Professional Documents

Culture Documents

Problems On Registration

Uploaded by

Sita RamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problems On Registration

Uploaded by

Sita RamCopyright:

Available Formats

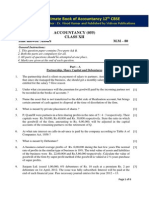

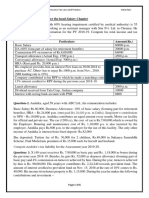

Problems on Registration

1. XY Clothing House deals in retailing of Men’s Garments. They have two shops, one in Delhi and another in

Ludhiana, Punjab. Following are other details for the FY 2019-20.

Total supplies from Delhi shop include supply of garments (taxable) worth Rs.18 lakhs; and supply of Khadi

Yarn (exempt) worth Rs.3.5 lakhs. Total supplies from Ludhiana shop include supply of garments (taxable)

worth Rs.10 lakhs; and supply of garments (taxable) through an agent, Mr. Z, worth Rs.1.2 lakhs. Exports

made during the year Rs.8 lakhs. Calculate the ATO of XY. Is XY liable for registration under GST?

2. Sudha Performance Fibers Ltd. [SPF Ltd.] is manufacturer of yarn, with operations in Mumbai. During the FY

2019-20, they have the following as outward supplies: Khadi Yarn (exempted supply) worth Rs.7 lakhs; Silk

yarn [liable for reverse charge under sec 9(3)] worth Rs.6 lakhs; and Polyester Yarn worth Rs.6 lakhs. During

the year SPF Ltd. has inward supply of Rs.2 lakhs on which reverse charge is applicable. What is SPF’s ATO? Is

SPF Ltd. liable for registration under GST?

3. What will be your answer, if SPF Ltd. has a branch in Sikkim from which they supply yarn worth Rs.2 lakhs?

4. Explain whether registration is required in the following cases:

a. A is a salaried employee (salary income being Rs.90 lakh). Besides he owns a residential property which is

let out for residential purposes (annual rent being Rs.20 lakh)

b. B, a chartered accountant, is Tax Head of A Ltd. (salary income being Rs.95 lakh). He owns a residential

property which is let out for residential purposes (annual rent being Rs.20 lakh). Besides, he gives tax

consultancy on part time basis (annual consultancy income being Rs.10,000)

c. C is a retired person (pension income being Rs.40,000 p.m.) Besides he has fixed deposit in a few banks

(annual interest being Rs.1999,600). Occasionally, he provides consultancy in flower decoration (annual

receipt being Rs.500)

d. D is an advocate. He provides legal services to Tata Chemicals Ltd. (annual consultancy being Rs.35 lakh).

He does not have any other income. What happens if D receives a consultancy amount of Rs.15 lakh?

What happens if D receives a consultancy amount of Rs.15 lakh and his place of business is in Agartala?

e. (i) E is an advocate. He provides legal services to Tata Chemicals Ltd. (annual consultancy being Rs.12

lakh). Besides, he has rental income of Rs.500 from letting out of commercial property. (ii) What happens

if E receives the consultancy amount of Rs.12 lakh (taxable on regular basis) and rental income of Rs.500?

(iii) What happens if E receives the consultancy amount of Rs.12 lakh (taxable on regular basis), rental

income Rs.500 and his place of business is in Shillong?

f. F Ltd. (incorporated on February 26, 2020) is engaged in manufacture of garments in Ludhiana. Its

turnover for the period ending 31 March, 2020 is Rs.6 lakh

g. G is engaged in supply of taxable goods and taxable supply of services. His turnover for the period ending

31 March, 2020 is Rs.38 lakh (supply of goods Rs.18 lakh, supply of services Rs.20 lakh)

h. H is engaged in supply of taxable goods and exempt goods. His turnover for the period ending 31 March,

2020 is Rs.19 lakh (taxable goods Rs.9 lakh, exempt goods Rs.10 lakh). He owns a residential house

property which is let out for residential purposes for an annual rent of Rs.4 lakh

i. J Ltd. is a short film producer for a Bangla TV Channel, located in Kolkata and ATO within threshold limit. K

is a photographer working for J Ltd, who is paid a royalty of Rs.30,000 for using his copyrights

j. L appoints M to procure certain goods from Tamil Nadu. M prepares a list of various suppliers who can

provide goods as desired by L. Finally, he identifies N (one of the suppliers) and direct him to send 1000

units to L. N will issue invoice directly to L

k. P, a well-known artist, appoints R (auctioneer) to auction his paintings. R arranges for the auction and

identifies the potential bidders. The highest bid is accepted, and the painting is sold to the highest bidder.

