Professional Documents

Culture Documents

W2 & Earnings: Emma Mims

Uploaded by

Isaiah MimsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

W2 & Earnings: Emma Mims

Uploaded by

Isaiah MimsCopyright:

Available Formats

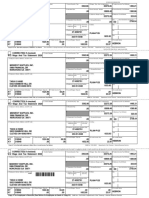

2018

a Employee's social security number

OMB No. 1545-0008

2018

W2 & EARNINGS 359-62-0010

c Employer's name, address, and ZIP code 1 Wages,tips,other compensation 2 Federal income tax

SUMMARY DOMINICAN UNIVERSITY 38922.43 1102.62

3 Social security wages 4 Social security tax

7900 W DIVISION 2493.81

40222.43

RIVER FOREST, IL 60305

Wage and Tax Statement

5 Medicare wages and tips 6 Medicare tax withheld

Copy B to be filed with Employee's Federal Income Tax Return.

b Employer's identification number d Control Number

40222.43 583.24

Federal Filing Copy

DOMINICAN UNIVERSITY

7 Social security tips 8 Allocated tips

7900 W DIVISION 36-2167855 78481-558524

e Employee's name and address 9 Verification code 10 Dependent care benefits

RIVER FOREST, IL 60305

e021-655d-26ad-dffc

EMMA MIMS 11 Nonqualified plans 12 See instrs. for box 12

4421 W. ADAMS C 25.22

CHICAGO, IL 60624 13 Stat emp. Ret. Plan 3 Party Sick

E 1300.00

X

14 Other BB 390.00

EMMA MIMS DD 22144.68

W2

15 State & Employer's state ID 16 State wages,tips,etc 17 State income tax 18 Local wages,tips,etc. 19 Local income tax 20 Locality name

Filing Status Exemptions IL 3621678550000 38922.43 1517.34

FITWH M 4

IL M 4

a Employee's social security number

OMB No. 1545-0008

2018

OTHER 359-62-0010

c Employer's name, address, and ZIP code 1 Wages,tips,other compensation 2 Federal income tax

Description Amount Box

DOMINICAN UNIVERSITY 38922.43 1102.62

GTLN401K 25.22 12 7900 W DIVISION 3 Social security wages 4 Social security tax

40222.43 2493.81

403B 1300.00 12 RIVER FOREST, IL 60305

Wage and Tax Statement

5 Medicare wages and tips 6 Medicare tax withheld

b Employer's identification number d Control Number

WAGES 40222.43 583.24

Copy 2 to be filed with Employee's State Income Tax Return.

State Filing Copy

7 Social security tips 8 Allocated tips

36-2167855 78481-558524

e Employee's name and address 9 Verification code 10 Dependent care benefits

EMMA MIMS

11 Nonqualified plans 12 See instrs. for box 12

4421 W. ADAMS C 25.22

CHICAGO, IL 60624 13 Stat emp. Ret. Plan 3 Party Sick

X E 1300.00

14 Other BB 390.00

DD 22144.68

W2

15 State & Employer's state ID 16 State wages,tips,etc 17 State income tax 18 Local wages,tips,etc. 19 Local income tax 20 Locality name

TOTAL GROSS WAGES 44169.59 IL 3621678550000 38922.43 1517.34

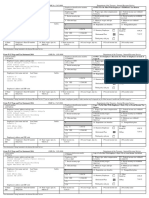

Description Amount Box

Soc. Security Wages 40222.43 3

Medicare Wages 40222.43 5

a Employee's social security number

OMB No. 1545-0008

2018

Fed. Taxable Wages 38922.43 1 359-62-0010

c Employer's name, address, and ZIP code 1 Wages,tips,other compensation 2 Federal income tax

IL Taxable Wages 38922.43 16

DOMINICAN UNIVERSITY 38922.43 1102.62

WITHHOLDINGS 3 Social security wages 4 Social security tax

7900 W DIVISION

Description Amount Box 40222.43 2493.81

RIVER FOREST, IL 60305

Wage and Tax Statement

City or Local Filing Copy

5 Medicare wages and tips 6 Medicare tax withheld

Fed. Income Tax 1102.62 2 b Employer's identification number d Control Number

40222.43 583.24

7 Social security tips 8 Allocated tips

Soc. Security Tax 2493.81 4 36-2167855 78481-558524

Copy 2 for Employee's City/Local Income Tax Return.

