Professional Documents

Culture Documents

DAIBB Foreign Exchange-1

Uploaded by

ashraf294Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DAIBB Foreign Exchange-1

Uploaded by

ashraf294Copyright:

Available Formats

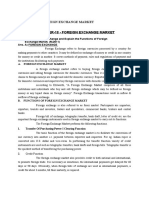

International Trade & Foreign Exchange

1. What are the various methods of payments that are used to settle payments

arising from international trade? Briefly describe them.

2. What is authorized dealer? What are the roles/ functions of authorized dealers?

3. What are the sources from which foreign exchange is supplied in the black

market (hundi) and the purposes for which it is used? How this market is used

for money laundering?

4. What do you mean by forward exchange?

5. Distinguish between Fixed Exchange Rates and Floating Exchange Rates

6. Distinguish between Spot Rate and Forward Rate

7. Distinguish between Direct and Indirect Exchange Rate

8. Distinguish between Revaluation and Devaluation

9. Discuss the factors affecting the exchange rate of a currency under a floating

exchange rate system.

10. What are the factors responsible for appreciation or depreciation of a currency?

Or, Factors that effected to appreciation or depreciation of a currency

11. What are the factors that contributed to depreciation of Bangladesh Taka

recently?

Or, Factor considered to depreciation of Bangladeshi Currency

12. What are the causes of changes in the exchange rates of currencies?

13. Discuss the kind of exchange rate system that operates in respect of

Bangladesh taka.

Or, Types of Exchange rate systems that operates in respect of Bangladesh

14. What does exchange control means?

Or, What is Exchange Control

15. What are the main features of exchange control in Bangladesh?

16. How does the central bank maintain controls over foreign exchange

transactions in Bangladesh?

Or, Explain about Foreign exchange restrictions and foreign exchange controls

17. Suggest the changes that can be made in the exchange control regulations to

create a conductive and market friendly business environment

18. Major Factors that Affect the Foreign Exchange Market in Bangladesh

19. What are the various types of letter of credit? What are the parties involved in a

letter of credit?

20. Describe the purposes and the types of pre-shipment export credit.

21. Describe the different types of export credits.

Or, Describe the purposes and the types pre-shipment and Post-shipment

export credit.

22. Distinguish between LIM & LTR

23. Discuss the various types of credit facilities offered to importers by the banks

24. Discuss the various types of post-shipment import finance provided by the

banks

25. Identify the possible risk associated with import finance and the steps that can

be taken to minimize these risks

26. Identify the risk associated with loans granted to the importers against Trust

Receipt and how these risks can be mitigated

For more info, please contact to 01712 043880 Page 1 of 29

27. Briefly discuss the advantages and disadvantages of financing imports under

LTR

28. Define Documentary Credit. What are the advantages of a Documentary Credit?

29. Distinguish between documentary credit and documentary collection

30. Describe briefly the types of frauds that occur in connection with documentary

credit.

31. Discuss the features of Documentary Credit/ Letter of Credit

32. Discuss the duty and responsibility of Opening Bank/ Issuing Bank under

confirmed L/C

33. Discuss the duty and responsibility of Advising Bank/ Corresponding Bank

34. What is meant by balance of payments?

35. Describe the factors responsible for adverse balance of payments.

36. What corrective steps a developing country like Bangladesh can take to correct

an adverse balance of payments?

37. How does Balance of Trade differ from Balance of Payments?

Or, Difference between Balance of Trade and Balance of Payments

38. What are the principal incentives offered for foreign investment in Bangladesh?

39. Analyze the favorable and adverse impacts of foreign investment on Bangladesh

economy.

40. What are the measures you would suggest to improve the climate for foreign

investment in Bangladesh.

41. What do you mean by Flight of Capital? Describe why & how capital flight from

Bangladesh? What preventive steps you would suggest to stop capital flight?

42. Describe the various methods available to overseas Bangladesh Nationals for

transfer of funds to the home country. What are the problems normally

encountered by them for such transfer?

43. Discuss the trends and main sources of foreign exchange remittances

44. Analyze the importance/ impact of remittance in the Bangladesh economy

45. What are your suggestions for improvement of the banking channel for

remittances to Bangladesh at low cost and greater speed?

46. What is the Functions of World Bank?

47. Discuss the objectives and roles of the world bank to promote economic

development of its member countries

48. Role of World Bank in the economic development in Bangladesh

Or, Give a brief account of its assistance to Bangladesh for development of

various sectors of the economy

For more info, please contact to 01712 043880 Page 2 of 29

1. What are the various methods of payments that are used to settle

payments arising from international trade? Briefly describe them.

There are different methods which are adopted to make international payment,

through the banking system. Following are the main methods:

1. Letter of Credit: It is a document issued by the importers bank to exporter

authorizing him to draw drafts on the bank payable on demand on the specified

terms and conditions.

2. Mail Transfer (MT): The payment can be also made in other country by mail

transfer. Here the selling office of the bank sends written instructions by mail to

the paying bank for the payment.

3. Telegraphic Transfer (TT): Telegraphic transfer is an order by telegram to a

bank to pay a specified sum of money to the specified person.

4. Foreign Bank Draft: It is an order drawn by a bank on its foreign branch or

correspondent to pay specific sum of money on demand to bearer or to the

person.

5. Money Order: The payment can be made to a person who is living in other

country through money order.

6. Travelers Cheque: It is an order drawn by a bank upon itself to pay on demand

the purchaser of the cheques. The paying bank after comparing the signatures

of purchase, which he has signed at the time of the purchasing of cheques and

makes the payment.

7. Travelers L/C: It is used to finance foreign travel is addressed to banks in

foreign countries authorizing the person to whom it is issued to draw drafts on

the issuer.

8. Open Account: The goods are sold on our open account. If an exporter has full

confidence on the importer he can sell the goods in another country on our

open account without getting any surety for the third party.

9. Foreign Exchange Dealers: In every country foreign exchange dealers purchase

and sell the foreign currency and pay in the home currency for meeting their

local money demands and sell it to the persons visiting foreign countries.

10. Bill of Exchange: It is a main and most effective method of transferring

payments that a written order addressed by one person to another. The

creditor orders to the debtor to pay a particular amount to the payee.

2. What is authorized dealer? What are the roles/ functions of

authorized dealers?

Authorized Dealers:

As per section 2 of Foreign Exchange Regulation act 1947, Authorized Dealer means

a person, for the time being authorized to deal in Foreign Exchange. In other words

Authorized Dealer means a Bank, authorized by Central Bank to deal in foreign

exchange. There are some persons or firms, authorized by Central Bank to deal in

foreign exchange with limited scope, are called Authorized Money Changers.

Functions of Authorised Dealer

Authorised Dealer can handle all kinds of Foreign Exchange transaction as per

FER Act 1947 under the instruction of Bangladesh Bank. Following are the

main function of an Authorised Dealer.

For more info, please contact to 01712 043880 Page 3 of 29

1. Exchange of Foreign Currencies.

2. To make arrangement with Foreign Correspondent.

3. Buying & Selling Foreign Currencies

4. Handling of Inward & Outward Remittance

5. Opening of L/C & Settlement of Payment.

6. Investment in Foreign Trade.

7. Opening & Maintenance of Accounts with Foreign Banks 'under intimation to

Bangladesh Bank.

8. Export documents handling

3. What are the sources from which foreign exchange is supplied in the

black market (hundi) and the purposes for which it is used? How this

market is used for money laundering?

