Professional Documents

Culture Documents

Standard Chart of Accounts For Smaller Law Offices

Uploaded by

Vivian Narvaja0 ratings0% found this document useful (0 votes)

11 views1 pageMnahahshhsisudh

Original Title

mca (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMnahahshhsisudh

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageStandard Chart of Accounts For Smaller Law Offices

Uploaded by

Vivian NarvajaMnahahshhsisudh

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

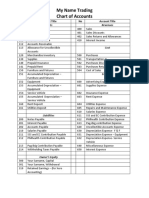

Standard Chart of Accounts for Smaller Law Offices

Assets 514 Employee Retirement Benefits

100 Cash in Bank 518 Employee Training & Education

109 Petty Cash 519 Other Employee Costs

120 Client Advances-Unbilled-CTRL

130 Client Advances-Billed-CTRL Occupancy

140 Other Receivables, Deposits, etc. 520 Office Rent

150 Furniture, Fixtures & Equipment 521 Parking

160 Leasehold Improvements 523 Real Estate Taxes & Insurance

170 Real Property 525 Utilities Other Than Telephone

180 Reserve: Depreciation & 527 Cleaning/Housekeeping -- Office

Amortization 530 Depreciation/Amortization -- Office

190 Other Assets 531 Maintenance & Repairs -- Office

198 Client Billings-CTRL

199 Lawyer Billings-CTRL Office Operations

540 Supplies, Stationery & Printing

Liabilities 541 Postage & Delivery

200 Accounts Payable 542 Library & Subscriptions

210 Federal Income Tax Withheld 543 Telephone/Communications

211 State Income Tax Withheld 545 Photocopy Expense

212 Employee FICA Tax Withheld 546 Computer Equipment

220 Employee Medical/Retirement 548 Equipment Rental

Withheld 550 Depreciation: Furniture, Fixtures &

Equipment

Segregated Liabilities 551 Other Maintenance Repairs

298 Client Trust Funds-CTRL

299 Liability: Client Trust Funds-CTRL Professional/Promotion

570 Travel & Related Expense

Owners Equity 571 Professional Dues & CLE

300 Equity Account: Owner #1 (et al.) 572 Recruiting: Professional Staff

301 Drawing Account: Owner #1 (et al.) 573 Entertainment

574 Promotion & Advertising

Profit/Loss Accounts

400 Fees: Income from Clients-CTRL Other Costs/Expenses

460 Other Income/Receipts 580 Insurance: Professional/Other

480 Costs: Income-Producing Property 581 Other Taxes and Similar Costs

582 Client Advances Written Off-CTRL

Compensation Costs 590 Miscellaneous Expenses

500 Secretarial

501 Word Processing

502 Paralegals/Clerks

503 Lawyers

504 Other Non-Owner Employees

510 FICA & Unemployment Taxes

You might also like

- Stanley - Your Voice (1957) PDFDocument396 pagesStanley - Your Voice (1957) PDFŠašavi Sam MajmunNo ratings yet

- Chart of AccountsDocument6 pagesChart of AccountsKevzz EspirituNo ratings yet

- Arib Business Chart of AccountsDocument9 pagesArib Business Chart of Accountskakao100% (1)

- Revised Chart of AccountsDocument2 pagesRevised Chart of AccountsChris TineNo ratings yet

- ASME B16.5 Flange Rating CalculatorDocument10 pagesASME B16.5 Flange Rating Calculatorfaizal100% (2)

- Wolf Gone Wild - Juliette CrossDocument312 pagesWolf Gone Wild - Juliette CrossAbdelhediNo ratings yet

- Muscle Mag August 2014Document148 pagesMuscle Mag August 2014ElthonJeffrey100% (5)

- Standard Chart of Accounts For Smaller Law OfficesDocument1 pageStandard Chart of Accounts For Smaller Law OfficesVivian NarvajaNo ratings yet

