Professional Documents

Culture Documents

N. Narayanan v. Adjudicating Officer, SEBI: Facts in Brief

Uploaded by

AVNISH PRAKASHOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

N. Narayanan v. Adjudicating Officer, SEBI: Facts in Brief

Uploaded by

AVNISH PRAKASHCopyright:

Available Formats

N.

Narayanan v. Adjudicating Officer, SEBI

<(2013) 12 SCC 152> | <Division Bench - K.S. Radhakrishnan, Dipak Misra> | <Supreme Court of India>

Facts in brief

The appellant was the promoter as well as a whole time Director of M/s Pyramid Saimira

Theatre Limited (PSTL), a company registered under the Companies Act, 1956. The

shares of PSTL were listed on Bombay Stock Exchange Ltd. (BSE) and National Stock

Exchange (NSE) at the relevant time. The company was involved in the business of

Exhibition (Theatre), Film and Television, Content Production, Distribution, Hospitality,

Food & Beverage, Animation and Gaming and Cine Advertising etc. The company had

nine Directors, including the appellant herein. The investigation department of SEBI

noticed that the company had committed serious irregularities in its books of accounts and

showed inflated profits and revenues in the financial statements and lured the general

public to invest in the shares of the company based on such false financial statements

thereby violated the provisions of Securities and Exchange Board of India (Prohibition of

Fraudulent and Unfair Trade Practice Relating to Securities Market) Regulations, 2003

(for short ‘Regulations 2003’). Consequently, a notice was issued to the appellant and to

the other Directors stating that they had violated Section 12A of SEBI Act and Regulation

3(b), 3(c), 3(d), 4(1), 4(2)(a), 4(2)(e), 4(2)(f), 4(2)(k), 4(2)(r) of Regulations 2003 and

were directed to show cause why appropriate directions as deemed fit and proper under

Sections 11, 11B and 11(4) of the SEBI Act read with Regulation 11 of Regulations 2003

be not issued against them.

Response of the Appellant

The appellant said that although he was the Whole Time Director as well as Promoter of

the company, yet was not involved in the day-to-day management of the company and that

he was looking after the Human Resource Department of the company. Further, it was also

stated that the financial statements, accounts etc. were prepared and duly audited by the

statutory auditors, verified by the audit committees and reviewed by the managing

Director and that, in the company, the role of each Director was confined to his field of

operation.

Judgement of the Court

Court on defence taken by WTM

The appellant has taken the stand, as already stated, that even though he was a whole time

Director he was not conversant with the accounts and finance and was only dealing with

the human resource management of the company, hence, he had no fraudulent intention to

deceive the investors. We find it difficult to accept the contention. The appellant,

admittedly, was a whole time Director of the company, as regards the preparation of the

annual accounts, the balance-sheet and financial statement and laying of the same before

the company at the Annual General Meeting and filing the same before the Registrar of the

Companies as well as before SEBI, the Directors of the company have greater

responsibility, especially when the company is a registered company. Directors of the

companies, especially of the listed companies, have access to inside knowledge, such as,

financial position of the company, dividend rates, annual accounts etc. Directors are

expected to exercise the powers for the purposes for which they are conferred. Sometimes

they may misuse their powers for their personal gain and makes false representations to

the public for unlawful gain.

Final Decision

Above being the factual and legal position, we are of the view that the SEBI has rightly

restrained the appellant for a period of two years from the date of that order from buying,

selling or dealing with any securities, in any manner, or accessing the securities market,

directly or indirectly and from being Director of any listed company and that the

adjudicating officer has rightly imposed a penalty of Rs.50 lakhs under Section 15HA of

SEBI Act. The appeals are, therefore, dismissed. However, there will be no order as to

costs.

You might also like

- Kumar Mangalam Birla CommitteeDocument52 pagesKumar Mangalam Birla CommitteeVijay Srinivas KukkalaNo ratings yet

- Exchange Board of India, Has Held That "Administrative Orders Such As Circulars Issued UnderDocument6 pagesExchange Board of India, Has Held That "Administrative Orders Such As Circulars Issued UnderSubh AshishNo ratings yet

- TCase Analysis - N. Narayanan v. Adjudicating Officer, SEBIDocument9 pagesTCase Analysis - N. Narayanan v. Adjudicating Officer, SEBIdude100% (1)