Hundi or money carrier system is prevalent as informal procedure of remittance

sending in most of the cases. Hundi refers to the illegal money exchange not

supported by the international or national legal structure. The exchange rate

offered by the hundi operators is 1-2% higher than the official exchange rate. They

do not charge anything for transaction. It is the fastest method of transaction. In

urgent situations this is the quickest method for sending money. The hundi

operators provide door to door services. It was interesting to note that there are

other social reasons for sending remittance through hundi. Few mentioned they

send money to wives, fathers or brothers separately and preferred to keep the

amounts sent secret, as it creates tension among the family members. Hundi

provides the opportunity to maintain such confidentiality.

A number of reasons have been attached to the growth of Hundi market. These

include:

1. Financing smuggling of various items, including gold;

2. Existing tax regime leading to under- invoicing of imports;

3. Unholy alliance between officials of financial institutions and hundi elements;

4. Financing recruitment charges of the recruiters;

5. Difference between official and unofficial exchange rates;

6. Quality and speed of service;

7. Ability to reach clients both in destination countries and in the source countries.

4. What do you mean by forward exchange?

A Forward Exchange Contract is an agreement between two financial institutions, in

which they agrees to buy or sell foreign currency on a fixed future date, or during a

period expiring on a fixed future date, at a fixed rate of exchange. The forward

exchange contracts, both buying and selling, may be either fixed or optional term

contracts. The party agreeing to buy the underlying asset in the future assumes a

long position, and the party agreeing to sell the asset in the future assumes a short

position. Forward Exchange Contracts can be used to cover the exchange risk

between two country’s currencies.

For more info, please contact to 01712 043880 Page 4 of 29

5. Distinguish between Fixed Exchange Rates and Floating Exchange

Rates

[2 Answer]

A fixed exchange rate is a rate the government sets and maintains as the official

exchange rate. A set price will be determined against a major world currency. In

order to maintain the local exchange rate, the central bank buys and sells its own

currency on the foreign exchange market in return for the currency to which it is

pegged.

A floating exchange rate is determined by the private market through supply and

demand. It is often termed "self-correcting," as any differences in supply and

demand will automatically be corrected in the market. As see, if demand for a

currency is low, its value will decrease, thus making imported goods more

expensive and stimulating demand for local goods and services.

Sl. Fixed exchange rate Floating exchange rate

A nominal exchange rate that is set Determined by the private market

1 firmly by the local monetary authority through supply and demand as self-

corrected

Imposed by a local official exchange Imposed by rate of foreign exchange

2

rate system markets

3 Rate is stable in general Rate fluctuates constantly

The main economic advantage is that The economic main advantage is that

4 they promote international trade and they leave the monetary and fiscal

investment authorities free to pursue internal goals

The main disadvantage is that it The main disadvantage is encourage

discourage to international trade and more to international trade and

5

investment due to nominal exchange investment due to autonomous

rate system monetary system

6. Distinguish between Spot Rate and Forward Rate

Spot exchange rates are the rates that are applicable for purchase and sale of

foreign exchange on spot delivery basis or immediate delivery basis. The term spot

denotes immediate happening and closing of transaction, practically it takes two

business days for a spot exchange transaction to get settled.

Forward exchange rates, in contrast, are the rates that are applicable for the

delivery of foreign exchange at a certain specified future date. For example, a

foreign exchange contract may specify that the payment has to be settled after 3

months, or it may be a 90-day maturity contract.

7. Distinguish between Direct and Indirect Exchange Rate

A direct quote is an exchange rate expressed in terms of the number of units of

domestic currency corresponding to one unit of the foreign currency. In other

words, it involves quoting in fixed units of foreign currency against variable

amounts of the domestic currency.

An indirect quote is the expression of an exchange rate in terms of the number of

units of a foreign currency corresponding to a single unit of the domestic currency.

For more info, please contact to 01712 043880 Page 5 of 29

In an indirect quote, the foreign currency is a variable amount and the domestic

currency is fixed at one unit.

8. Distinguish between Revaluation and Devaluation

Revaluation means a change of a price of goods or products. This term is specially

used as revaluation of a currency, where it means a rise of currency to the relation

with a foreign currency in a fixed exchange rate. In floating exchange rate correct

term would be appreciation.

Devaluation in modern monetary policy is a reduction in the value of a currency

with respect to those goods, services or other monetary units with which that

currency can be exchanged. It means official lowering of the value of a currency

within a fixed exchange rate system, by which the monetary authority formally sets

a new fixed rate with respect to a foreign currency.

9. Discuss the factors affecting the exchange rate of a currency under a

floating exchange rate system.

The exchange rate of a currency under a floating exchange is determined by market

forces such as supply and demand. These factors are:

1. Currency appreciation & depreciation: Currencies in a floating exchange

system can either appreciate or depreciate. Appreciation is when a floating

exchange system increases in value in terms of another currency. Depreciation is

when a currency decreases in value in terms of another currency.

2. Flow of funds: When there is an imbalance in balance of payments, there will

either be an inflow of funds as foreign investment and an outflow of funds as

invest to foreign countries.

3. Interest rate over inflation: Due to the higher or lower interest rate over

inflation, the investors will tend to chose or not chose to invest in the country

with the higher or lower differential of interest rate over inflation respectively.

4. Trade balance: There will be higher demand for the currency that export much

more than the import and lower demand for currency that import much more

than the export, because of the imbalance.

5. Investor’s confidence: Investors are dependent to the country's economic

strengths that they will be more likely to buy that country's assets, pushing up

the value of country's currency.

6. Speculation: When people expect appreciation or depreciation, the demand of

the currency will increase or decrease respectively.

10. What are the factors responsible for appreciation or depreciation of a

currency?

Or, Factors that effected to appreciation or depreciation of a currency

1. Relative Product Prices: If a country's goods are relatively cheap, foreigners

will want to buy those goods. In order to buy those goods, they will need to buy the

nation's currency.

2. Supply and Demand: The principles of supply and demand apply to the

appreciation and depreciation of currency values. If a country injects new currency

into its economy, it increases the money supply.

For more info, please contact to 01712 043880 Page 6 of 29

3. Inflation and Deflation: Inflation occurs when the general prices of goods and

services that are causes of the value of the currency to depreciate, reducing

purchasing power. Simultaneously, deflation acts reversely.

4. Monetary Policy: A country with easy monetary policy will be increasing the

supply of their currency, which will cause the currency to depreciate. This country

with restrictive monetary policy will be decreasing the supply and the currency

should appreciate.

5. Economic Outlook: The negative impacts on major economic indicators like

retail sales, GDP and a high/ rising unemployment rate can also depreciate currency

value. If the economy is in a strong growth period, the currency value will

appreciates.

6. Trade Deficits: When the trade deficit of a country increases, the value of the

domestic currency depreciates. Simultaneously, when it decreases, the value of its

domestic currency appreciates.

11. What are the factors that contributed to depreciation of Bangladesh

Taka recently?

Or, Factor considered to depreciation of Bangladeshi Currency

The factors affecting behind the currency depreciation of Bangladeshi taka recently

are mentioned below:

1. High Inflation: The main cause of high inflation in Bangladesh is oil and food

price hike in abroad. The high level of inflation in the economy leads to lower the

value of local currency taka.

2. Low Foreign Direct Investment: The growth rate of foreign direct

investment is showing a declining trend. In the recent past, the FDI growth rate is

severely low.

3. Trade Deficit: For the inception of floating exchange rate regime, the export

volume has increasing trends; as the huge amount of trade deficit with an

increasing trend.

