Professional Documents

Culture Documents

Johnnys w4 PDF

Uploaded by

Anthony OrozcooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Johnnys w4 PDF

Uploaded by

Anthony OrozcooCopyright:

Available Formats

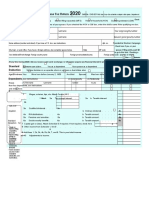

OMB No. 1545-0008 REISSUED STATEMENT OMB No.

1545-0008 REISSUED STATEMENT

d Control Number 1 Wages, tips, other compensation 2 Federal income tax withheld d Control Number 1 Wages, tips, other compensation 2 Federal income tax withheld

6086.94 292.10 6086.94 292.10

b Employer identification number (EIN) 3 Social security wages 4 Social security tax withheld b Employer identification number (EIN) 3 Social security wages 4 Social security tax withheld

93-0994537 6086.94 377.39 93-0994537 6086.94 377.39

a Employee’s social security number 5 Medicare wages and tips 6 Medicare tax withheld a Employee’s social security number 5 Medicare wages and tips 6 Medicare tax withheld

624-42-0553 6086.94 88.26 624-42-0553 6086.94 88.26

c Employer’s name, address and ZIP code c Employer’s name, address and ZIP code

KOOSHAREM, LLC AS AGENT FOR KOOSHAREM, LLC AS AGENT FOR

3820 STATE STREET 3820 STATE STREET

REAL TIME STAFFING SERVICES REAL TIME STAFFING SERVICES

SANTA BARBARA CA 93105 SANTA BARBARA CA 93105

7 Social security tips 8 Allocated tips 9 7 Social security tips 8 Allocated tips 9

10 Dependent care benefits 11 Nonqualified plans 12a 10 Dependent care benefits 11 Nonqualified plans 12a

Code

Code

12b 12c 12d 12b 12c 12d

Code

Code

Code

Code

Code

Code

13 Statutory Retirement Third-party 14 Other 13 Statutory Retirement Third-party 14 Other

employee plan sick pay employee plan sick pay

CASDI 60.87 CASDI 60.87

e Employee’s name, address and ZIP code e Employee’s name, address and ZIP code

JONATHAN A LUGO JONATHAN A LUGO

APT P APT P

14354 AMAR RD 14354 AMAR RD

LA PUENTE CA 91744 LA PUENTE CA 91744

2014 2014

15 State Employer’s state I.D. no. 16 State wages, tips, etc. 15 State Employer’s state I.D. no. 16 State wages, tips, etc.

CA 45664323 6086.94 CA 45664323 6086.94

W-2 W-2

Form

Form

Wage and Tax Statement 17 State income tax 18 Local wages, tips, etc. Wage and Tax Statement 17 State income tax 18 Local wages, tips, etc.

Copy C For EMPLOYEE’S 34.91 Copy B To Be Filed With 34.91

RECORDS (See Notice to Employee’s FEDERAL Tax

Employee on back of Copy B.) Return.

This information is being furnished to the This information is being furnished to the

Internal Revenue Service. If you are required 19 Local income tax 20 Locality name Internal Revenue Service. 19 Local income tax 20 Locality name

to file a tax return, a negligence penalty or

other sanction may be imposed on you if this

income is taxable and you fail to report it.

Department of the Treasury – Department of the Treasury –

Internal Revenue Service Internal Revenue Service

OMB No. 1545-0008 REISSUED STATEMENT OMB No. 1545-0008 REISSUED STATEMENT

d Control Number 1 Wages, tips, other compensation 2 Federal income tax withheld d Control Number 1 Wages, tips, other compensation 2 Federal income tax withheld

6086.94 292.10 6086.94 292.10

b Employer identification number (EIN) 3 Social security wages 4 Social security tax withheld b Employer identification number (EIN) 3 Social security wages 4 Social security tax withheld

93-0994537 6086.94 377.39 93-0994537 6086.94 377.39

a Employee’s social security number 5 Medicare wages and tips 6 Medicare tax withheld a Employee’s social security number 5 Medicare wages and tips 6 Medicare tax withheld

