Professional Documents

Culture Documents

Lakewood Tennis Club LTC Operates An Indoor Tennis Facility The

Uploaded by

Hassan Jan0 ratings0% found this document useful (0 votes)

86 views1 pageOriginal Title

Lakewood Tennis Club Ltc Operates an Indoor Tennis Facility The

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

86 views1 pageLakewood Tennis Club LTC Operates An Indoor Tennis Facility The

Uploaded by

Hassan JanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Lakewood Tennis Club LTC operates an indoor tennis

facility The #2696

Lakewood Tennis Club (LTC) operates an indoor tennis facility. The company charges a $ 150

annual membership fee plus a member rental rate of $ 20 per court per hour. LTC’s fiscal year

end is August 31. LTC’s revenue recognition policy is described in its financial statement notes

as follows:Revenue Recognition — LTC earns revenue from two sources. Annual membership

fees are earned by providing 12 months of services to members, so they are reported as

membership revenue as they are earned over that 12- month period. Court rental fees are

earned by renting courts each day, so they are reported as service revenue as courts are used

by members.On August 31, 10 new members joined and paid the annual membership fee in

cash. The memberships do not begin until September 1. For the week ended September 11,

LTC provided 190 court- hours of rental services for members and collected its fees in cash. On

September 13, LTC purchased and received tennis balls and other supplies. The regular retail

price was $ 220, but LTC negotiated a lower amount ($ 200) that is to be paid in October. On

September 15, LTC paid $ 1,500 to employees for the hours they worked from September 1–

15. For the two weeks ended September 25, LTC provided 360 court- hours for members and

collected its fees in cash. On September 26, LTC’s courts were used for a member’s birthday

party. LTC expects the member to pay the special event booking fee of $ 210 on Saturday,

October 2. On September 27, LTC wrote a $ 300 check to an advertising company to prepare

advertising flyers that will be inserted in local newspapers on October 1. On September 29, LTC

received $ 210 on account for the member’s birthday party that was held on September 26. On

September 30, LTC submitted its electricity and natural gas meter readings online. According to

the suppliers’ websites, the total charges for the month will be $ 300. This amount will be paid

on October 17 through a preauthorized online payment.Required:1. Indicate the accounting

equation effects of the August and September events, using a table similar to the one shown for

Demonstration Case B on page 116. Reference each transaction by date.2. Prepare journal

entries to record the August and September events described above. Reference each

transaction by date.3. Using your answer to requirement 1 or 2, calculate LTC’s preliminary net

income for September. Is LTC profitable, based on its preliminary net income?4. Identify at least

two adjustments that LTC will be required to make before it can prepare a final income

statement for September.View Solution:

Lakewood Tennis Club LTC operates an indoor tennis facility The

ANSWER

http://paperinstant.com/downloads/lakewood-tennis-club-ltc-operates-an-indoor-tennis-facility-

the/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- The Treasurer of The Senior Social Club Has Prepared TheDocument1 pageThe Treasurer of The Senior Social Club Has Prepared TheBube KachevskaNo ratings yet

- The Following Transactions Occur Over The Remainder of The Year AugDocument2 pagesThe Following Transactions Occur Over The Remainder of The Year AugBube KachevskaNo ratings yet

- Accountancy & Auditing-I Subjective - 1Document4 pagesAccountancy & Auditing-I Subjective - 1zaman virkNo ratings yet

- CH 2Document4 pagesCH 2ايهاب غزالةNo ratings yet

- FABM 1 Study Hall ProblemDocument1 pageFABM 1 Study Hall Problemricartejoy0508No ratings yet

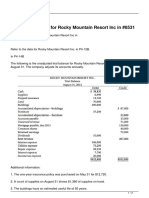

- Refer To The Data For Rocky Mountain Resort Inc inDocument2 pagesRefer To The Data For Rocky Mountain Resort Inc inMiroslav GegoskiNo ratings yet

- Accounting Cycle Problem Question No.1.1Document2 pagesAccounting Cycle Problem Question No.1.1kmillat33% (3)

