Professional Documents

Culture Documents

J J Enterprises Is Formed On December 31 2000

J J Enterprises Is Formed On December 31 2000

Uploaded by

Freelance WorkerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

J J Enterprises Is Formed On December 31 2000

J J Enterprises Is Formed On December 31 2000

Uploaded by

Freelance WorkerCopyright:

Available Formats

J J Enterprises is formed on December 31 2000 #4087

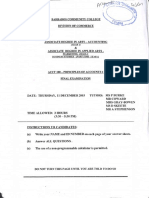

J & J Enterprises is formed on December 31, 2000. At that point it buys one asset costing

$2,487. The asset has a three-year life with no salvage value and is expected to generate cash

flows of $1,000 on December 31 in the years 2001, 2002, and 2003. Actual results are exactly

the same as plan. Depreciation is the firm’s only expense. All income is to be distributed as

dividends on the three dates mentioned. Other information: The price index stands at 100 on

December 31, 2000. It goes up to 104 and 108 on January 1, 2002 and 2003, respectively. Net

realizable value of the asset on December 31 in the years 2001, 2002, and 2003 is $1,500,

$600, and 0, respectively. Replacement cost for a new asset of the same type is $2,700,

$3,000, and $3,300 on the last day of the year in 2001, 2002, and 2003, respectively. Revenue

is $1,000 per year and the internal rate of return is 10% and all cash flows are received (and

distributed) on December 31. Required: Income statements for the years 2001, 2002, and 2003

under: Historical costing General price-level adjustment Exit valuation Replacement cost

Discounted cash flowsView Solution:

J J Enterprises is formed on December 31 2000

ANSWER

http://paperinstant.com/downloads/j-j-enterprises-is-formed-on-december-31-2000/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Case-Stern Press Corp.Document37 pagesCase-Stern Press Corp.Darwin Dionisio ClementeNo ratings yet

- 1 Case PDFDocument6 pages1 Case PDFsyeda alinaNo ratings yet

- CIMA Masters Gateway F2 MCQDocument27 pagesCIMA Masters Gateway F2 MCQObaidul Hoque NomanNo ratings yet

- 16Document23 pages16Alex liao0% (1)

- AFAR 2018 FOREX and Translation of FSDocument5 pagesAFAR 2018 FOREX and Translation of FSMikko RamiraNo ratings yet

- Accounting Adjusting EntriesDocument12 pagesAccounting Adjusting EntriesChin-Chin SantiagoNo ratings yet

- MCQ With AnswersDocument27 pagesMCQ With AnswersAnonymous qi4PZkNo ratings yet

- Solution For Chapter 16 Investments (13 E)Document8 pagesSolution For Chapter 16 Investments (13 E)RaaNo ratings yet

- Mishal Mustafa BTA111 Prof. WuDocument2 pagesMishal Mustafa BTA111 Prof. WuMishalm96No ratings yet

- J&J 5th EditionDocument13 pagesJ&J 5th EditionNicholas Malvin SaputraNo ratings yet

- The Balance Sheet of Investtech Inc at December 31 2013Document1 pageThe Balance Sheet of Investtech Inc at December 31 2013Miroslav GegoskiNo ratings yet

- 01 - Preweek Lecture and ProblemsDocument15 pages01 - Preweek Lecture and ProblemsMelody GumbaNo ratings yet

- ENMG602 Week5 HW3Document3 pagesENMG602 Week5 HW3Issam TamerNo ratings yet

- Dirk Company Reported The Following Balances at December 31 2018Document1 pageDirk Company Reported The Following Balances at December 31 2018CharlotteNo ratings yet

- 13.prepayment and Accruals ExpenseDocument5 pages13.prepayment and Accruals ExpenseDave ChowtieNo ratings yet

- Surya Citra Media TBK Bilingual 31 Des 2012 FinalDocument117 pagesSurya Citra Media TBK Bilingual 31 Des 2012 FinalHikhman Dwi RNo ratings yet

- HKALE PACCT Question Book 2002 Paper 2Document10 pagesHKALE PACCT Question Book 2002 Paper 2Elien ZosNo ratings yet

- A Partial Portion of The Balance Sheet at December 31Document1 pageA Partial Portion of The Balance Sheet at December 31hassan taimourNo ratings yet

- Practice 5 InvestmentDocument12 pagesPractice 5 InvestmentParal Fabio MikhaNo ratings yet

