Professional Documents

Culture Documents

Audit Fot Liability Problem #2

Uploaded by

Ma Teresa B. CerezoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Fot Liability Problem #2

Uploaded by

Ma Teresa B. CerezoCopyright:

Available Formats

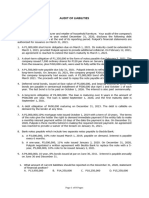

Problem 2

In conjunction with your firm’s examination of the financial statements of Ronryan

Company as of December 31, 2007, you obtained from the voucher register the information

shown in the work paper below.

Item Entry Date Description Amount Account Charged

1. 12/18/07 Supplies, purchased FOB

destination, 12/15/07;

received, 12/17/07 15,000 Supplies on hand

2. 12/18/07 Auto insurance, 12/15/07

to 12/15/08 24,000 Prepaid insurance

3. 12/21/07 Repair services; received

12/20/07 19,000 Repairs and Main.

4. 12/21//07 Merchandise shipped FOB

shipping point, 12/20/07;

received, 12/24/07 12,300 Inventory

5. 12/21/07 Payroll, 12/07/07 – 12/21/07

(12 working days) 69,000 Sal. and wages

6. 12/26/07 Subscription to Tax Journals

for 2008 5,000 Dues & subs

7. 12/28/07 Utilities for December 2007 24,000 Utilities expense

8. 12/28/07 Merchandise shipped FOB

destination, 12/24/07;

received, 1/2/08 111,000 Inventory

9. 12/28/07 Merchandise shipped FOB

shipping point, 12/26/07;

received, 1/3/08 84,000 Inventory

10. 1/5/08 Payroll 12/21/07 – 1/05/08

(12 working days. 4 working

days in January) 72,000 Sal. and wages

11. 1/10/08 Merchandise shipped FOB

destination, 1/03/08,

received, 1/10/08 38,000 Inventory

12. 1/14/08 Interest on bank loan,

10/10/07 to 01/10/08 30,000 Interest

expense

13. 1/15/08 Manufacturing equipment

installed, 12/29/07 254,000 Machinery

14. 1/15/08 Dividends declared,

12/15/07 160,000 Dividends payable

Accrued liabilities of 12/31/07 were as follows:

Accrued payroll P 48,000

Accrued interest payable 26,667

Dividends payable 160,000

The accruals made on December 31, 2007 were reversed effective January 1, 2008.

Review the data given above and prepare adjusting journal entries to correct the accounts

on December 31, 2007. Assume that the company follows FOB terms for recording

inventory purchases.

Questions

1. The entry to adjust item #2 is

a. Insurance expense 24,000 c. Insurance expense 1,000

Prepaid insurance 24,000 Prepaid insurance 1,000

b. Insurance expense 1,000 d. No adjustment

Prepaid insurance 1,000

2. The entry to adjust item #10 is

a. Salaries expense 48,000 c. Accrued payroll 48,000

Accrued payroll 48,000 Salaries expense 24,000

b. Accrued payroll 48,000 Cash 72,000

Salaries expense 48,000 d. No adjustment

3. The entry to adjust item #12 is

a. Interest expense 26,667 c. Interest expense 26,667

Interest payable 26,667 Interest payable 3,333

b. Interest expense 30,000 Cash 30,000

Interest payable 30,000 d. No adjustment

4. The entry to adjust item #13

a. Machinery 254,000 c. No adjustment

AP – others 254,000

b. AP – others 254,000 d. No adjustment since payment

Machinery 254,000 was made on Jan. 15, 2008

5. The entry to adjust item #14

a. Dividends declared 160,000 c. No adjustment

Dividends payable160,000

b. Dividends payable 160,000 d. No adjustment since payment

Dividends declared 160,000 was made on Jan. 15, 2008.

