Professional Documents

Culture Documents

Solved Return To The Rona Delivery Truck Example in Exhibit 10 5

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Return To The Rona Delivery Truck Example in Exhibit 10 5

Uploaded by

Anbu jaromiaCopyright:

Available Formats

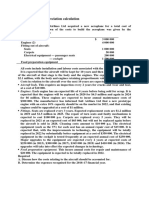

(SOLVED) Return to the RONA delivery truck example in

Exhibit 10 5

Return to the RONA delivery truck example in Exhibit 10 5 Return to the RONA delivery truck

example in Exhibit 10-5 on page 589. Suppose RONA sold the truck on December 31, 2016, for

$31,000 cash, after using the truck for three full years. Amortization for 2016 has already been

[…]

On March 31 2014 JetHapppy Airways purchased a used Boeing On March 31, 2014,

JetHapppy Airways purchased a used Boeing jet at a cost of $40,000,000. JetHappy expects to

fly the plane for six years and expects it to have a residual value of $4,000,000. Compute

JetHappy’s amortization on the […]

At the beginning of 2014 FlyFast Airways purchased a used At the beginning of 2014, FlyFast

Airways purchased a used Boeing aircraft at a cost of $50,000,000. FlyFast expects the plane

to remain useful for five years (6,000,000 miles) and to have a residual value of $4,000,000.

FlyFast expects the […]

FlyFast Airways repaired one of its Boeing 767 aircraft at FlyFast Airways repaired one of its

Boeing 767 aircraft at a cost of $600,000, which FlyFast paid in cash. FlyFast erroneously

capitalized this cost as part of the cost of the plane. How will this accounting error affect

FlyFast’s net […]

GET ANSWER- https://accanswer.com/downloads/page/1731/

EnCana the giant oil company holds huge reserves of oil EnCana, the giant oil company, holds

huge reserves of oil and gas assets. Assume that at the end of 2014, EnCana’s cost of oil and

gas assets totaled approximately $18 billion, representing 2.4 billion barrels of oil and gas

reserves […]

In 2012 Global Millwrights purchased a milling machine for 4 000 In 2012, Global Millwrights

purchased a milling machine for $4,000, debiting Milling Equipment. During 2012 and 2013,

Global recorded total amortization of $2,000 on the machine. In January 2014, Global traded in

the machine for a new one with […]

Use your answers to Exercise 9 13 to journalize Suncare Corporation s Use your answers to

Exercise 9-13 to journalize Suncare Corporation’s transactions as follows (round to the nearest

dollar): May 31 Sold a telecommunications system, receiving a 9-month, 10 percent, $200,000

note from the city of Edson, Alberta. Suncare […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1731/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Solved On July 13 2014 Caldwell Company Bought Equipment For 5 280Document1 pageSolved On July 13 2014 Caldwell Company Bought Equipment For 5 280Anbu jaromiaNo ratings yet

- Solved Westjet Airlines LTD Leases Aircraft and When Doing So TheDocument1 pageSolved Westjet Airlines LTD Leases Aircraft and When Doing So TheAnbu jaromiaNo ratings yet

- Solved Depreciation Information For Buckingham LTD Is Given in Be9 4 UsingDocument1 pageSolved Depreciation Information For Buckingham LTD Is Given in Be9 4 UsingAnbu jaromiaNo ratings yet

- Air Links A Commuter Airline Company Is Considering Replacing OneDocument1 pageAir Links A Commuter Airline Company Is Considering Replacing OneFreelance WorkerNo ratings yet

- Exercises Ppe PDFDocument6 pagesExercises Ppe PDFمعن الفاعوري100% (1)

- Tutorial 6 QsDocument6 pagesTutorial 6 QsDylan Rabin PereiraNo ratings yet

- Exercise On Chapter 2Document2 pagesExercise On Chapter 2Anwar Adem100% (3)

- Solved Pitt Reported The Following Information For 2018 and 2019 Required Compute Pitt SDocument1 pageSolved Pitt Reported The Following Information For 2018 and 2019 Required Compute Pitt SAnbu jaromiaNo ratings yet