Medicare Tax 583.24 6 e Employee's name and address 9 Verification code 10 Dependent care benefits

IL Income Tax 1517.34 17 EMMA MIMS

11 Nonqualified plans 12 See instrs. for box 12

DEDUCTIONS 4421 W. ADAMS C 25.22

Description Amount Box CHICAGO, IL 60624 13 Stat emp. Ret. Plan 3 Party Sick

X E 1300.00

403(b) Annuity 1300.00 12 14 Other BB 390.00

Roth 403B Plan 390.00 12 DD 22144.68

Health ER Premium 18528.12 12

W2

Health 125 Deduction 3616.56 12

15 State & Employer's state ID 16 State wages,tips,etc 17 State income tax 18 Local wages,tips,etc. 19 Local income tax 20 Locality name

Section 125 Benefit Plan 3947.16 IL 3621678550000 38922.43 1517.34

a Employee's social security number

OMB No. 1545-0008

2018

359-62-0010

c Employer's name, address, and ZIP code 1 Wages,tips,other compensation 2 Federal income tax

DOMINICAN UNIVERSITY 38922.43 1102.62

3 Social security wages 4 Social security tax

7900 W DIVISION

40222.43 2493.81

Employee Reference Copy

RIVER FOREST, IL 60305

Wage and Tax Statement

5 Medicare wages and tips 6 Medicare tax withheld

b Employer's identification number d Control Number

40222.43 583.24

7 Social security tips 8 Allocated tips

36-2167855 78481-558524

e Employee's name and address 9 Verification code 10 Dependent care benefits

EMMA MIMS e021-655d-26ad-dffc

11 Nonqualified plans 12 See instrs. for box 12

4421 W. ADAMS C 25.22

CHICAGO, IL 60624 13 Stat emp. Ret. Plan 3 Party Sick

E 1300.00

Copy C for Employee's records.

X

14 Other BB 390.00

DD 22144.68

W2

15 State & Employer's state ID 16 State wages,tips,etc 17 State income tax 18 Local wages,tips,etc. 19 Local income tax 20 Locality name

IL 3621678550000 38922.43 1517.34

You might also like

- IRM Sect 21.7.13Document218 pagesIRM Sect 21.7.13joelvw100% (9)

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- Benjamin Stark - Completing A 1040 Form Activity - 5258486Document3 pagesBenjamin Stark - Completing A 1040 Form Activity - 5258486api-444969952100% (1)

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- TGDocument2 pagesTGpr995No ratings yet

- Form 1040Document2 pagesForm 1040Jessi100% (6)

- Anderson, Elle 2019 Federal Tax ReturnDocument13 pagesAnderson, Elle 2019 Federal Tax ReturnElle Anderson100% (2)

- 2020 - PmaDocument2 pages2020 - Pmalaniya rossNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- W2 & Earnings: Vanessa Sapien GonzalezDocument4 pagesW2 & Earnings: Vanessa Sapien GonzalezVANESSA SAPIEN GONZALEZNo ratings yet

- Shell Case Study PDFDocument2 pagesShell Case Study PDFNobody100% (1)

- Magnum Management Corp One Cedar Point DR Sandusky Oh 44870Document7 pagesMagnum Management Corp One Cedar Point DR Sandusky Oh 44870Hermes Andrés LugmañaNo ratings yet

- 05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDocument3 pages05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDonna WoodallNo ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- W2 Preview titleDocument1 pageW2 Preview titlemrs merle westonNo ratings yet

- 2021 W-2 Earnings SummaryDocument2 pages2021 W-2 Earnings Summaryrachel sanchezNo ratings yet

- 0LH47 0LH47 0429 20180101 W2Report W2Report 001Document2 pages0LH47 0LH47 0429 20180101 W2Report W2Report 001charly4877No ratings yet

- 0LH47 0LH47 0429 20180101 1095report 001Document1 page0LH47 0LH47 0429 20180101 1095report 001charly4877No ratings yet

- A082000109a0298508172c001c: Contact InformationDocument1 pageA082000109a0298508172c001c: Contact InformationYudo KunaNo ratings yet