The invoice for the supply of the painting is issued by R on behalf of P and the painting is delivered to the

successful bidder

l. X Ltd. is a paper manufacturing company. Head office and manufacturing unit of the company are situated

in Kolkata. The company has 3 branches – Mumbai, Indore and Surat.

You might also like

- QuestionsDocument5 pagesQuestionsTris EatonNo ratings yet

- Icai 3Document14 pagesIcai 3Raghav TibdewalNo ratings yet

- Business Taxation MBA III 566324802Document5 pagesBusiness Taxation MBA III 566324802mohanraokp2279No ratings yet

- Icse Class X Maths Practise Sheet 1 GST PDFDocument2 pagesIcse Class X Maths Practise Sheet 1 GST PDFHENA KHANNo ratings yet

- Question BankDocument16 pagesQuestion BankTris EatonNo ratings yet

- +++C$C, CCC$ CDocument7 pages+++C$C, CCC$ CKomal Damani ParekhNo ratings yet

- Practice Paper 5 Class Xii AccountancyDocument8 pagesPractice Paper 5 Class Xii AccountancyDinesh KumarNo ratings yet

- Tax Assignment For FinalDocument4 pagesTax Assignment For FinalEnaiya IslamNo ratings yet

- Mock Test Series 2 QuestionsDocument10 pagesMock Test Series 2 QuestionsSuzhana The WizardNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- MTP 2 Idt 2019Document10 pagesMTP 2 Idt 2019kartikNo ratings yet

- Chpter 1, Scope & Levy, Nat & POS, AllDocument14 pagesChpter 1, Scope & Levy, Nat & POS, AllBhavika KhetleNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- 7 Wi 8 Es AVatv NFK 0 LF QHaDocument9 pages7 Wi 8 Es AVatv NFK 0 LF QHaPranshu SethiNo ratings yet

- Mba 3 Sem Tax Planning and Management Jan 2019Document3 pagesMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhNo ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- 16UCO5MC03Document4 pages16UCO5MC03Ñìkíl G KårølNo ratings yet

- Assignment 2 FPTMDocument1 pageAssignment 2 FPTMSiva SankariNo ratings yet

- Practical Question Bank: Faculty of Commerce, Osmania UniversityDocument4 pagesPractical Question Bank: Faculty of Commerce, Osmania Universitymekala sailajaNo ratings yet

- Tax NumericalsDocument11 pagesTax NumericalsRohit PanpatilNo ratings yet

- Tax AssignmentDocument4 pagesTax AssignmentkaRan GUptД100% (1)

- Income Tax - I Subj - Code:113020 Section-ADocument3 pagesIncome Tax - I Subj - Code:113020 Section-AThiru VenkatNo ratings yet

- Taxation Short Questions AnswersDocument4 pagesTaxation Short Questions AnswersSheetal IyerNo ratings yet

- Partnership AccountingDocument21 pagesPartnership AccountingTharun P.Mu.No ratings yet

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- 9 Partnership Question 3Document5 pages9 Partnership Question 3kautiNo ratings yet

- GST RevisionDocument10 pagesGST RevisionSumit rautelaNo ratings yet

- Value Added Tax: Developed and Compiled by CA. Shesh Mani DahalDocument10 pagesValue Added Tax: Developed and Compiled by CA. Shesh Mani Dahalसुजन सापकोटाNo ratings yet

- ScibdDocument1 pageScibdketakiNo ratings yet

- Residential StatusDocument24 pagesResidential StatusGaurav BeniwalNo ratings yet

- Rates On Profession TaxDocument7 pagesRates On Profession Taxknikesh58No ratings yet

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraNo ratings yet

- Income Tax InternalDocument1 pageIncome Tax InternalPavani KunchallaNo ratings yet

- CAF-6 Mock Paper by SkansDocument6 pagesCAF-6 Mock Paper by SkansMehak AliNo ratings yet

- Legal & Tax Aspects of BusinessDocument5 pagesLegal & Tax Aspects of BusinessNikhil KasatNo ratings yet

- Mock Sep 2023 - Question PaperDocument8 pagesMock Sep 2023 - Question Paperfahadkhn871No ratings yet

- FA-III Question BankDocument13 pagesFA-III Question BankmeenasarathaNo ratings yet

- Problems On Tax ManagementDocument44 pagesProblems On Tax ManagementBalaji Elangovan25% (4)

- CA IPCC ExamDocument9 pagesCA IPCC ExamTushar BhattacharyyaNo ratings yet

- Single SystemDocument7 pagesSingle SystemRobert HensonNo ratings yet

- Assignment 1 For MBA 2020Document10 pagesAssignment 1 For MBA 2020Sichen UpretyNo ratings yet

