Professional Documents

Culture Documents

Given

Uploaded by

COriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Given

Uploaded by

CCopyright:

Available Formats

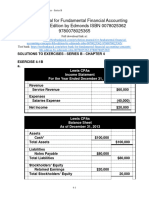

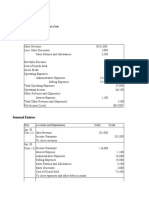

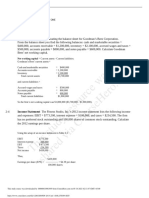

Understanding income statement relationships

During the year, cost of goods sold was $120,000; income from operations was $114,000

and selling, general, and administrative expenses were $66,000.

Required:

Calculate net sales, gross profit, income before taxes, and net income. (Hint: Exhibit 2-2 may be

Given:

Cost of Goods Solds= 120000

Income from Operations= 114000

Income Tax Expense= 24000

Interest Expense= 18000

Selling, General, Admin Expense= 66000

Calculate: Red are values solved for

Net Sales 300000

Cost of Goods Sold 120000

Gross Profit 180000

Selling, General, Admin Expense 66000

Income from Operations 114000

Interest Expense 18000

Income Before Taxes 96000

Income Tax Expense 24000

Net Income 72000

rom operations was $114,000; income tax expense was $24,000; interest expense was $18,000;

expenses were $66,000.

me. (Hint: Exhibit 2-2 may be used as a solution model.)

You might also like

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- Managrial Accounting (0301211) Assignment 1 On Chapter 1Document5 pagesManagrial Accounting (0301211) Assignment 1 On Chapter 1بشير حيدرNo ratings yet

- P4 MISE2014.Budgeting Exercices PDFDocument7 pagesP4 MISE2014.Budgeting Exercices PDFLeah Mae NolascoNo ratings yet

- Acc2002 PPT FinalDocument53 pagesAcc2002 PPT FinalSabina TanNo ratings yet

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- Accounting RatiosDocument7 pagesAccounting Ratios27h4fbvsy8No ratings yet

- Problem Ratio 2022Document1 pageProblem Ratio 2022Mohd shariqNo ratings yet

- Pa12 Trần Khánh Vy Hw Ch5Document5 pagesPa12 Trần Khánh Vy Hw Ch5Vy Tran KhanhNo ratings yet

- Statement of Comprehensive Income Part 2 StudentDocument7 pagesStatement of Comprehensive Income Part 2 StudentAG VenturesNo ratings yet

- Statement of Comprehensive Income Part 2Document8 pagesStatement of Comprehensive Income Part 2AG VenturesNo ratings yet

- Fundamental Financial Accounting Concepts 8th Edition Edmonds Solutions Manual 1Document68 pagesFundamental Financial Accounting Concepts 8th Edition Edmonds Solutions Manual 1john100% (36)

- Common Size Statement Analysis PDF Notes 1Document10 pagesCommon Size Statement Analysis PDF Notes 124.7upskill Lakshmi V0% (1)

- Course Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Document4 pagesCourse Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Wild GhostNo ratings yet

- EC 1 - Acctg Cycle Part 2 Sample ProblemsDocument1 pageEC 1 - Acctg Cycle Part 2 Sample ProblemsChelay EscarezNo ratings yet

- Solutions To ProblemsDocument22 pagesSolutions To ProblemsSyeed AhmedNo ratings yet

- Cash Flow Statement Assignment No. 1 SOLDocument1 pageCash Flow Statement Assignment No. 1 SOLMahmoud IbrahimNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Lesson 2 Week 2 FABM 2Document30 pagesLesson 2 Week 2 FABM 2Mikel Nelson AmpoNo ratings yet

- 137 - Tugas TerstreukturDocument1 page137 - Tugas TerstreukturFransiska JessicaNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- Fundamental Financial Accounting Concepts 8th Edition Edmonds Solutions Manual 1Document36 pagesFundamental Financial Accounting Concepts 8th Edition Edmonds Solutions Manual 1christopherdiazypidwrqfez100% (26)

- Name: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingDocument2 pagesName: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingIrish C. BamuyaNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Assignment 03Document7 pagesAssignment 03Nadeera GalagedarageNo ratings yet

- Purpose of Cash Flow StatementDocument4 pagesPurpose of Cash Flow Statement1abhishek1No ratings yet

- Ratio Analysis Solved ProblemsDocument34 pagesRatio Analysis Solved ProblemsHaroon KhanNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting AssignmentKhaliq AhmadNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- Chapter 2 MathDocument3 pagesChapter 2 Mathwowipev155No ratings yet

- Case 5-32&33Document4 pagesCase 5-32&33Majde Qasem100% (1)

- Applied Overhads 60,000 Calculation of Actual OverheadDocument2 pagesApplied Overhads 60,000 Calculation of Actual OverheadRoshaanNo ratings yet

- Lecture 20 IA 2022 EELUDocument48 pagesLecture 20 IA 2022 EELUGeorge SobhyNo ratings yet

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- PROJ Jul22 BBAHONS AFM8 Final 20221205090359Document10 pagesPROJ Jul22 BBAHONS AFM8 Final 20221205090359Melokuhle MhlongoNo ratings yet

