Professional Documents

Culture Documents

Online CTC Calculator With Salary Annexure Excel Download

Uploaded by

Faruk PatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Online CTC Calculator With Salary Annexure Excel Download

Uploaded by

Faruk PatelCopyright:

Available Formats

Online CTC calculator

PayHR Online CTC salary calculator helps HR

and Payroll Accountant's to calculate how much

Net Salary to be paid to employees based on

agreed CTC.

Instruction to follow;

1. Enter annual CTC amounts and, then select

the compliance settings as per your

establishment applicability,

2. Scroll down, you will view the Salary Structure

calculation based on details provided by you,

3. Done..! Bookmark this page for your regular

use.

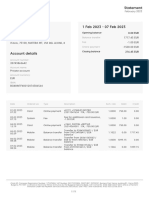

Enter Yearly CTC amount?

270000

Enter Minimum Basic Wage monthly

amount as per State Act?

18200

Is PF applicable for this CTC?

Yes _____ No

Is PF Ceiling applicable for this CTC?

Limit upto Rs.15,000/- per month

Yes _____ No

Is ESIC applicable for this CTC?

Yes _____ No

Is Gratuity a part of your company policy?

Yes _____ No

Is Statutory Bonus applicable for this

CTC?

Yes _____ No

Is Professional Tax applicable, if yes than

enter monthly amount?

200

If any onetime PLI/Annual Bonus/Variable

Pay, etc part of CTC?

Enter yearly amount

CTC Calculated is as follows:

Below salary amount is calculated based

on the above amount and setting entered

by you. If there is any change in limits,

then you can make changes in below limits

to get desired CTC amount by clicking on

"Recalculate" button

1. Online Income Tax Calculator as per

☛

both tax regime Online Tax Calculator

2021-22

2. How to design CTC structure with limits

☛ Understanding Salary and

Reimbursement

3. Download various HR Templates ☛

Download Now

Recalculate

Fixed Allowance Type Monthly.Amt_ Yearly.Amt_ Limits/Wages

Fully

Basic Salary 18,200 218,400 0 %

Taxable

Hour Rent

Tax Exempt 0 0 0 %

Allowance

LTA Allowance Tax Exempt 0 0 0 %

Fully

Other Allowance 109 1,308 Balance

Taxable

Total Gross Salary 18,309 219,708

PF employer Employer

1,800 21,600 15,000

contribution rate 12%

ESIC employer Employer

0 0 0

contribution rate 3.25%

Gratuity employer Gratuity rate

875 10,500 18,200

contribution 4.81%

Bonus rate

Statutory Bonus 1,516 18,192 18,200

8.33%

Total CTC 22,500 270,000

PLI/Bonus/Variable Performance

0 0

Pay Pay

Total

CTC(Including 270,000

Variable)

PF employee Employee

1,800 21,600 15,000

contribution rate 12%

ESIC employee Employee

0 0 0

contribution rate 0.75%

Profesional Tax 200 2,400

Net take Home 16,309 195,708

If you want to download Advanced Excel CTC

Calculator combine with "Fixed allowance" +

"Reimbursment" along with option to set limits,

then download the latest automatic 'CTC Salary

Calculator Click here

About US

PayHR provides tools for HR and Payroll

professionals by providing online calculators for

Income Tax, Statutory Bonus, HRA exemption,

CTC Salary, Gratuity, etc. Still more to come...!

Read More

Contact Us

We love to share ideas

For any questions drop an email to

Email : payhr.in@gmail.com

Popular Posts

Excel CTC Calculator for HR Professionals

! 2020-04-22

HR's Tool

☛ Gratuity Calculator

☛ Professional Tax Rates

☛ Labour Welfare Fund Rates

☛ Online Tax Calculator 2021-22

☛ Excel CTC Salary Calculator

☛ Online HRA Exemption Calculator

☛ Online Statutory Bonus Calculator

Subscribe to our

newsletter

email address

Subscribe

We respect your

privacy.No spam ever!

! TWITTER " LINKEDIN

PayHR Blog 2022 | Brought To You by PayHR

You might also like

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument1 pageSalary Calculation Yearly & Monthly Break Up of Gross SalarySRS ENTERPRISESNo ratings yet

- Calculate CTC componentsDocument2 pagesCalculate CTC componentsranjana sharmaNo ratings yet

- Hyd - Cal. WTP BaggiDocument27 pagesHyd - Cal. WTP BaggiChief Engineer PMUNo ratings yet

- MBR Design SheetDocument9 pagesMBR Design SheetVenkatesh SivaramanNo ratings yet

- Presentation of WTPDocument75 pagesPresentation of WTPsiddhartha pandaNo ratings yet

- 50 KLD Biological & Tertiary Treatment Plant - RLS FinalDocument19 pages50 KLD Biological & Tertiary Treatment Plant - RLS FinalkezaihrajNo ratings yet

- Techno-Commercial Offer For 600 KLD STP MBBRDocument9 pagesTechno-Commercial Offer For 600 KLD STP MBBRTech MongerNo ratings yet

- 04 Sec. 3 Sewage Characteristics and Effluent Discharge Requirements PDFDocument8 pages04 Sec. 3 Sewage Characteristics and Effluent Discharge Requirements PDFVic KeyNo ratings yet

- Nitrogen RemovalDocument96 pagesNitrogen RemovalnusageniNo ratings yet

- Summary Report: RO System Flow DiagramDocument3 pagesSummary Report: RO System Flow Diagramjugal ranaNo ratings yet

- Pre-Feasibility Report For Proposed Construction Project of "Santnagari" atDocument12 pagesPre-Feasibility Report For Proposed Construction Project of "Santnagari" atMohammedNo ratings yet

- Old Formula MBBRDocument190 pagesOld Formula MBBRRoland LumpasNo ratings yet

- 40 KLD MBR QuoteDocument15 pages40 KLD MBR QuoteV Narasimha RajuNo ratings yet

- OtherDocument20 pagesOtherVineet Chaudhary100% (1)

- Pipe Network Analysis: Chemical Engineer's GuideDocument12 pagesPipe Network Analysis: Chemical Engineer's GuideRio BuiNo ratings yet

- PFD FileDocument11 pagesPFD FileNaveen MahawarNo ratings yet

- CETP (Common Effluent Treatment Plant) at IIE Pantnagar On BOT (Build, Operate and Transfer)Document14 pagesCETP (Common Effluent Treatment Plant) at IIE Pantnagar On BOT (Build, Operate and Transfer)rvsingh17No ratings yet

- 1295 - Offer 50 KLD Package Type STP 27.08.2022 - RemovedDocument11 pages1295 - Offer 50 KLD Package Type STP 27.08.2022 - RemovedsanjeevNo ratings yet

- Colligative Properties ExplainedDocument26 pagesColligative Properties ExplainedYAWAR SAEED100% (1)

- ETP & STP TrainingDocument116 pagesETP & STP TrainingMUHAMMAD AWAIS UR REHMANNo ratings yet

- 0.8 MLD STP Design DrawingsDocument9 pages0.8 MLD STP Design DrawingsAminur RahmanNo ratings yet

- Lime DosingDocument16 pagesLime Dosingthiru84No ratings yet

- WWTP Budgeting SaddamDocument11 pagesWWTP Budgeting SaddamAQUAMART INDONESIANo ratings yet

- Flocculator Eng PDFDocument2 pagesFlocculator Eng PDFAbdul LatifNo ratings yet

- ICS-A02-1103 (B1) Hydraulic Calculations (090110)Document12 pagesICS-A02-1103 (B1) Hydraulic Calculations (090110)HRK65No ratings yet

- 150 KLD fecal sludge treatment plant design basisDocument56 pages150 KLD fecal sludge treatment plant design basissharan kommi100% (1)

- KUBOTA Submerged Membrane Unit Optional Parts: Lifting Tool Guide SetDocument1 pageKUBOTA Submerged Membrane Unit Optional Parts: Lifting Tool Guide SetmutazsalihNo ratings yet

- 39MLD STP at Daulatganj - Survey, Investigation, Design, Supply, ConstructionDocument56 pages39MLD STP at Daulatganj - Survey, Investigation, Design, Supply, ConstructionNaveen NagisettiNo ratings yet

- Process calculation for STP (Township and PlantDocument30 pagesProcess calculation for STP (Township and PlantKamod RaiNo ratings yet

