Professional Documents

Culture Documents

iNCOME TAX MODEL Q.P

Uploaded by

AndalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

iNCOME TAX MODEL Q.P

Uploaded by

AndalCopyright:

Available Formats

VELS INSTITUTE OF SCIENCE, TECHNOLOGY AND ADVANCED STUDIES

SCHOOL OF _MANAGEMENT STUDIES

Department of COMMERCE(A & F)

Model Examination Nov 2021

SUBJECT TITLE: INCMETAX LAW & PRACTICE - I Maximum Marks: 100

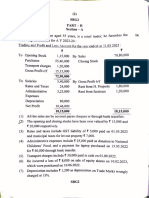

SUBJECT CODE: 18CBCF52 YEAR/SEM: III YEAR/5TH SEM

Register No: Invigilator Name &

Signature:

Date: 11-11-2021 Duration : 3HRS

Knowl Marks

Q. Ma C

PART-A (Answer all the questions) edge awarde

No rks O

Level d

1 Who is called ‘Representative Assessee’? 3 1 K3

2 Mr J an Indian citizen goes abroad on 1.4.2013 for the first time. He 3 2 K4

returns to India on 15.02.2020, During the P.Y 2020-2021, he was in

India only for 185 days. Find his residential status for the assessment

year 2021-22.

3 Define the term “Salary”. 3 2 K4

4 Compute the amount of basic salary for the previous year 2020-21 of an 3 1 K2

officer of a public sector undertaking who is appointed on 1.9.2015 in

the grade of Rs.18000- 500 - 20000- 600- 26000. He gets his increment

after every twelve months and his salary is due on the last date of the

month.

5 Calculate taxable HRA from the following: HRA received -Rs.1000 p.m. 3 1 K2

Rent paid for rented house -Rs.1500 p.m. Salary -Rs. 10500 p.m. D.A-

Rs. 500 p.m.

6 Write a note an ‘unrealised rent’. 3 1 K3

7 From the volume particulars compute gross annual value. Municipal 3 2 K4

value is 60,000,, fair rent 65,000 standard Rent 59,500 , actual rents

72,000.

8 What do you mean by ‘Self generated assets’. 3 2 K4

9 A firm’s stock of goods valued on 1.04.2020 at Rs. 2,50,000 at 20% 3 1 K2

below the cost. Calculate the amount of under valuation of stock.

10 State the meaning of Additional Depreciation. 3 1 K2

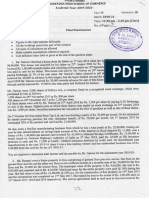

PART-B (Answer any 5)

11 State the different classes of Assessees. 8 2 K2

Particulars of income of Mr Subramanian who is resident but not

ordinary resident in India for the assessment year 2021 -22 are given

below.

12 1.Income earned in Pakistan but received in India Rs.5,00,000 8 2

K4

2.Share of profit from a firm in India Rs. 1,00,000

3.Past untaxed foreign income Rs. 3,00,000.

Compute Gross Total Income.

13 8 2

What are the fully exempted allowances as per IT act? K2

Calculate taxable HRA from the following: HRA received -Rs.1000 p.m.

14 Rent paid for rented house -Rs.1500 p.m. Salary -Rs. 10500 p.m. D.A- 8 2

K5

Rs. 500 p.m.

Calculate the amount of R.P.F. which is taxable.

15 A.Salary Rs. 7,500 p.m 8 2

B.Employer’s contribution to RPF @ 14% of Salary K5

C.Interest credited to RPF during the year @ 12% is Rs. 24,000.

Mr R has got house A. The particular for the previous year 2020 -21 are

given below

A.Fair rent Rs 90,000

B.Standard rent under rent control act Rs 70,000

16 C.Municipal value are Rs 80,000 8 1

D.Municipal tax paid by the owner RS8000 K3

E.Annual rent Rs 96,000

F.Annual rent received Rs 80,000

G.Vacancy period two months

Determine the annual value for the previous year 2020-21.