- Chart of AccountsDocument1 pageChart of Accountssharomeo castroNo ratings yet

- Bida Tech Workpaper Revised 06252021 EBBDocument23 pagesBida Tech Workpaper Revised 06252021 EBBTrisha Mae Mendoza MacalinoNo ratings yet

- Provided by Tutoring Services 1 Chart of AccountsDocument6 pagesProvided by Tutoring Services 1 Chart of AccountsAn Cj De'LexusNo ratings yet

- Account Code Account TitleDocument3 pagesAccount Code Account TitleMavel PanganibanNo ratings yet

- Dr. Domingo Clinic Chart of Accounts: Account Numbers Account Titles Current AssetsDocument2 pagesDr. Domingo Clinic Chart of Accounts: Account Numbers Account Titles Current AssetsmariaNo ratings yet

- Chart of AccountsDocument8 pagesChart of AccountsFarhana Yeasmin ShuchanaNo ratings yet

- Chart of AccountDocument1 pageChart of AccountGIAHLYN SALABSABNo ratings yet

- 03 - Practice Set - Chart of AccountsDocument1 page03 - Practice Set - Chart of AccountsRenz Gabriel BautistaNo ratings yet

- 0Document2 pages0Hyuna KimNo ratings yet

- Chart of Accounts East Asia DistributorsDocument2 pagesChart of Accounts East Asia Distributorsrachelprincess.monteroso23No ratings yet

- Lembar JasaDocument40 pagesLembar JasaSindi YulianiNo ratings yet

- Sole Chart of Accounts Chart of AccountsDocument1 pageSole Chart of Accounts Chart of Accountsrachelprincess.monteroso23No ratings yet

- Chart of Accounts and ReportingDocument35 pagesChart of Accounts and ReportingSafiullah KamawalNo ratings yet

- Chart of AccountsDocument1 pageChart of AccountsMybel Alcantara BelgaNo ratings yet

- CPS - NGAS Modified Charts of AccountsDocument63 pagesCPS - NGAS Modified Charts of Accountsjerico kier nonoNo ratings yet

- Assets Accounts GuideDocument3 pagesAssets Accounts GuideSofia NadineNo ratings yet

- Chart of Accounts GuideDocument14 pagesChart of Accounts GuideAlexandra SarmuyanNo ratings yet

- Code) : XXX-XXX-XXX-XXXDocument7 pagesCode) : XXX-XXX-XXX-XXXRiska Renitha SariNo ratings yet

- Accounting WorkbookDocument17 pagesAccounting WorkbookyamyamyamNo ratings yet

- QBO 2020 Math Revealed Chart of Accounts For ImportingDocument2 pagesQBO 2020 Math Revealed Chart of Accounts For ImportingTaniavami ClarisseNo ratings yet

- Chua Enterprise Accounting Cycle Case"TITLE"Monthly Financials for Insurance & Supplies Adjusting EntriesDocument2 pagesChua Enterprise Accounting Cycle Case"TITLE"Monthly Financials for Insurance & Supplies Adjusting EntriesCoolvetica100% (1)

- FAR Practice SetDocument37 pagesFAR Practice SetCarla TalanganNo ratings yet

- Basic Accounting Quiz 2.0Document4 pagesBasic Accounting Quiz 2.0Jensen Rowie PasngadanNo ratings yet

- Pioneer Advertising Chart of AccountsDocument1 pagePioneer Advertising Chart of Accountskinanti andiaryNo ratings yet

- Pioneer AdverstingDocument1 pagePioneer Adverstingkinanti andiaryNo ratings yet

- Account Titles and Descriptions for Financial StatementsDocument13 pagesAccount Titles and Descriptions for Financial StatementsVrix Ace MangilitNo ratings yet

- Chart of Accounts Code Account Title Assets Current AssetsDocument2 pagesChart of Accounts Code Account Title Assets Current Assetsshau ildeNo ratings yet