4. Pressure on international reserves: Growth in exports thus far has not

matched rising import bills and slow remittance. Hence there has been a continuous

pressure on the international reserves of the country.

5. Demand-Supply mismatch: It has been created in the foreign exchange

market, leading the continuous depreciation that has been observing for the last

year or so.

12. What are the causes of changes in the exchange rates of currencies?

The factors can change the exchange rate of a currency are as follows:

1. Differentials in Inflation: As a general rule, a country with a consistently

lower inflation rate exhibits a rising currency value, as its purchasing power

increases relative to other currencies.

2. Differentials in Interest Rates: A higher or lower interest rate offer lenders in

an economy a higher or lower return relative to other countries respectively. It

results cause the exchange rate.

3. Current-Account Deficits: A current account deficit shows the country is

spending more on foreign trade than it is earning, and it is borrowing capital from

For more info, please contact to 01712 043880 Page 7 of 29

foreign sources to make up the deficit. The excess demand of foreign currency

lowers the exchange rate and also it may occur oppositely.

4. Public Debt: A large public debt encourages inflation, and if inflation is high,

the debt will be serviced and ultimately paid off with cheaper currency in the future.

Thus, it will determine the currency rate.

5. Trade imbalances: The size of any trade deficit between two countries will also

affect those countries' currency exchange rates. This is because they result in an

imbalance of currency reserves among the trading partners.

6. Political Stability and Economic Performance: Foreign investors inevitably

seek out stable countries with strong economic performance in which to invest.

Political turmoil, for example, can cause a loss of confidence in a currency and a

movement of capital to the currencies of more stable countries.

7. Government intervention: The currency exchange rate may be imposed by its

government, i.e. wealth of the citizens, domestic production, country’s labor cost.

Also it may depend on altering the monetary and fiscal policies, and by directly

intervening in the currency markets and so on.

8. Speculators: It is typically have tremendous amounts of capital that they can

use to either buy or sell any currency as cause the currency value will fluctuate.

13. Discuss the kind of exchange rate system that operates in respect of

Bangladesh taka.

Or, Types of Exchange rate systems that operates in respect of

Bangladesh

The exchange rate management is one of the central issues of macroeconomic

policies of Bangladesh.

There are four types of exchange rate system. These are fixed, freely floating,

managed float and pegged types. Historically, Bangladesh had been maintaining

various pegged exchange rate regimes or fixed exchange rate regimes.

1. Fixed exchange rate system

2. Floating exchange rate system

On May 31, 2003, Bangladesh switched to floating exchange rate system by

abandoning the adjustable pegged system in order to discover the actual value of

foreign currencies.

There are two type of floating exchange rate system like-

a. Freely floating exchange rate system

b. Managed float exchange rate system

3. Pegged exchange rate system

Bangladesh had been maintaining various pegged exchange rate regimes, such as

pegged to the British pound sterling (1972-1979), pegged to a basket of major

trading partners' currencies with pound sterling as the intervening currency (1980-

1982), pegged to a basket of major trading partners' currencies with US dollar as

the intervening currency (1983-1999), and an adjustable pegged system (2000-

2003).

For more info, please contact to 01712 043880 Page 8 of 29

14. What does exchange control means?

Or, What is Exchange Control

Foreign exchange controls are various forms of controls imposed by a government

on the purchase/sale of foreign currencies by residents or on the purchase/sale of

local currency by nonresidents. Some common foreign exchange controls include:

- Banning the use of foreign currency within the country

- Banning locals from possessing foreign currency

- Restricting currency exchange to government-approved exchangers

- Fixed exchange rates

- Restrictions on the amount of currency that may be imported or exported

15. What are the main features of exchange control in Bangladesh?

The main features of exchange control include:

1. Convertibility of Bangladesh Taka: The Taka is fully convertible for current

account transactions. All current transactions may be conducted by individuals/

firms without prior permission of Bangladesh Bank.

2. Opening of Bank Account by a Foreign Investor: A non-resident can open

a NITA, FC and NFCD Account with any AD in Bangladesh from abroad to fund

transfer.

3. Bringing in Cash from Abroad by a Foreign Investor: A foreigner can bring

exchange in any form. A declaration is required at entry time when it excess

$5000.

4. Transfer of Capital and Capital Gains: The repatriation of sale proceeds of

shares may be made through an AD if such investment takes place through

NITA operation.

5. Transfer of profit and dividend accruing to a foreign investor: Post tax

profit of branches and dividends of companies can be remitted through ADs.

6. Remittance of proceeds from liquidation of industrial under staking

7. Remittance of royalty, technical know-how & technical assistance fees

8. Repatriation of savings, retirement benefits and salary of foreigners employed in

Bangladesh

9. Investment Facilitating Measures

16. How does the central bank maintain controls over foreign exchange

transactions in Bangladesh?

Or, Explain about Foreign exchange restrictions and foreign exchange

controls

Foreign exchange restrictions and foreign exchange controls occupy a special place

among the non-tariff regulatory instruments of foreign economic activity. Foreign

exchange restrictions constitute the regulation of transactions of residents and

nonresidents with currency and other currency values. Also an important part of the

mechanism of control of foreign economic activity is the establishment of the

national currency against foreign currencies.

There are foreign exchange control and currency regulations in Bangladesh. The

Foreign Exchange Regulation Act of 1947 (FERA) regulates all foreign payments and

any sale, exchange, lending and conversion of currencies and securities. Under the

For more info, please contact to 01712 043880 Page 9 of 29

Act, all foreign exchange activities must be performed by an authorised dealer.

Guidelines for foreign exchange transactions based on FERA issued by the Central

Bank of Bangladesh also apply.

17. Suggest the changes that can be made in the exchange control

regulations to create a conductive and market friendly business

environment

1. The transition from tariffs to non-tariff barriers: One of the reasons why

industrialized countries have moved from tariffs to NTBs is the fact that developed

countries have sources of income other than tariffs. Historically, in the formation of

nation-states, governments had to get funding. They received it through the

introduction of tariffs. This explains the fact that most developing countries still rely

on tariffs as a way to finance their spending. Developed countries can afford not to

depend on tariffs, at the same time developing NTBs as a possible way of

international trade regulation. The second reason for the transition to NTBs is that

these tariffs can be used to support weak industries or compensation of industries,

which have been affected negatively by the reduction of tariffs. The third reason for

the popularity of NTBs is the ability of interest groups to influence the process in

the absence of opportunities to obtain government support for the tariffs.

2. Non-tariff barriers today: With the exception of export subsidies and quotas,

NTBs are most similar to the tariffs. Tariffs for goods production were reduced

during the eight rounds of negotiations in the WTO and the General Agreement on

Tariffs and Trade (GATT). After lowering of tariffs, the principle of protectionism

demanded the introduction of new NTBs such as technical barriers to trade (TBT).

According to statements made at United Nations Conference on Trade and

Development (UNCTAD, 2005), the use of NTBs, based on the amount and control

of price levels has decreased significantly from 45% in 1994 to 15% in 2004, while

use of other NTBs increased from 55% in 1994 to 85% in 2004.

Increasing consumer demand for safe and environment friendly products also have

had their impact on increasing popularity of TBT. Many NTBs are governed by WTO

agreements, which originated in the Uruguay Round (the TBT Agreement, SPS

Measures Agreement, the Agreement on Textiles and Clothing), as well as GATT

articles. NTBs in the field of services have become as important as in the field of

usual trade.

