Professional Documents

Culture Documents

Income Tax Internal

Uploaded by

Pavani KunchallaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Internal

Uploaded by

Pavani KunchallaCopyright:

Available Formats

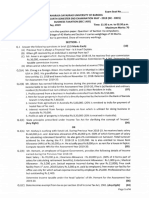

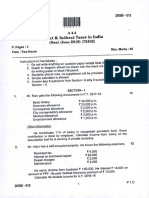

ANISH DEGREE COLLEGE – SAKET ANISH DEGREE COLLEGE – SAKET

B.COM II (COM & HONS) B.COM II (COM & HONS)

I INTERNAL EXAMINATION- 2022-23 I INTERNAL EXAMINATION- 2022-23

SUBJECT: INCOME TAX SUBJECT: INCOME TAX

ANSWER THE FOLLOWING 5 X 10 =50 ANSWER THE FOLLOWING 5 X 10 =50

1. Sri Akash Dikshit is having income from long term gain Rs.2, 80,000 and 1. Sri Akash Dikshit is having income from long term gain Rs.2, 80,000 and

Rs.7, 20,000 from other heads of income. Calculate tax liability. Rs.7, 20,000 from other heads of income. Calculate tax liability.

2. a. Smt. Sravanthi is working as an officer in Andhra Pradesh Government. 2. a. Smt. Sravanti is working as an officer in Andhra Pradesh Government.

Her salary particulars are Basic pay Rs.11, 000pm, CCA Rs.900pm, Her salary particulars are Basic pay Rs.11, 000pm, CCA Rs.900pm,

Entertainment allowance Rs.800pm. Compute the amount of Entertainment allowance Rs.800pm. Compute the amount of

entertainment allowance allowed as deduction. entertainment allowance allowed as deduction.

b. Mr. Anant is employed in a firm at Mumbai, his salary details are b. Mr. Anant is employed in a firm at Mumbai, his salary details are.

Basic pay Rs.16,000pm, DA Rs. 4,000pm (enters for retirement benefit), Basic pay Rs.16,000pm, DA Rs. 4,000pm (enters for retirement benefit),

Commission 1% on sales amounting to Rs. 20 lakhs. He is getting HRA Commission 1% on sales amounting to Rs. 20 lakhs. He is getting HRA.

Rs. 8,000pm and actual rent paid by him is Rs. 5,000pm. Calculate the Rs. 8,000pm and actual rent paid by him is Rs. 5,000pm. Calculate the

unexempted HRA to be charged under the Income from salary. unexempted HRA to be charged under the Income from salary.

3. Explain various incomes which do not form part of Total Income. 3. Explain various incomes which do not form part of Total Income.

4. Mr. Mohan Reddy is the owner of house property whose 4. Mr. Mohan Reddy is the owner of house property whose

Municipal Rental Value 250000 Municipal Rental Value 250000

Standard Rent 360000 Standard Rent 360000

Actual rent received 25000pm Actual rent received 25000pm

Fair rental value 210000 Fair rental value 210000

Municipal taxes 30000(out of which 15000 due) Municipal taxes 30000(out of which 15000 due)

Interest on loan taken 45000 Interest on loan taken 45000

Compute income from house property Compute income from house property

5. Mr. Vigneshwar sold his residential house for Rs. 32,50,000 on 15th 5. Mr. Vigneshwar sold his residential house for Rs. 32,50,000 on 15th

August 2020-21 (CII =317) which he purchased on 10-08-1988 for Rs. August 2020-21 (CII =317) which he purchased on 10-08-1988 for Rs.

1,02,000 Fair market value on 1-4-2001 is Rs. 8,50,000 selling expenses 1,02,000 Fair market value on 1-4-2001 is Rs. 8,50,000 selling expenses

2%. Compute the Income from Capital Gain and Income from other heads 2%. Compute the Income from Capital Gain and Income from other heads

is 3,14,20,000. Calculate Tax liability. is 3,14,20,000. Calculate Tax liability.

