Professional Documents

Culture Documents

Handout No. 3 Accrev San Beda

Uploaded by

Justine CruzCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Handout No. 3 Accrev San Beda

Uploaded by

Justine CruzCopyright:

Available Formats

CURRENT LIABILITIES_PROVISIONS_CASH TO ACCRUAL BASIS_CASH

FLOW_OPERATING SEGMENT_INTERIM REPORTING AIR-OCT2019

MODULE 3

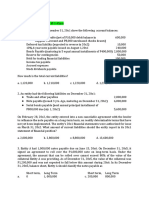

1. NI Co. has the following liabilities as of December 31, 20x1:

Trade account payable net of debit balance in supplier’s account 1,200,000

of ₱20,000,net of unreleased checks of ₱16,000, and net of post-

dated checks ₱8,000.

Credit balance in customer’s accounts 8,000

Financial liability at FVPL 200,000

Bonds payable maturing in 10 equal annual instalments of P400,000 4,000,000

12%, 5-year note payable issued on 01 October 20x1 400,000

Deferred tax liability 20,000

Unearned Rent 16,000

Contingent liability 40,000

Reserve for contingencies 100,000

How much is the total current liabilities?

Refinancing agreement – no discretion

2. PE Co. has a ₱4,000,000 loan payable as of December 31, 20x1 that is

maturing on July 1, 20x2. On February 1, 20x2, PE Co. entered into a

refinancing agreement with a bank to refinance the loan on a long-term

basis. Both parties are financially capable of honoring the agreement’s

provisions. PE’s financial statements were authorized for issue on March

12, 20x2. How much is presented as current liability in relation to the

loan in PE 20X1 year-end financial statements?

Refinancing agreement – with discretion

3. QE Co. has a ₱4,000,000 loan payable as of December 31, 20x1 that is

maturing on July 1, 20x2. On February 1, 20x2, QE Co. entered into a

refinancing agreement with a bank to refinance the loan on a long-term

basis. Both parties are financially capable of honoring the agreements

provisions. QE has the discretion to refinance or roll over the loan for at

least twelve months from December 31, 20x1 under an existing loan facility.

QE’s financial statements were authorized for issue on March 15, 20x2. How

much is presented as current liability in relation to the loan in QE’s 20x1

year-end financial statements?

Refinancing agreement-completed as of end reporting period

4. RC Co. has a ₱4,000,000 loan payable as of December 31, 20x1 that is

maturing on July 1, 20x2. On December 1, 20x1, RC Co. entered into a

refinancing agreement with a bank to refinance the loan on long-term basis.

The refinancing and roll over transaction was completed on December 31,

20x1. How much is presented as current liability in relation to the loan in

RC’s 20x1 year-end financial statements?

Refinancing agreement-with interest payable

5. SO Co. has a 10%, ₱4,000,000 loan payable as of December 31, 20x1 that is

maturing on July 1, 20x2. The loan is dated July 1, 19x1 and pays annual

interest every July1. On February 1, 20x2, SO Co. entered into a

refinancing agreement with a bank to refinance the loan on a long-term

basis. Both parties are financially capable of honoring the agreement’s

provisions. SO has the discretion to refinance or roll over the loan for at

least twelve months from December 31, 20x1 under an existing loan facility.

SO’s financial statements were authorized for issue on March 15, 20x2. How

much is presented as current liability in SO’s 20x1 year-end financial

statements?

Breach of loan agreement-grace period received after year-end

6. On January 1, 20x1, TS Co. took a 3-year, ₱4,000,000 loan from a bank. The

loan agreement requires TS to maintain a current ratio of 2:1. If the

current ratio falls below 2:1, the loan becomes payable on demand. As of

December 31, 20x1, TS’s current ratio is 1.8:1. On January 5, 20x2, the

bank agrees not to collect the loan in 20x2 and gave TS 12 months to

rectify the breach of loan in TS’s 20x1 year-end financial statements?

Breach of loan agreement-grace period received after year-end

7. On January 1, 20x1, DS Co. took a 3-year, ₱4,000,000 loan from a bank. The

loan agreement requires DS to maintain a current ratio of 2:1. If the

current ratio falls below 2:1, the loan becomes payable on demand. As of

December 31, 20x1, DS’s current ratio resulted to 1.8:1 and the bank agreed

Albert I. Rivera, CPA, MBA, CRA

1 of 10

CURRENT LIABILITIES_PROVISIONS_CASH TO ACCRUAL BASIS_CASH

FLOW_OPERATING SEGMENT_INTERIM REPORTING AIR-OCT2019

MODULE 3

not to collect the loan in 20x2 and gave DS 12 months to rectify the breach

of loan agreement. How much is presented as current liability in relation

to the loan in DS 20x1 year-end financial statements?

Obligation payable on demand

8. On December 31, 20x1, SR Co. has a ₱4,000,000 note payable on demand.

However on December 31, 20x1, there is no indication that the payee on the

note will demand payment over the next 12 months. How much is the current

liability in relation to the note in SR’s 20x1 year-end financial

statements?

Unearned revenue-sale of goods

UN Co. requires advance payment for custom-built guitar effects, gadgets, and

racks. The records of UN Co. show the following:

Unearned revenue, January 1, 20x1 ₱4,000,000

Advances received during 20x1 40,000,000

Advances applied to orders shipped in 20x1 32,000,000

Advance pertaining to orders to orders cancelled in 20x1

1,200,000

9. How much is the current liability if the advance payments received are non-

refundable?

10. How much is the current liability if the advance payments received are

refundable?

Unearned subscription – monthly

CC CO. sells subscriptions for an industry publication published monthly and

shipped to subscribers every 15th of the month. However, subscriptions

received after the November 1 cut-off date is held for publication in the

following year. Receipts during 20x1 for subscriptions were made evenly.

