Professional Documents

Culture Documents

Cotton Marketing News

Uploaded by

Morgan IngramOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cotton Marketing News

Uploaded by

Morgan IngramCopyright:

Available Formats

REPRESENTING COTTON GROWERS THROUGHOUT ALABAMA, FLORIDA, GEORGIA, NORTH CAROLINA, SOUTH CAROLINA, AND VIRGINIA

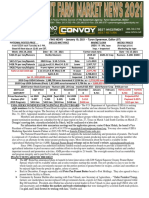

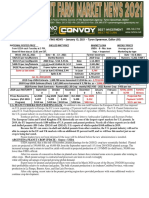

COTTON MARKETING NEWS

Volume 19, No. 4 February 12, 2021

numbers, my first reaction was that some of the decreases seemed

Sponsored by small given all the high corn and soybean price talk recently. But then

we have to remember that cotton acreage was down in 2020 already.

There is little doubt that corn, soybeans, grain sorghum, and peanuts

Good and Eventful Week Still Leaves Questions and Uncertainty may take acres from cotton in some situations. I know here in

Georgia, for example, with our strong basis on corn, corn acres are

Cotton prices have been highly variable (wild) over the past week or very likely to increase. I am told that peanut prices are also up and

more with triple digit moves up and down for 6 consecutive days Feb attractive. But rotation may be an issue in some cases.

4-11. Typically, this can be a sign of market surprises (good or bad)

and/or nervousness.

Crop Price Ratios

Prices continued up today with old crop March futures breaking 87 2021 Crop Futures 2020 Crop

cents and new crop December just under 84 cents. Crop 12/11/20 01/11/21 02/11/21 02/10/20

Cotton (Dec) $0.7237 $0.7660 $0.8378 $0.7248

Corn (Dec) $4.12 $4.41 $4.52 $4.03

Soybeans (Nov) $10.53 $11.55 $11.74 $9.19

Corn/Cotton 5.69 5.76 5.40 5.56

Sbeans/Cotton 14.55 15.08 14.01 12.68

Both corn and soybeans have lost ground to cotton over the past

month based on comparative prices (price ratios have declined). The

current price ratios are better than last year this time for soybeans

but lower for corn.

This week’s export report yesterday showed shipments the highest

yet for the year. But sales were down for the second week in a row.

On Tuesday, USDA released its monthly US and World supply/demand

projections for February.

It was expected the size of the 2020 US crop might be revised down

slightly. It was not and remains at 14.95 million bales.

As hoped and expected, US exports for the 2020 crop marketing

year were raised from 15.25 to 15.5 million bales. It is possible and

likely this could be raised more in future reports.

US ending stocks were trimmed 300,000 bales.

World production was raised a net 1.27 million bales. China’s

production for 2020 was raised 1.5 million bales.

But offsetting this, World demand/Use was raised 1.48 million

bales from the January estimate. Increases were made for India,

China, Turkey, Pakistan, and Bangladesh.

Imports for China, even with the higher production, were increased

½ million bales.

It’s worth noting that China’s ending stocks are now raised 1 million

bales from the January estimate. The USDA Outlook Forum will be held next week Feb 18-19. This will

be the first look at US and World forecasts for the 2021 crop. Key

On Wednesday, the National Cotton Council released results of their factors will include the demand/Use outlook for the 2021 crop year.

2021 planting intentions survey. Individual state numbers were

released on Thursday. The survey suggests that the US will plant Cotton Economist-Retired

11.47 million acres this year—down 5.2%. It has been expected that Professor Emeritus of Cotton Economics

acres will likely be down this year so this should come as no surprise.

The move to 80 cents could impact that. Looking at individual state

You might also like

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Morgan IngramNo ratings yet

- Peanut Marketing News - January 22, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - January 22, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument2 pagesCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Morgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Broiler Hatchery 01-06-21Document2 pagesBroiler Hatchery 01-06-21Morgan IngramNo ratings yet

- Cit 0121Document4 pagesCit 0121Morgan IngramNo ratings yet

- 1,000 Acres Pounds/Acre TonsDocument1 page1,000 Acres Pounds/Acre TonsMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Answer To The Question From The BookDocument11 pagesAnswer To The Question From The BookCindy KimNo ratings yet

