Professional Documents

Culture Documents

FAAC Requirement

Uploaded by

Johanna HamdanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAAC Requirement

Uploaded by

Johanna HamdanCopyright:

Available Formats

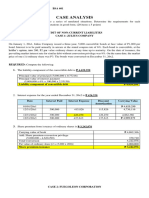

CASE 1

On January 1, 20x1 , ABC Co. acquired 8%, P1,000,000 bonds. The principal is due on December 31, 20x5

but interest is due annually starting December 31, 20x1. The effective interest rate is 12%. The bonds

are classified investment measured at amortized cost.

Required : Journalize the entries related to the purchase and amortization of the bond

CASE 2

On January 1, 20x1 , ABC Co. acquired 12%, P1,000,000 bonds. The principal is due on December 31,

20x5 but interest is due annually starting December 31, 20x1. The effective interest rate is 8%. The

bonds are classified investment measured at amortized cost.

Required : Journalize the entries related to the purchase and amortization of the bond

CASE 3

On January 1 , 20x1 , ABC Co. acquired 12% , P1,000,000 bonds . The bonds were classified as

investment measured at amortized cost. Principal on those bonds mature as follows

December 31, 20x1 200,000

December 31, 20x2 200,000

December 31, 20x3 200,000

December 31, 20x4 200,000

December 31, 20x5 200,000

The interest is due annually at year-end. The effective interest rate on the bonds is 8%

Required : Journalize the entries related to the purchase and amortization of the bond

CASE 4

On January 1 , 20x1 , ABC Co. acquired 8% , P1,500,000 bonds . The bonds were classified as investment

measured at amortized cost. Principal on those bonds mature as follows

December 31, 20x1 100,000

December 31, 20x2 200,000

December 31, 20x3 300,000

December 31, 20x4 400,000

December 31, 20x5 500,000

The interest is due annually at year-end. The effective interest rate on the bonds is 12%

Required : Journalize the entries related to the purchase and amortization of the bond

You might also like

- Intermediate Accounting 1 FinalDocument5 pagesIntermediate Accounting 1 FinalCix SorcheNo ratings yet

- Notes Payable and Bonds Payable - Quiz - With Answers - For PostingDocument8 pagesNotes Payable and Bonds Payable - Quiz - With Answers - For PostingWinny PoeNo ratings yet

- p1 24 Bonds PayableDocument5 pagesp1 24 Bonds PayablePrincess MangudadatuNo ratings yet

- Handout No. 3 Accrev San BedaDocument10 pagesHandout No. 3 Accrev San BedaJustine CruzNo ratings yet

- Activity 1Document2 pagesActivity 1Harold Beltran DramayoNo ratings yet

- Chapter 2 - Notes PayableDocument3 pagesChapter 2 - Notes PayableXiena40% (5)

- Accounting - NotesDocument2 pagesAccounting - NotesRica CamonNo ratings yet

- Midterm Exam - Ac-2Document7 pagesMidterm Exam - Ac-2Lyca ArcenaNo ratings yet

- Accounting For Business Combinations Final Term ExaminationDocument3 pagesAccounting For Business Combinations Final Term ExaminationJasper LuagueNo ratings yet

- REVIEWERDocument13 pagesREVIEWERCamille BagueNo ratings yet

- Quiz On InvestmentDocument3 pagesQuiz On InvestmentDan Andrei BongoNo ratings yet

- Quiz - Chapter 32 - She Part 1 PrintingDocument3 pagesQuiz - Chapter 32 - She Part 1 PrintingAllen Kate50% (2)

- Financial Instruments CASE STUDIES FRDocument5 pagesFinancial Instruments CASE STUDIES FRDaniel AdegboyeNo ratings yet

- Midterm Exam MWF Released To StudentsDocument3 pagesMidterm Exam MWF Released To StudentsAliah AutenticoNo ratings yet

- Sa1 Reviewer PT.1Document8 pagesSa1 Reviewer PT.1Shenina ManaloNo ratings yet

- Long Quiz in Intermediate Accounting 1 PART 1aDocument4 pagesLong Quiz in Intermediate Accounting 1 PART 1aGillian mae Garcia0% (2)

- Quiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Document2 pagesQuiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Martin ManuelNo ratings yet

- Intermediate Acctg Quiz 1Document4 pagesIntermediate Acctg Quiz 1Frenzy PopperNo ratings yet

- REVIEWer Take Home QuizDocument3 pagesREVIEWer Take Home QuizNeirish fainsan0% (1)

- ReceivablesDocument4 pagesReceivablesKentaro Panergo NumasawaNo ratings yet

- 04 Handout 1Document9 pages04 Handout 1prettyboiy19No ratings yet

- Assignment 03 Investments in Debt SecuritiesDocument4 pagesAssignment 03 Investments in Debt SecuritiesJella Mae YcalinaNo ratings yet