Information on subscriptions is shown below:

Unearned revenue – January 1, 20x1 ₱ 12,000,000

Receipts from subscriptions during 96,0000,000

20x1

11. How much is the unearned revenue balance on December 31, 20x1?

12. How much is the revenue from subscriptions during 20x1?

Unearned subscription- semi-annual

ES Co. sells one-year subscriptions for an industry publication published

semiannually and shipped to subscribers on May 1 and November 1. Subscriptions

received after April 1 and October 1 cut-off dates are held for the next

publication. Receipts during 20x1 for subscriptions were made evenly.

Information on subscriptions is shown below:

Unearned revenue – January 1, 20x1 ₱12,000,000

Receipts from subscriptions during 96,000,000

20x1

13. How much is the revenue balance on December 31, 2x10?

Gift certificates

14. IF Co. sells gift certificates that expire one year after their

issuance. Information on a gift certificates is shown below:

Unearned revenue – gift certificates. ₱2,400,000

Jan 1, 20x1

Gift certificates sold during 20x1 4,000,000

Prior year gift certificates redeemed 1,600,000

in 20x1

Gift certificates sold and redeemed in 2,800,000

20x1

IF’s past experience indicates that 10% of gift certificates sold will not be

redeemed. How much is the revenue on December 31, 20x1?

Deposits for returnable containers

15. IU Co. requires deposits from customers for the container goods sold.

The customers are refunded for deposits received when the containers are

returned within two years from date of sale of the related goods. Deposits

for the containers not returned within the limit are regarded as proceeds

from retirement of the containers.

Albert I. Rivera, CPA, MBA, CRA

2 of 10

CURRENT LIABILITIES_PROVISIONS_CASH TO ACCRUAL BASIS_CASH

FLOW_OPERATING SEGMENT_INTERIM REPORTING AIR-OCT2019

MODULE 3

Information for 20x3 is as follows:

Container deposits at December 31, 20x2 from deliveries in:

20x1 ₱80,000

20x2 180,000 ₱260,000

Deposits for containers delivered in 20x3 360,000

Deposits for containers returned in 20x3 from

deliveries in:

20x1 ₱36,000

20x2 100,000

20x3 184,000 320,000

How much is the liability for deposits on returnable containers on December

31, 20x3?

Best estimate

16. In 20x1, BABU Co. received a court order requiring the cleanup of

environmental damages caused by one of BABU’s factory. BABU’s has no other

realistic alternative but to comply with the court order. Other entities

have incurred around ₱60M for similar clean-up; however, BABU’s best

estimate of the cost of cleanup is ₱80M. How much is the provision to be

recognized?

Expected value

17. In 20x1, CABU Co. recalled a product due to a possible defect caused by

a manufacturing factory equipment. The products recalled will be repaired

free of charge. CABU is uncertain whether all products recalled will have

possible defect. However, the following estimate was made by estimate was

made by CABU’s engineers and managerial and approved by the board of

directors.

Repair cost Probability

80,000,000 5%

60,000,000 20%

40,000,000 35%

20,000,000 40%

How much is the provision to be recognized?

Mid point

18. In 20x1, a lawsuit was filed against DABU Co. of patent infringement.

The plaintiff is claiming ₱40M in damages DABU’S legal counsel believes

that is probable that DABU will lose the lawsuit and pay damages of not

less than ₱40M but not more than ₱400M. the probability of any amount

within the range is a s likely as any other amount also within the range.

The plaintiff has offered to settle the lawsuit out of court for ₱360M but

DABU did not agree to the settlement. How much is provision to be reported

in DABU’s year-end financial statement?

Reimbursement

19. FABU Co. is engaged in logistics services. During the year, a warehouse

was destroyed by fire. It was estimated that FABU will probably pay around

200M in damages caused to the goods owned by customers that were contained

in the destroyed warehouse. The contents of the warehouse at any given

point of time are insured 80M. FABU’s claim for the insurance has been

approved for payment by the insurance company. How much is the provision to

be recognized?

Onerous contract – purchase commitment

20. On January 1, 20x1, GABU Co. signed a three year, non-cancelable

purchase contract, which allows GABU Co. to purchase up to ₱60,000 units of

a microchip annually from HABU Co. at ₱100 per unit and guarantees a

minimum annual purchase of ₱15,000 units. At year-end, it was found out

that the goods are absolute. GABU had ₱10,000 units of this inventory at

December 31, 20x1, and believes these parts can be sold as scrap for ₱20

per unit. How much is the loss on purchase commitment?

Warranty Expense

21. JABU FUNNY Co. provides 3-year warranty for the products it sells. JABU

estimates that warranty costs ₱400 per unit sold. As of January 1, 20x1,

the liability for warranty has a balance of ₱8000,000 for units sold in

20x0. During the year JABU sold 5,000 units and actual warranty costs

incurred were ₱1,240,000.How much is the warranty expense recognized in

20x1?

22. How much is the balance of the warranty obligation as December 31, 20x1?

Albert I. Rivera, CPA, MBA, CRA

3 of 10

CURRENT LIABILITIES_PROVISIONS_CASH TO ACCRUAL BASIS_CASH

FLOW_OPERATING SEGMENT_INTERIM REPORTING AIR-OCT2019

MODULE 3

Warrant liability

23. KABU provides2-year warranty for products sold. Estimated cost of

warranty is 2% in the year of sale and 4% after the year of sale.

Information on KABU’s sale is shown below:

Year Sale Actual Warranty Costs

20x1 40,000,000 1,600,000

20x2 48,000,000 2,000,000

How much is the balance of the warranty obligation as of December 31, 20x2

assuming those pertaining to 20x1 sales have not yet expired as of 20x2 year-

end?

Premium expense

24. LABU Co. launched a sales promotion in 20x1.For every ten empty packs

returned to LABU plus ₱200,000, customers will receive a set of kitchen

knives. LABU estimates that 40% of the packs sold will be redeemed.

