Professional Documents

Culture Documents

The Financial Statements of Ford Motor Company Reveal The Information

Uploaded by

Taimur Technologist0 ratings0% found this document useful (0 votes)

21 views1 pageOriginal Title

The Financial Statements of Ford Motor Company Reveal the Information

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views1 pageThe Financial Statements of Ford Motor Company Reveal The Information

Uploaded by

Taimur TechnologistCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

The financial statements of Ford Motor Company reveal

the information #4729

The financial statements of Ford Motor Company reveal the information regarding income taxes

shown in Exhibit 2.8.Requireda. Assuming that Ford had no significant permanent differences

between book income and taxable income, did income before taxes for financial reporting

exceed or fall short of taxable income for Year 10? Explain.b. Did net loss before taxes for

financial reporting exceed or fall short of taxable loss for Year 11 ? Explain.c. Will the

adjustment to net income for deferred taxes to compute cash flow from operations in the

statement of cash flows result in an addition or subtraction for Year 10? For Year 11?d. Firms

must recognize expenses related to employee benefit plans as employees provide services but

claim an income tax deduction only when they make cash payments to the benefit plan. Why

are deferred taxes related to employee benefit plans disclosed as a deferred tax asset instead

of a deferred tax liability? Suggest reasons for the direction of the change in amounts for this

deferred tax asset between Year 9 and Year 11.e. Firms must recognize expenses related to

dealer and customer allowances and claims when they recognize sales revenues but claim an

income tax deduction when they make cash payments or provide warranty services. Why are

deferred taxes related to this item disclosed as a deferred tax asset? Suggest reasons for the

direction of the change in amounts for this deferred tax asset between Year 9 and Year 11.f.

Firms must recognize expenses for credit losses as they recognize sales revenues but claim an

income tax deduction when they establish the uncollectibility of a particular customer's account.

Why are deferred taxes related to credit losses disclosed as a deferred tax asset? Suggest

reasons for the direction of the change in amounts for this deferred tax asset between Year 9

and Year 11.g. Ford uses the straight-line depreciation method for financial reporting and

accelerated depreciation methods for income tax purposes. Why are deferred taxes related to

depreciation disclosed as a deferred tax liability? Suggest reasons for the direction of the

change in amounts for this deferred tax liability between Year 9 and Year 11.h. Ford leases

automobiles and trucks to customers under multiyear leases. For financial reporting, Ford treats

these leases as capital, or financing, leases, with income from the manufacturing activity

recognized at the time of delivery of the vehicle to the customer and interest revenue on the

finance receivable recognized over time. For tax reporting, Ford treats these arrangements as

operating leases, with rent revenue recognized over time as customers make periodic lease

payments. Why are deferred taxes related to finance receivables disclosed as a deferred tax

liability? Suggest reasons for the direction of the change in amounts for this deferred tax liability

between Year 9 and Year 11.View Solution:

The financial statements of Ford Motor Company reveal the information

ANSWER

http://paperinstant.com/downloads/the-financial-statements-of-ford-motor-company-reveal-the-

information/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- HDFCBANK SlipDocument1 pageHDFCBANK SlipShashikant Thakre65% (20)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Chart of Accounts of Clara S Design Service of MontrealDocument1 pageThe Chart of Accounts of Clara S Design Service of MontrealTaimur TechnologistNo ratings yet

- Iht 421Document2 pagesIht 421khemg100% (1)

- The Chart of Accounts of Angel S Delivery Service of FlinDocument1 pageThe Chart of Accounts of Angel S Delivery Service of FlinTaimur TechnologistNo ratings yet

- The Bookkeeper of Floore Company Records Credit Sales in ADocument1 pageThe Bookkeeper of Floore Company Records Credit Sales in ATaimur TechnologistNo ratings yet

- IRS Form W-8BEN With Affidavit of Unchanged Status Instructions Feb 2006Document1 pageIRS Form W-8BEN With Affidavit of Unchanged Status Instructions Feb 2006Jennipher Lin100% (4)

- The Financial Statements of CJ For The Year To 31Document1 pageThe Financial Statements of CJ For The Year To 31Taimur TechnologistNo ratings yet

- The Engineering Department of A Large Firm Is Overly CrowdedDocument1 pageThe Engineering Department of A Large Firm Is Overly CrowdedTaimur TechnologistNo ratings yet