- Theory and Precatice of GSTDocument3 pagesTheory and Precatice of GSTakking0146No ratings yet

- ACC 203 Taxation in NepalDocument9 pagesACC 203 Taxation in NepalSophiya PrabinNo ratings yet

- Financial StatementDocument15 pagesFinancial StatementPankaj SharmaNo ratings yet

- Holidays Home Work Xii 2023-24Document5 pagesHolidays Home Work Xii 2023-24Akshat TiwariNo ratings yet

- Paper 16 - Direct Tax Laws and International Taxation MCQs - Multiple Choice Questions (MCQ) - StepFly (WQUX040821)Document41 pagesPaper 16 - Direct Tax Laws and International Taxation MCQs - Multiple Choice Questions (MCQ) - StepFly (WQUX040821)Sreeharan MPNo ratings yet

- Tax Mid Term Draft: 15 MarksDocument4 pagesTax Mid Term Draft: 15 MarksWaasfa100% (1)

- Old Question Practice2Document3 pagesOld Question Practice2Anuska JayswalNo ratings yet

- Income Tax 1 - 20223Document3 pagesIncome Tax 1 - 20223nimalpes21No ratings yet

- Worksheet Unit1Document8 pagesWorksheet Unit1Kaushal pateriyaNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- CA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Document36 pagesCA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Velayudham ThiyagarajanNo ratings yet

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbNo ratings yet

- Tax - M-1 ProblemsDocument14 pagesTax - M-1 ProblemsChikke GowdaNo ratings yet

- Debenture TheoryDocument33 pagesDebenture TheorySita RamNo ratings yet

- Economic and Industry Analysis Class Discussion SlidesDocument5 pagesEconomic and Industry Analysis Class Discussion SlidesSita RamNo ratings yet

- Role of PeopleDocument52 pagesRole of PeopleSita RamNo ratings yet

- A Study On Different Marketing Strategy of Life Insurance CompaniesDocument11 pagesA Study On Different Marketing Strategy of Life Insurance CompaniesSita RamNo ratings yet

- Project Network Diagrams AOA/AON: - Activity On Arrow (AOA) - Activity On Node (AON)Document5 pagesProject Network Diagrams AOA/AON: - Activity On Arrow (AOA) - Activity On Node (AON)shujaNo ratings yet

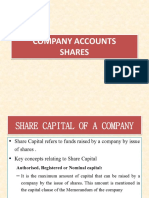

- Company Accounts SharesDocument18 pagesCompany Accounts SharesSita RamNo ratings yet

- NPV Problem With SolutionDocument5 pagesNPV Problem With SolutionSita RamNo ratings yet

- Estimating Project CostsDocument33 pagesEstimating Project CostsSita RamNo ratings yet

- Competences With The Aim ofDocument183 pagesCompetences With The Aim ofSita RamNo ratings yet

- Cultural Criteria Classification - Assignment PDFDocument3 pagesCultural Criteria Classification - Assignment PDFSita Ram0% (1)

- Competences With The Aim ofDocument145 pagesCompetences With The Aim ofSita RamNo ratings yet

- Business Analytics-Proposal ReportDocument9 pagesBusiness Analytics-Proposal ReportSita RamNo ratings yet

- Competences With The Aim ofDocument145 pagesCompetences With The Aim ofSita RamNo ratings yet

- Module-8: Internationalization, Driver, Porter's Diamond, Market Selection & Entry, Portfolio & PerformanceDocument37 pagesModule-8: Internationalization, Driver, Porter's Diamond, Market Selection & Entry, Portfolio & PerformanceSita Ram100% (1)

- Laddering: Sanjay FuloriaDocument7 pagesLaddering: Sanjay FuloriaSita RamNo ratings yet

- Unit 2 Project ManagementDocument98 pagesUnit 2 Project ManagementSita RamNo ratings yet

- Chapter 14 International MarketingDocument50 pagesChapter 14 International MarketingSita RamNo ratings yet

- Project Scope: Sanjay FuloriaDocument14 pagesProject Scope: Sanjay FuloriaSita RamNo ratings yet

- Estimating Project CostsDocument33 pagesEstimating Project CostsSita RamNo ratings yet

- Chapter 12 Foreign Direct InvestmentDocument46 pagesChapter 12 Foreign Direct InvestmentSita Ram100% (1)

- Module-8 (BS)Document70 pagesModule-8 (BS)Sita Ram100% (1)

- Project Scope and WBSDocument19 pagesProject Scope and WBSSita RamNo ratings yet