Most of the NTB can be defined as protectionist measures, unless they are related

to difficulties in the market, such as externalities and information asymmetries

between consumers and producers of goods. An example of this is safety standards

and labeling requirements.

The need to protect sensitive to import industries, as well as a wide range of trade

restrictions, available to the governments of industrialized countries, forcing them to

resort to use the NTB, and putting serious obstacles to international trade and

world economic growth. Thus, NTBs can be referred as a new of protection which

has replaced tariffs as an old form of protection.

3. Limits of Foreign Exchange Trading

The foreign exchange market of the country is confined to the city of Dhaka. The 32

scheduled banks operating as authorized dealers in the inter-bankforeign exchange

For more info, please contact to 01712 043880 Page 10 of 29

market are not permitted to run a position beyond certainlimits. In the event of

speculation on an appreciation of the value, anauthorized dealer may buy more

foreign currencies than it needs, but at theend of the day it must maintain its limit

by selling excess currencies either inthe inter-bank market or to customers.

Authorized dealers maintain clearingaccounts with the Bangladesh Bank in dollar,

pound sterling, mark and yento settle their mutual claims. If there any excess

foreign exchange holdingsexist after these transactions, it is obligatory for them to

sell it to theBangladesh Bank. In case of shortfall of the limit, authorized dealers

have tocover it either through purchase from the market or from the

BangladeshBank.

18. Major Factors that Affect the Foreign Exchange Market in Bangladesh

Some of the major factors that affect the foreign exchange market in Bangladesh

are:

i) Exchange rates

ii) Remittances

iii)Foreign Exchange Reserve

iv) Foreign Exchange Regulations

19. What are the various types of letter of credit? What are the parties

involved in a letter of credit?

[

- Unconfirmed L/C-

- Confirmed L/C-

- Standby L/C-

- Revolving L/C-

- Transferable L/C

- Back to Back L/C-

- Pre-Advise-

- Tender Guarantee(Bid Bond)-

- Performance Guarantee(Performance Band)

- Advance Payment Guarantee-

- Facility Guarantee, Maintenance Guarantee, Shipping Guarantee-

- Commercial L/C

- Bank Guarantee ]

The different types of Letter of Credit (LC) can be categorized as follows: -

1. Confirmed LC: It issued by a foreign bank, with validity confirmed by a

bank of origin. A seller who requires a confirmed LC from the buyer is assured of

payment by the origin bank even if the foreign buyer or the foreign bank

defaults.

2. Deferred Payment Credit: It provides for payment some time after

presentation of the shipping documents by seller.

3. Discrepancy LC: When documents presented do not conform to the LC, it is

referred to as a "discrepancy".

For more info, please contact to 01712 043880 Page 11 of 29

4. Documentary Credit: Commercial LC provides for payment by a bank to

the name beneficiary, usually the seller of merchandise, against delivery of

documents specified in the credit.

5. Irrevocable LC: LC with a fixed expiration date that carries the irrevocable

obligation of the issuing bank to pay the exporter when all of the terms and

conditions of the LC have been met.

6. Red Clause LC: It allows the exporter to receive a percentage of the face

value of the LC in advance of shipment.

7. Revocable LC: It can be cancelled or altered by the Drawee (buyer) after it

has been issued by the Drawee's bank.

8. Transferable LC: it allows all or a portion of the proceeds to be transferred

from the original beneficiary to one or more additional beneficiaries.

9. LC, Payment by sight draft: Document, issued by a bank per instructions

by a buyer of goods, authorizing the seller to draw a specified terms, usually the

receipt by the bank of certain documents within a given time.

The parties involved in a letter of credit are as follows:

1. Applicant- who is opener of LC, generally a buyer of goods to make invoice

value of goods.

2. Issuing Bank- issues a letter of credit at request of applicant that undertakes to

honor a complying presentation of the beneficiary.

3. Beneficiary- It is the seller of the goods or the provider of the services in a

standard commercial letter of credit transaction.

4. Advising bank- who takes responsibility to communicate and arranges to send

documents to LC opening bank.

5. Confirming bank- confirms and guarantees to undertake the responsibility of

payment or negotiation acceptance under the credit.

6. Negotiating Bank- who negotiates documents delivered to bank by beneficiary

of LC.

7. Reimbursing bank- who authorized to honor the reimbursement claim of

negotiation/ payment/ acceptance.

20. Describe the purposes and the types of pre-shipment export credit.

Pre-shipment finance is required for procurement of goods, processing the raw

materials, packing, baling and storage, transporting the goods to the port of

shipment, freight, inspection and other charges and export duty. It is essentially a

short term credit. It is liquidated by negotiation/ purchase of export bills. Pre-

shipment credit is in most cased granted against irrevocable/ confirmed LCs or firm

contracts received by the exporter form overseas buyers. In all cases, credit-

worthiness and reputation of the foreign buyer needs to be ascertained before

extending such credits. The credit-worthiness and performance of the exporter are

also taken into consideration for sanction of the credit limit.

21. Describe the different types of export credits.

Or, Describe the purposes and the types pre-shipment and Post-

shipment export credit.

Exporter needs finance at two stages: pre-shipment and post-shipment stages. Pre-

shipment finance is required for procurement of goods, processing the raw

For more info, please contact to 01712 043880 Page 12 of 29

materials, packing, baling and storage, transporting the goods to the port of

shipment, freight, inspection and other charges and export duty, if any.

After the shipment, while he waits for the money from the buyer, he needs money

to get ready for executing future orders. What he can do is selling or discounting

the export bills with his bank to generate funds. It is what call post-shipment credit.

Pre-shipment Export Credit:

1. O/D (Hypothecation): Under this arrangement, limit is sanctioned against firm

export contract/ irrevocable LC on hyphenation of raw materials or finished

goods meant for export.

2. O/O (Pledge): This type facility offer to the customer, integrity is beyond

doubted as it intended for procuring, processing, packing etc. of exportable

merchandise, which can’t be conveniently taken to bank’s custody.

3. Packing Credit: It is sanctioned against security of R/R, B/R, truck receipt, etc.

evidencing transportation of goods from up-country to the port for shipment.

PACKING CREDIT is any loan or advance granted or any other credit provided

by a bank to an exporter for financing the purchase, processing, manufacturing

or packing of goods prior to shipment, on the basis of letter of credit opened in

his favor or in favor of some other person, by an overseas buyer or a confirmed

and irrevocable order for the export of goods from the producing country or any

other evidence of an order for export from that country having been placed on

the exporter or some other person, unless lodgment of export orders or letter

of credit with the bank has been waived.

4. Advance against Red Clause LC

5. Advance against Green Clause LC

Post-shipment Export Credit:

1. Negotiation/ Purchase of Documents

2. Advance against export bills

3. DA/DP/Sight bills

4. Noting/ Protesting

5. Advising fate of the bill

6. Realization of collection charges, Interest etc.

7. Case in Need

8. Clearance, storage, Insurance etc. at destination

9. Mode of Presentation of the bill

10. Finance of export documents of collection basis (FDBC)

11. Discounting of Usance bills (DA Bills)

22. Distinguish between LIM & LTR

LIM: This type of finance is offered to the importer to finance their needs for

meeting the cost including freight, insurance, and customs and excise duty payable

on the imported merchandise. The lending bank mostly pledges the imported

goods. The merchandise is released for the use of the importer (borrower) upon

repayment of the bank’s finance and charges either fully or partially, on production

of the Delivery Order issued by the banker in favor of the borrower.)

