Professional Documents

Culture Documents

Financial Accounting and Reporting Chapter 4 Problem 3

Uploaded by

Paula BautistaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting and Reporting Chapter 4 Problem 3

Uploaded by

Paula BautistaCopyright:

Available Formats

Financial Accounting and Reporting

Chapter 4

Accounting Cycle of a Service Provider: Journalizing, Posting, Trial Balance, Adjustments and Financial

Statements

Problem 3

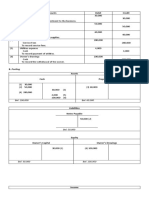

Robert Espiritu began operation to provide credit collection services on September 2017. The

Unadjusted trial balance as of September 30, 2017 is as shown below:

Robert Espiritu

Trial Balance

September 30,2017

Cash and Cash equivalent P174,000

Accounts Receivable 96,200

Office Supplies 10,500

Prepaid insurance 24,000

Equipment 300,000

Notes Payable P100,000

Accounts Payable 123,500

Unearned Service Income 50,000

R. Espiritu, Capital 200,000

R. Espiritu, Drawings 6,000

Service income 176,200

Salaries expense 12,000

Transportation expense 13,000

Rent expense 12,000

Miscellaneous Expenses 2,000

------------- --------------

TOTAL P649,700 P649,700

========

=========

Additional data:

a. Unused office supplies on September 30,2017 is P7,500.

b. The Equipment was acquired on September 1, 2017 with useful life of 5 years and

with estimated residual value of P30,000.

c. Interest on the notes payable is 18%. The note was issued on September 1, 2017.

d. The prepaid insurance is for a period of six months taken September 1, 2017.

e. Service income earned but unbilled, P3,800.

f. 60% of the Unearned service income has been earned as of September 30,2017.

g. Aging of the accounts receivable indicates the following;

Age Amount % of Collectability

0 -10 days P55,000 100%

11 -20 days 20,000 90%

21 - 30 days 25,000 70%

Required:

1. Enter the unadjusted trial balance on a worksheet and complete the worksheet.

2. Journalize the adjusting entries.

3. Prepare the adjusted trial balance

4. Prepare the financial statements

a. Statement of Financial Position

b. Statement of Profit or Loss

c. Statement of Changes in Equity

5. Journalize the closing entries.

6. Post the closing entries.

7. Prepare the Post-closing Trial Balance.

8. Prepare the reversing entries.

You might also like

- Adjusting Entries Problems 2022 DahonogDocument2 pagesAdjusting Entries Problems 2022 DahonogBaltazar JustinianoNo ratings yet

- FOA Final OutputDocument18 pagesFOA Final OutputGwyneth MogolNo ratings yet

- Accounting Review: Key Financial ConceptsDocument23 pagesAccounting Review: Key Financial Conceptsjoyce KimNo ratings yet

- Unadjusted Trial Balance Adjustments Account Titles Debit Credit DebitDocument6 pagesUnadjusted Trial Balance Adjustments Account Titles Debit Credit DebitAllen CarlNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document8 pagesFinancial Accounting and Reporting: Exercise 1Lenneth Mones0% (1)

- General Journal, GeveraDocument2 pagesGeneral Journal, GeveraFeiya LiuNo ratings yet

- Jose Calves Realty Year-End Adjustments and Financial StatementsDocument2 pagesJose Calves Realty Year-End Adjustments and Financial StatementsMariecris BatasNo ratings yet

- Calculate Depreciation and Net Book Value of BuildingDocument5 pagesCalculate Depreciation and Net Book Value of Buildingangela flores100% (1)

- Adjusting Entries Company A ExercisesDocument19 pagesAdjusting Entries Company A ExercisesRodolfo CorpuzNo ratings yet

- Adjusting Entries for Uncollectible AccountsDocument6 pagesAdjusting Entries for Uncollectible AccountsKristine IvyNo ratings yet

- General Ledger - Adrianne, Mendoza-BSBA-1 BLK BDocument6 pagesGeneral Ledger - Adrianne, Mendoza-BSBA-1 BLK BJaks ExplorerNo ratings yet

- Analyze City Laundry transactionsDocument4 pagesAnalyze City Laundry transactionsJasmine Acta100% (1)

- Sample Problem For Last MeetingDocument11 pagesSample Problem For Last MeetingLylanie Alcoran AnibNo ratings yet

- 9 - Special JournalDocument30 pages9 - Special JournalYallyNo ratings yet

- Accounting Practice SetDocument8 pagesAccounting Practice SetZyn Marie OccenoNo ratings yet

- FABM ActivityDocument3 pagesFABM ActivityRey VillaNo ratings yet

- Cindy Lota - Activity No. 3 - Statement of Financial PositionDocument6 pagesCindy Lota - Activity No. 3 - Statement of Financial PositionCindy LotaNo ratings yet

- Accounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Document16 pagesAccounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Fider GracianNo ratings yet

- Liabilities Amount CalculationDocument6 pagesLiabilities Amount CalculationRoel Cababao50% (2)

- Accounting Cycle Journal Entries Without Chart of Accounts Case IIIDocument3 pagesAccounting Cycle Journal Entries Without Chart of Accounts Case IIIGoogle UserNo ratings yet

- A. Journal Entries Accounts Debit CreditDocument3 pagesA. Journal Entries Accounts Debit CreditAnne AlagNo ratings yet

- Group Quiz 1Document3 pagesGroup Quiz 1Joselito Marane Jr.No ratings yet

- 5 Adjusting Entries For Prepaid ExpenseDocument4 pages5 Adjusting Entries For Prepaid Expenseapi-299265916No ratings yet

- JKL Company Statement of Financial Position For The Year 2015 & 2016 JKL CompanyDocument2 pagesJKL Company Statement of Financial Position For The Year 2015 & 2016 JKL CompanyHazel Gumapon100% (1)

- Accounting Cycle for Merchandising BusinessDocument2 pagesAccounting Cycle for Merchandising BusinessAnne Alag100% (1)

- Financial Statement ExampleDocument12 pagesFinancial Statement ExampleRhem Capisan100% (1)

- Negros Occidental (ACCOUNTING1)Document7 pagesNegros Occidental (ACCOUNTING1)Maxine Ceballos Glodove100% (1)

- AssignmentDocument16 pagesAssignmentSABORDO, MA. KRISTINA COLEENNo ratings yet

- Chan Accounting FirmDocument45 pagesChan Accounting FirmNina Gaboy100% (1)

- Total: Nancy Mulles Data Encoders May 15 2018Document6 pagesTotal: Nancy Mulles Data Encoders May 15 2018Tashnim AreejNo ratings yet

- Adjusting Journal EntriesDocument12 pagesAdjusting Journal EntriesAngelica ManahanNo ratings yet

- Exercise 3 Leah GarciaDocument12 pagesExercise 3 Leah GarciaMa Sophia Mikaela EreceNo ratings yet

- Completing the Accounting Cycle: Steps and StatementsDocument16 pagesCompleting the Accounting Cycle: Steps and StatementsVeniceNo ratings yet

- Financial Transaction WorksheetDocument6 pagesFinancial Transaction WorksheetAnya DaniellaNo ratings yet

- JOURNALIZINGDocument2 pagesJOURNALIZINGArneld SantiagoNo ratings yet

- This Study Resource Was Shared ViaDocument8 pagesThis Study Resource Was Shared Viadave iganoNo ratings yet

- May 1 110 P100,000 310: W. Kayayan Accounting Firm General JournalDocument14 pagesMay 1 110 P100,000 310: W. Kayayan Accounting Firm General JournalShania ReighnNo ratings yet

- Activity - Preparation of Financial StatementsDocument4 pagesActivity - Preparation of Financial StatementsJoy ValenciaNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document19 pagesFundamentals of Accountancy, Business and Management 1Shiellai Mae Polintang0% (1)

- Financial Acctg AdjustmentsDocument28 pagesFinancial Acctg AdjustmentsLj BesaNo ratings yet

- General Leger Cleaning Business FinancialsDocument3 pagesGeneral Leger Cleaning Business FinancialsAriel Palay100% (1)

- Group 6Document6 pagesGroup 6Love KarenNo ratings yet

- AccountingDocument5 pagesAccountingAbe Loran PelandianaNo ratings yet

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- Chapter 1 Acctg Equation JournalizingDocument4 pagesChapter 1 Acctg Equation JournalizingNicole Marie Pontay BajadeNo ratings yet

- Business Finance: Mrs. Leah O. RualesDocument28 pagesBusiness Finance: Mrs. Leah O. RualesCleofe Sobiaco100% (1)

- 10-Column Worksheet FormDocument1 page10-Column Worksheet Formobrie diazNo ratings yet

- Basic Acctg 4th SatDocument11 pagesBasic Acctg 4th SatJerome Eziekel Posada PanaliganNo ratings yet

- Title Defense WindstripDocument5 pagesTitle Defense WindstripNico AbenojaNo ratings yet

- Quizzes - Chapter 6 - Accounting Books - Journal and LedgerDocument5 pagesQuizzes - Chapter 6 - Accounting Books - Journal and LedgerAmie Jane MirandaNo ratings yet

- Lesley Dela Cruz Clearners Financial StatementsDocument7 pagesLesley Dela Cruz Clearners Financial StatementsJasmine ActaNo ratings yet

