Professional Documents

Culture Documents

SCOMNET - Research Hive - 1 July 2020

Uploaded by

Jazzy0 ratings0% found this document useful (0 votes)

14 views2 pagesSCOMNET - Research Hive - 1 July 2020

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSCOMNET - Research Hive - 1 July 2020

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pagesSCOMNET - Research Hive - 1 July 2020

Uploaded by

JazzySCOMNET - Research Hive - 1 July 2020

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

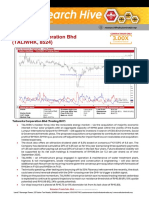

Supercomnet Technologies Bhd

(SCOMNET, 0001)

Supercomnet Technologies Bhd (Fundamental BUY with TP 1.63)

• We remain convinced on Supercomnet Technologies Bhd (“Scomnet”) growth prospects thus raising our

earnings estimates by 12% and 13% for this and next year respectively.

• We are reiterating our BUY call with a target price of RM1.63 premised on 30x PER FY21 which is still at

discount to Bursa Malaysia Healthcare Index 34x PER.

• Scomnet share price has surged to high of RM1.60 since our initial coverage report back in April 2020

and has since pull back to a more reasonable level post its 1Q20 results.

• It remains the leading Original Equipment Manufacturer of automotive cables and with their medical

segment will continue to be the key catalyst for growth over the next few years from increased

spending in healthcare amidst the Covid-19 pandemic.

• Based on their profit track record, Main Board transfer would make sense and it will serve as a re-rating

catalyst to justify their healthcare PER.

• To recap, its medical cables are approved by the European Medical Agency (“EMA”) and Food & Drug

Administration (“FDA”) for Europe and North & Central America with key clients such as Edwards

Lifesciences and Ambu, both major players in different segments of cardiovascular medical devices

space globally.

• Balance sheet remains robust with net cash of RM50m and zero borrowings.

• Margins is set to improve to 18% from the current 15% with new products in the pipeline.

• Growth momentum remains on track with double digit growth of 49% and 25% in EPS for FY20 and

FY21 respectively potentially pushing it to record levels.

This document has been prepared for general circulation based on information obtained from sources believed

to be reliable but we do not make any representations as to its accuracy or completeness. Any

recommendation contained in this document does not have regard to the specific investment objectives,

financial situation and the particular needs of any specific person who may read this document. This document

is for the information of addressees only and is not to be taken in substitution for the exercise of judgement by

addressees and further shall not be re-distributed to any other third party. Rakuten Trade Sdn Bhd accepts no

liability whatsoever for any direct or consequential loss arising from any use of this document or any

solicitations of an offer to buy or sell any securities. Rakuten Trade Sdn Bhd and its associates, their directors,

and/or employees may have positions in, and may affect transactions in securities mentioned herein from time

to time in the open market or otherwise, and may receive brokerage fees or act as principal or agent in dealings

with respect to these companies.

The Contra Trade account allows clients to buy shares based on available cash and/or collateral shares value

after hair cut at a higher multiplier. The multiplier varies according to the type of counters clients intend to buy.

Outstanding purchase(s) in the Contra Account need to be paid and/or settled within 2 (two) trading days after

the transaction date (T), failing which it will be force-sold on T+2.

Published:

RAKUTEN TRADE SDN BHD

Registration No: 199301011963 (266701-P) Kenny Yee Shen Pin

Level 7, Kenanga Tower, 237, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia Head of Research

You might also like

- SCOMNET - Research Hive - 7 Sept 2020Document2 pagesSCOMNET - Research Hive - 7 Sept 2020JazzyNo ratings yet

- SCOMNET - Research Hive - 17 Aug 2020Document2 pagesSCOMNET - Research Hive - 17 Aug 2020JazzyNo ratings yet

- SCOMNET - Research Hive - 13 Apr 2020Document2 pagesSCOMNET - Research Hive - 13 Apr 2020JazzyNo ratings yet

- MTAG - Research Hive - 27 Aug 2020Document2 pagesMTAG - Research Hive - 27 Aug 2020JazzyNo ratings yet

- APPASIA - Research Hive - 27 July 2020Document2 pagesAPPASIA - Research Hive - 27 July 2020JazzyNo ratings yet