You might also like

- September: (CBCS) (F +R) (2016-17 and Onwards)Document7 pagesSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeNo ratings yet

- IT QuestionDocument3 pagesIT QuestionSathish SmartNo ratings yet

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Unit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503Document5 pagesUnit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503jyoti.singh100% (1)

- RA - M16UCM12 - B.Com. - 24.03.2021 - FNDocument4 pagesRA - M16UCM12 - B.Com. - 24.03.2021 - FNkavinilavan14072004No ratings yet

- 16UCO5MC03Document4 pages16UCO5MC03Ñìkíl G KårølNo ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- Tax H Question 2021Document3 pagesTax H Question 2021Aporupa BarNo ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- 2 - House Property Problems 22-23Document5 pages2 - House Property Problems 22-2320-UCO-517 AJAY KELVIN ANo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- Income Tax II Illustration IFOS PDFDocument5 pagesIncome Tax II Illustration IFOS PDFSubramanian SenthilNo ratings yet

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionDocument7 pagesCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhNo ratings yet

- House Propery QuestionsDocument6 pagesHouse Propery QuestionsTauseef AzharNo ratings yet

- Income From House Property: Annual ValueDocument6 pagesIncome From House Property: Annual ValueSaddam KhanNo ratings yet

- IPCC Gr.I Paper 4 TaxationDocument10 pagesIPCC Gr.I Paper 4 TaxationAyushi RajputNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- House Property 1Document14 pagesHouse Property 1Sarvar Pathan100% (3)

- Semester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesSemester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksAnshu kumarNo ratings yet

- SFS U.G. B.com. Income TaxDocument3 pagesSFS U.G. B.com. Income TaxAbinash VeeraragavanNo ratings yet

- PAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaDocument7 pagesPAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaAnmol JajuNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Da 144Document4 pagesDa 144GeethaNo ratings yet

- Tybms Sem5 DT Nov19Document5 pagesTybms Sem5 DT Nov19omsantoshbhosale01No ratings yet

- 1 Business TaxationDocument4 pages1 Business TaxationchouhanjainilNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- Bíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆDocument8 pagesBíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆSudhir SoudagarNo ratings yet

- Income Tax and Auditing Code: B-104: AssignmentDocument2 pagesIncome Tax and Auditing Code: B-104: AssignmentHritik singhNo ratings yet

- QB Ipu 2024Document2 pagesQB Ipu 2024uditnarayan8721663No ratings yet

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- Bcom 402Document220 pagesBcom 402Prabhu SahuNo ratings yet

- Prolems of House PropertyDocument2 pagesProlems of House PropertypriyaNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Bachelor's Degree Programme (BDP) : Assignment 2020-2021Document4 pagesBachelor's Degree Programme (BDP) : Assignment 2020-2021Tulasiram PatraNo ratings yet

- Income From House PropertyDocument26 pagesIncome From House PropertySuyash Patwa100% (1)

- Class 4 QuestionsDocument5 pagesClass 4 Questionsbaqarnaqvi6204No ratings yet

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Document10 pagesReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGNo ratings yet

- 5.1 Questions On Income From House PropertyDocument3 pages5.1 Questions On Income From House PropertyAashi GuptaNo ratings yet

- 029 Practice Test 08 Taxation Test Solution Subjective Udesh RegularDocument8 pages029 Practice Test 08 Taxation Test Solution Subjective Udesh Regulardeathp006No ratings yet

- BBAHDSE504Document4 pagesBBAHDSE504shen kinoNo ratings yet

- 28 5 Income TaxDocument50 pages28 5 Income Taxemmanuel JohnyNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Model Set SolutionDocument40 pagesModel Set SolutionRajan NeupaneNo ratings yet

- 68 Practical Questions of House PropertyDocument14 pages68 Practical Questions of House PropertyshrikantNo ratings yet

- Direct IndirectTaxesinIndia October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A E31C0FB4Document3 pagesDirect IndirectTaxesinIndia October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A E31C0FB4Mubin Shaikh NooruNo ratings yet

- Income Tax Test 2020-21Document6 pagesIncome Tax Test 2020-21Arihant DagaNo ratings yet

- Setoff and Carry ForwardDocument5 pagesSetoff and Carry ForwardSrinivas T. RajuNo ratings yet

- iNCOME TAX MODEL Q.PDocument3 pagesiNCOME TAX MODEL Q.PAndalNo ratings yet

- Income Tax II Illustration Computation of Total Income PDFDocument7 pagesIncome Tax II Illustration Computation of Total Income PDFSubramanian SenthilNo ratings yet

- Ratio Analysis-1Document3 pagesRatio Analysis-1Ramakrishna J RNo ratings yet

- Vol 1 31032019 PDFDocument9 pagesVol 1 31032019 PDFPradeep KattimaniNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Revised Syllabus For Semester VIII, IX & X: Solapur University, SolapurDocument20 pagesRevised Syllabus For Semester VIII, IX & X: Solapur University, SolapursantoshNo ratings yet

