Professional Documents

Culture Documents

Advance Accounting Bcom SEm 1 - Dec 2015

Advance Accounting Bcom SEm 1 - Dec 2015

Uploaded by

Ekta Rana0 ratings0% found this document useful (0 votes)

12 views16 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views16 pagesAdvance Accounting Bcom SEm 1 - Dec 2015

Advance Accounting Bcom SEm 1 - Dec 2015

Uploaded by

Ekta RanaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 16

pe

ey

Si

Seat No. :

NQ-110

value December-2015

B.Com, Sem--I

CE-101A : Advanced Accounting & Auditing

(Financial Accounting-1)

: 3 Hours} [Max. Marks : 70

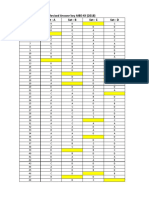

‘ 2 ¥ za Bcd vue curd cad.

» fit the J

| Go) dea, lad ada 4: 5 seth eugedi tal-qsatt aaa cuter &. ded

i

stant. add DA yo: 1 B

Rai z frase z iE

ater 50,000 | wa ue 25s 15,000 a

abel ale 30,000 | Gere Pets 1,80,000 \P

gl ala 15,000 | zisveil 1,07,000

ariel oisle 18,000

SERS ert 75,000

ad:

aden 75,000

wal 24,000

adeuel 15,000

3,02,000 3,02,000

dr Vad Rada evi 21 Basal fl yr Guam :

— wet aud % 50,000

= oft wud 1,85,000

Batil ad as aushers varieWl % 5,000 ed, F olla exer amd

%3,5004i asd sani audfl.

Rata vel & 10,000 2ierwarti ated veil, vet vue vel £7,500 ail eel.

ofa sual rid F 2,500 els ala ad U5 ec.

SAL Gaualad ated sel 1 al, BAL BA F 3,000 VA elem eHat Ha IF

asad ud. iB

sent qu veld” wes adel ealad yas dar sal.

aL

1 PTO.

(a) ss eudyrd edad wel tewt quail veh, sy atuetd

vale 3 Ad mer 8, d dei ama wl Da wd vel 4d

sari ae stueicl dss eal ealad was dae sal.

daw, omy Al Rela 3:2: Ltt wuavri dsl-qaaud ada culled ea

Beal cuatl ysaell avid ell yell Ral ays % 90,000, = 75,000 4

% 40,000 ed. deal wudl % 35,500 Bascal dauseiieh Anada ed. Barat

wel a2 aiid Ble 7,5004iN € 6,000 walla wal.

als oulerdl Vad Hel 01-01-2013 WAA Adar at 01-04-2013 ae AL

CBresl wren seal aud. at. 31-12-2013 ey YRL acl atl fle

wuRectl wae eurate Uae cel VUE UALetL tStefl LLC) $21 + 7

©

= (1) ch 31-12-2013 ele YL ant aM dou = 12,00,000 8. 3 AA

a CU, 01-01-2013 LL 31-03-2013 «1 ale yeld dave ¥ 2,40,000 8.

(2) ct 31-12-2013 Ble yRt act arte aur ate Awa vidi sia “isl

F % 480,000 8. tgrqsart vcd dard Rad DA yxe d :

: ‘ i

a aug aid det 39,000

4 stad wir 72,000

Rea ous 18,000

amy ol 12,000

wilde al 1,500

| sedser al 7.500

| auth wal 6,000 (b)

i Aare slats 24,000

aaa

vilaell ydail ta 2d q 2 clash dated asl arlaela BRss ad

g adel asa 3 ale ? wail seeil wa amd.

| 2 rial UPLSsf Arua ewe F 100i As ear 1,25,000 SBadl dei adarle

& 1,25,00,0000 J. Surlal 40% 421 Maz Yrial ML2 20% VIBHA eeLe UL ee 14

ade dls 254 Al yor sacl edl :

BRD WA 20

reel wed e40 olan wa )

Mar CUdl BLA 30

ofa wut aL 730

ae adael DA wud seaai suck; ©

ual Hee set 25,000 2

eG 7/3 wl Ae adael 20,000 te e

Mel 1/4 WL ae adel 5,000 22. «

50,000 az

NQ-110 2 a

yd

all

ya

aa

VL

fa

a

Lad

(DAs Guz «ily avi : (Alsuat ads)