Explain ‘Deemed profit’ U/S 41.

17 8 1

K4

Mr. Arumugam has provided the following particulars. Written down

18 value of block of plant and machinery on 1.4.2020 was Rs. 6,00,000, A 8 1 K5

new machinery was purchased in May 2020, costing Rs. 2,00,000. He

sold machinery on 15th Sep 2020 for Rs. 80,000. The rate of depreciation

of all machinery is 15%. Calculate the amount of depreciation.

PART -C (Answer any 2)

For the accounting year ended 3l march 2021, Mr.sasikanth furnished

the following particulars of his income.

A.salary received in India 60000.

B.profit from business in Germany but received in India Rs. 15000.

C.income from house property in Pakistan deposited in bank there

Rs.12000.

D.profit from business established in Bangladesh but business is

controlled from India Rs. 46000.

19 E.income accrued in India but received in Sweden Rs. 25000. 15 2 K2

F.In this accounting year Mr. Sasikanth has brought into India foreign

income of earlier year Rs. 42700.

G.profit from sales of plant at Mumbai (50%received in Bankok)

Rs.160000.

H.Interest on Japan development bonds (60%received in India). Rs.

100000.

Compute the total income if (i) he is Resident (ii) Not Ordinarily

Resident or (iii) he is Non-Resident.

Compute the taxable salary of Mrs Davi of Madurai (population 18

lacs) for the AY 2021-2022 from the following particulars :

A.basic pay Rs.8000 pm

B.dearness allowance of Rs 2000 PM (enters into retirement benefits)

C.bonus Rs.8000 p.a

D.Rent free accommodation provided by the employer, the fair rental

value of which is Rs 20000 PA. The cost of furniture provided there is

20 Rs. 10000 15 2 K2

E.entertainment allowances Rs 500pm

F.Employees contribution to RPF is at 15 % of salary

G.Employer’s contribution to RPF is at Rs 15000 P.a.

H.Interest credited to Provident fund at 9.5% per annum amounted to Rs.

1900

I.Free use of a larger motor car for both official and personal purposes.

Driver is also provided by the employer.

21 Mr. Faiz has occupied two houses for his residential purpose, particular 15 2 K2

of which are as follows:

Particulars House I House II

Rs. Rs.

Municipal valuation 30,000 30,000

Standard rent 20,000 ----

Fair rent 18,000 35,000

Municipal taxes paid 2,400 3,600

Repairs Nil 200

Ground rent 7,000 400

Insurance premium 1,300 600

‘Faiz’ borrows Rs. 30,000 @ 20% interest p.a for construction of house

II (date of borrowings: June 1, 2010; date of Repayment of loan

10.5.2019 construction of both houses is completed in May 2015).

Compute the taxable income under the head of house property.

Mr. Y is a Chartered Accountant in Chennai. You are given the income

and expenditure account for the year 2021-22. Compute his income from

profession for the AY : 2021-22.

Expenditure Rs. Income Rs.

To Office 33,000 By Audit fees 3,00,000

Rent

To Salary to 75,000 By Financial 60,000

staff Consultancy

services

To Charities 5,000 By Interest on 22,000

deposits

To Gift to 6,000 By Dividend on 6,000

relatives units of UTI

To 2,400

Subscription

22 for- Journals 15 1 K2

To Drawings 16,000

To Car 24,000

expenses

To Household 8,600

expenses

To NSC 40,000

Purchased

To Net income 2,10,000

4,20,000 4,20,000

Additional information

1.Office rent Rs. 3,000 paid not recorded.

2.Depreciation of car during the year is Rs. 6,000

3.30% of car expenses are related to personal purpose.

