Cantwell An Architect Organized Cantwell Architects On July 1Document1 pageLynn Cantwell An Architect Organized Cantwell Architects On July 1trilocksp SinghNo ratings yet

- Sanlucas Inc Provides Home Inspection Services To Its Clients The PDFDocument2 pagesSanlucas Inc Provides Home Inspection Services To Its Clients The PDFDoreen0% (1)

- On July 1 2006 Leon Cruz Established An Interior DecoratingDocument1 pageOn July 1 2006 Leon Cruz Established An Interior DecoratingM Bilal SaleemNo ratings yet

- On August 31 2015 The Rijo Equipment Repair Corp S Post ClosingDocument1 pageOn August 31 2015 The Rijo Equipment Repair Corp S Post ClosingMiroslav GegoskiNo ratings yet

- Fo A I Assignment1Document2 pagesFo A I Assignment1solomon tadeseNo ratings yet

- At The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- At The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Assignment QuestionsDocument13 pagesAssignment QuestionsAiman KhanNo ratings yet

- On December 1 Curt Walton Began An Auto Repair Shop PDFDocument1 pageOn December 1 Curt Walton Began An Auto Repair Shop PDFhassan taimourNo ratings yet

- For The Past Several Years Derrick Epstein Has Operated ADocument1 pageFor The Past Several Years Derrick Epstein Has Operated AM Bilal SaleemNo ratings yet

- On October 31 2015 The Alou Equipment Repair Corp S Post ClosingDocument1 pageOn October 31 2015 The Alou Equipment Repair Corp S Post ClosingMiroslav GegoskiNo ratings yet

- Trafflet Enterprises Incorporated On May 3 2011 The Company EngagedDocument1 pageTrafflet Enterprises Incorporated On May 3 2011 The Company EngagedAmit PandeyNo ratings yet

- ANSWER KEY Adjustments Quiz 2Document6 pagesANSWER KEY Adjustments Quiz 2Christine Mae BurgosNo ratings yet

- FSA-Tutorial 1-Fall 2022Document4 pagesFSA-Tutorial 1-Fall 2022chtiouirayyenNo ratings yet

- Dana La Fontsee Opened Pro Window Washing Inc On July PDFDocument1 pageDana La Fontsee Opened Pro Window Washing Inc On July PDFAnbu jaromiaNo ratings yet

- Consider Each of The Following Independent Cases and Prepare TheDocument1 pageConsider Each of The Following Independent Cases and Prepare Thehassan taimourNo ratings yet

- Prime Time Realty Acts As An Agent in Buying SellingDocument1 pagePrime Time Realty Acts As An Agent in Buying SellingM Bilal SaleemNo ratings yet

- Nordtown Company Is A Marketing Firm The Company S Trial BalanceDocument1 pageNordtown Company Is A Marketing Firm The Company S Trial Balancetrilocksp SinghNo ratings yet

- Adjustments Quiz 2Document6 pagesAdjustments Quiz 2Loey ParkNo ratings yet

- Test (BBA)Document5 pagesTest (BBA)Ab Wahab100% (4)

- A Building That Was Purchased December 31Document2 pagesA Building That Was Purchased December 31muhaNo ratings yet

- On June 1 2014 Bob Lutz Opened Lutz Repair ServiceDocument1 pageOn June 1 2014 Bob Lutz Opened Lutz Repair ServiceAmit PandeyNo ratings yet

- Adjusting Entries: Problem 1Document9 pagesAdjusting Entries: Problem 1Wholehearted LayoutsNo ratings yet

- Comprehensive Accounting Cycle ProblemDocument2 pagesComprehensive Accounting Cycle ProblemYidnekachew DerbewNo ratings yet

- Donegan S Lawn Care Service Began Operations in July 2011 TheDocument1 pageDonegan S Lawn Care Service Began Operations in July 2011 Thetrilocksp SinghNo ratings yet

- Jessica Pothier Opened Funflatables On June 1 The Company RentsDocument1 pageJessica Pothier Opened Funflatables On June 1 The Company RentsLet's Talk With HassanNo ratings yet

- Individual AssignmentDocument2 pagesIndividual AssignmentmuhaNo ratings yet

- AP Problems 2015Document20 pagesAP Problems 2015Rodette Adajar Pajanonot100% (1)

- The Complete Accounting CycleDocument2 pagesThe Complete Accounting CycleAiman KhanNo ratings yet

- 1321691530financial AccountingDocument21 pages1321691530financial AccountingMuhammadOwaisKhan0% (1)

- Glenrose Servicing Began Operations On June 1 2014 The TransactionsDocument1 pageGlenrose Servicing Began Operations On June 1 2014 The TransactionsHassan JanNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2Rubab MirzaNo ratings yet

- The Company Recorded The Following Summary Journal Entries During July ADocument1 pageThe Company Recorded The Following Summary Journal Entries During July AMuhammad ShahidNo ratings yet

