Professional Documents

Culture Documents

Single Entry System

Uploaded by

Kaila Mae Tan DuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Single Entry System

Uploaded by

Kaila Mae Tan DuCopyright:

Available Formats

Single entry system

o System of record keeping in w/c transactions are not analyzed and recorded in the

double entry framework

o When records are incomplete

o Records maintained are represented only by the so-called “bare essentials”

o Normally includes a record of cash, AR, AP, PPE and taxes paid

o Major record under the single entry system: cashbook

Maintained showing all receipts and disbursements

o And because no specific accounts for the receipts and disbursements are debited or

credited

Only a description is made

With respect to AR and AP – only a list of customers and creditors is made with

their corresponding balances

Single entry method

o Compare the capital or retained earnings at the beginning of the year and capital and

retained earnings at the end of the same year after taking into consideration

withdrawals or dividends and additional investments

Difference is either net income or net loss

o Net assets approach or capital maintenance approach

Formula for proprietorship or partnership

Capital, end of the year XX

Add: Withdrawals XX

Total XX

Less: Capital, beginning of year XX

Additional Investments XX XX

Net income (loss) XX

Formula for corporation

Retained earnings, end XX

Add: Dividends declared or paid XX

Other items that decrease the retained earnings

But not profit or loss XX XX

Total XX

Less: RE, beg. XX

Other items that increase retained earnings but not

Profit or loss XX

Net income (loss) XX

Increase in assets and decrease in liabilities

o Increase net assets

Increase in liabilities and decrease in assets

o Decrease net assets

Dividend paid

o Added back to net assets because it decreased net assets but not representing profit or

loss

Increase in share capital and increase in share premium

o Deducted because they increased net assets but not representing profit or loss

Preparation of Financial Statements

o Involves the computation of individual revenue and expense balances by reference to

cash receipts and disbursements and the change in assets and liabilities

o Formulas used in converting cash basis to accrual basis of accounting

Involve the computation of

Sales

Purchases

Income other than sales

Expenses in general

o Statement of Financial position

Involves inventorying, counting and verification procedures to determine the

nature and amount of most assets and liabilities

o Accounts and notes receivable

Summarized from unpaid sales invoices and promissory notes

o Merchandise on hand, supplies and other inventories

Could be counted and their cost determined from purchase invoices

o Cost of PPE

Established by reference to deeds of sale and other documents evidencing

ownership of title

o Accounts and notes payable

Determined from purchase invoices, memoranda, correspondence and even

consultation with creditors

o Ownership equity or capital

Difference between the value assigned to assets and liabilities

You might also like

- Borris 1040 1Document2 pagesBorris 1040 1api-581728153100% (3)

- I'm Seller: CVV + Dumps + Track1&2 Paypal + Do WU Transfer + Bank Login + SMTP + RDP + Sell Software + Ship All CountryDocument4 pagesI'm Seller: CVV + Dumps + Track1&2 Paypal + Do WU Transfer + Bank Login + SMTP + RDP + Sell Software + Ship All Countrydavid2525% (4)

- Statement of Cash FlowsDocument33 pagesStatement of Cash FlowsKyriye OngilavNo ratings yet

- Clover Go ContractDocument9 pagesClover Go Contracttaoacu20000% (1)

- The Income StatementDocument48 pagesThe Income StatementtheresourceshelfNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Advance Financial Management - Financial Tools - Written ReportDocument36 pagesAdvance Financial Management - Financial Tools - Written Reportgilbertson tinioNo ratings yet

- Tiderc Drac (Credit Card)Document74 pagesTiderc Drac (Credit Card)Abhijeet KulshreshthaNo ratings yet

- IAS-7 Cash Flow StatementDocument36 pagesIAS-7 Cash Flow StatementSumon MonNo ratings yet

- Notes To Financial StatementsDocument9 pagesNotes To Financial StatementsCheryl FuentesNo ratings yet

- Tax Digest 1Document2 pagesTax Digest 1Nikko Sterling100% (2)

- Financial Statements: An OverviewDocument34 pagesFinancial Statements: An OverviewMUSTAFA KAMAL BIN ABD MUTALIP / BURSAR100% (1)