- Exam 1 5Document6 pagesExam 1 5Alex Schuldiner0% (1)

- On December 31 2010 Sauder Associates Owned The Following PDFDocument1 pageOn December 31 2010 Sauder Associates Owned The Following PDFAnbu jaromiaNo ratings yet

- WK 4 More Practice Adjusting EntriesDocument8 pagesWK 4 More Practice Adjusting EntriesOsman Bin SaifNo ratings yet

- HKALE PACCT Question Book 2001 Paper 1Document15 pagesHKALE PACCT Question Book 2001 Paper 1Elien ZosNo ratings yet

- Solved On January 1 2020 Perry Manufacturing Issued Bonds With ADocument1 pageSolved On January 1 2020 Perry Manufacturing Issued Bonds With AAnbu jaromiaNo ratings yet

- Tugas C12Document2 pagesTugas C12Yandra FebriyantiNo ratings yet

- Home Realty Inc Has Been Operating For Three Years and PDFDocument1 pageHome Realty Inc Has Been Operating For Three Years and PDFhassan taimourNo ratings yet

- Financial Asset at Fair Value Through Profit or LossDocument1 pageFinancial Asset at Fair Value Through Profit or LossJohnallenson DacosinNo ratings yet

- Goldstar Communications Was Organized On December 1 of The CurrentDocument1 pageGoldstar Communications Was Organized On December 1 of The Currenttrilocksp SinghNo ratings yet

- Depreciation Syd Act SL and DDB The Following Data Relate To PDFDocument1 pageDepreciation Syd Act SL and DDB The Following Data Relate To PDFAnbu jaromiaNo ratings yet

- Accounting ExerciseDocument40 pagesAccounting ExerciseAsri Marwa UmniatiNo ratings yet

- Sikes Corporation Whose Annual Accounting Period Ends On December 31Document1 pageSikes Corporation Whose Annual Accounting Period Ends On December 31Freelance WorkerNo ratings yet

- New Microsoft Word DocumentDocument5 pagesNew Microsoft Word DocumentAdil HassanNo ratings yet

- MFRS 121 Tutorial Ques - 62022 UploadDocument4 pagesMFRS 121 Tutorial Ques - 62022 UploadZhaoYing TanNo ratings yet

- On December 31 2014 Turnball Associates Owned The Following SecuritiesDocument1 pageOn December 31 2014 Turnball Associates Owned The Following SecuritiesAmit PandeyNo ratings yet

- Greyhawk Investments Inc S Articles of Incorporation Authorize The Company ToDocument2 pagesGreyhawk Investments Inc S Articles of Incorporation Authorize The Company ToCharlotteNo ratings yet

- Adjustment Data For Ms Ellen S Laundry Inc For The YearDocument1 pageAdjustment Data For Ms Ellen S Laundry Inc For The Yeartrilocksp SinghNo ratings yet

- Adjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsDocument31 pagesAdjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsFlorenz AmbasNo ratings yet

- December 11th 2013 (KB)Document4 pagesDecember 11th 2013 (KB)nic tNo ratings yet

- ABMM LKT Des 2012Document193 pagesABMM LKT Des 2012Dessy MargariscaNo ratings yet

- Refer To The Information Provided in p10 2a p10 2a Donnie Hilfiger Has TwoDocument1 pageRefer To The Information Provided in p10 2a p10 2a Donnie Hilfiger Has TwoBube KachevskaNo ratings yet

- On December 31 2015 Turnball Associates Owned The Following SecuritiesDocument1 pageOn December 31 2015 Turnball Associates Owned The Following SecuritiesAmit PandeyNo ratings yet

- The University South Pacific: School of Accounting and FinanceDocument9 pagesThe University South Pacific: School of Accounting and FinanceTetzNo ratings yet

- Aero Inc Had The Following Balance Sheet at December 31 PDFDocument1 pageAero Inc Had The Following Balance Sheet at December 31 PDFAnbu jaromiaNo ratings yet

- The Intangible Assets Section of Time Company at December 31 PDFDocument1 pageThe Intangible Assets Section of Time Company at December 31 PDFAnbu jaromiaNo ratings yet

- Grade 9 Accounting p2Document5 pagesGrade 9 Accounting p2AliNo ratings yet

- Aber Corporation S Balance Sheet at December 31 2009 Is PresenDocument1 pageAber Corporation S Balance Sheet at December 31 2009 Is PresenM Bilal SaleemNo ratings yet