- HEXTAR - Research Hive - 02 June 2020Document2 pagesHEXTAR - Research Hive - 02 June 2020JazzyNo ratings yet

- CCK - Research Hive - 26 Aug 2020Document2 pagesCCK - Research Hive - 26 Aug 2020JazzyNo ratings yet

- OPTIMAX - Research Hive - 3 Sept 2020Document2 pagesOPTIMAX - Research Hive - 3 Sept 2020JazzyNo ratings yet

- TRIMODE - Research Hive - 8 Feb 2021Document2 pagesTRIMODE - Research Hive - 8 Feb 2021JazzyNo ratings yet

- ASIAPLY - Research Hive - 17 Nov 2020Document2 pagesASIAPLY - Research Hive - 17 Nov 2020JazzyNo ratings yet

- TCS - Research Hive - 11 Jan 2021Document2 pagesTCS - Research Hive - 11 Jan 2021JazzyNo ratings yet

- Mah Sing Group BHD (Trading BUY)Document2 pagesMah Sing Group BHD (Trading BUY)JazzyNo ratings yet

- BSTEAD - Research Hive - 22 Sept 2020Document2 pagesBSTEAD - Research Hive - 22 Sept 2020JazzyNo ratings yet

- PremiumTechnicals-Nov26 15 GammonDocument2 pagesPremiumTechnicals-Nov26 15 GammonWarren RiveraNo ratings yet

- Report On Budget 2012-13Document4 pagesReport On Budget 2012-13Kunal JainNo ratings yet

- Ipo X-RayDocument3 pagesIpo X-Rayrahul kumarNo ratings yet

- Bull Positions Cut On Rate Cut: Punter's CallDocument4 pagesBull Positions Cut On Rate Cut: Punter's CallPraveenNo ratings yet

- Maintain Buy' On M&M - TP Rs.800: Research Notes - Buy M&M, Aban Offshore, L&T, Hold DLF, Reduce Rpower (June 01, 2012)Document3 pagesMaintain Buy' On M&M - TP Rs.800: Research Notes - Buy M&M, Aban Offshore, L&T, Hold DLF, Reduce Rpower (June 01, 2012)Nas Mall RegisterNo ratings yet

- L&T Financi L Services: A e H S e e eDocument53 pagesL&T Financi L Services: A e H S e e eNimesh PatelNo ratings yet

- RHB Equity 360°: 8 July 2010 (QL, Banks, Kencana Technical: Proton) - 08/07/2010Document3 pagesRHB Equity 360°: 8 July 2010 (QL, Banks, Kencana Technical: Proton) - 08/07/2010Rhb InvestNo ratings yet

- Research - Note - 2012 02 17 - 10 13 08 000000Document2 pagesResearch - Note - 2012 02 17 - 10 13 08 000000Kurian ThomasNo ratings yet

- Bekasi Fajar Buy: Keeping A Cautious View Despite Recovery SignsDocument4 pagesBekasi Fajar Buy: Keeping A Cautious View Despite Recovery Signste_gantengNo ratings yet

- Press Release: CAE Announces Closing of Marketed Public OfferingDocument3 pagesPress Release: CAE Announces Closing of Marketed Public OfferingHiroKoNo ratings yet

- Equity 99 Smart LinkDocument3 pagesEquity 99 Smart LinkSachinShingoteNo ratings yet

- Jagran Prakashan LTD: EquitiesDocument3 pagesJagran Prakashan LTD: EquitiesAnonymous y3hYf50mTNo ratings yet

- ICICIdirect NewTelecomPolicy2011 SectorUpdateDocument3 pagesICICIdirect NewTelecomPolicy2011 SectorUpdateSoodamany Ponnu PandianNo ratings yet

- High Conviction Basket: Consumption: Stock Name Weighatge RationaleDocument2 pagesHigh Conviction Basket: Consumption: Stock Name Weighatge RationaleShrikrushnaKawatheNo ratings yet

- Company Note - Kaynes TechnologiesDocument4 pagesCompany Note - Kaynes TechnologiespalakNo ratings yet

- Research - Note - 2012 06 13 - 12 01 08 000000Document2 pagesResearch - Note - 2012 06 13 - 12 01 08 000000adithyauNo ratings yet

- Marco Polo Marine: Corporate News FlashDocument3 pagesMarco Polo Marine: Corporate News FlashphuawlNo ratings yet