S000 Grell aewril wie seid ad dav etl west aU. 212 ad aude

ome ttt “bell Hl A wud U2 ad wars Bd.

wet 3 Al we ya Hee sea deat alee 1000 a2 sina, eel, det eRe Wan

eHelal “WEL, HAL avid wy aASeUL vetl, CURE At Get SULA 5% ysad well.

sat 3 T4 dz vee 23 cud “de aduela dead” s00 de adaell seavii

auch edd daa 2A wer eraLtt wel RAWAL FEN AS ad Aet a2 wat But

Sue Bt Ai BUA,

Gln stir wed auc cue Sul ate whet owe x D2 wet SELL wrell one

50% EARL HL 70% Sactnt Me Sue etal % seit oud yal opus wa add

eA owe Yo 2 ae Gur sLeti AMaLU.

sulert Sefer aluseal x32 avila avi,

mat

(a) FA. ile atet cir 30022 ue dads 75,7 2B aka asada well,

Sul are det a % Az avd Hawi eu, BL aeart atet dat 600 de Gua

Tr ysarla vl. Ml az A Ml va Ua one wa HI. eda alll

yard F 10 uc well cue Fuel are alle gt AHI 70% mw

aleayeal get ARHiell sor de BA. sig, AeA & 740 ud yet ord cele

santa sual, Sudlu aud andldl 32 aurila aul aid judd alusetL

ak well oud due sal.

(b) etoue Rivt alicia a2 well wed LD wrod ;

& avd vig %.

Berd z Rate z

aay Ql vid, 1,400 | dal oud 8,400

yl eeuetd mud 700

UL LI as a4, 6.300

8,400 8,400

deel yaad % 100 ed wd 40 eds oRUS aaa eal, AD ae wre

Rai Sue eat ail dail aeys de SA owe vseal wal. 2 lela

aU deel 22 al met ala dle oie usat 2a Ault alsa ¥3d1

sands anil, 4

3

(1) Aa SBadl de 21) dull wal oadei

2) su Bad ae

GB) Watt ae vee wlearll Sell atl Aoraseil

P.T.O.

Java a we Rael Aflardl sax sol Aorased Read all, AA Bet

Pa auf wee daca anova waa sede aval:

Rela BIBS det 50,000, 12% Aaa Ds. da es 104d 10% MBCA wed

gear $29 8, Ra Sali Wal (ER Rint aes wuncURALe oUsL A awe eel

z

Ass wl ds Med 10,000

el ult Md, 3,00,000

WALL Bt 4,50,000

eel 20,000

Reda Re iat Guz caldar asiel aaa Bre Gur 13 tal Nad A drawl au9U.

Freie Ws. de waa ater Ue iss MA Asell oudl F 50,000 2a. Suefl atzt

og) deuni Sad de es T 10rd T 1st oud Mae Fiat HR USA O.

@

Jrclal da owe aba az Gua omy ctati Amda Od.

ual

MD aGier Bell att. 300M aot, 2013 Vell usa’ MA yer a:

z

10,000 SBaal de eds Tol Tsorwus wha 80,000

ALL Bed 20,000

dl ued itd 80,000

oooh Mb 10,000

Raz Mase ytryeisill Beda sel 10,000

(b)

(©)

NQ-H10

Jefe aura void alar seta wx aettdlll ousaiell aye ota aa

ye erwd ari aud d aa ye oud sera one duel tet wail aban,

SBad AV eds T 10d F120 ond awe wsavl aud G, 2 Bel ld Sell

vat Ay SBad ysl cawd ae al As yal oud wa de cilia 23

aan wd. ucla ase wad awrila aul.

el duclat wast Baar yw, Sul WA 80,000 SBadl Ae ets Z 10 21

overt Geer % 2,40,0001 8. Suef alls aout asl seed % gurl 10%

asd RRses Use asad. (euicril €2 20%) Sul BA 3% MBM wed

BS. ila gael well eueila aul.

ona de aed of 7 ola adaallar ASuer ast ela aul.

14

PHL,

Q ait

wd.