Solution

1. No Adjustment

2. Insurance expense 1,000

Prepaid insurance 1,000

3. No Adjustment

4. No Adjustment

5. No Adjustment

6. Prepaid subscription 5,000

Dues and subscription 5,000

7. No adjustment

8. Accounts payable 111,000

Inventory 111,000

9. No adjustment

10. No adjustment

11. No adjustment

12. No adjustment

13. Machinery 254,000

AP – others 254,000

14. No adjustment

Answer:

1. B 2. D 3. D 4. A 5. C

You might also like

- CHAPTER 8 Caselette Audit of LiabilitiesDocument32 pagesCHAPTER 8 Caselette Audit of LiabilitiesNavarro, April Rose P.No ratings yet

- Audit of Liabilities AdjustmentsDocument27 pagesAudit of Liabilities AdjustmentsChinee CastilloNo ratings yet

- CHAPTER 8 - Audit of Liabilities: Problem 1Document27 pagesCHAPTER 8 - Audit of Liabilities: Problem 1Mikaela Gale CatabayNo ratings yet

- Audit of Liabilities and Loss ContingenciesDocument21 pagesAudit of Liabilities and Loss Contingencieskara albueraNo ratings yet

- AP Liab 1stsetDocument9 pagesAP Liab 1stsetMaritessNo ratings yet

- CHAPTER 8 Caselette - Audit of LiabilitiesDocument27 pagesCHAPTER 8 Caselette - Audit of LiabilitiesNovie Marie Balbin Anit100% (1)

- Problem 1. ASHTA Company Has The Following TransactionsDocument2 pagesProblem 1. ASHTA Company Has The Following TransactionsJhunNo ratings yet

- Audit PAKYO COMPANY accounts payable transactionsDocument9 pagesAudit PAKYO COMPANY accounts payable transactionsAngel TumamaoNo ratings yet

- Aol 7-16Document4 pagesAol 7-16chowchow123No ratings yet

- Pistons Company adjusting entriesDocument2 pagesPistons Company adjusting entriesjhobsNo ratings yet

- Audit of Liabilities Problem No. 1: Auditing ProblemsDocument8 pagesAudit of Liabilities Problem No. 1: Auditing ProblemsSailah DimakutaNo ratings yet

- Audit of LiabilitiesDocument33 pagesAudit of Liabilitiesxxxxxxxxx96% (28)

- AUDITING-Audit of LiabilitiesDocument9 pagesAUDITING-Audit of LiabilitiesJamhel MarquezNo ratings yet

- CPA FIRM FINANCIALSDocument5 pagesCPA FIRM FINANCIALSJedea Joy LactaoenNo ratings yet

- Audit of LiabilitiesDocument5 pagesAudit of LiabilitiesMenacexgNo ratings yet

- True or False accounting quizDocument7 pagesTrue or False accounting quizMara ClaraNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Assignment (10 Marks)Document1 pageAssignment (10 Marks)AA BB MMNo ratings yet

- Assignment (10 Marks)Document1 pageAssignment (10 Marks)AA BB MMNo ratings yet

- Service Entity Module - Key To CorrectionDocument23 pagesService Entity Module - Key To CorrectionMiru YuNo ratings yet

- Accounting Battaglia 1 Question and AnswersDocument7 pagesAccounting Battaglia 1 Question and AnswersRina RaymundoNo ratings yet

- Adjusting EntriesDocument3 pagesAdjusting EntriesSheena LeysonNo ratings yet

- Liabilities PDFDocument6 pagesLiabilities PDFIya KangNo ratings yet

- Synthesis - AudProb (Q)Document8 pagesSynthesis - AudProb (Q)Anna Gian SobrevillaNo ratings yet

- Chapter 08Document26 pagesChapter 08Dan ChuaNo ratings yet

- Audit Liability 14 Chapter 7Document2 pagesAudit Liability 14 Chapter 7Ma Teresa B. CerezoNo ratings yet

- HT202ITM Activity-1Document12 pagesHT202ITM Activity-1timwellramos36No ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Adjusting Entries QuizDocument12 pagesAdjusting Entries QuizJuan Dela CruzNo ratings yet

- Costing and AccountancyDocument3 pagesCosting and AccountancyDeepakNo ratings yet

- LiabilityDocument8 pagesLiabilityAce DesabilleNo ratings yet

- Liability SeatworkDocument8 pagesLiability SeatworkMary Ann B. GabucanNo ratings yet