- Flint WTP O-M Manual With SOPs 553219 7Document83 pagesFlint WTP O-M Manual With SOPs 553219 7Omkar BharankarNo ratings yet

- Design & Sizing WWTPDocument30 pagesDesign & Sizing WWTPRavishankar ANo ratings yet

- Hydrochloric acid Regeneration of Cation Exchange Resin 225 HDocument8 pagesHydrochloric acid Regeneration of Cation Exchange Resin 225 HPravin BoteNo ratings yet

- FWD CALCULATION NOTESDocument10 pagesFWD CALCULATION NOTESMuhammad Ashraful ArifinNo ratings yet

- SHELL AND TUBE HEAT EXCHANGER DESIGNDocument16 pagesSHELL AND TUBE HEAT EXCHANGER DESIGNSarvagyaNo ratings yet

- Eterna Sewerage PumpsDocument4 pagesEterna Sewerage Pumpssatyendra singh50% (2)

- Tiger Bio Filter - InformationDocument3 pagesTiger Bio Filter - InformationPRASHANT INGALENo ratings yet

- WaterSoftner - Opened by M.gh.Document4 pagesWaterSoftner - Opened by M.gh.Hamdy AdelNo ratings yet

- Grit Removal & Treatment for Sustainable Grit RecyclingDocument47 pagesGrit Removal & Treatment for Sustainable Grit RecyclingRavena RemaditaNo ratings yet

- Estimate Baghpat STP RevisedDocument23 pagesEstimate Baghpat STP Revisedankur yadavNo ratings yet

- CIP Procedure of RO MembraneDocument2 pagesCIP Procedure of RO MembraneTanzila SiddiquiNo ratings yet

- ES0153-75320100-DBR-0001DM PlantDocument73 pagesES0153-75320100-DBR-0001DM Plantraaj bharath100% (1)

- MBR Membrane Offer for 30 MLD STPDocument8 pagesMBR Membrane Offer for 30 MLD STPakshay salviNo ratings yet

- Clarifier DesignDocument5 pagesClarifier DesignSwaminathan ThayumanavanNo ratings yet

- Memcor UF Product Data Sheet CPII MemRackDocument2 pagesMemcor UF Product Data Sheet CPII MemRackDio MiNo ratings yet

- Bom of 150 KLD Etp: SR - No Description Width (MM) Length /dia (MM) Hight (MM) Thikness (MM) F.B & Nos. Flow Rate /capDocument12 pagesBom of 150 KLD Etp: SR - No Description Width (MM) Length /dia (MM) Hight (MM) Thikness (MM) F.B & Nos. Flow Rate /capRajdeepsinhNo ratings yet

- Full Design of Componets OF Sewage Tretment Plant (200 KLD)Document4 pagesFull Design of Componets OF Sewage Tretment Plant (200 KLD)rahul100% (1)

- WWTFSP App.F1 Wastewater Flow ProjectionsDocument67 pagesWWTFSP App.F1 Wastewater Flow ProjectionsHuy NguyenNo ratings yet

- Industrial VillageDocument35 pagesIndustrial VillageRajani jirelNo ratings yet

- 02.12.21 90m3hr Euroclean-DHV MaithonDocument16 pages02.12.21 90m3hr Euroclean-DHV MaithonSagnik DasNo ratings yet

- 14-Lime Soda Ash Treatment PDFDocument43 pages14-Lime Soda Ash Treatment PDFRaj BisenNo ratings yet

- Water HammerDocument3 pagesWater HammerSrinivas ReddyNo ratings yet

- Hydraulic Design of Sewage Treatment PlantDocument9 pagesHydraulic Design of Sewage Treatment PlantSCR_010101No ratings yet

- CDE Sand Washing Plant Cost DetailsDocument3 pagesCDE Sand Washing Plant Cost DetailsKAMAL SINGHNo ratings yet

- Presentation - Jeddah Airport 2 ISTP (KOM)Document44 pagesPresentation - Jeddah Airport 2 ISTP (KOM)Mana DiaaNo ratings yet

- Catalog - Scientific Software GroupDocument32 pagesCatalog - Scientific Software GrouppetroljoseNo ratings yet

