Professional Documents

Culture Documents

Tutorial 6

Uploaded by

Jasintraswni Ravichandran0 ratings0% found this document useful (0 votes)

123 views5 pagesThe board of directors of Dorne Berhad may have breached their duty by investing in a Dubai real estate project during a known financial crisis in Dubai. Directors have a duty under the Companies Act to exercise reasonable care, skill, and diligence for the best interests of the company. By investing in Dubai despite being aware of the financial crisis and risk of losses, the board failed to appropriately consider the company's interests and exercise due care and skill in their decision making. As a result, the company has now incurred significant losses from the investment.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe board of directors of Dorne Berhad may have breached their duty by investing in a Dubai real estate project during a known financial crisis in Dubai. Directors have a duty under the Companies Act to exercise reasonable care, skill, and diligence for the best interests of the company. By investing in Dubai despite being aware of the financial crisis and risk of losses, the board failed to appropriately consider the company's interests and exercise due care and skill in their decision making. As a result, the company has now incurred significant losses from the investment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

123 views5 pagesTutorial 6

Uploaded by

Jasintraswni RavichandranThe board of directors of Dorne Berhad may have breached their duty by investing in a Dubai real estate project during a known financial crisis in Dubai. Directors have a duty under the Companies Act to exercise reasonable care, skill, and diligence for the best interests of the company. By investing in Dubai despite being aware of the financial crisis and risk of losses, the board failed to appropriately consider the company's interests and exercise due care and skill in their decision making. As a result, the company has now incurred significant losses from the investment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

Company Law : Tutorial Topic 6

Company’s Management

1)What is the meaning of “director”? Why is it important to determine whether a

person is a “director” under the company law?

A director manages the business of the company. Section 196(1) of the Companies Act 2016

provides that every private company must have at least one director while public companies

are required to have a minimum of two directors.

Section 2(1) of the CA 2016 defines the term director which reads any person occupying the

position of director of a corporation by whatever name called and includes a person in

accordance with whose directions or instructions the majority of the directors of a corporation

are accustomed to act and an alternate or a substitute director.

The power to manage the company’s business is vested in the board of directors. This has

been codified under Section 211 of the CA 2016.

In the case of Great Eastern Ry V Turner, it was stated that Directors are the mere trustees

or agents of the company, trustee of the company’s money and property, agents in the

transaction which they enter into on behalf of the company.

The director at common law owes a fiduciary duty to the company and he is to act honestly in

good faith for the benefit of the company and is to not abuse his powers or position. He is

also to avoid conflict of interest.

Section 213(1) of the CA 2016 provides for the duties of the directors. He is to exercise his

powers in good faith and for the best interest of the company. It is important to determine

who the director is under company law to ensure that all of this duties maybe executed to the

best of its abilities.

2) Advise the parties in the following scenario as to their eligibility to be appointed as a

director under the Companies Act 2016:

The qualifications of who maybe a director has been listed under Section 196(2) of the CA

2016 while who may not be directors are listed in Sections 198 & Section 199.

i) Jimmy was declared a bankrupt 5 years ago. Smelly Good Sdn Bhd now wishes to

appoint him as an additional director.

Section 198(1)(a) of the CA 2016 provides that an undischarged bankrupt cannot hold the

office or take part in the management of the office.

Section 198(3), provides that a bankrupt maybe appointed or hold office with the approval of

either the Official Receiver or the Court.

If he opts to get approval of the court, Section 198 (3) & (5), would require him to first serve

on the Official Receiver and the Registrar of Companies a notice of intention to apply for

leave.

ROC shall be made a party to the proceeding while Section 198(3)(b) provides that the

Official Receiver will be heard in court.

Issues might arise as to whether the official receiver must also be a party to the proceeding or

just served with court papers to attend court.

Based on the provisions above Jimmy maybe appointed as a director with the approval of

either Official Receiver or the Court.

ii) The number of directors in Stinky Bhd fall below two and Stinky Bhd now wishes to

appoint Jackie from South Africa as a director.

As per Section 196(4) of the CA 2016, the minimum director must ordinarily reside in

Malaysia having a principal residence in Malaysia. Section 196(4) does not require all

directors of a company to have their principal residence in Malaysia. In this present situation

there are two directors for Stinky Bhd if Jackie is appointed as director and the requirement is

that at least one director must fulfil the residency requirement if there is more than one

director. The requirement of Section 196(1) must be fulfilled by every company.

iii) Smell Good Bhd is a company specialising in natural, organic and aluminium free

deodorant / antiperspirant. Smell Good Bhd wishes to appoint Jeremy, who an engineer by

profession as director.