LTR: Trust Receipt (TR) is a type of short-term import loan to provide the buyer

with financing to settle goods imported under Letter of Credit where title of goods is

For more info, please contact to 01712 043880 Page 13 of 29

held by the bank. Under a TR arrangement, the Bank retains title to the goods but

allows the buyer to take possession of the goods on trust for resale before paying

the Bank on TR due date. TR financing is applicable to goods imported under

documentary credit.

23. Discuss the various types of credit facilities offered to importers by

the banks

1. Letter of Credit: This is made in the form of commitment on behalf of the

client to pay an agreed sum of money to the beneficiary of the L/C upon

fulfillment of terms and conditions of the credit.

2. Loan against Trust Receipt (LTR): LTR may provide when the documents

covering an import shipment are given without payment. Importer will hold the

goods of their sale proceeds in trust for the bank; until the loan allowed against

the Trust Receipt is fully paid.

3. Payment against Documents (PAD): It is a post-import finance to settle the

properly drawn import bills received by the bank in case adequate fund is not

available in client’s account.

4. Loan against Imported Merchandise (LIM): The lending bank mostly

pledges the imported goods. The merchandise is released for the use of the

importer (borrower) upon repayment of the bank’s finance and charges. LIM

may be created in two ways:

a) LIM on importer's request

b) Forced LIM

5. Bank Guarantee: The bank, on behalf of importer constituents or other

customers, issues guarantees in favor of beneficiaries abroad. The guarantees

may be both Performance and Financial.

6. Collection of Import Bills: In this case, the importers may be financed that

the bank collect the imports bills by authorized FOREX dealers outside the

country and the importer will collect the bills from local bank.

24. Discuss the various types of post-shipment import finance provided by

the banks

1. Loan against Trust Receipt (LTR): LTR may provide when the documents

covering an import shipment are given without payment. Importer will hold the

goods of their sale proceeds in trust for the bank; until the loan allowed against

the Trust Receipt is fully paid for a period of 30 to 180 days depends on nature

& amount of imported goods.

2. Payment against Documents (PAD): It is a post-import finance to settle the

properly drawn import bills received by the bank in case adequate fund is not

available in client’s account.

3. Loan against Imported Merchandise (LIM): It may be allowed on pledge

of goods, retaining margin 'prescribed on their landed cost, depending of their

categories. The Bank obtains a letter of undertaking and indemnity from the

parties, before getting the goods cleared through LIM account. LIM may be

created in two ways:

For more info, please contact to 01712 043880 Page 14 of 29

a) LIM on importer's request: In some cases the importer can’t able to retire

the bill by his own source of fund, he may request the bank to clear the

goods by creating LIM Account.

b) Forced LIM: In some cases importer do not come forward to retire the

goods. In these cases the bank themselves arrange to retire the goods

by pledge in Godown under bank’s lock & key. This type of payment is

called forced LIM.

25. Identify the possible risk associated with import finance and the steps

that can be taken to minimize these risks

Fraud Risks

There are various types of fraud like documentary fraud, counterpart fraud,

insurance scams, cargo theft, scuttling and piracy. The payment will be

obtained for nonexistent or worthless merchandise against presentation by

forged or falsified documents.

Credit itself may be funded.

Sovereign and Regulatory Risks

Performance of the Documentary Credit may be prevented by government

action outside the control of the parties.

Legal Risks

Possibility that performance of a Documentary Credit may be disturbed by legal

action relating directly to the parties and their rights and obligations under the

Documentary Credit

Risks to the Issuing Bank

Insolvency of the Applicant

Fraud Risk, Sovereign and Regulatory Risk and Legal Risks

Country Risk: The factors usually associated with this type of risk are the political

and economic stability of a country, exchange controls, if any, and the country's

penchant for protectionism of domestic industry at short notice. All these factors will

determine whether the country can and will honor their payment commitments-in

time.

Foreign Exchange Risk

Payments and receipts in foreign currency are an everyday occurrence in

international trade and the trader is always at the mercy of exchange rate

fluctuations due to various economic, political and even purely speculative reasons.

Insolvent Applicant: In case of insolvency of the importer, it would be difficult to

trace the proceeds of the goods.

Steps that can be taken to minimize these risks:

1. The bank may not deals with unknown or unrenowned importers in case of

large amount of transaction

2. Before opening LC, the bank should take steps to obtain credit report of the

foreign exporter. Bangladesh Bank also requires the banks to obtain credit

reports when the LC exceeds certain amount.

3. Bank must not need to finance when it knows a tendered document either

contains documents by the parties to be false or contains a forged signature or

a fraudulent alteration.

For more info, please contact to 01712 043880 Page 15 of 29

4. Bank must examine all documents stipulated in the credit with reasonable care,

to ascertain whether or not they appear, on their face, to be in compliance with

the terms and conditions.

5. In case of LIM facility, sometimes collateral in the form of landed property is

also be taken in addition to hypothecation/ pledge of the goods imported to

secure liquidation of the loan in time

26. Identify the risk associated with loans granted to the importers

against Trust Receipt and how these risks can be mitigated

However, in practice, Trust Receipt does not secure the position of the bank to a

significant extent. The risks are that—

1. The importer may re-pledge the goods with another bank or person;

2. The importer may sell the goods without remitting the amount into the bank;

3. In case of insolvency of the importer, it would be difficult to trace the proceeds

of the goods.

4. Another hazard is if the LTR have made against the restriction items have

imported subject to obtaining special permission from the concern Government

authorities like drugs, obscene and subversive literatures, firearms, ammunitions

and antiquated items.

Steps taken to mitigate the risks against LTR

1. The bank may not deals with unknown or unrenowned importers in case of large

amount of transaction

2. The bank not to allow the finance in case of shortage of importer’s experience,

reliability and reputation

3. The bank may not grant a LTR in case insolvent parties

4. The bank may not allow a LTR in case restriction items by the Government

27. Briefly discuss the advantages and disadvantages of financing imports

under LTR

Advantages/ Importance of LTR:

A trust receipt is typically used when a bank has lent money for, say, import of

goods, but the goods have to be released to the importer so they can be sold or

prepared for sale.

But until the loan has been repaid, the goods still belong to the bank. The trust

receipt evidences the bank's ownership of the goods. The borrower agrees to put

the goods at the disposal of the bank if required to do so, to keep them separate

from other goods etc. so they can be identified.

Trust receipts normally have a time limit associated with them. This is the time by

which the borrower's business cycle can be expected to have generated the money

to repay the loan.

It has to be said that the security provided by a trust receipt is rather poor. As its

name suggests, the borrower is trusted not to violate the terms of the agreement.

There are frequent cases of banks finding that they can't actually recover their

collateral.

For more info, please contact to 01712 043880 Page 16 of 29

Disadvantages of LTR:

One disadvantage of trust receipt financing is the requirement that a trust receipt

be issued for specific goods. For example, if the security is autos in a dealer’s

inventory, the trust receipts must indicate the cars by registration number. In order

to validate its trust receipts, the lending institution must send someone to the

borrower’s premises periodically to see that the auto numbers are correctly listed

because auto dealers who are in financial difficulty have been known to sell cars

backing trust receipts and then use the funds obtained for other operations rather

than to repay the bank. Problems are compounded if the borrower has a number of

different locations, especially if they are separated geographically from the lender.

To offset these inconveniences, warehousing has come into wide use as a method

of securing loans with inventory.

28. Define Documentary Credit. What are the advantages of a

Documentary Credit?

A documentary credit—also called a letter of credit—is a conditional guarantee of

payment in which an overseas bank takes responsibility for paying you after you

ship your goods, provided you present all the required documents (such as

documents of title, insurance policies, commercial invoices and regulatory

documents).