BT

aad

uri

1 bul

4g

HL at

10%

wwe

ead Reed sj aeady a 31-03-2013 lal yore;

Fate Gare ous | aan oud

sBadl deyd 7 1,20,000

loved Us. IAM. - 80,000

ALLA Bieta - 40,000

Rerae weahihe - 20,000

lal DR - 6,000

ASisHlt Mid (1-4-2012) > 10,000,

10% Relaal - 40,000

Rae wz aaa 2,000 S

12% M2 ULL - 20,000

wURsns $s bel ull Soi gua 2,000 10,000

rif souda Rises - 1,600

Bren Gu ava vig asaaua ale ad eu - 1,000

Raa oury 4,000 -

Raz Basdl 3,10,000 -

Rez Pasdl Guad ear cise - 110,000

3als (1-4-2012) 1,10,000 -

dad 98,000 -

eaueiel ad deer) 2,28,400 60,000

alsst ad ds 2,000 2,800

ideal 41,200 45,000

welel ad dane 14,90,000 | 17,98,000

we 20,000 16,000

AR BEL Gud oy 1,200 -

ALISA OUSLY 28,800 -

ug sedat ad dal 6,000 -

eattal Be uledy 3,000 -

Ud 2,000 -

AUetoute BL LeU atric, 800 4,000

jabs wal 2,000 =

WUE ML AR Asda uous 36,000 3,000

aa 400 | 23,87,400

Q-110 5

Ta

14

sen

SERA

AAA rufa eueati WOLA FuMaiaL, 1956 Heo Sulla alls Rene dae sel

(1) sud oud yf artar ydlat 50% Bed @. eds de culls Baa

Z 100-0 3.

(2) mura r2lod Het % 132,100 8. Bri Bard] als & 1,000 wala d.

3) Bee Basel ad AA aver ds

© ABUL Birtiae Lud 20,000

+ Beaeaz ued sigan wud F 10,000

« — SBadl de Gur Blass 15%

Rea | at. 31-3-2012 etal emuretl 62

wld use,

astetl 50,000 20,000 10%

wall 2,00,000 60,000 25%

atgal 40,000 20,000 20%

shiar 20,000 10,000 10%

Fue) tat ae vel oust neler yer aul aveavil aud d.

(4) sell Mod Da axe d :

© 10% RAAz weet Bette Vstel (1-4-2012) F 20,000

© 8%rll Arga adalrerdl ale Ceualbts Grd & 40,000 at. 1-10-2012 ele

walevia) © 38,000

© dae Rutt 800 SBA ale e8s F 1001 % 50 eeUd F 40,000,

(5) <0 daria Gar dave % 2,000d ed. F400 atau V2 WA aimatu d aA

HAMA ALA 2% Wel B.

(©) 10% wabis vel Hil ana 3.

(7) seRser aie DA avo einaell yBia seavti zude

aaa q

(a) eval Rove seu aedwaiel cu. 31-3-20130 aly Ad auseil davii wud :

Mitel] Gur oat 3

ol & | oud @)

masa asad (1-4-2012) - 17,000

mused Asda aUasdzl (1-4-2012) 12,000 =

wpUGd Asda wasde Cg al asada) | 18,000 -

yar surla ouasdel 800] 1,200

Ael-dsebt Md (1-4-2012) -| 24,000

NQ-110 6

vals

5 Baa

eth Vee

Lda

oo)

©)

2011-12 ausieeh aug at ysl ad a muasdeedl wae & 19,000 tél

4d. ug ave] sulle 181 & 42,000 8. mud abit ga tevtiel 50% atasderdl

Brus W rar v.

Grell wfe tA Sutlu culls Revolai 3A La calaed a seul Ww x3

apical eu,

AA aula aL 313-130 xl seu ada oLAad aut saad eutai

ada Arla aubls Rauelbti dell ae cated » 4

z

dayer aut det alia) 12,44,000

asda dua dal 44,000

Stall ousl dau dal 16,000

zal 4,50,000

sauet : deugoal visus ve asda suet wuda aed. ou ma date Bria ue

20% tal aA rlsda 9. at. 31-03-2013 ae mesh veued 3 4/5 ona.)

wed wll lel B 219 dell usaz Bret & 40,000 8.

“mianalas Petedl” A eietd 2au" eset ae Gerweer saul, 3

AA oul es dqeal wetu als seat aad well den 8. Bail wel yao

wie sll wal odd aA waren and all : (Sua ae ail) 14

(ly

Q)

warhol MGA Laurie Au a2 Gulla tad are?

