Professional Documents

Culture Documents

Lower Seymour Manufacturing LSM Is Building A Factory It Has

Lower Seymour Manufacturing LSM Is Building A Factory It Has

Uploaded by

Let's Talk With HassanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lower Seymour Manufacturing LSM Is Building A Factory It Has

Lower Seymour Manufacturing LSM Is Building A Factory It Has

Uploaded by

Let's Talk With HassanCopyright:

Available Formats

Lower Seymour Manufacturing LSM is building a factory It

has #3987

Lower Seymour Manufacturing (LSM) is building a factory'. It has signed a contract and paid a

third-party construction company $25,000,000 to build the factory. LSM also paid for design

changes and cost overruns totalling $1,000,000. In advance of signing the contract, LSM paid

legal fees of $50,000 to oversee the process of collecting bids to construct the premises. A

feasibility study costing $100,000 helped determine the design and facility needs. The president

suggested that she spent about one-quarter of the past year thinking about and discussing

matters related to the factory. Her annual salary' is $500,000.During the planning stage of the

factory, the company paid $200,000 for design drawings and plans for a factory that was

abandoned in favour of this project. Originally on the site was a building they had planned to

renovate. When they bought the site they capitalized the cost of this building. The unamortized

cost of the building is $750,000. It cost $95,000 to demolish this building.During the construction

period, one of the construction workers was injured. LSM was held partly liable for the injury and

had to pay' $300,000 as this was not covered by the company’s insurance policy.Interest costs

paid that were directly attributable to this project while under construction amounted to

$350,000. As senior management was distracted from their normal activities, it is conservatively

estimated that at least $400,000 in profits were lost.LSM spent $40,000 advertising the opening

of the factory. During construction, local citizens unexpectedly' challenged the project. The

company spent $125,000 in legal fees resolving these matters. Property' taxes of $110,000

were paid on the land while under construction. After the project was completed but before

occupancy, a further $35,000 in taxes was paid.To get final permission to build the factory, LSM

had to give to the city 10% of the land it had bought for the factory to be converted into a park

and green space. The cost of the entire parcel of land was $10,000,000. At the time the land

was given up, the entire parcel had a value of at least $15,000,000.Required:Determine the cost

of the PPE. Briefly justify the treatment of each cost component.View Solution:

Lower Seymour Manufacturing LSM is building a factory It has

ANSWER

http://paperinstant.com/downloads/lower-seymour-manufacturing-lsm-is-building-a-factory-it-

has/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- California Infrastructure Projects: Legal Aspects of Building in the Golden StateFrom EverandCalifornia Infrastructure Projects: Legal Aspects of Building in the Golden StateNo ratings yet

- Wedona Energy Consultants Prepares Adjusting Entries Monthly Based On AnDocument1 pageWedona Energy Consultants Prepares Adjusting Entries Monthly Based On AnLet's Talk With Hassan100% (1)

- Kashato Shirts SolutionsDocument13 pagesKashato Shirts SolutionsJeiger James Huizo100% (1)

- Accounting For Property Plant and Equipment Practice QuestionsDocument18 pagesAccounting For Property Plant and Equipment Practice QuestionsSophia Varias CruzNo ratings yet

- A Contractor's Guide to the FIDIC Conditions of ContractFrom EverandA Contractor's Guide to the FIDIC Conditions of ContractNo ratings yet

- Wondra Supplies Showed The Following Selected Adjusted Balances at ItsDocument1 pageWondra Supplies Showed The Following Selected Adjusted Balances at ItsLet's Talk With HassanNo ratings yet

- Chapter 10 - SlidesDocument38 pagesChapter 10 - Slidesernest gyapongNo ratings yet

- The Shares of Volkswagen Trade On The Frankfurt Stock ExchangeDocument1 pageThe Shares of Volkswagen Trade On The Frankfurt Stock ExchangeLet's Talk With HassanNo ratings yet

- Property, Plant and Equipement: Prior To Expense AfterDocument8 pagesProperty, Plant and Equipement: Prior To Expense AfterAvox EverdeenNo ratings yet