- Notice to Employee Tax and Wage InformationDocument1 pageNotice to Employee Tax and Wage InformationsageNo ratings yet

- IBR FormDocument3 pagesIBR FormBlayne MozisekNo ratings yet

- Please To Do Not Use The Back ButtonDocument2 pagesPlease To Do Not Use The Back ButtonDavid MillerNo ratings yet

- Important Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Document1 pageImportant Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Victor ErazoNo ratings yet

- Driver Record Screening Disclosure: Authorization For Release of Information For Employment ScreeningDocument1 pageDriver Record Screening Disclosure: Authorization For Release of Information For Employment ScreeningMucho FacerapeNo ratings yet

- Claimant/Job Seeker: Jimmy Burt Claimant ID Number: 0001729376 245 Brown RD Lake Charles, LA 70611-5312Document1 pageClaimant/Job Seeker: Jimmy Burt Claimant ID Number: 0001729376 245 Brown RD Lake Charles, LA 70611-5312Jimmy BurtNo ratings yet

- Wage and Tax Statement: Employee's Social Security NumberDocument6 pagesWage and Tax Statement: Employee's Social Security NumberErma MonieNo ratings yet

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNo ratings yet

- MyComputerCareercom at Raleigh LLC-Aretha J BosireDocument1 pageMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- Semir Demiri 50 14Th ST North Edgartown Ma 02539Document2 pagesSemir Demiri 50 14Th ST North Edgartown Ma 02539SemirNo ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocument7 pages2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNo ratings yet

- Johnnys w4 PDFDocument2 pagesJohnnys w4 PDFAnthony OrozcooNo ratings yet

- 2019 California Tax Return RefundDocument18 pages2019 California Tax Return RefundPolo PoloNo ratings yet

- Unemployment compensation and state tax infoDocument1 pageUnemployment compensation and state tax infoJackson kaylaNo ratings yet

- Reset Password Request FormDocument1 pageReset Password Request Formblon majorsNo ratings yet

- Form W-4 (2018) : Specific InstructionsDocument4 pagesForm W-4 (2018) : Specific InstructionsRony MartinezNo ratings yet

- Base Builder - New Hire PaperworkDocument10 pagesBase Builder - New Hire Paperworkelhard shalloNo ratings yet

- Application 1Document2 pagesApplication 1api-379634245No ratings yet

- Instructions For Recipient: Statement FOR Recipients OF Unemployment InsuranceDocument13 pagesInstructions For Recipient: Statement FOR Recipients OF Unemployment InsuranceChristian RiveraNo ratings yet

- Loan AppDocument9 pagesLoan Appanon-209253No ratings yet

- 0ZB43 0ZB44 1837 20200101 W2Report W2Report 001Document2 pages0ZB43 0ZB44 1837 20200101 W2Report W2Report 001Ian CabanillasNo ratings yet

- Planilla Federal Keyla 2021Document2 pagesPlanilla Federal Keyla 2021Keyla VelezNo ratings yet

- Certain Government Payments: Copy B For RecipientDocument2 pagesCertain Government Payments: Copy B For RecipientDylan Bizier-Conley100% (1)

- 398 2019 ArchiveTaxReturnDocument10 pages398 2019 ArchiveTaxReturnjimmy naranjoNo ratings yet

- Employment ApplicationDocument3 pagesEmployment ApplicationColby KeatingNo ratings yet

- Julian Saud 1095a 2022Document8 pagesJulian Saud 1095a 2022Neyda LarroqueNo ratings yet

- ACCESS Florida: Benefits InformationDocument14 pagesACCESS Florida: Benefits InformationAnonymous 6rGFYgvNo ratings yet

- Green Ghost Tacos Employement ApplicationDocument3 pagesGreen Ghost Tacos Employement ApplicationRaymond Rios Jr.No ratings yet

- Pyw219s Ee PDFDocument1 pagePyw219s Ee PDFBeyonceNo ratings yet

- Duplicate: Certain Government PaymentsDocument2 pagesDuplicate: Certain Government PaymentsPrincewill OdenigboNo ratings yet

- Square 2022 W-2Document2 pagesSquare 2022 W-2Zane CardinalNo ratings yet

- File your 1040 tax return onlineDocument2 pagesFile your 1040 tax return onlineSammi Bowe100% (1)