- Transaction 9 20 2022Document3 pagesTransaction 9 20 2022Flores ,Christian John B.No ratings yet

- CengageNOWv2 - Online Teaching and Learning Resource From Cengage Learning Week 3Document5 pagesCengageNOWv2 - Online Teaching and Learning Resource From Cengage Learning Week 3Swapan Kumar SahaNo ratings yet

- Classification of Revised Object HeadsDocument5 pagesClassification of Revised Object HeadsArun EmmiNo ratings yet

- Charts of Accounts of Eagle Wheels Auto Solutions For QBDocument16 pagesCharts of Accounts of Eagle Wheels Auto Solutions For QBMuhammad UsmanNo ratings yet

- BOOKKEEPPING EQA CorporationDocument21 pagesBOOKKEEPPING EQA CorporationLovely Rose GuinilingNo ratings yet

- 2 Mechadising Calma2Document1 page2 Mechadising Calma2Ej VerolaNo ratings yet

- Ma. Tintin Merchandising December TransactionsDocument3 pagesMa. Tintin Merchandising December Transactionsncl grcNo ratings yet

- Tek Düzen Hesap Plani (The Uniform Chart of Accounts)Document14 pagesTek Düzen Hesap Plani (The Uniform Chart of Accounts)dinaNo ratings yet

- Chart of Accounts: Account NumberingDocument15 pagesChart of Accounts: Account NumberingrjrjrjNo ratings yet

- Newly registered BPO corporation financial recordsDocument3 pagesNewly registered BPO corporation financial recordsB17 NASH AMIEL B. REYESNo ratings yet

- Drill 01Document1 pageDrill 01Sangre DodieNo ratings yet

- CPS - NGAS Modified Charts of AccountsDocument77 pagesCPS - NGAS Modified Charts of AccountsRussel Saracho100% (1)

- 1 Darna PerpetualDocument1 page1 Darna PerpetualEj VerolaNo ratings yet

- Chart of Accounts for Quicky Elite Taxi Service CompanyDocument2 pagesChart of Accounts for Quicky Elite Taxi Service Companytricks lastogNo ratings yet

- 1 Darna Perpetual PDFDocument1 page1 Darna Perpetual PDFZemin MorenoNo ratings yet

- Merchandising Company Accounting CycleDocument2 pagesMerchandising Company Accounting CycleEj VerolaNo ratings yet

- CADocument30 pagesCAZulfa Aulia Nurul PutriNo ratings yet

- Chart of Accts Problem 11Document2 pagesChart of Accts Problem 11Stephanie RobinsonNo ratings yet

- COA11Document1 pageCOA11ramdanialdi12rNo ratings yet

- Columban College, Inc: Center For Lifelong Learning and Skills DevelopmentDocument1 pageColumban College, Inc: Center For Lifelong Learning and Skills DevelopmentPinky DaisiesNo ratings yet

- Default Chart of AccountsDocument4 pagesDefault Chart of Accountsjmanzungu2820No ratings yet

- Exercise Principles Accounting IDocument2 pagesExercise Principles Accounting Imariya oumerNo ratings yet

- CPS / NGAS Chart of Accounts for Water DistrictsDocument61 pagesCPS / NGAS Chart of Accounts for Water DistrictsVina Ocho CadornaNo ratings yet

- Uacs CodeDocument16 pagesUacs CodeJohn Angel ReyesNo ratings yet

- CHART For Dissemination-Updated PinakaupdatedDocument92 pagesCHART For Dissemination-Updated Pinakaupdatedjerico kier nonoNo ratings yet

- No. Akun Description CRDocument14 pagesNo. Akun Description CRbilqis almahyraNo ratings yet

- Model Policies and Procedures for Not-for-Profit OrganizationsFrom EverandModel Policies and Procedures for Not-for-Profit OrganizationsNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Tapping Volcanic Energy for Human UseDocument9 pagesTapping Volcanic Energy for Human UseThartson Oliveros MagdadaroNo ratings yet