- Order in The Matter of Asurre Agrowtech LimitedDocument44 pagesOrder in The Matter of Asurre Agrowtech LimitedShyam SunderNo ratings yet

- Writ Petition-Bank of Rajasthan-Latest ModifiedDocument51 pagesWrit Petition-Bank of Rajasthan-Latest ModifiedLive LawNo ratings yet

- Financial Markets Assignment Sem-2Document14 pagesFinancial Markets Assignment Sem-2Prerna BhansaliNo ratings yet

- Rights of shareholders to inspect booksDocument7 pagesRights of shareholders to inspect bookshardikgosaiNo ratings yet

- Interface Between IBC and SEBI Vis-A-Vis Collective Investment Scheme Under Section 11 AA, SEBI Act, 1992Document3 pagesInterface Between IBC and SEBI Vis-A-Vis Collective Investment Scheme Under Section 11 AA, SEBI Act, 1992Suprabh GargNo ratings yet

- Regulatory Framework of Securities LawsDocument24 pagesRegulatory Framework of Securities Lawsshivangidubey9415No ratings yet

- Hari Sankaran V UOI &others 2019 Indlaw SC 586Document9 pagesHari Sankaran V UOI &others 2019 Indlaw SC 586SAI SUVEDHYA RNo ratings yet

- Failure To Detect and Report The Scams That Took Place Involving IL&FS and Its 21 Entities When They Were The Auditors of The IL&FSDocument4 pagesFailure To Detect and Report The Scams That Took Place Involving IL&FS and Its 21 Entities When They Were The Auditors of The IL&FSJay NirupamNo ratings yet

- Topic 5Document2 pagesTopic 5Vishwas SharmaNo ratings yet

- Order Against The Past Director of Sunplant Forgings Limited Viz. Shri Ameet SinghDocument9 pagesOrder Against The Past Director of Sunplant Forgings Limited Viz. Shri Ameet SinghShyam SunderNo ratings yet

- Sahara JudgmentDocument270 pagesSahara JudgmentFirstpostNo ratings yet

- Order in Respect of Vee Realties India LimitedDocument26 pagesOrder in Respect of Vee Realties India LimitedShyam SunderNo ratings yet

- ILFS Auditors Case ExplainedDocument4 pagesILFS Auditors Case ExplainedPrince PathakNo ratings yet

- DLF V SEBIDocument5 pagesDLF V SEBINAMAN SHAHNo ratings yet

- Order in The Matter of Sai Prasad Properties LimitedDocument25 pagesOrder in The Matter of Sai Prasad Properties LimitedShyam SunderNo ratings yet

- Order in The Matter of Goldmine Food Products LimitedDocument15 pagesOrder in The Matter of Goldmine Food Products LimitedShyam SunderNo ratings yet

- SEBI's Role in Regulating Indian Capital MarketsDocument7 pagesSEBI's Role in Regulating Indian Capital MarketsKalpesh ThakurNo ratings yet

- SEBI's Role in Regulating Primary MarketsDocument13 pagesSEBI's Role in Regulating Primary Marketsrashi bakshNo ratings yet

- So Near IndDocument238 pagesSo Near Indniteshkumar sharmaNo ratings yet

- Objectives of IBCDocument4 pagesObjectives of IBCKRITI SRIVASTAVA 19213218No ratings yet

- Sonear IPO DetailsDocument238 pagesSonear IPO DetailsManjeet KhannaNo ratings yet

- Adjudication Order in The Matter of M/s Coromandel International Limited (Erstwhile Liberty Phosphate Limited) Page 1 of 9Document9 pagesAdjudication Order in The Matter of M/s Coromandel International Limited (Erstwhile Liberty Phosphate Limited) Page 1 of 9Shyam SunderNo ratings yet

- Civil Judge Sro 234Document24 pagesCivil Judge Sro 234aswinecebeNo ratings yet

- SEBI As A Capital Market RegulatorDocument22 pagesSEBI As A Capital Market RegulatorKamta Prasad SahuNo ratings yet

- CORPO RECIT 053023 (AutoRecovered)Document6 pagesCORPO RECIT 053023 (AutoRecovered)paul esparagozaNo ratings yet

- Suggestions For SECCDocument9 pagesSuggestions For SECCMoneylife FoundationNo ratings yet

- Failure To Detect and Report The Scams That Took Place Involving IL&FS and Its 21 Entities When They Were The Auditors of The IL&FSDocument4 pagesFailure To Detect and Report The Scams That Took Place Involving IL&FS and Its 21 Entities When They Were The Auditors of The IL&FSJay NirupamNo ratings yet

