Professional Documents

Culture Documents

Calculate The Expected Rate of Return On Each Alternative and

Uploaded by

Amit PandeyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculate The Expected Rate of Return On Each Alternative and

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: Calculate the expected rate of return on each

alternative and

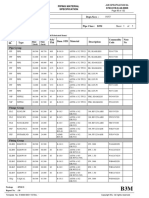

Calculate the expected rate of return on each alternative, and fill in the blanks in the row for r in

the table.

Assume that you recently graduated with a major in finance, and you just landed a job as a

financial planner with Barney Smith Inc., a large financial services corporation. Your first

assignment is to invest $100,000 for a client. Because the funds are to be invested in a

business at the end of 1 year, you have been instructed to plan for a 1-year holding period.

Further, your boss has restricted you to the investment alternatives shown in the table with their

probabilities and associated outcomes. (Disregard for now the items at the bottom of the data;

you will fill in the blanks later.) Barney Smith’s economic forecasting staff has developed

probability estimates for the state of the economy, and its security analysts have developed a

sophisticated computer program that was used to estimate the rare of return on each alternative

under each state of the economy. Alta Industries is an electronics firm; Repo Men Inc. collects

past-due debts; and American Foam manufactures mattresses and various other foam

products. Barney Smith also maintains an “index fund” that owns a market-weighted fraction of

all publicly traded stocks; you can invest in that fund, and thus obtain average stock market

results. Given the situation as described, answer the followingquestions.

Calculate the expected rate of return on each alternative and

ANSWER

https://solvedquest.com/calculate-the-expected-rate-of-return-on-each-alternative-and/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- Portfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationFrom EverandPortfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationRating: 3 out of 5 stars3/5 (1)

- How Is Market Risk Measured For Individual Securities How Are BetaDocument1 pageHow Is Market Risk Measured For Individual Securities How Are BetaAmit PandeyNo ratings yet

- The Cost of Doing Business Study, 2019 EditionFrom EverandThe Cost of Doing Business Study, 2019 EditionNo ratings yet

- Suppose You Suddenly Remembered That The Coefficient of Variation CV 100105Document1 pageSuppose You Suddenly Remembered That The Coefficient of Variation CV 100105Amit PandeyNo ratings yet

- Saving Capitalism From Short-Termism: How to Build Long-Term Value and Take Back Our Financial FutureFrom EverandSaving Capitalism From Short-Termism: How to Build Long-Term Value and Take Back Our Financial FutureRating: 3.5 out of 5 stars3.5/5 (2)

- 1 Suppose Investors Raised Their Inflation Expectations by 3 PDocument1 page1 Suppose Investors Raised Their Inflation Expectations by 3 PAmit PandeyNo ratings yet

- Corporate Financial Analysis: A Comprehensive Beginner's Guide to Analyzing Corporate Financial risk, Statements, Data Ratios, and ReportsFrom EverandCorporate Financial Analysis: A Comprehensive Beginner's Guide to Analyzing Corporate Financial risk, Statements, Data Ratios, and ReportsNo ratings yet

- 1 Should Portfolio Effects Impact The Way Investors Think AbouDocument1 page1 Should Portfolio Effects Impact The Way Investors Think AbouAmit PandeyNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Suppose You Created A Two Stock Portfolio by Investing 50 000 IDocument1 pageSuppose You Created A Two Stock Portfolio by Investing 50 000 IAmit PandeyNo ratings yet

- 1 Why Is The T Bill S Return Independent of The StateDocument1 page1 Why Is The T Bill S Return Independent of The StateAmit PandeyNo ratings yet

- Suppose An Investor Starts With A Portfolio Consisting of One 100107Document1 pageSuppose An Investor Starts With A Portfolio Consisting of One 100107Amit PandeyNo ratings yet

- Case Study of Equitty Analysis - MbaDocument2 pagesCase Study of Equitty Analysis - MbaAli HyderNo ratings yet

- Fina ManDocument20 pagesFina ManhurtlangNo ratings yet

- Assignment-1:Investment Management 2020Document2 pagesAssignment-1:Investment Management 2020Rajkumar RakhraNo ratings yet