- Rem 211 Report by Group 1Document36 pagesRem 211 Report by Group 1Qayyuum RohaidiNo ratings yet

- UNIT 3 Income From House PropertyDocument104 pagesUNIT 3 Income From House Propertydob BoysNo ratings yet

- Ongc Welfare Scheam Hr-ErDocument68 pagesOngc Welfare Scheam Hr-Erramchander100% (1)

- House Property Exam QP - 9-12-19Document16 pagesHouse Property Exam QP - 9-12-19geddadaarunNo ratings yet

- 5 6255829688661311881Document32 pages5 6255829688661311881Yusuf Musa TungaNo ratings yet

- Income From House PropertyDocument12 pagesIncome From House PropertydipxxxNo ratings yet

- Unit 8 PDFDocument19 pagesUnit 8 PDFAsar QabeelNo ratings yet

- AhmedabadDocument4 pagesAhmedabadSubodh KumarNo ratings yet

- MPSC Town Planner Exam DetailDocument4 pagesMPSC Town Planner Exam DetailjaspishNo ratings yet

- CAF-6 Income From PropertyDocument2 pagesCAF-6 Income From PropertyMuhammad FaisalNo ratings yet

- Chapter-8 (House Property)Document40 pagesChapter-8 (House Property)BoRO TriAngLENo ratings yet

- TLE10 - ACP-NC-II - G10 - Q1 - Mod4 - Prepare Production Plan According To Enterprise Requirements - v3Document24 pagesTLE10 - ACP-NC-II - G10 - Q1 - Mod4 - Prepare Production Plan According To Enterprise Requirements - v3carolina lizardo100% (1)

- The Valuation Return FormDocument2 pagesThe Valuation Return FormCindy Lakhram75% (4)

- Booc Vs 5 Star MKTGDocument7 pagesBooc Vs 5 Star MKTGRonz RoganNo ratings yet

- A DsbddlknslkcnsDocument21 pagesA DsbddlknslkcnsAsharf AliNo ratings yet

- Problems and Prospects of Land Fees Administration in Rivers State, NigeriaDocument9 pagesProblems and Prospects of Land Fees Administration in Rivers State, NigeriaOpata OpataNo ratings yet

- Dep't of Transportation v. Adams Outdoor Advertising of Charlotte LP, No. 206PA16 (N.C. Sep. 29, 2017)Document38 pagesDep't of Transportation v. Adams Outdoor Advertising of Charlotte LP, No. 206PA16 (N.C. Sep. 29, 2017)RHTNo ratings yet

- Cal - Dot - Right of Way Manual - ch11Document324 pagesCal - Dot - Right of Way Manual - ch11prowagNo ratings yet

- Income From House PropertyDocument23 pagesIncome From House PropertySahil14JNo ratings yet

- Case Study 1Document3 pagesCase Study 1Narra JanardhanNo ratings yet

- Land Economics FinalDocument46 pagesLand Economics FinalSimiloluwa EmmanuelNo ratings yet

- Exercise For Building Plant MachineryDocument29 pagesExercise For Building Plant MachineryGere TassewNo ratings yet

- G.R. No. 26085 August 12, 1927 Severino Tolentino and Potenciana MANIO, Plaintiffs-Appellants, BENITO GONZALEZ SY CHIAM, Defendants-AppelleeDocument9 pagesG.R. No. 26085 August 12, 1927 Severino Tolentino and Potenciana MANIO, Plaintiffs-Appellants, BENITO GONZALEZ SY CHIAM, Defendants-AppelleeYong YongNo ratings yet

- Annual Value of House PropertyDocument3 pagesAnnual Value of House PropertyAyub ChowdhuryNo ratings yet

- PDF Document AB2D94598B09 1Document28 pagesPDF Document AB2D94598B09 120BRM051 Sukant SNo ratings yet

- Income From House PropertyDocument7 pagesIncome From House PropertyJoyanta SinghaNo ratings yet

- Revised Property Tax Guidelines in Telangana Dt. 9-10-2014Document67 pagesRevised Property Tax Guidelines in Telangana Dt. 9-10-2014VINOD METTANo ratings yet

- TAX 22-9-2020 Income From House PropertyDocument13 pagesTAX 22-9-2020 Income From House PropertyChitraNo ratings yet

- Tolentino v. Gonzales Sy Chiam, G.R. No. 26085, August 12, 1927 - EVDocument48 pagesTolentino v. Gonzales Sy Chiam, G.R. No. 26085, August 12, 1927 - EVYodh Jamin OngNo ratings yet