- Yours FaithfullyDocument15 pagesYours FaithfullyElena RaskNo ratings yet

- P13 Corporate Laws ComplianceDocument3 pagesP13 Corporate Laws Compliancekiran babuNo ratings yet

- CA Final Law Solution Nov 2015 by CS Tejpal ShethDocument9 pagesCA Final Law Solution Nov 2015 by CS Tejpal ShethAnjana AvoodaiappanNo ratings yet

- Chrissworld Limited IPO: Offering Details and Prospectus SummaryDocument71 pagesChrissworld Limited IPO: Offering Details and Prospectus SummaryjdNo ratings yet

- Order Against Ishita Consultancy Private LTD in Respect of Dealings in The Scrip of Riba Textiles LimitedDocument11 pagesOrder Against Ishita Consultancy Private LTD in Respect of Dealings in The Scrip of Riba Textiles LimitedShyam SunderNo ratings yet

- ElforgefinallofDocument170 pagesElforgefinallofDivya PinchaNo ratings yet

- Irac AnalysisDocument6 pagesIrac AnalysisVaishali RathiNo ratings yet

- Order in The Matter of Kukar Sons (Indo French) Exports Ltd.Document11 pagesOrder in The Matter of Kukar Sons (Indo French) Exports Ltd.Shyam SunderNo ratings yet

- Treasury Shares ExplainedDocument11 pagesTreasury Shares ExplainedMaristela Mark JezrelNo ratings yet

- CA9813 Sahara CombinedDocument263 pagesCA9813 Sahara CombinedmailtoashishNo ratings yet

- WTM/SR/CIS/WRO-ILO/ 45 / 03/2015: Page 1 of 16Document16 pagesWTM/SR/CIS/WRO-ILO/ 45 / 03/2015: Page 1 of 16Shyam SunderNo ratings yet

- Word FULLDocument7 pagesWord FULLfara_lianaNo ratings yet

- Order in The Matter of Lawa Coated Papers LimitedDocument2 pagesOrder in The Matter of Lawa Coated Papers LimitedShyam SunderNo ratings yet

- Interim Order in Respect of Ambitious Diversified Projects Management LimitedDocument15 pagesInterim Order in Respect of Ambitious Diversified Projects Management LimitedShyam SunderNo ratings yet

- U P & e S: B.a., Ll.b. (H .) eDocument5 pagesU P & e S: B.a., Ll.b. (H .) ePintu RaoNo ratings yet

- SEBI RegistrationDocument4 pagesSEBI RegistrationpiyushNo ratings yet

- Securities & Exchange Board of IndiaDocument36 pagesSecurities & Exchange Board of IndiamanpreetsinghmandayNo ratings yet

- 1 Ip DR VbsreddyDocument4 pages1 Ip DR VbsreddyvbsreddyNo ratings yet

- Interim Order Cum Show Cause Notice in The Matter of Real Sunshine Corp LimitedDocument11 pagesInterim Order Cum Show Cause Notice in The Matter of Real Sunshine Corp LimitedShyam SunderNo ratings yet

- EmpeerhpDocument286 pagesEmpeerhpsaraiyaaneeshNo ratings yet

- Roles Functions OF: & SebiDocument24 pagesRoles Functions OF: & SebiGourav GuptaNo ratings yet

- Title: Sahara V/s Sebi Case Analysis: Facts of The CaseDocument5 pagesTitle: Sahara V/s Sebi Case Analysis: Facts of The CaseSpotify tkadNo ratings yet

- SEBI Regulates Indian Capital MarketsDocument7 pagesSEBI Regulates Indian Capital MarketsAshish ThengariNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Total Raffinage CaseDocument69 pagesTotal Raffinage CaseAVNISH PRAKASHNo ratings yet

- Peróxidos Orgánicos, SA, Established in San Cugat Del Vallés (Spain), RepresentedDocument37 pagesPeróxidos Orgánicos, SA, Established in San Cugat Del Vallés (Spain), RepresentedAVNISH PRAKASHNo ratings yet

- Case 7Document20 pagesCase 7AVNISH PRAKASHNo ratings yet

- 2462020Document1 page2462020AVNISH PRAKASHNo ratings yet

- Suo Motu 04 of 2016Document29 pagesSuo Motu 04 of 2016AVNISH PRAKASHNo ratings yet