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- (Module 3) ProblemsDocument17 pages(Module 3) ProblemsArriane Dela CruzNo ratings yet

- Working Trial Balance Audit AdjustmentsDocument4 pagesWorking Trial Balance Audit Adjustments김우림0% (3)

- Uniform Ltd adjusting entriesDocument11 pagesUniform Ltd adjusting entriesThi Van Anh VUNo ratings yet

- 4 5805514475188521062Document3 pages4 5805514475188521062eferem100% (5)

- Comprehensive Problem 2Document4 pagesComprehensive Problem 2Nicole Anne Santiago SibuloNo ratings yet

- Illustrative Problem 1111Document4 pagesIllustrative Problem 1111venice cambryNo ratings yet

- Presentation1 AutosavedDocument19 pagesPresentation1 AutosavedJoefet PatalotNo ratings yet

- Q.Prepare A Statement of P & L A/C As Per Revised Schedule III AnsDocument6 pagesQ.Prepare A Statement of P & L A/C As Per Revised Schedule III AnsTejas ChandanshiveNo ratings yet

- GJ No. 1Document6 pagesGJ No. 1AN AdeNo ratings yet

- Accounting For Warranties and PremiumsDocument8 pagesAccounting For Warranties and Premiumsalcazar rtuNo ratings yet

- Correcting The Trial Balance 2022Document3 pagesCorrecting The Trial Balance 2022Charlemagne Jared RobielosNo ratings yet

- CK Shah VUAPURWATA Mid-Semester Exam Q&ADocument26 pagesCK Shah VUAPURWATA Mid-Semester Exam Q&Aangel100% (1)

- CashDocument37 pagesCashRyan SanchezNo ratings yet

- Lecture-6 Adjusted Trial BalanceDocument22 pagesLecture-6 Adjusted Trial BalanceWajiha NadeemNo ratings yet

- Adjusting entries for ASHTADocument1 pageAdjusting entries for ASHTAJhunNo ratings yet

- Module 3 - Caragan, Adriane Ronn B. (CORRESPONDENCE)Document8 pagesModule 3 - Caragan, Adriane Ronn B. (CORRESPONDENCE)WonnNo ratings yet

- Financial Accounting Adjusting EntriesDocument11 pagesFinancial Accounting Adjusting Entriesmagdy kamelNo ratings yet

- Tugas Personal Ke-1 Week 2: Soal 1Document14 pagesTugas Personal Ke-1 Week 2: Soal 1meifangNo ratings yet

- Adjusting Entries: Problem 1Document9 pagesAdjusting Entries: Problem 1Wholehearted LayoutsNo ratings yet

- Student Name: Class: Student No.: .Document5 pagesStudent Name: Class: Student No.: .Thao LeNo ratings yet

- Adjusting Entry - AnswerDocument8 pagesAdjusting Entry - AnswerReighjon Ashley C. TolentinoNo ratings yet

- ACT1101, PRB, Midterm, Wit Ans KeyDocument5 pagesACT1101, PRB, Midterm, Wit Ans KeyDyen100% (1)

- 4 6026199395324659830Document30 pages4 6026199395324659830Beka Asra100% (1)

- Asistensi AK1 10 SeptDocument13 pagesAsistensi AK1 10 SeptIsmunandar D AnandaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 9Document1 pageChapter 15 Afar Solman (Dayag 2015ed) - Prob 9Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Full Goodwill ApproachDocument2 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Full Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 9Document1 pageChapter 15 Afar Solman (Dayag 2015ed) - Prob 9Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 8Document5 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 8Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Advance Accounting 2015 ConsolidationDocument2 pagesAdvance Accounting 2015 ConsolidationMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 8Document5 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 8Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Document1 pageChapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 8Document5 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 8Ma Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Document2 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Ma Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 4 & 5Document4 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 4 & 5Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 3 Case 3 & 4Document2 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 3 Case 3 & 4Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Document2 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Ma Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Document1 pageChapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 3 Case 3 & 4Document2 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 3 Case 3 & 4Ma Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 4 & 5Document4 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 4 & 5Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Advance Accounting 2015 ConsolidationDocument2 pagesAdvance Accounting 2015 ConsolidationMa Teresa B. CerezoNo ratings yet

