Professional Documents

Culture Documents

Health Plan Funding

Uploaded by

MCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Health Plan Funding

Uploaded by

MCopyright:

Available Formats

THE MILES ORGANIZATION, INC.

Employers Have Choices In Funding Health Plans: Alternatives Explored, Self

Funding Detailed

Employers sponsoring medical or dental plans can finance such plans fully through insurance,

through self funding (or self insurance), or through some combination of the two. The following

summarizes various forms of funding, and details many of the questions to be asked by an employer

that is considering some degree of self funding.

Employers have several choices in financing their employees' health care coverage, and these choices range from fully

insured to fully self insured (or self funded). Alternative financing methods include these options:

z Fully-pooled insurance —“Fully insured” (prospective premium) is the traditional, fully insured financing

arrangement. An insurance company determines a premium rate per covered person and, in return, pays benefits and

provides other services related to the plan (for example, actuarial, legal communication, and underwriting services).

The rates are determined before the beginning of the plan year, hence, the term prospective premium. These rates may

be determined based on the employer's own claim experience, the insurer's “book of business,” or a combination of the

two.

z Minimum premium (partial self insurance) through an insurance carrier. This method reduces many of the elements

found in the retention component of the premium. Instead of paying the insurance company the full premium, the

employer pays a “minimum” premium each month. This monthly premium generally is equal to the retention

component. The employer also opens a bank account that the insurer uses to pay claims; each time a benefit payment is

paid, the employer funds the account for the amount of the payment. In a variation of this method, the employer may

negotiate with the insurer so that the reserves will be held as employer assets rather than with the insurer.

Because the money used to pay claims never goes through the insurance company's accounts, premium taxes do not

have to be paid on claim amounts. This eliminates about 90% of the premium tax payable. A minimum premium

contract is still an insured plan, and therefore, all state mandated benefits still apply. The insurer continues to provide

the same services that it provides a fully insured policyholder. If actual claims exceed the protected amount, the insurer

pays for this excess. If the insurer does pay for an excess, they may carry forward the payment to future years just like

any other conventionally insured funding method.

z Partial self insurance with stop loss reinsurance through an insurance carrier or third party administrator (TPA).

Stop-loss insurance for health care takes several forms. An employer can purchase specific stop loss insurance, which

reimburses for individual claims over a specified amount, aggregate stop loss insurance, which reimburses for group

claims that exceed a specified amount, or both specific and aggregate stop loss insurance. In addition, the stop loss

insurance will cover either the plan, in which case the reimbursement is made to beneficiaries, or the stop loss can

cover the employer, in which case reimbursement is made to the employer. If the stop loss is carried by the employer

and not the plan, the plan will be considered to be completely self funded for Form 5500 purposes.

z Complete self-insurance, in which the employer assumes all of the financial risk for providing health care benefits

to its employees. Typically, a self-insured employer will set up a special trust fund to earmark money (corporate and

employee contributions) to pay incurred claims. As noted above, self-insured plans with stop loss insurance that

reimburses the employer but not the plan are considered fully-self funded for Form 5500 purposes, because the plan

remains at risk for all of the incurred claims.

Copyright © 2006, CCH INCORPORATED. All rights reserved.

Why Self Fund?

According to the Self Insurance Institute of America, employers are most likely to consider self insurance because of

the following reasons:

z The employer can customize the plan to meet the specific health care needs of its work force, as opposed to

purchasing a “one-size-fits-all” insurance policy.

z The employer maintains control over the health plan reserves, enabling maximization of interest income —income

that would be otherwise generated by an insurance carrier through the investment of premium dollars.

z The employer does not have to pre-pay for coverage, thereby providing for improved cash flow.

z The employer is not subject to conflicting state health insurance regulations/benefit mandates, as self insured health

plans are regulated under federal law (ERISA).

z The employer is not subject to state health insurance premium taxes, which are generally 2-3% of the premium's

dollar value.

z The employer is free to contract with the providers or provider network best suited to meet the health care needs of

its employees.

Although self-insured plans escape state insurance laws and regulations, they nonetheless must comply with these

federal laws: the Employee Retirement Income Security Act (ERISA), Health Insurance Portability and Accountability

Act (HIPAA), Consolidated Omnibus Budget Reconciliation Act (COBRA), the Americans with Disabilities Act

(ADA), the Pregnancy Discrimination Act, the Age Discrimination in Employment Act (ADEA), the Civil Rights Act,

and various other budget reconciliation acts such as Tax Equity and Fiscal Responsibility Act (TEFRA), Deficit

Reduction Act (DEFRA), and the Economic Recovery Tax Act (ERTA).

Copyright © 2006, CCH INCORPORATED. All rights reserved.

