Professional Documents

Culture Documents

Financial Reporting Mcom 3 Semester: Assets

Uploaded by

Yasir AminOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Reporting Mcom 3 Semester: Assets

Uploaded by

Yasir AminCopyright:

Available Formats

FINANCIAL REPORTING

MCOM 3rd SEMESTER

TOTAL MARKS 50

TIME ALLOWED 2 HOURS

Q1. You have been given the following information relating to a limited liability company called

Abdullah and Co. This company is preparing financial statements for the year ended 31 May 2020.

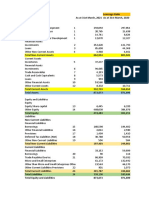

STATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED 31 MAY 2020

RS.'000

Revenue 66,600

Cost of sales (13,785)

Gross profit 52,815

Distribution costs (7,530)

Administrative expenses (2,516)

Investment income 146

Finance cost (1,177)

Profit before tax 41,738

Tax (9,857)

Profit for the year 31,881

Retained earnings brought forward at 1 June 2019 28,063

Retained earnings carried forward at 31 May 2020 59,944

STATEMENTS OF FINANCIAL POSITION AS AT 31 MAY

2020 2019

RS. 000 RS.000

Assets

Non-current assets

Cost 144,844 114,785

Accumulated depreciation (27,433) (26,319)

117,411 88,466

Current assets

Inventory 24,931 24,065

Trade receivables 18,922 13,238

Cash 3,689 2,224

47,542 39,527

Total assets 164,953 127,993

Equity and liabilities

Equity

Ordinary share capital 27,000 23,331

Share premium 14,569 10,788

Revaluation surplus 15,395 7,123

Retained earnings 59,944 28,063

Noncurrent liabilities 116,908 69,305

6% loan note 17,824 24,068

Current liabilities

Bank overdraft 5,533 6,973

Trade payables 16,699 20,324

Taxation 7,989 7,323

30,221 34,620

Total equity and liabilities 164,953 127,993

Additional information

During the year ended 31 May 2020, the company sold a piece of equipment for

Rs.3,053,000, realizing a profit of Rs.1,540,000. There were no other disposals of non-

current assets during the year.

Depreciation of Rs.5,862,000 has been charged.

There were no amounts outstanding in respect of interest payable or receivable as at 31

May 2019 or 2020.

There were no dividends paid or declared during the year.

Based on the above information

Q1. Prepare cash flow from operating activity 15 marks

Q2. Cash flow from investing Activity 10 Marks

Q3 Cash flow from financing activity 10 marks

Q4.

Define components of financial statements in lights of IAS 1 in detail including purpose and basis

of preparing each components. (10 Marks)

Q5s.

Define format of each component allowed by IAS 1 with illustrative example. (5 Marks)

You might also like

- Fusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司Document22 pagesFusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司in resNo ratings yet

- Jaiz Bank Q1 2019 financial statementsDocument44 pagesJaiz Bank Q1 2019 financial statementsMusodiq AbolarinNo ratings yet

- Audited Financial Statements of NKR Engineering (Private) LimitedDocument19 pagesAudited Financial Statements of NKR Engineering (Private) LimitedMustafa hadiNo ratings yet

- Ecopack Limited Financial StatementsDocument84 pagesEcopack Limited Financial StatementspolodeNo ratings yet

- Mobile Telecommunications Company Saudi ArabiaDocument28 pagesMobile Telecommunications Company Saudi ArabiaAliNo ratings yet

- BOC Kenya H1 2020 Group ResultsDocument2 pagesBOC Kenya H1 2020 Group ResultsValamunis DomingoNo ratings yet

- HKSE Interim Results AnnouncementDocument34 pagesHKSE Interim Results Announcementin resNo ratings yet

- CIPLADocument10 pagesCIPLAMAGOMU DAN DAVIDNo ratings yet

- Audit Report For Azahar Trading Ltd.Document11 pagesAudit Report For Azahar Trading Ltd.Muhammad Humayun IslamNo ratings yet

- Cocoaland Holdings 2Q19 resultsDocument14 pagesCocoaland Holdings 2Q19 resultsSajeetha MadhavanNo ratings yet

- Greenko - Investment - Company - Audited - Combined - Financial - Statements - FY 2018 - 19Document102 pagesGreenko - Investment - Company - Audited - Combined - Financial - Statements - FY 2018 - 19hNo ratings yet