- Case 133 - Odango Vs NLRC PDFDocument2 pagesCase 133 - Odango Vs NLRC PDFJC HilarioNo ratings yet

- Republic of The Philippines vs. Leonor de La Rama, Et Al G.R. No. L-21108, November 29, 1966Document4 pagesRepublic of The Philippines vs. Leonor de La Rama, Et Al G.R. No. L-21108, November 29, 1966Marianne Hope VillasNo ratings yet

- Mike S Lemonade Stand Ails Purchased A Parcel of Land ForDocument1 pageMike S Lemonade Stand Ails Purchased A Parcel of Land ForLet's Talk With HassanNo ratings yet

- The Following Payments and Receipts Are Related To Land Land 120258Document1 pageThe Following Payments and Receipts Are Related To Land Land 120258M Bilal SaleemNo ratings yet

- Welded Tube USA - 2012Document2 pagesWelded Tube USA - 2012anthonius70No ratings yet

- Giesen Corp Purchased Land With Two Old Buildings On ItDocument1 pageGiesen Corp Purchased Land With Two Old Buildings On ItFreelance WorkerNo ratings yet

- Acquisition Costs of Realty Pollachek Co Purchased Land As A PDFDocument1 pageAcquisition Costs of Realty Pollachek Co Purchased Land As A PDFLet's Talk With HassanNo ratings yet

- Elm Limited Had The Following Transactions and Events During TheDocument1 pageElm Limited Had The Following Transactions and Events During TheTaimour HassanNo ratings yet

- Chapters 10 and 11 OutlineDocument11 pagesChapters 10 and 11 OutlineHamzah B ShakeelNo ratings yet

- Diy-Problems (Questionnaire)Document10 pagesDiy-Problems (Questionnaire)May RamosNo ratings yet

- A To Z Fabrication Inc Engaged in The Following BusinessDocument1 pageA To Z Fabrication Inc Engaged in The Following BusinessDoreenNo ratings yet

- Week 7 Ch10 Plant Assets Natural Resources and Intangible AssetsDocument67 pagesWeek 7 Ch10 Plant Assets Natural Resources and Intangible Assetspegagus98No ratings yet

- Plant Assets, Natural Resources, Intangible AssetsDocument80 pagesPlant Assets, Natural Resources, Intangible Assetsaderagaming 2719No ratings yet

- Analyze The Following Transactions and Show Their Effects On TheDocument1 pageAnalyze The Following Transactions and Show Their Effects On Thehassan taimourNo ratings yet

- Chapter 09 - Palnt - Natural Resources and Intangible AssetsDocument81 pagesChapter 09 - Palnt - Natural Resources and Intangible Assetshuynhthianhviet.0208No ratings yet

- Plant Asset Accy112Document14 pagesPlant Asset Accy112Maria OmarNo ratings yet

- CCH Federal Taxation Comprehensive Topics 2013 1st Edition Harmelink Test Bank 1Document30 pagesCCH Federal Taxation Comprehensive Topics 2013 1st Edition Harmelink Test Bank 1laurie100% (37)

- Quotation # 01 - RevisedDocument7 pagesQuotation # 01 - RevisedUmar AwaisNo ratings yet

- Accounting Principles: Plant Assets, Natural Resources, and Intangible AssetsDocument78 pagesAccounting Principles: Plant Assets, Natural Resources, and Intangible AssetsWadood AhmedNo ratings yet

- Multiple Choice Questions 1 Hickory Company Made A Lump Sum PurchaseDocument2 pagesMultiple Choice Questions 1 Hickory Company Made A Lump Sum PurchaseHassan JanNo ratings yet

- Chapter 10 Intermediate Final RevisionDocument8 pagesChapter 10 Intermediate Final Revisionmagdy kamelNo ratings yet

- Asset Acquisition Logan Industries Purchased The Following Asset PDFDocument1 pageAsset Acquisition Logan Industries Purchased The Following Asset PDFAnbu jaromiaNo ratings yet