624-42-0553 6086.94 88.26 624-42-0553 6086.94 88.26

c Employer’s name, address and ZIP code c Employer’s name, address and ZIP code

KOOSHAREM, LLC AS AGENT FOR KOOSHAREM, LLC AS AGENT FOR

3820 STATE STREET 3820 STATE STREET

REAL TIME STAFFING SERVICES REAL TIME STAFFING SERVICES

SANTA BARBARA CA 93105 SANTA BARBARA CA 93105

7 Social security tips 8 Allocated tips 9 7 Social security tips 8 Allocated tips 9

10 Dependent care benefits 11 Nonqualified plans 12a 10 Dependent care benefits 11 Nonqualified plans 12a

Code

Code

12b 12c 12d 12b 12c 12d

Code

Code

Code

Code

Code

Code

13 Statutory Retirement Third-party 14 Other 13 Statutory Retirement Third-party 14 Other

employee plan sick pay employee plan sick pay

CASDI 60.87 CASDI 60.87

e Employee’s name, address and ZIP code e Employee’s name, address and ZIP code

JONATHAN A LUGO JONATHAN A LUGO

APT P APT P

14354 AMAR RD 14354 AMAR RD

LA PUENTE CA 91744 LA PUENTE CA 91744

2014 2014

15 State Employer’s state I.D. no. 16 State wages, tips, etc. 15 State Employer’s state I.D. no. 16 State wages, tips, etc.

CA 45664323 6086.94 CA 45664323 6086.94

Form

W-2

Form

W-2

Wage and Tax Statement 17 State income tax 18 Local wages, tips, etc. Wage and Tax Statement 17 State income tax 18 Local wages, tips, etc.

Copy 2 To Be Filed With 34.91 Copy 2 To Be Filed With 34.91

Employee’s State, City, or Employee’s State, City, or

Local Income Tax Return. Local Income Tax Return.

19 Local income tax 20 Locality name 19 Local income tax 20 Locality name

Department of the Treasury – Department of the Treasury –

Internal Revenue Service Internal Revenue Service

Notice to Employee Instructions for Employee Instructions for Employee (Continued) term life insurance over $50,000 (former employees

Do you have to file? Refer to the form 1040 Box 1. Enter this amount on the wages line of your tax (Continued from the back of copy B.) only). See “Other Taxes” in the Form 1040 instructions.

Instructions to determine if you are required to file a return. Elective deferrals (codes D, E, F, and S) and P-Excludable moving expense reimbursements paid

tax return. Even if you do not have to file a tax return, Box 2. Enter this amount on the federal income tax designated Roth contributions (codes AA, BB, and EE) directly to employee (not included in boxes 1, 3, or 5)

you may be eligible for a refund if box 2 shows an withheld line of your tax return. under all plans are generally limited to a total of Q-Nontaxable combat pay. See the instructions for

amount or if you are eligible for any credit. Earned Box 5. You may be required to report this amount on $17,500 ($12,000 if you only have SIMPLE plans; Form 1040 or Form 1040A for details on reporting this

income credit (EIC). You may be able to take the $20,500 for section 403(b) plans if you qualify for the amount. R-Employer contributions to your Archer MSA.

Form 8959, Additional Medicare Tax. See Form 1040

15-year rule explained in Pub. 571). Deferrals under Report on form 8853, Archer MSAs and Long-Term

EIC for 2014 if your adjusted gross income (AGI) is instructions to determine if you are required to

code G are limited to $17,500. Deferrals under code H Care Insurance Contracts. S-Employee salary

less than a certain amount. The amount of the credit complete Form 8959.

are limited to $7,000. However, if you were at least age reduction contributions under a section 408(p) SIMPLE

is based on income and family size. Workers without Box 6. This amount includes the 1.45% Medicare Tax