- The Following Is The Unadjusted Trial Balance For Rocky MountainDocument2 pagesThe Following Is The Unadjusted Trial Balance For Rocky MountainMiroslav GegoskiNo ratings yet

- Lisa Duncan A Junior in College Has Been Seeking WaysDocument1 pageLisa Duncan A Junior in College Has Been Seeking Waystrilocksp SinghNo ratings yet

- MGMT 30A: Midterm 2Document25 pagesMGMT 30A: Midterm 2FUSION AcademicsNo ratings yet

- Campus Theater Adjusts Its Accounts Every Month Below Is TheDocument1 pageCampus Theater Adjusts Its Accounts Every Month Below Is Thetrilocksp SinghNo ratings yet

- COMSATS University Islamabad: Accounting IDocument3 pagesCOMSATS University Islamabad: Accounting IHassan MalikNo ratings yet

- On September 1 Pat Hopkins Established Ona Cloud Corporation OccDocument1 pageOn September 1 Pat Hopkins Established Ona Cloud Corporation OccLet's Talk With HassanNo ratings yet

- CCP302Document21 pagesCCP302api-3849444No ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument3 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- Assignment 3Document2 pagesAssignment 3mzk2352613No ratings yet

- Service Pro Corp SPC Is Preparing Adjustments For Its SeptemberDocument1 pageService Pro Corp SPC Is Preparing Adjustments For Its SeptemberFreelance WorkerNo ratings yet

- Roe Int Calc Method v2Document3 pagesRoe Int Calc Method v2Jesus SalamancaNo ratings yet

- The Off Campus Playhouse Adjusts Its Accounts Every Month Below IsDocument1 pageThe Off Campus Playhouse Adjusts Its Accounts Every Month Below IsAmit PandeyNo ratings yet

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- Kohat University of Science & Technology: (KUST) Institute of Business StudiesDocument2 pagesKohat University of Science & Technology: (KUST) Institute of Business Studiesilyas muhammadNo ratings yet

- Attention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Document17 pagesAttention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Mahalaxmi RamasubramanianNo ratings yet

- Journalizing - ExercisesDocument6 pagesJournalizing - ExercisesSophia Criciel GumatayNo ratings yet

- Baker Street Cinema Quiz 2a SolutionsDocument24 pagesBaker Street Cinema Quiz 2a SolutionsBurhan AzharNo ratings yet

- Test (BBA)Document5 pagesTest (BBA)Ab Wahab100% (4)

- United States Bankruptcy Court Southern District of New YorkDocument18 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Accounting AnswersDocument5 pagesAccounting AnswersallhomeworktutorsNo ratings yet

- Proposed Schedule - Copyright Fees-2020Document49 pagesProposed Schedule - Copyright Fees-20202PlusNo ratings yet

- On September 1 2010 The Following Were The Account BalancesDocument1 pageOn September 1 2010 The Following Were The Account BalancesM Bilal SaleemNo ratings yet

- 21p 4solDocument3 pages21p 4solrimasinghaniNo ratings yet

- Problem 1 Current Liability Entries and Adjustments: InstructionsDocument6 pagesProblem 1 Current Liability Entries and Adjustments: Instructionsbeeeeee100% (1)

- Exercises 1Document8 pagesExercises 1Altaf HussainNo ratings yet

- Smith CountyAssignment IDocument1 pageSmith CountyAssignment ILemuel VelasquezNo ratings yet

- Responsibility For All Executory Costs, Which Amount To $5,500 Per Year, and Are Paid EachDocument12 pagesResponsibility For All Executory Costs, Which Amount To $5,500 Per Year, and Are Paid EachRian RorresNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument20 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- AssignmentDocument2 pagesAssignmentabdullah khanNo ratings yet

- Analisis Biaya Semester Gasal 2016 - 2017 Tugas Individual IDocument1 pageAnalisis Biaya Semester Gasal 2016 - 2017 Tugas Individual IMaulana HasanNo ratings yet

- 1 AccountingDocument2 pages1 Accountingcdchisler_532671072No ratings yet

- On November 30 The End of The Current Fiscal YearDocument1 pageOn November 30 The End of The Current Fiscal YearAmit PandeyNo ratings yet