- Allied latterDocument58 pagesAllied latterahmedkanewwiseNo ratings yet

- Antler Fabric Printers (PVT) LTD 2016Document37 pagesAntler Fabric Printers (PVT) LTD 2016IsuruNo ratings yet

- Condensed Quarterly Accounts (Un-Audited)Document10 pagesCondensed Quarterly Accounts (Un-Audited)Perah ShaikhNo ratings yet

- Total Nigeria PLC Financial Statements for Q1 2015Document44 pagesTotal Nigeria PLC Financial Statements for Q1 2015ADEYEMI AZEEZ KakaNo ratings yet

- The WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Document4 pagesThe WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Mohammad Abram MaulanaNo ratings yet

- Accounting Information System HomeWork 1 Jazan UniversityDocument7 pagesAccounting Information System HomeWork 1 Jazan Universityabdullah.masmaliNo ratings yet

- Panasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalDocument12 pagesPanasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalGan ZhiHanNo ratings yet

- Vietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Document24 pagesVietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Như ThảoNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Financial Statement 7EDocument9 pagesFinancial Statement 7ENurin SyazarinNo ratings yet

- 08 MWSS2020 - Part1 FSDocument6 pages08 MWSS2020 - Part1 FSGabriel OrolfoNo ratings yet

- Note 2019: Income StatementDocument19 pagesNote 2019: Income StatementSyeda Sarwish RizviNo ratings yet

- SHV Port - FS English 31 Dec 2019 - SignedDocument54 pagesSHV Port - FS English 31 Dec 2019 - SignedNithiaNo ratings yet

- Bawang International (Group) Holding Limited 霸 王 國 際( 集 團 )控 股 有 限 公 司Document23 pagesBawang International (Group) Holding Limited 霸 王 國 際( 集 團 )控 股 有 限 公 司william zengNo ratings yet

- Aritzia Inc. Q1 2021 FSDocument25 pagesAritzia Inc. Q1 2021 FSKevin GitauNo ratings yet

- Alasseel Financial ResultsDocument17 pagesAlasseel Financial ResultsmohamedNo ratings yet

- HKEX Interim ResultsDocument39 pagesHKEX Interim Resultsin resNo ratings yet

- Greenko Investment Company Financial StatementsDocument93 pagesGreenko Investment Company Financial StatementsDSddsNo ratings yet

- Scotiabank Peru Financial Statements - 2018Document80 pagesScotiabank Peru Financial Statements - 2018Juan CalfunNo ratings yet

- UAS ALK Ganjil 2018-2019 SulasDocument10 pagesUAS ALK Ganjil 2018-2019 SulasZulkarnainNo ratings yet

- Hotel RoyalDocument28 pagesHotel RoyalFasasi Abdul Qodir AlabiNo ratings yet

- A Wholly-Owned Subsidiary of Philippine National Oil CompanyDocument4 pagesA Wholly-Owned Subsidiary of Philippine National Oil CompanyLolita CalaycayNo ratings yet

- Section A - Answer Question One (Compulsory Question)Document5 pagesSection A - Answer Question One (Compulsory Question)Adeel KhalidNo ratings yet

- HK-Listed Fu Shou Yuan's 2019 Annual ResultsDocument48 pagesHK-Listed Fu Shou Yuan's 2019 Annual ResultsJ. BangjakNo ratings yet

- Preparation of Financial StatementsDocument12 pagesPreparation of Financial StatementsPrincessNo ratings yet

- Arab Sudanese Bank Financial Statements 2018Document30 pagesArab Sudanese Bank Financial Statements 2018Shadow PrinceNo ratings yet

- Financial Statements 2021Document6 pagesFinancial Statements 2021Shehzad QureshiNo ratings yet

- March 2021 Nine Month Orion PharmaDocument26 pagesMarch 2021 Nine Month Orion PharmaAfia Begum ChowdhuryNo ratings yet

- Audi Aulia S (1814190008) - Tugas P5 Akuntansi InternasionalDocument17 pagesAudi Aulia S (1814190008) - Tugas P5 Akuntansi InternasionalAuliaNo ratings yet

- HKEx Financial Data 14chDocument12 pagesHKEx Financial Data 14chzakkNo ratings yet

- Fin - AnalysisDocument2 pagesFin - Analysisajignacio.05No ratings yet

- 02 BacarraIN2020 FSDocument9 pages02 BacarraIN2020 FSRichard MendezNo ratings yet