- Problem 15Document1 pageProblem 15Alyssa Jane G. AlvarezNo ratings yet

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- SAP B1 Fundamentals AccountingDocument33 pagesSAP B1 Fundamentals AccountingJosef SamoranosNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceLaurice RacraquinNo ratings yet

- BMSH2003 Business Transactions and Adjusting EntriesDocument2 pagesBMSH2003 Business Transactions and Adjusting EntriesLaisan SantosNo ratings yet

- 6 Adjusting Entry For Depreciation ExpenseDocument3 pages6 Adjusting Entry For Depreciation Expenseapi-299265916No ratings yet

- Accounting Cycle of A Merchandising Business: Prepared By: Prof. Jonah C. PardilloDocument41 pagesAccounting Cycle of A Merchandising Business: Prepared By: Prof. Jonah C. PardilloRoxe XNo ratings yet

- MD JiloDocument6 pagesMD JiloAbdi Mucee TubeNo ratings yet

- Financial Accounting and Reporting Chapter 4 Problem 3Document1 pageFinancial Accounting and Reporting Chapter 4 Problem 3Paula BautistaNo ratings yet

- External and Internal CriticismsDocument15 pagesExternal and Internal CriticismsNicole CabesasNo ratings yet

- ICT Five Generations of Computers PDFDocument24 pagesICT Five Generations of Computers PDFPaula BautistaNo ratings yet

- L S C A: A Alle Ollege NtipoloDocument4 pagesL S C A: A Alle Ollege NtipoloPaula BautistaNo ratings yet

- Chapter 15 Multiple Choice Questions and ProblemsDocument14 pagesChapter 15 Multiple Choice Questions and Problemsmarycayton83% (6)

- Activity 1Document1 pageActivity 1Paula BautistaNo ratings yet

- FAR Assignment 5 Adjusting EntriesDocument2 pagesFAR Assignment 5 Adjusting EntriesPaula BautistaNo ratings yet

- Problem 2-3: Multiple Choice: SolutionDocument4 pagesProblem 2-3: Multiple Choice: SolutionPaula BautistaNo ratings yet

- Quiz - Overview of Government AccountingDocument5 pagesQuiz - Overview of Government AccountingPaula Bautista80% (5)

- Chapter 13: Operating Segment Segment Reporting - Core PrincipleDocument10 pagesChapter 13: Operating Segment Segment Reporting - Core PrinciplePaula BautistaNo ratings yet

- Revenues and ReceiptsDocument2 pagesRevenues and ReceiptsPaula BautistaNo ratings yet

- CHAPTER 15: SINGLE ENTRY ACCOUNTINGDocument12 pagesCHAPTER 15: SINGLE ENTRY ACCOUNTINGPaula Bautista100% (2)

- CHAPTER 15: SINGLE ENTRY ACCOUNTINGDocument12 pagesCHAPTER 15: SINGLE ENTRY ACCOUNTINGPaula Bautista100% (2)

- Sol - Man. Chapter6 StatementofcashflowsDocument1 pageSol - Man. Chapter6 StatementofcashflowsPaula BautistaNo ratings yet

- Chapter 2 Statement of Comprehensive Income MCQsDocument1 pageChapter 2 Statement of Comprehensive Income MCQsPaula BautistaNo ratings yet

- Quiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsDocument3 pagesQuiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsPaula BautistaNo ratings yet

- Chapter 13: Operating Segment Segment Reporting - Core PrincipleDocument10 pagesChapter 13: Operating Segment Segment Reporting - Core PrinciplePaula BautistaNo ratings yet

- Cash Basis To Accrual Basis of Accounting: Problem 1: For Classroom DiscussionDocument9 pagesCash Basis To Accrual Basis of Accounting: Problem 1: For Classroom DiscussionPaula BautistaNo ratings yet

- Quiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsDocument3 pagesQuiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsPaula BautistaNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingPaula BautistaNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingPaula BautistaNo ratings yet

- Sol - Man. Chapter6 StatementofcashflowsDocument1 pageSol - Man. Chapter6 StatementofcashflowsPaula BautistaNo ratings yet

- Cash Basis To Accrual Basis of Accounting: Problem 1: For Classroom DiscussionDocument9 pagesCash Basis To Accrual Basis of Accounting: Problem 1: For Classroom DiscussionPaula BautistaNo ratings yet

- An Existentialist Ethics PDFDocument5 pagesAn Existentialist Ethics PDFPaula BautistaNo ratings yet

- C10 Process Costing Part 2 PDFDocument12 pagesC10 Process Costing Part 2 PDFPaula BautistaNo ratings yet

- Statement of Financial Position: Problem 1: True or FalseDocument13 pagesStatement of Financial Position: Problem 1: True or FalsePaula Bautista0% (1)

- Sol. Man. - Chapter 5 - Statement of Changes in EquityDocument1 pageSol. Man. - Chapter 5 - Statement of Changes in EquityPaula BautistaNo ratings yet