Marks Obtained for the CO’s

CO

CO1: CO2: CO3: CO4: Total Marks:

5:

Distribution of Questions based on Bloom’s Taxonomy-Knowledge Level

You might also like

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- September: (CBCS) (F +R) (2016-17 and Onwards)Document7 pagesSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeNo ratings yet

- Income Tax IISep Oct 2022Document15 pagesIncome Tax IISep Oct 2022supritha724No ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- Reg No. 3 4 Sol: SpecifiedDocument4 pagesReg No. 3 4 Sol: SpecifiedXjdkkdNo ratings yet

- Bíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆDocument8 pagesBíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆSudhir SoudagarNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- Da 144Document4 pagesDa 144GeethaNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- DT 1 QDocument23 pagesDT 1 QG INo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- Income Tax Quesion BankDocument22 pagesIncome Tax Quesion BankPaatrickNo ratings yet

- Income Tax May23 Free ResourcesDocument29 pagesIncome Tax May23 Free ResourcesPurna PatelNo ratings yet

- RA - M16UCM12 - B.Com. - 24.03.2021 - FNDocument4 pagesRA - M16UCM12 - B.Com. - 24.03.2021 - FNkavinilavan14072004No ratings yet

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- CA Inter N22 - Tax Model QPDocument14 pagesCA Inter N22 - Tax Model QPNAVEEN SURYA MNo ratings yet

- 2 - House Property Problems 22-23Document5 pages2 - House Property Problems 22-2320-UCO-517 AJAY KELVIN ANo ratings yet

- IT QuestionDocument3 pagesIT QuestionSathish SmartNo ratings yet

- (April-18) (HBC-202) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document4 pages(April-18) (HBC-202) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Business TaxationDocument4 pagesBusiness Taxationshejal naikNo ratings yet

- Income Tax 1 - 20223Document3 pagesIncome Tax 1 - 20223nimalpes21No ratings yet

- Business Taxation MBA III 566324802Document5 pagesBusiness Taxation MBA III 566324802mohanraokp2279No ratings yet

- 5.1 Questions On Income From House PropertyDocument3 pages5.1 Questions On Income From House PropertyAashi GuptaNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Vol 1 31032019 PDFDocument9 pagesVol 1 31032019 PDFPradeep KattimaniNo ratings yet

- Income TaxDocument4 pagesIncome TaxsebastianksNo ratings yet

- Document From Rajan®Document5 pagesDocument From Rajan®Anit LuckyNo ratings yet

- Tax Nov 21 RTPDocument25 pagesTax Nov 21 RTPShailjaNo ratings yet

- Tax H Question 2021Document3 pagesTax H Question 2021Aporupa BarNo ratings yet

- Eco 11Document4 pagesEco 11ps5927510No ratings yet

- Part - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceDocument12 pagesPart - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceShashwat SharmaNo ratings yet

- Icai Module QuestionsDocument26 pagesIcai Module QuestionsrachitNo ratings yet

- MEFA Nov2003 RR211701Document10 pagesMEFA Nov2003 RR211701Nizam Institute of Engineering and Technology LibraryNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- ITLP Question BankDocument9 pagesITLP Question BankRitik SinghNo ratings yet

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaNo ratings yet

- Assessment 1Document4 pagesAssessment 1lalshahbaz57No ratings yet

- Tybms Sem5 DT Nov19Document5 pagesTybms Sem5 DT Nov19omsantoshbhosale01No ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- Questions 34nosDocument21 pagesQuestions 34nosAshish TomsNo ratings yet

- BBAHDSE504Document4 pagesBBAHDSE504shen kinoNo ratings yet

- Capital Gain 2Document11 pagesCapital Gain 2Aishwarya SundararajNo ratings yet

- Direct Taxes 3f5UWmuZoHDocument2 pagesDirect Taxes 3f5UWmuZoHMadhuram SharmaNo ratings yet

- Income Tax - I Subj - Code:113020 Section-ADocument3 pagesIncome Tax - I Subj - Code:113020 Section-AThiru VenkatNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- 0452 s03 Ms 2 PDFDocument6 pages0452 s03 Ms 2 PDFlie chingNo ratings yet

