Professional Documents

Culture Documents

Correcting The Trial Balance 2022

Uploaded by

Charlemagne Jared RobielosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Correcting The Trial Balance 2022

Uploaded by

Charlemagne Jared RobielosCopyright:

Available Formats

CA5101 – Financial Accounting and Reporting

First Term, Academic Year 2022-2023

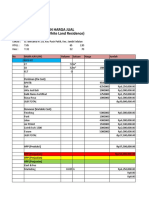

CORRECTING THE TRIAL BALANCE

PROBLEM A. Rockwell Repairs Services gave you the following trial balance dated December 31,

2022.

Debit Credit

Cash P4,500

Accounts receivable 27,000

Repair supplies 500

Furniture and fixtures 10,000

Repair equipment 33,100

Accounts payable P5,750

Notes payable 25,250

Rockwell, capital 56,000

Rockwell, drawing 6,000

Service income 135,300

Repair supplies expense 15,000

Rent expense 40,000

Salaries expense 60,000

Utilities expense 25,000

Total P221,500 P221,500

Because of the unequal balances of the debit and credit side of the trial balance, you have

gathered the following information:

a. A debit to Rockwell, drawing P500 was posted to the debit side of Rockwell, capital.

b. A credit to Accounts receivable of P100 was posted to the correct account but as P1,000.

c. A debit to cash of P450 was posted to the debit side of cash as P540.

d. A P500 debit to Furniture and fixtures was posted twice.

e. A P500 debit entry to Salaries expense was not posted.

f. A transaction was credited and posted to Service income P2,000 instead of to Accounts

receivable.

g. A debit to Accounts payable for P195 was posted to the correct account but on the credit

side.

h. A debit to Accounts receivable of P500 was posted to the debit side of Cash.

1. What is the correct total of the trial balance?

2. What is the correct amount of cash?

3. Compute for the total amount of assets.

4. Compute for the total amount of liabilities.

5. How much is the net income/(loss) for the month of December?

6. Compute for the ending balance of capital.

PROBLEM B. The newly hired accountant of Greenbelt Gym Co. has prepared the following trial

balance for the month of July:

Greenbelt Gym Co.

Trial Balance

July 31, 2022

Debits Credits

Cash P329,400

Accounts receivable 100,000

Notes receivable 300,000

Office supplies 15,600

Prepaid insurance P26,400

Gym equipment 460,000

Furniture and fixtures 120,500

Accounts payable 156,300

Greenbelt, capital 1,240,000

Service income 344,400

Salaries expense 30,000

Rent expense 43,000

Taxes and licenses 8,600

Advertising expense 11,600

Utilities expense 9,400

Total P1,389,500 P1,805,700

The following errors have been discovered:

a. The ending cash balance shown on the general ledger is P392,400.

b. A 42,000 debit to accounts receivable was posted on the credit side of the same account.

c. A 27,200 debit to accounts payable was posted on the credit side of the same account.

d. The withdrawal of the owner amounting to P40,000 was recorded as an additional

investment.

e. A debit to the advertising expense account was posted as a credit to the service income

account, P400.

f. The service income account is overstated by P4,000.

7. What is the correct trial balance total?

8. How much is the net income of Greenbelt for the month of July?

9. How much is total assets of the company as of July 31, 2022?

PROBLEM C. The trial balance prepared by the accountant of Samson Company at December 31,

2022 did not balance. Debit total was P580,000 and credit total was P548,000. In determining

the cause of the difference, you discovered the following errors:

a. The wages payable account balance of P93,000 was listed in the trial balance as P39,000.

b. A debit of P5,000 for the drawing account of Samson, the owner, was posted to the credit

side of Samson, capital.

c. A debit entry for accounts receivable was posted to the credit side, P6,000.

d. A P20,000 credit to be made to Service Income account was credited to the Accounts

Receivable account instead.