Information on transactions during the year is as follows:

Units Amount

SALES 500,000 3B

Sets of kitchen knives

purchased (₱800 per set) 300,000 240M

Number of packs redeemed 45,000

How much is the premium expense in 20x1?

Premium liability

25. MABU FRANK Co. launched a sales promotion in 20x1. For every five

bottles returned to MABU, customers will receives a T-shirt. The unit cost

of the T-shirt Is ₱400. MABU estimates that 80% of sales will be redeemed.

Additional information is as follows:

Units

Sales in 20x1 500,000

Sales in 20x2 900,000

T-shirts distributed in 20x1 60,000

T-shirts distributed in 20x2 147,000

How much is the liability for premiums as of December 31, 20x2 ?

Liability for refunds

26. NABU RECKLESSLY BOLD Co. has a policy of refunding purchases to

unsatisfied customers even though NABU is under no legal obligation to do

so. NABU’s policy of making refunds is made known to the public. Past

experience shows that 10% of sales are returned and customers are refunded.

It also estimated that 60% of sales returns are from sales on account. In

20x1, NABU Co. had ₱4,000,000 total sales, 60% of which were on account.

How much is the provision to be recognized?

Guarantee for indebtedness of others

27. On January 1, 20x1, PABU Co. guaranteed a ₱4,000,000 loan obtained by

RABU, Inc. from a bank. On December 31, 20x1, RABU defaulted on its loan

and it became probable that PABU will be held liable to the bank for

₱4,000,000 loan taken by RABU. How much is the provision to be recognized?

Cash/Accrual Basis - Sales

The following information was taken from the records of Feliciano Co.

Cash sales - gross 2,000,000

Trade accounts receivable- beg. 2,400,000

Trade accounts receivable – end 1,600,000

Trade notes receivable increased by 1,200,000

Collections on receivables 4,000,000

Sales returns and discounts (inclusive of 20,000 payments to 80,000

customers)

Write-offs of accounts receivable 40,000

Recoveries of accounts receivable written-off (included in 16,000

collections)

Trade notes receivable discounted (Note receivable was 120,000

directly credited)

28. How much is the net sales under cash basis of accounting?

29. How much is the net sales under accrual basis of accounting?

Albert I. Rivera, CPA, MBA, CRA

4 of 10

CURRENT LIABILITIES_PROVISIONS_CASH TO ACCRUAL BASIS_CASH

FLOW_OPERATING SEGMENT_INTERIM REPORTING AIR-OCT2019

MODULE 3

Purchases and cost of goods sold

The following information was taken from the records of Lagasca Company

Cash purchases – gross 1,200,000

Trade accounts payable – beg. 2,000,000,

Trade accounts payable – end 1,600,000

Trade notes payable decreased by 800,000

Cash payments on payables 4,000,000

Purchase returns and discounts (inclusive of 60,000 receipts 80,000

from suppliers)

Inventory increased by 400,000

30. How much is the net purchases under cash basis of accounting?

31. How much is the cost goods sold under cash basis of accounting?

32. How much is the net purchases under accrual basis of accounting?

33. How much is the goods sold under accrual basis of accounting?

Other items of income

Celestino Co. has the following information:

Accrued rent income – January 1 1,600,000

Accrued rent income – December 31 800,000

Unearned rent, January 1 1,200,000

Unearned rent, December 2,000,000

Rental payments received 4,000,000

34. How much is the rent income under cash basis accounting?

35. How much is the rent income under accrual basis of accounting?

Other items of income

36. The following information was taken from the records of Cabuco Inc.

Accrued rent income –January 1 1,600,000

Accrued rent income –December 31 800,000

Unearned rent, January 1 1,200,000

Unearned rent, December 2,000,000

Rent income under account basis 2,400,000

How much is then rent income under cash basis?

Other items of expense

37. Correa Co. has the following information:

Prepaid insurance –January 1 1,600,000

Prepaid insurance –December 31 800,000

Insurance payable – Decreased by 1,200,000

Insurance payments 4,000,000

How much is the rent expense under accrual basis?

Other items of expense

38. The following information was taken from the records of Alvarez Co.

Prepaid insurance – January 1 1,6900,000

Prepaid insurance - Dec 31 800,000

Insurance payable decreased by 1,200,000

Rent expense under accrual basis 3,600,000

How much is the rent expense under cash basis?

CASH FLOW STATEMENT

Analysis of Cash account Method

The movements in the cash account of Austin Co. during 20x2 are shown below.

Cash

Beg 400 7,600 Purchases

Sales 12,000 2,400 Operating expenses

Interest income 40 60 Interest expenses

Rent income 540 140 Income taxes

Divided income 80

200 Investment in FVOCI

Sale of held for trading securities 1,600 2,200 Purchase of equipment

Sale of old building 1,040 Loan granted to

260 employee

Collection of non-trade note 120 Payment of loan

Albert I. Rivera, CPA, MBA, CRA

5 of 10

CURRENT LIABILITIES_PROVISIONS_CASH TO ACCRUAL BASIS_CASH

FLOW_OPERATING SEGMENT_INTERIM REPORTING AIR-OCT2019

MODULE 3

480 borrowed

Proceeds from Bank loan 3,200 400 Reacquisition of shares

Issuance 1,940 180 Dividends

7,040 end

39. How much is the cash flows from operating activities?

40. How much is the cash flows from investing activities?

41. How much is the cash flows from financing activities?

T-Account Method

ALANIS had the following information during 20x2:

Accounts receivables, January 1, 20x2 2,400

Accounts receivables, December 31, 20x2 1,600

Sales on account and cash sales 32,000

Bad debts expense 800

Accounts payable, January 1, 20x2 1,400

Accounts payable, December 31, 20x2 800

Cost of sales 16,000

Increase in inventory 3,600

Operating expenses on accrual basis 4,880

Increase in accrued payables for operating 1,640

expenses

Decrease in prepaid operating expenses 1,560

Property, plant, and equipment, January 1, 20x2 7,200

Property, plant, and equipment, December 31, 20x2 10,800

Additional information

There were no write-offs of accounts receivables during the year.