- Solved Jesse Owns A Duplex Used As Residential Rental Property TheDocument1 pageSolved Jesse Owns A Duplex Used As Residential Rental Property TheAnbu jaromiaNo ratings yet

- Solved On January 2 2018 David Corporation Purchased A Patent ForDocument1 pageSolved On January 2 2018 David Corporation Purchased A Patent ForAnbu jaromiaNo ratings yet

- Chapter 9 ExercisesDocument2 pagesChapter 9 ExercisesAreeba QureshiNo ratings yet

- AIS16Exercises SCDocument6 pagesAIS16Exercises SCSarah GherdaouiNo ratings yet

- Assignment On DepreciationDocument4 pagesAssignment On DepreciationNouman MujahidNo ratings yet

- Chapter 8 - Handout (Student Version) - TaggedDocument5 pagesChapter 8 - Handout (Student Version) - TaggedSteven JiangNo ratings yet

- Solved Skiles Company S Weekly Payroll Amounts To 15 000 and Payday IsDocument1 pageSolved Skiles Company S Weekly Payroll Amounts To 15 000 and Payday IsAnbu jaromiaNo ratings yet

- Depreciation QuestionsDocument3 pagesDepreciation QuestionsAhmed Hayat WagganNo ratings yet

- At The Beginning of The Fiscal Year The Borland CompanyDocument1 pageAt The Beginning of The Fiscal Year The Borland CompanyTaimour HassanNo ratings yet

- Recitation #9Document5 pagesRecitation #9wtfNo ratings yet

- Since Opening in 2009 Akron Aviation Has Built Light AircraftDocument1 pageSince Opening in 2009 Akron Aviation Has Built Light AircraftAmit PandeyNo ratings yet

- Depreciation Problems With AnswersDocument1 pageDepreciation Problems With AnswersJHEZERIE NEPOMUCENONo ratings yet

- Topic 4 - Assets - Demonstration ExercisesDocument2 pagesTopic 4 - Assets - Demonstration ExercisesReenalNo ratings yet

- Assignment For Intermediate Financial Accounting IIDocument5 pagesAssignment For Intermediate Financial Accounting IIDawitNo ratings yet

- Group4 - IndiGo Airlines PDFDocument14 pagesGroup4 - IndiGo Airlines PDFNeeraj GargNo ratings yet

- Individual Assignment 1Document2 pagesIndividual Assignment 1Getiye LibayNo ratings yet

- Plant Assets, Natural Resources, and Intangible AssetsDocument47 pagesPlant Assets, Natural Resources, and Intangible Assetsshojib khan100% (1)

- Canada Canning Company Owns Processing Equipment That Had An InitialDocument1 pageCanada Canning Company Owns Processing Equipment That Had An Initialhassan taimourNo ratings yet

- Fall Semester - 2020 2021 Assignment IV - DepreciationDocument1 pageFall Semester - 2020 2021 Assignment IV - DepreciationJayagokul SaravananNo ratings yet

- Acct CH.7 H.W.Document8 pagesAcct CH.7 H.W.j8noelNo ratings yet

- Solved Java Hut Leased A Specialty Expresso Machine For A 10 YearDocument1 pageSolved Java Hut Leased A Specialty Expresso Machine For A 10 YearAnbu jaromiaNo ratings yet

- A Firm Is Considering Replacing A Machine That Has BeenDocument1 pageA Firm Is Considering Replacing A Machine That Has BeenFreelance WorkerNo ratings yet

- Comprehensive Fixed Asset Problem Darby Sporting Goods Inc Has PDFDocument1 pageComprehensive Fixed Asset Problem Darby Sporting Goods Inc Has PDFAnbu jaromiaNo ratings yet

- FA Project - Angela EditingDocument26 pagesFA Project - Angela EditingJustina SoonariNo ratings yet

- CH 09Document101 pagesCH 09Armand Muhammad100% (1)

- Practice Exercise Ch10Document2 pagesPractice Exercise Ch10Nguyễn Dương Thanh PhươngNo ratings yet

- PPE SticeDocument3 pagesPPE SticeLara Lewis Achilles100% (1)