- Solved Heavenly Displays Inc Puts Together Large Scale Fireworks Displays Primarily For CanadaDocument2 pagesSolved Heavenly Displays Inc Puts Together Large Scale Fireworks Displays Primarily For CanadaDoreenNo ratings yet

- Business Math 12Document9 pagesBusiness Math 12Scottie James Martin FaderangaNo ratings yet

- 11 BST Businessservices tp01Document6 pages11 BST Businessservices tp01RajatNo ratings yet

- 4N4 2012 Assignment 1Document3 pages4N4 2012 Assignment 1adsasda6817No ratings yet

- National Internal Revenue CodeDocument23 pagesNational Internal Revenue Codeuserfriendly12345No ratings yet

- A Study of Financial PlanningDocument64 pagesA Study of Financial PlanningKishor KhatikNo ratings yet

- Rewards, Incentives and Pay For PSDocument77 pagesRewards, Incentives and Pay For PSAvinaw KumarNo ratings yet

- Lim Unit 7 TaxDocument2 pagesLim Unit 7 TaxIvan AnaboNo ratings yet

- Harlan Foundation: Company BackgroundDocument4 pagesHarlan Foundation: Company BackgroundPrachiNo ratings yet

- Bobby & BettyDocument6 pagesBobby & BettySimon KingNo ratings yet

- Rmo 38-83Document1 pageRmo 38-83saintkarriNo ratings yet

- COVID-19 Employee PackDocument5 pagesCOVID-19 Employee PackAnh-Tuan TranNo ratings yet

- rc339 Fill 23eDocument5 pagesrc339 Fill 23esalimpublicNo ratings yet

- Kaisahan at Kapatiran NG Mga Manggagawa at Kawani Sa MWC Vs MWC DDocument3 pagesKaisahan at Kapatiran NG Mga Manggagawa at Kawani Sa MWC Vs MWC DMichael Parreño VillagraciaNo ratings yet

- Pas 12 Income TaxesDocument3 pagesPas 12 Income TaxesR.A.No ratings yet

- CCA Notice - December 2022Document1 pageCCA Notice - December 2022Wews WebStaffNo ratings yet

- PCL Chap 2 en Ca PDFDocument45 pagesPCL Chap 2 en Ca PDFRenso Ramirez JimenezNo ratings yet

- Payment For Week Ending 10-04-2020Document1 pagePayment For Week Ending 10-04-2020Florin VaetusNo ratings yet

- Offer Letter: Code of ConductDocument1 pageOffer Letter: Code of ConductMahesh MiriyalaNo ratings yet

- TAX LESSON 4 PART 1 COMPUTATIONDocument13 pagesTAX LESSON 4 PART 1 COMPUTATIONJhe CaNo ratings yet

- T04 - Profits TaxDocument18 pagesT04 - Profits Taxting ting shihNo ratings yet

- eFPS Home - Efiling and Payment System PDFDocument2 pageseFPS Home - Efiling and Payment System PDFRegs AccountingTaxNo ratings yet

- U.S. Individual Income Tax Return: Filing Status XDocument8 pagesU.S. Individual Income Tax Return: Filing Status XTehone Teketelew100% (1)

- Comp MNGTDocument48 pagesComp MNGTGeetika apurvaNo ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- Goldwing Corporation Offers Enriched Parental Benefits To Its Staff While PDFDocument1 pageGoldwing Corporation Offers Enriched Parental Benefits To Its Staff While PDFTaimur TechnologistNo ratings yet

- Income Tax AY 2020-21 Sem III B.comh - Naveen MittalDocument99 pagesIncome Tax AY 2020-21 Sem III B.comh - Naveen MittalNisha PatelNo ratings yet

- MODULE 1 Understanding Personal FinanceDocument43 pagesMODULE 1 Understanding Personal FinanceAnore, Anton NikolaiNo ratings yet

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldDocument1 pageGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaNo ratings yet

- Taxation Malaysia Home Acca GlobalDocument12 pagesTaxation Malaysia Home Acca GlobalLee Yee Mei100% (1)