(a) Girt dle oteie wigan 2

(by) wees webae Hisaun wd

(Were de wea seal ad

(aad were We del aiscun wd

zt Rec oad aleydl ¥ 80,00,000, 635 & 100") as AH adardel 8. deal

wal isuad ei al AS de Guz “ity sala oud” 1 ual. a deal wud

77,500 A G2 uaa WA asarla ela wa a Ay sala earl 254

T 62,500 cle, el Dea sual dedls 254 Bell ual 2

(a) %25 ) %780

©) 220 @ %625

Pega Rel ud au yer d ;

wouatla SRA dex & 5,00,000, UG ude gra % 25,000, rdl ala,

Sl F 40,000, F YPit REsrs 15%, dl asaauca BRLses ded aa 2

(@) 75,000 (b) %72,750

© %71,250 (@) 69,000

1 PTO.

(4) wes fel ana Wl spaada 2. de wa Sad AL eda 8. 5%

spyada Dae ya Gad = 100 8 wi OBadl def wt Gaa z10 8. ah

2011-12 AA 2012-13 aici Bpyada 2 aa wuatell oud & 2,00,000 art

SP-adl darfl ousl € 5,00,000 Qa wal BMA RA GeRises ats & 8,000 art

15,000, aX 201 Liza 2012-134i els el of 2012-1391 S4efl ate saad

Aedes yada RRs 254

@ 3,000 (b) © 5,000

(© % 10,000 (@ © 12,000

Time

(5) delet Gaga apse 22 HR aysdl awd art “etl Aavll ait + ela

Asal? Instru

(@ def adbis Brat 2svill

) Aah Hee ude Baal 25%

(Reh eulbus rat 25%tll

(@ AeLawe we Badu 25%!

6)

Gort BAA Md,

Rada ours wed,

apaae Higl ours wud” 48 BAA MSL aaduvai ealadl?

(a) % 6,000 (by % 12,000

() = 18,000 @ 224,000

jure) weia els & 8,000, agra 22s & 6,000, apd wile & 2,00,000

ai A fuck deur GUE 20% nigh Ad Sha, ell Aauertl 24 Sed awe?

(a) % 235,200 (by %2,45,000

() &1,96,000 (a) %2,50,000

oO

gurl gat As Bar Giasd tt o1-o4-20100 ay welead wal. ud 15%

cach FeAl Ouse, Vale” WEA aad Hid a 8. al. 31-03-2013 V1% BARE

cue Gard € 12,28,250 el, dl Rasa canna” Beal aa? q

(a) 25,00,000 (by %22,00,000

(©) © 20,00,000 (@_ %19,50,000

(oy Git Fadl aust Heer Bae aatatll grad oud © 75,0004 vd. al

gamarid Gur euer % 5,50,000, al eet ae wad vada wt

£250,000 eel. A auarivill 62 5% 8A, al ueoned) 224 Bee) aH ?

zg

f

|

1

(@ = 16,250 (b) = 25,000

(© 12,500 (a) 715,250

oi

8 iQ

NQ-110

NQ-110

December-2015,

B.Com., Sem.-I

CE-IOLA : Advanced Accounting & Auditing

(Financial Accounting-1)

‘Time: 3 Hours] [Max. Marks : 70

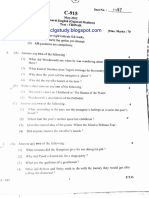

Instruction Show required working as part of your answer.

(a) Saumya, Juhi and Shonali share Profit and Loss in the proportion of 4: 5: 1.

Their Balance Sheet is as follows : 7

Liabilities z Assets z

Creditors: 50,000 | Cash in hand 15,000

Saumya’s Loan, 30,000 | Fixed Assets 1,80,000

Juhi’s Loan 15,000 | Investments 1,07,000

Reserve Fund 18,000

Contingency Reserve | 75,000

Capital :

Saumya 75,000

Juhi 24,000

Shonali 15,000

3,02,000 3,02,000

‘The partnership is dissolved and the assets realized as follows :

~ First Installment 50,000

~ Second Installment 1,85,000

On the date of the dissolution, there was a contingent liability of @ 5,000 against

the firm, which was settled at € 3,500 at the time of second installment.

Dissolution expenses were estjmated at % 10,000 but these actually amounted

® 7,500.

Shonali took stock worth & 2,500 at the time of second installment,

The firm was forced to pay % 3,000 out of second installment for which no

provision was made in the books.