A documentary credit is a separate contract from an export contract. The parties to

a documentary credit deal with documents, not the goods that the documents

relate to.

Documentary credits are a common method of payment in the international trade of

goods as they offer some protection to both you and your buyer.

The advantages of a Documentary Credit:

For the Exporter/Seller:

1. The seller has the obligation of buyer's bank's to pay for the shipped goods;

2. Reducing the production risk, if the buyer cancels or changes his order

3. The opportunity to get financing in the period between the shipment of the

goods and receipt of payment (especially, in case of deferred payment).

4. The seller is able to calculate the payment date for the goods.

5. The buyer will not be able to refuse to pay due to a complaint about the goods

For The Importer/Buyer:

1. The bank will pay the seller for the goods, on condition that the latter presents

to the bank the determined documents in line with the terms of the letter of

credit;

2. The buyer can control the time period for shipping of the goods;

3. By a letter of credit, the buyer demonstrates his solvency;

4. In the case of issuing a letter of credit providing for delayed payment, the seller

grants a credit to the buyer.

5. Providing a letter of credit allows the buyer to avoid or reduce pre-payment.

For more info, please contact to 01712 043880 Page 17 of 29

29. Distinguish between documentary credit and documentary collection

Back-to-Back credit is a seller financing tool where seller goes to his bank for

amendment of the master LC and get issued another LC in favor of the main

supplier and also it is a LC where main buyer does not get to know that who is main

supplier.

A transferable letter of credit allows the beneficiary to act as a middleman and

transfer his rights under a letter of credit to another party or parties who may be

suppliers of the goods.

There are two major differences between a documentary collection and a

documentary credit: (1) the draft involved is not drawn by the seller (the "drawer")

upon a bank for payment, but rather on the buyer itself (the "drawee"), and (2) the

seller's bank has no obligation to pay upon presentation but, more simply, acts as a

collecting or remitting bank on behalf of the seller, thus earning a commission for

its services.

30. Describe briefly the types of frauds that occur in connection with

documentary credit.

NEED UPDATE

A letter of credit fraud is a type of scam in which the scammer attempts to make

money via faulty business transactions or tells victims that a letter of credit is an

investment.

1. One way of performing letter of credit fraud is to create a fake company. The

scammer will tell the victim that he or she is a representative for a company that

can ship goods to the victim at very low costs. After the victim signs the letter of

credit, the scammer goes to a bank and collects the money. The company will

then typically disappear, and the victim either will receive nothing or will receive

vastly inferior goods.

2. The second method of performing a letter of credit fraud is to tell the victim that

the letter represents an investment. The scammer tells the victim that he or she

will receive a high interest rate from purchasing the fake letter of credit. Letters

of credit are not investments, however, and cannot be used as such.

31. Discuss the features of Documentary Credit/ Letter of Credit

Characteristics of a Documentary Letter of Credit:

1. a written obligation on the part of the bank to pay a specified amount

subject to meeting of the conditions of the letter of credit stipulated by the

buyer

2. the bank assumes the obligation towards the seller on the basis of request by the

buyer

3. an irrevocable obligation

4. various types of letters of credit:

a. import, export (customer, supplier)

b. notified, confirmed

c. transferable, revolving, standby letter of credit

5. one of the most important and best elaborated payment instruments

6. used in international and domestic trade

For more info, please contact to 01712 043880 Page 18 of 29

7. certainty for the buyer that payment of a specific amount will not be made

until the seller meets the conditions set by the buyer

8. certainty for the seller that he or she will be paid for the goods after the

conditions of the letter of credit are met

32. Discuss the duty and responsibility of Opening Bank/ Issuing Bank

under confirmed L/C

1. Duty owned to the applicant:

i. The duty to issue an efficacious credit: The buyer has approach to opening of

a documentary credit in favor of the seller, on the terms set out in the

contract of sale that a contractual relationship comes into existence between

the buyer and the bank.

ii. The duty to receive and examine the required documents and make payment

in accordance with the credit's stipulation.

iii. The fraud exception: The fraud exception under a tendered document either

contains statements known by the beneficiary to be false or contains a forged

signature or a fraudulent alteration.

2. Duty owned to the beneficiary:

The obligation is to receive, examine the required documents and make payment.

All that the issuing bank do should be consistent with the rule, actually that is the

duty it owned to the beneficiary. These are:

i. The doctrine of strict compliance and standard for examining the documents

ii. Duty to raise all discrepancies in a reasonable time

3. The issuing bank's duty to reimburse the correspondent bank

33. Discuss the duty and responsibility of Advising Bank/ Corresponding

Bank

Correspondent bank (usually in the exporter's country) of an issuing bank (usually

in the importer's country) that receives a letter of credit (L/C) from the issuing bank

for authenticating it and informing ('advising') the exporter (the L/C's beneficiary)

that a L/C has been opened by the importer in the exporter's favor.

The advising bank usually also takes on other roles in the transaction, such as

1. C the letter of credit (playing the role of the 'confirming bank'),

2. Accepting a bill of exchange by endorsing it (becoming the 'accepting bank')

and/or,

3. Paying the exporter on presentation of documents (becoming the 'paying bank'

or 'negotiating bank').

34. What is meant by balance of payments?

A record of all transactions made between one particular country and all other

countries during a specified period of time. BOP compares the dollar difference of

the amount of exports and imports, including all financial exports and imports. A

negative balance of payments means that more money is flowing out of the country

than coming in, and vice versa. Balance of payments may be used as an indicator of

economic and political stability.

For more info, please contact to 01712 043880 Page 19 of 29

35. Describe the factors responsible for adverse balance of payments.

1. Low export: due to low demand elasticity for exports and decline of the supply

of goods for export.

2. Increase in demands for imports: due to low production of essential goods in the

domestic economy.

3. Unfavorable terms of trade: due to the fall in price of exports and the rise of

price of exports which leads to low amount of receipts from abroad and the high

amount of payments abroad.

4. Shortage of capital goods: the capital goods then have to be imported at

whatever price.

5. Devaluation policy: which happens when the country's export have low price

elasticity and when the imports have inelastic demand or when other countries

which export similar products also devalue their currencies.

6. Unfavorable climatic condition: This leads to fall in the country’s production,

which leads to low export.

36. What corrective steps a developing country like Bangladesh can take

to correct an adverse balance of payments?

When there is a deficit, a country has to adopt various methods to correct it. The

methods that can be applied include:

(a) Export promotion: One of the best way to promote export is to provide subsidies

to exporters and applying tax exemption and trade fairs. These can encourage and

empower the exporters, and with more production and export the disequilibrium

can be reduced or corrected altogether.

(b) Reducing expenditure on imports: This can be done by imposing high import

tarrifs, thus importation of goods will be reduced thus domestic goods will have to

be more production of domestic goods, the outflow of the government funds will be

reduced.

(c) Devaluation policy: The reduction of currency is made in order to promote

exports and discourage imports, as when a currency is devalued exports become

cheaper while imports become more expensive.

(d) Increasing production: In this, the production of export goods is increased hand

in hand with the increase of the production of goods which would otherwise be

imported.

(e) International cooperation: International organizations such as IMF, the World

Bank and the World Trade Organization, can help to correct the balance of payment

through aids, grants and loans.