- Stoffers BA BMSDocument101 pagesStoffers BA BMSpendejitusNo ratings yet

- State of The Industry 2022 TRADocument52 pagesState of The Industry 2022 TRAAndrew Lymn-PenningNo ratings yet

- Shorter - Strategic Tools - Efe Ife Ie Space BCG QSPMDocument23 pagesShorter - Strategic Tools - Efe Ife Ie Space BCG QSPMUTTAM KOIRALANo ratings yet

- Yum S Equity Research Report 1661623813Document20 pagesYum S Equity Research Report 1661623813Javier ChanNo ratings yet

- Agri CHAPTER 3 and 4Document22 pagesAgri CHAPTER 3 and 4Girma UniqeNo ratings yet

- Kogta Financial (India) LTDDocument3 pagesKogta Financial (India) LTDAnandNo ratings yet

- Confirmed Divergence Manual PDFDocument57 pagesConfirmed Divergence Manual PDFDigitsmarterNo ratings yet

- Compute and Account For The Initial Capital Contribution of The Partners in The PartnershipDocument5 pagesCompute and Account For The Initial Capital Contribution of The Partners in The PartnershipKathleenNo ratings yet

- Economics For Today Asia Pacific 5th Edition Layton Test BankDocument34 pagesEconomics For Today Asia Pacific 5th Edition Layton Test Banklovellednayr984100% (27)

- Introduction To Corporate Finance: Fourth EditionDocument48 pagesIntroduction To Corporate Finance: Fourth EditionTyler NielsenNo ratings yet

- Ajio FL0134368404 1582910716162 PDFDocument1 pageAjio FL0134368404 1582910716162 PDFNidhi ChuletNo ratings yet

- KTS Free Ver 2Document16 pagesKTS Free Ver 2Nam NguyenNo ratings yet

- PayrollDocument3 pagesPayrolldesiree joy corpuz100% (1)

- PAMB Medical Revision-35376814 PDFDocument9 pagesPAMB Medical Revision-35376814 PDFSoon SoonNo ratings yet

- The Interest Rate On Your Savings Account Is Going Down Soon - 01072020Document2 pagesThe Interest Rate On Your Savings Account Is Going Down Soon - 01072020PawełNo ratings yet

- Company Law Case Laws - 2020 & 2021Document18 pagesCompany Law Case Laws - 2020 & 2021Dr A. K. SubramaniNo ratings yet

- AlbertvilleBoazGuntersville - AL - 2023Document93 pagesAlbertvilleBoazGuntersville - AL - 2023ravee12No ratings yet

- Statement of Axis Account No:922010061271618 For The Period (From: 07-08-2023 To: 06-02-2024)Document23 pagesStatement of Axis Account No:922010061271618 For The Period (From: 07-08-2023 To: 06-02-2024)vijaypsymaNo ratings yet

- Ii Puc AccountsDocument3 pagesIi Puc AccountsShekarKrishnappaNo ratings yet

- Book 1Document6 pagesBook 1Naveen BishtNo ratings yet

- RFB ReviewerDocument99 pagesRFB ReviewerAmpy SasutonaNo ratings yet

- MSBA7004 2023 - Class 1 - Intro To Operations Analytics - BeforeclassDocument51 pagesMSBA7004 2023 - Class 1 - Intro To Operations Analytics - Beforeclasslucie.xu.yimei100% (1)

- Time Value of Money: Instructor: Ajab Khan BurkiDocument86 pagesTime Value of Money: Instructor: Ajab Khan BurkiGaurav KarkiNo ratings yet

- FinanceDocument6 pagesFinancecharlie tunaNo ratings yet

- The Social Economy in The UK: Roger Spear, CRU, Open University, UKDocument20 pagesThe Social Economy in The UK: Roger Spear, CRU, Open University, UKjisanus5salehinNo ratings yet

- PNJ Final 2Document22 pagesPNJ Final 2Nguyễn Quỳnh HươngNo ratings yet

- Fact-Sheet 20191230 08 Idxbumn20 PDFDocument1 pageFact-Sheet 20191230 08 Idxbumn20 PDFvivafatma92No ratings yet

- Agrani Bank LTD.: Statement of AccountDocument2 pagesAgrani Bank LTD.: Statement of AccountBeximco Computers LTDNo ratings yet

- Genting Malaysia BerhadDocument13 pagesGenting Malaysia BerhadNur Athirah Binti Mahdir100% (1)