- Underline The Final Answers: ONLY If Any Question Lacks Information, State Your Reasonable Assumption and ProceedDocument4 pagesUnderline The Final Answers: ONLY If Any Question Lacks Information, State Your Reasonable Assumption and ProceedAbhishek GhoshNo ratings yet

- FM11 CH 04 Mini-Case Old6Document19 pagesFM11 CH 04 Mini-Case Old6AGNo ratings yet

- HBS Ameritrade Corporate Finance Case Study SolutionDocument6 pagesHBS Ameritrade Corporate Finance Case Study SolutionEugene Nikolaychuk100% (5)

- R CF E NPV CF E: Historic RF On LTBDocument2 pagesR CF E NPV CF E: Historic RF On LTBBhawna Khosla100% (2)

- Case 8Document3 pagesCase 8Neil GumbanNo ratings yet

- WACC Project Instructions FinalDocument6 pagesWACC Project Instructions FinalMandaviNo ratings yet

- WACC Project Instructions FinalDocument6 pagesWACC Project Instructions FinalMandaviNo ratings yet

- WACC Project Instructions FinalDocument6 pagesWACC Project Instructions FinalMandaviNo ratings yet

- WACC Project Instructions FinalDocument6 pagesWACC Project Instructions FinalMandaviNo ratings yet

- Project (Take-Home) Fall - 2021 Department of Business AdministrationDocument5 pagesProject (Take-Home) Fall - 2021 Department of Business AdministrationAftab AliNo ratings yet

- Chap 14 Problem SolutionsDocument39 pagesChap 14 Problem SolutionsNAFEES NASRUDDIN PATELNo ratings yet

- Investment Appraisal With Solved ExamplesDocument29 pagesInvestment Appraisal With Solved Examplesnot toothlessNo ratings yet

- FNCE623 Solution To Final Exam 2021 WinterDocument4 pagesFNCE623 Solution To Final Exam 2021 Winteralka murarkaNo ratings yet

- CH 14Document41 pagesCH 14Liyana ChuaNo ratings yet

- Case 19 NotesDocument5 pagesCase 19 NotesFLODOHANo ratings yet

- Fnbslw444 - Case StudyDocument5 pagesFnbslw444 - Case Studyinfobrains05No ratings yet

- The Venture Capital MethodDocument3 pagesThe Venture Capital Methodsidthefreak809100% (1)

- Cost of Capital, WACC and BetaDocument3 pagesCost of Capital, WACC and BetaSenith111No ratings yet

- Camp and Fevurly Financial Planners Have Forecasted Revenues For TheDocument1 pageCamp and Fevurly Financial Planners Have Forecasted Revenues For TheTaimour HassanNo ratings yet

- Solved A Section 20 Subsidiary of A Major U S Bank IsDocument1 pageSolved A Section 20 Subsidiary of A Major U S Bank IsM Bilal SaleemNo ratings yet

- Dear AndyDocument7 pagesDear AndyIqra JawedNo ratings yet

- GoStudy CFA L3 Equation Guide For 2017Document26 pagesGoStudy CFA L3 Equation Guide For 2017Sumit Raj ShahNo ratings yet

- Solved Given The Following Facts About Sammie Bright Calculate His PreliminaryDocument1 pageSolved Given The Following Facts About Sammie Bright Calculate His PreliminaryAnbu jaromiaNo ratings yet

- LawnMate Company Manufactures Power Mowers That Are Sold Throughout The United States andDocument2 pagesLawnMate Company Manufactures Power Mowers That Are Sold Throughout The United States andsiti nadhirahNo ratings yet

- Quiz 2Document40 pagesQuiz 2MAYANK JAINNo ratings yet

- Appendix DDocument3 pagesAppendix DhermerryNo ratings yet

- FINA 410 - Exercises (NOV)Document7 pagesFINA 410 - Exercises (NOV)said100% (1)