The CA 2016 provides that it does not require a director to have a specific academic or

professional qualification. Section 213(2) provides that a director shall exercise reasonable

care, skill and diligence.

In the case of Re Brazilian Rubber Plantation and Estates Ltd, it was held that a director

can no longer escape liability because he lacked the knowledge, skill and experience. He is to

have the knowledge, skill and experience expected of the director having the same

responsibilities.

Jeremy is not required to specialize in the organic antiperspirant field but he is to have

knowledge, skill and experience expected of the director having the same responsibilities.

iv) Selvi, aged 79 residing in India wishing to be the director of Bahagia Bhd. He was once

convicted for fraud.

Section 198(1) provides that a person who has been convicted disqualified as a director on

the ground that he was convicted of one of the offence stated may not hold office as a director

or take part in the management of the company. Section 198(4) includes the offence of fraud.

Section 198(6) provides for the prohibition period that is for a period of five years from the

date he was convicted.

He may be reappointed to hold the office as a director with the court’s approval as per in

Section 198(4).

In the present situation, Selvi was convicted for fraud once and the time frame is not

stipulated. If it had been over the prohibition period then he can be elected as a director with

the approval of court.

3) Jaime and Cersei, husband and wife are the directors of their company, Lannister Bhd.

They had a fight and are getting a divorce and Cersei is planning to remove Jaime as the

director of Lannister Bhd before the expiration of his tenure in Nov 2019.

(a) Advise Cersei on her plan.

A director maybe removed in accordance with provision in Section 206.

Section 206(2), provides that the company may by ordinary resolution remove a director from

office before the expiry of his term.

Section 206 gives an opportunity to members of a public company to remove a director if

they are dissatisfied with his performance. In this case, there is no indication that Jamie’s

removal was due to his performance but instead attributed to the impending divorce.

The provision allows for members of the public company to remove director by passing an

ordinary resolution. The resolution is passed when it garners more than half of the votes cast.

Steps that is to be taken before the meeting is that following Section 206(3), members who

want to remove a director are required to serve a special notice or notice of intention on the

company at least 28 days before the scheduled member’s meeting.

The company will then send the notice to the director who may respond to it orally or written.

During the meeting the director is entitled to speak to the members and may also request

written response to be read out at the meeting if it was not sent to the members.

The resolution to remove directors will be then put to vote, It will be passed if more than half

the votes are obtained.

As per the provisions above, members are given the chance to remove directors when they

are dissatisfied with the director’s performance and removal is to be done when more than

half of the votes can be obtained when resolution is passed. Cersei intends to remove Jamie

due to their impending divorce and it had nothing to do with his performance as the director. I

would advise her to not go ahead with her decision and instead wait for Jamie’s term to be

over.

(b) Jaime found out about Cersei’s plan and seek for RM3.5million as a compensation.

Advise Lannister Bhd.

Section 227 of the CA provides that it is not lawful for a company to pay a director for

compensation for loss of office. It is not lawful for the company to make any payment to its

director in connection with the transfer of the company’s property.

These prohibitions are subject to certain exceptions. First of all, the particulars of the

payment including the amount have to be disclosed to the members and members have passed

a resolution to approve the payment.

If the director had received the payment without the member’s approval the director shall be

deemned to have received it in trust and company can demand for its repayment at any time.

In this particular situation, in the event that Jamie seeks for his compensation it is not lawful

for the Lancister Bhd to pay his compensation for the loss of office. However with the

exception that the particulars of the payment has to be disclosed and the resolution passed is

approved, Lancister Bhd may pay to compensate Jamie

**not sure**

(c) Soon after his removal, it was found out that Jaime had authorised for Lannister

Bhd to give a loan to his secretary Ms. Ros for RM500,000. Advise Lannister Bhd. **not

sure**

4)Sheikh Oberyn, an investor from Dubai has invited Dorne Berhad to invest in a real estate

housing project in Dubai which worth RM5 million. Upon discussions and persuasions from

Sheikh Oberyn, the board of directors finally decided that it is in that best interest of the

company to invest in the Dubai Project though they knew that Dubai is in the state of

financial crisis. It has recently been discovered that the Dubai Project that the company

invested on has been affected by the Dubai financial crisis and that the company incurred

huge losses from the investment.