10. What is the correct trial balance total?

You might also like

- Accounting Exam Review: Multiple Choice and Journal EntriesDocument3 pagesAccounting Exam Review: Multiple Choice and Journal EntriesPatricia Camille AustriaNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- Accounting Exam Review on Financial Statements, Adjusting Entries and Journalizing TransactionsDocument3 pagesAccounting Exam Review on Financial Statements, Adjusting Entries and Journalizing TransactionsPatricia Camille Austria50% (2)

- Corporate LiquidationDocument3 pagesCorporate LiquidationJasmine Marie Ng CheongNo ratings yet

- 05 Completing The Accounting Cycle PROBLEMSDocument5 pages05 Completing The Accounting Cycle PROBLEMSbetlogNo ratings yet

- 1. Chapter 3new BOOK QuestionsDocument5 pages1. Chapter 3new BOOK Questionsgameppass22No ratings yet

- Error in Recording & Posting: Fabm 2Document17 pagesError in Recording & Posting: Fabm 2Earl Hyannis Elauria0% (1)

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- Final Exams AccountingDocument6 pagesFinal Exams AccountingCzarina Joy PeñaNo ratings yet

- Tesorero, Princess Kelly V, HRM 1-4 Baen m9Document6 pagesTesorero, Princess Kelly V, HRM 1-4 Baen m9Kelly TesoreroNo ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- Quizzer - Financial Accounting ProcessDocument8 pagesQuizzer - Financial Accounting ProcessLuisitoNo ratings yet

- BSA2201 BDD MBCarolino M8Activityno.2Document5 pagesBSA2201 BDD MBCarolino M8Activityno.2Earl Carolino100% (1)

- Adjusting Entries QuizDocument12 pagesAdjusting Entries QuizJuan Dela CruzNo ratings yet

- 9005 - Corporate LiquidationDocument5 pages9005 - Corporate LiquidationAjmerick AgupeNo ratings yet

- Group Assignment On Fundamentals of Accounting IDocument6 pagesGroup Assignment On Fundamentals of Accounting IKaleab ShimelsNo ratings yet

- Accounting CycleDocument6 pagesAccounting CycleElla Acosta0% (1)

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- #1-Illustrative ProblemDocument19 pages#1-Illustrative ProblemNisharie AbanNo ratings yet

- BKNC3 - Activity 1 - Review ExamDocument3 pagesBKNC3 - Activity 1 - Review ExamDhel Cahilig0% (1)

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- ACCTBA1 - Quiz 3Document2 pagesACCTBA1 - Quiz 3Marie Beth BondestoNo ratings yet

- Mr. Sam's new consulting company transactionsDocument7 pagesMr. Sam's new consulting company transactionsMoni TafechNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Northern Cpa Review: First Pre-Board ExaminationDocument13 pagesNorthern Cpa Review: First Pre-Board ExaminationKim Cristian MaañoNo ratings yet

- Icb 1Document9 pagesIcb 1Diana GallardoNo ratings yet

- Assignment No 4Document3 pagesAssignment No 4analyngrace1No ratings yet

- Problem No 5 (Acctg. 1)Document5 pagesProblem No 5 (Acctg. 1)Ash imoNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- Auditing ProblemsDocument29 pagesAuditing ProblemsPrincesNo ratings yet

- Home Office, Branch Accounting & Business CombinationDocument5 pagesHome Office, Branch Accounting & Business CombinationPaupauNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Dra. Santiago Medical ServicesDocument6 pagesDra. Santiago Medical ServicesFelicity BondocNo ratings yet

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- 2 Exercises On FS 2023-2024 Additional For GformDocument2 pages2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzNo ratings yet

- Accounting Principles Pilot TestDocument6 pagesAccounting Principles Pilot TestNguyễn Thị Ngọc AnhNo ratings yet

- 9405 - Corporate LiquidationDocument4 pages9405 - Corporate LiquidationKenneth Anthony BalitayoNo ratings yet

- Cash Accrual Single EntryDocument3 pagesCash Accrual Single EntryJustine GuilingNo ratings yet

- Financial Accounting - Chapter 4Document14 pagesFinancial Accounting - Chapter 4Phưn ĂnNo ratings yet

- Ay16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 2Document9 pagesAy16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 2Maketh.ManNo ratings yet