- Risk and Return in Practice - ProblemsDocument6 pagesRisk and Return in Practice - ProblemsKinNo ratings yet

- Question and Answer - 24Document30 pagesQuestion and Answer - 24acc-expertNo ratings yet

- Start Up ExpensesDocument6 pagesStart Up ExpensesnoegamezNo ratings yet

- Solved Three Machines Are Employed in An Isolated Area They EachDocument1 pageSolved Three Machines Are Employed in An Isolated Area They EachM Bilal SaleemNo ratings yet

- Quiz 3Document33 pagesQuiz 3Arup DeyNo ratings yet

- Financial Ratio Report Group 1Document9 pagesFinancial Ratio Report Group 1maxine claire cutingNo ratings yet

- Assignment (Take-Home) Fall - 2020Document3 pagesAssignment (Take-Home) Fall - 2020Muhamad Farhan KhanNo ratings yet

- S S M M I T: Loan Chool of Anagement Assachusetts Nstitute of EchnologyDocument11 pagesS S M M I T: Loan Chool of Anagement Assachusetts Nstitute of Echnologyshanky1124No ratings yet

- FMA Assignemnt Question PaperDocument3 pagesFMA Assignemnt Question PaperHaris KhanNo ratings yet

- BetaDocument8 pagesBetaAdnan MaqboolNo ratings yet

- Merrill Finch IncDocument7 pagesMerrill Finch IncAnaRoqueniNo ratings yet

- UntitledDocument13 pagesUntitledJocelyn GiselleNo ratings yet

- Emerging Market BetasDocument37 pagesEmerging Market Betasmintyfresh123No ratings yet

- Solved The Following Table Shows Nominal GDP and An Appropriate PriceDocument1 pageSolved The Following Table Shows Nominal GDP and An Appropriate PriceM Bilal SaleemNo ratings yet

- CH 02 Mini CaseDocument18 pagesCH 02 Mini CaseCuong LeNo ratings yet

- Risk and COCDocument28 pagesRisk and COCaneeshaNo ratings yet

- Use The Same Abbreviations As in 1 26 To Answer TheDocument1 pageUse The Same Abbreviations As in 1 26 To Answer TheLet's Talk With HassanNo ratings yet

- Zimmerman Company of Shawnee Kansas Spreads Herbicides and Applies LiquidDocument1 pageZimmerman Company of Shawnee Kansas Spreads Herbicides and Applies LiquidAmit PandeyNo ratings yet

- You May Refer To The Opening Story of Tony andDocument3 pagesYou May Refer To The Opening Story of Tony andAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- You Were Appointed The Manager of Drive Systems Division DSDDocument2 pagesYou Were Appointed The Manager of Drive Systems Division DSDAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- You Are The Controller For Crystalclean Services A Company ThatDocument2 pagesYou Are The Controller For Crystalclean Services A Company ThatAmit PandeyNo ratings yet

- You Have Been Hired To Assist The Management of GreatDocument2 pagesYou Have Been Hired To Assist The Management of GreatAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Wright Manufacturing Has Recently Studied Its Order Filling ProcDocument1 pageWright Manufacturing Has Recently Studied Its Order Filling ProcAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- XL Industries Uses Department Budgets and Performance Reports in PlanningDocument1 pageXL Industries Uses Department Budgets and Performance Reports in PlanningAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- Winston Medical Clinic Proposed The Acquisition of Some Expensive X RayDocument2 pagesWinston Medical Clinic Proposed The Acquisition of Some Expensive X RayAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Wayne Coyle The Controller of Pei Potato Co Is DisillusionedDocument1 pageWayne Coyle The Controller of Pei Potato Co Is DisillusionedAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Article 10 - Headquarters or Regions Who Leads Growth in EMDocument4 pagesArticle 10 - Headquarters or Regions Who Leads Growth in EMRNo ratings yet

- Manual AdeptDocument196 pagesManual AdeptGonzalo MontanoNo ratings yet

- Container Industry Value ChainDocument14 pagesContainer Industry Value ChainRasmus ArentsenNo ratings yet