(a) Discuss whether the board of directors has breached their duty as directors to

the company.

Section 211 provides for the general powers to manage the company that is given to the

board of directors. Section 31(2) of the CA 2016 provides for the rights, powers, duties and

obligations of the directors unless it is modified by company’s constitution. Section 213(1)

provides that a director is to exercise his powers in accordance with this Act for proper

purpose and in good faith for the interest of the company. The director of a company shall

exercise shall exercise knowledge, skill and reasonable care.

In the present situation, the BOD of Dorne Berhad were expected to exercise reasonable care

and exert diligence while exercising their skills and knowledge. It is evident that although

they had wanted to invest in the Dubai Project based on the fact that it was for the best

interest of the company it is evident that they did not exercise the skills and knowledge

expected of a director having the same responsibilities.

They were aware of the financial crisis that Dubai was experiencing and an investment in a

situation like this is definitely something that would incur a loss of the company. If they had

exercised that reasonable care prior to investing they could have prevented the loss that the

company incurred.

Therefore it is evident that the BOD had breached their duties to the company.

(b) The BOD now claim that they relied on the evaluation report prepared by their

lawyer and accountant and should not be held accountable for the losses. Advise Dorne

Berhad.

Section 211 provides that it is the power to manage company’s business is usually vested in

the board of directors. The Board has all the powers necessary for managing, directing and

supervising the management of the company.

Based on the purview of the provision above the BOD has all the necessary powers to

manage and supervise the management of the company. They cannot rely on the fact that the

evaluation report prepared by the lawyers and accountants were the reason behind the loses.

They were vested with the power and it was for them to exercise it with diligence.

Therefore, the BOD may not rely on this reasoning to account them for being not responsible

for the loses incurred by the company.

You might also like

- Compare and Contrast The StandardizedDocument1 pageCompare and Contrast The StandardizedVikram Kumar100% (1)

- Tutorial 7Document2 pagesTutorial 7Hello PeopleNo ratings yet

- New PRESENTATION. MaximsDocument57 pagesNew PRESENTATION. MaximsNNo ratings yet

- (Iii) The Possible Risks For The Parties To Crowdfunding TransactionDocument4 pages(Iii) The Possible Risks For The Parties To Crowdfunding TransactionRyna LimNo ratings yet

- William V GreatrexDocument1 pageWilliam V GreatrexTIong RanGersNo ratings yet

- Tan Boon Kean VDocument7 pagesTan Boon Kean VAmirah AmirahNo ratings yet

- Questions - Contract LawDocument6 pagesQuestions - Contract LawBryan EngNo ratings yet

- Section 73A Defence for BanksDocument7 pagesSection 73A Defence for BanksIsa MajNo ratings yet

- Kathiravelu Ganesan & Anor v. Kojasa Holdings BHDDocument9 pagesKathiravelu Ganesan & Anor v. Kojasa Holdings BHDNuna ZachNo ratings yet

- In The High Court of Malaya at Kuala Terengganu in The State of Terengganu, Malaysia BANKRUPTCY NO: 29NCC-4238-03/2015Document4 pagesIn The High Court of Malaya at Kuala Terengganu in The State of Terengganu, Malaysia BANKRUPTCY NO: 29NCC-4238-03/2015Deeyla KamarulzamanNo ratings yet

- Wong Eng V Chock Mun ChongDocument2 pagesWong Eng V Chock Mun ChongMuhd DanielNo ratings yet

- LEHA BINTE JUSOH V AWANG JOHORI 1978 .DocherhDocument2 pagesLEHA BINTE JUSOH V AWANG JOHORI 1978 .DocherhMinNie Yee100% (4)

- Compiled Land Law AssignmentDocument17 pagesCompiled Land Law AssignmentAmir RezaNo ratings yet

- Reduction of CapitalDocument5 pagesReduction of CapitalIntanSyakieraNo ratings yet

- Legal Framework of TakafulDocument20 pagesLegal Framework of TakafulMahyuddin KhalidNo ratings yet

- FUGITIVE ECONOMIC OFFENDERS BILL 2018 IN CORPORATE FIELD - EditedDocument13 pagesFUGITIVE ECONOMIC OFFENDERS BILL 2018 IN CORPORATE FIELD - EditedVaibhav GhildiyalNo ratings yet

- LAWS2301 Take Home AssignmentDocument6 pagesLAWS2301 Take Home AssignmenthenryshaoNo ratings yet