Questions Employers Should Ask

Knowing the answers to the following questions will help employers decide whether or not to self fund:

z Is the plan an insured contract or some form of administrative services only (ASO)?

z Who settles claims?

z What is the minimum/fixed cost and what is the maximum claims liability (have you checked to see that the same

costs are included in each contract and the same census data is being utilized)?

z Are the minimum/fixed costs guaranteed? If not, how is final retention calculated?

z What is the maximum cost (or minimum fixed plus maximum claims liability)?

z What are the incurred and paid dates utilized in the specific and aggregate stop-loss? When changing insurance

carriers, there are always some claims still not received and processed by the current insurance carrier on the date

plans change. These claims must be processed by either the current carrier or the new insurance carrier or TPA.

contract settlement periods include —

z 12/12 (12 Months Incurred/12 Months Paid): Claims incurred and paid within the plan year.

z 12/15 (12 Months Incurred/15 Months Paid): Claims incurred within the plan year and paid within the plan year plus

three months following.

z 15/12 (15 Months Incurred/12 Months Paid): Claims incurred within the plan year plus three months prior, and paid

within the plan year.

z 14/12 (14 Months Incurred/12 Months Paid): Claims incurred within the plan year plus two months prior, and paid

within the plan year.

z 24/12 (24 Months Incurred/12 Months Paid): Claims incurred within the plan year plus 12 months prior, and paid

within the plan year. Second year (renewal) contracts become 24/12 or paid contracts.

z What is the level of the specific/pooling agreement? Are specific/pooling claims reimbursed, or does the carrier and

TPA assume payment responsibility as soon as the level is reached?

z Is the specific/pooling agreement based on one claim and is there an additional aggregating provision in the

agreement?

Assume a contract provision calling for a $35,000 specific stop loss with a $50,000 aggregating additional specific stop

loss. The reinsurer would not reimburse for a claim until the corporation has reached an additional $50,000 specific

stop loss incurred by one or more insureds who are over their $35,000 specific stop loss. All claims must be incurred

during the contract period.

z On what corridor is the aggregate stop loss/maximum claims liability based? The reinsurance or insurance carrier

will determine what it believes expected claims will be. It will use past claims and trend (inflation) to reach this

number. It will then inflate this number by 20%, 25% (most typical), 30%, or 35%, and this new number will become

the maximum claims liability or attachment point. For example, if expected claims are $1.2 million, a 25% corridor

increases the employer's maximum liability to $1.5 million.

As soon as claims reach $1.5 million, the employer would not have the liability, and the insurance company would

have liability for all claims in excess of $1.5 million. The employer would obviously like the lowest corridor (20%) so

the point where the insurance company gets involved will be lower. The lower the corridor the higher the premium.

z Can the corridor be increased and the fixed/ minimum cost decreased?

z Are aggregate/maximum claims liability reimbursed and do the carrier and TPA assume payment responsibility as

soon as the maximum is exceeded? Do the aggregate/maximum claims liability contracts contain a monthly rolling

aggregate?

Copyright © 2006, CCH INCORPORATED. All rights reserved.

z Can a claim deficit on the aggregate/maximum claims liability be applied to next year's contract if the contract is

renewed? If yes, how much and how is the carry forward amount arrived at? Can a claim deficit on the

aggregate/maximum claims liability be applied to next year's contract if the contract is terminated? If yes, how much

and how is the carry forward amount arrived at?

z Who holds and sets the amount for reserves or is there a terminal liability/run-out protection? The latter refers to

coverage the plan sponsor may purchase for claim run-off —if the plan sponsor terminates a partially self-funded plan,

it must still pay for claims incurred under the contract, but not paid by the end of the plan year. Under a fully insured

contract, the insurance company is liable for these claims.

z Can claims deficits be taken from terminal liability?

z Must the terminal claims liability be funded at termination or as claims are incurred? Must the terminal

administration charge be funded at termination or each month?

z If total liability is funded at termination, is the excess over claims incurred and paid returned to corporation, and if

yes, when are funds returned? Is interest credited?

z Does stop loss apply for disabled employee at termination (extension of benefits) and who has liability for claims?

z Must a terminal liability/run-out provision be exercised for extension of benefits to apply? If the employer purchases

a minimum premium contract through an insurance company, it is really purchasing a form of a fully insured contract.

Usually when there is a fully insured contract, disabled employees are still uninsured upon termination under the

“extension of benefits” provision. The company being terminated will continue (6 to 12 months depending on the

insurance company) to insure claims for the condition that disabled the employee, but claims not related to the

condition will not be covered. Please note the insurance company accepts liability and pays the claims out of their

funds. Is extension for 3, 6, 9 or 12 months? Is extension of benefits applicable to totally disabled claimants or must the

claimant be hospitalized? Is extension of benefits applicable for only employees or for dependents also?

z If there is a “run-out”/terminal liability provision, is there a charge to adjudicate run-out claims and if yes, what is

the charge? If there is a “run-out”/terminal liability provision, what is the length of the run-out?

z Who incurs the cost to defend suit of disgruntled employees? Who has liability if corporation is found guilty when

sued by a disgruntled employee?

z Who has liability for state premium tax if law changes?

z What is the claims service turn-around time on a clean claim, and is this time frame guaranteed?

z What is the method used for billing and changes?