- Topic 4 PP&EDocument62 pagesTopic 4 PP&Efastidious_5100% (1)

- CH 10Document55 pagesCH 10KHANH Du NgocNo ratings yet

- CH 10Document81 pagesCH 10Putu DenyNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument34 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldPaulina RegginaNo ratings yet

- The Following Expenditures and Receipts Are Related To Land LandDocument1 pageThe Following Expenditures and Receipts Are Related To Land LandM Bilal SaleemNo ratings yet

- ACCO ch10Document80 pagesACCO ch10Samar BarakehNo ratings yet

- Selected Transactions For The Decorators Mill LTD An Interior DecoratorDocument1 pageSelected Transactions For The Decorators Mill LTD An Interior DecoratorBube KachevskaNo ratings yet

- A Number of Business Transactions Carried Out by Smalling ManufacturingDocument1 pageA Number of Business Transactions Carried Out by Smalling Manufacturingtrilocksp Singh0% (1)

- Chevalierltr (Final)Document4 pagesChevalierltr (Final)tulocalpoliticsNo ratings yet

- Case Study 001Document9 pagesCase Study 001Fahad ShaikNo ratings yet

- Lili Corporation Acquires New Equipment at A Cost ofDocument1 pageLili Corporation Acquires New Equipment at A Cost ofHassan JanNo ratings yet

- Solved James The Owner of An Auto Parts Store Told HisDocument1 pageSolved James The Owner of An Auto Parts Store Told HisAnbu jaromiaNo ratings yet

- Handout 3 - Plant Assets, Natural Resources, and Intangible AssetsDocument81 pagesHandout 3 - Plant Assets, Natural Resources, and Intangible Assetsyoussef abdellatifNo ratings yet

- 10 PpeDocument53 pages10 PpeSalsa Byla100% (1)

- P-6 Aset TetapDocument65 pagesP-6 Aset TetapRaehan RaesaNo ratings yet

- Property and Equipment Accounting (Chapter 3)Document19 pagesProperty and Equipment Accounting (Chapter 3)Atif KhosoNo ratings yet

- Tax CaseDocument10 pagesTax Caseapi-127372805No ratings yet

- CH 10Document83 pagesCH 10Thư TrầnNo ratings yet

- IrvingCC Packet 2009-12-17Document32 pagesIrvingCC Packet 2009-12-17Irving BlogNo ratings yet

- Zeidler Company Bought A Building and The Land On Which PDFDocument1 pageZeidler Company Bought A Building and The Land On Which PDFHassan JanNo ratings yet

- Land, Building, and MachineryDocument3 pagesLand, Building, and MachineryheythereitsclaireNo ratings yet

- Intermediate Accounting I PpeDocument2 pagesIntermediate Accounting I PpeJoovs JoovhoNo ratings yet

- Intermediate Accounting 11Th Edition Nikolai Test Bank Full Chapter PDFDocument67 pagesIntermediate Accounting 11Th Edition Nikolai Test Bank Full Chapter PDFprise.attone.itur100% (6)

- Intermediate Accounting 11th Edition Nikolai Test BankDocument61 pagesIntermediate Accounting 11th Edition Nikolai Test Bankesperanzatrinhybziv100% (29)

- Questions No 1 PB 7.1Document2 pagesQuestions No 1 PB 7.1L iNo ratings yet

- Weygandt Kimmel Keiso 9 EditionDocument11 pagesWeygandt Kimmel Keiso 9 EditionShuvro ChakravortyNo ratings yet

- CH 10Document9 pagesCH 10Saleh RaoufNo ratings yet

- Intermediate AccountingDocument66 pagesIntermediate AccountingTiến NguyễnNo ratings yet

- Kleinfelder Company Has Decided To Lease Its New Office BuildingDocument1 pageKleinfelder Company Has Decided To Lease Its New Office BuildingM Bilal SaleemNo ratings yet

- ch10 Kieso IFRS4 PPTDocument61 pagesch10 Kieso IFRS4 PPT1234778No ratings yet

- MA Case Question 11-72Document2 pagesMA Case Question 11-72guptarahul1992No ratings yet