- TBS India X3 Legislation Pack v3 2016Document3 pagesTBS India X3 Legislation Pack v3 2016Mohamed AliNo ratings yet

- Chapter 3Document55 pagesChapter 3Âbîjîţh KBNo ratings yet

- Chapter 3-Adjusting The AccountsDocument69 pagesChapter 3-Adjusting The AccountsMahmud Al HasanNo ratings yet

- Intercompany Fixed AssetsDocument5 pagesIntercompany Fixed Assetstungoldonette3No ratings yet

- Ifrs 8: Operating SegmentsDocument15 pagesIfrs 8: Operating SegmentsAANo ratings yet

- Peoplesoft Enterprise Asset Lifecycle Management Fundamentals 9.1 PeoplebookDocument276 pagesPeoplesoft Enterprise Asset Lifecycle Management Fundamentals 9.1 PeoplebookEdwin RomeroNo ratings yet

- OVERHEADS - Topic 7Document21 pagesOVERHEADS - Topic 7Alepha TemboNo ratings yet

- 64157studentjournal Apr2021aDocument36 pages64157studentjournal Apr2021asunil1287No ratings yet

- Ch.3 - National Income - Related Aggregates ( (Macro Economics - 12th Class) ) - Green BookDocument23 pagesCh.3 - National Income - Related Aggregates ( (Macro Economics - 12th Class) ) - Green BookMayank Mall100% (1)

- PPE Investments Working PaperDocument15 pagesPPE Investments Working PaperMarriel Fate CullanoNo ratings yet

- Ready To Eat VegetablesDocument7 pagesReady To Eat VegetablesMita TannaNo ratings yet

- Worksheet ProblemsDocument3 pagesWorksheet ProblemsClaren Sidnne MadridNo ratings yet

- Tutorial 10-Internal Auditing: Review QuestionsDocument5 pagesTutorial 10-Internal Auditing: Review Questionscynthiama7777No ratings yet

- Business Income Calculation UdomDocument23 pagesBusiness Income Calculation UdomMaster Kihimbwa100% (1)

- Chapter 1: Partnership: Part 1: Theory of AccountsDocument10 pagesChapter 1: Partnership: Part 1: Theory of AccountsKeay Parado0% (1)

- Past CPA Board On MASDocument11 pagesPast CPA Board On MASjoshNo ratings yet

- Chapter 3 Tax AnswersDocument55 pagesChapter 3 Tax Answersawby04100% (2)

- Standard Chart of Accounts For Smaller Law OfficesDocument1 pageStandard Chart of Accounts For Smaller Law OfficesVivian NarvajaNo ratings yet

- 032431986X 104971Document5 pages032431986X 104971Nitin JainNo ratings yet

- Entrepreneur Chapter 18Document6 pagesEntrepreneur Chapter 18CaladhielNo ratings yet

- 3-1int 2003 Dec QDocument6 pages3-1int 2003 Dec Qjalan1989No ratings yet

- General DirectionDocument3 pagesGeneral DirectionWondimagegn Kibret EjiguNo ratings yet

- Wmu Fy19 Ncaa Report - FinalDocument79 pagesWmu Fy19 Ncaa Report - FinalMatt BrownNo ratings yet

- Assets Management Policy: by Girra Walter EmailDocument23 pagesAssets Management Policy: by Girra Walter EmailSAMDNo ratings yet

- Management Accounting Problem Unit 3Document17 pagesManagement Accounting Problem Unit 3princeNo ratings yet

- R31 Non-Current (Long-Term) Liabilities Q BankDocument16 pagesR31 Non-Current (Long-Term) Liabilities Q BankAhmedNo ratings yet

- IB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsDocument7 pagesIB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsS3F1No ratings yet

- Managerial Accounting (2-2 Marks Question)Document27 pagesManagerial Accounting (2-2 Marks Question)Shruti LatherNo ratings yet

- Compre2 ReviewerDocument6 pagesCompre2 ReviewerMark Joseph OlinoNo ratings yet