- Ethics DigestDocument29 pagesEthics DigestTal Migallon100% (1)

- GSTR1 Stupl 08ABFCS1229J1Z9 November 2021 BusyDocument92 pagesGSTR1 Stupl 08ABFCS1229J1Z9 November 2021 BusyYathesht JainNo ratings yet

- Indian Economic Development: DAV Fertilizer Public School, BabralaDocument96 pagesIndian Economic Development: DAV Fertilizer Public School, Babralakavin sNo ratings yet

- Strategic Planning ModuleDocument78 pagesStrategic Planning ModuleQueenElaineTulbeNo ratings yet

- Answers Governmental Accounting ExercisesDocument10 pagesAnswers Governmental Accounting Exerciseswerewolf2010No ratings yet

- Airport Design WIRATMAN ARCHITECTURE. Imelda Akmal Architecture Writer Studio Wiratman - Revisi CP II - Indd 3 10 - 5 - 16 10 - 21 AMDocument9 pagesAirport Design WIRATMAN ARCHITECTURE. Imelda Akmal Architecture Writer Studio Wiratman - Revisi CP II - Indd 3 10 - 5 - 16 10 - 21 AMRasyidashariNo ratings yet

- Feminist Trade PolicyDocument5 pagesFeminist Trade PolicyMerckensNo ratings yet

- Chapter 01 Ten Principles of EconomicsDocument30 pagesChapter 01 Ten Principles of EconomicsTasfia Rahman Riva100% (1)

- Only Tool in Laguna Woods Village's Toolbox Is A HammerDocument5 pagesOnly Tool in Laguna Woods Village's Toolbox Is A Hammer"Buzz" AguirreNo ratings yet

- List of Turkish CompaniesDocument5 pagesList of Turkish CompaniesMary GarciaNo ratings yet

- Presentation - Sacli 2018Document10 pagesPresentation - Sacli 2018Marius OosthuizenNo ratings yet

- Liebherr Annual-Report 2017 en Klein PDFDocument82 pagesLiebherr Annual-Report 2017 en Klein PDFPradeep AdsareNo ratings yet

- Porter 5 Force FinalDocument35 pagesPorter 5 Force FinalAbinash BiswalNo ratings yet

- 115 - Yam v. CA DigestDocument2 pages115 - Yam v. CA DigestStephieIgnacioNo ratings yet

- Finec 2Document11 pagesFinec 2nurulnatasha sinclairaquariusNo ratings yet

- B5M ElDocument3 pagesB5M ElBALAKRISHNANNo ratings yet

- Trade, Growth and Jobs: Commission Contribution To The European CouncilDocument20 pagesTrade, Growth and Jobs: Commission Contribution To The European CouncilлюдмилаNo ratings yet

- Syllabus DUDocument67 pagesSyllabus DUMohit GoyalNo ratings yet

- Accesorios Ape TheexzoneDocument64 pagesAccesorios Ape TheexzoneLucas GomezNo ratings yet

- Indraneel N M.com SBKDocument3 pagesIndraneel N M.com SBKJared MartinNo ratings yet

- Fin 254 SNT Project Ratio AnalysisDocument29 pagesFin 254 SNT Project Ratio Analysissoul1971No ratings yet

- PPSAS 28 - Financial Instruments - Presentation 3-18-2013Document3 pagesPPSAS 28 - Financial Instruments - Presentation 3-18-2013Christian Ian LimNo ratings yet

- Origin and Theoretical Basis of The New Public Management (NPM)Document35 pagesOrigin and Theoretical Basis of The New Public Management (NPM)Jessie Radaza TutorNo ratings yet

- Financial ServicesDocument42 pagesFinancial ServicesGururaj Av100% (1)

- EntrepDocument2 pagesEntrepJersey RamosNo ratings yet

- Collection of Pitch Decks From Venture Capital Funded StartupsDocument22 pagesCollection of Pitch Decks From Venture Capital Funded StartupsAlan Petzold50% (2)

- Business StudiesDocument2 pagesBusiness StudiesSonal JhaNo ratings yet