- Ex. 10-135-Nonmonetary ExchangeDocument4 pagesEx. 10-135-Nonmonetary ExchangeCarlo ParasNo ratings yet

- XM Satellite Radio Which Launched Its Satellite Radio Service inDocument1 pageXM Satellite Radio Which Launched Its Satellite Radio Service inLet's Talk With HassanNo ratings yet

- Xion Supply Uses A Sales Journal A Purchases Journal ADocument1 pageXion Supply Uses A Sales Journal A Purchases Journal ALet's Talk With HassanNo ratings yet

- Wilson Machine Tools Inc A Manufacturer of Fabricated Metal ProductsDocument1 pageWilson Machine Tools Inc A Manufacturer of Fabricated Metal ProductsLet's Talk With HassanNo ratings yet

- Wipro Limited Together With Its Subsidiaries and Equity Accounted InvesteesDocument1 pageWipro Limited Together With Its Subsidiaries and Equity Accounted InvesteesLet's Talk With HassanNo ratings yet

- Wyeth Formerly American Home Products Is A Global Leader inDocument1 pageWyeth Formerly American Home Products Is A Global Leader inLet's Talk With HassanNo ratings yet

- Yoklic Corporation Currently Manufactures A Subassembly For Its Main ProductDocument1 pageYoklic Corporation Currently Manufactures A Subassembly For Its Main ProductLet's Talk With HassanNo ratings yet

- Wicom Servicing Completed These Transactions During November 2014 Its FirstDocument1 pageWicom Servicing Completed These Transactions During November 2014 Its FirstLet's Talk With HassanNo ratings yet

- Wilm Schmidt The Owner of Wilm S Window Washing Services HadDocument1 pageWilm Schmidt The Owner of Wilm S Window Washing Services HadLet's Talk With HassanNo ratings yet

- Wright Company Leases An Asset For Five Years On DecemberDocument1 pageWright Company Leases An Asset For Five Years On DecemberLet's Talk With HassanNo ratings yet

- The Savage Corporation Purchased Three Milling Machines On January 1Document1 pageThe Savage Corporation Purchased Three Milling Machines On January 1Let's Talk With HassanNo ratings yet

- The Standard Deviation of A Foreign Asset in Local CurrencyDocument1 pageThe Standard Deviation of A Foreign Asset in Local CurrencyLet's Talk With Hassan100% (1)

- Winfrey Designs Had An Unadjusted Credit Balance in Its AllowanceDocument1 pageWinfrey Designs Had An Unadjusted Credit Balance in Its AllowanceLet's Talk With HassanNo ratings yet

- The Simon Machine Tools Company Is Considering Purchasing A NewDocument1 pageThe Simon Machine Tools Company Is Considering Purchasing A NewLet's Talk With HassanNo ratings yet

- The Shares of Microsoft Were Trading On Nasdaq On JanuaryDocument1 pageThe Shares of Microsoft Were Trading On Nasdaq On JanuaryLet's Talk With HassanNo ratings yet

- The Perkins Construction Company Bought A Building For 800 000 ToDocument1 pageThe Perkins Construction Company Bought A Building For 800 000 ToLet's Talk With HassanNo ratings yet

- The Rocky Mountain Publishing Company Is Considering Introducing A NewDocument1 pageThe Rocky Mountain Publishing Company Is Considering Introducing A NewLet's Talk With HassanNo ratings yet

- The Qantas Group Integrates A Sustainability Report With Its AnnualDocument1 pageThe Qantas Group Integrates A Sustainability Report With Its AnnualLet's Talk With HassanNo ratings yet

- The Ripcord Parachute Club of Burlington Employs Three People andDocument1 pageThe Ripcord Parachute Club of Burlington Employs Three People andLet's Talk With HassanNo ratings yet

- The Records of Thomas Company As of December 31 2014Document1 pageThe Records of Thomas Company As of December 31 2014Let's Talk With HassanNo ratings yet