- Revenue From Contracts With Customers: Problem 1: True or FalseDocument12 pagesRevenue From Contracts With Customers: Problem 1: True or FalsePaula Bautista88% (8)

- Sol. Man. - Chapter 4 - Nca Held For Sale & Discontinued Opns.Document10 pagesSol. Man. - Chapter 4 - Nca Held For Sale & Discontinued Opns.Crown Garcia50% (4)

- Statement of Comprehensive Income: Problem 1: True or FalseDocument17 pagesStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- COM 4 HSC - Korean WarDocument10 pagesCOM 4 HSC - Korean Warmanthan pujaraNo ratings yet

- Römer, Schmid, Bühler, Joseph Story BTWN Egypt & Israel 2021Document186 pagesRömer, Schmid, Bühler, Joseph Story BTWN Egypt & Israel 2021Keith Hurt100% (1)

- Pat B Inggris 8 Utama-1Document9 pagesPat B Inggris 8 Utama-1Bimbel FirdausNo ratings yet

- Final Rajdhani ProjectDocument44 pagesFinal Rajdhani ProjectLakruwan GunawardanaNo ratings yet

- Quarter 4 English 10 Weeks 1-2Document14 pagesQuarter 4 English 10 Weeks 1-2Karla Lyca Sequijor EscalaNo ratings yet

- Report On Sexual Abuse in The Catholic Church in FloridaDocument19 pagesReport On Sexual Abuse in The Catholic Church in FloridaABC Action NewsNo ratings yet

- Solved Table 2 5 Shows Bushels of Wheat and Yards of ClothDocument1 pageSolved Table 2 5 Shows Bushels of Wheat and Yards of ClothM Bilal SaleemNo ratings yet

- Norah Jones PDFDocument2 pagesNorah Jones PDFJuanJoseHerreraBerrio100% (4)

- 11 Republic vs. Marcopper Mining Corp Cd1Document2 pages11 Republic vs. Marcopper Mining Corp Cd1Leigh AllejeNo ratings yet

- Memorandum Order No. 2016-003 - PEZADocument19 pagesMemorandum Order No. 2016-003 - PEZAYee BeringuelaNo ratings yet

- Practical Malware AnalysisDocument45 pagesPractical Malware AnalysisHungvv10No ratings yet

- EVS Complete Notes PDFDocument148 pagesEVS Complete Notes PDFrevantrajkpdh2002No ratings yet

- Supreme Court of the Philippines upholds constitutionality of Act No. 2886Document338 pagesSupreme Court of the Philippines upholds constitutionality of Act No. 2886OlenFuerteNo ratings yet

- Plate 2Document9 pagesPlate 2MichaelViloria0% (1)

- Noli Me TangereDocument2 pagesNoli Me TangereLilimar Hao EstacioNo ratings yet

- IIPDocument47 pagesIIParnabb_16No ratings yet

- RishabhDocument38 pagesRishabhpooja rodeNo ratings yet

- Argumentative EssayDocument4 pagesArgumentative Essayapi-359901349No ratings yet

- Malawi ECSR4Document196 pagesMalawi ECSR4Andrew MkombaNo ratings yet

- Monzo Bank Statement 2020 10 26 193614Document5 pagesMonzo Bank Statement 2020 10 26 193614Lorena PennaNo ratings yet

- Living With A SulphurDocument4 pagesLiving With A SulphurcelliasttNo ratings yet

- The Sun Invincible: Timothy J. O'Neill, FRCDocument4 pagesThe Sun Invincible: Timothy J. O'Neill, FRCC UidNo ratings yet

- Ban Social Media Debate CardsDocument1 pageBan Social Media Debate CardsSyrah YouNo ratings yet

- Informal Letters and EmailsDocument7 pagesInformal Letters and EmailsSimona SingiorzanNo ratings yet

- The Liquid Chemical Company Manufactures and Sells A Range ofDocument2 pagesThe Liquid Chemical Company Manufactures and Sells A Range ofAmit PandeyNo ratings yet

- Case Digests on Violations of Canons 16-18 of the Code of Professional ResponsibilityDocument4 pagesCase Digests on Violations of Canons 16-18 of the Code of Professional ResponsibilityRosana Villordon SoliteNo ratings yet

- Invitation 8th Convocation 2024Document3 pagesInvitation 8th Convocation 2024Jaya Simha ReddyNo ratings yet

- Herzfeld 1980 Honour and ShameDocument14 pagesHerzfeld 1980 Honour and ShameAnonymous M3PMF9iNo ratings yet

- MKTG FormsDocument4 pagesMKTG FormsMarinellie Estacio GulapaNo ratings yet

- PDocument151 pagesPfallstok311No ratings yet