Professional Documents

Culture Documents

PERDANA - Research Hive - 13 Jan 2020

Uploaded by

Jazzy0 ratings0% found this document useful (0 votes)

11 views2 pagesPERDANA - Research Hive - 13 Jan 2020

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPERDANA - Research Hive - 13 Jan 2020

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesPERDANA - Research Hive - 13 Jan 2020

Uploaded by

JazzyPERDANA - Research Hive - 13 Jan 2020

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Perdana Petroleum Bhd

(PERDANA, 7108)

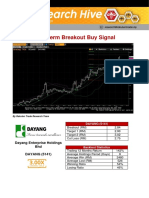

Perdana Petroleum (Trading Buy, TP:RM0.48, SL: RM0.36)

• Perdana Petroleum shares (which closed at 41.5 sen last Friday) are showing a positive bias. The stock is presently

hovering at the lower range of an upward sloping price channel that stretches back to May 2019.

• Riding on the technical momentum, its share price could climb to test the Nov 2019’s high of 48 sen (R1). A breakout

from this threshold could then send the stock to challenge the Mar 2019’s peak of 54 sen (R2). This represents potential

upside of 15.7% and 30.1%, respectively.

• In terms of downside risk, we have identified key support levels at 36 sen (S1) and 30 sen (S2).

• Perdana Petroleum is a beneficiary of rising oil prices, which are showing signs of renewed upward momentum amid

the escalating geopolitical risk in the Middle East.

• Perdana Petroleum (which is involved in the provision of marine support services such as the provision of vessels for

the upstream oil & gas industry) will likely secure more contract wins on the back of increased capex spending by oil

majors as oil prices climb further.

• The Group is in a position to leverage on its business relationship with major shareholder Dayang Enterprise, which

holds a 60.5% stake in Perdana Petroleum and is in the business of provision of maintenance services and chartering

of marine vessels for the oil and gas industry. Last Thursday, Perdana Petroleum announced that it has been awarded

contracts RM50m to charter its vessels to Dayang Enterprise.

• The Company has just completed a rights issue proposal involving the issuance of 1.46bn Redeemable Convertible

Preference Shares (RCPS) on 8 Jan 2020. The fund-raising activity (with total proceeds of RM476m) represents part

of a group-wide debt restructuring exercise. On a pro-forma basis, this would have cut its gearing from 1.08x (as of

end-Sep 2019) to 0.15x post-the rights issue exercise.

• Whilst Perdana Petroleum is currently loss-making (with its results for 9-month ended Sep 2019 showing a net loss of

RM20.3m), the Group posted a net profit of RM18.1m in the most recent quarter of 3Q19 (partly attributable to an one-

off exceptional gain of RM10.6m).

• Its bottomline is expected to get a lift from: (a) interest savings following the debt settlement. In its circular to

shareholders, the Company estimated gross interest savings of RM31.3m arising from the corporate exercise; and (b)

higher vessel utilisation rate, which has increased from 79% in 2Q19 to 91% in 3Q19.

• Based on its pro-forma book value per share of RM1.16 (as of Sep 2019), the stock is now trading at PBV of 0.36x.

This document has been prepared for general circulation based on information obtained from sources believed to be reliable

but we do not make any representations as to its accuracy or completeness. Any recommendation contained in this document

does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person

who may read this document. This document is for the information of addressees only and is not to be taken in substitution

for the exercise of judgement by addressees and further shall not be re-distributed to any other third party. Rakuten Trade

Sdn Bhd accepts no liability whatsoever for any direct or consequential loss arising from any use of this document or any

solicitations of an offer to buy or sell any securities. Rakuten Trade Sdn Bhd and its associates, their directors, and/or

employees may have positions in, and may affect transactions in securities mentioned herein from time to time in the open

market or otherwise, and may receive brokerage fees or act as principal or agent in dealings with respect to these companies.