- Topic 4 Modes of Originating ProcessDocument9 pagesTopic 4 Modes of Originating ProcessJasintraswni RavichandranNo ratings yet

- Rights of Beneficiaries AssignmentDocument36 pagesRights of Beneficiaries AssignmentJasintraswni RavichandranNo ratings yet

- Simplify The Above ParagraphDocument56 pagesSimplify The Above ParagraphAmjad NiaziNo ratings yet

- Oracle Applications Messages ManualDocument952 pagesOracle Applications Messages ManualrohitkchaubeNo ratings yet

- Tutorial 5 Company LawDocument7 pagesTutorial 5 Company LawWei Weng ChanNo ratings yet

- Tutorial 1 Company LawDocument15 pagesTutorial 1 Company LawAmmar MustaqimNo ratings yet

- UIL2722 (2020) Zina Theft Midterm Problematic CasesDocument3 pagesUIL2722 (2020) Zina Theft Midterm Problematic CasesNBT OO100% (1)

- Sukhinderjit Singh Muker V Arumugam Deva RajDocument15 pagesSukhinderjit Singh Muker V Arumugam Deva RajNik Nur FatehahNo ratings yet

- The Malaysian Court HierarchyDocument42 pagesThe Malaysian Court HierarchySerene LimNo ratings yet

- Meor Atiqulrahman Bin Ishak v. Fatimah SihiDocument7 pagesMeor Atiqulrahman Bin Ishak v. Fatimah SihiNurul SyafiqahNo ratings yet

- Topic2 LawofContractdocxDocument22 pagesTopic2 LawofContractdocxfariddragonNo ratings yet

- Ismail bin Mohamad v Wan Khairani bt Wan MahmoodDocument9 pagesIsmail bin Mohamad v Wan Khairani bt Wan MahmoodSofiah OmarNo ratings yet

- CONSIDERATION IN CONTRACT LAWDocument9 pagesCONSIDERATION IN CONTRACT LAWMD RasedNo ratings yet

- TOPIC 1 - Sale of GoodsDocument49 pagesTOPIC 1 - Sale of GoodsnisaNo ratings yet

- LAW379 Sept 2011Document8 pagesLAW379 Sept 2011greeny83No ratings yet

- Nature of A PartnershipDocument27 pagesNature of A PartnershipschafieqahNo ratings yet

- DocDocument5 pagesDoc--bolabolaNo ratings yet

- Contract Ii Case Review (Per & CC)Document37 pagesContract Ii Case Review (Per & CC)khairiah tsamNo ratings yet

- Alteration of Memorandum of Association (MOA) (Company Update)Document12 pagesAlteration of Memorandum of Association (MOA) (Company Update)Shyam Sunder0% (1)

- Law436 Contracts Final AssessmentDocument6 pagesLaw436 Contracts Final AssessmentaurymNo ratings yet

- L9. Winding UpDocument16 pagesL9. Winding UpShady Hfz100% (1)

- (FC) (2006) 2 MLJ 209 - The Great Eastern Life Assurance Co LTD V Indra Janardhana MenonDocument9 pages(FC) (2006) 2 MLJ 209 - The Great Eastern Life Assurance Co LTD V Indra Janardhana MenonAlae KieferNo ratings yet

- Compulsory in Malaysia (PT I) : Acquisition of LandDocument14 pagesCompulsory in Malaysia (PT I) : Acquisition of LandKaren Tan100% (2)

- Contract Ii Case Review (Condition)Document9 pagesContract Ii Case Review (Condition)khairiah tsamNo ratings yet

- Partnership Law Guide to Joint Liability, Dissolution and Partner RelationsDocument25 pagesPartnership Law Guide to Joint Liability, Dissolution and Partner RelationsFia IsmailNo ratings yet

- Case Brief - Pender V Lushington (1866) 6 CH D 70Document3 pagesCase Brief - Pender V Lushington (1866) 6 CH D 70bernice100% (1)

- Public Prosecutor V Yuvaraj - (1969) 2 MLJ 8Document6 pagesPublic Prosecutor V Yuvaraj - (1969) 2 MLJ 8Eden YokNo ratings yet

- HALIJAH V MORAD & ORS - (1972) 2 MLJ 166Document4 pagesHALIJAH V MORAD & ORS - (1972) 2 MLJ 166NuraniNo ratings yet

- Court Rules Pre-Incorporation Contract Valid Under Companies ActDocument4 pagesCourt Rules Pre-Incorporation Contract Valid Under Companies ActMohamad Wafiy100% (1)