- Analytical Income Statement and Balance SheetDocument38 pagesAnalytical Income Statement and Balance SheetSanjayNo ratings yet

- Bir Form 1904Document2 pagesBir Form 1904Kate Brzezinska50% (4)

- FinAcct Module 5 AssDocument2 pagesFinAcct Module 5 AssShaliqah Xalyqa Rizzah MacabalangNo ratings yet

- Statement of Cash FlowsDocument18 pagesStatement of Cash FlowsBon juric Jr.No ratings yet

- Preparation of Financial StatementsDocument34 pagesPreparation of Financial StatementspriyankaNo ratings yet

- Corporation - Transactions Subsequent To FormationDocument7 pagesCorporation - Transactions Subsequent To FormationJohncel Tawat100% (1)

- 01 Accounting Study NotesDocument8 pages01 Accounting Study NotesJonas ScheckNo ratings yet

- Statement of Cash FLowsDocument44 pagesStatement of Cash FLowsNeerunjun HurlollNo ratings yet

- Chapter OneDocument35 pagesChapter OnesasaNo ratings yet

- Chapter 21Document2 pagesChapter 21Wassim AlwanNo ratings yet

- LAS ABM - FABM12 Ie 9 Week 4Document7 pagesLAS ABM - FABM12 Ie 9 Week 4ROMMEL RABONo ratings yet

- Class Notes - Non Profit Making OrganizationsDocument10 pagesClass Notes - Non Profit Making OrganizationsmahmoudfatahabukarNo ratings yet

- Ita - Chapter 1Document12 pagesIta - Chapter 1Ali aliNo ratings yet

- Lecture 1Document119 pagesLecture 1Yucel BozbasNo ratings yet

- Cash Flow Statement 2019 HL Question Worked SolutionDocument5 pagesCash Flow Statement 2019 HL Question Worked SolutionConor MurphyNo ratings yet

- Cfas Report Pas 1 & 7Document57 pagesCfas Report Pas 1 & 7sean lawrenceNo ratings yet

- Afa 5Document5 pagesAfa 5akash raymondNo ratings yet

- FR Group Lesson 1Document16 pagesFR Group Lesson 1Adebola OguntayoNo ratings yet

- Unit 2 - 04 - Balance Sheet & Income StatementDocument45 pagesUnit 2 - 04 - Balance Sheet & Income Statementbabitjha664No ratings yet

- Single EntryDocument26 pagesSingle EntryMac b IBANEZNo ratings yet

- Subect: Accountancy CLASS: XII (SESSION 2020-21) Unit 1 - Financial Statements of Not-For-The-Profit Organisations Handout - 1Document2 pagesSubect: Accountancy CLASS: XII (SESSION 2020-21) Unit 1 - Financial Statements of Not-For-The-Profit Organisations Handout - 1ayeshaNo ratings yet

- Lesson 04 - Cash Flow StatementDocument5 pagesLesson 04 - Cash Flow Statementpulitha kodituwakkuNo ratings yet

- NpoDocument17 pagesNpoLeila OuanoNo ratings yet

- Financial Statement Analysis For Decision MakingDocument10 pagesFinancial Statement Analysis For Decision Makingihs2107No ratings yet

- The Cashflow StatementDocument17 pagesThe Cashflow StatementNdumiso MsizaNo ratings yet

- Cash Flow Statement - Lecture 6-8Document41 pagesCash Flow Statement - Lecture 6-8SHIVA THAVANI100% (1)

- Accounting For NPO PDFDocument31 pagesAccounting For NPO PDFNicole TaylorNo ratings yet

- Statement of Comprehensive IncomeDocument13 pagesStatement of Comprehensive IncomeJethro RafaNo ratings yet

- Financial StatementsDocument6 pagesFinancial Statementsnatasha dikolaNo ratings yet

- Bad Debts and Provision For Doubtful Debts Bad DebtsDocument28 pagesBad Debts and Provision For Doubtful Debts Bad DebtsAngel LawsonNo ratings yet

- Current Assets On The Balance Sheet: Raw Materials Work in Process Finished GoodsDocument2 pagesCurrent Assets On The Balance Sheet: Raw Materials Work in Process Finished GoodsAraNo ratings yet

- Financial Statement AnalysisDocument54 pagesFinancial Statement AnalysisSMILE ANIMATIONNo ratings yet