Prepare a statement showing Cash distribution by “Maximum Loss Method”.

OR

9 7 P.O.

a

(2) How “Maximum Loss Method” of ‘Piecemeal distribution of cash’ is different

fiom “Surplus Capital Method” ? Explain in brief and from the below mentioned

information show the cash distribution under the Surplus Capital Method.

Velji, Hasmukh and Dinesh are partners sharing profits and losses in the ratio of

3:2: 1. Their capitals at the time of payment of the last installment are % 90,000,

% 75,000 and € 40,000 respectively. The last installment from the sale of assets of

¥ 35,500 was received. % 6,000 was spent out of % 7,500 kept reserve for

dissolution expenses.

(b) _Vaidehi Limited was incorporated on 01-04-2013 to purchase a running business of

partnership firm from 01-01-2013. From the information given below about the

year ending on 31-12-2013, determine profit prior to incorporation and post

incorporation.

(1) The total sales of the year ending on 31-12-2013 is % 12,00,000 out of

which sales from 01-01-2013 to 31-03-2013 amounted to & 2,40,000,

(2) The Gross Profit showed by Trading Account for the year ending on 31-12-2013

is € 4,80,000. Following information relates to the Profit and Loss Account :

i :

e Rent and taxes 39,000

i Salaries of employees 72,000

i ‘ Debenture Interest 18,000

Wy General Expenses 12,000

| Audit Fees 1,500

| Director's Fees 7,500

Formation Expenses 6,000 a a

Selling Commission 24,000 q

OR

‘What is meant by profit prior to incorporation ? Can “Profit prior to Incorporation’

be distributed as dividend to Shareholders ? Explain with required reasons.

TTI

2. The authorized capital of Aashna Limited is € 1,25,00,000 divided into 1,25,000 equity

shares of @ 100 each. The company issued 40% capital for public at a premium of 20%.

Amount payable per share was as follows :

;

1 On Application 720

i On Allotment 740 (including premium)

q On First call 230

a On Second call 730

i + Shares were allotted as under :

i Allotment in full 25,000 shares 7 ©

a Allotment of 2/3 shares applied for 20,000 shares

i Allotment of 1/4" shares applied for 5,000 shares

50,000 shares

NQ-110 10 110

s different

mentioned |

a

the ratio of

2% 90,000,

of assets o}

veserve for

business of

v about the |

1 and. post

000 out of

000.

(31-12-2013

's Account: |

corporation”

&

5,000 equity

ium of 20%.

(©) Write short note fiom the following :

The applications for 5,000 shares were refused and the amount was refunded to them.

‘Money overpaid on applications was credited to allotment account and call account.

Pravin to whom 1,000 shares were allotted on the basis of allotment in full, paid the

first call amount of shares at the time of allotment. After that he fails to pay anything to

the company.

Kavita to whom 800 shares were allotted on the basis of 2/3 shares applied for, failed to

pay the allotment money and first call money and her shares were forfeited after first

call.

After asking second call, company forfeits all the shares of Pravin, After forfeiture 50%

ofPravin’s shares and 70% of Kavita’s share company reissues at & 8 fully paid up, and

receives money on shares,

Pass necessary Journal Entries in the books of the Aashna Ltd.

OR

(a) Mr. Aamir fails to pay € 5 including % 2 premium on his 300 number of shares,

company forfeits all his shares. Mr. Shahrukh fails to pay % 3 on his 600 number

of shares, company also forfeits these shares after giving due notice to him. Face

value of both the shares was & 10. Afier forfeiture company reissues 70% of

Mr. Aamir’s shares and 50% of Mr. Shahrukh’s shares to Mr. Gangia teli at & 7 as

fully paid up in the market, pass required Journal Entries of forfeiture in the book

of company. Also prepare share forfeiture account in the books of company. 7

(b) The following is the Share Forfeiture Account in the books of Babaji Limited: 4

Dr. Share Forfeiture Account cr,

Particulars z Particulars z

To Share Capital Aic. | 1400] By Share Capital | 8,400

To Capital Reserve 700

To Balance cid 6300

8,400 8,400

The face value of a share was € 100/- and % 40/- per share was not paid and hence

these shares were forfeited, out of which some share were reissued.