- The Equitee Corporation Was Incorporated On January 2 2015 With PDFDocument1 pageThe Equitee Corporation Was Incorporated On January 2 2015 With PDFLet's Talk With HassanNo ratings yet

- Lee Chang Opened Chang S Cleaning Service On July 1 2010 PDFDocument1 pageLee Chang Opened Chang S Cleaning Service On July 1 2010 PDFAnbu jaromiaNo ratings yet

- Sui Sells Presses at December 31 2011 Sui S Inventory AmountedDocument1 pageSui Sells Presses at December 31 2011 Sui S Inventory AmountedAmit PandeyNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- ACTG 240 - Solutions 01Document4 pagesACTG 240 - Solutions 01xxmbetaNo ratings yet

- Les Stanley Established An Insurance Agency On July 1 20y5Document1 pageLes Stanley Established An Insurance Agency On July 1 20y5Miroslav GegoskiNo ratings yet

- Practice Tests Final ExamDocument10 pagesPractice Tests Final Examgio gio0% (1)

- Acct504 w3 Case Study NoorDocument20 pagesAcct504 w3 Case Study NoorNoorehira Naveed100% (2)

- Assignment IIDocument4 pagesAssignment IIAfifa TonniNo ratings yet

- @2015 Assignment I IFA IIDocument2 pages@2015 Assignment I IFA IIgenenegetachew64No ratings yet

- Pre-Week Auditing Problems 2014Document41 pagesPre-Week Auditing Problems 2014Pat Closa80% (15)

- Heidi Jara Opened Jara S Cleaning Service On July 1 2015Document1 pageHeidi Jara Opened Jara S Cleaning Service On July 1 2015trilocksp SinghNo ratings yet

- Eos CupFinal RoundDocument7 pagesEos CupFinal RoundMJ YaconNo ratings yet

- On December 31 2010 Clean and White Linen Supplies LTDDocument1 pageOn December 31 2010 Clean and White Linen Supplies LTDFreelance WorkerNo ratings yet

- MBA Review Questions CH 8 & CH 10 Princ. Acc. IIDocument5 pagesMBA Review Questions CH 8 & CH 10 Princ. Acc. IIMirna Kassar100% (1)

- Record The Following Transactions On Page 2 of The Journal:: InstructionsDocument3 pagesRecord The Following Transactions On Page 2 of The Journal:: InstructionsItsF2bleAP 37100% (1)

- 5 6188442313212035099Document19 pages5 6188442313212035099JamieNo ratings yet

- Microsoft Word - In-Class Exercise Chapter 7 - RevisedDocument12 pagesMicrosoft Word - In-Class Exercise Chapter 7 - RevisedAndaman BunjongkarnNo ratings yet

- Linda Blye Opened Cardinal Window Washing Inc On July 1Document1 pageLinda Blye Opened Cardinal Window Washing Inc On July 1M Bilal SaleemNo ratings yet

- Utopia Realty Acts As An Agent in Buying Selling RentingDocument1 pageUtopia Realty Acts As An Agent in Buying Selling RentingM Bilal SaleemNo ratings yet

- For CDEEDocument7 pagesFor CDEEmikiyas zeyedeNo ratings yet

- FI504 Case Study 1Document16 pagesFI504 Case Study 1hereforanswersNo ratings yet

- Individual Assignment For FOA - IDocument5 pagesIndividual Assignment For FOA - IteshutilahunNo ratings yet

- Fundamentals of Accountancy, Business, and Management Final Assessment ActivityDocument6 pagesFundamentals of Accountancy, Business, and Management Final Assessment ActivityWerNo ratings yet

- Financial Accounting - Practice 1Document6 pagesFinancial Accounting - Practice 1ManiNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- Panoramic Solution: Hikvision Certified Security ProfessionalDocument68 pagesPanoramic Solution: Hikvision Certified Security Professionaleduardo urbaNo ratings yet

- The Use of Digital Dental Photography in An EasterDocument6 pagesThe Use of Digital Dental Photography in An EasterDannilo CerqueiraNo ratings yet

- David Bate: Photographies The Memory of PhotographyDocument12 pagesDavid Bate: Photographies The Memory of PhotographyronaldoNo ratings yet

- Rahul Nigam 1684076079528Document2 pagesRahul Nigam 1684076079528rahul nigamNo ratings yet

- Exp1 - Nur Aliya Binti Ikmal Hisham - A Lab On Crime Scene EvaluationDocument12 pagesExp1 - Nur Aliya Binti Ikmal Hisham - A Lab On Crime Scene EvaluationMOHAMAD IMRAN ZAMBERINo ratings yet

- Colorama BrochureDocument20 pagesColorama BrochureAna WilkesNo ratings yet

- Peter Bak in Cam Profile For Sony Cameras V2Document6 pagesPeter Bak in Cam Profile For Sony Cameras V2irfan syam100% (1)

- Landscape Lighting Guide 2015Document42 pagesLandscape Lighting Guide 2015FadlullahA.KadirNo ratings yet