Published:

RAKUTEN TRADE SDN BHD (266701-P) Kenny Yee Shen Pin

Level 7, Kenanga Tower, 237, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia Head of Research

You might also like

- ASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014From EverandASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014No ratings yet

- Iso 14001 Sample ProceduresDocument19 pagesIso 14001 Sample ProceduresMichelle Baxter McCullochNo ratings yet

- Travel Services AgreementDocument36 pagesTravel Services AgreementEllijala VarunNo ratings yet

- BBMF2023 Tutorial Group 3 Power Root BerhadDocument35 pagesBBMF2023 Tutorial Group 3 Power Root BerhadKar EngNo ratings yet

- La Bugal BLaan Tribal Association Inc. vs. RamosDocument62 pagesLa Bugal BLaan Tribal Association Inc. vs. RamosAKnownKneeMouseeNo ratings yet

- Swot Analysis of GentingDocument4 pagesSwot Analysis of Gentingandrew_wang83% (6)

- Relativity of ContractsDocument7 pagesRelativity of ContractsCristy C. Bangayan100% (1)

- BSTEAD - Research Hive - 22 Sept 2020Document2 pagesBSTEAD - Research Hive - 22 Sept 2020JazzyNo ratings yet

- HEXTAR - Research Hive - 02 June 2020Document2 pagesHEXTAR - Research Hive - 02 June 2020JazzyNo ratings yet

- Mah Sing Group BHD (Trading BUY)Document2 pagesMah Sing Group BHD (Trading BUY)JazzyNo ratings yet

- OPTIMAX - Research Hive - 3 Sept 2020Document2 pagesOPTIMAX - Research Hive - 3 Sept 2020JazzyNo ratings yet

- MTAG - Research Hive - 27 Aug 2020Document2 pagesMTAG - Research Hive - 27 Aug 2020JazzyNo ratings yet

- RHB Equity 360° (TNB, AirAsia Technical: Berjaya Corp) - 09/06/2010Document3 pagesRHB Equity 360° (TNB, AirAsia Technical: Berjaya Corp) - 09/06/2010Rhb InvestNo ratings yet

- RHB Equity 360° - 12 July 2010 (Motor, B-Toto, Mah Sing Technical: Titan, Axiata)Document3 pagesRHB Equity 360° - 12 July 2010 (Motor, B-Toto, Mah Sing Technical: Titan, Axiata)Rhb InvestNo ratings yet

- SCOMNET - Research Hive - 7 Sept 2020Document2 pagesSCOMNET - Research Hive - 7 Sept 2020JazzyNo ratings yet

- RHB Equity 360° (Media, Motor, Sunway City, Glomac Technical: IRC) - 24/03/2010Document3 pagesRHB Equity 360° (Media, Motor, Sunway City, Glomac Technical: IRC) - 24/03/2010Rhb InvestNo ratings yet

- ASIAPLY - Research Hive - 17 Nov 2020Document2 pagesASIAPLY - Research Hive - 17 Nov 2020JazzyNo ratings yet

- SCOMNET - Research Hive - 17 Aug 2020Document2 pagesSCOMNET - Research Hive - 17 Aug 2020JazzyNo ratings yet

- Genting Plantations Berhad: Likely To Move Higher in The Near Term - 12/10/2010Document2 pagesGenting Plantations Berhad: Likely To Move Higher in The Near Term - 12/10/2010Rhb InvestNo ratings yet

- CCK - Research Hive - 26 Aug 2020Document2 pagesCCK - Research Hive - 26 Aug 2020JazzyNo ratings yet

- Thesun 2009-06-12 Page15 Epfs q1 Investment Income Drops 10Document1 pageThesun 2009-06-12 Page15 Epfs q1 Investment Income Drops 10Impulsive collectorNo ratings yet

- Gadang 3QFY20 Results PDFDocument4 pagesGadang 3QFY20 Results PDFAHMADNo ratings yet

- RHB Equity 360° - 23 June 2010 (Sunway Holdings, Motor, O&G, Kencana, KFC, Proton Technical: My E.G.)Document4 pagesRHB Equity 360° - 23 June 2010 (Sunway Holdings, Motor, O&G, Kencana, KFC, Proton Technical: My E.G.)Rhb InvestNo ratings yet

- TRIMODE - Research Hive - 8 Feb 2021Document2 pagesTRIMODE - Research Hive - 8 Feb 2021JazzyNo ratings yet

- TCS - Research Hive - 11 Jan 2021Document2 pagesTCS - Research Hive - 11 Jan 2021JazzyNo ratings yet

- SCOMNET - Research Hive - 1 July 2020Document2 pagesSCOMNET - Research Hive - 1 July 2020JazzyNo ratings yet

- Lafarge Malaysia: A Plunging QuarterDocument3 pagesLafarge Malaysia: A Plunging QuarterRachel LauNo ratings yet

- RHB Equity 360° (Market, Motor, Ta Ann, Evergreen, ILB, MAS Technical: MAS) - 17/08/2010Document4 pagesRHB Equity 360° (Market, Motor, Ta Ann, Evergreen, ILB, MAS Technical: MAS) - 17/08/2010Rhb InvestNo ratings yet

- RHB Equity 360° (Allianz, CIMB, Sime, GentMsia, GentBhd, Sunrise, AEON, WTK, Kossan, Mah Sing, YNH, Puncak Technical: Berjaya Corp) - 27/08/2010Document4 pagesRHB Equity 360° (Allianz, CIMB, Sime, GentMsia, GentBhd, Sunrise, AEON, WTK, Kossan, Mah Sing, YNH, Puncak Technical: Berjaya Corp) - 27/08/2010Rhb InvestNo ratings yet

- SCOMNET - Research Hive - 13 Apr 2020Document2 pagesSCOMNET - Research Hive - 13 Apr 2020JazzyNo ratings yet

- Pharmaniaga BHD (BUY, EPS ) : NeutralDocument5 pagesPharmaniaga BHD (BUY, EPS ) : NeutrallivaNo ratings yet

- RHB Equity 360° (Faber, Fitters, Quill Capita Technical: Landmarks) - 30/07/2010Document3 pagesRHB Equity 360° (Faber, Fitters, Quill Capita Technical: Landmarks) - 30/07/2010Rhb InvestNo ratings yet

- E&o - 2013 06 3 - RR - 4qfy13Document3 pagesE&o - 2013 06 3 - RR - 4qfy13Priesilia PresleyNo ratings yet

- RHB Equity 360° - 19 October 2010 (ILB, Public Bank Technical: Ann Joo)Document3 pagesRHB Equity 360° - 19 October 2010 (ILB, Public Bank Technical: Ann Joo)Rhb InvestNo ratings yet

- NewsRelease 10september2014Document3 pagesNewsRelease 10september2014Invest StockNo ratings yet

- Thesun 2009-08-19 Page14 Zeti Upbeat On Bond MarketDocument1 pageThesun 2009-08-19 Page14 Zeti Upbeat On Bond MarketImpulsive collectorNo ratings yet

- UEM Land Holdings Berhad: A Chance To Scale Higher To RM1.80 - 19/7/2010Document2 pagesUEM Land Holdings Berhad: A Chance To Scale Higher To RM1.80 - 19/7/2010Rhb InvestNo ratings yet

- RHB Equity 360° - 17 September 2010 (Evergreen, Power, HSL, Petra Perdana Technical: IOI)Document3 pagesRHB Equity 360° - 17 September 2010 (Evergreen, Power, HSL, Petra Perdana Technical: IOI)Rhb InvestNo ratings yet

- DUTALND AnnualReport2013Document134 pagesDUTALND AnnualReport2013Hèñry LimNo ratings yet

- RHB Equity 360° (MCIL, Pos, Petronas Gas Technical: Affin) - 07/04/2010Document3 pagesRHB Equity 360° (MCIL, Pos, Petronas Gas Technical: Affin) - 07/04/2010Rhb InvestNo ratings yet

- CMA PrivatizationDocument4 pagesCMA PrivatizationInvest StockNo ratings yet

- RHB Equity 360° - 21 October 2010 (Media, Rubber Gloves, Puncak Niaga, WCT, Axis REIT, BAT Technical: AFG)Document4 pagesRHB Equity 360° - 21 October 2010 (Media, Rubber Gloves, Puncak Niaga, WCT, Axis REIT, BAT Technical: AFG)Rhb InvestNo ratings yet

- Barrons This Singaporean Stock Could Be More Than 60% Undervalued 1 June 2017Document3 pagesBarrons This Singaporean Stock Could Be More Than 60% Undervalued 1 June 2017qpmoerzhNo ratings yet

- RHB Equity 360° - 4 October 2010 (Construction, Property, BAT Technical: Zelan, Genting Msia)Document3 pagesRHB Equity 360° - 4 October 2010 (Construction, Property, BAT Technical: Zelan, Genting Msia)Rhb InvestNo ratings yet

- Genting Malaysia Berhad: Further Upside Will Confirm The Upswing... 28/06/2010Document2 pagesGenting Malaysia Berhad: Further Upside Will Confirm The Upswing... 28/06/2010Rhb InvestNo ratings yet

- RHB Equity 360° - 23 September 2010 (Media, Sunway REIT, Tan Chong, KPJ Technical: Sunrise)Document4 pagesRHB Equity 360° - 23 September 2010 (Media, Sunway REIT, Tan Chong, KPJ Technical: Sunrise)Rhb InvestNo ratings yet

- RHB Equity 360° (Motor, Pos, Sunway, LPI Technical: KUB, E&O) - 12/04/2010Document4 pagesRHB Equity 360° (Motor, Pos, Sunway, LPI Technical: KUB, E&O) - 12/04/2010Rhb InvestNo ratings yet

- RHB Equity 360° - (IJM Land, Consumer, Construction, Dialog, Top Glove Technical: WCT)Document3 pagesRHB Equity 360° - (IJM Land, Consumer, Construction, Dialog, Top Glove Technical: WCT)Rhb InvestNo ratings yet

- Maintain Buy' On M&M - TP Rs.800: Research Notes - Buy M&M, Aban Offshore, L&T, Hold DLF, Reduce Rpower (June 01, 2012)Document3 pagesMaintain Buy' On M&M - TP Rs.800: Research Notes - Buy M&M, Aban Offshore, L&T, Hold DLF, Reduce Rpower (June 01, 2012)Nas Mall RegisterNo ratings yet

- RHB Equity 360° - 18 June 2010 (Gaming, AFG, Sunway, SP Setia Technical: Petra Perdana)Document3 pagesRHB Equity 360° - 18 June 2010 (Gaming, AFG, Sunway, SP Setia Technical: Petra Perdana)Rhb InvestNo ratings yet

- RHB Equity 360° - (Axiata, UMW, Gent Msia, AMMB, MAHB, MBM, Star, Hunza Technical: Gent Msia, Gamuda) - 18/08/2010Document4 pagesRHB Equity 360° - (Axiata, UMW, Gent Msia, AMMB, MAHB, MBM, Star, Hunza Technical: Gent Msia, Gamuda) - 18/08/2010Rhb InvestNo ratings yet

- BIMBSec - Dialog Company Update - Higher and Deeper - 20120625Document2 pagesBIMBSec - Dialog Company Update - Higher and Deeper - 20120625Bimb SecNo ratings yet

- KTL Global Limited Annual Report 2014Document120 pagesKTL Global Limited Annual Report 2014WeR1 Consultants Pte LtdNo ratings yet

- See Hup Seng 3Q13 Net Profit Gains 44% To S$2.5 Million: EWS EleaseDocument3 pagesSee Hup Seng 3Q13 Net Profit Gains 44% To S$2.5 Million: EWS EleaseInvest StockNo ratings yet

- Financial & Risk AnalysisDocument49 pagesFinancial & Risk Analysisnabila rahmanzNo ratings yet

- Thesun 2009-07-23 Page15 Petronas Gas To Spend Rm1bil To Revamp Ageing PlantsDocument1 pageThesun 2009-07-23 Page15 Petronas Gas To Spend Rm1bil To Revamp Ageing PlantsImpulsive collectorNo ratings yet

- RHB Equity 360° - 22/02/2010 (Market, Genting Spore, EON Cap, Proton, Sime Darby, ILB Technical: Latexx, AFG)Document4 pagesRHB Equity 360° - 22/02/2010 (Market, Genting Spore, EON Cap, Proton, Sime Darby, ILB Technical: Latexx, AFG)Rhb InvestNo ratings yet

- Previous Day Highlights News For The Day: Edge MarketsDocument2 pagesPrevious Day Highlights News For The Day: Edge MarketsMohd Amiruddin Abd RahmanNo ratings yet

- RHB Equity 360°: 8 July 2010 (QL, Banks, Kencana Technical: Proton) - 08/07/2010Document3 pagesRHB Equity 360°: 8 July 2010 (QL, Banks, Kencana Technical: Proton) - 08/07/2010Rhb InvestNo ratings yet

- RHB Equity 360° (RHB Equity 360° Technical: Top Glove) - 08/09/2010Document2 pagesRHB Equity 360° (RHB Equity 360° Technical: Top Glove) - 08/09/2010Rhb InvestNo ratings yet

- Alliance Financial Group BHD: A "Double Buy" Signal On The Momentum Indicators - 21/6/2010Document2 pagesAlliance Financial Group BHD: A "Double Buy" Signal On The Momentum Indicators - 21/6/2010Rhb InvestNo ratings yet

- RHB Equity 360° - 3 August 2010 (PLUS, Semicon, Notion Vtec, Unisem, Axiata, AMMB Technical: MPHB, KNM)Document4 pagesRHB Equity 360° - 3 August 2010 (PLUS, Semicon, Notion Vtec, Unisem, Axiata, AMMB Technical: MPHB, KNM)Rhb InvestNo ratings yet

- Petronas Gas Berhad (Forex)Document12 pagesPetronas Gas Berhad (Forex)KAR ENG QUAHNo ratings yet

- Proton Holdings Berhad: Could Cut Above RM5.00 Soon - 20/09/2010Document2 pagesProton Holdings Berhad: Could Cut Above RM5.00 Soon - 20/09/2010Rhb InvestNo ratings yet

- FPGROUP - Research Hive - 14 Feb 2020Document2 pagesFPGROUP - Research Hive - 14 Feb 2020JazzyNo ratings yet

- SCOMNET - Research Hive - 13 Apr 2020Document2 pagesSCOMNET - Research Hive - 13 Apr 2020JazzyNo ratings yet

- DAYANG - Research Hive - 21 Jan 2020Document2 pagesDAYANG - Research Hive - 21 Jan 2020JazzyNo ratings yet

- TCS - Research Hive - 11 Jan 2021Document2 pagesTCS - Research Hive - 11 Jan 2021JazzyNo ratings yet

- TRIMODE - Research Hive - 8 Feb 2021Document2 pagesTRIMODE - Research Hive - 8 Feb 2021JazzyNo ratings yet

- SCOMNET - Research Hive - 17 Aug 2020Document2 pagesSCOMNET - Research Hive - 17 Aug 2020JazzyNo ratings yet

- APPASIA - Research Hive - 27 July 2020Document2 pagesAPPASIA - Research Hive - 27 July 2020JazzyNo ratings yet

- ASIAPLY - Research Hive - 17 Nov 2020Document2 pagesASIAPLY - Research Hive - 17 Nov 2020JazzyNo ratings yet

- CCK - Research Hive - 26 Aug 2020Document2 pagesCCK - Research Hive - 26 Aug 2020JazzyNo ratings yet

- SCOMNET - Research Hive - 7 Sept 2020Document2 pagesSCOMNET - Research Hive - 7 Sept 2020JazzyNo ratings yet

- Granularity of GrowthDocument4 pagesGranularity of GrowthAlan TangNo ratings yet

- Profil AVANCER FM SERVICES SDN BHDDocument23 pagesProfil AVANCER FM SERVICES SDN BHDmazhar74No ratings yet

- COURSE CONTENT in HE 503 Foods Nut. Ed 2nd Sem. 2021 2022 FINALDocument6 pagesCOURSE CONTENT in HE 503 Foods Nut. Ed 2nd Sem. 2021 2022 FINALLISA MNo ratings yet

- Year 1 Homework ToysDocument7 pagesYear 1 Homework Toyscyqczyzod100% (1)

- Persephone and The PomegranateDocument3 pagesPersephone and The PomegranateLíviaNo ratings yet

- Annaphpapp 01Document3 pagesAnnaphpapp 01anujhanda29No ratings yet

- Facilitators of Globalization PresentationDocument3 pagesFacilitators of Globalization PresentationCleon Roxann WebbeNo ratings yet

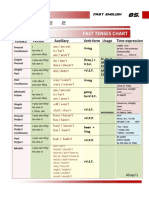

- Table 2: Fast Tenses ChartDocument5 pagesTable 2: Fast Tenses ChartAngel Julian HernandezNo ratings yet

- 1 Summative Test in Empowerment Technology Name: - Date: - Year & Section: - ScoreDocument2 pages1 Summative Test in Empowerment Technology Name: - Date: - Year & Section: - ScoreShelene CathlynNo ratings yet

- SAP FICO Course Content - Core Global ITDocument12 pagesSAP FICO Course Content - Core Global ITVenkatrao VaraganiNo ratings yet

- Military Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersDocument13 pagesMilitary Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersEswar StarkNo ratings yet

- Discussion: Functions, Advantages and Disadvantages of BIOPOT Cassava Peel and Husk CharcoalDocument4 pagesDiscussion: Functions, Advantages and Disadvantages of BIOPOT Cassava Peel and Husk CharcoalAhmad BurhanudinNo ratings yet

- Impacts of Cultural Differences On Project SuccessDocument10 pagesImpacts of Cultural Differences On Project SuccessMichael OlaleyeNo ratings yet

- Test 6Document7 pagesTest 6RuslanaNo ratings yet

- The Body of The Atman in The Katha UpanishadDocument4 pagesThe Body of The Atman in The Katha UpanishadmikikiNo ratings yet

- 09 Task Performance 1-ARG - ZABALA GROUPDocument6 pages09 Task Performance 1-ARG - ZABALA GROUPKylle Justin ZabalaNo ratings yet

- ChinduDocument1 pageChinduraghavbiduru167% (3)

- Deed OfAdjudication Cresencio Abuluyan BasilioDocument4 pagesDeed OfAdjudication Cresencio Abuluyan BasilioJose BonifacioNo ratings yet

- COVID19 Management PlanDocument8 pagesCOVID19 Management PlanwallyNo ratings yet

- Cases in Political Law Review (2nd Batch)Document1 pageCases in Political Law Review (2nd Batch)Michael Angelo LabradorNo ratings yet

- Marking SchemeDocument8 pagesMarking Schememohamed sajithNo ratings yet

- OECD - AI Workgroup (2022)Document4 pagesOECD - AI Workgroup (2022)Pam BlueNo ratings yet

- Tugas Etik Koas BaruDocument125 pagesTugas Etik Koas Baruriska suandiwiNo ratings yet

- The Overseas Chinese of South East Asia: Ian Rae and Morgen WitzelDocument178 pagesThe Overseas Chinese of South East Asia: Ian Rae and Morgen WitzelShukwai ChristineNo ratings yet

- Project Initiation & Pre-StudyDocument36 pagesProject Initiation & Pre-StudyTuấn Nam NguyễnNo ratings yet

- Posh TTTDocument17 pagesPosh TTTKannanNo ratings yet