Pass necessary “Journal Entries” for forfeiture and re-issued of shares in the

books of the company.

any one) 3

(1) _ Provisions of the Companies Act in respect of Sweat Equity Shares,

(2) Potential Equity Shares

(3) Provisions of Companies Act for buy-back of shares

NQt0 H P.T.O.

80 of Companies Act for redeeming preference

3. After Explaining Provisions of Section

books of,

shares in detail, you are required to pass required Joumal Entries in the

Hiren Ltd. from the below mentioned information :

Hiren Ltd. wants to redeem its 50,000, 12% Redeemable Preference Shares of 10,

cach, at 10% premium. Balances of certain accounts of Hiren Ltd. before redemption is

mentioned below :

z

Cash & Bank Balance 10,000

Profit and Loss Account 3,00,000

General Reserve 4,50,000

Investments 20,000

Hiren Ltd. sells the above-mentioned investments by charging 1/3 profit on sales value

of the investment. Company will keep Closing Cash and Bank Balance at % 50,000

after the redemption of Preference Shares. Company will issue required number of

Equity Shares each of € 10 at 15 to the public, company receives all the money on the |

shares issued. ii,

oR

(a) Following are the balances of Shri Sachin Ltd. as on 30" June 2013 = =

: - is

10,000 Equity Shares of & 10 each, @ 8 paid up 80,000 S

General Reserve 20,000 iis

Capital Redemption Reserve 80,000 aA

Securities Premium 10,000 ae

: Profit arising from Revaluation of fixed assets 10,000 al

i Itwas resolved in the annual general meeting of the company, to make their partly” | py

i paid shares as fully paid shares from reserves. a

1y will issue required number of equity.

‘After making it fully paid up, compan’

Shares each of ® 10 at & 12 so that the company can issue one fully paid up equit Ge

share as Bonus against one fully paid up equity share held. Re

Pass required Journal Entries in the book of company. St

Ac

(b) As per the Balance Sheet of Harshey Ltd. company has 80,000 equity shares ac

of & 10 and 6% debentures of € 2,40,000. It was resolved in the Annual General, | Ba

Meeting of the company that company will pay in cash tax free dividend at 10% | pr

(tax rate 20%). Company repays debentures at a premium of 3%. Pass Journal Sa

Entries from the given transactions.

(©) What do you mean by Bonus shares ? Write any three sources of bom

distribution. 110

NQ-110 2

SESH orm meeeRT OO

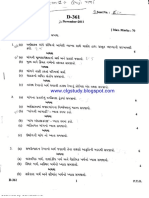

The following is the Trial Balance of Deval Ltd. as on 31-3-2013 :

110 B

Partaan Batons | Sates

Equity Share Capital - 1,20,000

10% Preference share capital = 80,000

General Reserve . 40,000

Debenture Redemption Fund - 20,000

Securities Premium - 6,000

Profit & Loss Account (1-4-2012) - 10,000

10% Debentures - 40,000

Discount on Debentures 2,000 -

12% Public Deposits - 20,000

PF. and PF. Contribution 2,000 10,000

Unclaimed Dividend - 1,600

Interest accrued but not due on debentures - 1,000

Interest on Debentures 4,000 -

Fixed Assets 3,10,000 -

Depreciation fund on fixed assets - 1,10,000

Stock (1-4-2012) 1,10,000 -

Investments 98,000 -

Debtors and Creditors 2,28,400 60,000

Cash and Bank 2,000 2,800

Bills 41,200 45,000

Purchases and Sales 14,90,000 | 17,98,000

Returns 20,000 16,000

Interest on Public Deposit 1,200 -

Carriage Inward 28,800 -

Rent, Taxes and Insurance 6,000 -

Stationery and Postage 3,000 -

Advertisement 2,000 -

Bad Debts and Bad Debt Reserve 800 4,000

Preliminary Expenses 2,000 -

Salary and Unpaid Salary 36,000 3,000

Total 23,87,400 | 23,87,400

14

P.T.O.

‘After considering the following information, prepare the Final Accounts of the

‘Company according to the provisions of the Companies Act, 1956.

oO

@

@)

4)

(5)

o)

(a

NQ-110

The paid up capital of the company is 50% of its authorized capital. The face

value of each shares is € 100.

The value of closing stock is € 1,32,100 which includes stationery stock worth

= 1,000.

