Professional Documents

Culture Documents

On November 1 Year 1 Alexandria Company Sold Merchandise To

On November 1 Year 1 Alexandria Company Sold Merchandise To

Uploaded by

Freelance WorkerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

On November 1 Year 1 Alexandria Company Sold Merchandise To

On November 1 Year 1 Alexandria Company Sold Merchandise To

Uploaded by

Freelance WorkerCopyright:

Available Formats

On November 1 Year 1 Alexandria Company sold

merchandise to #3421

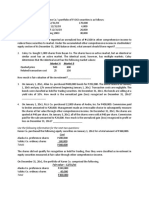

On November 1, Year 1, Alexandria Company sold merchandise to a foreign customer for

100,000 francs with payment to be received on April 30, Year 2. At the date of sale, Alexandria

Company entered into a six-month forward contract to sell 100,000 francs. The forward contract

is properly designated as a cash flow hedge of a foreign currency receivable. Relevant

exchange rates for the franc are:Alexandria Company's incremental borrowing rate is 12

percent. The present value factor for four months at an annual interest rate of 12 percent (1

percent per month) is 0.9610.Required:Prepare all journal entries, including December 31

adjusting entries, to record the sale and forward contract. What is the impact on net income in

Year 1? What is the impact on net income in Year 2?View Solution:

On November 1 Year 1 Alexandria Company sold merchandise to

ANSWER

http://paperinstant.com/downloads/on-november-1-year-1-alexandria-company-sold-

merchandise-to/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- ACCT 251 Practice Set 2021 - 1Document28 pagesACCT 251 Practice Set 2021 - 1Earl Justine FerrerNo ratings yet

- Advance Acctg Foreign Currency ProblemsDocument6 pagesAdvance Acctg Foreign Currency ProblemsManila John20% (5)

- Presented Below Is Information Pertaining To Delsnyder Specialty Foods ADocument1 pagePresented Below Is Information Pertaining To Delsnyder Specialty Foods ALet's Talk With HassanNo ratings yet

- Tugas C12Document2 pagesTugas C12Yandra FebriyantiNo ratings yet

- Using The Trial Balance Prepared For Binbutti Engineering in PartDocument1 pageUsing The Trial Balance Prepared For Binbutti Engineering in PartFreelance Worker0% (2)

- Artco Inc Engages in Various Transactions With Companies in TheDocument1 pageArtco Inc Engages in Various Transactions With Companies in TheFreelance WorkerNo ratings yet

- On December 1 2016 Lynch Incorporated Sold 18 000 of MerchandiseDocument1 pageOn December 1 2016 Lynch Incorporated Sold 18 000 of MerchandiseHassan JanNo ratings yet

- Brookhurst Company A U S Based Company Established A Subsidiary in SouthDocument1 pageBrookhurst Company A U S Based Company Established A Subsidiary in SouthFreelance WorkerNo ratings yet

- Alexander Corporation A U S Based Company Acquired 100 Percent of ADocument1 pageAlexander Corporation A U S Based Company Acquired 100 Percent of ALet's Talk With HassanNo ratings yet

- Assuming A Forward Contract To Sell 100 000 Israeli Shekels WasDocument1 pageAssuming A Forward Contract To Sell 100 000 Israeli Shekels WasFreelance WorkerNo ratings yet

- On August 1 Year 1 Huntington Corporation Placed An OrderDocument1 pageOn August 1 Year 1 Huntington Corporation Placed An OrderFreelance Worker0% (1)

- On December 1 2015 Prosen Distributing Company Had The FollowingDocument1 pageOn December 1 2015 Prosen Distributing Company Had The Followingtrilocksp SinghNo ratings yet

- Cling On LTD Sells Rock Climbing Products and Also Operates An IndoorDocument2 pagesCling On LTD Sells Rock Climbing Products and Also Operates An IndoorMiroslav GegoskiNo ratings yet

- FOREX - LectureDocument4 pagesFOREX - LectureJEP WalwalNo ratings yet

- On December 1 2010 Sleezer Distributing Company Had The FollowDocument1 pageOn December 1 2010 Sleezer Distributing Company Had The FollowM Bilal SaleemNo ratings yet