- Resource Levelling and SmoothingDocument19 pagesResource Levelling and SmoothingSita RamNo ratings yet

- Chapter 13 Multinational EnterprisesDocument19 pagesChapter 13 Multinational EnterprisesSita RamNo ratings yet

- 128656Document19 pages128656Sita RamNo ratings yet

- NPV Problem With SolutionDocument5 pagesNPV Problem With SolutionSita RamNo ratings yet

- Project ClosureDocument28 pagesProject ClosureSita RamNo ratings yet

- Project Control, SV, PV, and ACDocument63 pagesProject Control, SV, PV, and ACSita RamNo ratings yet

- NPV Problem With SolutionDocument5 pagesNPV Problem With SolutionSita RamNo ratings yet

- GROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanDocument4 pagesGROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanJoatham GenovisNo ratings yet

- DILG Region IV Credit Cooperative: 822 Quezon Avenue, Bgy. Paligsahan, Quezon CityDocument5 pagesDILG Region IV Credit Cooperative: 822 Quezon Avenue, Bgy. Paligsahan, Quezon CityRowena MarabellaNo ratings yet

- K 12Document11 pagesK 12Geselle Delos SantosNo ratings yet

- XYZ Company - Fin Game ExcelDocument363 pagesXYZ Company - Fin Game ExcelNick ChongsanguanNo ratings yet

- Sugar Crisis in Pakistan-Compatible1Document26 pagesSugar Crisis in Pakistan-Compatible1Bushra Riaz50% (2)

- Budget Planner - Overview / Help: InstructionsDocument7 pagesBudget Planner - Overview / Help: InstructionsPalkesh TrivediNo ratings yet

- Example Problem Goal Programming PDFDocument21 pagesExample Problem Goal Programming PDFkash100% (1)

- (Rupiah) Zoom November 2021Document3 pages(Rupiah) Zoom November 2021net auNo ratings yet

- Invoice M112308296312009275Document1 pageInvoice M112308296312009275Bruh YooinkNo ratings yet

- Module A (5th Edition) - Part 1 PDFDocument550 pagesModule A (5th Edition) - Part 1 PDFDonald ShumNo ratings yet

- 2022 Mayo Clinic 990 PublicDocument201 pages2022 Mayo Clinic 990 Publicinforumdocs100% (1)

- English For Financial Literacy Volume 1Document313 pagesEnglish For Financial Literacy Volume 1Azure Pear HaNo ratings yet

- 2020 Albany County BudgetDocument378 pages2020 Albany County BudgetDave LucasNo ratings yet

- Maruti 17-18 Financial StatementDocument264 pagesMaruti 17-18 Financial StatementRagu RamNo ratings yet

- Sample Questions On WTWDocument1 pageSample Questions On WTWBaldovino VenturesNo ratings yet

- Ceramics Project ProfileworknehDocument30 pagesCeramics Project Profileworknehsajidaliyi100% (3)

- Start and Run A Successful Beauty Salon - A Comprehensive Guide To Managing or Acquiring Your Own SalonDocument273 pagesStart and Run A Successful Beauty Salon - A Comprehensive Guide To Managing or Acquiring Your Own Salondeepankar100% (4)

- The First Lutheran Church Endowment Fund By-LawsDocument7 pagesThe First Lutheran Church Endowment Fund By-LawspostscriptNo ratings yet

- What Is A Business?Document29 pagesWhat Is A Business?Bushra IshratNo ratings yet

- Gitanjali Gems Annual Report FY2012-13Document120 pagesGitanjali Gems Annual Report FY2012-13Himanshu JainNo ratings yet

- 32585Document1 page32585anand suryaNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)AnesNo ratings yet

- Ryan Harvey ResumeDocument2 pagesRyan Harvey ResumeRyan HarveyNo ratings yet

- Iii. Value-Added Tax Destination PrincipleDocument25 pagesIii. Value-Added Tax Destination PrincipleJIJAMNNo ratings yet

- General Information About-ExportDocument52 pagesGeneral Information About-Exportcarlos.vinklerNo ratings yet

- G.R. No. 134062Document12 pagesG.R. No. 134062Klein CarloNo ratings yet

- Chapter 4 For FilingDocument9 pagesChapter 4 For Filinglagurr100% (1)

- Romanian Consumer BehaviourDocument25 pagesRomanian Consumer BehaviourMiruna CrăciunNo ratings yet

- Business Tax AssignementDocument7 pagesBusiness Tax AssignementAleya MonteverdeNo ratings yet

- 12 Accountancy Revision Notes Part B CH 1 PDFDocument20 pages12 Accountancy Revision Notes Part B CH 1 PDFniks525No ratings yet