The details of fixed assets are as under :

Pars | SPSS [Pero | poten

Building 50,000 20,000 10%

Machinery 2,00,000 60,000 25%

Vehicles 40,000 20,000 20%

Furniture 20,000 10,000 10%

“The company is providing depreciation as per “Diminishing Balance Method”.

‘The details of investments are as under :

© 10% debenture redemption fund investments (1-4-2012) % 20,000

© 8%Central Government loan (Face value % 40,000 purchased on 1-10-2012) ’

% 38,000

= 800 equity shares of Keyur Ltd. of € 100 each % 50 per share paid up”

40,000.

Unrecorded credit sales amounted to % 2,000. Write off € 400 as Bad Debts and

provide Bad Debt Reserve @ 2% on debtors.

Write off preliminary expenses by 10%.

‘The Directors have proposed the following appropriations :

© General Reserve ¥ 20,000

+ Debenture Redemption Fund © 10,000

«Dividend on Equity shares 15%

OR

Following balances are taken from Trial Balance of “Hardi Ltd” as on 31" March

2013:

Name of Accounts Dr.& | Crt

Provision for Income-tax (1-4-2012) = | 17,000

‘Advance payment of Income-tax (1-4-2012) | 12,000 -

‘Advance payment of Income-tax 18,000 -

(paid during current year)

Tncome-tax deducted at source 800} 1,200

Profit & Loss Ale. (1-4-2012) ~ | 24,000

14

(2)

G)

10-2012)

paid up

Debts and

1° March,

Assessment in respect of Income-tax of the previous year 2011-12 was completed

during the current year and Income-tax liability of € 19,000 has been determined.

Current year profit of the company is € 42,000. The company has made provision

for income-tax at 50% on current year’s profit.

From the above information, pass Journal Entries and show their effect in Final

Balance Sheet of company.

Show the effects in the annual accounts of the company, after taking. into

consideration the balances of the trial balance on 31-3-13 and adjustments

Adjustments : The sales figures includes goods sent on sales or return basis,

which was sent after adding 20% profit on sales. Customers have informed on

31-03-2013 that they had retained 4/5 of the goods whose cost price was

% 40,000.

(©) Give three examples of Fictitious Assets and Contingent Liabilities, 3

For each of the following sub-questions more than one answers are given, out of which

select the correct answer. Give necessary calculation or explanation as part of ‘your

answer. (write any 7)

4

(1) Securities premium cannot be used to

(@) issue of bonus shares

(b) to write off preliminary expenses

(©) toredcem preference shares

(@) to write off shares issued on discount

@) The subscribed share capital of Ram Ltd. is © 80,00,000 of ¥ 100 each, There

‘were no calls in arrear till the final call was made. If the final call made and was

paid on 77,500 shares and if the calls in arrear amounted to % 62,500, then the

final call per share must be

fa) %25 (b+) 7.80

(ce) %20 (d) %62.5

() The details of Pinkush Ltd, are as under :

Equity share capital called up & 5,00,000, calls in advance € 25,000, Calls in arvear

40,000, proposed dividend 15%, what will be the amount of Dividend payable?

@ %75,000 (b) & 72,750

(© 71,250 (d) %69,000

15 PTO.

mentioned below : 4

z

Sales (including sales tax) 12,44,000

Sales tax paid 44,000

Unpaid sales tax 16,000

Debtors 4,50,000

i

(4) The authorized share capital of Abhishek Ltd. consists of both cumulative

preference shares and equity shares. Each 5% cumulative preference share has a

par value of % 100. Each equity share has a par value of € 10. At the end of the

year 2011-12 and 2012-13, the cumulative preference share capital balance was

% 2,00,000 and the equity share capital balance was % 5,00,000, if dividend

declarations totaled % 8,000 and & 15,000 in the year 2011-12 and 2012-13,

respectively, the dividends paid to the equity shareholders in the year 2012-13

must be

@ %3,000 (b) & 5,000

(© %10,000 (@) % 12,000

(5) As per the SEBI guidelines, on issue of shares, the application money should not,

= be less than 3

q (@) 2.5% of the nominal value of shares

o (©) 25% of the issue price of shares

i (©) 25% of the nominal value of shares

(@ 25% of the issue price of shares 1

© Particulars Debit | Credit

69% Debenture Account = | 3,00,000

i Debenture Interest Account | 6,000} —

1]

i ‘Which amount is shown in balance sheet as “Outstanding Interest on Debenture” ?