- CRISIL Research Ier Report Sterlite Technologies 2012Document28 pagesCRISIL Research Ier Report Sterlite Technologies 2012J Shyam SwaroopNo ratings yet

- Idea Cellular LTD.Document10 pagesIdea Cellular LTD.saurabhkumar0664No ratings yet

- RHB Equity 360° - (Axiata, UMW, Gent Msia, AMMB, MAHB, MBM, Star, Hunza Technical: Gent Msia, Gamuda) - 18/08/2010Document4 pagesRHB Equity 360° - (Axiata, UMW, Gent Msia, AMMB, MAHB, MBM, Star, Hunza Technical: Gent Msia, Gamuda) - 18/08/2010Rhb InvestNo ratings yet

- RHB Equity 360° (B-Toto/Tanjong, Telecom, Semicon, Oil & Gas Technical: Sinotop) - 02/07/2010Document3 pagesRHB Equity 360° (B-Toto/Tanjong, Telecom, Semicon, Oil & Gas Technical: Sinotop) - 02/07/2010Rhb InvestNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- RHB Equity 360° (Media, Motor, Sunway City, Glomac Technical: IRC) - 24/03/2010Document3 pagesRHB Equity 360° (Media, Motor, Sunway City, Glomac Technical: IRC) - 24/03/2010Rhb InvestNo ratings yet

- Vardhaman Special SteelsDocument5 pagesVardhaman Special SteelsupsahuNo ratings yet

- Market Focus 20101013Document1 pageMarket Focus 20101013limml63No ratings yet

- Press Release: 15 April: Smurfit Kappa Group PLCDocument3 pagesPress Release: 15 April: Smurfit Kappa Group PLCJose RodriguesNo ratings yet

- Midcaps: Value BuysDocument4 pagesMidcaps: Value Buysapi-234474152No ratings yet

- Market Impact: HDFC Bank Investment Advisory GroupDocument2 pagesMarket Impact: HDFC Bank Investment Advisory GroupMLastTryNo ratings yet

- Consolidation Time: Punter's CallDocument4 pagesConsolidation Time: Punter's CallNaleep GuptaNo ratings yet

- Felda News FlashDocument3 pagesFelda News FlashBimb SecNo ratings yet

- Marico LTD Q2'13 Earning EstimateDocument2 pagesMarico LTD Q2'13 Earning EstimateSuranjoy SinghNo ratings yet

- Notes From Invest Malaysia 2014: KPJ HealthcareDocument7 pagesNotes From Invest Malaysia 2014: KPJ Healthcareaiman_077No ratings yet

- TriQuint RFMD Merger Investor PresentationDocument11 pagesTriQuint RFMD Merger Investor PresentationspeedybitsNo ratings yet

- MSVN Strategy 2024 HuyDocument14 pagesMSVN Strategy 2024 HuyphatNo ratings yet

- RHB Equity 360° (RHB Equity 360° Technical: Top Glove) - 08/09/2010Document2 pagesRHB Equity 360° (RHB Equity 360° Technical: Top Glove) - 08/09/2010Rhb InvestNo ratings yet

- Glaxosmithkline PLC: Research ReportDocument8 pagesGlaxosmithkline PLC: Research Reportrumi2accaNo ratings yet

- Premarket KnowledgeBrunch Microsec 30.11.16Document5 pagesPremarket KnowledgeBrunch Microsec 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Pharmaniaga BHD (BUY, EPS ) : NeutralDocument5 pagesPharmaniaga BHD (BUY, EPS ) : NeutrallivaNo ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- L&T - Investor Presentation - Q2 FY201Document58 pagesL&T - Investor Presentation - Q2 FY201SCNo ratings yet

- Q2 FY17 Results Update: Power Grid: Company Details: Quarterly HighlightsDocument4 pagesQ2 FY17 Results Update: Power Grid: Company Details: Quarterly Highlightsnabamita pyneNo ratings yet

- RHB Equity 360° - 1 September 2010 (Benchmarking, Property, Semicon, O&G, Sunway City, Glomac, Maxis, Kurnia Asia, KPJ, KNM Technical: UMW)Document5 pagesRHB Equity 360° - 1 September 2010 (Benchmarking, Property, Semicon, O&G, Sunway City, Glomac, Maxis, Kurnia Asia, KPJ, KNM Technical: UMW)Rhb InvestNo ratings yet