- Simple Activated Sludge Design With Septic Tank 3000Document4 pagesSimple Activated Sludge Design With Septic Tank 3000AlyannaKatePalasNo ratings yet

- STP BioshaftDocument54 pagesSTP BioshaftImran KhanNo ratings yet

- Annex 29 Area Calculation For Extended AerationDocument1 pageAnnex 29 Area Calculation For Extended AerationPradeep DavuluriNo ratings yet

- Payslip 102703 202303 PDFDocument1 pagePayslip 102703 202303 PDFAnagha AnuNo ratings yet

- 'KS21596'NovDocument1 page'KS21596'NovRiya paiNo ratings yet

- Tariff ScheduleDocument33 pagesTariff ScheduleFaruk PatelNo ratings yet

- SWG Maint GeDocument26 pagesSWG Maint Gegosalhs9395No ratings yet

- Group D 2018 Vacencey Detalies PDFDocument33 pagesGroup D 2018 Vacencey Detalies PDFSanjeev KumarNo ratings yet

- PRO450 Electrical SafetyDocument6 pagesPRO450 Electrical SafetyAndrew SahabatNo ratings yet

- ELECTRICAL Engineering Interview Questions With AnswersDocument16 pagesELECTRICAL Engineering Interview Questions With AnswersAnonymous YuZX1Ot3No ratings yet

- Log 1Document19 pagesLog 1Faruk PatelNo ratings yet

- Member Passbook DetailsDocument2 pagesMember Passbook DetailsFaruk PatelNo ratings yet

- 9305 20-80 KVA Users and Installation Manual 1015543D GBDocument40 pages9305 20-80 KVA Users and Installation Manual 1015543D GBFahd AhmedNo ratings yet

- Electrical Design & CostingDocument1 pageElectrical Design & CostingFaruk PatelNo ratings yet

- Battery MaintenanceDocument9 pagesBattery MaintenanceRajat Kumar100% (1)

- DocumentDocument6 pagesDocumentFaruk PatelNo ratings yet

- Electrical Instrumentation Exam QuestionsDocument1 pageElectrical Instrumentation Exam QuestionsFaruk PatelNo ratings yet

- G Gheewaala Application FormDocument2 pagesG Gheewaala Application FormFaruk PatelNo ratings yet

- MiVideo Log Analysis Fails Server SyncDocument5 pagesMiVideo Log Analysis Fails Server SyncFaruk PatelNo ratings yet

- MiVideo Log Analysis Fails Server SyncDocument5 pagesMiVideo Log Analysis Fails Server SyncFaruk PatelNo ratings yet

- Electrical Engineering Most Important 770 MCQs PDFDocument120 pagesElectrical Engineering Most Important 770 MCQs PDFFaruk Patel100% (5)

- Attachment PDFDocument1 pageAttachment PDFFaruk PatelNo ratings yet

- Caller (1) Receiver (2) : Switching Center Base Station (2) Base StationDocument16 pagesCaller (1) Receiver (2) : Switching Center Base Station (2) Base StationNauman-ur-RasheedNo ratings yet

- Vaillant boiler installation diagram conditionsDocument20 pagesVaillant boiler installation diagram conditionsMark MaxwellNo ratings yet

- File 3287Document8 pagesFile 3287Faruk PatelNo ratings yet

- Wiring Diagrams and Electrical Test - Heating eDocument22 pagesWiring Diagrams and Electrical Test - Heating eFaruk PatelNo ratings yet

- My ResumeDocument2 pagesMy ResumeFaruk PatelNo ratings yet

- My ResumeDocument2 pagesMy ResumeFaruk PatelNo ratings yet

- 12Document6 pages12Faruk PatelNo ratings yet

- 16Document9 pages16Faruk PatelNo ratings yet

- 22Document9 pages22Faruk PatelNo ratings yet

- MC5 InfoDocument4 pagesMC5 InfoFaruk PatelNo ratings yet

- 18Document5 pages18Faruk PatelNo ratings yet

- Group D 2018 Vacencey Detalies PDFDocument33 pagesGroup D 2018 Vacencey Detalies PDFSanjeev KumarNo ratings yet

- Renewal Premium Acknowledgement: Policy DetailsDocument1 pageRenewal Premium Acknowledgement: Policy DetailsTejpal Singh ShekhawatNo ratings yet