- Cast Resin Planning Guidelines GEAFOL PDFDocument24 pagesCast Resin Planning Guidelines GEAFOL PDFtenk_man100% (1)

- GER Bangladesh EngDocument12 pagesGER Bangladesh Engfarhan.anjum20032004No ratings yet

- Online Pharmacy: Customer ProfilingDocument6 pagesOnline Pharmacy: Customer ProfilingGeorge SebastianNo ratings yet

- Lodging EstablishmentsDocument2 pagesLodging EstablishmentsMich A. Gonzales0% (1)

- Traits and BehaviorDocument8 pagesTraits and BehaviorNorwafa Cariga EspinosaNo ratings yet

- Wörterbuch Der Humanbiologie - Dictionary of Human Biology - Deutsch - Englisch - Englisch - Deutsch. English - German - German - English (PDFDrive)Document1,002 pagesWörterbuch Der Humanbiologie - Dictionary of Human Biology - Deutsch - Englisch - Englisch - Deutsch. English - German - German - English (PDFDrive)MilaNo ratings yet

- DBXLH 8585B VTMDocument4 pagesDBXLH 8585B VTMmau_mmx5738No ratings yet

- RR No. 6-2015 PDFDocument5 pagesRR No. 6-2015 PDFErlene CompraNo ratings yet

- Seven Appear in Court On Cocaine, P Charges After North Island Drug Raids - NZ HeraldDocument3 pagesSeven Appear in Court On Cocaine, P Charges After North Island Drug Raids - NZ HeraldVagamundos ArgentinosNo ratings yet

- Duconmix CRP 400Document2 pagesDuconmix CRP 400FounTech612No ratings yet

- Volcanic Eruption Types and ProcessDocument18 pagesVolcanic Eruption Types and ProcessRosemarie Joy TanioNo ratings yet

- TS68Document52 pagesTS68finandariefNo ratings yet

- Effects of Cutting Classes For Grade 11 TEC Students of AMA Computer College Las PiñasDocument5 pagesEffects of Cutting Classes For Grade 11 TEC Students of AMA Computer College Las PiñasGgssNo ratings yet

- Edc Power Plant FacilitiesDocument32 pagesEdc Power Plant FacilitiesMichael TayactacNo ratings yet

- Wartsila Tribo PackDocument7 pagesWartsila Tribo Packsuper_seeker100% (1)

- The Four Common Types of Parenting StylesDocument11 pagesThe Four Common Types of Parenting StylesIka_Dyah_Purwa_1972100% (3)

- Flame Amplifier HoneywellDocument8 pagesFlame Amplifier Honeywellgavo vargoNo ratings yet

- Project: M/S Cae-Gondia at Nagpur Cable Schedule For Proposed ProjectDocument26 pagesProject: M/S Cae-Gondia at Nagpur Cable Schedule For Proposed ProjectMurali MohanNo ratings yet

- Diseases That Cause HypoproteinemiaDocument12 pagesDiseases That Cause HypoproteinemiaRachel Marie M. GaniaNo ratings yet

- Vetotop Doc Technical Map en 3573Document4 pagesVetotop Doc Technical Map en 3573Rebel XNo ratings yet

- Individual Differences and Personality in "Ugly Betty", S01E01Document6 pagesIndividual Differences and Personality in "Ugly Betty", S01E01Starling HunterNo ratings yet

- ZavzpretDocument21 pagesZavzpretNeethu Anna StephenNo ratings yet

- Name: Sport: Movement PrepDocument24 pagesName: Sport: Movement PrepS HNo ratings yet

- Ibsen in PracticeDocument17 pagesIbsen in PracticevictorkalkaNo ratings yet

- AU440-36V-MH: DimensionsDocument2 pagesAU440-36V-MH: DimensionsJohnny FucahoriNo ratings yet