- Due To Paucity of Time, The Matter Could Not Be Taken Up. List The Appeal For Admission (Fresh Case) ' On 20 No. 2Document1 pageDue To Paucity of Time, The Matter Could Not Be Taken Up. List The Appeal For Admission (Fresh Case) ' On 20 No. 2AVNISH PRAKASHNo ratings yet

- 20320Document1 page20320AVNISH PRAKASHNo ratings yet

- Suo Motu 03 of 2016Document38 pagesSuo Motu 03 of 2016AVNISH PRAKASHNo ratings yet

- 562020Document2 pages562020AVNISH PRAKASHNo ratings yet

- In ReDocument50 pagesIn ReAVNISH PRAKASHNo ratings yet

- I.A. Filed by The Learned Counsel For Respondent No. 3 Is Taken On Record. List This Appeal Along With Interlocutory Application For Admission (After Notice) ' On 24Document1 pageI.A. Filed by The Learned Counsel For Respondent No. 3 Is Taken On Record. List This Appeal Along With Interlocutory Application For Admission (After Notice) ' On 24AVNISH PRAKASHNo ratings yet

- SSRN Id1968371Document20 pagesSSRN Id1968371AVNISH PRAKASHNo ratings yet

- 19.03.2020 Letter To Stock Exchange Regarding Initiation of CIRP ProcessDocument14 pages19.03.2020 Letter To Stock Exchange Regarding Initiation of CIRP ProcessAVNISH PRAKASHNo ratings yet

- The Present Information Has Been Filed by Mr. Ved Prakash Tripathi, ("Informant") On 04.03.2020 Under Section 19 (1) (A) of The Competition ActDocument6 pagesThe Present Information Has Been Filed by Mr. Ved Prakash Tripathi, ("Informant") On 04.03.2020 Under Section 19 (1) (A) of The Competition ActAVNISH PRAKASHNo ratings yet

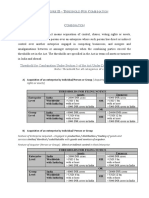

- Annexure II - CombinationDocument2 pagesAnnexure II - CombinationAVNISH PRAKASHNo ratings yet

- Annexure I - DefinitionsDocument4 pagesAnnexure I - DefinitionsAVNISH PRAKASHNo ratings yet

- Vizrt: 3D Real Time Graphic MarketDocument2 pagesVizrt: 3D Real Time Graphic MarketAVNISH PRAKASHNo ratings yet

- Mitigating NCLTDocument43 pagesMitigating NCLTAVNISH PRAKASHNo ratings yet

- Century Spinning and Manufacturing Company LTD ands700397COM885217Document5 pagesCentury Spinning and Manufacturing Company LTD ands700397COM885217AVNISH PRAKASHNo ratings yet

- Territorial Jurisdiction of Courts in IndiaDocument3 pagesTerritorial Jurisdiction of Courts in Indiakhushbu guptaNo ratings yet

- Peróxidos Orgánicos, SA, Established in San Cugat Del Vallés (Spain), RepresentedDocument37 pagesPeróxidos Orgánicos, SA, Established in San Cugat Del Vallés (Spain), RepresentedAVNISH PRAKASHNo ratings yet

- Case 1Document73 pagesCase 1AVNISH PRAKASHNo ratings yet

- Repographics NCLAT OrderDocument12 pagesRepographics NCLAT OrderAVNISH PRAKASHNo ratings yet

- Ipr All Nation GuideDocument273 pagesIpr All Nation GuideAVNISH PRAKASHNo ratings yet

- Total Raffinage CaseDocument69 pagesTotal Raffinage CaseAVNISH PRAKASHNo ratings yet

- Competition Law CaseDocument44 pagesCompetition Law CaseSatish kumarNo ratings yet

- India's First Day-Night TestDocument2 pagesIndia's First Day-Night TestAVNISH PRAKASHNo ratings yet

- India Men's Cricket Team HistoryDocument5 pagesIndia Men's Cricket Team HistoryAVNISH PRAKASHNo ratings yet

- Case 4Document77 pagesCase 4AVNISH PRAKASHNo ratings yet

- Discussion Paper On Blockchain Technology and Competition: April 2021Document49 pagesDiscussion Paper On Blockchain Technology and Competition: April 2021AVNISH PRAKASHNo ratings yet