- The Following Is River Tours Limited S Unadjusted Trial Balance atDocument2 pagesThe Following Is River Tours Limited S Unadjusted Trial Balance atMiroslav GegoskiNo ratings yet

- Assignment 3Document8 pagesAssignment 3jhouvanNo ratings yet

- WRD Ab - Az.ch02 SV Analyzing TransactionDocument41 pagesWRD Ab - Az.ch02 SV Analyzing TransactionJames Ade AlexanderNo ratings yet

- Accruals and PrepaymentDocument2 pagesAccruals and PrepaymentNadine Davidson100% (1)

- Gambaran Proses Pencatatan AkuntansiDocument3 pagesGambaran Proses Pencatatan AkuntansiAntonius WibisonoNo ratings yet

- Ch03 Harrison 8e GE SMDocument113 pagesCh03 Harrison 8e GE SMMuh BilalNo ratings yet

- Economic Impact of Oakland Athletics Ballpark at Howard TerminalDocument13 pagesEconomic Impact of Oakland Athletics Ballpark at Howard TerminalZennie AbrahamNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument20 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- For The Past Several Years Dawn Lytle Has Operated ADocument1 pageFor The Past Several Years Dawn Lytle Has Operated AM Bilal SaleemNo ratings yet

- B.A. Circular On Loan Repayment Dt. 12-04-2021Document2 pagesB.A. Circular On Loan Repayment Dt. 12-04-2021hazarataliNo ratings yet

- April'2010 To June'2010Document1 pageApril'2010 To June'2010tarunbhattacharyaNo ratings yet

- D.C. Government Sues Don PeeblesDocument13 pagesD.C. Government Sues Don PeeblesMike Madden100% (2)

- Slowhand Services Was Formed On May 1 2010 The Following PDFDocument1 pageSlowhand Services Was Formed On May 1 2010 The Following PDFAnbu jaromiaNo ratings yet

- The Books of Binkerton Corporation Carried The Following Account Balances PDFDocument1 pageThe Books of Binkerton Corporation Carried The Following Account Balances PDFFreelance WorkerNo ratings yet

- Jun-10, Dec-10, Jun-11, Dec 11Document64 pagesJun-10, Dec-10, Jun-11, Dec 11Celena Daiton83% (6)

- Midterm Bi ADocument13 pagesMidterm Bi AFabiana BarbeiroNo ratings yet

- The Following Is Ortega Limo Service LTD S Unadjusted Trial BalanceDocument2 pagesThe Following Is Ortega Limo Service LTD S Unadjusted Trial BalanceMiroslav GegoskiNo ratings yet

- 17-1018 House Construction ProceduresDocument2 pages17-1018 House Construction ProceduresN-jay ErnietaNo ratings yet

- The Ford Construction Company Is Considering Acquiring A New EarthmoverDocument1 pageThe Ford Construction Company Is Considering Acquiring A New EarthmoverHassan JanNo ratings yet

- The Following Transactions Were Taken From The Records of TrevorDocument1 pageThe Following Transactions Were Taken From The Records of TrevorHassan JanNo ratings yet

- The Georgia Ceramic Company Has An Automatic Glaze Sprayer ThatDocument1 pageThe Georgia Ceramic Company Has An Automatic Glaze Sprayer ThatHassan Jan100% (1)

- The Following List of Accounts Is Taken From The DecemberDocument1 pageThe Following List of Accounts Is Taken From The DecemberHassan JanNo ratings yet

- The Following Problem Will Continue From One Chapter To TheDocument1 pageThe Following Problem Will Continue From One Chapter To TheHassan JanNo ratings yet

- The Following Three Situations Require Adjusting Journal Entries To PrepareDocument1 pageThe Following Three Situations Require Adjusting Journal Entries To PrepareHassan JanNo ratings yet

- The Following Table Shows The Returns and Valuations of SelectedDocument1 pageThe Following Table Shows The Returns and Valuations of SelectedHassan JanNo ratings yet

- The Following Information Is Taken From The Records of EastDocument1 pageThe Following Information Is Taken From The Records of EastHassan JanNo ratings yet