- PERDANA - Research Hive - 13 Jan 2020Document2 pagesPERDANA - Research Hive - 13 Jan 2020JazzyNo ratings yet

- Af 313 Q&a KiraDocument88 pagesAf 313 Q&a Kiraannampunga25No ratings yet

- CTOS Digital (CTOS MK/HOLD/RM1.54/Target: RM1.34) : Malaysia DailyDocument3 pagesCTOS Digital (CTOS MK/HOLD/RM1.54/Target: RM1.34) : Malaysia DailyaimanNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- PWRWELL - Research Hive - 27 May 2020Document2 pagesPWRWELL - Research Hive - 27 May 2020JazzyNo ratings yet

- FPGROUP - Research Hive - 14 Feb 2020Document2 pagesFPGROUP - Research Hive - 14 Feb 2020JazzyNo ratings yet

- KSL - Research Hive - 18 May 2020Document2 pagesKSL - Research Hive - 18 May 2020JazzyNo ratings yet

- ANCOM - Research Hive - 13 May 2020Document2 pagesANCOM - Research Hive - 13 May 2020JazzyNo ratings yet

- MEDIAC - Research Hive - 21 Apr 2020Document2 pagesMEDIAC - Research Hive - 21 Apr 2020JazzyNo ratings yet

- MUIPROP - Research Hive - 17 Feb 2020Document2 pagesMUIPROP - Research Hive - 17 Feb 2020JazzyNo ratings yet

- PERDANA - Research Hive - 13 Jan 2020Document2 pagesPERDANA - Research Hive - 13 Jan 2020JazzyNo ratings yet

- KIPREIT - Research Hive - 12 March 2020Document2 pagesKIPREIT - Research Hive - 12 March 2020JazzyNo ratings yet

- RCE - Research Hive - 13 Feb 2020Document2 pagesRCE - Research Hive - 13 Feb 2020JazzyNo ratings yet

- DAYANG - Research Hive - 21 Jan 2020Document2 pagesDAYANG - Research Hive - 21 Jan 2020JazzyNo ratings yet

- FGV - Research Hive - 06 Jan 2020Document2 pagesFGV - Research Hive - 06 Jan 2020JazzyNo ratings yet

- KPJ - Research Hive - 5 Feb 2020Document2 pagesKPJ - Research Hive - 5 Feb 2020JazzyNo ratings yet

- RGB - Research Hive - 30 Jan 2020Document2 pagesRGB - Research Hive - 30 Jan 2020JazzyNo ratings yet

- TRIMODE - Research Hive - 8 Feb 2021Document2 pagesTRIMODE - Research Hive - 8 Feb 2021JazzyNo ratings yet

- KGB - Research Hive - 6 Aug 2020Document2 pagesKGB - Research Hive - 6 Aug 2020JazzyNo ratings yet

- Thematic-210208-Around The World in 18 ChartsDocument6 pagesThematic-210208-Around The World in 18 ChartsJazzyNo ratings yet

- TALIWRK - Research Hive - 2 Dec 2020Document2 pagesTALIWRK - Research Hive - 2 Dec 2020JazzyNo ratings yet

- MAHSING - Research Hive - 26 Jan 2021Document2 pagesMAHSING - Research Hive - 26 Jan 2021JazzyNo ratings yet

- TCS - Research Hive - 11 Jan 2021Document2 pagesTCS - Research Hive - 11 Jan 2021JazzyNo ratings yet

- RCE - Research Hive - 8 Oct 2020Document2 pagesRCE - Research Hive - 8 Oct 2020JazzyNo ratings yet

- Mah Sing Group BHD (Trading BUY)Document2 pagesMah Sing Group BHD (Trading BUY)JazzyNo ratings yet

- CCK - Research Hive - 26 Aug 2020Document2 pagesCCK - Research Hive - 26 Aug 2020JazzyNo ratings yet

- ASIAPLY - Research Hive - 17 Nov 2020Document2 pagesASIAPLY - Research Hive - 17 Nov 2020JazzyNo ratings yet

- BSTEAD - Research Hive - 22 Sept 2020Document2 pagesBSTEAD - Research Hive - 22 Sept 2020JazzyNo ratings yet

- OPTIMAX - Research Hive - 3 Sept 2020Document2 pagesOPTIMAX - Research Hive - 3 Sept 2020JazzyNo ratings yet

- Movie Review of THORDocument8 pagesMovie Review of THORSiva LetchumiNo ratings yet

- Marketing Measurement Done RightDocument16 pagesMarketing Measurement Done RightWasim Ullah0% (1)

- Wa200-8 Venss06304 1904 PDFDocument24 pagesWa200-8 Venss06304 1904 PDFOktiano BudiNo ratings yet

- Construction of Perimeter Fence of BFP NHQ PDFDocument133 pagesConstruction of Perimeter Fence of BFP NHQ PDFYalla ChaitanyaNo ratings yet

- Musk Founded Space Exploration Technologies Corporation, or Spacex, in 2002 With TheDocument4 pagesMusk Founded Space Exploration Technologies Corporation, or Spacex, in 2002 With TheLauren Harris0% (1)

- Panel Hospital List IGIDocument6 pagesPanel Hospital List IGIAbdul RahmanNo ratings yet

- Helical Coil FlowDocument4 pagesHelical Coil FlowAshish VermaNo ratings yet

- p1632 eDocument4 pagesp1632 ejohn saenzNo ratings yet

- Syllabus - Building Rehabilitation Anfd Forensic en - 220825 - 181244Document3 pagesSyllabus - Building Rehabilitation Anfd Forensic en - 220825 - 181244M O H A N A V E LNo ratings yet

- Case Study Presentation - CGDocument37 pagesCase Study Presentation - CGapi-290866384No ratings yet

- Business English ExerciseDocument11 pagesBusiness English ExerciseAdeline KwanNo ratings yet

- WHITE TOWN GROUP-4 FinalDocument112 pagesWHITE TOWN GROUP-4 Finalaswath manojNo ratings yet

- DTS Nozzles R3Document2 pagesDTS Nozzles R3meilia teknikNo ratings yet

- Program Logic FormulationDocument69 pagesProgram Logic FormulationIan OffemariaNo ratings yet

- Srinivasa Ramanujan - Britannica Online EncyclopediaDocument2 pagesSrinivasa Ramanujan - Britannica Online EncyclopediaEvariste MigaboNo ratings yet

- CR-805 Retransfer PrinterDocument2 pagesCR-805 Retransfer PrinterBolivio FelizNo ratings yet

- CfoDocument13 pagesCfocarmen pirvanNo ratings yet

- Digital ThermometerDocument12 pagesDigital Thermometershahpatel19No ratings yet

- Modal Verbs of Ability and PossibilityDocument12 pagesModal Verbs of Ability and PossibilitymslolinrNo ratings yet

- E Commerce and Its Influence in Changing in Purchasing Behavior of Modern ConsumersDocument13 pagesE Commerce and Its Influence in Changing in Purchasing Behavior of Modern ConsumersRichard VillanuevaNo ratings yet

- Architecture of Neural NWDocument79 pagesArchitecture of Neural NWapi-3798769No ratings yet

- Epidemiological Triad of HIV/AIDS: AgentDocument8 pagesEpidemiological Triad of HIV/AIDS: AgentRakib HossainNo ratings yet

- AC7140 Rev CDocument73 pagesAC7140 Rev CRanga100% (1)

- Management Glossary - Musa KamawiDocument50 pagesManagement Glossary - Musa KamawiKazi Nazrul IslamNo ratings yet

- Keira Knightley: Jump To Navigation Jump To SearchDocument12 pagesKeira Knightley: Jump To Navigation Jump To SearchCrina LupuNo ratings yet

- AMX Prodigy Install ManualDocument13 pagesAMX Prodigy Install Manualsundevil2010usa4605No ratings yet

- Subsea Pipeline Job DescriptionDocument2 pagesSubsea Pipeline Job DescriptionVijay_DamamNo ratings yet

- CA-idms Ads Alive User Guide 15.0Document142 pagesCA-idms Ads Alive User Guide 15.0svdonthaNo ratings yet

- Memo ALS Literacy MappingDocument4 pagesMemo ALS Literacy MappingJEPH BACULINANo ratings yet

- Summary of The Pilot ProjectDocument46 pagesSummary of The Pilot ProjectSrinivasan JeganNo ratings yet