Equipment with an accumulated depreciation of ₱800 was sold during the

year for ₱480 resulting to a gain on sale of ₱60.

42. How much is the cash receipts from customers?

43. How much is the cash payments to suppliers?

44. How much is the cash payments for operating expenses?

45. How much is the cash payment for acquisition of property, plant, and

equipment?

T-Account Method-Cash receipts (w/ write-off)

46. Kirsten Co. has the following information as of December 31, 20x1:

Jan. 1 Dec. 31

Accounts receivables 100,000 250,000

Allowance for bad debts 15,000 20,000

Net credit sales 850,000

Bad debt expense 60,000

Recoveries 20,000

How much is the total cash receipts from customers during the period?

Cash flow from operating activities – Indirect method

47. Kurt Co. has the following information as of December 31, 20x2:

Jan. 1 Dec. 31

Accounts receivable 16,000 20,000

Allowance for bad debts (400) (1,000)

Prepaid rent 3,840 3,200

Accounts payable 6,800 8,800

Kurt reported profit of ₱8,800 for the year, after depreciation expense of

₱200. Gain on sale of Equipment of ₱240, and restructuring and other

provisions of ₱400. None of the provisions recognized during the period

affected cash.

How much is the cash flows from operating activities?

Cash flow from investing and financing activities

Karen Co. had the following information for 20x2:

Acquired 3-month treasury bills for ₱200,000

Acquired equipment with a purchase price of ₱4,000,000 by paying 20% in

cash and issuing a note payable for the balance. There were no payments

made on the note during the year.

Albert I. Rivera, CPA, MBA, CRA

6 of 10

CURRENT LIABILITIES_PROVISIONS_CASH TO ACCRUAL BASIS_CASH

FLOW_OPERATING SEGMENT_INTERIM REPORTING AIR-OCT2019

MODULE 3

Acquired land with fair value of ₱3,200,000 by issuing shares with

aggregate par value of ₱2,400,000. The excess is credited to share

premium.

Extended a ₱1,600,000 loan to a director.

Borrowed ₱1,280,000 from a bank. Used the cash proceeds as follows:

₱800,000 for additional working capital and ₱480,000 to settle scrip

dividends declared in 20x1

Settled an outstanding note payable by issuing shares with aggregate par

value of ₱800,000. Share premium resulted from the transaction amounted

to ₱280,000.

48. How much is the net cash flows from (used in) investing activities?

49. How much is the net cash flows from (used in) financing activities?

OPERATING SEGMENT

Quantitative thresholds

50. AIR Co. is preparing its year-end financial statements and has identified the following operating segments:

Segments Revenues Profit (loss) Assets

A 4,000,000 800,000 56,000,000

B 4,800,000 560,000 72,000,000

C 1,080,000 (280,000) 48,000,000

D 960,000 (2,800,000) 4,000,000

E 1,160,000 200,000 5,600,000

Totals 12,000,000 (1,520,000) 185,600,000

What are the reportable segments?

Management approach and Aggregation

51. AIR Co. engages in five diversified operations namely, operations A,B, C, D and E Information on these

segments are shown below:

Segments Revenues Profit (loss) Assets

A 3,200 800 40,000

B 3,200 400 8000

C 200 40 4,000

D 600 80 8,000

E 800 280 24,000

Totals 8,000 1,600 84,000

Additional information:

For internal reporting purposes segments A and B are considered as one operating segment.

Segment E is considered as an operating segment for internal decision making purposes.

Segments C and D have similar economic characteristics and share a majority of the aggregation criteria

What are the reportable segments?

Limit on external revenue

52. AIR Co. is preparing its year-end financial statements and has identified the following operating segments:

External Inter-segment Total

Segments revenues revenues revenues Profit Assets

A 4,800,000 2,400,000 7,200,000 2,800,000 48,000,000

B 1,600,000 400,000 2,000,000 1,600,000 28,000,000

C 1,000,000 - 1,000,000 400,000 4,000,000

D 800,000 - 800,000 320,000 3,200,000

E 600,000 - 600,000 280,000 2,800,000

F 400,000 - 400,000 200,000 2,000,000

Totals 9,200,000 2,800,000 12,000,000 5,600,000 88,000,000

Management believes that between segments C, D, E and F, segment C is most relevant to external users of

financial statements. What are the reportable segments?

Major customers

53. AIR Co. has the following information its reporting segments.

External Inter-segment Total

Segments revenues revenues revenues Profit Assets

A 4,800,000 2,400,000 7,200,000 2,800,000 48,000,000

B 1,600,000 400,000 2,000,000 1,600,000 28,000,000

C 1,000,000 - 1,000,000 400,000 4,000,000

Albert I. Rivera, CPA, MBA, CRA

7 of 10

CURRENT LIABILITIES_PROVISIONS_CASH TO ACCRUAL BASIS_CASH

FLOW_OPERATING SEGMENT_INTERIM REPORTING AIR-OCT2019

MODULE 3

D 800,000 - 800,000 320,000 3,200,000

E 600,000 - 600,000 280,000 2,800,000

F 400,000 - 400,000 200,000 2,000,000

Totals 9,200,000 2,800,000 12,000,000 5,600,000 88,000,000

AIR Co. shall provide disclosure for major customers if revenues from transactions with single external customer

amount to how much?