50 in 2014, your employer may have allowed an (not included in box 1) T-Adoption benefits (not

children could qualify for a smaller credit. You and withheld on all Medicare wages and tips shown in Box

additional deferral of up to $5,500 ($2,500 for section included in box 1). Complete Form 8839, Qualified

any qualifying children must have valid social security 5, as well as the 0.9% Additional Medicare Tax on any Adoption Expenses, to compute any taxable and

numbers (SSNs). You cannot take the EIC if your of those Medicare wages and tips above $200,000. 401(k)(11) and 408(p) SIMPLE plans). This additional

deferral amount is not subject to the overall limit on nontaxable amounts. V-Income from exercise of

investment income is more than the specified amount Box 8. This amount is not included in boxes 1, 3, 5, or nonstatutory stock option(s) (included in boxes 1, 3 (up

for 2014 or if income is earned for services provided 7. For information on how to report tips on your tax elective deferrals. For code G, the limit on elective

deferrals may be higher for the last 3 years before you to social security wage base), and 5) See Pub. 525

while you were an inmate at a penal institution. For return, see your Form 1040 instructions. You must and instructions for Schedule D (Form 1040) for

2014 income limits and more information, visit file Form 4137, Social Security and Medicare Tax on reach retirement age. Contact your plan administrator

for more information. Amounts in excess of the overall reporting requirements. W-Employer contributions

www.irs.gov/eitc. Also see Pub. 596, Earned Income Unreported Tip Income, with your income tax return to (including amounts the employee elected to contribute

Credit. Any EIC that is more than your tax liability report at least the allocated tip amount unless you can elective deferral limit must be included in income. See

the “Wages, Salaries, Tips, etc.” line instructions for using a section 125 (cafeteria) plan) to your health

is refunded to you, but only if you file a tax return. prove a smaller amount. If you have records that show savings account. Report on Form 8889, Health

Clergy and religious workers. If you are not subject the actual amount of tips you received, report that Form 1040.

Note: If a year follows code D through H, S, Y, AA, BB, Savings Accounts (HSAs). Y-Deferrals under a section

to social security and Medicare taxes, see Pub. 517, amount even if it is more or less than the allocated 409A nonqualified deferred compensation plan Z-

Social Security and Other Information for Members of tips. On Form 4137 you will calculate the social or EE, you made a make-up pension contribution for a

prior year(s) when you were in military service. To Income under section 409A on a nonqualified deferred

the Clergy and Religious Workers. Corrections. If security and Medicare tax owed on the allocated tips compensation plan. This amount is also included in

your name, SSN, or address is incorrect, correct shown on your Form(s) W-2 that you must report as figure whether you made excess deferrals, consider

these amounts for the year shown, not the current box 1. It is subject to an additional 20% tax plus

Copies B, C, and 2 and ask your employer to correct income and on other tips you did not report to your interest. See “Other Taxes” in the Form 1040

your employment record. Be sure to ask the employer employer. By filing Form 4137, your social security tips year. If no year is shown, the contributions are for the

current year. A-Uncollected social security or RRTA instructions. AA- Designated Roth contributions under

to file Form W-2c, Corrected Wage and Tax will be credited to your social security record (used to a section 401(k) plan. BB- Designated Roth

tax on tips. Include this tax on Form 1040. See “Other

Statement, with the Social Security Administration figure your benefits). contributions under a section 403(b) plan DD-Cost of

Taxes” in the Form 1040 instructions. B-Uncollected

(SSA) to correct any name, SSN, or money amount Box 10. This amount includes the total dependent employer-sponsored health coverage. The amount

Medicare tax on tips. Include this tax on Form 1040.

error reported to the SSA on Form W-2. Be sure to care benefits that your employer paid to you or reported with Code DD is not taxable. EE-

See “Other Taxes” in the Form 1040 instructions. C-

get your copies of Form W-2c from your employer for incurred on your behalf (including amounts from a Designated Roth contributions under a governmental