- The Payroll Register For Rice Company of Sackville Is SummarizedDocument1 pageThe Payroll Register For Rice Company of Sackville Is SummarizedLet's Talk With HassanNo ratings yet

- Location Entry CodesDocument25 pagesLocation Entry CodesKitso SekotsweNo ratings yet

- The Decline of The WASP AmericaDocument6 pagesThe Decline of The WASP AmericamcarolinagoveNo ratings yet

- 05 Islamisasi Filipina PDFDocument12 pages05 Islamisasi Filipina PDFDaniell DandoyNo ratings yet

- Lagrangian Dynamics Problem SolvingDocument5 pagesLagrangian Dynamics Problem Solvingvivekrajbhilai5850No ratings yet

- Letterhead For MUDocument2 pagesLetterhead For MUGiezel TagaanNo ratings yet

- International Law and International OrganizationDocument3 pagesInternational Law and International OrganizationDexter LingbananNo ratings yet

- JAPAN Insurance MarketDocument12 pagesJAPAN Insurance MarketGabriela DendeaNo ratings yet

- Jeena Jeena Guitar Chords - Badlapur With Strumming PatternDocument3 pagesJeena Jeena Guitar Chords - Badlapur With Strumming PatternnfsNo ratings yet

- FM11 CH 21 ShowDocument47 pagesFM11 CH 21 ShowDaood AbdullahNo ratings yet

- Garrett Vent Wastegate Install Guide-1Document12 pagesGarrett Vent Wastegate Install Guide-1Stanislav TsonchevNo ratings yet

- Fluid Mech. EFM Assignment 2 (Answers)Document4 pagesFluid Mech. EFM Assignment 2 (Answers)Tik HonNo ratings yet

- Bomb DetectionDocument3 pagesBomb DetectionOarms AdvanceNo ratings yet

- Proposal Tax Payer EducationDocument22 pagesProposal Tax Payer EducationDenis Robert Mfugale100% (1)

- Leave and Licence: Page 1 of 19Document19 pagesLeave and Licence: Page 1 of 19Himanshu SrivastavaNo ratings yet

- Islam in Africa Research Project: The Project For The Research of Islamist Movements (PRISM) Herzliya, ISRAELDocument12 pagesIslam in Africa Research Project: The Project For The Research of Islamist Movements (PRISM) Herzliya, ISRAELalwagieNo ratings yet

- A Study On Effectiveness of GrievanceDocument11 pagesA Study On Effectiveness of GrievanceUsman Mohideen KsNo ratings yet

- Report - Property Tax in MalaysiaDocument19 pagesReport - Property Tax in MalaysiaVenessa WahNo ratings yet

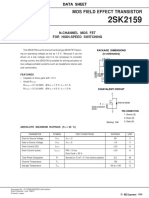

- 2SK2159Document6 pages2SK2159hectorsevillaNo ratings yet

- Cyberattack ReadingDocument2 pagesCyberattack ReadingMary Carmen DíazNo ratings yet

- 10347v5a Teachers GuideDocument52 pages10347v5a Teachers Guideapi-324415177No ratings yet

- Principles of Tasawwuf-MYDocument5 pagesPrinciples of Tasawwuf-MYNasif Akbar MulyadiNo ratings yet

- Colgate Palmolive ModelDocument51 pagesColgate Palmolive ModelAde FajarNo ratings yet

- R V Itturiligaq, 2020 NUCA 6Document23 pagesR V Itturiligaq, 2020 NUCA 6NunatsiaqNewsNo ratings yet

- Reviewer HRMDocument5 pagesReviewer HRMJohn Carlo MagsinoNo ratings yet

- Class Test (Feb)Document3 pagesClass Test (Feb)Puja BhardwajNo ratings yet

- Advanced Fluid Mechanics: Incompressible Flow of Viscous FluidsDocument33 pagesAdvanced Fluid Mechanics: Incompressible Flow of Viscous FluidsTri WidayatnoNo ratings yet

- Management of Inter-Government and Other Fund Transfers - 01Document36 pagesManagement of Inter-Government and Other Fund Transfers - 01DB BañasNo ratings yet