- The Directors of Panel A Public Limited Company Are ReviewingDocument2 pagesThe Directors of Panel A Public Limited Company Are ReviewingTaimur TechnologistNo ratings yet

- The Edison Power Company Currently Owns and Operates A Coal FiredDocument1 pageThe Edison Power Company Currently Owns and Operates A Coal FiredTaimur TechnologistNo ratings yet

- The Doraville Machinery Company Is Planning To Expand Its CurrentDocument1 pageThe Doraville Machinery Company Is Planning To Expand Its CurrentTaimur TechnologistNo ratings yet

- The Financial Statements of Ag Are Given Below Income Statement ForDocument1 pageThe Financial Statements of Ag Are Given Below Income Statement ForTaimur TechnologistNo ratings yet

- The Electrolux Group Hereafter Electrolux Is A Producer of HomeDocument1 pageThe Electrolux Group Hereafter Electrolux Is A Producer of HomeTaimur TechnologistNo ratings yet

- The Federal Highway Administration Predicts That by The Year 2005Document1 pageThe Federal Highway Administration Predicts That by The Year 2005Taimur TechnologistNo ratings yet

- The Closing Balance Sheet Items Are Given Below For JasonDocument1 pageThe Closing Balance Sheet Items Are Given Below For JasonTaimur TechnologistNo ratings yet

- The Dallas Machine Shop Expects To Have An Annual TaxableDocument1 pageThe Dallas Machine Shop Expects To Have An Annual TaxableTaimur TechnologistNo ratings yet

- The Financial Statements of Target Corporation A Retail Chain RevealDocument1 pageThe Financial Statements of Target Corporation A Retail Chain RevealTaimur TechnologistNo ratings yet

- The City of Opelika Was Having A Problem Ting LandDocument1 pageThe City of Opelika Was Having A Problem Ting LandTaimur TechnologistNo ratings yet

- The Company Lalo Company Headquartered in Vaduz Is A CompanyDocument4 pagesThe Company Lalo Company Headquartered in Vaduz Is A CompanyTaimur TechnologistNo ratings yet

- The Delaware Chemical Corporation Is Considering Investing in A NewDocument1 pageThe Delaware Chemical Corporation Is Considering Investing in A NewTaimur TechnologistNo ratings yet

- The Current Dollar Yield Curve On The International Bond MarketDocument1 pageThe Current Dollar Yield Curve On The International Bond MarketTaimur TechnologistNo ratings yet

- The City of Prattsville Is Comparing Two Plans For SupplyingDocument1 pageThe City of Prattsville Is Comparing Two Plans For SupplyingTaimur TechnologistNo ratings yet

- The Cash General Ledger Account Balance of Gladstone LTD WasDocument1 pageThe Cash General Ledger Account Balance of Gladstone LTD WasTaimur TechnologistNo ratings yet

- The Columbus Electronics Company Is Considering Replacing A 1 000 Pound Capacity ForkliftDocument1 pageThe Columbus Electronics Company Is Considering Replacing A 1 000 Pound Capacity ForkliftTaimur TechnologistNo ratings yet

- The City of Portland Sanitation Department Is Responsible For TheDocument2 pagesThe City of Portland Sanitation Department Is Responsible For TheTaimur TechnologistNo ratings yet

- The Consolidated Statement of Financial Position For Mic As atDocument1 pageThe Consolidated Statement of Financial Position For Mic As atTaimur TechnologistNo ratings yet

- The December 31 2014 Unadjusted Trial Balance For Tucker PhotographersDocument1 pageThe December 31 2014 Unadjusted Trial Balance For Tucker PhotographersTaimur TechnologistNo ratings yet

- The Chart of Accounts For Angel S Delivery Service of FlinDocument1 pageThe Chart of Accounts For Angel S Delivery Service of FlinTaimur TechnologistNo ratings yet

- The Charleston Textile Company Is Considering Acquiring A New KnittingDocument1 pageThe Charleston Textile Company Is Considering Acquiring A New KnittingTaimur TechnologistNo ratings yet

- The Balance Sheet and Other Information in The Question RelateDocument1 pageThe Balance Sheet and Other Information in The Question RelateTaimur TechnologistNo ratings yet

- The Bragg Stratton Company Manufactures A Specialized Motor ForDocument1 pageThe Bragg Stratton Company Manufactures A Specialized Motor ForTaimur TechnologistNo ratings yet