37. How does Balance of Trade differ from Balance of Payments?

Or, Difference between Balance of Trade and Balance of Payments

Basis of

Balance of Trade (BOT) Balance of Payment (BOP)

Difference

It defined as difference It is flow of cash between

1. Definition between export and import of domestic country and all other

goods and services. foreign countries.

2. Formula BOT = Net Earning on Export BOP = Current Account + Capital

For more info, please contact to 01712 043880 Page 20 of 29

- Net payment for imports Account + or - Balancing item (

Errors and omissions)

Balance of Payment will be

favorable, if you have surplus in

If export is more than current account for paying your

import, at that time, BOT will all

3.Favourable or

be favorable. If import is past loans in your capital account.

Unfavorable

more than export, at that Balance of payment will be

time, BOT will be unfavorable unfavorable, if you have current

account deficit and you took more

loan from foreigners.

4. Solution of

To Buy goods and services To stop taking of loan

Unfavorable

from domestic country. from foreign countries.

Problem

a) cost of production

b) availability of raw

a) Conditions of foreign lenders.

materials

5. Factors b) Economic policy of Govt.

c) Exchange rate

c) all the factors of BOT

d) Prices of goods

manufactured at home

It shows debit and credit of Credit means to receipt and

current account. earning both current and capital

6. Meaning of

Credit means total export of account and debit means total

Debit and

different goods and services outflow of cash both current and

Credit

and debit means total import capital account and difference

of goods and services in between debit and credit will be

current account net balance of payment.

31. What are the principal incentives offered for foreign investment in

Bangladesh?

1. Tax Generally 5 to 7 years. However, for power generation exemption

Exemptions : is allowed for 15 years.

No import duty for export oriented industry. For other industry it is

2. Duty :

@ 5% ad valorem.

i. Double taxation can be avoided in case of foreign investors on

the basis of bilateral agreements.

3. Tax Law : ii. Exemption of income tax upto 3 years for the expatriate

employees in industries specified in the relevant schedule of

Income Tax ordinance.

4. Remittance : Facilities for full repatriation of invested capital, profit and divided.

An investor can wind up on investment either through a decision of

the AGM or EGM. Once a foreign investor completes the formalities

5. Exit :

to exit the country, he or she can repatriate the sales proceeds

after securing proper authorization from the Central Bank.

Foreign investor can set up ventures either wholly owned on in

6. Ownership :

joint collaboration with local partner.

For more info, please contact to 01712 043880 Page 21 of 29

38. Analyze the favorable and adverse impacts of foreign investment on

Bangladesh economy.

Favorable impacts of foreign investment on Bangladesh economy:

1) Overcoming domestic resource constraint: It inflows are believed to be more

stable and easier to service than other sources of foreign private capital such as

commercial debts or portfolio investment.

2) Raising the productivity of labor and capital: FDI raises the productivity of labor,

and employment quality. Economies of scope and scale and managerial

efficiency can raise the productivity and returns of all production inputs.

3) Generating employment: Increased employment, like investment, will have a

multiplier effect on the economy and stimulate a dynamic growth cycle.

4) Easing the balance of payments constraints: It constitutes an inflow on the

capital account and allows the economy to sustain the deficit on the current

account without devaluing the currency.

5) Raising exports: It is in fact one reason why developing country govt. tries to

attract FDI through the creation of export processing zones (EPZs).

6) Access to technology: FDI brings in new technology, which may have positive

spillover effects for other local firms.

7) Access to markets: It can help host countries gain easy access to the lucrative

markets of the rich countries.

8) Benefits to environment: It have better access to and knowledge of

environmentally sound technologies and are expected to bring such

technologies to the host country.

9) Benefits to consumers: Consumers are benefited from increased FDI inflows in

the form of lower prices and improved product quality.

10) FDI may also contribute increased revenue to the government.

Adverse impacts of foreign investment on Bangladesh economy:

1. Impact on domestic savings: The FDI may also have a negative effect on

domestic savings, as it gives room for an increase in consumption in the

recipient country.

2. Decapitalization effect: FDI brings in capital, but also leads to a stream of

return flow of profit, other investment incomes and accumulated interest, and

repatriation of capital.

3. Effects on balance of payments: FDI have a positive effect on balance of

payments, there must be a strong enough positive trade effect to offset the

negative decapitalization effect.

4. Denationalization effect: The ownership of firms is transferred from domestic to

foreign hands and the foreign share of the nation’s wealth stock increases

relative to local share.

5. Impact on development: The impact of FDI on development also depends upon

the type of FDI, i.e., whether it is in the form of “Greenfield investment” or

“merger and acquisition”.

6. Instability: Contrary to the conventional wisdom that FDI is a stable form of

longer-term foreign capital inflows, an UNCTAD report shows that FDI can also

be a source of considerable financial instability.

For more info, please contact to 01712 043880 Page 22 of 29

39. What are the measures you would suggest to improve the climate for

foreign investment in Bangladesh.

The measures that would be suggested to improve the environment for foreign

investment are as follows:

1. Capital Controls: Capital controls encourage black markets for foreign currency.

So, it should be a effective controls system for improvement of foreign

investments.

2. Allows a limited capital flight: Another strategy that governments can use to

limit capital flight is to make holding domestic currency more attractive by

keeping it undervalued relative to other currencies or by keeping local interest

rates high.

3. Tackle tax havens and address tax evasion: Tax evasion can be reduced by

relying more on consumption or sales taxes and less on taxes on interest and

profits.

4. Arrangements among control bodies: Agreements among countries and central

banks can add to the credibility of these situations.

5. Reforms in international monitory system: It ensures stability of exchange

rates, and must build upon the principles of cooperation and solidarity.

6. Private capital: One encouraging sign is that private capital has begun to return

to countries for which future prospects have brightened.

7. Reform accounting standards: It must be improved in order to prevent

excessive risk taking as well as tax avoidance and tax evasion practices.

40. What do you mean by Flight of Capital? Describe why & how capital

flight from Bangladesh? What preventive steps you would suggest to

stop capital flight?

Flight of capital is the movement of money from one investment to another in

search of greater stability or increased returns. Sometimes specifically refers to the

movement of money from investments in one country to another in order to avoid

country-specific risk (such as high inflation or political turmoil) or in search of higher

returns. The outflows are sometimes large enough to affect a country's entire

financial system.

Why & how capital flight from Bangladesh:

1. Overvalued Exchange Rate: An anticipated depreciation erodes the value of the

domestic currency, prompting the residents to convert domestic assets into

foreign assts.

2. Financial Sector Inefficiencies: The services provided by the financial sector are

not time-befitting and technology used is not sophisticated enough to meet the

demand of the customers.

3. Monetization of Fiscal Deficits: Fiscal deficits are normally financed by printing

money, which leads to monetary expansion, inflationary pressure, and finally

accentuates the inflation tax.

4. Tax Effects: Due to high income and corporate tax rates, taxpayers frequently

avoid paying taxes by keeping money out of the country.

For more info, please contact to 01712 043880 Page 23 of 29

5. Political and Economic Uncertainty: The uncertainty factors associated with

occasional political instability and important economic policy announcements

motivate capital flight.

6. Rigidity on Capital Movement: Legal embargo imposed on the transfer of

foreign exchange from the country gives rise to the hundi business.

7. Weak Capital Market: One important point worth mentioning is that historically

the capital market in Bangladesh did not play much prominent role. As result,

the capital may be flight.

Preventive steps you would suggest to stop capital flight:

1. Reform the international monetary system: It ensures stability of exchange

rates, and must build upon the principles of cooperation and solidarity.