- Forex PDFDocument5 pagesForex PDFErika LanezNo ratings yet

- Ia Reviewer QuizzesandexamsDocument22 pagesIa Reviewer QuizzesandexamsReady PlayerNo ratings yet

- Intermediate Accounting 1 FinalDocument5 pagesIntermediate Accounting 1 FinalCix SorcheNo ratings yet

- Quiz Ia Quiz IaDocument2 pagesQuiz Ia Quiz IaMili Dit0% (1)

- REVIEWer Take Home QuizDocument3 pagesREVIEWer Take Home QuizNeirish fainsan0% (1)

- 555 On Its December 31 2013 Consolidated Balance Sheet What AmountDocument1 page555 On Its December 31 2013 Consolidated Balance Sheet What AmountMiroslav GegoskiNo ratings yet

- On November 1 2013 Ambrose Company Sold Merchandise To ADocument1 pageOn November 1 2013 Ambrose Company Sold Merchandise To AMiroslav GegoskiNo ratings yet

- The Company S Yearend Is 31 December 20x3 Prepare Ledger AccountsDocument1 pageThe Company S Yearend Is 31 December 20x3 Prepare Ledger AccountsMiroslav GegoskiNo ratings yet

- Palmerstown Company Established A Subsidiary in A Foreign Country OnDocument1 pagePalmerstown Company Established A Subsidiary in A Foreign Country OnFreelance WorkerNo ratings yet

- Solved The Bradford Company Sold The Entire Bond Issue Described inDocument1 pageSolved The Bradford Company Sold The Entire Bond Issue Described inAnbu jaromiaNo ratings yet

- The Accounts Listed On The Next Page Appeared in TheDocument1 pageThe Accounts Listed On The Next Page Appeared in TheM Bilal SaleemNo ratings yet

- On December 1 2014 Boline Distributing Company Had The FollowingDocument1 pageOn December 1 2014 Boline Distributing Company Had The Followingtrilocksp SinghNo ratings yet

- During 2016 Dora Company Completed The Following Transactions Jan 1 TradedDocument1 pageDuring 2016 Dora Company Completed The Following Transactions Jan 1 Tradedhassan taimourNo ratings yet

- Handout No. 3 Accrev San BedaDocument10 pagesHandout No. 3 Accrev San BedaJustine CruzNo ratings yet

- Quiz 2.docx Afar 2Document2 pagesQuiz 2.docx Afar 2Ella Turato100% (1)

- Quality Watches Completed The Following Selected Transactions During 2016 and PDFDocument1 pageQuality Watches Completed The Following Selected Transactions During 2016 and PDFTaimour HassanNo ratings yet

- FAR ModuleDocument6 pagesFAR ModuleFannilyn Florentino GonzalesNo ratings yet

- At December 31 2015 Grand Company Reported The Following As: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt December 31 2015 Grand Company Reported The Following As: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- JA p.6Document2 pagesJA p.6Von Andrei MedinaNo ratings yet

- The Following Accounts Appeared in The December 31 Trial Balance PDFDocument1 pageThe Following Accounts Appeared in The December 31 Trial Balance PDFFreelance WorkerNo ratings yet

- Long Quiz in Intermediate Accounting 1 PART 1aDocument4 pagesLong Quiz in Intermediate Accounting 1 PART 1aGillian mae Garcia0% (2)

- Carbon Company Entered Into The Following Trans Actions During November NovDocument1 pageCarbon Company Entered Into The Following Trans Actions During November Novhassan taimourNo ratings yet

- Solved Keystone Corporation Issued 1 Million of Five Year 5 Bonds DatedDocument1 pageSolved Keystone Corporation Issued 1 Million of Five Year 5 Bonds DatedAnbu jaromiaNo ratings yet

- Accounting Problem CHART OF ACCOUNTSDocument6 pagesAccounting Problem CHART OF ACCOUNTSkarenlasuncionNo ratings yet

- College Coasters Is A San Antonio Based Merchandiser Specializing inDocument1 pageCollege Coasters Is A San Antonio Based Merchandiser Specializing inTaimur TechnologistNo ratings yet