- TF 02803374Document3 pagesTF 02803374api-407743290No ratings yet

- U.S. Individual Income Tax Return: See Separate InstructionsDocument4 pagesU.S. Individual Income Tax Return: See Separate InstructionsNewsTeam20100% (1)

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationYut ChiaNo ratings yet

- P010 636211442428322820 T14385011dupD1 PDFDocument1 pageP010 636211442428322820 T14385011dupD1 PDFAnonymous pY5EUXUpaNo ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument10 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramPratham TiwariNo ratings yet

- Employment Application 2Document3 pagesEmployment Application 2api-311207039No ratings yet

- USCIS Form I-9: Employment Eligibility VerificationDocument2 pagesUSCIS Form I-9: Employment Eligibility VerificationL vallejo15No ratings yet

- P.O. Box 9046, Olympia, WA 98507 unemployment benefits and tax documentsDocument2 pagesP.O. Box 9046, Olympia, WA 98507 unemployment benefits and tax documentsJoshua PrimacioNo ratings yet

- M. Giraldo PDFDocument3 pagesM. Giraldo PDFMayken GiraldoNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- W21225760934 0 PDFDocument2 pagesW21225760934 0 PDFAnonymous czHLQeLPB4No ratings yet

- XXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084Document6 pagesXXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084CR FNo ratings yet

- IRS Pub 15 - 1988Document56 pagesIRS Pub 15 - 1988cluetusNo ratings yet

- Wage and Tax Statement Wage and Tax StatementDocument1 pageWage and Tax Statement Wage and Tax StatementFabiola UrgilésNo ratings yet

- Form 1040Document2 pagesForm 1040karthu48No ratings yet

- Lance Dean 2013 Tax Return - T13 - For - RecordsDocument57 pagesLance Dean 2013 Tax Return - T13 - For - Recordsjessica50% (4)

- Form 1040A Tax Credit DetailsDocument3 pagesForm 1040A Tax Credit DetailsYosbanyNo ratings yet

- Act ch10 l04 EnglishDocument7 pagesAct ch10 l04 EnglishLinds Rivera100% (1)

- IRS Publication 15 Withholding Tax Tables 2010Document73 pagesIRS Publication 15 Withholding Tax Tables 2010Wayne Schulz100% (1)

- Summary of W-2 Statements: Warning: Please Use A Different PDF ViewerDocument2 pagesSummary of W-2 Statements: Warning: Please Use A Different PDF ViewermattNo ratings yet

- 7 Social security tipsDocument1 page7 Social security tipsmichelle analieNo ratings yet

- 0ZQ73 0ZQ73 2075 20220101 W2Report W2Report 001Document2 pages0ZQ73 0ZQ73 2075 20220101 W2Report W2Report 001ligia vazquezNo ratings yet

- UnknownDocument4 pagesUnknownnayla marie santiago cuadradoNo ratings yet

- F 843Document1 pageF 843Manjula.bsNo ratings yet

- 25 Appx II 25esstDocument14 pages25 Appx II 25esstLauren D DanielleNo ratings yet

- Swift V SchaltenbrandDocument64 pagesSwift V SchaltenbrandpropertyintangibleNo ratings yet

- Supreme Court of Florida - The Case of Brayshaw's vs. Agency of Workforce InnovationDocument15 pagesSupreme Court of Florida - The Case of Brayshaw's vs. Agency of Workforce InnovationtallahasseeexposedNo ratings yet

- AdjustmentsDocument78 pagesAdjustmentsKpGadaNo ratings yet

- US Internal Revenue Service: I1040Document153 pagesUS Internal Revenue Service: I1040IRS100% (7)

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returnapi-268415505No ratings yet

- IT Recruiter Training: Mamsys Consulting Services LTDDocument49 pagesIT Recruiter Training: Mamsys Consulting Services LTDsrk4u88No ratings yet

- IRS Criminal Investigation Annual ReportDocument28 pagesIRS Criminal Investigation Annual ReportJames CampbellNo ratings yet

- Construction AccountingDocument12 pagesConstruction AccountingtezgajNo ratings yet

- No Match IRS Procedures For Incorrect SSNsDocument6 pagesNo Match IRS Procedures For Incorrect SSNslg900df5063No ratings yet