- SPA Form 32A (2 Applicant)Document1 pageSPA Form 32A (2 Applicant)KIRAN2SINGH25% (4)

- Short Notice - 2024-RHQ - 26 - 02 - 2024Document1 pageShort Notice - 2024-RHQ - 26 - 02 - 2024shikhashivangi24No ratings yet

- Visual Politics of PsychoanalysisDocument281 pagesVisual Politics of PsychoanalysisMariano Veliz0% (1)

- Validated Assessment Scales For The Upper Face - ESCALA de MERZDocument11 pagesValidated Assessment Scales For The Upper Face - ESCALA de MERZRafael Autran Cavalcante AraújoNo ratings yet

- Group 2 - Procedure TextDocument10 pagesGroup 2 - Procedure TextMillah KamilahNo ratings yet

- Wingtraone Drone: Technical SpecificationsDocument18 pagesWingtraone Drone: Technical SpecificationsMurillo ViniciusNo ratings yet

- APTIS (Collocations) IVDocument4 pagesAPTIS (Collocations) IVEnglish 21No ratings yet

- Monochromatic Collage Self Portrait Lesson PlanDocument6 pagesMonochromatic Collage Self Portrait Lesson Planapi-326099554No ratings yet

- Film Characteristic CurvesDocument7 pagesFilm Characteristic CurvesvinaNo ratings yet

- Technical Bulletin: Minilab ProcessingDocument53 pagesTechnical Bulletin: Minilab Processingyarko yorkoNo ratings yet

- WAH5 SEN Term 3 Standard TestDocument6 pagesWAH5 SEN Term 3 Standard TestMilagros ConcinaNo ratings yet

- Color Matters: Unit 1Document8 pagesColor Matters: Unit 1Meryem Küçük MoldurNo ratings yet

- Simple Chunky Knit Hat PDFDocument2 pagesSimple Chunky Knit Hat PDFSimona TuderașcuNo ratings yet

- Dwnload Full Marketing Management 15th Edition Kotler Test Bank PDFDocument36 pagesDwnload Full Marketing Management 15th Edition Kotler Test Bank PDFendergram0942No ratings yet

- GizmoDocument7 pagesGizmoSempronioNo ratings yet

- Reading Exercises 0627Document22 pagesReading Exercises 0627lydianDNo ratings yet

- Camera Logging Template CompleteDocument1 pageCamera Logging Template Completeapi-555963633No ratings yet

- Slaughterhouse Five Comic StripDocument3 pagesSlaughterhouse Five Comic Stripapi-478264715100% (1)

- Think 2 WBDocument128 pagesThink 2 WBEstela MerlosNo ratings yet

- Advertisement PNRD Details.Document8 pagesAdvertisement PNRD Details.Dipak BorsaikiaNo ratings yet

- Codes and Conventions of A Magazine Contents PageDocument3 pagesCodes and Conventions of A Magazine Contents Pageapi-281811935No ratings yet

- Q2 Mirror and Lens Equation 1Document18 pagesQ2 Mirror and Lens Equation 1justindimaandal8No ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterFrom EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterRating: 3.5 out of 5 stars3.5/5 (487)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedRating: 2.5 out of 5 stars2.5/5 (5)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (9)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- All The Beauty in the World: The Metropolitan Museum of Art and MeFrom EverandAll The Beauty in the World: The Metropolitan Museum of Art and MeRating: 4.5 out of 5 stars4.5/5 (83)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- The United States of Beer: A Freewheeling History of the All-American DrinkFrom EverandThe United States of Beer: A Freewheeling History of the All-American DrinkRating: 4 out of 5 stars4/5 (7)

- All You Need to Know About the Music Business: Eleventh EditionFrom EverandAll You Need to Know About the Music Business: Eleventh EditionNo ratings yet

- Getting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsFrom EverandGetting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsRating: 4.5 out of 5 stars4.5/5 (10)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (399)

- Women's Work: The First 20,000 Years: Women, Cloth, and Society in Early TimesFrom EverandWomen's Work: The First 20,000 Years: Women, Cloth, and Society in Early TimesRating: 4.5 out of 5 stars4.5/5 (191)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- What Customers Hate: Drive Fast and Scalable Growth by Eliminating the Things that Drive Away BusinessFrom EverandWhat Customers Hate: Drive Fast and Scalable Growth by Eliminating the Things that Drive Away BusinessRating: 5 out of 5 stars5/5 (1)

- Lean Six Sigma: The Ultimate Guide to Lean Six Sigma, Lean Enterprise, and Lean Manufacturing, with Tools Included for Increased Efficiency and Higher Customer SatisfactionFrom EverandLean Six Sigma: The Ultimate Guide to Lean Six Sigma, Lean Enterprise, and Lean Manufacturing, with Tools Included for Increased Efficiency and Higher Customer SatisfactionRating: 5 out of 5 stars5/5 (2)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet