Professional Documents

Culture Documents

RGB - Research Hive - 30 Jan 2020

Uploaded by

Jazzy0 ratings0% found this document useful (0 votes)

20 views2 pagesRGB - Research Hive - 30 Jan 2020

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRGB - Research Hive - 30 Jan 2020

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views2 pagesRGB - Research Hive - 30 Jan 2020

Uploaded by

JazzyRGB - Research Hive - 30 Jan 2020

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

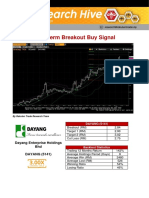

RGB International Bhd

(RGB, 0037)

RGB International (Trading Buy, TP:RM0.225, SL: RM0.155)

• From a technical perspective, RGB International (RGB)’s share price (which closed at RM0.175 yesterday) is on the

verge of breaking away from a negative sloping trendline after languishing inside a tight price range since early Sep

2019.

• Interestingly, there is renewed interest from investors in accumulating RGB shares. Trading activity in the stock is

on the rise with daily average trading volume increasing from 2.2m shares last week to 3.2m shares so far this week.

• A breakout on the upside could lift the share price to our resistance targets of RM0.225 (R1) and RM0.255 (R2).

This represents potential returns of 28.6% and 45.7%, respectively.

• In terms of downside risk, we have set the support levels at RM0.155 (S1) and RM0.135 (S2), which are 11.4% and

22.9% below its last traded price, respectively.

• Fundamentally, RGB has shown better sequential quarterly earnings, with net profit rising from RM6.7m in 1Q19 to

RM7.2m in 2Q19 to RM11.2m in 3Q19. Assuming 4Q19 result (due to be out next month) is similar to 3Q19,

estimated full-year earnings of RM36.3m would translate to an undemanding FY19 P/E of 7.4x.

• RGB – a leading supplier of electronic gaming machines and casino equipment as well as a key machine concession

primarily in Malaysia, Singapore and IndoChina – is in a position to ride on the growing gaming industry in the region.

It is also currently in a strong financial position with a net cash position of RM32.1m or 2.1 sen per share as of end

Sep 2019.

This document has been prepared for general circulation based on information obtained from sources believed to be reliable

but we do not make any representations as to its accuracy or completeness. Any recommendation contained in this document

does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person

who may read this document. This document is for the information of addressees only and is not to be taken in substitution

for the exercise of judgement by addressees and further shall not be re-distributed to any other third party. Rakuten Trade

Sdn Bhd accepts no liability whatsoever for any direct or consequential loss arising from any use of this document or any

solicitations of an offer to buy or sell any securities. Rakuten Trade Sdn Bhd and its associates, their directors, and/or

employees may have positions in, and may affect transactions in securities mentioned herein from time to time in the open

market or otherwise, and may receive brokerage fees or act as principal or agent in dealings with respect to these companies.

Published:

RAKUTEN TRADE SDN BHD (266701-P) Kenny Yee Shen Pin

Level 7, Kenanga Tower, 237, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia Head of Research

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Group7 AnadarkoDocument16 pagesGroup7 AnadarkoHimanshu BohraNo ratings yet

- R21 Currency Exchange Rates PDFDocument34 pagesR21 Currency Exchange Rates PDFAbhijeet PatilNo ratings yet

- FPGROUP - Research Hive - 14 Feb 2020Document2 pagesFPGROUP - Research Hive - 14 Feb 2020JazzyNo ratings yet

- SCOMNET - Research Hive - 13 Apr 2020Document2 pagesSCOMNET - Research Hive - 13 Apr 2020JazzyNo ratings yet

- PERDANA - Research Hive - 13 Jan 2020Document2 pagesPERDANA - Research Hive - 13 Jan 2020JazzyNo ratings yet

- TRIMODE - Research Hive - 8 Feb 2021Document2 pagesTRIMODE - Research Hive - 8 Feb 2021JazzyNo ratings yet

- DAYANG - Research Hive - 21 Jan 2020Document2 pagesDAYANG - Research Hive - 21 Jan 2020JazzyNo ratings yet

- TCS - Research Hive - 11 Jan 2021Document2 pagesTCS - Research Hive - 11 Jan 2021JazzyNo ratings yet

- CCK - Research Hive - 26 Aug 2020Document2 pagesCCK - Research Hive - 26 Aug 2020JazzyNo ratings yet

- SCOMNET - Research Hive - 17 Aug 2020Document2 pagesSCOMNET - Research Hive - 17 Aug 2020JazzyNo ratings yet

- Mah Sing Group BHD (Trading BUY)Document2 pagesMah Sing Group BHD (Trading BUY)JazzyNo ratings yet

- ASIAPLY - Research Hive - 17 Nov 2020Document2 pagesASIAPLY - Research Hive - 17 Nov 2020JazzyNo ratings yet

- SCOMNET - Research Hive - 7 Sept 2020Document2 pagesSCOMNET - Research Hive - 7 Sept 2020JazzyNo ratings yet

- HEXTAR - Research Hive - 02 June 2020Document2 pagesHEXTAR - Research Hive - 02 June 2020JazzyNo ratings yet

- BSTEAD - Research Hive - 22 Sept 2020Document2 pagesBSTEAD - Research Hive - 22 Sept 2020JazzyNo ratings yet

- MTAG - Research Hive - 27 Aug 2020Document2 pagesMTAG - Research Hive - 27 Aug 2020JazzyNo ratings yet

- APPASIA - Research Hive - 27 July 2020Document2 pagesAPPASIA - Research Hive - 27 July 2020JazzyNo ratings yet

- OPTIMAX - Research Hive - 3 Sept 2020Document2 pagesOPTIMAX - Research Hive - 3 Sept 2020JazzyNo ratings yet

- Projected Income StatementDocument4 pagesProjected Income StatementRavi DhillonNo ratings yet

- Functions of The Money Market: #1 Financing TradeDocument2 pagesFunctions of The Money Market: #1 Financing TradeDiyaNo ratings yet

- Fixed Income 6.1. Basic Features of A Fixed-Income Security 6.1.1. 6.1.1.1. Basic Features of A Fixed-Income SecurityDocument80 pagesFixed Income 6.1. Basic Features of A Fixed-Income Security 6.1.1. 6.1.1.1. Basic Features of A Fixed-Income SecurityEvelyn YangNo ratings yet

- Bida SRCP 20181217 FDocument61 pagesBida SRCP 20181217 FRidwan Haque DolonNo ratings yet

- Forex Hedging StrategiesDocument235 pagesForex Hedging StrategiesahmadNo ratings yet

- Aec Fund Apr 2018Document50 pagesAec Fund Apr 2018IGift WattanatornNo ratings yet

- Ratio Analysis Project ReportDocument82 pagesRatio Analysis Project ReportkartikNo ratings yet

- SUMMARY OF ChAPTER 4: EXTERNAL ASSESSMENTDocument10 pagesSUMMARY OF ChAPTER 4: EXTERNAL ASSESSMENTnoor74900No ratings yet

- B. RAK Ceramics (Bangladesh) Ltd. (For The Year Ended 31 December XXX)Document6 pagesB. RAK Ceramics (Bangladesh) Ltd. (For The Year Ended 31 December XXX)Imdad JeshinNo ratings yet

- Chapter 4 - Budgetary ControlDocument12 pagesChapter 4 - Budgetary ControlediwskiNo ratings yet

- Environmental, Social and Governance (ESG) Activities - Research SpotlightDocument18 pagesEnvironmental, Social and Governance (ESG) Activities - Research SpotlightStanford GSB Corporate Governance Research Initiative78% (9)

- EdgeReport BALKRISIND CaseStudy 22-11-2022 240Document34 pagesEdgeReport BALKRISIND CaseStudy 22-11-2022 240malayalamedits100No ratings yet

- Profitable Candlestick PatternsDocument53 pagesProfitable Candlestick Patternsaan_pkppk88% (17)

- LGU Chart of AccountsDocument12 pagesLGU Chart of AccountsthegianthonyNo ratings yet

- Present Values, The Objectives of The Firm, and Corporate GovernanceDocument31 pagesPresent Values, The Objectives of The Firm, and Corporate GovernanceTanvi KatariaNo ratings yet

- HorsefieldDocument2 pagesHorsefieldMarie Xavier - FelixNo ratings yet

- NGNGNDocument2 pagesNGNGNshera48No ratings yet

- Financial Accounting Chapter 7Document57 pagesFinancial Accounting Chapter 7Waqas MazharNo ratings yet

- Financial Ratio AnalyzesDocument11 pagesFinancial Ratio AnalyzesNardsdel RiveraNo ratings yet

- 5 - Capital StructureDocument3 pages5 - Capital StructureSlim CharniNo ratings yet

- 1-Exercises On Stockholders' Equity 1Document2 pages1-Exercises On Stockholders' Equity 1Chrystelle Gail LiNo ratings yet

- 2nd Yr Midterm 2nd Sem ReviewerDocument19 pages2nd Yr Midterm 2nd Sem Reviewerchiji chzzzmeowNo ratings yet

- Soft Copy ReportDocument3 pagesSoft Copy ReportChristine Nathalie BalmesNo ratings yet

- Studi Komparasi Pembentukan Portofolio Optimal Menggunakan Model Markowitz Dan Model Indeks TunggalDocument15 pagesStudi Komparasi Pembentukan Portofolio Optimal Menggunakan Model Markowitz Dan Model Indeks TunggalSaida RahmawatiNo ratings yet

- Real Options Real Options Real Options Real Options: J B Gupta ClassesDocument14 pagesReal Options Real Options Real Options Real Options: J B Gupta ClassesManjunatha PrasadNo ratings yet

- Stock-Picking Strategies - Introduction - Investopedia2Document5 pagesStock-Picking Strategies - Introduction - Investopedia2Rishikesh DevaneNo ratings yet

- Chapter 7-10Document8 pagesChapter 7-10Jolina T. OrongNo ratings yet

- SimexDocument3 pagesSimexRoland Ron BantilanNo ratings yet