- Preparing Financial StatementsDocument14 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- 09 Solutions PDFDocument15 pages09 Solutions PDFJaa Nat Cheung100% (1)

- Quiz On InvestmentDocument3 pagesQuiz On InvestmentDan Andrei BongoNo ratings yet

- Week 4 AssignmentDocument6 pagesWeek 4 AssignmentJames Bradley HuangNo ratings yet

- K&E Fee Statememt Aero Oct $3.93 MillionDocument238 pagesK&E Fee Statememt Aero Oct $3.93 MillionKirk HartleyNo ratings yet

- Rainy Day Umbrella Corporation Had The Following Balances at December PDFDocument1 pageRainy Day Umbrella Corporation Had The Following Balances at December PDFLet's Talk With HassanNo ratings yet

- f3 LSBF ExamDocument12 pagesf3 LSBF ExamIlam Acca Kotli AKNo ratings yet

- Tones Industries Has The Following Patents On Its December 31Document1 pageTones Industries Has The Following Patents On Its December 31M Bilal SaleemNo ratings yet

- Black and Decker Corporation Annual Report (Set 1)Document6 pagesBlack and Decker Corporation Annual Report (Set 1)Daniel MunozNo ratings yet

- Riverside Company Completed The Following Two Transactions The Annual AccountingDocument1 pageRiverside Company Completed The Following Two Transactions The Annual AccountingFreelance WorkerNo ratings yet

- Fundamentals of Advanced Accounting 8th Edition Hoyle Test Bank DownloadDocument75 pagesFundamentals of Advanced Accounting 8th Edition Hoyle Test Bank Downloadallisonpalmergxkyjcbirw100% (25)

- ADMF LKT Des 2012Document101 pagesADMF LKT Des 2012Dessy MargariscaNo ratings yet

- Inflation-indexed Securities: Bonds, Swaps and Other DerivativesFrom EverandInflation-indexed Securities: Bonds, Swaps and Other DerivativesNo ratings yet

- Vencap Inc Is A Venture Capital Financier It Estimates ThatDocument1 pageVencap Inc Is A Venture Capital Financier It Estimates ThatFreelance WorkerNo ratings yet

- Valor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsDocument1 pageValor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsFreelance WorkerNo ratings yet

- Using The Trial Balance Prepared For X Factor Accounting in PartDocument1 pageUsing The Trial Balance Prepared For X Factor Accounting in PartFreelance WorkerNo ratings yet

- Using The Trial Balance Prepared For Binbutti Engineering in PartDocument1 pageUsing The Trial Balance Prepared For Binbutti Engineering in PartFreelance Worker0% (2)

- Using The Ledger Balances and Additional Data Shown On TheDocument1 pageUsing The Ledger Balances and Additional Data Shown On TheFreelance WorkerNo ratings yet

- Using The Information Provided in Part 1 of Problem 1Document1 pageUsing The Information Provided in Part 1 of Problem 1Freelance WorkerNo ratings yet

- Using The Information in Problem 3 9a Complete The Following in ProblemDocument1 pageUsing The Information in Problem 3 9a Complete The Following in ProblemFreelance WorkerNo ratings yet

- Using The Information in Problem 3b Complete The Requirements AssumingDocument1 pageUsing The Information in Problem 3b Complete The Requirements AssumingFreelance WorkerNo ratings yet

- Using The Information in Exercise 7 A Present The Journal EntriesDocument1 pageUsing The Information in Exercise 7 A Present The Journal EntriesFreelance WorkerNo ratings yet

- Using The Following Independent Situations Answer The Following Questions SituationDocument1 pageUsing The Following Independent Situations Answer The Following Questions SituationFreelance WorkerNo ratings yet

- Using The General Journal Entries Prepared in Problem 2 3b CompleteDocument1 pageUsing The General Journal Entries Prepared in Problem 2 3b CompleteFreelance WorkerNo ratings yet

- Ubs Ag Is A Global Provider of Financial Services ToDocument1 pageUbs Ag Is A Global Provider of Financial Services ToFreelance WorkerNo ratings yet

- Use The Data From Problem 6 5a and Do The QuestionDocument1 pageUse The Data From Problem 6 5a and Do The QuestionFreelance WorkerNo ratings yet