- Ia Assignment 2Document2 pagesIa Assignment 2Shekinah SesbrenoNo ratings yet

- Financial Statement Preparation April 4Document3 pagesFinancial Statement Preparation April 4Sher Adeeb Bin Faisal 2115167690No ratings yet

- Akuntansi Pengatar Ke 11Document2 pagesAkuntansi Pengatar Ke 11WiwitvlogNo ratings yet

- Statement of Comprehensive Income: Problem 1: True or FalseDocument17 pagesStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- Cash Flow Statement (Direct Method)Document3 pagesCash Flow Statement (Direct Method)Margarette RobiegoNo ratings yet

- Income Statement-Mcq ProblemsDocument3 pagesIncome Statement-Mcq Problemschey dabestNo ratings yet

- Comprehensive Income & NcahsDocument6 pagesComprehensive Income & NcahsNuarin JJ67% (3)

- ALFADocument3 pagesALFADiane MoutranNo ratings yet

- Intermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsDocument13 pagesIntermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsMuhammad MalikNo ratings yet

- Other Comprehensive Income: Items That Will Not Be Reclassified Subsequently To Profit or LossDocument6 pagesOther Comprehensive Income: Items That Will Not Be Reclassified Subsequently To Profit or LossKeahlyn BoticarioNo ratings yet

- FORUM FINANCE - Daniel Korompis (2540117893)Document5 pagesFORUM FINANCE - Daniel Korompis (2540117893)Daniel KorompisNo ratings yet

- C5B Profitability AnalysisDocument6 pagesC5B Profitability AnalysisSteeeeeeeephNo ratings yet

- Home Depot Balance SheetDocument4 pagesHome Depot Balance SheetNicolas ErnestoNo ratings yet

- BUSN AssigmentDocument4 pagesBUSN AssigmentMalik Khurram AwanNo ratings yet

- Kings Inc - Cost AcctgDocument2 pagesKings Inc - Cost AcctgShinjiNo ratings yet

- Neale Corporation Financial StatementDocument4 pagesNeale Corporation Financial StatementkerryNo ratings yet

- Teaching Note - Cash FlowDocument21 pagesTeaching Note - Cash Flowmohit rajputNo ratings yet

- Tugas Personal Pertama AKDocument7 pagesTugas Personal Pertama AKerni75% (4)

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowTang De MelanciaNo ratings yet

- Proj CostDocument64 pagesProj CostCarlisle ChuaNo ratings yet

- Supplemental Homework ProblemsDocument64 pagesSupplemental Homework ProblemsRolando E. CaserNo ratings yet

- Business Finance SamplesDocument2 pagesBusiness Finance SamplesjoeromesantosNo ratings yet

- Fin 201 1stsolution SetDocument6 pagesFin 201 1stsolution Set123xxNo ratings yet

- J.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessFrom EverandJ.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessNo ratings yet

- Problem 9.25Document3 pagesProblem 9.25CNo ratings yet

- Co. Included The Following Information For The Year Ended December 31, 2019 (Amounts in Millions)Document1 pageCo. Included The Following Information For The Year Ended December 31, 2019 (Amounts in Millions)CNo ratings yet

- One-Half of Its First Year of Life.) : Asset's Life UsingDocument6 pagesOne-Half of Its First Year of Life.) : Asset's Life UsingCNo ratings yet

- Co. Included The Following Information For The Year Ended December 31, 2019 (Amounts in Millions)Document1 pageCo. Included The Following Information For The Year Ended December 31, 2019 (Amounts in Millions)CNo ratings yet

- Financial Statement Effects of Depreciation-Straight-Line Versus Accelerated Methods Assume That A Company Chooses An Accelerated Method of Calculating DepreciationDocument2 pagesFinancial Statement Effects of Depreciation-Straight-Line Versus Accelerated Methods Assume That A Company Chooses An Accelerated Method of Calculating DepreciationCNo ratings yet

- Problem 5.30Document3 pagesProblem 5.30CNo ratings yet

- Problem 5.30Document3 pagesProblem 5.30CNo ratings yet

- Assets Liabilties + Paid in Capital + (BEG Retained Earnings + Net Income - Dividends End Retained Earnings) Firm ADocument2 pagesAssets Liabilties + Paid in Capital + (BEG Retained Earnings + Net Income - Dividends End Retained Earnings) Firm ACNo ratings yet

- Assets Liabilties + Paid in Capital + (BEG Retained Earnings + Net Income - Dividends End Retained Earnings) Firm ADocument2 pagesAssets Liabilties + Paid in Capital + (BEG Retained Earnings + Net Income - Dividends End Retained Earnings) Firm ACNo ratings yet

- Assets Liabilties + Paid in Capital + (BEG Retained Earnings + Net Income - Dividends End Retained Earnings) Firm ADocument2 pagesAssets Liabilties + Paid in Capital + (BEG Retained Earnings + Net Income - Dividends End Retained Earnings) Firm ACNo ratings yet

- Problem 2.19Document3 pagesProblem 2.19CNo ratings yet

- Problem 5.30Document3 pagesProblem 5.30CNo ratings yet

- Exercise 2.7: Following AbbreviationsDocument3 pagesExercise 2.7: Following AbbreviationsCNo ratings yet