- Topic One, Non For ProfitDocument10 pagesTopic One, Non For Profitmichaelkanje28No ratings yet

- Cashflow StatementsDocument4 pagesCashflow Statementsfaith bakasaNo ratings yet

- Cash Flow Statements6Document28 pagesCash Flow Statements6kimuli FreddieNo ratings yet

- Dac 511: Corporate Financial Reporting & Analysis Group 5 Cash Flow AnalysisDocument44 pagesDac 511: Corporate Financial Reporting & Analysis Group 5 Cash Flow AnalysisJan Dave Ogatis100% (1)

- Statement of Cash Flow Chapter 2Document10 pagesStatement of Cash Flow Chapter 2Mary Ann PacilanNo ratings yet

- Left Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer TwoDocument6 pagesLeft Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer Twoamberle smithNo ratings yet

- Company Accounts To StudentsDocument14 pagesCompany Accounts To StudentsIRUNGU BRENDA MURUGINo ratings yet

- FAC1502 - Study Unit 3 - 2023Document11 pagesFAC1502 - Study Unit 3 - 2023Olwethu PhikeNo ratings yet

- Unit 5Document37 pagesUnit 5Rej HaanNo ratings yet

- Finals - Fina 221Document14 pagesFinals - Fina 221MARITONI MEDALLANo ratings yet

- Cash Flow StatementDocument46 pagesCash Flow StatementSiraj Siddiqui100% (1)

- Lecture 4 - Income StatementDocument78 pagesLecture 4 - Income StatementMutesa ChrisNo ratings yet

- Financial Statements: An OverviewDocument41 pagesFinancial Statements: An OverviewGaluh Boga Kuswara100% (1)

- Financial Statements, Cash Flow, and Taxes: Answers To End-Of-Chapter QuestionsDocument3 pagesFinancial Statements, Cash Flow, and Taxes: Answers To End-Of-Chapter Questionstan lee hui100% (1)

- Small Company Limited Report and Accounts 31 December 2007: Registered Number 123456Document21 pagesSmall Company Limited Report and Accounts 31 December 2007: Registered Number 123456Salman ZiaNo ratings yet

- Financial Statements Receipts & Payments A/c Income & Expenditure A/c Balance SheetDocument14 pagesFinancial Statements Receipts & Payments A/c Income & Expenditure A/c Balance SheetAnita YadavNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2Document2 pagesFundamentals of Accountancy, Business, and Management 2Accounting StuffNo ratings yet

- Finanancial Statements NotesDocument10 pagesFinanancial Statements Notespetco95No ratings yet

- A Lecture6 9 29 22Document46 pagesA Lecture6 9 29 22by ScribdNo ratings yet

- Topic 4 Accounting For Non Profit Making EntitiesDocument17 pagesTopic 4 Accounting For Non Profit Making Entitiestwahirwajeanpierre50No ratings yet

- Final Accounts/Financial Statements: MeaningDocument8 pagesFinal Accounts/Financial Statements: MeaningLipika haldarNo ratings yet

- Linear Programming ReviewerDocument4 pagesLinear Programming ReviewerKaila Mae Tan DuNo ratings yet

- Quarterly Value-Added Tax Return: DLN: PsicDocument2 pagesQuarterly Value-Added Tax Return: DLN: PsicKaila Mae Tan DuNo ratings yet

- PD 679 - Unclaimed Balances ActDocument3 pagesPD 679 - Unclaimed Balances ActKaila Mae Tan DuNo ratings yet

- Chapter 34Document10 pagesChapter 34Kaila Mae Tan DuNo ratings yet

- Chap 31-32Document5 pagesChap 31-32Kaila Mae Tan DuNo ratings yet

- Chapter 8 - TaxationDocument20 pagesChapter 8 - TaxationKaila Mae Tan DuNo ratings yet

- 2020 Sept 1 Accumulated Depreciation 102,028 Interest Expense 2,268 Lease Liability 22,732 Loss On Finance Lease 117,840 Right of Use Asset 244,868Document1 page2020 Sept 1 Accumulated Depreciation 102,028 Interest Expense 2,268 Lease Liability 22,732 Loss On Finance Lease 117,840 Right of Use Asset 244,868Kaila Mae Tan DuNo ratings yet