- The Following Is The Complete Mineral Exploration Development and ExtractionDocument1 pageThe Following Is The Complete Mineral Exploration Development and ExtractionHassan JanNo ratings yet

- The Following Information Relates To The Defined Benefits Pension SchemeDocument1 pageThe Following Information Relates To The Defined Benefits Pension SchemeHassan JanNo ratings yet

- The Following Is A Letter That I Received From ADocument1 pageThe Following Is A Letter That I Received From AHassan JanNo ratings yet

- The Following Is An Extract of Errsea S Balances of PropertyDocument1 pageThe Following Is An Extract of Errsea S Balances of PropertyHassan JanNo ratings yet

- The Following Information Has Been Extracted From The Draft FinancialDocument1 pageThe Following Information Has Been Extracted From The Draft FinancialHassan JanNo ratings yet

- The Following General Ledger Accounts and Additional Information Are TakenDocument1 pageThe Following General Ledger Accounts and Additional Information Are TakenHassan JanNo ratings yet

- The Following Data For Schwartz Company Represent A Summary ofDocument1 pageThe Following Data For Schwartz Company Represent A Summary ofHassan JanNo ratings yet

- The Following Data Has Been Estimated For Macquarie Machinery WhoDocument1 pageThe Following Data Has Been Estimated For Macquarie Machinery WhoHassan JanNo ratings yet

- The Following Conditions Existed For Maxit Co On October 31Document1 pageThe Following Conditions Existed For Maxit Co On October 31Hassan JanNo ratings yet

- The Following Figures Have Been Extracted From The Accounting RecordsDocument1 pageThe Following Figures Have Been Extracted From The Accounting RecordsHassan JanNo ratings yet

- The Florida Citrus Inc Fci Produces and Veils A HighlyDocument1 pageThe Florida Citrus Inc Fci Produces and Veils A HighlyHassan JanNo ratings yet

- The Following Account Balances For The Year Ended 30th JuneDocument1 pageThe Following Account Balances For The Year Ended 30th JuneHassan JanNo ratings yet

- Payment Form: 12 - DecemberDocument2 pagesPayment Form: 12 - DecemberElbert Natal100% (1)

- WBGST Rules 2017 - Amended Upto 18.10.2017 PDFDocument411 pagesWBGST Rules 2017 - Amended Upto 18.10.2017 PDFAdesh KumarNo ratings yet

- Project On Value Added TaxDocument38 pagesProject On Value Added TaxKavita NadarNo ratings yet

- International VAT For Dummies PDFDocument53 pagesInternational VAT For Dummies PDFFlorența Jafri0% (1)

- Tax 1st Preboard A LUDocument9 pagesTax 1st Preboard A LUAnonymous 7HGskNNo ratings yet

- Swargeeya Sanjibhai Rupjibhai Memorial Trust's: ATOM Payment GatewayDocument2 pagesSwargeeya Sanjibhai Rupjibhai Memorial Trust's: ATOM Payment GatewayAjay SainiNo ratings yet

- Jonathan M Luna Account Number: 5779 81XX XXXX 2560: Account Activity Since Your Last StatementDocument4 pagesJonathan M Luna Account Number: 5779 81XX XXXX 2560: Account Activity Since Your Last StatementJonathan LunaNo ratings yet

- Chapter 1 Introduction To GSTDocument5 pagesChapter 1 Introduction To GSTabhay javiyaNo ratings yet

- Taxation Law Pre Bar Notes 2019 Part 2 TermsDocument10 pagesTaxation Law Pre Bar Notes 2019 Part 2 TermsThea Faye Buncad CahuyaNo ratings yet

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocument2 pagesCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsJyasmine Aura V. AgustinNo ratings yet

- Amway India Money PlanDocument16 pagesAmway India Money PlanSoumitra RoyNo ratings yet

- Moza Jahangirabad Acc#1226203518874 Moza Jahangirabad Acc#1226203518874 Moza Jahangirabad Acc#1226203518874Document1 pageMoza Jahangirabad Acc#1226203518874 Moza Jahangirabad Acc#1226203518874 Moza Jahangirabad Acc#1226203518874Shahmeer - ul-HassanNo ratings yet