INTERIM REPORTING

Recognition and measurement in interim periods

54. AIR Co. reports profit before tax of ₱1,500,000 in its 2 nd quarter

interim financial statements before consideration for the following:

a. Inventory with a carrying amount ₱200,000 has a net realizable value of

₱120,000.it is expected that the decline in value will reverse in the

3rd quarter.

b. An investment property measured under the cost model has a carrying

amount of ₱350,000 but its recoverable amount is ₱210,000.

c. An investments in FVPL measured at acquisition cost of ₱200,000 has a

fair value of ₱250,000 as at the end of 2 nd quarter however, the

increase in fair value is expected to be temporary.

d. No depreciation is recognized during the 2nd quarter. The annual

straight-line depreciation of items of PPE is ₱600,000.

e. ABC co. has a policy of providing 12 days paid vacation leaves for its

employees. The vacation leaves are vesting and accumulating amounting to

₱440,000 for the year. However, only ₱100,000 worth paid vacation leaves

has been availed of during the quarter.

How much is the adjusted profit before taxes for current quarter?

Cost incurred unevenly

55. AIR Co. is preparing its interim financial statements for the period

ended March 31, 20x1. The following relate to the transactions during the

first quarter:

a. Total sales for the interim period was ₱4,000,000

b. Cost of sales was ₱1,800,000.

c. AIR is liable for 5% commission on its sales to its sales

representatives and agents. No commission has yet been paid as of March

31, 20x1.

d. The allowance for doubtful accounts has a balance of ₱20,000 as of

January 1,20x1 the required balance as of March 31, 20x1 is ₱60,000.

There were no write-offs or recoveries during the period.

e. A building with historical cost of ₱4, 800,000 is being depreciated over

5 years using straight line method.

f. AIR prepaid one-year insurance on its assets for ₱160,000 on January

1,20x1.

g. Property taxes for 20x1 amounting to₱104,000 was paid in January.

h. Advertising costs of ₱200,000 were incurred in February on promotional

activities held on Valentine’s Day.

i. Year-end staff bonuses are expected to be around ₱368,000 employees

become entitled to the bonuses as they provide services to AIR during

the year.

j. AIR’s president is entitled to 10% bonus on profit before bonus taxes

k. Loss on sale of used equipment on March 2, 20x1 was ₱120,000.

l. AIR incurred ₱48,000 on unanticipated repairs on its factory equipment

on March 16, 20x1.

m. Due to the unexpected breakdown of the factory equipment on March 16,

20x1, AIR has planned a major periodic overhaul of its other equipment

to be held annually starting December 31, 20x1. The cost of the major

planned periodic overhaul is estimated at ₱192,000.

n. AIR leases one of its retail stores. Monthly rentals are ₱20,000,

however, the lease contracts provide for a contingent rent equal to 2%

of the excess of sales over ₱3,600,000.

o. AIR’s budget for 20x1 included charitable contributions of ₱96,000 and

employee training costs of ₱52,000. None of those costs were incurred as

of March 31, 20x1.

p. Other operating expenses incurred during the first quarter totalled

₱480,000.

Albert I. Rivera, CPA, MBA, CRA

8 of 10

CURRENT LIABILITIES_PROVISIONS_CASH TO ACCRUAL BASIS_CASH

FLOW_OPERATING SEGMENT_INTERIM REPORTING AIR-OCT2019

MODULE 3

How much is the profit (loss) for the first quarter ended March 31, 20x1?

Provision-Changes in estimates

56. Among the transactions of AIR WIPEOUT Co. for the first two quarters of

20x1 were the following:

AIR recognized a ₱400,000 write-down in its inventory during the first

quarter. AIR had expected that the write down will reverse in the second

quarter, and in fact, in the second quarter, the recovery exceeded the

previous write-down by ₱80,000.

AIR provides warranty for its sales. In the first quarter, AIR estimated

a 5% warranty obligation on its first quarter sales of 4,000,000. In the

second quarter, a change in accounting estimate was made. It was

estimated that the cost of warranty should be 10% of total sales. The

second quarter sales amounted ₱4,800,000.

AIR has been estimating its bad debt expense as 2% of credit sales.

However, in the second quarter, a change was made to the percentage of

ending receivable. Under this method, the required balance of the

allowance for doubtful accounts as of June 30, 20x1 is computed

₱120,000. The allowance has a balance of ₱20,000 at the beginning of the

year. Total write-offs during the first six months of 20x1 amounted to

48,000; recoveries totalled ₱12,000. Credit sales for the 1st and 2nd

quarters amounted to ₱4,000,000 and ₱8,000,000, respectively.

What is the net effect of the transactions listed above on profit loss before

tax in the first quarter interim financial statements?

57. What is the net effect of the transactions listed above on profit or

loss before tax in the second quarter interim financial statements?

Measurement of interim income tax expenses

58. AIR Co. expects to earn 400,000 pre-tax profit each quarter. AIR has tax

rates of 20% on the first 800,000 of annual earnings and 30% on all

additional earnings. Actual earnings match expectations. How much is the

weighted average annual income tax rate?

59. How much is the income tax expense recognized in the first quarter

interim financial statements?

60. How much is the income tax expense recognized in the third quarter

interim financial statements?

Income tax benefit

AIR Company expects to incur losses of ₱60,000 in each of the first and second

quarters of the year but expects to earn pre-tax profits of₱ 60,000 in each of

the last two quarters (thus having zero profit for the year). AIR estimated a

weighted average income tax rate of 30%. Actual earnings match expectations.

61. How much is the income tax expense recognized in the first quarter

interim financial statements?

62. How much is the income tax expense recognized in the third quarter

interim financial statements

Tax year and financial year do not coincide

AIR PAY Co.’s financial reporting year ends JUNE 30 and reports quarterly. Its

taxable year ends December 31. For the financial year that begins July 1, 20x1

and ends June 30,20x2, AIR earns ₱80,000 pre-tax profit each quarter. The

estimated average annual income tax rate is 30% in 20x1 and 40% in 20x2.