- Exercises On Accounting CycleDocument7 pagesExercises On Accounting CycleXyriene RocoNo ratings yet

- Assignment 4 - Corporate LiquidationDocument5 pagesAssignment 4 - Corporate LiquidationEdmar PuruggananNo ratings yet

- ACC111 Accounting Review - Assets, Liabilities, Adjusting EntriesDocument3 pagesACC111 Accounting Review - Assets, Liabilities, Adjusting EntriesJunneth Pearl HomocNo ratings yet

- Far Reviewer Comprehensive Various Problems QuestionsDocument5 pagesFar Reviewer Comprehensive Various Problems QuestionsCharles Eli AlejandroNo ratings yet

- Agency and Branch Accounting - General Procedures - v.2.0Document3 pagesAgency and Branch Accounting - General Procedures - v.2.0Catherine SelladoNo ratings yet

- Financial Accounting and Reporting Chapter 4 Problem 3Document1 pageFinancial Accounting and Reporting Chapter 4 Problem 3Paula BautistaNo ratings yet

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- Assignment 1 Accounting Cycle For Service Business Part 2Document3 pagesAssignment 1 Accounting Cycle For Service Business Part 2Iya GarciaNo ratings yet

- Audit of ReceivablesDocument68 pagesAudit of ReceivablesJoseph SalidoNo ratings yet

- PRAC 1 SECOND PREBOARD TRIAL BALANCE ERRORSDocument12 pagesPRAC 1 SECOND PREBOARD TRIAL BALANCE ERRORSKim Cristian MaañoNo ratings yet

- Partnership 2021 - Long ProblemsDocument5 pagesPartnership 2021 - Long ProblemsMichael MagdaogNo ratings yet

- Indicate Whether The Statement Is True or FalseDocument6 pagesIndicate Whether The Statement Is True or Falseae zeinNo ratings yet

- Activity Analyzing TransactionsDocument7 pagesActivity Analyzing TransactionsalexamajeranoNo ratings yet

- ACW1120-Week 5 Practice Q-Topic 5-Prepare FSDocument8 pagesACW1120-Week 5 Practice Q-Topic 5-Prepare FSGan ZhengweiNo ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Assignment 2 Ca5101Document12 pagesAssignment 2 Ca5101Charlemagne Jared RobielosNo ratings yet

- Financial Statement Problem CDocument2 pagesFinancial Statement Problem CCharlemagne Jared RobielosNo ratings yet

- CA5101 Accounting CycleDocument52 pagesCA5101 Accounting CycleCharlemagne Jared RobielosNo ratings yet

- 2022 Completion of The Accounting CycleDocument30 pages2022 Completion of The Accounting CycleCharlemagne Jared RobielosNo ratings yet

- FAR Chapter3 - FinalDocument18 pagesFAR Chapter3 - FinalCharlemagne Jared RobielosNo ratings yet

- 2022 Adjusting Journal EntriesDocument40 pages2022 Adjusting Journal EntriesCharlemagne Jared RobielosNo ratings yet

- FAR2021Document14 pagesFAR2021Charlemagne Jared RobielosNo ratings yet

- Index of Activities: Chartered Accountants Program Financial Accounting & ReportingDocument150 pagesIndex of Activities: Chartered Accountants Program Financial Accounting & ReportingJAGRUITI JAGRITINo ratings yet

- Presentation - HDFC Dividend Yield FundDocument27 pagesPresentation - HDFC Dividend Yield FundRitesh ChatterjeeNo ratings yet

- narrative report day 1Document9 pagesnarrative report day 1cjalletaNo ratings yet

- Sydnor2010 - Overinsuring Modest RisksDocument24 pagesSydnor2010 - Overinsuring Modest RisksRoberto PaezNo ratings yet

- PO GCWS G85012 To MIDocument6 pagesPO GCWS G85012 To MIandika bukopinNo ratings yet