- PH Taxes Guide: National & Local TaxesDocument2 pagesPH Taxes Guide: National & Local TaxesYzah CariagaNo ratings yet

- 1601-FQ Final Jan 2018 Rev DPADocument2 pages1601-FQ Final Jan 2018 Rev DPAMarvin AmparadoNo ratings yet

- Purchase Unit 116 Tierra Verde TownhomeDocument2 pagesPurchase Unit 116 Tierra Verde Townhomeshrine obenietaNo ratings yet

- 2018-2019 Sbi StatementDocument9 pages2018-2019 Sbi StatementPower MuruganNo ratings yet

- Icard Statement 01.2023Document1 pageIcard Statement 01.2023anastasiya DubininaNo ratings yet

- Discussion Forum Bus 5111 Unit 2Document2 pagesDiscussion Forum Bus 5111 Unit 2MohamedNo ratings yet

- RMC No. 14-2021Document1 pageRMC No. 14-2021nathalie velasquezNo ratings yet

- Iesco Online BilllDocument2 pagesIesco Online BilllMohammad NaveedNo ratings yet

- Liza ItineraryDocument23 pagesLiza Itineraryjose randyNo ratings yet

- ForwardInvoice ORD660948335Document4 pagesForwardInvoice ORD660948335Nitin GuptaNo ratings yet

- "Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Document3 pages"Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Christopher Vinoth0% (2)

- Civil List DocumentDocument284 pagesCivil List DocumentmalanarunaNo ratings yet

- AirAsia Travel Itinerary and Invoice for Booking ZS82QXDocument2 pagesAirAsia Travel Itinerary and Invoice for Booking ZS82QX邱子桐No ratings yet

- Enjoy Connection Globally.: Tax Invoice/ Tax Credit NoteDocument39 pagesEnjoy Connection Globally.: Tax Invoice/ Tax Credit NoteahsanukkakarNo ratings yet

- LESCO Online Customer Bill Printing Document TitleDocument1 pageLESCO Online Customer Bill Printing Document TitlekhadijaNo ratings yet

- Maths PPT Income Tax-Diya ShahDocument5 pagesMaths PPT Income Tax-Diya ShahBrain ChampsNo ratings yet

- Plastic MoenyDocument59 pagesPlastic MoenyAppasaheb ManeNo ratings yet

- Other Income Tax Accounting Rules and ExamplesDocument19 pagesOther Income Tax Accounting Rules and ExamplesHabtamu Hailemariam AsfawNo ratings yet

- Istilah Pajak Dalam Bahasa InggrisDocument2 pagesIstilah Pajak Dalam Bahasa Inggrisroida hasugianNo ratings yet

- INV0003114227 - 2021 Geobank Renewal - Brazil GB0432Document1 pageINV0003114227 - 2021 Geobank Renewal - Brazil GB0432Dailison SilvaNo ratings yet

- Acknowledgement Receipt: The Ark Vehicle Trading & General Merchandise IncDocument1 pageAcknowledgement Receipt: The Ark Vehicle Trading & General Merchandise IncJoseph S. Palileo Jr.No ratings yet

- Tax Rates Card 2023 GC - 220819 - 230837Document5 pagesTax Rates Card 2023 GC - 220819 - 230837smnomanNo ratings yet

- Mxbar - PL - Oper: Auto Invoice Execution and Validation ReportDocument4 pagesMxbar - PL - Oper: Auto Invoice Execution and Validation ReportAntonio Arroyo SolanoNo ratings yet

- FRFRDocument3 pagesFRFRNaeem AhmadNo ratings yet

- Mepco Full BillDocument1 pageMepco Full Billfaheemhashmi7050No ratings yet

- BilledStatements 4806 16-10-22 18.18Document2 pagesBilledStatements 4806 16-10-22 18.18Harsh NawariaNo ratings yet

- New Union Bank StatementDocument4 pagesNew Union Bank StatementAshish kumar100% (1)

- Appendix 48 - PCVDocument13 pagesAppendix 48 - PCVHelen Paragas Solivar AranetaNo ratings yet

- United Airlines V CIRDocument1 pageUnited Airlines V CIRiciamadarangNo ratings yet