- Templates: Your Own Sub Headline This Is An Example Text. Go Ahead and Replace It With Your Own TextDocument28 pagesTemplates: Your Own Sub Headline This Is An Example Text. Go Ahead and Replace It With Your Own TextsivapathasekaranNo ratings yet

- Thoma Cash FlowDocument2 pagesThoma Cash FlowflorentinaNo ratings yet

- Solved 1 Use The Data of Problem 5 6a To Prepare Anarel PDFDocument1 pageSolved 1 Use The Data of Problem 5 6a To Prepare Anarel PDFAnbu jaromiaNo ratings yet

- Pacific Airlines Operated Both An Airline and Several Rental CarDocument1 pagePacific Airlines Operated Both An Airline and Several Rental CarAmit PandeyNo ratings yet

- Pacific Airlines Operated Both An Airline and Several Rental CarDocument1 pagePacific Airlines Operated Both An Airline and Several Rental CarAmit PandeyNo ratings yet

- Depreciation CalculationDocument29 pagesDepreciation CalculationRavineahNo ratings yet

- Initial Cost of EquipmentDocument10 pagesInitial Cost of EquipmentRamin AminNo ratings yet

- PPE ExerciseDocument4 pagesPPE ExerciseLlyod Francis LaylayNo ratings yet

- 2021 COAF 4201 GroupsDocument16 pages2021 COAF 4201 GroupsTawanda Tatenda HerbertNo ratings yet

- C 5 A: P U B A: Hapter Cquisitions Urchase and Se of Usiness SsetsDocument17 pagesC 5 A: P U B A: Hapter Cquisitions Urchase and Se of Usiness SsetsKenKdwNo ratings yet

- Solved Freshfood Corp Has 3 000 000 of Convertible Bonds Payable Outstanding WithDocument1 pageSolved Freshfood Corp Has 3 000 000 of Convertible Bonds Payable Outstanding WithAnbu jaromiaNo ratings yet

- During 2010 Its First Year of Operations As A DeliveryDocument1 pageDuring 2010 Its First Year of Operations As A DeliveryM Bilal SaleemNo ratings yet

- Templates: Your Own Sub Headline This Is An Example Text. Go Ahead and Replace It With Your Own TextDocument28 pagesTemplates: Your Own Sub Headline This Is An Example Text. Go Ahead and Replace It With Your Own TextKashish GuptaNo ratings yet

- Extractor Company Leased A Machine On July 1 2015 UnderDocument1 pageExtractor Company Leased A Machine On July 1 2015 UnderMuhammad ShahidNo ratings yet

- 737-800 ExtnDocument6 pages737-800 ExtnIshmum Monjur NilockNo ratings yet

- Session 1b Accounting For AssetsDocument20 pagesSession 1b Accounting For AssetsFeku RamNo ratings yet

- Sampson Corporation Was Organized in 2014 To Operate A Financial PDFDocument1 pageSampson Corporation Was Organized in 2014 To Operate A Financial PDFLet's Talk With HassanNo ratings yet

- Chapter 10: Plant Assets, Natural Resources and Intangibles Important TermsDocument2 pagesChapter 10: Plant Assets, Natural Resources and Intangibles Important TermsMarwan DawoodNo ratings yet

- Crisis and Debt Restructuring at Kingfisher AirlinesDocument5 pagesCrisis and Debt Restructuring at Kingfisher AirlinesAnk's SinghNo ratings yet

- ACCT550 Homework Week 6Document6 pagesACCT550 Homework Week 6Natasha DeclanNo ratings yet

- Solved Lento Inc Owned Machinery With A 30 000 Initial Cost BasisDocument1 pageSolved Lento Inc Owned Machinery With A 30 000 Initial Cost BasisAnbu jaromiaNo ratings yet

- CH 09Document94 pagesCH 09Sahar YehiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Montacargas Caterpillar P5000Document26 pagesMontacargas Caterpillar P5000Eslizalde Rh100% (2)