Taxable cost of group-term life insurance over $50,000

all corrections made so you may file them with your section 125 (cafeteria) plan). Any amount over $5,000 (included in boxes 1, 3 (up to social security wage section 457(b) plan. This amount does not apply to

tax return. If your name and SSN are correct but are is also included in box 1. Complete Form 2441, Child base), and 5) D-Elective deferrals to a section 401(k) contributions under a tax-exempt organization section

not the same as shown on your social security card, and Dependent Care Expenses, to compute any cash or deferred arrangement. Also includes deferrals 457(b) plan. Box 13. If the “Retirement plan” box is

you should ask for a new card that displays your taxable and nontaxable amounts. under a SIMPLE retirement account that is part of a checked, special limits may apply to the amount of

correct name at any SSA office or by calling 1-800- Box 11. This amount is (a) reported in box 1 if it is section 401(k) arrangement. E-Elective deferrals under traditional IRA contributions you may deduct. See Pub.

772-1213. You also may visit the SSA at a distribution made to you from a nonqualified deferred a section 403(b) salary reduction agreement F-Elective 590, Individual Retirement Arrangements (IRAs). Box

www.socialsecurity.gov. Cost of employer- compensation or nongovernmental section 457(b) plan deferrals under a section 408(k)(6) salary reduction 14. Employers may use this box to report information

sponsored health coverage (if such cost is or (b) included in box 3 and/or 5 if it is a prior year SEP G-Elective deferrals and employer contributions such as state disability insurance taxes withheld, union

provided by the employer). The reporting in Box 12, deferral under a nonqualified or section 457(b) plan (including nonelective deferrals) to a section 457(b) dues, uniform payments, health insurance premiums

using Code DD, of the cost of employer-sponsored that became taxable for social security and Medicare deferred compensation plan H-Elective deferrals to a deducted, nontaxable income, educational assistance

health coverage is for your information only. The taxes this year because there is no longer a section 501(c)(18)(D) tax-exempt organization plan. payments, or a member of the clergy’s personage

amount reported with Code DD is not taxable. substantial risk of forfeiture of your right to the deferred See “Adjusted Gross Income” in the Form 1040 allowance and utilities. Railroad employers use this

Credit for excess taxes. If you had more than one amount. This box should not be used if you had a instructions for how to deduct. J-Nontaxable sick pay box to report RRTA compensation, Tier 1 tax, Tier II

employer in 2014 and more than $7,254 in social deferral and a distribution in the same calendar year. If (information only, not included in boxes 1, 3 or 5) K- tax, Medicare tax and Additional Medicare Tax. Include

security and/or Tier I railroad retirement (RRTA) taxes this happens and you are or will be age 62 by the end 20% excise tax on excess golden parachute payments. tips reported by the employee to the employer in

were withheld, you may be able to claim a credit for of the calendar year, your employer should file form See “Other Taxes” in the Form 1040 instructions. L- railroad retirement (RRTA) compensation.

the excess against your federal income tax. If you SSA-131 with the Social Security Administration and Substantiated employee business expense Note. Keep Copy C of Form W-2 for at least 3 years

had more than one railroad employer and more than give you a copy. reimbursements (nontaxable) M-Uncollected social after the due date for filing your income tax return.

$3,828 in Tier II RRTA tax was withheld, you also Box 12. The following list explains the codes shown in security or RRTA tax on taxable cost of group-term life However, to help protect your social security

may be able to claim a credit. See your Form 1040 or box 12. You may need this information to complete insurance over $50,000 (former employees only). See benefits, keep Copy C until you begin receiving social

Form 1040A instructions and Pub. 505, Tax your tax return. “Other Taxes” in the Form 1040 instructions. N- security benefits, just in case there is a question about

Withholding and Estimated Tax. (Instructions for Employee continued on the back of copy C.) Uncollected Medicare tax on taxable cost of group- your work record and/or earnings in a particular year.