- The Candy Co of Lethbridge Pays Its Workers Twice EachDocument1 pageThe Candy Co of Lethbridge Pays Its Workers Twice EachTaimur TechnologistNo ratings yet

- 121719-2006-Pansacola v. Commissioner of Internal Revenue20190605-5466-1nfbihwDocument7 pages121719-2006-Pansacola v. Commissioner of Internal Revenue20190605-5466-1nfbihwJose Antonio BarrosoNo ratings yet

- Kent County May ElectionsDocument3 pagesKent County May ElectionsWXMINo ratings yet

- Tax 2 - Midterm Quiz 2Document6 pagesTax 2 - Midterm Quiz 2Uy SamuelNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- T3 Ans 1,2,4 (RA - DD)Document8 pagesT3 Ans 1,2,4 (RA - DD)MinWei1107No ratings yet

- Commissioner of Internal Revenue v. Melchor JavierDocument1 pageCommissioner of Internal Revenue v. Melchor JavierRaquel DoqueniaNo ratings yet

- Schedule Test Series@Vision IASDocument16 pagesSchedule Test Series@Vision IASDeep LightNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document18 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Arjun VermaNo ratings yet

- 3033 - Pvmi - 2023 - 03Document1 page3033 - Pvmi - 2023 - 03Faize muflisahNo ratings yet

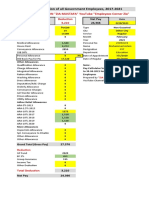

- Pay Calculation of All Government Employees, 2017-2021: by ZMCRC: Zia BWN "Zia Mustafa" Youtube "Employees Corner Zia"Document2 pagesPay Calculation of All Government Employees, 2017-2021: by ZMCRC: Zia BWN "Zia Mustafa" Youtube "Employees Corner Zia"GES 225No ratings yet

- Basis of Malaysian Income TaxDocument6 pagesBasis of Malaysian Income TaxhisyamstarkNo ratings yet

- Slides 8Document31 pagesSlides 8Erico MatosNo ratings yet

- External Version - Eud Nigeria Project CompendiumDocument82 pagesExternal Version - Eud Nigeria Project CompendiumYusuf Maitama SuleNo ratings yet

- Plagiarism - ReportDocument5 pagesPlagiarism - ReportabbishekNo ratings yet

- BIR Ruling 383-15 - Dividends Received by Luxembourg Entity (Participation Exemption)Document5 pagesBIR Ruling 383-15 - Dividends Received by Luxembourg Entity (Participation Exemption)Jerwin DaveNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 062022Document3 pagesGSTR3B 27BCGPS7468K1ZR 062022Aman JaiswalNo ratings yet

- Income Tax by Sachin RevekarDocument5 pagesIncome Tax by Sachin RevekarSACHIN REVEKARNo ratings yet

- P2 Examination - BAM 031 - Income Taxation.3Document9 pagesP2 Examination - BAM 031 - Income Taxation.3Rosemarie VillanuevaNo ratings yet

- B2B Ecostore - Billing Letter - January 2020 TEMPLATEDocument3 pagesB2B Ecostore - Billing Letter - January 2020 TEMPLATEkevin echiverriNo ratings yet

- Online CTC Calculator With Salary Annexure Excel DownloadDocument1 pageOnline CTC Calculator With Salary Annexure Excel DownloadFaruk PatelNo ratings yet

- Filed Dakota Patriot PAC 2022 Year EndDocument3 pagesFiled Dakota Patriot PAC 2022 Year EndRob Port100% (1)

- Income Taxation, Latest Edition, Bangawan, Rex BDocument5 pagesIncome Taxation, Latest Edition, Bangawan, Rex BPrincess SalvadorNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument17 pagesU.S. Individual Income Tax Return: Filing StatusCristian BurnNo ratings yet

- NPP 2016 Manifesto FullDocument192 pagesNPP 2016 Manifesto FullJoseph AmegatcherNo ratings yet

- Pay Slip: Cpa Global Support Services India PVT LTDDocument1 pagePay Slip: Cpa Global Support Services India PVT LTDSurendra BudaniaNo ratings yet

- Quiz in Fringe Benefits PDFDocument3 pagesQuiz in Fringe Benefits PDFangelo vasquezNo ratings yet

- Capitalallowances 2Document13 pagesCapitalallowances 2Teh Chu LeongNo ratings yet