- 1 3Document1 page1 3Kaila Mae Tan DuNo ratings yet

- 1 3Document1 page1 3Kaila Mae Tan DuNo ratings yet

- Annual Payments 23,981.62 PV of Annuity in Advance at 10% For 5 Years 4.1699 Right of Use Asset 100,000.96Document1 pageAnnual Payments 23,981.62 PV of Annuity in Advance at 10% For 5 Years 4.1699 Right of Use Asset 100,000.96Kaila Mae Tan DuNo ratings yet

- Getting Paid Math 2.3.9.A1Document3 pagesGetting Paid Math 2.3.9.A1Aethan King AveNo ratings yet

- Cash DepositsDocument4 pagesCash DepositsAnne Schindler100% (1)

- 1-61339289563 G0060858057Document8 pages1-61339289563 G0060858057Shahaan ZulfiqarNo ratings yet

- Tamil Nadu Tax On Professions, Trades, Callings and Employments Act, 1992Document23 pagesTamil Nadu Tax On Professions, Trades, Callings and Employments Act, 1992Latest Laws Team100% (2)

- SwiftDocument3 pagesSwiftvhauamirNo ratings yet

- Canapi - 04 Quiz 1Document2 pagesCanapi - 04 Quiz 1sora fpsNo ratings yet

- Booking Confirmation On IRCTC, Train: 15028, 04-Jan-2022, SL, GKP - CPRDocument1 pageBooking Confirmation On IRCTC, Train: 15028, 04-Jan-2022, SL, GKP - CPRRajat SrivastavNo ratings yet

- ECON 3410 - Money and Payment SystemDocument39 pagesECON 3410 - Money and Payment SystemAysha KamalNo ratings yet

- La Frutera vs. CIRDocument1 pageLa Frutera vs. CIRMaricar Corina CanayaNo ratings yet

- I AnnexureDocument4 pagesI AnnexureRiSHI KeSH GawaINo ratings yet

- ACC 4711 ACC 4611 AY 2021-2022 S1 Detailed Weekly Schedule - Updated 31 Jul 2021Document2 pagesACC 4711 ACC 4611 AY 2021-2022 S1 Detailed Weekly Schedule - Updated 31 Jul 2021Chloe NgNo ratings yet

- Unauthorized Ach DebitDocument3 pagesUnauthorized Ach DebitSui JurisNo ratings yet

- Sample: Annual Escrow Account Statement Sample ONLYDocument2 pagesSample: Annual Escrow Account Statement Sample ONLYjohnbombomNo ratings yet

- Example of Financial ReportDocument4 pagesExample of Financial Reportaufar syehanNo ratings yet

- Kshatriya Foods MokDocument13 pagesKshatriya Foods MokAzharNo ratings yet

- 93-05 - Estate and Trust TaxationDocument6 pages93-05 - Estate and Trust TaxationJuan Miguel UngsodNo ratings yet

- Sales Receipt Accurate - Maret 2014Document26 pagesSales Receipt Accurate - Maret 2014Rinaldi SinagaNo ratings yet

- Payroll Chapter 2 (SPOONFEED)Document16 pagesPayroll Chapter 2 (SPOONFEED)Isaiah Jacob CarolinoNo ratings yet

- Chapter 5 - Labor Accounting - Control and Costing Timekeeping ProceduresDocument6 pagesChapter 5 - Labor Accounting - Control and Costing Timekeeping ProceduresKhai Ed PabelicoNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSoumyadeep RoyNo ratings yet

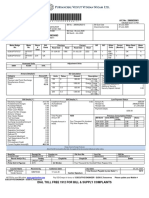

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocument1 pagePrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsLearning WebsiteNo ratings yet

- A History of Tax and Taxation in Colonial ZambiaDocument3 pagesA History of Tax and Taxation in Colonial Zambiamuna moono100% (1)

- IBM Salary CalculatorDocument11 pagesIBM Salary Calculatorapi-3817239100% (7)

- Written Report Special Treatment of Fringe Benefits FINAL....Document13 pagesWritten Report Special Treatment of Fringe Benefits FINAL....SANTIAGO CHESKAMAE OQUIANo ratings yet