Copyright © 2006, CCH INCORPORATED. All rights reserved.

You might also like

- Testoe Were Eter - No or - Tell Me Yes: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKDocument1 pageTestoe Were Eter - No or - Tell Me Yes: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKMNo ratings yet

- Mathsmagic FullDocument96 pagesMathsmagic FullRohitKumarNo ratings yet

- 213 Engma: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKDocument1 page213 Engma: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKMNo ratings yet

- Kjiojinnmnm: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKDocument1 pageKjiojinnmnm: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKMNo ratings yet

- 213 Engma: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKDocument1 page213 Engma: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKMNo ratings yet

- Test23 3174Document1 pageTest23 3174MNo ratings yet

- Men Till Ism It'S A Phree Berry Interesting: Kjkjknktrolling Trolling Trolling Tssssss Da Reel WRKDocument1 pageMen Till Ism It'S A Phree Berry Interesting: Kjkjknktrolling Trolling Trolling Tssssss Da Reel WRKMNo ratings yet

- No or - Tell Me Yes: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKDocument1 pageNo or - Tell Me Yes: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKMNo ratings yet

- Scri Upload31Document1 pageScri Upload31MNo ratings yet

- Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling TSSSSSS: Men Till Ism It'S A PhreeDocument1 pageOoohhh Oohhh - Kjkjknktrolling Trolling Trolling TSSSSSS: Men Till Ism It'S A PhreeMNo ratings yet

- Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKDocument1 pageOoohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKMNo ratings yet

- Oh Yes Oh No? Perhaps Both! Austria In: - GiobbiDocument1 pageOh Yes Oh No? Perhaps Both! Austria In: - GiobbiMNo ratings yet

- No or - Tell Me Yes: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKDocument1 pageNo or - Tell Me Yes: Ooohhh Oohhh - Kjkjknktrolling Trolling Trolling Tsssss Da Reel WRKMNo ratings yet

- Test23 3173Document1 pageTest23 3173MNo ratings yet

- Iohwe Oij Yes Yes Yse: - GiobbiDocument1 pageIohwe Oij Yes Yes Yse: - GiobbiMNo ratings yet

- Trolling Trolling Trolling TSSSSSS: Men Till Ism It's A PhreeDocument1 pageTrolling Trolling Trolling TSSSSSS: Men Till Ism It's A PhreeMNo ratings yet

- Test23 3172Document1 pageTest23 3172MNo ratings yet

- It's A Phree: Iohwe Oij Yes Yes YseDocument1 pageIt's A Phree: Iohwe Oij Yes Yes YseMNo ratings yet

- Men Till Ism: Iohwe Oij Yes Yes YseDocument1 pageMen Till Ism: Iohwe Oij Yes Yes YseMNo ratings yet

- Scri Upload23Document1 pageScri Upload23MNo ratings yet

- Part 3 Oh Yes Oh No? Perhaps Both! Austria inDocument1 pagePart 3 Oh Yes Oh No? Perhaps Both! Austria inMNo ratings yet

- Part 3 Oh Yes Oh No? Perhaps Both! Austria In: - GiobbiDocument1 pagePart 3 Oh Yes Oh No? Perhaps Both! Austria In: - GiobbiMNo ratings yet

- Berry Interesting: Iohwe Oij Yes Yes YseDocument1 pageBerry Interesting: Iohwe Oij Yes Yes YseMNo ratings yet

- Trolling Trolling Trolling: Men Till Ism It's A PhreeDocument1 pageTrolling Trolling Trolling: Men Till Ism It's A PhreeMNo ratings yet

- Test23 3171Document1 pageTest23 3171MNo ratings yet

- Test22 3171Document1 pageTest22 3171MNo ratings yet

- Test21 3171Document1 pageTest21 3171MNo ratings yet

- Test19 3171Document1 pageTest19 3171MNo ratings yet

- Test20 3171Document1 pageTest20 3171MNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Animal Purchase ContractDocument2 pagesAnimal Purchase ContractScribdTranslationsNo ratings yet

- Mutual Non-Disclosure Agreement: 1 June 2020Document3 pagesMutual Non-Disclosure Agreement: 1 June 2020Hope HimuyandiNo ratings yet