IN-STORE ONLINE EN NUESTRAS OFICINAS RECIBE EN LÍNEA

GET $50 OR 25% OFF RECIBA $50

O

25%

AL INSTANTE de descuento en

INSTANTLY Federal &

State Return**

en una tarjeta las Declaraciones

on a prepaid Visa® card.* Visa® prepagada* Federal y Estatal**

800.234.1040 800.234.1040

jacksonhewitt.com jacksonhewitt.com

*Le obsequiamos $50 en una tarjeta preferencial JH Visa prepagada disponible hasta el 31 de marzo

*$50 provided on a JH Preferred Prepaid Visa Card and available through March del 2015. Esta oferta no es válido con ninguna otra promoción o descuento. Se requiere el pago

31, 2015. Not valid with any other promotion or discount. Minimum tax prep fee mInimo del costo de la preparación de la devolución. Pregunte a su Profesional de Impuestos o visite

required. Ask a Tax Pro or see jacksonhewitt.com for details. nuestra página Jacksonhewitt.com para más detalles.

**Oferta válida para honorarios por preparación de impuestos únicamente. No se aplica a productos

**Offer valid for online tax preparation only and may not be combined with any other financieros, a productos de Internet u otros servicios. Presente el cupón en el momento de la

offer, discount or promotional price. Does not apply to financial products, in-store preparación de impuestos. Válido únicamente en los centros participantes. No puede combinarse

tax preparation fees or other services. Terms and conditions apply. 25CICP2014 con otras ofertas. La mayoría de las oficinas son de propiedad y operación independientes.

25CICPSP2014

You might also like

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- TGDocument2 pagesTGpr995No ratings yet

- TaxForms PDFDocument2 pagesTaxForms PDFLMN214100% (1)

- 2015 Tax Return Documents (US Auto Motors LLC) Revised PDFDocument20 pages2015 Tax Return Documents (US Auto Motors LLC) Revised PDFzlNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- W2 Preview titleDocument1 pageW2 Preview titlemrs merle westonNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- Hiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134 Hiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134Document3 pagesHiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134 Hiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134Jenn BrownNo ratings yet

- Notice to Employee Tax and Wage InformationDocument1 pageNotice to Employee Tax and Wage InformationsageNo ratings yet

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDocument1 pageMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisNo ratings yet

- A082000109a0298508172c001c: Contact InformationDocument1 pageA082000109a0298508172c001c: Contact InformationYudo KunaNo ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocument7 pages2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNo ratings yet

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- IRS W-2 Form TitleDocument1 pageIRS W-2 Form TitleKeller Brown JnrNo ratings yet

- Preview Copy Do Not File: Profit or Loss From BusinessDocument1 pagePreview Copy Do Not File: Profit or Loss From BusinessRon KnightNo ratings yet

- 05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDocument3 pages05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDonna WoodallNo ratings yet

- W2 & Earnings: Emma MimsDocument1 pageW2 & Earnings: Emma MimsIsaiah MimsNo ratings yet

- Wage and Tax Statement Wage and Tax StatementDocument3 pagesWage and Tax Statement Wage and Tax StatementNathan VosNo ratings yet

- 0LH47 0LH47 0429 20180101 1095report 001Document1 page0LH47 0LH47 0429 20180101 1095report 001charly4877No ratings yet

- Sarah Paredes 21w2Document2 pagesSarah Paredes 21w2Sarah ParedesNo ratings yet

- 0LH47 0LH47 0429 20180101 W2Report W2Report 001Document2 pages0LH47 0LH47 0429 20180101 W2Report W2Report 001charly4877No ratings yet

- UnknownDocument24 pagesUnknownanyanwuchigozie560No ratings yet

- Individual Tax ReturnDocument6 pagesIndividual Tax Returnaklank_218105No ratings yet

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNo ratings yet

- 2021 W-2 and Earnings SummaryDocument2 pages2021 W-2 and Earnings SummaryKawljeet Singh KohliNo ratings yet

- 2022 Schedule 3 (Form 1040)Document2 pages2022 Schedule 3 (Form 1040)Riley CareNo ratings yet

- Julian Saud 1095a 2022Document8 pagesJulian Saud 1095a 2022Neyda LarroqueNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document3 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09gary hays100% (1)

- Square 2022 W-2Document2 pagesSquare 2022 W-2Zane CardinalNo ratings yet

- Loan AppDocument9 pagesLoan Appanon-209253No ratings yet

- Semir Demiri 50 14Th ST North Edgartown Ma 02539Document2 pagesSemir Demiri 50 14Th ST North Edgartown Ma 02539SemirNo ratings yet