@) 76,000 (b) % 12,000

(© &18,000 (@ % 24,000

(7) Average stock of company is % 8,000, Opening stock % 6,000, Net purchase

% 2,00,000 and if the company charges 20% profit on sales, what will be the

He Raa...

amount of sales ?

@) %2,35,200 (b) © 2,45,000

(© %1,96,000 (4) © 2,50,000

(8) A company have purchased one fixed asset on 01-04-2010, company provides

depreciation at the rate of 15% as per Diminishing Balance Method, its written

fl

" down value as on 31-03-2013 after depreciation comes to & 12,28,250. What will

i be the original cost of the asset ? 2

i @ %25,00,000 (b) © 22,00,000

4 (© %20,00,000 (@) % 19,50,000

d (9) Opening Balance of the Debtors Account in the books of Umang Company w:

a % 25,000, credit sales during the year is % 5,50,000, cash collection from

q Debtors amounting to & 2,50,000. What will be the amount of Bad Debts, if th

i rate of Bad Debt amounted to 5% ?

a (@ 216,250 (b) % 25,000

i @ &12,500 (d) % 15,250

y ——— NN-|

NQ-110 16

Ga

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Statistics Bcom Sem 1 - Dec 2015Document8 pagesStatistics Bcom Sem 1 - Dec 2015Ekta RanaNo ratings yet

- General English Bcom Sem 1 Dec 2015Document12 pagesGeneral English Bcom Sem 1 Dec 2015Ekta RanaNo ratings yet

- CC 103 Accountancy 1 Bcom SEm 1 Dec 2015Document17 pagesCC 103 Accountancy 1 Bcom SEm 1 Dec 2015Ekta RanaNo ratings yet

- CC Bcom SEm 1 Dec 2015Document7 pagesCC Bcom SEm 1 Dec 2015Ekta RanaNo ratings yet

- Financial Accounting-I Sem-1 (GU-DEC-2014)Document12 pagesFinancial Accounting-I Sem-1 (GU-DEC-2014)Ekta RanaNo ratings yet

- English Sem-1 (GU-DEC-2014)Document16 pagesEnglish Sem-1 (GU-DEC-2014)Ekta RanaNo ratings yet

- (313 F Forensic Science, Law & Crime Detection Methods) - 2019Document2 pages(313 F Forensic Science, Law & Crime Detection Methods) - 2019Ekta RanaNo ratings yet

- 207K Legal Terms Phrases MaximsDocument46 pages207K Legal Terms Phrases MaximsEkta RanaNo ratings yet

- Aibe Answer Key 12 Final PDFDocument3 pagesAibe Answer Key 12 Final PDFEkta RanaNo ratings yet

- Special ContractDocument2 pagesSpecial ContractEkta RanaNo ratings yet

- Use of Law Journal and Legal Software Sem 1 MarchDocument2 pagesUse of Law Journal and Legal Software Sem 1 MarchEkta RanaNo ratings yet

- Umesh Darji 8866645782: Scanned by CamscannerDocument8 pagesUmesh Darji 8866645782: Scanned by CamscannerEkta RanaNo ratings yet

- Umesh Darji 8866645782: Scanned by CamscannerDocument4 pagesUmesh Darji 8866645782: Scanned by CamscannerEkta RanaNo ratings yet

- Umesh Darji 8866645782: Scanned by CamscannerDocument8 pagesUmesh Darji 8866645782: Scanned by CamscannerEkta RanaNo ratings yet

- Umesh Darji 8866645782: Scanned by CamscannerDocument4 pagesUmesh Darji 8866645782: Scanned by CamscannerEkta RanaNo ratings yet

- State Flattened Flattened PDFDocument8 pagesState Flattened Flattened PDFEkta RanaNo ratings yet

- Umesh Darji 8866645782: Scanned by CamscannerDocument4 pagesUmesh Darji 8866645782: Scanned by CamscannerEkta RanaNo ratings yet

- State Flattened Flattened PDFDocument8 pagesState Flattened Flattened PDFEkta RanaNo ratings yet

- Umesh Darji 8866645782: Scanned by CamscannerDocument4 pagesUmesh Darji 8866645782: Scanned by CamscannerEkta RanaNo ratings yet