63. How much is the income tax expense recognized in the first quarter

interim financial statements?

64. How much is the income tax expense recognized in the third quarter

interim financial statements?

Net operating loss carry forward

AIR Co. reports quarterly and has a operating loss carry forward of ₱40,000

for income tax purposes at the start of the current financial year for which a

deferred tax asset has not been recognized. AIR earns ₱40,000 in the first

quarter of the current year and expects to earn ₱40,000 in each of three

Albert I. Rivera, CPA, MBA, CRA

9 of 10

CURRENT LIABILITIES_PROVISIONS_CASH TO ACCRUAL BASIS_CASH

FLOW_OPERATING SEGMENT_INTERIM REPORTING AIR-OCT2019

MODULE 3

remaining quarters. Excluding the carry forward, the estimated average annual

income tax rate is expected to be 40%.

65. How much is the income tax expense recognized in the first quarter

interim financial statements?

66. How much is the income tax expense recognized in the third quarter

interim financial statements?

Net operating loss carry forward

AIR Company reported a net operating loss carry forward of 80,000 in its most

recent annual financial statements. During the year, AIR earned 40,000 in each

of the first two quarters and ₱60,000 in each of the last two quarters.

Excluding the carry forward, the estimated average annual income tax rate is

40%.

67. How much is the income tax expense recognized in the first quarter

interim financial statements?

68. How much is the income tax expense recognized in the third quarter

interim financial statements?

Albert I. Rivera, CPA, MBA, CRA

10 of 10

You might also like

- Asian Development Bank Trust Funds Report 2020: Includes Global and Special FundsFrom EverandAsian Development Bank Trust Funds Report 2020: Includes Global and Special FundsNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Sa1 Reviewer PT.1Document8 pagesSa1 Reviewer PT.1Shenina ManaloNo ratings yet

- Q1Document6 pagesQ1Ray Pop0% (2)

- Current Liabilities: Redemption of Certificates Lapse of CertificatesDocument3 pagesCurrent Liabilities: Redemption of Certificates Lapse of CertificatesGrezel NiceNo ratings yet

- Quiz - Chapter 1 - Current Liabilities - 2021Document3 pagesQuiz - Chapter 1 - Current Liabilities - 2021Jennifer RelosoNo ratings yet

- Current Liabilities QuizDocument66 pagesCurrent Liabilities QuizURBANO CREATIONS PRINTING & GRAPHICS100% (1)

- Requirement: Determine The Financial Liabilities To Be Disclosed in The NotesDocument4 pagesRequirement: Determine The Financial Liabilities To Be Disclosed in The NotesInvisible CionNo ratings yet

- Midterm Exam - Ac-2Document7 pagesMidterm Exam - Ac-2Lyca ArcenaNo ratings yet

- Module-12 Far CL Provision El CLDocument4 pagesModule-12 Far CL Provision El CLJohn Frederick OroNo ratings yet

- Total LiablitiesDocument28 pagesTotal LiablitiesmarinNo ratings yet

- Answer Key - M1L2 PDFDocument4 pagesAnswer Key - M1L2 PDFEricka Mher IsletaNo ratings yet

- Chapter 1 None CompressDocument9 pagesChapter 1 None CompressiadcNo ratings yet

- Financial instrument derecognition and impairment exercisesDocument3 pagesFinancial instrument derecognition and impairment exercisesMinh TuệNo ratings yet

- REVIEWer Take Home QuizDocument3 pagesREVIEWer Take Home QuizNeirish fainsan0% (1)

- Quiz - Provisions Cont. Liab. Cont. AssetsDocument3 pagesQuiz - Provisions Cont. Liab. Cont. AssetsJhanelle Marquez60% (5)

- Midterm Exam MWF Released to StudentsDocument3 pagesMidterm Exam MWF Released to StudentsAliah AutenticoNo ratings yet

- Quiz - Cash and Cash Equivalents (3.3.22)Document5 pagesQuiz - Cash and Cash Equivalents (3.3.22)Nicole ValentinoNo ratings yet

- Financial Instruments CASE STUDIES FRDocument5 pagesFinancial Instruments CASE STUDIES FRDaniel AdegboyeNo ratings yet

- Test 2 FarDocument3 pagesTest 2 FarMa Jodelyn RosinNo ratings yet

- Ia 2 Compilation of Quiz and ExercisesDocument16 pagesIa 2 Compilation of Quiz and ExercisesclairedennprztananNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisChi ChiNo ratings yet

- CH7 - DiscussionDocument8 pagesCH7 - DiscussionRichell ArtuzNo ratings yet

- IA3 5copiesDocument6 pagesIA3 5copiesChloe CataluñaNo ratings yet

- At 31 May 20X7 RobertaDocument6 pagesAt 31 May 20X7 RobertaTrung Anh NguyenNo ratings yet

- 04_Handout_1(43)Document9 pages04_Handout_1(43)prettyboiy19No ratings yet

- EXERCISEsDocument18 pagesEXERCISEsJess SiazonNo ratings yet

- Year Sales Actual Warranty ExpendituresDocument5 pagesYear Sales Actual Warranty ExpendituresMinie KimNo ratings yet

- Sample IA QuestionDocument3 pagesSample IA QuestionElisa Ferrer RamosNo ratings yet

- Current Liabilities - Assignment - With Answers - For PostingDocument3 pagesCurrent Liabilities - Assignment - With Answers - For Postingemman neri50% (2)

- D. Discounted - YES Pledged - NODocument9 pagesD. Discounted - YES Pledged - NOJasper LuagueNo ratings yet

- Intermediate Accounting 2: Chapter 3: The Accounting Equation (FAR By: Millan)Document34 pagesIntermediate Accounting 2: Chapter 3: The Accounting Equation (FAR By: Millan)Patricia GalvezNo ratings yet