- IHC Financial Statments For Period Ended 30 September 2020 - English PDFDocument40 pagesIHC Financial Statments For Period Ended 30 September 2020 - English PDFHafisMohammedSahibNo ratings yet

- Quarterly Report 20200930Document18 pagesQuarterly Report 20200930Ang SHNo ratings yet

- Bursa Q3 2015 FinalDocument16 pagesBursa Q3 2015 FinalFakhrul Azman NawiNo ratings yet

- HBL Financial Statements for the nine months ended September 30, 2022Document69 pagesHBL Financial Statements for the nine months ended September 30, 2022Irfan MasoodNo ratings yet

- WWF Indonesia Foundation 2022 Financial StatementsDocument4 pagesWWF Indonesia Foundation 2022 Financial StatementsnellyNo ratings yet

- Grumpy Cat Company Comparative Statements of Financial Position December 31, 2020 and 2019 2020 2019 AssetsDocument2 pagesGrumpy Cat Company Comparative Statements of Financial Position December 31, 2020 and 2019 2020 2019 AssetsKatherine GablinesNo ratings yet

- Dynamic FileDocument90 pagesDynamic FileEN Al-massNo ratings yet

- Example For Financial Statement AnalysisDocument2 pagesExample For Financial Statement AnalysisMobile Legends0% (1)

- SCALP Handout 040Document2 pagesSCALP Handout 040Eren CuestaNo ratings yet

- SCALP Handout 040Document2 pagesSCALP Handout 040Cher NaNo ratings yet

- SCALP Handout 040Document2 pagesSCALP Handout 040Cher NaNo ratings yet

- Parcial InglesDocument7 pagesParcial InglesJorge CastilloNo ratings yet

- Directors' Report Highlights Q1 2018 Financial ResultsDocument24 pagesDirectors' Report Highlights Q1 2018 Financial ResultsAsma RehmanNo ratings yet

- Leverage RatioDocument3 pagesLeverage RatioRahul PrasadNo ratings yet

- Q2 2019 Interim Financial Statements Brick Brewing CoDocument12 pagesQ2 2019 Interim Financial Statements Brick Brewing CoyanaNo ratings yet

- Orascom Development Holding AG 3 Months 2020 Financial StatementsDocument28 pagesOrascom Development Holding AG 3 Months 2020 Financial StatementsTawfeeg AwadNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Business Tax CalculationDocument4 pagesBusiness Tax CalculationYasir AminNo ratings yet

- Final-term Exam InstructionsDocument1 pageFinal-term Exam InstructionsYasir AminNo ratings yet

- BRM Paper Mcom MorningDocument3 pagesBRM Paper Mcom MorningYasir AminNo ratings yet

- EVEN Taxation Paper 2021 EVEN 2,4,6,8,0Document4 pagesEVEN Taxation Paper 2021 EVEN 2,4,6,8,0Yasir AminNo ratings yet

- Please Follow The Instructions CarefullyDocument3 pagesPlease Follow The Instructions CarefullyYasir AminNo ratings yet

- RB - EconomyDocument10 pagesRB - EconomyYasir AminNo ratings yet

- Value Proposition Tool PDFDocument1 pageValue Proposition Tool PDFYasir AminNo ratings yet

- Topi Csofassi Gnment SDocument4 pagesTopi Csofassi Gnment SYasir AminNo ratings yet

- Lecture Common Stock ValuationDocument31 pagesLecture Common Stock ValuationYasir AminNo ratings yet

- Topi Csofassi Gnment SDocument4 pagesTopi Csofassi Gnment SYasir AminNo ratings yet

- BMI - Business Model CanvasDocument1 pageBMI - Business Model CanvasDario Bernardo Montufar BlancoNo ratings yet

- Topi Csofassi Gnment SDocument4 pagesTopi Csofassi Gnment SYasir AminNo ratings yet

- Value Proposition Tool PDFDocument1 pageValue Proposition Tool PDFYasir AminNo ratings yet

- Value Proposition Design ToolTM for Positive Customer ExperienceDocument1 pageValue Proposition Design ToolTM for Positive Customer ExperienceYasir AminNo ratings yet

- 7C's AssignmentDocument5 pages7C's AssignmentYasir AminNo ratings yet

- NetworkingDocument5 pagesNetworkingYasir AminNo ratings yet

- PepsiCo marketing report analysisDocument19 pagesPepsiCo marketing report analysisYasir AminNo ratings yet

- MS - International Reporting ISAE 3000Document166 pagesMS - International Reporting ISAE 3000zprincewantonxNo ratings yet

- Aws D14.4 D14.4MDocument134 pagesAws D14.4 D14.4Mgeorgadam198380% (5)

- Research Paper On Tik TokDocument23 pagesResearch Paper On Tik Tokaskaboutaccounts2187100% (2)

- Unit 2 Export Policy Framework: 2.0 ObjectivesDocument11 pagesUnit 2 Export Policy Framework: 2.0 ObjectiveskajalNo ratings yet

- Burwood Council LSPS Summary OnlineDocument3 pagesBurwood Council LSPS Summary OnlineDorjeNo ratings yet

- Review Quality Assurance PDFDocument339 pagesReview Quality Assurance PDFBelayneh TadesseNo ratings yet

- Moises Sanchez-Zaragoza, A077 273 744 (BIA July 14, 2016)Document8 pagesMoises Sanchez-Zaragoza, A077 273 744 (BIA July 14, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Advantages and Disadvantages For Nurses of Using Social MediaDocument3 pagesAdvantages and Disadvantages For Nurses of Using Social Mediajoana marie reyesNo ratings yet

- Linux Commands NetDocument5 pagesLinux Commands NetAditya KumarNo ratings yet

- Mariemar Villaroza ResearchDocument4 pagesMariemar Villaroza ResearchRhie VillarozaNo ratings yet

- I T CDocument57 pagesI T C33swati100% (7)

- HolaDocument5 pagesHolaioritzNo ratings yet

- Secured Party Creditor Payment Cover LetterDocument2 pagesSecured Party Creditor Payment Cover LetterlandmarkchurchofhoustonNo ratings yet

- Chapter 11Document48 pagesChapter 11Rasel SarkerNo ratings yet

- ABDULLAH BOZKURT - Iran Plays Subversive Role in Turkey PDFDocument4 pagesABDULLAH BOZKURT - Iran Plays Subversive Role in Turkey PDFAnonymous Bbxx7Z9No ratings yet

- IDCF Guidelines 2016Document47 pagesIDCF Guidelines 2016anunad100% (2)

- Chapter 7: UNEMPLOYMENT: Definition Of: (United Nations)Document16 pagesChapter 7: UNEMPLOYMENT: Definition Of: (United Nations)Alok RanjanNo ratings yet

- Tom Barry - International Skateboarder!: Lesson 2 HomeworkDocument1 pageTom Barry - International Skateboarder!: Lesson 2 HomeworkMr TrungNo ratings yet

- Encuesta Sesión 6 - Inglés 3 - Septiembre 29 - Prof. Oscar NiquénDocument3 pagesEncuesta Sesión 6 - Inglés 3 - Septiembre 29 - Prof. Oscar NiquénRobacorazones TkmNo ratings yet

- Songbook: E-MailDocument25 pagesSongbook: E-Mailkarol_surovy0% (1)

- Encyclopedia Galactica (1979)Document60 pagesEncyclopedia Galactica (1979)Eric Paddon100% (8)

- Nota StrategicDocument2 pagesNota StrategicFakhruddin FakarNo ratings yet

- Functions of MoneyDocument15 pagesFunctions of MoneyRidhima MathurNo ratings yet

- Ias 19 NotesDocument41 pagesIas 19 NotesTanyahl MatumbikeNo ratings yet

- CCC Letter To CPMGDocument3 pagesCCC Letter To CPMGAjay PandeyNo ratings yet

- Dwnload Full South Western Federal Taxation 2019 Essentials of Taxation Individuals and Business Entities 22nd Edition Raabe Test Bank PDFDocument36 pagesDwnload Full South Western Federal Taxation 2019 Essentials of Taxation Individuals and Business Entities 22nd Edition Raabe Test Bank PDFsuidipooshi100% (10)

- DeweyDecimalClassificationChart PDFDocument1 pageDeweyDecimalClassificationChart PDFAdrian ValdesNo ratings yet

- EEDI and SEEMP Guide for Yachts and OSVsDocument3 pagesEEDI and SEEMP Guide for Yachts and OSVskuruvillaj2217No ratings yet

- RizalDocument14 pagesRizalJohn Christopher BadiolaNo ratings yet

- ProCapture-T User Manual V1.1 - 20210903 PDFDocument65 pagesProCapture-T User Manual V1.1 - 20210903 PDFahmad khanNo ratings yet