- Certain Government Payments: Copy B For RecipientDocument2 pagesCertain Government Payments: Copy B For RecipientDylan Bizier-Conley100% (1)

- U.S. Individual Income Tax Return: See Separate InstructionsDocument4 pagesU.S. Individual Income Tax Return: See Separate InstructionsNewsTeam20100% (1)

- Make Necessary Changes in Only Orange Colored Fields.: Proceed To Calculation Will Be Initially "No"Document36 pagesMake Necessary Changes in Only Orange Colored Fields.: Proceed To Calculation Will Be Initially "No"xakilNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return7cf42b5d98No ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument8 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramOsayameGaius-ObasekiNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerHot HeartsNo ratings yet

- 398 2019 ArchiveTaxReturnDocument10 pages398 2019 ArchiveTaxReturnjimmy naranjoNo ratings yet

- Hynum Greg Angela - 20i - CCDocument76 pagesHynum Greg Angela - 20i - CCAdmin OfficeNo ratings yet

- Tax FormsDocument2 pagesTax FormsBridget May Cruz100% (1)

- January 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Document8 pagesJanuary 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Zechariah Kennedy100% (1)

- Wage and Tax Statement: Employee's Social Security NumberDocument6 pagesWage and Tax Statement: Employee's Social Security NumberErma MonieNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document1 pageProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09rohit dasNo ratings yet

- 2021TaxReturnPDF 221003 100736Document18 pages2021TaxReturnPDF 221003 100736Tracy SmithNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- Important Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Document1 pageImportant Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Victor ErazoNo ratings yet

- Edgar JDocument2 pagesEdgar Japi-585014034No ratings yet

- Please To Do Not Use The Back ButtonDocument2 pagesPlease To Do Not Use The Back ButtonDavid MillerNo ratings yet

- 2019 California Tax Return RefundDocument18 pages2019 California Tax Return RefundPolo PoloNo ratings yet

- File your 1040 tax return onlineDocument2 pagesFile your 1040 tax return onlineSammi Bowe100% (1)

- P010 636211442428322820 T14385011dupD1 PDFDocument1 pageP010 636211442428322820 T14385011dupD1 PDFAnonymous pY5EUXUpaNo ratings yet

- Planilla Federal Keyla 2021Document2 pagesPlanilla Federal Keyla 2021Keyla VelezNo ratings yet

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- Direct Loans MPN SummaryDocument15 pagesDirect Loans MPN Summarydog dogNo ratings yet

- W-2 Form DetailsDocument1 pageW-2 Form DetailsSadiki LuhandeNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- 5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeDocument2 pages5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeWenn RamírezNo ratings yet

- Gwmain RDocument1 pageGwmain Rfznq9n4rkrNo ratings yet

- Upload 10 MoreDocument1 pageUpload 10 MoreAnthony OrozcooNo ratings yet

- Johnnys w4 PDFDocument2 pagesJohnnys w4 PDFAnthony OrozcooNo ratings yet

- Upload 10 MoreDocument1 pageUpload 10 MoreAnthony OrozcooNo ratings yet

- Upload 10 MoreDocument1 pageUpload 10 MoreAnthony OrozcooNo ratings yet

- WHERE YOU ARE EliseDocument2 pagesWHERE YOU ARE EliseAnthony OrozcooNo ratings yet

- WHERE YOU ARE EliseDocument2 pagesWHERE YOU ARE EliseAnthony OrozcooNo ratings yet

- Mundo de Letras Parte 3Document14 pagesMundo de Letras Parte 3Anthony OrozcooNo ratings yet

- Mundo de Letras Parte 4Document17 pagesMundo de Letras Parte 4Anthony OrozcooNo ratings yet

- Mundo de Letras Parte 2Document12 pagesMundo de Letras Parte 2Anthony OrozcooNo ratings yet

- F 3911Document2 pagesF 3911Sergio Andrés Garavito NavarroNo ratings yet