- Prelim Answer Key: Redemption of Certificates Lapse of CertificatesDocument8 pagesPrelim Answer Key: Redemption of Certificates Lapse of CertificatesNikky Bless LeonarNo ratings yet

- Liability Chap1 4Document5 pagesLiability Chap1 4prey kunNo ratings yet

- Current Liabilities StudentsDocument7 pagesCurrent Liabilities StudentsEmmanuelNo ratings yet

- Chapter 2 - Notes PayableDocument3 pagesChapter 2 - Notes PayableXiena40% (5)

- Activity1 MidtermsDocument3 pagesActivity1 Midtermslil mixNo ratings yet

- Notes Payable and Loans PayableDocument3 pagesNotes Payable and Loans PayableLovenia M. FerrerNo ratings yet

- Hand Out 1 Practice SetDocument6 pagesHand Out 1 Practice SetLayka ResorezNo ratings yet

- Quiz 4 Chapter 7 and 8Document5 pagesQuiz 4 Chapter 7 and 8June Antony Lim HechanovaNo ratings yet

- Intermediate Accounting 1 FinalDocument5 pagesIntermediate Accounting 1 FinalCix SorcheNo ratings yet

- Quiz 2 AuditingDocument18 pagesQuiz 2 Auditingaldrin elsisuraNo ratings yet

- Chapter 4 Bad DebtsDocument5 pagesChapter 4 Bad DebtsDeveender Kaur JudgeNo ratings yet

- Exercise LiabilitiesDocument2 pagesExercise LiabilitiesAlaine Milka GosycoNo ratings yet

- FAAC RequirementDocument1 pageFAAC RequirementJohanna HamdanNo ratings yet

- Notes and Loans Payable ExercisesDocument3 pagesNotes and Loans Payable ExercisesLovenia M. FerrerNo ratings yet

- AP RecDocument3 pagesAP RecDanica PastranaNo ratings yet

- Intermediate Accounting 1 QuizDocument4 pagesIntermediate Accounting 1 QuizGillian mae Garcia0% (2)

- Activity 1Document2 pagesActivity 1Harold Beltran DramayoNo ratings yet

- Assessment Current LiabilitiesDocument6 pagesAssessment Current LiabilitiesEdward Glenn BaguiNo ratings yet

- Final-exam-intermediateDocument24 pagesFinal-exam-intermediateIrene Grace Edralin AdenaNo ratings yet

- Current Liabilities ProblemsDocument6 pagesCurrent Liabilities ProblemsClaudette ClementeNo ratings yet

- Quiz Chapter+2 Notes+payable+-+Document2 pagesQuiz Chapter+2 Notes+payable+-+Rena Jocelle NalzaroNo ratings yet

- LiabilitiesDocument5 pagesLiabilitiesViky Rose EballeNo ratings yet

- Chapter 2: Current Liabilities, Provisions, and ContingenciesDocument14 pagesChapter 2: Current Liabilities, Provisions, and ContingenciesGirma NegashNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyFrom EverandCorporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaJustine CruzNo ratings yet

- HO RelevantCostingDocument3 pagesHO RelevantCostingJustine CruzNo ratings yet

- San Beda University: College of Arts and Sciences Department of AccountancyDocument2 pagesSan Beda University: College of Arts and Sciences Department of AccountancyJustine CruzNo ratings yet

- Department of Accountancy MANAGERIAL ACCOUNTING - General Concepts M. B. GuiaDocument3 pagesDepartment of Accountancy MANAGERIAL ACCOUNTING - General Concepts M. B. GuiaJustine CruzNo ratings yet

- CORPORATION LAW PRINCIPLESDocument20 pagesCORPORATION LAW PRINCIPLESStephanie Valentine100% (10)

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaJustine CruzNo ratings yet

- Negotiable Instruments Law - ReviewerDocument10 pagesNegotiable Instruments Law - ReviewerZaira Gem Gonzales100% (16)

- Law On Partnership ReviewerDocument13 pagesLaw On Partnership ReviewerJustine CruzNo ratings yet

- Cash Accounts Receivable and InventoryDocument5 pagesCash Accounts Receivable and InventoryJustine CruzNo ratings yet

- Cash Practical Auditing Solution ManualDocument24 pagesCash Practical Auditing Solution ManualCharlyneNo ratings yet

- Long Term Construction ContractsDocument4 pagesLong Term Construction ContractsJustine CruzNo ratings yet

- Cpa Review School of The Philippines ManilaDocument7 pagesCpa Review School of The Philippines Manilaxara mizpahNo ratings yet

- CPA REVIEW SCHOOL FINANCIAL ACCOUNTING TOPICSDocument6 pagesCPA REVIEW SCHOOL FINANCIAL ACCOUNTING TOPICSAljur SalamedaNo ratings yet

- CPA Review: Investment Property and Cash Surrender ValueDocument3 pagesCPA Review: Investment Property and Cash Surrender ValueAljur SalamedaNo ratings yet

- Chapter 9 - Shareholders' Equity ReviewDocument12 pagesChapter 9 - Shareholders' Equity ReviewLouie De La Torre50% (4)

- Empleo Chapter 6 Investments in Financial Instruments PDFDocument19 pagesEmpleo Chapter 6 Investments in Financial Instruments PDFRhenielou CristobalNo ratings yet

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- Cash and Cash Equivalents AccountingDocument2 pagesCash and Cash Equivalents AccountingJustine CruzNo ratings yet

- Chaper 1 - FS AuditDocument12 pagesChaper 1 - FS AuditLouie De La Torre60% (5)

- Chapter 5 - Inventories and Related ExpensesDocument13 pagesChapter 5 - Inventories and Related ExpensesiCayeeee100% (5)

- Chapter 2 - Correction of Errors PDFDocument12 pagesChapter 2 - Correction of Errors PDFRonald90% (10)