- Financial Instruments: Class 6Document6 pagesFinancial Instruments: Class 6KristenNo ratings yet

- Quiz Chapter+3 Bonds+Payable+&+Other+ConceptsDocument5 pagesQuiz Chapter+3 Bonds+Payable+&+Other+ConceptsRena Jocelle NalzaroNo ratings yet

- Final Exam IntermediateDocument24 pagesFinal Exam IntermediateIrene Grace Edralin AdenaNo ratings yet

- Intermediate Accounting 2 (Notes Payable) - Problem 6Document2 pagesIntermediate Accounting 2 (Notes Payable) - Problem 6DM MontefalcoNo ratings yet

- Chapter 6-Receivables 2Document4 pagesChapter 6-Receivables 2Emma Mariz Garcia100% (7)

- Aec 22 - Notes ReceivableDocument3 pagesAec 22 - Notes ReceivableIrish Jane Patricio AcumanNo ratings yet

- Takehome Assessment No. 4Document9 pagesTakehome Assessment No. 4Raezel Carla Santos Fontanilla0% (4)

- FR ACCA Test FullDocument16 pagesFR ACCA Test Fullduducchi2308No ratings yet

- Current Liabilities - Assignment - With Answers - For PostingDocument3 pagesCurrent Liabilities - Assignment - With Answers - For Postingemman neri50% (2)

- Current Liabilities: Redemption of Certificates Lapse of CertificatesDocument3 pagesCurrent Liabilities: Redemption of Certificates Lapse of CertificatesGrezel NiceNo ratings yet

- Quiz - Chapter 1 - Current Liabilities - 2021Document3 pagesQuiz - Chapter 1 - Current Liabilities - 2021Jennifer RelosoNo ratings yet

- Final Exam - Intermediate Accounting 2Document11 pagesFinal Exam - Intermediate Accounting 2Patricia EsplagoNo ratings yet

- Shareholders' Equity (Part 1) : Share Premium Retained EarningsDocument3 pagesShareholders' Equity (Part 1) : Share Premium Retained EarningsJamie Rose Aragones0% (3)

- Investment Test BankDocument9 pagesInvestment Test BankSherri BonquinNo ratings yet

- IA3 5copiesDocument6 pagesIA3 5copiesChloe CataluñaNo ratings yet

- Practice Problems CH 12Document3 pagesPractice Problems CH 12Samira PereziqNo ratings yet

- Q1Document6 pagesQ1Ray Pop0% (2)

- CH7 - DiscussionDocument8 pagesCH7 - DiscussionRichell ArtuzNo ratings yet

- Investments (Part 1) : Multiple Choice - Computational Financial AssetsDocument20 pagesInvestments (Part 1) : Multiple Choice - Computational Financial AssetsCristina ElizaldeNo ratings yet

- Reviewer For Mid Term ExamDocument12 pagesReviewer For Mid Term ExamJannelle SalacNo ratings yet

- Quiz Chapter+2 Notes+payable+-+Document2 pagesQuiz Chapter+2 Notes+payable+-+Rena Jocelle NalzaroNo ratings yet

- Fadm / Group Case Study/ Joyo IncDocument3 pagesFadm / Group Case Study/ Joyo IncS GuptaNo ratings yet

- Total LiablitiesDocument28 pagesTotal LiablitiesmarinNo ratings yet

- Auditing Problem Final Exam With Answer Only, No SolutionDocument23 pagesAuditing Problem Final Exam With Answer Only, No SolutionRheu Reyes100% (1)

- ACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019Document11 pagesACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019nothingNo ratings yet

- Quiz Chapter 5 Notes Receivable PDFDocument8 pagesQuiz Chapter 5 Notes Receivable PDFShantal kate LimNo ratings yet

- Notes PayableDocument10 pagesNotes PayableMia Casas100% (5)

- Quiz 1 in Ia3Document6 pagesQuiz 1 in Ia3Dorothy NadelaNo ratings yet

- Notes Receivable - Ia 1Document4 pagesNotes Receivable - Ia 1Aldrin CabangbangNo ratings yet

- Activity Chapter 5: Effect On December 31, 20X1: Using Straight Line MethodDocument2 pagesActivity Chapter 5: Effect On December 31, 20X1: Using Straight Line MethodRandelle James FiestaNo ratings yet

- Abbie Merry VecinaBSA 6011Document7 pagesAbbie Merry VecinaBSA 6011elleeeewoodssssNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Asian Development Bank Trust Funds Report 2020: Includes Global and Special FundsFrom EverandAsian Development Bank Trust Funds Report 2020: Includes Global and Special FundsNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet