Professional Documents

Culture Documents

Supply Demand Money

Uploaded by

didi chen0 ratings0% found this document useful (0 votes)

8 views2 pagesOriginal Title

supply demand money

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesSupply Demand Money

Uploaded by

didi chenCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Supply and Demand for Money

In an economy, the concept of supply and demand is always prevalent in different

aspects. For instance, money; it is an integral part in the functions of an economy and is widely

used as a medium of exchange for commodities and services. Money is also used daily by

individuals, businesses, governments and the like for many purposes. This may be used for

essentials and necessities, for business operations, for financial support, and more. Hence, it is

clearly demanded by what comprises the entirety of an economy. With that, questions such as:

where does money come from, how does money circulate in an economy, and who utilizes this

money, often arise regarding such topics. In this paper, it will tackle the topics of money supply,

money creation, and money multiplier, which will answer these questions and give an overview

of how the supply and demand for money functions in an economy. It will also deal with the

concept of economic indicators, as it is also related on how it influences the supply and demand

for money.

To begin with, the supply for money is created and given by central banks, which is then

distributed to other commercial banks who provides services of loans and deposits for

individuals and entities in an economy. The demand for money can be categorized into three:

transaction demand, money needed for purchasing goods; precautionary demand, money needed

for unexpected financial emergencies; and asset motive/speculative demand, money used for

purchasing assets and investments. With that, there is the process of money creation. For

instance, the government’s spending comes from taxes, however, this can also be financed in

another way such as a bond. A bond is promise to pay a certain amount of money, including

interest, after a certain period which then constitutes a debt obligation. The government secures a

bond from the central bank in order to meet the costs for the society. The money circulating in

this process is what drives the economy. Moreover, money creation is regulated by central banks,

as they are also who decides the level of money creation in an economy. It is also a leading

process for the increase in money supply.

In relation to money generating from central banks, it is also involved with the concept of

money supply This entails that the total stock of money circulating in an economy is measured

by the money supply. It includes stock of notes or other money equivalents that can be easily

converted to cash which is referred to as narrow money or M0. While there is also broad money

or M4 which is comprised of notes, plus coins, plus deposits in bank accounts, and other liquid

assets. With this, money supply is a basis on how money circulates in the economy, as it

measures the total supply or stock of money at a given point in time. Money supply is also

controlled by central banks; this is because they dictate the interest rates, the printing of new

money, and the like, which in turn can either increase or decrease the money supply. Moreover,

individuals, or entities such as businesses or corporations either go to banks for a loan, or to

deposit money for their savings. Hence, when these individuals and entities deposit their money

in banks, the banks then use a fraction of this money as a reserve for those who apply for loans.

This is referred to as fractional reserve banking, which is commonly discussed under the money

multiplier.

In continuance from the topic firstly mentioned, money multiplier is simply one (1)

divided by the reserve ratio. This means that in each dollar/peso the banks generate, there is an

increase in additional money to circulate in the economy. Furthermore, banks also often use the

fractional reserve banking, which is a system that states a fraction of bank deposits are reserved

by actual cash on hand and is also available for withdrawal. This entails that banks cannot lend

one’s entire deposit, but only a fraction of it, as the rest are reserved. In money multiplier, it

plays a large part of in money creation. This is because a greater portion of money is carried out

by commercial banks that provide credit, or loans from individuals to businesses. When a loan is

granted, the bank uses its collected deposits from its customers to finance this credit with added

interest. This forms the supply and demand for money in an economy.

In addition to these topics, there are also economic indicators that influences the supply

and demand for money. Firstly, the primary economic indicator which is the Gross Domestic

Product (GDP), shows the overall performance of an economy. It consists of, consumption,

investment, government expenditure, and net exports. The relation of GDP to the supply for

money is important since is shows the impact such. For example, when the GDP shows an

increase in economic productivity, the value of money in circulation rises. Another economic

indicator is inflation. This is because it presents a significant effect on an economy, as well as its

effect on money supply. When central banks decide to produce more money, there will be an

increase in the money supply, which will cause inflation. Hence, when there is inflation, the

demand for money will also be affected depending on the money circulating the economy.

In conclusion, money is used in the day to day lives of individuals and entities in an

economy. This is either through loans, and incomes which then can be turned into deposits

primarily for banks. There is always a demand for money, and the central bank is the main

supplier for such. It controls the interest rates, the money circulating the economy, and

ultimately, the people who utilizes it, such as individuals, businesses, and governments.

Furthermore, there are also the concepts of money creation, money supply, and money multiplier

which aids in the understanding of supply and demand for money. Economic indicators, such as

GDP and inflation are linked in the supply and demand for money, as it indicates the impact and

influence on the overall economy.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Treasury Management: - Functions and OperationsDocument40 pagesTreasury Management: - Functions and Operationsdidi chen100% (2)

- Asian Academy For Excellence Foundation, Inc.: Practical Accounting 2-Cost CPA Review O2017Document6 pagesAsian Academy For Excellence Foundation, Inc.: Practical Accounting 2-Cost CPA Review O2017didi chenNo ratings yet

- Monetary Policy: Jump To Navigation Jump To SearchDocument27 pagesMonetary Policy: Jump To Navigation Jump To Searchdidi chenNo ratings yet

- Uneven Regulatory Playing Field and Bank Transparency AbroadDocument4 pagesUneven Regulatory Playing Field and Bank Transparency Abroaddidi chenNo ratings yet

- Monpol 3fm5 Deleon KamylleDocument1 pageMonpol 3fm5 Deleon Kamylledidi chenNo ratings yet

- Fundamental Analysis Vs Technical AnalysisDocument2 pagesFundamental Analysis Vs Technical Analysisdidi chenNo ratings yet

- ABARQUEZ, Fritzie Anne E. AGPALASIN, Frances Audree E. DE GUZMAN, Junierose Ann E. DE LEON, Kamylle Anne T. 2FM5Document27 pagesABARQUEZ, Fritzie Anne E. AGPALASIN, Frances Audree E. DE GUZMAN, Junierose Ann E. DE LEON, Kamylle Anne T. 2FM5didi chenNo ratings yet

- REVIEW OF PRINCIPLES - Derivatives (Part 2) DELEONDocument2 pagesREVIEW OF PRINCIPLES - Derivatives (Part 2) DELEONdidi chenNo ratings yet

- Health Education Teaches About PhysicalDocument4 pagesHealth Education Teaches About Physicaldidi chenNo ratings yet

- STS Reflective Narrative RubricsDocument2 pagesSTS Reflective Narrative Rubricsdidi chenNo ratings yet

- REVIEW OF PRINCIPLES - DerivativesDocument2 pagesREVIEW OF PRINCIPLES - Derivativesdidi chenNo ratings yet

- Juridical Persons: Prescriptions in GeneralDocument4 pagesJuridical Persons: Prescriptions in Generaldidi chenNo ratings yet

- Enforce Contributions From Its Subjects ToDocument3 pagesEnforce Contributions From Its Subjects Todidi chenNo ratings yet

- Legal DocsDocument1 pageLegal Docsdidi chenNo ratings yet

- Bridge Drawings (Part II) For SRCTIP-DOR-W-NNM-ICB-3Document27 pagesBridge Drawings (Part II) For SRCTIP-DOR-W-NNM-ICB-3Santosh AryalNo ratings yet

- Minutes of Board of Directors Meeting 2Document3 pagesMinutes of Board of Directors Meeting 2Multiplan RINo ratings yet

- Rera Report6919 PDFDocument78 pagesRera Report6919 PDFPawan RanjanNo ratings yet

- XXFIN OTA GL Account Analysis 120921 1Document24 pagesXXFIN OTA GL Account Analysis 120921 1mahendra kumarNo ratings yet

- NullDocument153 pagesNullapi-258902630% (1)

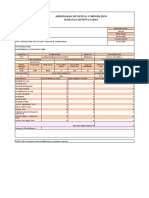

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDocument1 pageAhmedabad Municipal Corporation Mahanagar Sewa SadanGOLD COINNo ratings yet

- Sharing Capex DemandDocument277 pagesSharing Capex DemandUD BLOGNo ratings yet

- Malta Comp Reg & TaxDocument5 pagesMalta Comp Reg & TaxGigi LunetteNo ratings yet

- Ariyalur District BrochureDocument14 pagesAriyalur District BrochureKB_mitNo ratings yet

- Weakness: Mpesa: PSB Krishna - Bharghava Chaitanya - Pushkar ShuklaDocument6 pagesWeakness: Mpesa: PSB Krishna - Bharghava Chaitanya - Pushkar ShuklakrishnaNo ratings yet

- Tax DigestsDocument206 pagesTax DigestsPio Guieb AguilarNo ratings yet

- Galvanic Spa SumplesDocument14 pagesGalvanic Spa Sumplesdandusha100% (3)

- Vietnamese Railway 28.2.2019Document12 pagesVietnamese Railway 28.2.2019Phạm Tiến ĐạtNo ratings yet

- James Robertson Financial Disclosure Report For 2010Document7 pagesJames Robertson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Fundamental Principles of Taxation in The Light of Modern DevelopmentsDocument222 pagesFundamental Principles of Taxation in The Light of Modern Developmentsaveros12No ratings yet

- PENGENALAN TTL Rev 1 PDFDocument25 pagesPENGENALAN TTL Rev 1 PDFJoni IrawanNo ratings yet

- J500873620 EneroDocument11 pagesJ500873620 Eneroimportadora vencairoNo ratings yet

- A Presentation On GATTDocument34 pagesA Presentation On GATTVinod Menon100% (2)

- Low Fouling, High Temperature Air Preheaters For The Carbon Black IndustryDocument3 pagesLow Fouling, High Temperature Air Preheaters For The Carbon Black IndustryffownNo ratings yet

- Sy B.com Corporate Finance I Nbixwlvtx4Document2 pagesSy B.com Corporate Finance I Nbixwlvtx4Madhuram SharmaNo ratings yet

- Knitted Garment PDFDocument9 pagesKnitted Garment PDFkvNo ratings yet

- Defaulter List For 2011-2012 Aug (2) CurrentDocument20 pagesDefaulter List For 2011-2012 Aug (2) CurrentpsapalikarNo ratings yet

- TripuraDocument2 pagesTripuraSAYAN SAHUNo ratings yet

- IndiaDocument36 pagesIndiaAbhishek ParasherNo ratings yet

- MLM Basic CourseDocument64 pagesMLM Basic CourseKarlo Mikhail MongayaNo ratings yet

- NepalDocument9 pagesNepalShady ElawadlyNo ratings yet

- Tata STRIVE Skill Development Centre Launched in HyderabadDocument2 pagesTata STRIVE Skill Development Centre Launched in HyderabadAnkita NimbaleNo ratings yet

- ShoeDocument1 pageShoePRASHANT PRIYADARSHINo ratings yet

- ADVENT OF EUROPEANS IN INDIA - EnglishDocument5 pagesADVENT OF EUROPEANS IN INDIA - EnglishsubhankaraichNo ratings yet

- VACANCY Technician-1-Ore-Control-2023Document2 pagesVACANCY Technician-1-Ore-Control-2023normanNo ratings yet