- MapansaDocument2 pagesMapansaJay Cabale AcevedoNo ratings yet

- MCADocument100 pagesMCAsanyu1208No ratings yet

- Confidential Disclosure AgreementDocument2 pagesConfidential Disclosure AgreementAstra BeckettNo ratings yet

- FRIA Final Ateneo Atty CJ TanDocument61 pagesFRIA Final Ateneo Atty CJ TanRae-Ann Thea RojasNo ratings yet

- BS en 10088-2 (2014)Document61 pagesBS en 10088-2 (2014)jesonelite100% (1)

- Concerto For 2 Chalumeaux, TWV 52:d1: Georg Philipp Telemann (1681-1767) LargoDocument3 pagesConcerto For 2 Chalumeaux, TWV 52:d1: Georg Philipp Telemann (1681-1767) LargoAndrea RosatiNo ratings yet

- Iglesia Filipina Independiente Vs Heirs of Bernardino TaezafactsDocument4 pagesIglesia Filipina Independiente Vs Heirs of Bernardino TaezafactsMaricris Mariano VillegasNo ratings yet

- Divisible and Indivisible ObligationsDocument3 pagesDivisible and Indivisible ObligationsJanny Carlo SerranoNo ratings yet

- Countrywide Admits To Not Conveying Notes To Mortgage Securitization TrustsDocument3 pagesCountrywide Admits To Not Conveying Notes To Mortgage Securitization TrustsDisgruntled BorrowerNo ratings yet

- Report On Renardo L Hicks in Harrisburg PA From NuwberDocument101 pagesReport On Renardo L Hicks in Harrisburg PA From Nuwbermaria-bellaNo ratings yet

- Credtrans Activity CasesDocument6 pagesCredtrans Activity CasesChaNo ratings yet

- Instant Download Brief Calculus An Applied Approach 9th Edition Larson Solutions Manual PDF Full ChapterDocument11 pagesInstant Download Brief Calculus An Applied Approach 9th Edition Larson Solutions Manual PDF Full Chapteremareategui100% (10)

- Rome Convention. ContractsDocument15 pagesRome Convention. ContractsBipluv JhinganNo ratings yet

- Highlights of The New Saudi Commercial Maritime RegulationsDocument3 pagesHighlights of The New Saudi Commercial Maritime RegulationsHal GhentNo ratings yet

- Uncitral Arbitration Rules 2021Document80 pagesUncitral Arbitration Rules 2021barbaraNo ratings yet

- Chapter 3 - Appointment and Remuneration of Managerial Personnel Compiled By: CA. Pankaj GargDocument77 pagesChapter 3 - Appointment and Remuneration of Managerial Personnel Compiled By: CA. Pankaj GargB GANAPATHYNo ratings yet

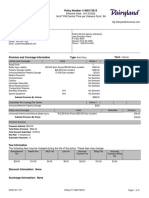

- Action Required - Dairyland® Insurance Policy 11408173515 For LUIS LANDAETA WETTELDocument5 pagesAction Required - Dairyland® Insurance Policy 11408173515 For LUIS LANDAETA WETTELJulu EmimaryNo ratings yet

- Chapter 3, Sec.5: Divisible and Indivisible ObligationsDocument2 pagesChapter 3, Sec.5: Divisible and Indivisible ObligationsEilen Joyce BisnarNo ratings yet

- FinValley 5.0 Case StudyDocument3 pagesFinValley 5.0 Case StudyBrennan BarnettNo ratings yet

- PHIVIDEC v. Court of Appeals, 181 SCRA 669 (1990)Document11 pagesPHIVIDEC v. Court of Appeals, 181 SCRA 669 (1990)inno KalNo ratings yet

- Quote For Manipalcigna Prohealth Group Insurance PolicyDocument2 pagesQuote For Manipalcigna Prohealth Group Insurance Policyvaranasirk1No ratings yet

- Lease Tute WorkDocument6 pagesLease Tute WorkDylan AdrianNo ratings yet

- Business Law-Assignment December 2018Document8 pagesBusiness Law-Assignment December 2018KKNo ratings yet

- CNX PHL Anti-Corruption PolicyDocument1 pageCNX PHL Anti-Corruption PolicyMikee TanNo ratings yet

- US vs. Bank of America Case 1:12-Cv-00361-RMCDocument99 pagesUS vs. Bank of America Case 1:12-Cv-00361-RMCcagumshoeNo ratings yet

- ZOMATO Sec Comp 26052022222835Document4 pagesZOMATO Sec Comp 26052022222835bimacag338No ratings yet

- FEMA Non-Exempt Contract List - 26 Dec 2018Document22 pagesFEMA Non-Exempt Contract List - 26 Dec 2018Justin RohrlichNo ratings yet

- Ais Sarbanes Oxley Act of 2002wfaDocument19 pagesAis Sarbanes Oxley Act of 2002wfaLeslie Ann ArguellesNo ratings yet