- Preston Corporation Sdn. Bhd. v. Edward Leong & OrsDocument3 pagesPreston Corporation Sdn. Bhd. v. Edward Leong & Orsnadrafatima100% (8)

- Ethics June 2019 Q1Document3 pagesEthics June 2019 Q1NorHusninaKhairudinNo ratings yet

- HASSAN V ISMAIL - (1970) 1 MLJ 210Document6 pagesHASSAN V ISMAIL - (1970) 1 MLJ 210Iqram MeonNo ratings yet

- Ucl3612 Company Law I Tri 1, 2020/2021 Tutorial Topic 2: Promoters and Pre-Incorporation ContractsDocument7 pagesUcl3612 Company Law I Tri 1, 2020/2021 Tutorial Topic 2: Promoters and Pre-Incorporation ContractsClara SusaieNo ratings yet

- Topic 6 Debenture and LoanDocument15 pagesTopic 6 Debenture and LoanYEOH KIM CHENGNo ratings yet

- Golden Approach SDN BHD V Pengarah Tanah DanDocument9 pagesGolden Approach SDN BHD V Pengarah Tanah DanIqram MeonNo ratings yet

- Part 1 Sale of GoodsDocument24 pagesPart 1 Sale of GoodsChen HongNo ratings yet

- Case-Section 3 (1) Partnership Act 1961 Malayan Law Journal UnreportedDocument16 pagesCase-Section 3 (1) Partnership Act 1961 Malayan Law Journal UnreportedAZLINANo ratings yet

- Malaysia's Constitution and Fundamental LibertiesDocument4 pagesMalaysia's Constitution and Fundamental Libertiesuchop_xxNo ratings yet

- Partnership and Company Law 148447820048447 PreviewDocument3 pagesPartnership and Company Law 148447820048447 PreviewZati TyNo ratings yet

- Interpreting "Save in Accordance with LawDocument125 pagesInterpreting "Save in Accordance with LawLuqman Hakeem100% (1)

- Case Hotel Royal V Tina Travel - by Lokman Aiman PDFDocument2 pagesCase Hotel Royal V Tina Travel - by Lokman Aiman PDFkeira100% (1)

- Entitled to Trust Funds Despite Change of PlansDocument10 pagesEntitled to Trust Funds Despite Change of PlansKajim SharibiNo ratings yet

- Datuk Jagindar Singh & Ors V Tara Rajaratnam, (1983) 2Document18 pagesDatuk Jagindar Singh & Ors V Tara Rajaratnam, (1983) 2ainur syamimiNo ratings yet

- Federal Constitution of MalaysiaDocument9 pagesFederal Constitution of MalaysiaRevathy KumaranNo ratings yet

- Sales of Goods ActDocument83 pagesSales of Goods ActM.k. YongNo ratings yet

- Ah Thian V Government of MalDocument3 pagesAh Thian V Government of MalMoganaJS100% (4)

- Company Law Individual Assignment Brief ExplainedDocument10 pagesCompany Law Individual Assignment Brief ExplainedMaheera AbdulwahidNo ratings yet

- Summary of Topic 4Document2 pagesSummary of Topic 4Husna RidzuanNo ratings yet

- Topic 3 PartiesDocument14 pagesTopic 3 PartiesJasintraswni RavichandranNo ratings yet

- Topic 1 Preliminary MattersDocument11 pagesTopic 1 Preliminary MattersJasintraswni RavichandranNo ratings yet

- Civil Courts JurisdictionDocument7 pagesCivil Courts JurisdictionJasintraswni RavichandranNo ratings yet

- UCL3612 Tri 2010 Tutorial 2 Promoters & Pre-Incorporation ContractsDocument1 pageUCL3612 Tri 2010 Tutorial 2 Promoters & Pre-Incorporation ContractsJasintraswni RavichandranNo ratings yet

- UCL3612 Tri 2010 CH 03 TutorialDocument1 pageUCL3612 Tri 2010 CH 03 TutorialJasintraswni RavichandranNo ratings yet

- Tutorial 6Document5 pagesTutorial 6Jasintraswni RavichandranNo ratings yet

- UCL3612 Tri 2010 Tutorial 2 Promoters & Pre-Incorporation ContractsDocument1 pageUCL3612 Tri 2010 Tutorial 2 Promoters & Pre-Incorporation ContractsJasintraswni RavichandranNo ratings yet

- 2mutual WillsDocument11 pages2mutual WillsJasintraswni RavichandranNo ratings yet

- Concept, Basic Characteristics & Preparation of Master PlanDocument3 pagesConcept, Basic Characteristics & Preparation of Master PlanGokulNo ratings yet

- Ais FormsDocument2 pagesAis FormsChris LampleyNo ratings yet

- MD Sajjad AnsariDocument2 pagesMD Sajjad AnsariMd sajjad afzalNo ratings yet

- EDHEC 10-2021 - Strategy (1108) - Answers To Real Options PartDocument7 pagesEDHEC 10-2021 - Strategy (1108) - Answers To Real Options PartSASNo ratings yet

- Chuka UniversityDocument20 pagesChuka UniversityBlack StormNo ratings yet

- DMS (Next Gen Dealer Management Systems DMS)Document13 pagesDMS (Next Gen Dealer Management Systems DMS)Ulfa AkhilNo ratings yet

- First Things First (1964 & 2000)Document5 pagesFirst Things First (1964 & 2000)MarinaCórdovaAlvésteguiNo ratings yet

- Unit 7 INTERNAL AND EXTERNAL INFLUENCES ON CUSTOMER BEHAVIOR IN TOURISMDocument6 pagesUnit 7 INTERNAL AND EXTERNAL INFLUENCES ON CUSTOMER BEHAVIOR IN TOURISMSayed Murtaza AliNo ratings yet

- Critical Thinking Exercise: Page 216, Industrial Relations, C. S. Venkata RamanDocument23 pagesCritical Thinking Exercise: Page 216, Industrial Relations, C. S. Venkata RamanPardeep DahiyaNo ratings yet

- Chapter 1 - Accounting Information Systems: An Overview: Dennis T. Fajarito, MBADocument36 pagesChapter 1 - Accounting Information Systems: An Overview: Dennis T. Fajarito, MBARohanne Garcia AbrigoNo ratings yet

- Las Tendencias Pedagógicas en América Latina. NassifDocument51 pagesLas Tendencias Pedagógicas en América Latina. NassifDora MuñozNo ratings yet

- Proposal - COVID19 Care CentersDocument10 pagesProposal - COVID19 Care CentersMOHD JIDINo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Mistak Done by IndiansDocument28 pagesMistak Done by Indiansamit mittal100% (1)

- Marisa IklanDocument30 pagesMarisa IklanFadell FmNo ratings yet

- Quant Process NotesDocument27 pagesQuant Process NotesDanie100% (1)

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument2 pagesIndian Income Tax Return Acknowledgement 2022-23: Assessment Yeardattam venkateswarluNo ratings yet

- Compact Printed Circuit Heat ExchangerDocument3 pagesCompact Printed Circuit Heat ExchangerNur Amanina50% (2)

- Form A: Paper-setting Blank Corporate Taxation ExamDocument3 pagesForm A: Paper-setting Blank Corporate Taxation ExamIshika PansariNo ratings yet

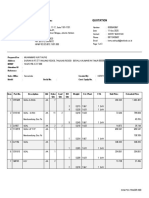

- PT Trakindo Utama: QuotationDocument3 pagesPT Trakindo Utama: QuotationANISNo ratings yet

- Bobcat Compact Excavator E16 Operation Maintenance Manual 6989423Document14 pagesBobcat Compact Excavator E16 Operation Maintenance Manual 6989423andrewshelton250683psa100% (67)

- Bizhub 40P: Designed For ProductivityDocument4 pagesBizhub 40P: Designed For ProductivityionutkokNo ratings yet

- Tender Pack RK3145-TE08 Concrete Lined Open DrainsDocument68 pagesTender Pack RK3145-TE08 Concrete Lined Open DrainsMahleka ConstructionNo ratings yet

- Chapter 5 Elasticity and Its ApplicationDocument41 pagesChapter 5 Elasticity and Its ApplicationeiaNo ratings yet

- Welcome To Mini Project Presentation On A Compartive Financial Performance Analysis of and Power by Means of Ratios Tata Steel and Jindal SteelDocument11 pagesWelcome To Mini Project Presentation On A Compartive Financial Performance Analysis of and Power by Means of Ratios Tata Steel and Jindal Steelब्राह्मण विभोरNo ratings yet

- Prefabricated StructureDocument129 pagesPrefabricated Structureemraan Khan100% (1)

- MiningDocument114 pagesMiningM Ansari100% (2)