- Woodward 37414 CDocument66 pagesWoodward 37414 CmdcurtoNo ratings yet

- Diagrams: N35-40ZRS, N30ZDRS (B265) N35ZDR, N45ZR (D264) N30ZDR, N35-40ZR (E470)Document28 pagesDiagrams: N35-40ZRS, N30ZDRS (B265) N35ZDR, N45ZR (D264) N30ZDR, N35-40ZR (E470)MONTACARGAS AVS100% (3)

- ECER14: Seat Belt Anchorage Strength TestDocument4 pagesECER14: Seat Belt Anchorage Strength TestArunkumarNo ratings yet

- NDT Requirements & Heat Treatment As Per ASME 19.05.2016Document6 pagesNDT Requirements & Heat Treatment As Per ASME 19.05.2016dileepaNo ratings yet

- CoolingDocument51 pagesCoolingnikoskarandinosNo ratings yet

- CokingDocument3 pagesCokingRavi Kumar TalikotaNo ratings yet

- Multistage Pump RepairDocument5 pagesMultistage Pump RepairCheyanSathishNo ratings yet

- Noise Pollution in PalawanDocument30 pagesNoise Pollution in Palawanĸěřbў mŏňNo ratings yet

- 365 Units: MR Malik Feroz KhanDocument2 pages365 Units: MR Malik Feroz KhanAzeem TalibNo ratings yet

- Carbon Footprint Reduction in The Textile Process ChainDocument6 pagesCarbon Footprint Reduction in The Textile Process ChainAnonymous Zsi5ODm2PYNo ratings yet

- Fonte de Alimentação 24V FMDocument1 pageFonte de Alimentação 24V FMJardenson CésarNo ratings yet

- Transmission LinesDocument60 pagesTransmission LinesJoshua RefeNo ratings yet

- NapajanjeDocument8 pagesNapajanjeМилан ЛукићNo ratings yet

- Research Work Week 14Document5 pagesResearch Work Week 14jonas lintagNo ratings yet

- YORK YVAA Air Cooled VSD Chiller Presentation Part 1Document40 pagesYORK YVAA Air Cooled VSD Chiller Presentation Part 1iga9481100% (4)

- Eaton Control Panel Design Guide NewarkDocument36 pagesEaton Control Panel Design Guide NewarkDavid LucioNo ratings yet

- Duncan TeaDocument1 pageDuncan TeaVinayBaleNo ratings yet

- Fixed Frequency Flyback Controller With Ultra-Low No Load Power ConsumptionDocument29 pagesFixed Frequency Flyback Controller With Ultra-Low No Load Power ConsumptionFabian OrtuzarNo ratings yet

- For Sustainable Energy: Our VisionDocument140 pagesFor Sustainable Energy: Our VisionSam ChanNo ratings yet

- Industry Guest Lecture On Heat TransferDocument28 pagesIndustry Guest Lecture On Heat TransferAsif SunnyNo ratings yet

- 17bec0026 Physics Da-1Document47 pages17bec0026 Physics Da-1gautamNo ratings yet

- Ha Red A 787986240Document30 pagesHa Red A 787986240tarun_aggarwaly5712No ratings yet

- General: FM-200/Micro 1002Document16 pagesGeneral: FM-200/Micro 1002durokNo ratings yet

- The Induction Motor - A Short Circuited Rotating Transformer - A Comparative Analysis C1503021014Document5 pagesThe Induction Motor - A Short Circuited Rotating Transformer - A Comparative Analysis C1503021014mkdir911No ratings yet

- LESCO - Duplicate Bill 2Document1 pageLESCO - Duplicate Bill 2dcivilhydelNo ratings yet

- BVS3000 Operation ManualDocument14 pagesBVS3000 Operation ManualTJ 4 SectionNo ratings yet

- Reverse Super Heater Fouling at AlpacDocument19 pagesReverse Super Heater Fouling at AlpacGAMING ChannelNo ratings yet

- RP F107 PDFDocument45 pagesRP F107 PDFPriyam KmNo ratings yet

- List of Provisionally Approved Companies RW 12Document2 pagesList of Provisionally Approved Companies RW 12saqibNo ratings yet