- IRS Finalizes Form 5472 Regulations For ForeignOwned, Domestic, Disregarded EntitiesDocument17 pagesIRS Finalizes Form 5472 Regulations For ForeignOwned, Domestic, Disregarded Entitiesmarianus hendrilensio sangaNo ratings yet

- Tax Quiz 2Document2 pagesTax Quiz 2Peng GuinNo ratings yet

- Penyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)Document1 pagePenyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)ElsaChanNo ratings yet

- Bali ItineraryDocument11 pagesBali Itineraryapi-505729019No ratings yet

- Gul BargaDocument916 pagesGul BargaShihan Ali KhanNo ratings yet

- BSP Memorandum No. M-2018-013Document2 pagesBSP Memorandum No. M-2018-013supremo10No ratings yet

- Postemployment Benefits: Employee's Employee Employee Obligation DecemberDocument25 pagesPostemployment Benefits: Employee's Employee Employee Obligation DecemberGabriel PanganNo ratings yet

- Saadiq SOCDocument31 pagesSaadiq SOCjoshmalikNo ratings yet

- Introduction To Income TaxDocument8 pagesIntroduction To Income TaxKartikNo ratings yet

- 1 - BOI-Advisory - Dated March 20 20Document2 pages1 - BOI-Advisory - Dated March 20 20Nicole PTNo ratings yet

- Seismic Loads Per IBCDocument20 pagesSeismic Loads Per IBChazeen_gedanNo ratings yet

- Indian Oil Corporation - Bitumen PricesDocument10 pagesIndian Oil Corporation - Bitumen PricesSanjib Mazumder69% (39)

- V1 09 May 2023Document5 pagesV1 09 May 2023Tushita RNo ratings yet

- Shipping & Billing Address: Neha Singh: Date: 23/02/2024Document2 pagesShipping & Billing Address: Neha Singh: Date: 23/02/2024tyrainternationalNo ratings yet

- Cash ReceiptDocument40 pagesCash ReceiptAneesh ChandranNo ratings yet

- August Salary SlipDocument1 pageAugust Salary SlipVipul TyagiNo ratings yet

- Tax - Midterm NTC 2017Document12 pagesTax - Midterm NTC 2017Red YuNo ratings yet

- Sanad Jadhav 2023 Mar 14 2023 Mar 24Document38 pagesSanad Jadhav 2023 Mar 14 2023 Mar 24Chetan KNo ratings yet

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterFrom EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterRating: 3.5 out of 5 stars3.5/5 (487)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- The United States of Beer: A Freewheeling History of the All-American DrinkFrom EverandThe United States of Beer: A Freewheeling History of the All-American DrinkRating: 4 out of 5 stars4/5 (7)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- All The Beauty in the World: The Metropolitan Museum of Art and MeFrom EverandAll The Beauty in the World: The Metropolitan Museum of Art and MeRating: 4.5 out of 5 stars4.5/5 (83)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedRating: 2.5 out of 5 stars2.5/5 (5)

- Pit Bull: Lessons from Wall Street's Champion TraderFrom EverandPit Bull: Lessons from Wall Street's Champion TraderRating: 4 out of 5 stars4/5 (17)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- The Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewFrom EverandThe Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewRating: 4.5 out of 5 stars4.5/5 (26)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Getting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsFrom EverandGetting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsRating: 4.5 out of 5 stars4.5/5 (10)

- All You Need to Know About the Music Business: Eleventh EditionFrom EverandAll You Need to Know About the Music Business: Eleventh EditionNo ratings yet

- INSPIRED: How to Create Tech Products Customers LoveFrom EverandINSPIRED: How to Create Tech Products Customers LoveRating: 5 out of 5 stars5/5 (9)

- The Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportFrom EverandThe Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportNo ratings yet

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- An Ugly Truth: Inside Facebook's Battle for DominationFrom EverandAn Ugly Truth: Inside Facebook's Battle for DominationRating: 4 out of 5 stars4/5 (33)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- All You Need to Know About the Music Business: 11th EditionFrom EverandAll You Need to Know About the Music Business: 11th EditionNo ratings yet