- G.R. No. L-5837 May 31, 1954 CRISTOBAL BONNEVIE, ET AL., Plaintiffs-Appellants, JAIME HERNANDEZ, Defendant-AppelleeDocument2 pagesG.R. No. L-5837 May 31, 1954 CRISTOBAL BONNEVIE, ET AL., Plaintiffs-Appellants, JAIME HERNANDEZ, Defendant-AppelleeRio LorraineNo ratings yet

- SampleDocument32 pagesSampleA. NurfauziahNo ratings yet

- Money (Rupiahs)Document5 pagesMoney (Rupiahs)Indarwati Siska PertiwiNo ratings yet

- 11 04 2Document1 page11 04 2muppala gowthamNo ratings yet

- 3 Day Cycle - Day 2. PART 2Document12 pages3 Day Cycle - Day 2. PART 2CristóbalTobalNo ratings yet

- Treasury Challan Codes For Bond, DhakaDocument2 pagesTreasury Challan Codes For Bond, DhakaMd. Mohsin KamalNo ratings yet

- 1 SMDocument10 pages1 SMAsmaa MufiidaNo ratings yet

- WorkSheet Capital GainDocument12 pagesWorkSheet Capital GainakshatkharcheNo ratings yet

- Mr. Sumit Sharma: Rs 1,230.74 Rs 0.00 Rs - 593.01 Rs 0.00 Rs 737.73Document3 pagesMr. Sumit Sharma: Rs 1,230.74 Rs 0.00 Rs - 593.01 Rs 0.00 Rs 737.73sumit sharmaNo ratings yet

- Success Story of Billionaire & Business Tycoon Vijay Mallya, Chairman of United Breweries Group, Kingfisher Airlines, Force India F1 Team, Royal Challengers, East Bengal FC ....Document12 pagesSuccess Story of Billionaire & Business Tycoon Vijay Mallya, Chairman of United Breweries Group, Kingfisher Airlines, Force India F1 Team, Royal Challengers, East Bengal FC ....Manmeet MongaNo ratings yet

- Terotechnology SummaryDocument9 pagesTerotechnology SummaryWichard BendixNo ratings yet

- Ferma-Sustainability 2021 FinalDocument24 pagesFerma-Sustainability 2021 FinalNeniNo ratings yet

- Estimasi Perhitungan Harga Jual Perumahan WLR 2Document25 pagesEstimasi Perhitungan Harga Jual Perumahan WLR 2Next LevelManagementNo ratings yet

- Materials Requirement Planning (MRP) : The Approach To Coordinated Scheduling For Dependent Demand ItemsDocument34 pagesMaterials Requirement Planning (MRP) : The Approach To Coordinated Scheduling For Dependent Demand Itemsjunaid aliNo ratings yet

- Schwab Company Case Analysis PDFDocument6 pagesSchwab Company Case Analysis PDFgoutam1235No ratings yet

- Going Public and Private Course OutlineDocument7 pagesGoing Public and Private Course OutlineAnurag JainNo ratings yet

- House Rental ApplicationDocument3 pagesHouse Rental Applicationsadafsuleimani51No ratings yet

- RE Sector IssuesDocument7 pagesRE Sector Issuessahaye.vikramjitNo ratings yet

- QualificationDocument536 pagesQualificationrajaa El ansariNo ratings yet

- Research Proposal Event StudyDocument5 pagesResearch Proposal Event StudyTheodor Octavian GhineaNo ratings yet

- New-Concept-English-2-Answers 1Document3 pagesNew-Concept-English-2-Answers 1sajmaNo ratings yet

- Shelton Gallery Had The Following Petty Cash Transactions in FebDocument1 pageShelton Gallery Had The Following Petty Cash Transactions in FebAmit PandeyNo ratings yet

- Sales Report: Philippine Seven CorporationDocument2 pagesSales Report: Philippine Seven CorporationGreyNo ratings yet

- Real Estate and Allied Services Community Group MasterclassDocument2 pagesReal Estate and Allied Services Community Group MasterclassTimi CrownNo ratings yet

- Yard Fencing KSEB 2Document6 pagesYard Fencing KSEB 2isan.structural TjsvgalavanNo ratings yet