- 1690894692Document263 pages1690894692Chetan KaleNo ratings yet

- D-STREET SEES BEST SAMVAT IN 12 YEARSDocument30 pagesD-STREET SEES BEST SAMVAT IN 12 YEARSAshu SinghNo ratings yet

- Mutual Fund AssignmentDocument51 pagesMutual Fund AssignmentKuljeet Singh83% (6)

- Inox ProspectusDocument537 pagesInox Prospectusgudachari4No ratings yet

- Cfdcir 04Document3 pagesCfdcir 04subodhmallyaNo ratings yet

- Order in The Matter of S.A.L. Steel Ltd.Document8 pagesOrder in The Matter of S.A.L. Steel Ltd.Shyam SunderNo ratings yet

- Corporate and Allied LawsDocument638 pagesCorporate and Allied LawsMayank Jain100% (1)

- Indigo Paints LimitedDocument402 pagesIndigo Paints LimitedSuresh Kumar DevanathanNo ratings yet

- ANAND-RATHI Tanuj Kumar ProjectDocument90 pagesANAND-RATHI Tanuj Kumar ProjectTanuj Kumar50% (2)

- Sterlite Technologies PDFDocument302 pagesSterlite Technologies PDFbardhanNo ratings yet

- Sucheta Dalal on Corruption & Friction Hindering Crypto & Ease of Doing Business in IndiaDocument68 pagesSucheta Dalal on Corruption & Friction Hindering Crypto & Ease of Doing Business in IndiapramodkrishnaNo ratings yet

- SEBI Informal Guidance Scheme 2003Document2 pagesSEBI Informal Guidance Scheme 2003Narasimhan SrinivasanNo ratings yet

- PDFDocument4 pagesPDFKaran PatilNo ratings yet

- Mazagon Dock Shipbuilders LTD DRHP - 20190807160934Document357 pagesMazagon Dock Shipbuilders LTD DRHP - 20190807160934SubscriptionNo ratings yet

- Journalism of Courage: SINCE 1932Document13 pagesJournalism of Courage: SINCE 1932kulvir singNo ratings yet

- "Debenture Trustee" - Position, Powers and Duties - It Is The LawDocument13 pages"Debenture Trustee" - Position, Powers and Duties - It Is The LawRohitSharmaNo ratings yet

- Investment FD (1652)Document22 pagesInvestment FD (1652)Soumya SinhaNo ratings yet

- SEBI ReportDocument314 pagesSEBI ReportRahul MadhavanNo ratings yet

- Capital Market ModuleDocument30 pagesCapital Market ModuleJaya Chandra ReddyNo ratings yet

- Distributor Empanelment FormDocument6 pagesDistributor Empanelment FormManu KumarNo ratings yet

- Aifs To Segregate and Ring-Fence Assets and Liabilities of Each Scheme Parameters Provided For First Close, Tenure and Change of Sponsor/ManagerDocument4 pagesAifs To Segregate and Ring-Fence Assets and Liabilities of Each Scheme Parameters Provided For First Close, Tenure and Change of Sponsor/ManagerELP LawNo ratings yet

- Edminister ElectricCircuitsDocument220 pagesEdminister ElectricCircuitshiralalnhpcNo ratings yet

- Petitioner SEBI MootDocument34 pagesPetitioner SEBI MootAkanksha YadavNo ratings yet

- Osmania LLB 3 YDC VI Sem SyllabusDocument8 pagesOsmania LLB 3 YDC VI Sem SyllabusganrgmaNo ratings yet

- Case Study On Insider TradingDocument2 pagesCase Study On Insider TradingAyushi Singh100% (2)

- Order in The Matter of M/s IHI Developers India LTDDocument14 pagesOrder in The Matter of M/s IHI Developers India LTDShyam SunderNo ratings yet

- Regulatory Framework For Corporate Governance in India M COM II 17-4Document9 pagesRegulatory Framework For Corporate Governance in India M COM II 17-4Monika ShaileshNo ratings yet

- MarckdraftDocument320 pagesMarckdraftarunohriNo ratings yet

- Nism Securities Operations and Risk ManagementDocument117 pagesNism Securities Operations and Risk ManagementKailashnath GantiNo ratings yet

- Morning India 20210323 Mosl Motilal OswalDocument8 pagesMorning India 20210323 Mosl Motilal Oswalvikalp123123No ratings yet