- Chapter 4 - Receivables and Related RevenuesDocument11 pagesChapter 4 - Receivables and Related RevenuesiCayeeee80% (5)

- ACC17-FAR Take Home Activities 1 and 2: Test IDocument19 pagesACC17-FAR Take Home Activities 1 and 2: Test IJustine Cruz67% (3)

- Is 40,000. Year Is 20,000 Year Is 5,000. Depreciation For The Year Is 3,000. Use of The Equipment Is Transferred To The Branch P10,000Document5 pagesIs 40,000. Year Is 20,000 Year Is 5,000. Depreciation For The Year Is 3,000. Use of The Equipment Is Transferred To The Branch P10,000Justine CruzNo ratings yet

- Take Home Activity 3Document6 pagesTake Home Activity 3Justine CruzNo ratings yet

- Measuring Goodwill/ Gain On Bargain Purchase: Practice Set No. 2Document5 pagesMeasuring Goodwill/ Gain On Bargain Purchase: Practice Set No. 2Justine CruzNo ratings yet

- THEDLesson 03 MORAL NORMSDocument37 pagesTHEDLesson 03 MORAL NORMSJustine Cruz100% (1)

- Our Country Is Going Through Its Most Profound Moral Crisis Since The Days of Martial LawDocument27 pagesOur Country Is Going Through Its Most Profound Moral Crisis Since The Days of Martial LawJustine CruzNo ratings yet

- THEDlesson02 1 The Nature of The GoodDocument17 pagesTHEDlesson02 1 The Nature of The GoodJustine CruzNo ratings yet

- College of Business & Accountancy Manila City 1 Sem SY 2021-22Document2 pagesCollege of Business & Accountancy Manila City 1 Sem SY 2021-22Shiela Mae Pon AnNo ratings yet

- Application of Accounting Software Main Module Nov 02 PDFDocument228 pagesApplication of Accounting Software Main Module Nov 02 PDFgizachewnani2011No ratings yet

- Managing Accounts Receivable & Inventory MCQsDocument20 pagesManaging Accounts Receivable & Inventory MCQsNorman DelirioNo ratings yet

- Practice Final Acct 1Document12 pagesPractice Final Acct 1hannahkellum08No ratings yet

- Short-Term Finance and PlanningDocument27 pagesShort-Term Finance and PlanningMiftahul Agusta100% (1)

- Jayshree Project ReportDocument86 pagesJayshree Project Reportmustkeem_qureshi7089No ratings yet

- Audit ReviewDocument9 pagesAudit ReviewephraimNo ratings yet

- Accounts Receivable ProblemsDocument9 pagesAccounts Receivable ProblemsNoemi GuevarraNo ratings yet

- Definition of 'Average Collection Period'Document6 pagesDefinition of 'Average Collection Period'krazymottoNo ratings yet

- Working Capital Management Lecture Notes CompressDocument10 pagesWorking Capital Management Lecture Notes CompressGwyneth TorrefloresNo ratings yet

- Prac One Final Pre BoardDocument7 pagesPrac One Final Pre BoardJose Stanley B. MendozaNo ratings yet

- Cashier V7.13 PDFDocument258 pagesCashier V7.13 PDFlearnlove13No ratings yet

- Virtual University Presents: Slide 1 / 69Document69 pagesVirtual University Presents: Slide 1 / 69mba departmentNo ratings yet

- 2011 Paper F3 QandA Sample Download v1Document25 pages2011 Paper F3 QandA Sample Download v1hoozhoon hoodhoodNo ratings yet

- Accounting Cycle of A Service Business-ExerciseDocument50 pagesAccounting Cycle of A Service Business-ExerciseHannah GarciaNo ratings yet

- Assignment # 4 26 CH 22Document6 pagesAssignment # 4 26 CH 22Ibrahim AbdallahNo ratings yet

- 6 Receivables ManagementDocument12 pages6 Receivables ManagementShreya BhagavatulaNo ratings yet

- Financial Accounting Fundamentals 6Th Edition Wild Test Bank Full Chapter PDFDocument67 pagesFinancial Accounting Fundamentals 6Th Edition Wild Test Bank Full Chapter PDFBriannaWashingtonpoyb100% (11)

- Decision Making Using Financial Ratios PDFDocument107 pagesDecision Making Using Financial Ratios PDFOmkar Reddy Punuru100% (3)

- Adv Acc Sol Manual 2008Document190 pagesAdv Acc Sol Manual 2008Khey Soniga RollanNo ratings yet

- Network performance metrics by site and vendorDocument1,731 pagesNetwork performance metrics by site and vendorUmar MiskiNo ratings yet

- Pre-Need Manual of Examination - CL2018 - 01Document53 pagesPre-Need Manual of Examination - CL2018 - 01Ipe ClosaNo ratings yet

- Name: Date: Score: CASH BUDGET (25 Points) : 11 Task Performance 1Document2 pagesName: Date: Score: CASH BUDGET (25 Points) : 11 Task Performance 1DianeNo ratings yet

- Problem 3&5Document17 pagesProblem 3&5panda 1No ratings yet

- Chap 4Document7 pagesChap 4Christine Joy OriginalNo ratings yet

- DBF QuestionsDocument8 pagesDBF QuestionsRam KumarNo ratings yet

- Chapter 02 - Basic Financial StatementsDocument111 pagesChapter 02 - Basic Financial Statementsyujia ZhaiNo ratings yet

- CH 5Document58 pagesCH 5marwan2004acctNo ratings yet

- Section - B - Group 14 - RMSDocument18 pagesSection - B - Group 14 - RMSHardikBansalNo ratings yet

- Preparation of Single Entity Financial Statements - Part 1Document18 pagesPreparation of Single Entity Financial Statements - Part 1Vasileios LymperopoulosNo ratings yet