- Aec 22 - Notes ReceivableDocument3 pagesAec 22 - Notes ReceivableIrish Jane Patricio AcumanNo ratings yet

- Lec2.7 SlidesDocument29 pagesLec2.7 SlidesmanandeepamazonNo ratings yet

- NFJPIA Mockboard 2011 P1 PDFDocument9 pagesNFJPIA Mockboard 2011 P1 PDFLei LucasNo ratings yet

- Clapton Guitar Company Entered Into The Following Transactions During 2016Document1 pageClapton Guitar Company Entered Into The Following Transactions During 2016Taimur TechnologistNo ratings yet

- Financial Accounting Week 4Document7 pagesFinancial Accounting Week 4chapmanalexis73No ratings yet

- Al Financial Accounting May Jun 2017Document5 pagesAl Financial Accounting May Jun 2017Akash79No ratings yet

- What Was The Net Increase or Decrease in Cash FlowDocument1 pageWhat Was The Net Increase or Decrease in Cash FlowLet's Talk With HassanNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsFelsie Jane PenasoNo ratings yet

- In Each of The Following Independent Cases The Company ClosesDocument1 pageIn Each of The Following Independent Cases The Company ClosesM Bilal SaleemNo ratings yet

- CHAPTER 4 Recording Business Transactions (Module)Document16 pagesCHAPTER 4 Recording Business Transactions (Module)Chona MarcosNo ratings yet

- Verlando Company Had The Following Account Balances and Information AvailableDocument1 pageVerlando Company Had The Following Account Balances and Information AvailableTaimour HassanNo ratings yet

- Quiz On InvestmentDocument3 pagesQuiz On InvestmentDan Andrei BongoNo ratings yet

- Accounting For Business Combinations Part 2 - Course AssessmentDocument8 pagesAccounting For Business Combinations Part 2 - Course AssessmentArn KylaNo ratings yet

- AfarDocument11 pagesAfarDonna Mae HernandezNo ratings yet

- Pertemuan 12 - Investasi Obligasi PDFDocument21 pagesPertemuan 12 - Investasi Obligasi PDFayu utamiNo ratings yet

- Tutorial Work 101Document9 pagesTutorial Work 101nomthandazomtshweni574No ratings yet

- Franchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Document4 pagesFranchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Vine AlparitoNo ratings yet

- Valor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsDocument1 pageValor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsFreelance WorkerNo ratings yet

- Vencap Inc Is A Venture Capital Financier It Estimates ThatDocument1 pageVencap Inc Is A Venture Capital Financier It Estimates ThatFreelance WorkerNo ratings yet

- Using The Ledger Balances and Additional Data Shown On TheDocument1 pageUsing The Ledger Balances and Additional Data Shown On TheFreelance WorkerNo ratings yet

- Using The Trial Balance Prepared For X Factor Accounting in PartDocument1 pageUsing The Trial Balance Prepared For X Factor Accounting in PartFreelance WorkerNo ratings yet

- Using The Information in Exercise 7 A Present The Journal EntriesDocument1 pageUsing The Information in Exercise 7 A Present The Journal EntriesFreelance WorkerNo ratings yet

- Using The Information in Problem 3 9a Complete The Following in ProblemDocument1 pageUsing The Information in Problem 3 9a Complete The Following in ProblemFreelance WorkerNo ratings yet

- Using The Information Provided in Part 1 of Problem 1Document1 pageUsing The Information Provided in Part 1 of Problem 1Freelance WorkerNo ratings yet

- Using The Following Independent Situations Answer The Following Questions SituationDocument1 pageUsing The Following Independent Situations Answer The Following Questions SituationFreelance WorkerNo ratings yet

- Ubs Ag Is A Global Provider of Financial Services ToDocument1 pageUbs Ag Is A Global Provider of Financial Services ToFreelance WorkerNo ratings yet

- Using The General Journal Entries Prepared in Problem 2 3b CompleteDocument1 pageUsing The General Journal Entries Prepared in Problem 2 3b CompleteFreelance WorkerNo ratings yet

- Use The Data From Problem 6 5a and Do The QuestionDocument1 pageUse The Data From Problem 6 5a and Do The QuestionFreelance WorkerNo ratings yet