2. Allow countries to introduce capital controls: The country should be allowed and

encouraged to use capital controls if they deem it necessary to manage their

economies, prevent contagion, raise revenue, and reduce volatility.

3. Rethink the banking system: A new regulatory system should include an

international supervisory and regulatory body. It prevents banks from becoming

too big to fail without adequate public control.

4. Enforce binding social and environmental standards: It should be put in place in

order to constrain banks & financial institutions to deploy capital in ways that

support the protection.

5. Introduce the speculator pays principle: Global taxes should be implemented

both to address speculative behaviors and to finance global public goods that

can prevent the capital flight.

6. Tackle tax havens and address tax evasion: Tax evasion can be reduced by

relying more on consumption or sales taxes and less on taxes on interest and

profits.

7. Reform accounting standards: It must be improved in order to prevent excessive

risk taking as well as tax avoidance and tax evasion practices.

41. Describe the various methods available to overseas Bangladesh

Nationals for transfer of funds to the home country. What are the

problems normally encountered by them for such transfer?

There are an ever larger number of options for sending money overseas or

processing international money transfers. Below are some of the methods available

to you:

1. Foreign Exchange Providers: When transferring much larger amounts of money,

for purchasing a property or starting up a business for example, or sending

regular payments abroad, it may often be cheaper to use a reputable currency

broker

2. Banks: Most of the UK banks offer money transfers, so long as you hold an

account with them and also the recipient.

3. Money Transfer Operators: It is are companies that only offer money transfer

services, usually through agents, and only send money between countries.

4. Online money transfer services/internet money transfers: For a small

percentage, you can send money via the internet using secure online payment

providers.

For more info, please contact to 01712 043880 Page 24 of 29

5. Prepaid money cards: Load up a prepaid card and spend abroad just as you

would a credit card or debit card.

The problems normally encountered by them for such transfer are:

1. Poor infrastructure in rural and semi-urban economy

2. Inadequate reach of private commercial banks within the country

3. Massive information asymmetry in the market

4. Active ‘Hundi’ market

5. Inefficiency of financial institutions

6. Poorly regulated exchange houses

7. Low literacy rate in the country

8. Uneven competition among financial institutions

9. Lack of investment in IT backbone development for market efficiency

10. Absence of a strong central payment gateway for ‘Straight Though Processing

(STP) of payment services

[

Problems created by fund transfer are as follows:

1. Brain drain: Brain drain is the most significant negative side of enjoying fund

transferring for any developing country like Bangladesh. Though we get an

important portion of remittance from our educated skilled person after all it is

not favorable because educated people are very important for our economy.

2. Income inequality: In a specific community, relative income inequality may be

found where there are both emigrants’ families and non-emigrants families due

to the variation in their income levels.

3. Regional disparities: In the same line of above reasoning regional disparities

may be found among emigrants’ intensive regions or districts like Sylhet,

Chittagong, Comilla, Noakhali, Dhaka etc. and less emigrants’ intensive regions

or districts of the country.

4. Increased demand for imported luxury goods: There is a tendency of

remittance earning families to purchase foreign luxury goods which creates

unfavorable condition in the balance of payments.

5. Misuse of remittance: Sometimes the young people of remittance earning family

easily get huge money on their hand and misuse that money creating various

types of immoral and illegal activities.

6. Social insecurity: Sometimes remittance earning families feel insecurity from

hijackers. They are sometimes compelled to pay to the bad section of the

society.]

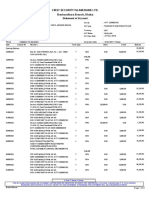

42. Discuss the trends and main sources of foreign exchange remittances

Trends in Local and Foreign Remittance in Bangladesh

Yr 07-08 in USD Yr 2008-9 in USD Yr 2009-10 in USD

NRB Remittances 7 million 8.5 million 10 million

Local Remittances 14 million 17 million 20 million

For more info, please contact to 01712 043880 Page 25 of 29

The main sources of Foreign Remittance in Bangladesh:

From Saudi Arabia, over a million workers sent $1,312 million during July-March

period of 2007. In the same period The United Kingdom came out as the second

biggest source of remittance with Bangladeshi Diaspora sending home $657 million

to their relatives at home, closely followed by $656 million from the United States of

America. Non-resident Bangladeshis remitted $559 million from the United Arab

Emirates and $494 million from Kuwait in July-March period of 2007.

43. Analyze the importance/ impact of remittance in the Bangladesh

economy

The ways in which remittances alleviate the poverty of individuals are, in the ‘first

round’ of effects, direct and fairly obvious. They include the following.

1. Survivalist income supplementation. For many recipients, remittances

provide food security, shelter, clothing and other basic needs.

2. Consumption ‘smoothing’. Many recipients of remittances, especially in

rural areas, have highly variable incomes. Remittances allow better matching

of incomes and spending, the misalignment of which otherwise threatens

survival and/or the taking on of debt.

3. Education. In many developing countries, education is expensive at all levels,

whatever the formal commitments of the State. Remittances can allow for the

payment of school fees and can provide the wherewithal for children to attend

school rather than working for family survival.

4. Housing. The use of remittances for the construction, upgrading and repair of

houses is prominent in many widely different circumstances.

5. Health. Remittances can be employed to access preventive and ameliorative

health care. As with education, affordable health care is often unavailable in

many remittance-recipient countries.

6. Debt. Being in thrall to moneylenders is an all-too-common experience for

many in the developing world. Remittances provide for the repayment of debts

and for the means to avoid the taking on of debt by providing alternative

income and asset streams.

7. Social spending. Day-to-day needs include various ‘social’ expenditures that

are culturally unavoidable. Remittances can be employed to meet marriage

For more info, please contact to 01712 043880 Page 26 of 29

expenses and religious obligations and, less happily but even more

unavoidable, funeral and related costs.

8. Consumer goods. Remittances allow for the purchase of consumer goods,

from the most humble and labor saving, to those that entertain and make for a

richer life

[Impact on the economy:

Totally the contribution of foreign remittance rising of living standard can

not be described so e a s i l y . S o t h e i m p o r t a n c e o f f o r e i g n r e m i t t a n c e

i n t h e e c o n o m y o f B a n g l a d e s h i s w i d e l y recognized and requires little

reiteration.

1. Impact on the GNP: Increase in foreign remittance also increases the national

income. As the national income increase the consumption of goods by the

country people also increase. So, production of goods by the different

organizations increases as well. It increases our country’s GNP.

2. Impact of remittance on consumption: As the remittance increase the consumption

of goods by the country people also increase.

3. Increase savings: Foreign remittance that comes from different developed

countries is increasing the level of our savings. The remittance

received by our country people is saving in different banks by making

long term or short term deposit.

4. Increase capital: Remittance received from different developed countries which is

saving in different banks a big source of capital. This huge amount of money is

investing is different project by the bank.

5. Impact of remittance on investment: Foreign remittance is increasing the investment

of our country. The remittance is using for small and big investment in

different project, establishing firm or industry, small or big shop which

increases the proper utilization of money.

6. Increase employment: As the investment increase, the employments of our

country also increase. The people of our country are getting jobs in

different project, firm or industries.

7. Impact of remittance on import: It has a bad impact on our economy. By increasing

remittance, it also increases consumption of foreign product. It increasing

the import of foreign product day by day as well, Peoples have

enough money to buy f oreign product, although government is

t r y i n g t o s a v e o u r d o m e s t i c companies by implementing necessary rules

and regulation.]

44. What are your suggestions for improvement of the banking channel

for remittances to Bangladesh at low cost and greater speed?